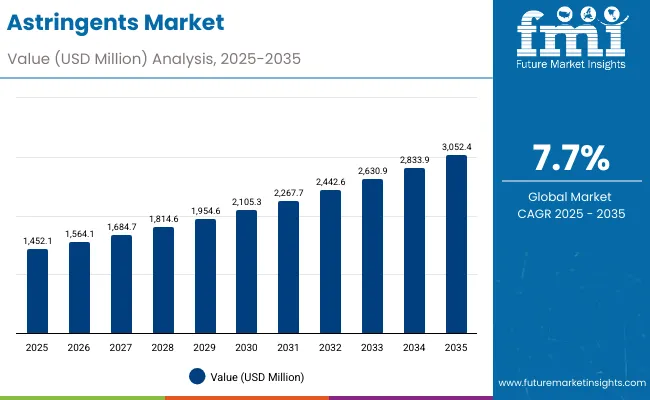

The Astringents Market is expected to record a valuation of USD 1,452.1 million in 2025 and USD 3,052.4 million in 2035, with an increase of USD 1,600.3 million, which equals a growth of more than 110% over the decade. The overall expansion represents a CAGR of 7.7% and more than a 2X increase in market size.

Astringents Market Key Takeaways

| Metric | Value |

|---|---|

| Astringents Market Estimated Value in (2025E) | USD 1,452.1 million |

| Astringents Market Forecast Value in (2035F) | USD 3,052.4 million |

| Forecast CAGR (2025 to 2035) | 7.7% |

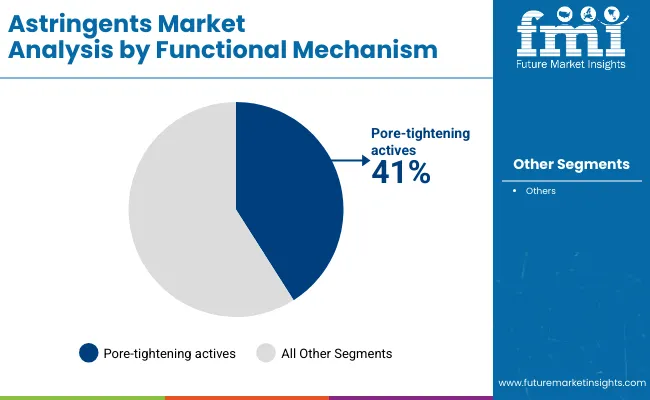

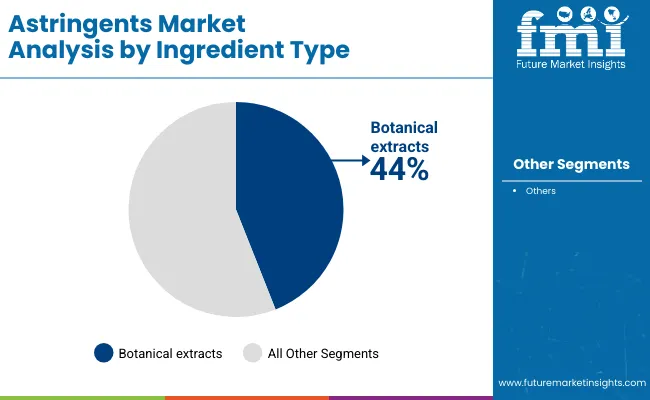

During the first five-year period from 2025 to 2030, the market increases from USD 1,452.1 million to USD 2,105.3 million, adding USD 653.2 million, which accounts for 41% of the total decade growth. This phase records steady adoption in skincare, men’s grooming, and cosmeceutical applications, driven by the rise of pore-refining and sebum-balancing products. Shorter product cycles and the popularity of over-the-counter facial toners and anti-acne cleansers reinforce the dominance of pore-tightening actives, catering to more than 41% of functional demand in 2025. Botanical extracts rise as a preferred option due to the global inclination toward plant-derived skincare actives, representing USD 638.9 million in sales in 2025.

The second half from 2030 to 2035 contributes USD 947.1 million, equal to 59% of total growth, as the market jumps from USD 2,105.3 million to USD 3,052.4 million. This acceleration is powered by the widespread adoption of cosmeceutical-grade astringents, encapsulated delivery systems, and hybrid formulations blending botanical and mineral-based actives. Premium body mists, men’s aftershaves, and advanced anti-acne gels see rapid traction as lifestyle shifts and higher skincare investments drive demand.

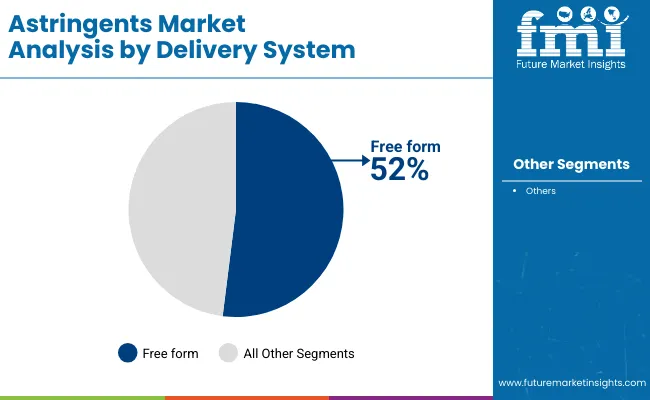

Encapsulated delivery systems and blended forms capture stronger interest as brands emphasize stability, controlled release, and compatibility with multifunctional formulations. By the end of the decade, encapsulated and blended formats account for nearly half the market share. At the same time, gel-based forms increasingly replace alcohol-heavy solutions, as consumers demand gentler and long-lasting application formats.

From 2020 to 2024, the Astringents Market grew steadily, supported by rising skincare product launches and increasing consumer awareness of pore care and sebum regulation. During this period, the competitive landscape was led by global ingredient manufacturers holding a combined over 30% share in functional actives, with companies such as Clariant, Givaudan, and Croda focusing on advanced botanical and mineral blends. Competitive differentiation relied on formulation stability, compatibility with cosmetic bases, and safety validation, while alcohol-based astringents declined in share due to consumer preference shifts toward gentler alternatives. Herbal-based extracts such as witch hazel and green tea distillates gained traction, positioning themselves as credible natural substitutes in mainstream skincare and grooming lines.

Demand for global astringents will expand to USD 1,452.1 million in 2025, and the revenue mix will shift as encapsulated and blended delivery systems rise to over 48% share by 2035. Traditional alcohol-based players face rising competition from botanical-driven brands offering clinically tested natural actives, microbiome-friendly solutions, and multifunctional pore-care innovations. Major suppliers are pivoting to hybrid portfolios, combining synthetic efficacy with natural-origin claims, to retain relevance in both premium cosmeceutical and mass-market grooming categories.

Emerging entrants specializing in encapsulation, AR/VR skin diagnostic compatibility, and dermatology-led cosmeceutical solutions are gaining share. The competitive advantage is moving away from singular raw material supply to end-to-end value chain integration, scalability of botanical sourcing, and science-backed consumer claims.

Advances in ingredient innovation and delivery formats have boosted the efficacy and safety profile of astringents, making them suitable for both mass-market and premium skincare. Pore-tightening actives dominate due to their direct impact on skin appearance, particularly in urban populations with higher exposure to pollutants and humidity that enlarge pores. Botanical extracts have gained preference as consumers seek plant-based, sustainable, and gentler alternatives to alcohol-heavy products.

Witch hazel distillates, green tea polyphenols, and chamomile actives are reshaping product formulations, aligning with the clean-label movement and consumer trust in natural ingredients. The rise of men’s grooming has also contributed significantly, with aftershaves and sebum-balancing cleansers finding adoption across emerging and mature markets.

Expansion of cosmeceuticals and hybrid beauty products has fueled further market momentum. With dermatology-backed claims and clinical validation becoming standard, encapsulated and blended delivery systems are gaining ground, ensuring long-lasting stability and consumer safety. The shift from solution/concentrate forms to gel bases aligns with consumer preference for comfort and mildness, especially in Asian markets.

The surge in skincare routines in China, India, and Japan, combined with demand for premium solutions in Europe and the USA, underpins sustained growth. Segment growth is expected to be led by pore-tightening actives, botanical extracts, and encapsulated formats, reflecting both functional efficacy and alignment with future consumer demand.

The Astringents Market is segmented by functional mechanism, ingredient type, delivery system, physical form, application, end use, and region. Functional mechanisms include pore-tightening actives, sebum-reducing actives, and skin-soothing & calming agents, reflecting diverse skin concerns driving product demand. Ingredient type spans botanical extracts, alcohol-based actives, witch hazel distillates, and mineral-based astringents, balancing natural and synthetic innovation. Delivery systems are classified as free form, encapsulated, and blended, highlighting the importance of formulation science and performance.

By physical form, the market includes solutions/concentrates, powders, and gel bases, catering to product diversity across applications. Applications cover facial toners, aftershaves, anti-acne cleansers, and body mists, linking to both skincare and grooming routines. End uses include skincare, men’s grooming, and cosmeceuticals, representing the crossover of consumer, clinical, and professional markets. Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, reflecting strong demand potential in both established and emerging economies.

| Functional Mechanism | Value Share% 2025 |

|---|---|

| Pore-tightening actives | 41% |

| Others | 59.0% |

The pore-tightening actives segment is projected to contribute 41% of the Astringents Market revenue in 2025, amounting to USD 595.36 million, maintaining its lead as the dominant functional mechanism. This leadership is driven by the increasing consumer emphasis on refined skin texture and reduced pore visibility, particularly in urban populations where pollution and humidity exacerbate skin issues. Brands have prioritized formulations featuring pore-refining ingredients that deliver visible results in facial toners, cleansers, and anti-acne products.

The segment’s strength is further reinforced by the rising availability of advanced botanical and mineral-based actives that not only minimize pores but also enhance overall skin health. With the surge in demand for multifunctional products, pore-tightening actives are being incorporated into hybrid cosmeceutical formulations, strengthening their long-term relevance. The adoption of clinical validation and dermatology-backed claims also plays a critical role in building consumer trust. This segment is expected to retain its position as the backbone of astringent formulations globally, particularly in skincare and men’s grooming.

| Ingredient Type | Value Share% 2025 |

|---|---|

| Botanical extracts | 44% |

| Others | 56.0% |

The botanical extracts segment is forecasted to hold 44% of the market share in 2025, representing USD 638.92 million in sales, led by its application in natural and sustainable skincare formulations. Botanical ingredients such as witch hazel distillates, chamomile, and green tea have become the cornerstone of modern astringent formulations, as consumers increasingly favor plant-based solutions over synthetic or alcohol-heavy alternatives. These extracts are valued for their multifunctional properties, offering pore-tightening, sebum-regulating, and soothing benefits within a single application.

The segment’s growth is also fueled by clean-label and sustainability trends, with consumers actively seeking products free from harsh chemicals and associated side effects. This has facilitated the widespread adoption of botanical extracts in both premium cosmeceuticals and mass-market skincare, bridging the gap between clinical efficacy and natural appeal. With ongoing research validating the safety and performance of plant-derived actives, the botanical extracts segment is positioned to continue its dominance, especially in Asia-Pacific and European markets where herbal and organic products have significant traction.

| Delivery System | Value Share% 2025 |

|---|---|

| Free form | 52% |

| Others | 48.0% |

The free form delivery system segment is projected to account for 52% of the Astringents Market revenue in 2025, equivalent to USD 755.09 million, establishing it as the leading delivery system type. Free form solutions remain popular due to their cost-effectiveness, formulation flexibility, and ease of integration across multiple product categories such as facial toners, aftershaves, and body mists. These formats allow manufacturers to maintain scalability and adaptability, catering to diverse consumer preferences without major processing complexities.

The dominance of free form is also supported by its compatibility with a wide range of ingredient types from alcohol-based actives to botanical extracts. However, rising innovation in encapsulated and blended delivery systems highlights a gradual market shift, as these advanced formats offer better stability, controlled release, and enhanced performance. Even so, free form delivery systems are expected to retain their leadership through 2030 due to their extensive presence in mass-market segments, before yielding gradual share gains to encapsulated formats in the premium cosmeceutical space. Their continued role as the foundation of astringent formulations makes them central to global market growth.

Rising penetration of cosmeceuticals bridging clinical and cosmetic care

The Astringents Market is increasingly shaped by the integration of cosmeceuticals products that combine pharmaceutical-grade efficacy with cosmetic appeal. Pore-tightening and sebum-regulating actives are being reformulated with encapsulated delivery systems, offering dermatology-backed claims that appeal to both doctors and consumers. For example, encapsulated botanical extracts allow for slower release and better stability, directly addressing consumer concerns about irritation from alcohol-based solutions. This convergence is particularly strong in markets like Japan, the USA, and Europe, where consumers demand evidence-based skincare. The push for medical-grade validation is driving new investments from top players such as DSM-Firmenich and BASF, fueling steady premiumization of the segment and pushing average selling prices upward.

Men’s grooming expansion beyond aftershaves into multi-functional skin toners

Historically, astringents were closely associated with aftershaves in men’s grooming. However, the category has now extended into multi-functional skin toners and anti-acne cleansers designed specifically for male consumers. Younger demographics in China, India, and South Korea are driving this demand, as men adopt multi-step skincare routines that were once dominated by women’s products. This is not only boosting pore-tightening actives but also creating new demand for botanical and mineral-based astringents that offer dual benefits of oil control and soothing. The men’s grooming driver is particularly important in Asia-Pacific, where men’s skincare is growing faster than women’s, helping the astringents category diversify its end-use base.

Decline in alcohol-based formulations due to safety and sensitivity concerns

One of the most significant restraints in the Astringents Market is the shrinking role of alcohol-based actives. Although once considered essential for quick pore tightening, these products are increasingly avoided due to associations with dryness, irritation, and long-term disruption of the skin barrier. Regulatory advisories and rising consumer awareness have accelerated this decline, particularly in mature markets such as North America and Western Europe. With alcohol-based astringents accounting for a substantial share of low-cost products, their decline challenges companies to either reformulate or risk revenue erosion. This shift places pressure on suppliers to replace alcohol actives with more expensive natural alternatives, raising production costs.

Uneven consumer education and cultural stigma in emerging markets

In markets like India and parts of Latin America, the penetration of advanced astringents is constrained by limited consumer education about product benefits beyond basic cleansing. While urban consumers are open to premium skincare, semi-urban and rural consumers often perceive astringents as "harsh" or unnecessary, partly due to earlier negative associations with alcohol-heavy solutions. This cultural barrier creates a lag in demand growth, despite high prevalence of oily skin and acne conditions. Bridging this education gap requires marketing investments and dermatology-led endorsements, which many mid-tier brands lack, slowing adoption outside urban centers.

Encapsulation technology transforming stability and efficacy

Encapsulation is emerging as a game-changer in the astringents market, especially for botanical and mineral actives. By embedding molecules within lipid or polymer shells, companies improve ingredient stability, enable controlled release, and reduce irritation risks. This is especially valuable for cosmeceutical positioning, where efficacy and safety must be clinically proven. Encapsulated witch hazel and green tea actives are gaining momentum in premium brands across Japan and Europe, and by 2030, encapsulated formats are expected to capture significant share from free form delivery. This trend also ties into sustainability, as encapsulation reduces the need for synthetic preservatives.

Shift from solution/concentrate to gel-based astringents

Consumer preference is shifting from traditional liquid or concentrate-based astringents toward gel-based formats. Gel bases are perceived as gentler, longer-lasting, and more compatible with multifunctional skincare routines. In Asia, gel-based astringents are being positioned as both hydrating and pore-minimizing, while in Europe, they are marketed as alcohol-free alternatives for sensitive skin. This trend is reinforced by the clean beauty movement, as gel formats allow brands to highlight "no alcohol, no irritation" claims. By 2035, gel formats are expected to lead growth within the physical form segment, reshaping how brands develop new product pipelines.

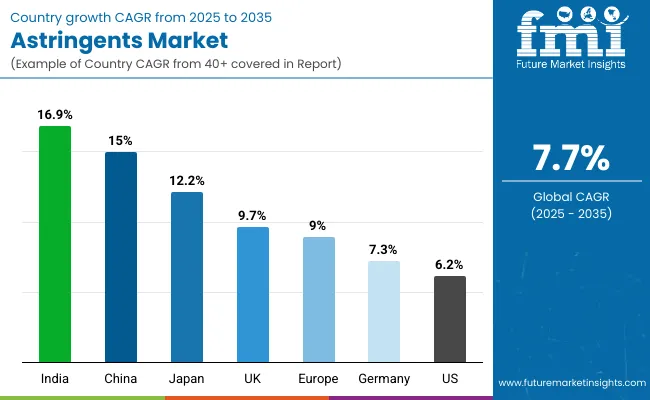

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 15.0% |

| USA | 6.2% |

| India | 16.9% |

| UK | 9.7% |

| Germany | 7.3% |

| Japan | 12.2% |

| Europe | 9.0% |

The country-wise outlook of the Astringents Market between 2025 and 2035 highlights sharp contrasts in adoption rates and consumer behavior. India emerges as the fastest-growing market with a CAGR of 16.9%, supported by its large young demographic base, high incidence of oily and acne-prone skin, and rapid expansion of affordable OTC skincare and grooming products. Domestic and international brands are capitalizing on herbal preferences by launching botanical and mineral-based astringents, often combined with traditional ayurvedic claims.

China, with a CAGR of 15.0%, follows closely, driven by the boom in cosmeceuticals and men’s grooming. Premiumization is particularly strong here, with urban consumers demanding encapsulated botanical actives and microbiome-friendly formulas. Japan, growing at 12.2%, reflects a distinct consumer inclination toward biotech-driven skincare with gel-based formats and clinically validated pore-minimizing solutions gaining momentum.

In contrast, mature Western markets are expanding at relatively modest but steady rates. The USA market grows at 6.2%, where consumer focus is shifting from alcohol-heavy solutions to dermatologist-backed botanical and mineral-based alternatives. Adoption is bolstered by the rise of men’s toners and aftershaves, though price sensitivity and competition from multifunctional skincare products cap growth. The UK at 9.7% and Germany at 7.3% reflect Europe’s balanced trajectory, where regulatory oversight and clean-label trends push innovation toward natural and encapsulated formats.

The broader Europe market, growing at 9.0%, benefits from cosmeceutical expansion and premium consumer positioning, though alcohol-based declines restrain overall value growth. Together, these regional dynamics demonstrate that while Asia-Pacific drives the highest growth momentum, Europe and North America remain critical for premium positioning and clinical validation of astringents.

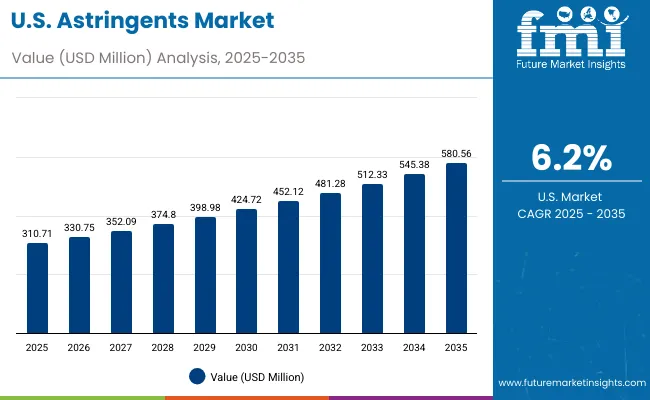

| Year | USA Astringents Market (USD Million) |

|---|---|

| 2025 | 310.71 |

| 2026 | 330.75 |

| 2027 | 352.09 |

| 2028 | 374.80 |

| 2029 | 398.98 |

| 2030 | 424.72 |

| 2031 | 452.12 |

| 2032 | 481.28 |

| 2033 | 512.33 |

| 2034 | 545.38 |

| 2035 | 580.56 |

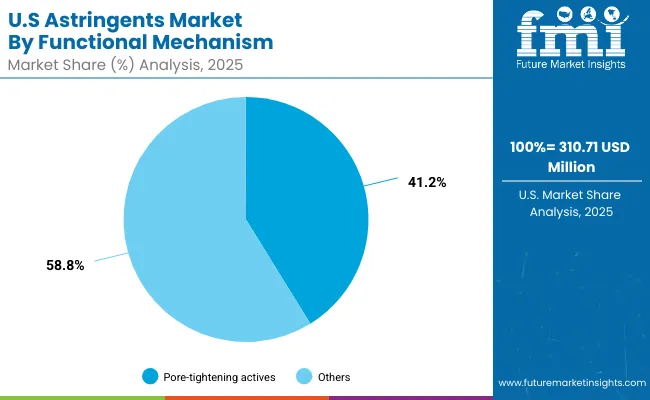

The Astringents Market in the United States is projected to grow at a CAGR of 6.2%, supported by increased consumer focus on skincare and men’s grooming. Pore-tightening actives dominate the USA segment, accounting for 41.2% of sales in 2025 (USD 128.0 million). Dermatologist-recommended formulations are driving premium demand, while mass-market brands continue to rely on cost-effective botanical and mineral-based alternatives. The healthcare-driven cosmeceutical segment, particularly in acne management, has also been a contributor to consistent growth.

The Astringents Market in the United Kingdom is expected to grow at a CAGR of 9.7%, reflecting consumer adoption of premium skincare and clean-label formulations. Botanical extracts and witch hazel-based solutions are the most widely used ingredients, given their natural positioning and alignment with UK consumers’ preference for herbal care. Demand is also expanding in men’s grooming, with aftershaves increasingly formulated with alcohol-free and soothing ingredients. Heritage cosmetic brands and niche cosmeceutical players are driving innovation in gel-based toners and microbiome-balancing formulas.

India is witnessing the fastest expansion in the Astringents Market, forecast to grow at a CAGR of 16.9% through 2035. Rapid urbanization and high prevalence of oily and acne-prone skin have made pore-tightening actives and anti-acne cleansers central to demand. Affordable OTC toners and herbal formulations dominate sales in tier-2 and tier-3 cities, while premium botanical and encapsulated formats are gaining popularity among metro consumers. The cultural affinity for ayurvedic and herbal solutions supports growth in botanical extracts, making India a stronghold for natural-origin astringents.

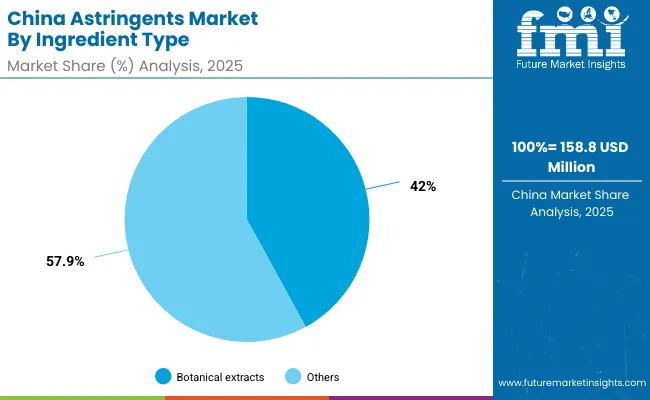

The Astringents Market in China is expected to grow at a CAGR of 15.0%, the second highest among major economies. Growth is being propelled by cosmeceutical adoption, men’s skincare expansion, and urban consumer preference for biotech-driven actives. Botanical extracts hold 42% of the market in 2025 (USD 66.9 million), reflecting consumer demand for natural but clinically validated solutions. China’s men’s grooming market is especially dynamic, with aftershaves and oil-control toners seeing double-digit growth. Local and international brands are investing in encapsulated delivery systems and alcohol-free gel-based formats to address consumer demand for gentler, high-efficacy skincare.

| USA By Functional Mechanism | Value Share% 2025 |

|---|---|

| Pore-tightening actives | 41.2% |

| Others | 58.8% |

The Astringents Market in the United States is valued at USD 310.71 million in 2025 and is projected to grow steadily to USD 580.56 million by 2035, reflecting a CAGR of 6.2%. Functional mechanisms are led by pore-tightening actives, which contribute 41.2% of revenues, equivalent to USD 128.0 million. This dominance stems from heightened consumer interest in pore-refining solutions, particularly in urban populations with higher exposure to pollutants and stress-related skin issues. The demand is supported by dermatology-backed toners and cosmeceutical formulations, which strengthen the credibility of these products.

Growth is also driven by the rise of men’s grooming, where alcohol-free aftershaves and sebum-control solutions are gaining popularity. American consumers are also shifting toward botanical and mineral-based astringents as safer, long-term alternatives to alcohol-heavy solutions. The competitive shift is visible in premium cosmeceuticals, where encapsulated delivery systems are gradually emerging but still secondary to free form and solution-based formats. With steady growth across skincare and grooming, the USA remains a stronghold for clinically validated, premium-positioned astringents.

| China By Ingredient Type | Value Share% 2025 |

|---|---|

| Botanical extracts | 42% |

| Others | 57.9% |

The Astringents Market in China is valued at USD 158.8 million in 2025 and is expected to record one of the fastest expansions globally with a CAGR of 15.0% through 2035. Ingredient types are led by botanical extracts, which account for 42% of demand, equivalent to USD 66.9 million. This reflects the strong consumer preference for herbal and natural actives, especially in skincare products targeting pore minimization and sebum control.

China’s growth is powered by the convergence of men’s grooming, cosmeceuticals, and premium skincare. Urban consumers in tier-1 cities are embracing encapsulated botanical actives and biotech-driven innovations, while domestic brands are scaling affordable free-form solutions for mass adoption. This dual-track growth allows both premium and mass-market players to thrive. With gel-based formats and microbiome-balancing products gaining traction, China is expected to surpass Europe in innovation-led growth momentum by 2030.

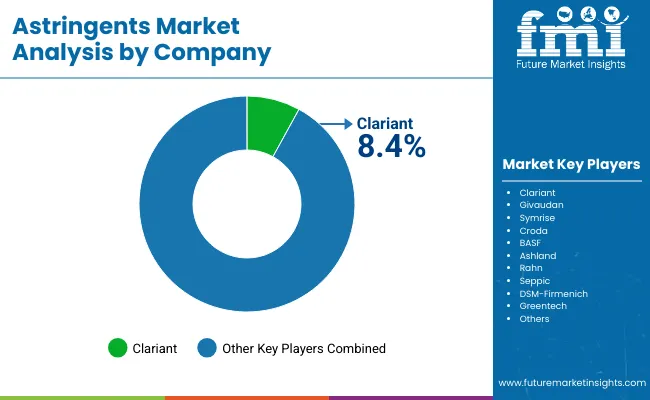

The Astringents Market is moderately fragmented, with multinational chemical suppliers, cosmeceutical ingredient specialists, and botanical-focused innovators competing for share. Clariant, with an 8.4% global market share, leads the space by focusing on multifunctional botanical and mineral-based actives tailored for skincare and cosmeceutical applications. Other leading global players include Givaudan, Symrise, Croda, BASF, Ashland, Rahn, Seppic, DSM-Firmenich, and Greentech, each leveraging unique strengths in natural-origin ingredients, encapsulation technologies, and dermatology-driven product validation.

Competitive differentiation is shifting away from single-ingredient supply toward complete ecosystems that integrate natural sourcing, advanced delivery formats, and clinical testing. Mid-sized players such as Rahn and Greentech emphasize specialization in clean-label botanical actives, while larger incumbents like BASF and DSM-Firmenich are investing in encapsulated delivery systems and cosmeceutical partnerships. Competitive intensity is further heightened by sustainability pressures, as ingredient suppliers are compelled to prove the traceability, safety, and performance of their actives. The market is expected to consolidate around suppliers that can balance scale, innovation, and clinical credibility, defining the next phase of global growth.

Key Developments in Astringents Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Functional Mechanism | Pore-tightening actives, Sebum-reducing actives, Skin-soothing & calming agents |

| Ingredient Type | Botanical extracts, Alcohol-based actives, Witch hazel distillates, Mineral-based astringents |

| Delivery System | Free form, Encapsulated, Blended |

| Physical Form | Solution/concentrate, Powder, Gel base |

| Application | Facial toners, Aftershaves, Anti-acne cleansers, Body mists |

| End Use | Skincare, Men’s grooming, Cosmeceuticals |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, China, India, Japan, Germany, United Kingdom, France, Brazil, Canada, South Africa |

| Key Companies Profiled | Clariant, Givaudan, Symrise, Croda, BASF, Ashland, Rahn, Seppic, DSM-Firmenich, Greentech |

| Additional Attributes | Dollar sales by functional mechanism, ingredient type, delivery system, and physical form; adoption trends in cosmeceuticals and men’s grooming; rising demand for botanical and alcohol-free formulations; software-like innovation vectors via encapsulation and controlled-release delivery; integration with AR/VR skin diagnostics and digital skin-twin routines; regional trends shaped by clean-label and microbiome-friendly claims; innovations in gel bases, witch hazel distillates, and mineral-based astringents; premiumization via clinical validation and dermatologist-backed claims. |

The Astringents Market is estimated to be valued at USD 1,452.1 million in 2025.

The market size for the Astringents Market is projected to reach USD 3,052.4 million by 2035.

The Astringents Market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in the Astringents Market are facial toners, aftershaves, anti-acne cleansers, and body mists.

In terms of delivery system, free form formats are set to command 52% share in the Astringents Market in 2025 (USD 755.09 million).

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA