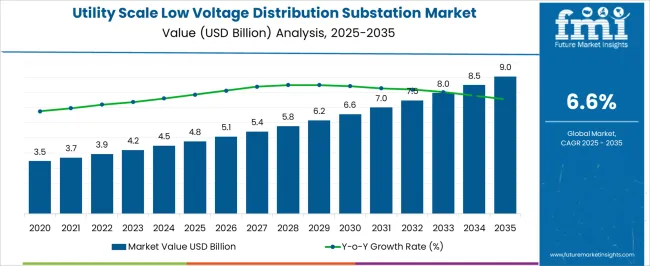

The utility scale low voltage distribution substation market is forecast to increase from USD 4.8 billion in 2025 to USD 9.0 billion by 2035, reflecting a CAGR of 6.6%. An inflection point mapping of the market identifies key stages where growth accelerates or experiences notable shifts due to technological adoption, policy support, and infrastructure expansion.

Between 2025 and 2030, the market rises from USD 4.8 billion to USD 6.6 billion, with a primary inflection point around 2027–2028 at USD 5.1–5.4 billion. This stage corresponds to rising investment in grid modernization, smart substation deployment, and urban electrification initiatives, which accelerate the adoption of low-voltage distribution solutions.

From 2030 to 2035, the market further climbs from USD 6.6 billion to USD 9.0 billion, with a second inflection point around 2032–2033 at USD 7.5–8.0 billion, marking the phase of rapid scaling and widespread deployment of digital and IoT-enabled substations. This period sees increasing penetration in emerging markets, enhanced operational efficiency, and regulatory support for low-carbon infrastructure. The market trajectory shows two major inflection points that define periods of accelerated growth, highlighting opportunities for technology providers, EPC contractors, and utilities to capitalize on evolving infrastructure demands. The analysis underscores the strategic importance of innovation, regional expansion, and policy alignment in sustaining long-term market momentum.

| Metric | Value |

|---|---|

| Utility Scale Low Voltage Distribution Substation Market Estimated Value in (2025 E) | USD 4.8 billion |

| Utility Scale Low Voltage Distribution Substation Market Forecast Value in (2035 F) | USD 9.0 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The utility scale low voltage distribution substation market is primarily driven by the power transmission and distribution market, which accounts for approximately 40–45% of total demand, as substations are essential for stepping down voltage and distributing electricity efficiently to end-users. The renewable energy market contributes around 20–22%, reflecting the growing integration of solar, wind, and other renewable sources into low-voltage distribution networks. The smart grid and energy management market holds roughly 15–17%, driven by the adoption of digital substations with real-time monitoring, automation, and energy efficiency enhancements. The electrical equipment manufacturing market contributes approximately 10–12%, as transformers, switchgear, and protection systems are integral components of substations. Lastly, the infrastructure development and urban electrification market accounts for 5–6%, supported by expanding urban, industrial, and commercial projects requiring reliable power distribution. Collectively, these parent markets define the technological, operational, and deployment ecosystem of the utility scale low voltage distribution substation market, enabling utilities, contractors, and manufacturers to enhance energy reliability, efficiency, and grid modernization across residential, commercial, and industrial segments worldwide.

The utility scale low voltage distribution substation market is witnessing robust growth, supported by increasing electricity demand, modernization of grid infrastructure, and the shift towards more resilient, efficient, and digitally enabled power systems. Rising urbanization and industrialization have been driving significant investments in power distribution networks, prompting utilities to deploy advanced substation technologies to enhance operational reliability.

Regulatory mandates for energy efficiency and grid stability are accelerating the adoption of modern control and monitoring solutions, while renewable energy integration is creating demand for substations capable of handling variable loads and bidirectional power flows. Market expansion is also being facilitated by the replacement of aging infrastructure and the deployment of automation systems to reduce outages and maintenance costs.

Over the forecast period, technological advancements, combined with strategic public-private investments in transmission and distribution infrastructure, are expected to sustain market momentum, with an emphasis on scalable, modular, and intelligent systems tailored to diverse regional energy needs.

The utility scale low voltage distribution substation market is segmented by technology, component, category, and geographic regions. By technology, utility scale low voltage distribution substation market is divided into Digital and Conventional. In terms of component, utility scale low voltage distribution substation market is classified into Substation Automation System, Communication Network, Electrical System, Monitoring & Control System, and Others.

Based on category, utility scale low voltage distribution substation market is segmented into New and Refurbished. Regionally, the utility scale low voltage distribution substation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

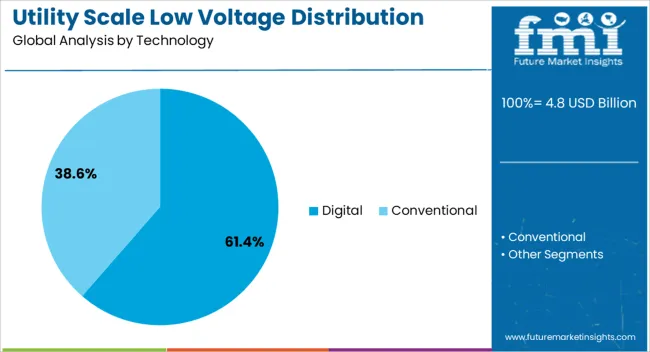

The digital technology segment, accounting for 61.4% of the technology category, has emerged as the dominant choice due to its superior monitoring, control, and diagnostic capabilities compared to conventional systems. Adoption has been propelled by the need for real-time data analytics, predictive maintenance, and enhanced grid visibility, which collectively improve operational efficiency and reduce downtime.

Digital substations enable integration with advanced communication protocols, facilitating interoperability across multiple grid components and enhancing system scalability. Their ability to adapt to evolving grid requirements, including renewable energy integration and distributed generation, has reinforced their market share.

Implementation has been further supported by declining costs of digital components and increasing utility awareness of long-term cost savings. Strategic deployments in urban and industrial hubs, coupled with supportive regulatory frameworks, have ensured sustained investment in this segment, positioning digital solutions as the preferred technology for future-ready low-voltage distribution substations.

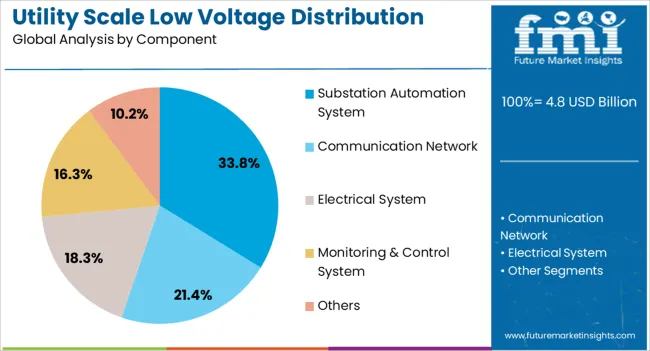

The substation automation system segment, representing 33.8% of the component category, is leading due to its critical role in improving substation performance, reducing manual intervention, and enhancing reliability. Its adoption has been driven by the increasing complexity of modern power distribution networks and the need for precise control, fault detection, and rapid recovery from outages.

Automation systems integrate intelligent electronic devices, advanced control software, and communication networks, enabling utilities to manage operations remotely and optimize load distribution. The segment’s growth has been supported by cost reductions in automation hardware and software, alongside the rising demand for asset optimization and lifecycle management.

Utility companies have been prioritizing automation to meet regulatory performance standards and minimize downtime, making it a cornerstone of modern substation projects. Over the coming years, advancements in artificial intelligence and IoT integration are expected to enhance the capabilities of substation automation systems further, solidifying their position in the market.

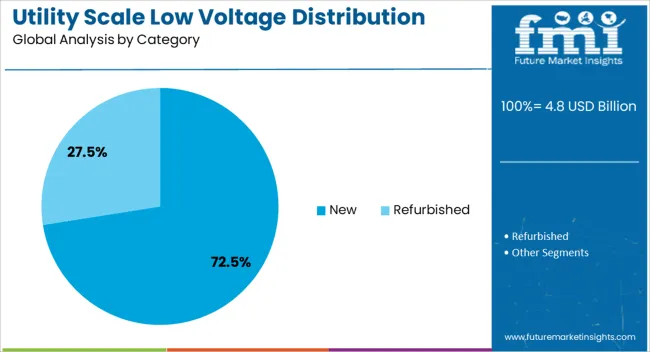

The new installations segment, holding 72.5% of the category, has maintained a leading position due to extensive grid expansion initiatives and the construction of new power infrastructure in both developed and emerging economies. Rising electricity consumption, coupled with the need to connect new industrial zones, residential developments, and renewable energy plants, has driven substantial investment in new substations.

Governments and private utilities are prioritizing new builds over retrofits to take advantage of modern technologies, higher efficiency standards, and modular designs that reduce deployment time. Large-scale rural electrification programs and the replacement of outdated systems with high-performance, future-ready solutions are also reinforcing the segment’s dominance.

Funding from international financial institutions for infrastructure development projects has further accelerated adoption. As energy systems continue to decentralize and demand for stable, efficient distribution networks grows, the new installations segment is expected to sustain its market leadership, underpinned by continuous technological and capacity enhancements.

Rising demand for reliable electricity distribution is driving adoption of low voltage (LV) distribution substations in industrial, commercial, and urban infrastructure projects. LV substations ensure safe and efficient power delivery from medium voltage networks to end-users, supporting industrial equipment, commercial facilities, and residential complexes. Key priorities include operational safety, load management, system reliability, and rapid deployment in expanding urban areas. Suppliers offering pre-engineered, modular, and easy-to-install LV substations with robust technical support are positioned to meet growing demand from utility companies, independent power producers, and large-scale infrastructure developers.

Utilities and power distribution companies are increasingly investing in LV substations to reduce losses, improve grid stability, and enhance system monitoring. LV substations are critical for integrating renewable energy sources, managing peak loads, and enabling smart grid functionalities. Their deployment ensures uninterrupted power supply for residential, commercial, and industrial consumers while supporting load balancing and fault management. Demand is further accelerated by urban expansion, industrialization, and modernization of existing grids. Suppliers providing turnkey solutions, modular designs, and integration support with SCADA and monitoring systems are well positioned to capture market share in rapidly developing regions.

The market is trending toward compact, modular LV substations equipped with smart monitoring, automation, and fault detection capabilities. Multi-functional units integrating protection, metering, and control features are increasingly preferred for urban, industrial, and renewable-connected grids. Remote monitoring, predictive maintenance, and digital integration improve operational efficiency, reduce downtime, and enhance grid resilience. Lightweight and pre-assembled designs reduce installation complexity and allow rapid deployment in congested or space-constrained environments. Suppliers providing technically advanced, reliable, and application-ready LV substations are best positioned to address the evolving demands of utility companies, industrial consumers, and smart city projects globally.

Constraints in the market include high capital costs, dependency on specialized equipment such as transformers, switchgear, and protective devices, and fluctuations in raw material prices. Compliance with regional safety standards, electrical codes, and environmental regulations adds complexity to design, manufacturing, and installation. Technical challenges involve ensuring voltage stability, thermal performance, fault tolerance, and ease of maintenance. Supply chain disruptions for critical components can impact project timelines. Buyers increasingly prioritize suppliers offering certified, pre-tested, and modular LV substations with quality assurance, design support, and reliable installation services to minimize downtime, optimize operations, and maintain regulatory compliance.

Opportunities exist in pre-fabricated, modular LV substations that reduce installation time and allow flexible expansion for industrial parks, commercial hubs, and urban grids. Integration with smart grid technologies, monitoring systems, and remote diagnostics enhances operational efficiency and predictive maintenance. Growing urbanization, renewable energy penetration, and industrial electrification in Asia-Pacific, Europe, and North America are driving adoption. Suppliers offering modular designs, technical support, installation services, and customization capabilities are best positioned to capitalize on these opportunities, enabling utilities and infrastructure developers to deploy efficient, reliable, and scalable LV distribution networks

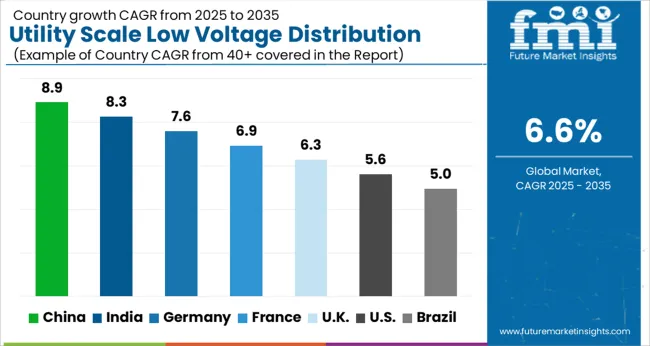

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

The global utility scale low voltage distribution substation market is projected to grow at a CAGR of 6.6% from 2025 to 2035. China leads at 8.9%, followed by India at 8.3%, France at 6.9%, the UK at 6.3%, and the USA at 5.6%. Growth is driven by urbanization, smart grid adoption, renewable energy integration, and infrastructure modernization. Modular, compact, and digitally monitored substations with automation and fault detection capabilities are increasingly adopted globally. Government initiatives, industrial expansion, and collaborations with international technology providers further accelerate market penetration and efficiency worldwide. The analysis includes over 40+ countries, with the leading markets detailed below.

The utility scale low voltage distribution substation market in China is projected to grow at a CAGR of 8.9% from 2025 to 2035, driven by rapid urbanization, industrial expansion, and increasing electricity demand. Investments in smart grid infrastructure and renewable energy integration are fueling adoption of advanced low voltage substations for efficient power distribution. Domestic manufacturers focus on compact, modular, and digitally monitored substations capable of real-time fault detection and load management. Industrial hubs in Jiangsu, Zhejiang, and Guangdong support manufacturing, deployment, and after-sales service. Collaborations with international technology providers enhance substation design, automation, and operational efficiency. Growth is further boosted by government policies promoting electrification, rural grid expansion, and renewable energy projects, ensuring stable and reliable power supply across regions.

The utility scale low voltage distribution substation market in India is expected to grow at a CAGR of 8.3% from 2025 to 2035, supported by government initiatives for rural electrification, grid modernization, and renewable energy integration. Rising electricity consumption across industrial, commercial, and residential sectors drives demand for utility scale low voltage substations. Domestic manufacturers are investing in compact, modular designs with real-time monitoring and fault management systems. Key industrial hubs in Maharashtra, Gujarat, and Tamil Nadu facilitate production, deployment, and maintenance. Collaborations with international suppliers enhance technology transfer, improve operational efficiency, and support high-reliability substation infrastructure. Increasing urbanization, smart city projects, and renewable energy capacity expansion further fuel growth.

The utility scale low voltage distribution substation market in France is projected to grow at a CAGR of 6.9% from 2025 to 2035, driven by grid modernization, renewable energy adoption, and urban infrastructure projects. French utilities prioritize compact, energy-efficient substations integrated with digital monitoring, remote operation, and real-time load management. Industrial and urban hubs support manufacturing, deployment, and maintenance of low voltage distribution infrastructure. Collaborations with international technology providers enable the adoption of advanced protection, automation, and fault detection systems. Expansion of electric mobility, smart grids, and decentralized renewable energy generation creates new opportunities for low voltage substation upgrades.

The UK market is expected to grow at a CAGR of 6.3% from 2025 to 2035, driven by rising electricity demand, renewable energy integration, and the modernization of aging infrastructure. Utilities are investing in compact, modular substations with digital monitoring, automation, and fault management systems to enhance operational reliability. Industrial hubs in London, Manchester, and Birmingham provide strong manufacturing, deployment, and service support. Government programs promoting smart grid deployment, EV infrastructure, and urban electrification further support market growth. Collaborations with global substation technology providers ensure integration of advanced control and automation systems. The focus on reliability, resilience, and low-voltage distribution efficiency drives continuous upgrades across commercial, industrial, and residential networks.

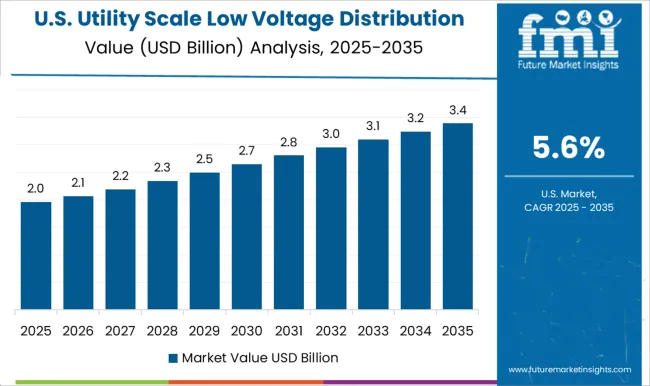

The USA market is projected to grow at a CAGR of 5.6% from 2025 to 2035, driven by urban infrastructure expansion, industrial growth, and integration of renewable energy sources. Utilities focus on modular, compact low voltage substations equipped with digital monitoring, automation, and fault detection systems. Key industrial hubs in Texas, California, and New York support manufacturing, deployment, and maintenance services. Expansion of smart grid projects, EV charging networks, and distributed renewable energy generation is fueling adoption. Collaborations with international technology providers help enhance substation efficiency, reliability, and safety standards. The USA market remains steady, driven by modernization programs and the need for resilient, flexible, and low-maintenance distribution infrastructure.

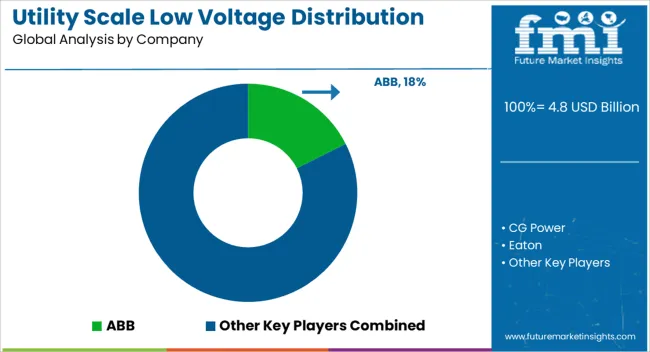

The utility scale low voltage distribution substation market is highly competitive, with major players including ABB, CG Power, Eaton, Efacec, General Electric, Hitachi Energy, L&T Electrical and Automation, Locamation, Open System International, Rockwell Automation, Schneider Electric, Siemens, Tesco Automation, and Texas Instruments. ABB is recognized for its modular turnkey substations, emphasizing energy efficiency, reliability, and ease of deployment for utility-scale applications. Siemens and Schneider Electric compete by integrating intelligent automation, digital monitoring, and smart grid compatibility, enabling predictive maintenance and real-time operational control. Their product brochures highlight modular switchgear, control panels, and monitoring systems designed for industrial and commercial power distribution. General Electric, Hitachi Energy, and Eaton focus on high-performance switchgear, transformers, and low voltage distribution panels. Solutions are engineered for durability, scalability, and adherence to international standards, supporting industrial, commercial, and utility networks.

L&T Electrical and Automation, CG Power, and Efacec provide regionally customized substations, combining robust engineering with rapid deployment. Their offerings include tailored busbar systems, protection devices, and control solutions that cater to local regulatory requirements and performance expectations. Advanced control and monitoring solutions are delivered by Rockwell Automation, Open System International, Locamation, Tesco Automation, and Texas Instruments. These companies integrate SCADA systems, communication modules, and digital interfaces to improve operational intelligence, fault detection, and energy management. Competitive strategies across the market focus on innovation, modularity, energy efficiency, and comprehensive service networks. Companies highlight product brochures emphasizing switchgear types, transformer capacities, automation solutions, and control panels. These portfolios target utility-scale, industrial, and commercial applications, addressing rising demand for resilient, intelligent, and sustainable low voltage distribution infrastructure. The combination of technological advancement, global support, and energy-efficient designs ensures companies remain competitive in a rapidly evolving market.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.8 Billion |

| Technology | Digital and Conventional |

| Component | Substation Automation System, Communication Network, Electrical System, Monitoring & Control System, and Others |

| Category | New and Refurbished |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, CG Power, Eaton, Efacec, General Electric, Hitachi Energy, L&T Electrical and Automation, Locamation, Open System International, Rockwell Automation, Schneider Electric, Siemens, Tesco Automation, and Texas Instruments |

| Additional Attributes | Dollar sales by equipment type (switchgear, transformers, control panels, monitoring systems), voltage class (low voltage, medium voltage), and application (industrial, commercial, utility-scale). Demand is driven by grid modernization, renewable energy integration, and the need for smart and resilient power distribution. Regional trends highlight strong growth in North America and Europe due to grid upgrades and renewable adoption, while Asia-Pacific shows rapid expansion driven by urbanization, industrialization, and investment in electricity infrastructure. |

The global utility scale low voltage distribution substation market is estimated to be valued at USD 4.8 billion in 2025.

The market size for the utility scale low voltage distribution substation market is projected to reach USD 9.0 billion by 2035.

The utility scale low voltage distribution substation market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in utility scale low voltage distribution substation market are digital and conventional.

In terms of component, substation automation system segment to command 33.8% share in the utility scale low voltage distribution substation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Utility Markers Market Size and Share Forecast Outlook 2025 to 2035

Utility Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Utility Terrain Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Utility Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Utility Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar PV EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Pouches Market Size and Share Forecast Outlook 2025 to 2035

Utility On Grid PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Utility Cases Market Insights - Growth & Demand 2025 to 2035

Utility Locator Market Report – Growth & Industry Forecast 2025 to 2035

Industry Share Analysis for Utility Pouches Companies

Utility Analytics and Energy Analytics Market Growth - Trends & Forecast through 2035

Utility Based Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Open Loop Current Transducer Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA