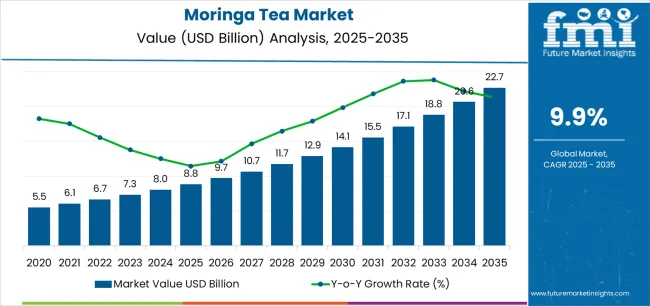

The Moringa Tea Market is estimated to be valued at USD 8.8 billion in 2025 and is projected to reach USD 22.7 billion by 2035, registering a compound annual growth rate (CAGR) of 9.9% over the forecast period.

The Moringa Tea market is experiencing robust growth, driven by increasing consumer preference for natural, plant-based beverages with health and wellness benefits. Rising awareness of antioxidant-rich and nutrient-dense products is supporting adoption across global markets. Organic certification is becoming a key factor in purchasing decisions, as consumers increasingly prioritize clean-label products free from pesticides and synthetic additives.

The market is also being shaped by growing demand for functional beverages that contribute to overall well-being, including digestive health, immunity support, and energy enhancement. Innovations in processing, packaging, and distribution are enhancing product shelf life and convenience, further encouraging consumption. Retail channels, e-commerce platforms, and health-focused specialty stores are enabling wider availability, increasing consumer access to high-quality Moringa tea.

As health-conscious lifestyles continue to grow, coupled with the expanding tea culture in emerging economies, the Moringa Tea market is expected to sustain long-term growth Investments in sustainable sourcing, ethical production practices, and educational marketing campaigns are further supporting market expansion.

| Metric | Value |

|---|---|

| Moringa Tea Market Estimated Value in (2025 E) | USD 8.8 billion |

| Moringa Tea Market Forecast Value in (2035 F) | USD 22.7 billion |

| Forecast CAGR (2025 to 2035) | 9.9% |

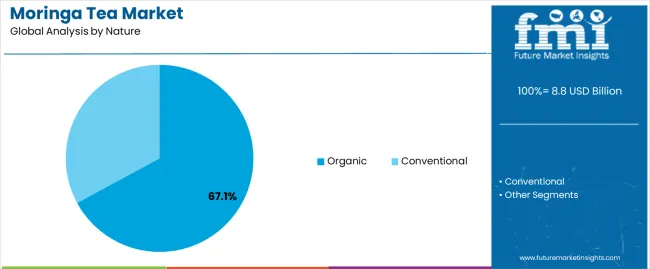

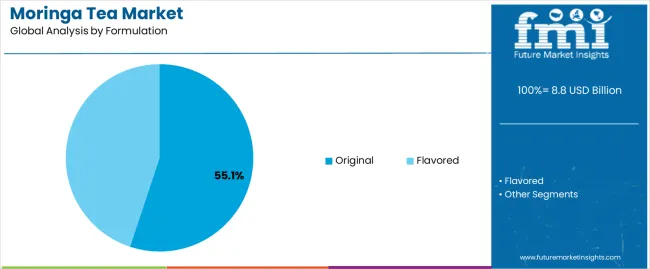

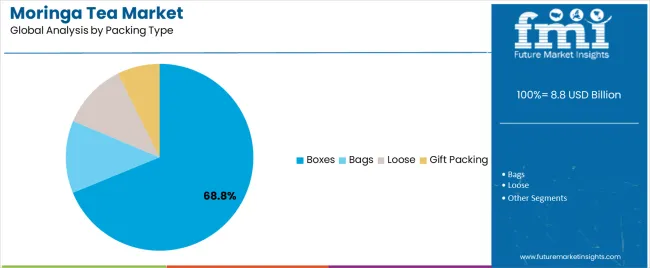

The market is segmented by Nature, Formulation, Packing Type, and Type and region. By Nature, the market is divided into Organic and Conventional. In terms of Formulation, the market is classified into Original and Flavored. Based on Packing Type, the market is segmented into Boxes, Bags, Loose, and Gift Packing. By Type, the market is divided into Crushed Leaves and Tea Infusion Bags. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The organic segment is projected to hold 67.1% of the Moringa Tea market revenue in 2025, establishing it as the leading nature category. Growth in this segment is being driven by increasing consumer demand for products that are natural, pesticide-free, and sustainably sourced. Organic Moringa tea is preferred for its perceived health benefits and alignment with wellness-oriented lifestyles.

The use of certified organic cultivation practices ensures consistency, quality, and traceability, which enhances consumer trust and loyalty. Retailers and e-commerce platforms are increasingly highlighting organic offerings, providing greater visibility and market penetration. Regulatory frameworks and certification standards are further reinforcing consumer confidence.

The segment’s growth is also supported by the premium pricing strategy, which aligns with the willingness of health-conscious consumers to invest in high-quality wellness products As lifestyle-driven consumption continues to rise, the organic nature segment is expected to maintain its leadership position, supported by increasing awareness of health benefits and sustainability practices.

The original formulation segment is expected to account for 55.1% of the market revenue in 2025, making it the leading formulation type. Growth is being driven by consumer preference for pure Moringa tea with minimal processing or added flavors. The original formulation offers authentic taste, maximum retention of nutrients, and high antioxidant content, making it attractive for wellness-conscious consumers.

Manufacturers are focusing on preserving the natural properties of Moringa leaves through advanced processing and quality control techniques. This segment also benefits from strong adoption among specialty tea consumers and health enthusiasts who seek unaltered botanical beverages.

Availability across retail and online channels, along with clear labeling emphasizing purity and origin, supports consumer trust and repeat purchases As the market for functional and natural beverages expands, the original formulation is expected to remain the dominant choice, reinforced by consumer preference for authenticity, health benefits, and consistent quality.

The boxes packing type segment is projected to hold 68.8% of the market revenue in 2025, establishing it as the leading packaging category. Growth in this segment is being driven by convenience, product protection, and enhanced shelf appeal. Box packaging facilitates easy storage, transport, and portion control while maintaining product quality and freshness.

The format is widely preferred by retailers and consumers for its stackability and professional presentation, which contributes to brand visibility. Sustainable and recyclable box materials are increasingly being adopted, aligning with growing consumer interest in environmentally responsible packaging.

The packaging also allows for clear labeling, branding, and marketing messages, which improve consumer awareness and trust As retail penetration and e-commerce adoption expand globally, the boxes packing type is expected to maintain its leading position, supported by consumer preference for convenience, durability, and premium presentation in the wellness beverage segment.

From 2020 to 2025, the moringa tea industry saw robust growth with a historical CAGR of 9.60%, facilitated by consumer awareness of its health aids and its traction as an organic medication. Demand for moringa tea thrusted as consumers transitioned toward healthier beverage alternatives.

For the period from 2025 to 2035, the growth is supposed to happen at a CAGR of 10.4%. Rising health consciousness is a significant propeller of the demand for the product. The increasing affordability of the tea variety, made possible by streamlining production methods, also enables greater sale.

| Attributes | Details |

|---|---|

| Market Value for 2020 | USD 6,978.80 million |

| Market CAGR from 2020 to 2025 | 9.60% |

The flourishing of moringa trees is confined to certain areas of the globe and even in those areas, the production may be seasonal. Thus, there are gaps in the supply of raw material to producers. This trend serves as a deterrent to the market.

Products made from moringa tea cost a bit more than those made from traditional tea leaves. This discourages price-conscious customers from consistently purchasing moringa tea, hampering the moringa tea market expansion.

The segmented market analysis of moringa tea shows that the boxes sector is leading the packaging type category, and the organic segment is commanding the nature category.

| Segment | Organic |

|---|---|

| Share (2025) | 67.1% |

Demand for natural and non-poisonous items has gone up leading to organic moringa tea becoming a favorite among health-conscious buyers. There is growing emphasis placed on greener agricultural practices, and organic farming methods used in cultivating moringa are well aligned with ecologically sound consumer preferences. Premium pricing prospects of organic moringa tea highlight its assumed value proposition, attracting the attention of a niche market segment that looks for quality products ethically sourced.

| Segment | Boxes |

|---|---|

| Share (2025) | 68.8% |

The quality and freshness of moringa tea leaves are sustained better in a box, which charms the customers. Retailers also prefer storing up boxes because of the ease of stackability, optimal shelf space usage, and expedited efficient inventory management.

The moringa tea market proliferation, which focus on the leading economies in the United States, Germany, China, Japan and India, can be observed in the subsequent tables. A comprehensive evaluation demonstrates that the United States has enormous moringa tea market opportunities.

| Nation | United States |

|---|---|

| CAGR (2025 to 2035) | 9.00% |

The United States moringa tea leaves market encountered robust growth amplified by health-conscious consumers, focusing on natural and organic products. The escalating consciousness about sustainable products intensifies the demand among carbon-neutral consumers in the United States.

The myriad culinary landscape in the United States proffers opportunities for moringa tea in various beverages and foods, strengthening the moringa tea industry. The market tactics emphasize the nutritional worth and its antioxidant properties which are the essential catalysts enticing health-conscious consumers in the United States.

| Nation | Germany |

|---|---|

| CAGR (2025 to 2035) | 8.10% |

Germany's market is bolstered by a strong tradition of herbal remedies, moringa tea is taking by storm for its perceived health benefits and natural ingredients. The German market's concentrate on sustainability and ethical sourcing going well with Moringa tea's eco-safe production activities, boosting consumer choice.

Moringa tea's adoption as a beverage and an ingredient in conventional German cuisine is helping it proliferate in the country. Germans are also becoming more interested in plant-based products and alternative medicines, seeing demand enhance in Germany for the product.

| Nation | China |

|---|---|

| CAGR (2025 to 2035) | 5.30% |

The China moringa tea leaves market is thriving as urbanization rates are climbing in the country, leading to greater demand for packaged beverages. Like suppliers of other food products in the country, the moringa tea market distributors are increasing their online presence to register more sales.

China’s health and wellness sector is vast and with the therapeutic health benefits of the product, the industry is thriving in the country. Moringa tea producers are capitalizing on Chinese customers’ affinity for herbal teas and natural drugs and medications to increase revenue.

| Nation | Japan |

|---|---|

| CAGR (2025 to 2035) | 5.20% |

Because of its potential effects in curbing age-related diseases, Japan, which has a large population of old people, is now becoming more attentive to it. Immune-boosting properties it allegedly possesses make it quite popular in Japan that is aligned with the focus on preventive healthcare. This cultural preference for herbal medicines and traditional medicine makes the moringa tea leaves market stronger in Japan.

| Country | India |

|---|---|

| CAGR (2025 to 2035) | 4.20% |

The rising concerns over pollution and environmental degradation in India make customers seek organic alternatives for immune system boosting and detoxification purposes. In India’s vibrant food and beverage sector which favours premium and exotic ingredients, there are opportunities for growth of moringa tea as a luxury product.

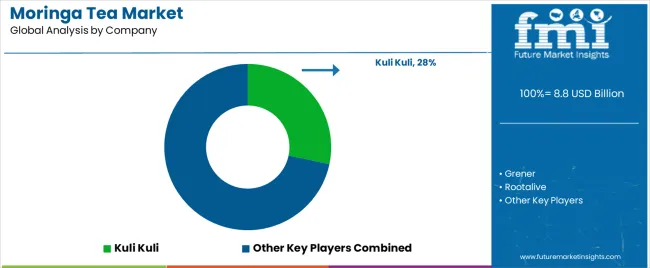

Several moringa tea vendors strive for market share. Kuli Kuli, Grener, Rootalive, Rainforest Herbs, and Ayuritz Phytonutrients Pvt. Ltd. are the dominant moringa tea producers at the forefront of the market. These moringa tea manufacturers have set themselves as the pathfinders, elevating innovation and setting distinct quality standards.

Kuli Kuli has earned a name for itself with its adoption of sustainable and responsible sourcing and manufacturing practices. Grener is pretty high-end with its quality teas. Rootalive has managed to carve a share of the pie for itself with its focus on organic ingredients. Rainforest Herbs has targeted sophisticated market with herbal teas and supplements. The enterprise brings its potent knowledge of botanicals into the sector to profit.

To aggrandize the competitive landscape, vendors of moringa Tea come up with individual strengths to strengthen sales and satisfy varied consumer demands. With time the market is maturing, thus these moringa tea suppliers are looking to pave the way forward through constant advancements and strategic market planning.

Prominent Enhancements and Inventions

| Company | Details |

|---|---|

| NEXE | NEXE Innovations declared XOMA Superfoods in January 2024 in response to the boosting needs of environmentally concerned and health-aware consumers. With the declaration of a new direct-to-consumer eCommerce platform, NEXE intends to amplify the quantity of products offered for online and subscription purchases. |

| MRSGI | The current CSR partnership between MRSGI and the moringa producers (GreenEarth Heritage Foundation) and Adlai (Kiboa Ridge Farms) was strengthened in December 2024. Through this collaboration agreement, MRSGI to give these small vendors access to a broader market by stocking their goods in certain Metro locations. |

| Green Provisions | Green Provisions' new moringa iced tea debuted in May 2024, is made with premium moringa leaves. This is a great iced tea that comes in a convenient bottle. |

| GNC Holdings, LLC | GNC Holdings, LLC launched in July 2020 that it designed to close up to 1,400 company-owned retail locations, most of which were found inside malls. |

The global moringa tea market is estimated to be valued at USD 8.8 billion in 2025.

The market size for the moringa tea market is projected to reach USD 22.7 billion by 2035.

The moringa tea market is expected to grow at a 9.9% CAGR between 2025 and 2035.

The key product types in moringa tea market are organic and conventional.

In terms of formulation, original segment to command 55.1% share in the moringa tea market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Moringa Oil Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Global Moringa Products Market Outlook – Trends, Demand & Forecast 2025–2035

Moringa Extract Market Analysis by Product Type, Form, End Use, Distribution Channel and by Region from 2025 to 2035

Tea Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Tear Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Tea Tree Oil Treatments Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tear-tab Lids Market Size and Share Forecast Outlook 2025 to 2035

Tea and Coffee Bags Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tea Infuser Market Analysis & Forecast by Material Type, Product Type, Distribution Store, and Region Through 2025 to 2035

Tea Packaging Market Size, Demand & Forecast 2025 to 2035

Teaseed Cake Market – Trends & Forecast 2025 to 2035

Tea-Based Skin Care Products Market Analysis by Product Type, Tea Type, Skin Type, Sales Channel and Region from 2025 to 2035

Competitive Breakdown of Tea Packaging Providers

Teabag Envelope Market Analysis based on Material Type, End Use, and Region through 2025 to 2035

Teak Decking Market Growth Analysis by Grade, Application and Region: Forecast for 2025 and 2035

Market Share Distribution Among Tea Packaging Machine Manufacturers

Market Share Breakdown of Leading Tear-Tab Lids Manufacturers

Competitive Breakdown of Tear Tape Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA