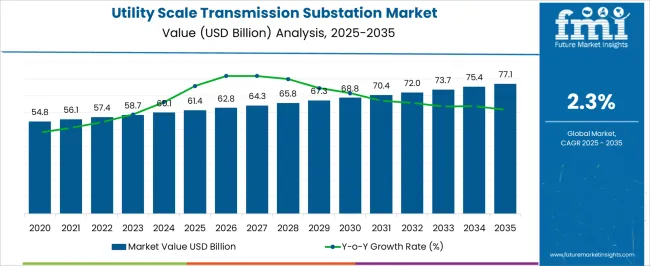

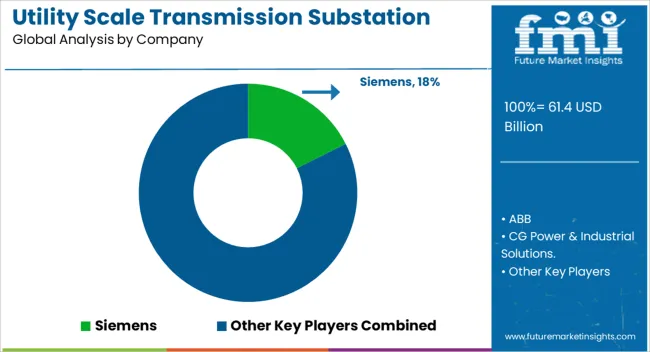

The utility scale transmission substation market is estimated to be valued at USD 61.4 billion in 2025 and is projected to reach USD 77.1 billion by 2035, registering a compound annual growth rate (CAGR) of 2.3% over the forecast period. The 10-year growth comparison of the utility scale transmission substation market reveals a gradual but firm expansion path. Valuations are forecasted to climb from USD 61.4 billion in 2025 to USD 77.1 billion in 2035, registering a compound annual growth rate (CAGR) of 2.3%. From 2025 through 2030, the progression is steady, moving through USD 62.8 billion in 2026 and reaching USD 68.8 billion by 2030. This measured rise is seen as a reflection of the industry’s reliance on stable infrastructure development and the constant requirement for efficient grid systems.

The pace might appear modest compared to more volatile markets, yet its reliability gives it a distinctive character. By 2035, the market is anticipated to advance toward USD 77.1 billion, highlighting the role substations play in ensuring grid dependability and uninterrupted electricity distribution. Large-scale projects are viewed as critical, given the pressure on transmission operators to reduce downtime and improve operational safety. It is believed that this market offers long-term security for investors and equipment suppliers who prioritize consistency over rapid growth.

The slow but decisive rise demonstrates that substations remain the backbone of energy distribution networks. The outlook suggests that opportunities for manufacturers and engineering firms will be shaped by the demand for durable, reliable, and scalable infrastructure, where margins are secured through performance rather than speed of expansion.

| Metric | Value |

|---|---|

| Utility Scale Transmission Substation Market Estimated Value in (2025 E) | USD 61.4 billion |

| Utility Scale Transmission Substation Market Forecast Value in (2035 F) | USD 77.1 billion |

| Forecast CAGR (2025 to 2035) | 2.3% |

The utility scale transmission substation market is a critical subset of the power transmission and distribution market, where it holds nearly 6-7% share due to its indispensable role in stepping up or stepping down voltage levels for efficient electricity transfer across long distances. Within the broader electrical equipment market, its share is about 4-5%, as substations are among the most capital-intensive assets within power infrastructure.

The renewable energy integration market represents another major parent sector, where utility scale substations account for approximately 5-6% share, enabling the connection of large solar, wind, and hydro projects to the grid while maintaining stability. In the grid modernization market, substations contribute around a 7-8% share, with growing demand for smart substations, digital monitoring, and automation to handle fluctuating loads and bidirectional energy flows. Within the overall energy and power infrastructure market, their contribution is close to 3-4%, reflecting their role as backbone assets in electricity delivery systems.

As electrification of industries and renewable integration accelerate worldwide, the market is expected to expand steadily, with its share in parent markets strengthening further as utilities prioritize investment in advanced, resilient substation infrastructure.

The utility scale transmission substation market is gaining traction due to increasing grid modernization efforts, renewable energy integration, and rising electricity demand across industrial and urban regions. Governments and private players are prioritizing infrastructure resilience and digital transformation to meet evolving load profiles and ensure uninterrupted power delivery.

Moreover, transmission operators are investing in automation, remote monitoring, and control systems to reduce operational risk and improve fault detection. These trends are especially prominent in countries undergoing electrification expansions and decarbonization transitions.

With supportive policies, upgraded asset management technologies, and growing investments in smart grids, the substation landscape is rapidly evolving to meet 21st-century energy distribution needs.

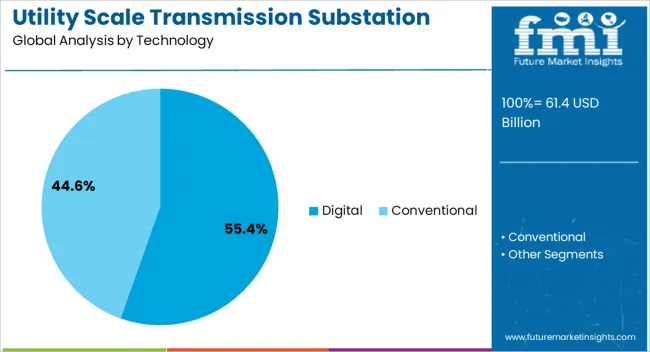

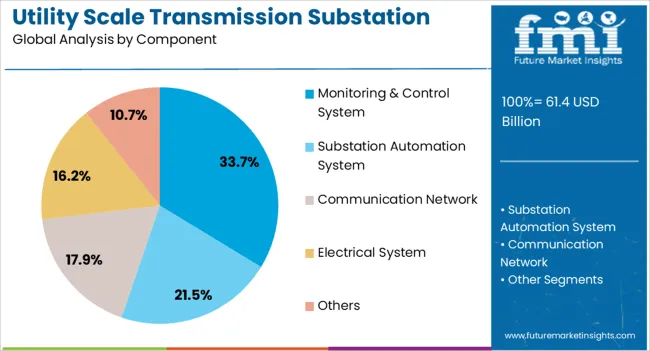

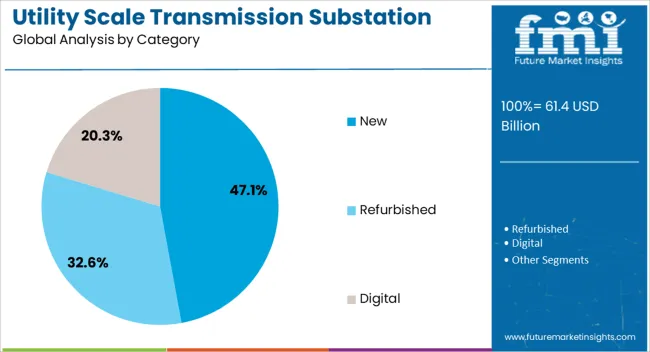

The utility scale transmission substation market is segmented by technology, component, category, voltage level, and geographic regions. By technology, utility scale transmission substation market is divided into Digital and Conventional. In terms of component, utility scale transmission substation market is classified into Monitoring & Control System, Substation Automation System, Communication Network, Electrical System, and Others.

Based on category, utility scale transmission substation market is segmented into New, Refurbished, and Digital. By voltage level, utility scale transmission substation market is segmented into High, Low, and Medium. Regionally, the utility scale transmission substation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Digital technology is anticipated to lead the utility scale transmission substation market with a projected share of 55.40% by 2025. This segment’s dominance stems from the increasing push for substation automation and digital control systems to enhance grid reliability and responsiveness.

Digital substations enable real-time monitoring, predictive maintenance, and streamlined data communication between components, significantly reducing human error and response times. Additionally, integration with SCADA and IoT platforms allows for advanced analytics, fault diagnosis, and energy efficiency optimization.

With the rising prevalence of cyber-secure, cloud-integrated systems and remote asset management capabilities, the digital segment is expected to remain the cornerstone of substation transformation projects worldwide.

Monitoring & control systems are expected to contribute 33.70% of the total component-level revenue, making them the leading component in the market. These systems are vital for real-time data collection, fault response automation, and equipment performance optimization.

Their role in enabling smart grid functionalities such as load balancing, voltage regulation, and frequency control has become critical. Increasing regulatory mandates for grid stability and resilience are prompting utilities to replace legacy systems with advanced, interoperable digital solutions.

As grid complexity rises with renewable energy sources and distributed generation, robust monitoring and control systems are becoming indispensable for efficient substation management.

The “New” category is projected to lead the market with a 47.10% share by 2025, reflecting the growing number of greenfield substation projects globally. Expanding urbanization, industrialization, and the need for reliable electricity access in under-electrified regions are driving new substation development.

This growth is particularly strong in Asia-Pacific, the Middle East, and parts of Africa, where infrastructure is being built from scratch to support economic expansion. New projects are increasingly integrating advanced digital architectures and sustainable materials from inception, offering a clean slate for modernization.

This segment also benefits from financial incentives, public-private partnerships, and climate-related infrastructure fundin,g pushing large-scale grid investment forward.

The utility scale transmission substation market is expanding with rising demand for grid modernization and renewable integration. Opportunities are being created by investments in solar and wind projects, along with digital substation adoption. Trends highlight automation, predictive maintenance, and modular designs enhancing efficiency. However, high costs, regulatory hurdles, and land acquisition challenges remain barriers. Long-term growth will hinge on digital upgrades and infrastructure partnerships.

Demand for utility scale transmission substations is being driven by the pressing need to strengthen power infrastructure and improve grid stability. Expanding electricity consumption in urban and industrial clusters is compelling utilities to enhance transmission capacity and ensure uninterrupted supply. The integration of distributed energy sources such as solar and wind is further intensifying the requirement for advanced substations capable of handling complex load flows. Governments are prioritizing modernization projects, while aging grid networks in developed economies create a steady demand pipeline for replacements and upgrades.

Significant opportunities exist in the integration of large-scale renewable energy projects, where substations act as critical nodes for power evacuation and transmission. Countries investing in utility-scale solar and wind farms rely heavily on high-capacity substations to distribute electricity efficiently across long distances. Energy storage systems, smart metering, and digital substation solutions provide added opportunities for vendors to diversify their offerings. Private sector participation in infrastructure development and public-private partnerships is further opening avenues for investment. Suppliers tailoring products for renewable-rich grids are likely to achieve stronger market positions.

A prominent trend in the market is the adoption of digital substations, which integrate intelligent electronic devices, automation software, and advanced communication protocols. Utilities are shifting toward condition-based monitoring and predictive maintenance to minimize downtime and extend asset lifecycles. Cybersecurity features are being embedded as substations become increasingly connected through IoT-enabled systems. Another trend is the growing emphasis on compact, modular substations that reduce space requirements and installation times. Collectively, these trends signal a transition toward more efficient, automated, and digitally controlled transmission infrastructure.

The development of utility scale transmission substations faces challenges linked to significant capital expenditure, long permitting processes, and complex land acquisition requirements. Securing approval from regulatory authorities can delay projects, particularly in regions with stringent environmental and safety guidelines. Cost overruns due to fluctuating raw material prices and logistical bottlenecks remain ongoing concerns. Moreover, cybersecurity threats associated with digital substations add another layer of complexity. To overcome these challenges, market participants need innovative financing models, strategic collaborations, and robust risk management strategies.

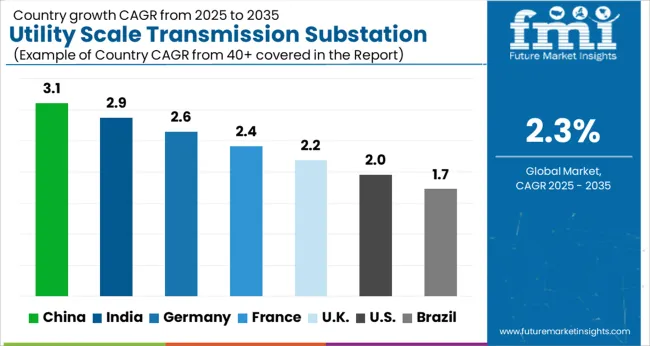

| Country | CAGR |

|---|---|

| China | 3.1% |

| India | 2.9% |

| Germany | 2.6% |

| France | 2.4% |

| UK | 2.2% |

| USA | 2.0% |

| Brazil | 1.7% |

The global utility scale transmission substation market is projected to grow at a CAGR of 2.3% from 2025 to 2035. China leads with a growth rate of 3.1%, followed by India at 2.9% and Germany at 2.6%. The United Kingdom records a growth rate of 2.2%, while the United States shows the slowest growth at 2.0%. Expansion is supported by the need for grid modernization, renewable power integration, and strengthening of transmission reliability. Emerging economies such as China and India are investing heavily in capacity expansion, while developed economies like the USA, UK, and Germany are prioritizing digital substations, automation, and grid flexibility. This report includes insights on 40+ countries; the top markets are shown here for reference.

The utility scale transmission substation market in China is growing at 3.1% CAGR, the highest among leading countries. Growth is driven by rapid grid expansion to handle rising electricity demand and the large-scale integration of solar and wind projects. State-backed investments in ultra-high-voltage (UHV) transmission corridors are accelerating deployment of advanced substations. China’s commitment to reducing power outages and maintaining transmission reliability positions substations as critical infrastructure. Local suppliers, alongside global players, are actively delivering smart solutions to support grid modernization.

The utility scale transmission substation market in India is advancing at 2.9% CAGR, fueled by a surge in renewable energy capacity and rising industrial demand. Substation expansion is essential for managing the country’s fast-growing solar and wind installations. Government-backed programs such as Green Energy Corridors are focused on improving transmission efficiency. The integration of smart substations is gaining momentum as utilities aim to reduce transmission losses and enhance resilience. International players are also entering the Indian market through joint ventures and partnerships.

The utility scale transmission substation market in Germany is growing at 2.6% CAGR, supported by the energy transition (Energiewende) and rising renewable penetration. The shift away from coal and nuclear is creating stronger demand for flexible transmission networks. German utilities are prioritizing automation, remote monitoring, and advanced insulation technologies in substations. Projects connecting offshore wind farms to onshore grids are accelerating investments. The focus on long-term grid reliability ensures substations remain a cornerstone of the country’s power sector.

The utility scale transmission substation market in the United Kingdom is expanding at 2.2% CAGR, influenced by the nation’s growing renewable fleet and electrification goals. Grid operators are upgrading substations to handle intermittent renewable energy flows and maintain reliability. The UK market emphasizes compact and modular substations for space-constrained areas, particularly in urban zones. Investments in offshore wind transmission links and interconnectors with neighboring countries are adding further demand. Local innovation in digital substations enhances resilience and control.

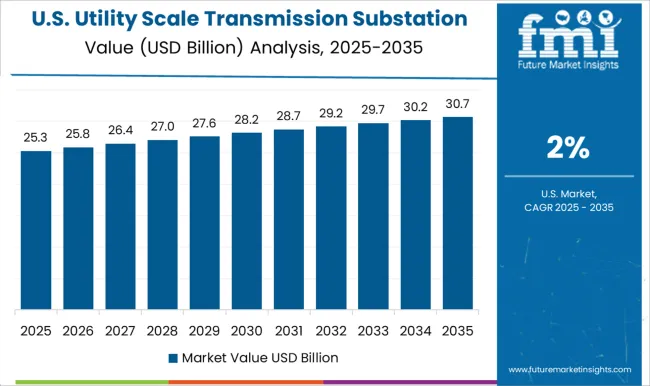

The utility scale transmission substation market in the United States is growing at 2.0% CAGR, the slowest among leading nations. Growth is supported by modernization of aging grid infrastructure and integration of renewable energy projects. Substation investments are focusing on enhancing cybersecurity, automation, and grid resilience against extreme weather events. Utilities are collaborating with technology providers to deploy digital control systems and predictive maintenance solutions. Federal and state initiatives supporting transmission upgrades continue to drive demand, though the market remains mature compared to Asia.

The utility scale transmission substation market is defined by global leaders competing on digitalization, grid reliability, and equipment efficiency. Siemens, ABB, and Hitachi Energy promote integrated substations that combine switchgear, transformers, and monitoring systems. Their brochures stress reduced downtime and lifecycle efficiency, targeting utilities modernizing grid infrastructure. Schneider Electric and Eaton focus on modular designs, emphasizing space-saving and cost reduction. General Electric leverages its legacy in grid systems, marketing automation and protection systems with strong service backing. Rockwell Automation, Texas Instruments, and Open System International compete by embedding automation and control intelligence, positioning substations as data-driven assets.

L&T Electrical and Automation and CG Power & Industrial Solutions highlight regional strength and turnkey solutions, presenting execution speed as a key differentiator. Efacec, Tesco Automation, and Locamation emphasize niche areas such as digital substations and control systems. Strategies are framed around resilience, safety compliance, and digital twin capability. Product brochures serve as the main competitive front, portraying substations as not only transmission hubs but as smart infrastructure enablers designed for future-ready power networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 61.4 Billion |

| Technology | Digital and Conventional |

| Component | Monitoring & Control System, Substation Automation System, Communication Network, Electrical System, and Others |

| Category | New, Refurbished, and Digital |

| Voltage Level | High, Low, and Medium |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens, ABB, CG Power & Industrial Solutions., Eaton, Efacec, General Electric, Hitachi Energy., L&T Electrical and Automation, Locamation, Open System International, Rockwell Automation., Schneider Electric, Tesco Automation, and Texas Instruments Incorporated |

| Additional Attributes | Dollar sales by substation type (air-insulated, gas-insulated, hybrid) and application (industrial, commercial, utility) are key metrics. Trends include rising demand for high-voltage infrastructure, integration with renewable energy, and focus on grid reliability. Regional adoption, automation technologies, and government investment in power distribution are driving market growth. |

The global utility scale transmission substation market is estimated to be valued at USD 61.4 billion in 2025.

The market size for the utility scale transmission substation market is projected to reach USD 77.1 billion by 2035.

The utility scale transmission substation market is expected to grow at a 2.3% CAGR between 2025 and 2035.

The key product types in utility scale transmission substation market are digital and conventional.

In terms of component, monitoring & control system segment to command 33.7% share in the utility scale transmission substation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Utility Markers Market Size and Share Forecast Outlook 2025 to 2035

Utility Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Utility Terrain Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Utility Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Utility Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar PV EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Pouches Market Size and Share Forecast Outlook 2025 to 2035

Utility On Grid PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Utility Cases Market Insights - Growth & Demand 2025 to 2035

Utility Locator Market Report – Growth & Industry Forecast 2025 to 2035

Industry Share Analysis for Utility Pouches Companies

Utility Analytics and Energy Analytics Market Growth - Trends & Forecast through 2035

Utility Scale Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Open Loop Current Transducer Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA