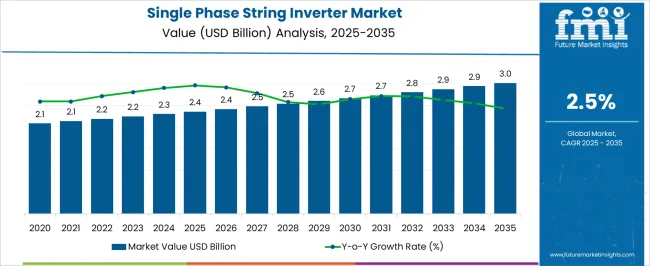

The Single Phase String Inverter Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 3.0 billion by 2035, registering a compound annual growth rate (CAGR) of 2.5% over the forecast period. The chart indicates a steady upward trajectory, though growth momentum remains modest compared to other renewable energy technologies. Early years of the forecast reflect gradual increases, with USD 2.5 billion in 2027 and USD 2.6 billion in 2028, before stabilizing around USD 2.7–2.8 billion through 2031. Toward the end of the forecast horizon, values approach USD 3.0 billion, suggesting incremental but sustained adoption.

The YoY growth rate exhibits fluctuations, with peaks around 2025–2026 and softening thereafter. This indicates an early adoption push followed by a more balanced phase where replacement cycles, grid upgrades, and cost-efficiency gains define the pace. Despite slower CAGR compared to storage or hybrid inverters, the segment continues to benefit from residential rooftop solar expansion, favorable government incentives, and advances in digital monitoring. Competitive pricing, integration with smart energy management, and compatibility with evolving solar modules also shape demand.

| Metric | Value |

|---|---|

| Single Phase String Inverter Market Estimated Value in (2025 E) | USD 2.4 billion |

| Single Phase String Inverter Market Forecast Value in (2035 F) | USD 3.0 billion |

| Forecast CAGR (2025 to 2035) | 2.5% |

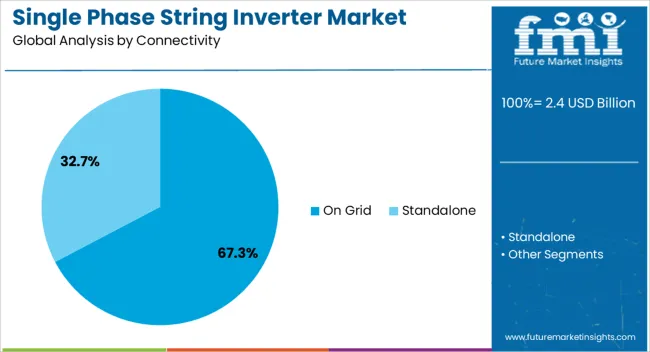

The single phase string inverter market is growing rapidly, driven by the increasing adoption of solar photovoltaic systems in residential settings. Industry developments and energy policy shifts have promoted on-grid solar installations due to their cost-effectiveness and ability to feed excess energy back to the utility grid.

The demand for reliable, efficient, and easy-to-install inverters has surged alongside rising awareness of renewable energy benefits and government incentives. Technological improvements in inverter design have enhanced system monitoring, connectivity, and energy conversion efficiency, making on-grid solutions more attractive for homeowners.

Furthermore, urbanization and the push for sustainable energy solutions have accelerated residential solar deployments globally. The market outlook remains positive, supported by smart grid integration and expanding solar infrastructure. Segment growth is expected to be led by on-grid connectivity and the residential application segment, reflecting the dominant drivers shaping the market.

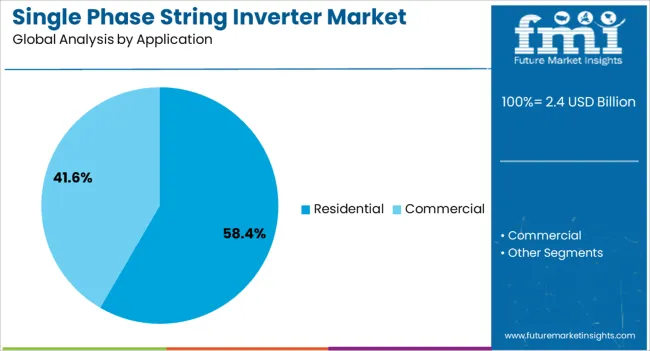

The single phase string inverter market is segmented by connectivity, application, and geographic regions. By connectivity, the single phase string inverter market is divided into On Grid and Standalone. In terms of application, the single-phase string inverter market is classified into Residential and Commercial. Regionally, the single phase string inverter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The On Grid connectivity segment is projected to hold 67.3% of the single phase string inverter market revenue in 2025, securing its leadership position. The widespread use of on-grid inverters is driven by their ability to efficiently connect solar power systems to the utility grid, allowing energy export during peak production periods.

This connectivity enables homeowners to reduce electricity costs and benefit from net metering policies. On-grid systems are preferred for their simplicity, lower installation costs, and the capability to synchronize with existing power infrastructure.

Moreover, advancements in grid-tied inverter technologies have improved system reliability and safety features, facilitating broader adoption. As governments worldwide continue to incentivize renewable energy integration, on-grid connectivity is expected to remain the dominant segment.

The Residential application segment is expected to account for 58.4% of the single phase string inverter market revenue in 2025, retaining its position as the leading application area. Growth in this segment is fueled by the rising interest of homeowners in adopting clean energy solutions to reduce utility bills and carbon footprints.

Residential solar systems benefit from the modularity and scalability of single phase string inverters, which suit typical household energy demands. Increased availability of financing options and government subsidies has also lowered barriers to adoption in residential markets.

Additionally, consumer awareness campaigns and advances in smart home technologies have encouraged more homeowners to invest in solar energy systems. As the demand for sustainable living grows, residential applications will continue to drive market expansion.

Single phase string inverters are advancing due to residential solar demand, policy support, competitive innovations, and hybrid integration. Their role in distributed generation continues to strengthen across global markets.

The single phase string inverter segment has been consistently strengthened by rising adoption in residential rooftop solar projects. These inverters are designed to convert direct current into alternating current at levels compatible with household electricity grids, making them a logical choice for homeowners. The increasing preference for distributed solar energy, encouraged by favorable policies such as net metering and government subsidies, has elevated their usage. Affordability compared to microinverters and ease of installation further reinforce their demand among small-scale solar system owners. Consumer awareness about energy independence has also contributed to higher installations. This shift toward localized energy generation ensures the single phase string inverter market maintains a strong base across residential applications worldwide.

Government policies and regulatory frameworks have acted as critical growth enablers for single phase string inverters. Many regions have introduced supportive rooftop solar programs, tax benefits, and zero-interest financing to accelerate solar penetration in households and small businesses. Such incentives have directly boosted the adoption rate of single phase solutions, which are well suited for distributed generation. Regulations promoting grid stability and decentralized electricity further enhance their deployment in suburban and rural settings. Compliance with international safety standards and evolving grid codes has also played a role in improving reliability and acceptance. This regulated environment not only encourages innovation in inverter design but also broadens the market base across different geographies.

Intensified competition among global and regional inverter manufacturers has shaped both pricing structures and technological performance of single phase string inverters. Companies are striving to deliver higher efficiency levels, smarter monitoring systems, and improved thermal management at reduced costs. This price-performance balance has created a favorable outlook for buyers seeking reliable yet cost-effective energy conversion systems. The market has witnessed increased focus on compact designs and user-friendly interfaces that appeal to household owners. Brand trust and distribution reach are also becoming major differentiators, with established players gaining an edge. As competition deepens, the overall market trajectory is being influenced by rapid product availability and consistent price reductions.

Integration of single phase string inverters with energy storage systems and emerging smart grid networks has emerged as a major driver of growth. Homeowners are increasingly opting for hybrid solar-plus-storage setups, which require compatible inverter solutions capable of managing both generation and storage flows. Advanced monitoring and communication features allow these inverters to interact with grid infrastructure, providing efficiency and reliability in decentralized networks. Their ability to balance power loads, support voltage control, and integrate with digital platforms has amplified adoption among energy-conscious consumers. With storage costs gradually declining, the role of single phase string inverters in hybrid applications is expected to expand significantly, reinforcing their long-term importance in renewable energy deployment.

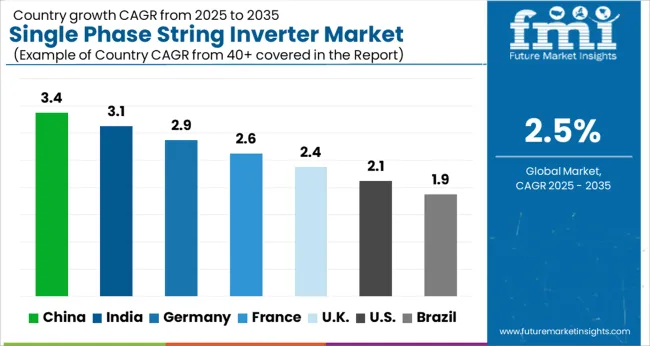

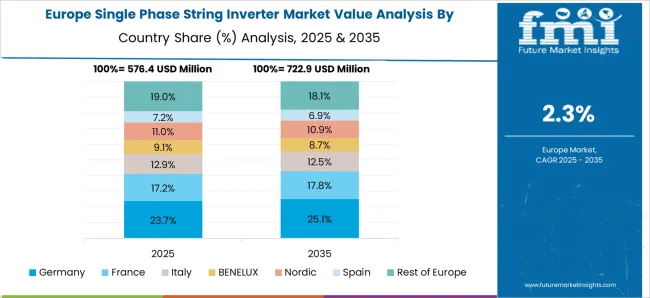

The single phase string inverter market is projected to expand globally at a CAGR of 2.5% from 2025 to 2035, with China leading at 3.4%, supported by extensive rooftop solar installations, favorable subsidy schemes, and strong adoption in residential projects. India follows at 3.1%, propelled by government-led solar programs, rural electrification drives, and increasing demand for cost-effective distributed power solutions.

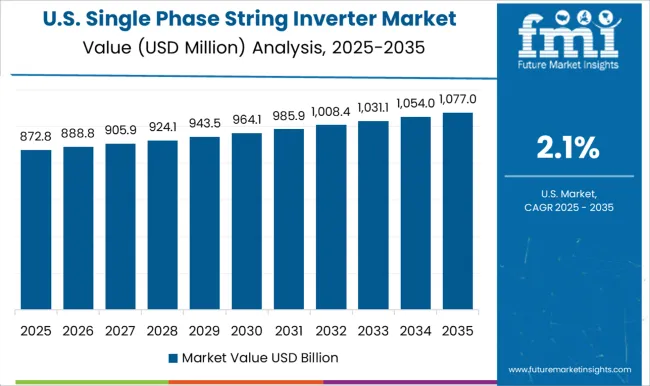

Germany records 2.9% growth, shaped by continued adoption of household solar arrays and regulatory measures for clean energy integration. France posts 2.6% CAGR, influenced by national solar targets and rising installation of compact rooftop systems. The UK shows 2.4% growth, supported by small-scale solar incentives, while the USA demonstrates 2.1%, reflecting a mature yet steadily growing residential rooftop solar landscape.

The CAGR for the single phase string inverter market in China was around 2.8% during 2020-2024 and improved to 3.4% in the 2025-2035 period. This growth has been shaped by extensive solar rooftop adoption, state-backed subsidy programs, and national targets for clean power integration. Rising household adoption of distributed energy systems has increased demand for reliable inverters. Government efforts to strengthen grid flexibility and smart energy distribution have supported strong installation volumes. Chinese manufacturers dominate the supply chain, which reduces costs and expands accessibility. This environment positions China as a leading contributor to global single phase string inverter demand.

The CAGR for the single phase string inverter market in India was about 2.6% during 2020-2024 and rose to 3.1% in the 2025-2035 period. This improvement has been driven by rural electrification programs, rooftop solar initiatives, and government-supported financing. Distributed solar has been encouraged in both rural and semi-urban areas, strengthening demand for small-scale inverter solutions. Local assembly operations and competitive pricing have ensured affordability. Supportive policies for residential solar ownership and awareness campaigns have further driven adoption. India’s energy transition efforts, coupled with consistent demand for reliable decentralized power, continue to expand the market footprint of single phase string inverters.

The CAGR for the single phase string inverter market in France was calculated at 2.1% during 2020-2024 and improved to 2.6% for 2025-2035. The increase reflects growing rooftop solar installations supported by favorable feed-in tariff policies and tax benefits. France has been encouraging energy decentralization, and residential systems benefit directly from this push. Awareness of grid stability and integration of digital monitoring features have accelerated inverter adoption. Competitive positioning of single phase models in the residential sector has ensured a steady market base. As more households participate in small-scale solar programs, the demand trajectory for these inverters has gained greater momentum.

The CAGR for the single phase string inverter market in the UK was 1.9% during 2020-2024 and rose to 2.4% in the 2025-2035 period, slightly above the global 2.5% average. This rise has been influenced by stronger adoption of small rooftop solar systems, net metering support, and gradual consumer preference for energy independence. Installers have been promoting compact, cost-effective inverters suitable for limited rooftop spaces. The UK has also emphasized regulatory compliance, which improved trust and reliability. Market expansion has been supported by growing hybrid adoption that combines rooftop panels with storage systems. As affordability improves, the country’s household inverter installations continue to gain ground steadily.

The CAGR for the single phase string inverter market in the USA was 1.7% during 2020-2024 and rose to 2.1% in 2025-2035. This improvement reflects consistent expansion of residential solar, supported by federal tax credits and state-level incentives. Consumers have preferred cost-effective inverter models for small rooftop projects. Reliability, ease of integration, and compatibility with smart home systems have been key adoption factors. Distribution networks and financing schemes have helped expand access to household users. Although the USA market is more mature than other regions, steady replacement demand, policy backing, and growing household electrification continue to strengthen inverter adoption across residential communities.

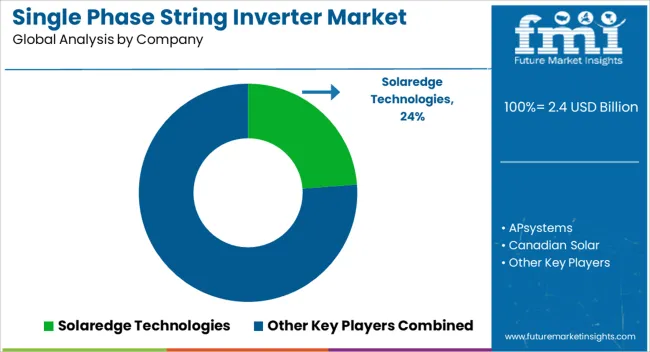

The single phase string inverter market is highly competitive, defined by the presence of global leaders and regional specialists offering advanced solar energy conversion technologies. Solaredge Technologies and Enphase Energy dominate with their extensive product portfolios, focusing on smart inverter systems with advanced monitoring and integration features for residential and small commercial applications.

APsystems and NingBo Deye Inverter Technology hold strong positions in multi-module and distributed inverter solutions, appealing to homeowners seeking flexibility and scalability. Canadian Solar and SUNGROW provide significant market strength through large-scale manufacturing capacity and broad distribution networks, ensuring affordability and global reach. Fronius International is recognized for high-efficiency inverters with robust durability and strong adoption across European markets. Huawei Technologies combines its electronics expertise with AI-enabled features, enhancing system optimization and grid interaction.

INVTSolar and UTL Solar carve out their roles in emerging economies, offering competitively priced solutions tailored to local rooftop installations. Competitive differentiation in this market is centered on efficiency rates, digital connectivity, compatibility with storage systems, and cost-to-performance balance. Companies are investing in compact designs, enhanced communication capabilities, and customer-centric service models to secure a larger footprint in the expanding residential and distributed solar sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 Billion |

| Connectivity | On Grid and Standalone |

| Application | Residential and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Solaredge Technologies, APsystems, Canadian Solar, Enphase Energy, Fronius International, Huawei Technologies, INVTSolar, NingBo Deye Inverter Technology, SUNGROW, and UTL Solar |

| Additional Attributes | Dollar sales, share, regional adoption trends, pricing benchmarks, competitor product portfolios, regulatory impact, storage integration demand, and distribution channel performance. |

The global single phase string inverter market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the single phase string inverter market is projected to reach USD 3.0 billion by 2035.

The single phase string inverter market is expected to grow at a 2.5% CAGR between 2025 and 2035.

The key product types in single phase string inverter market are on grid and standalone.

In terms of application, residential segment to command 58.4% share in the single phase string inverter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Single-channel Frequency Synthesizer Market Size and Share Forecast Outlook 2025 to 2035

Single-axis Drives Market Size and Share Forecast Outlook 2025 to 2035

Single Roller Cone Bits Market Size and Share Forecast Outlook 2025 to 2035

Single-use Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Single Board Computer Market Size and Share Forecast Outlook 2025 to 2035

Single-Serve Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Screw Extruder Market Size and Share Forecast Outlook 2025 to 2035

Single Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Single Axis Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Single-Mode Optical Fiber Market Size and Share Forecast Outlook 2025 to 2035

Single-Coated Medical Tape Market Size and Share Forecast Outlook 2025 to 2035

Single Superphosphate (SSP) Market Size and Share Forecast Outlook 2025 to 2035

Single-Photon Emission Computed Tomography Market Size and Share Forecast Outlook 2025 to 2035

Single Dose Detergent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Electron Transistor Market Size and Share Forecast Outlook 2025 to 2035

Single Colour Pad Printing Machines Market Size and Share Forecast Outlook 2025 to 2035

Single Portion Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Use Pallet Market Size and Share Forecast Outlook 2025 to 2035

Single Serve Coffee Container Market Size, Share & Forecast 2025 to 2035

Single Wall Jars Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA