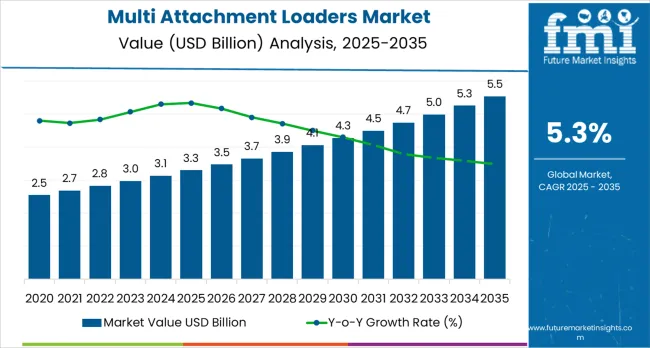

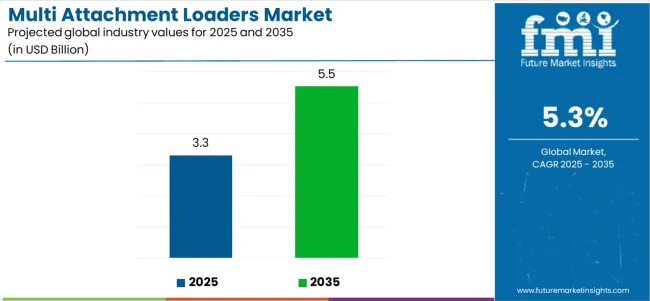

The multi attachment loaders market is projected to expand from USD 3.3 billion in 2025 to USD 5.5 billion by 2035, advancing at a 5.3% CAGR and adding USD 2.2 billion in new revenue. Growth is anchored in global infrastructure development, rapid mechanization of agriculture, and the shift toward versatile equipment that can perform multiple tasks with a single base machine. Between 2025 and 2030, the industry reaches USD 4.4 billion, accounting for 42.3% of decade growth as contractors and farmers replace single-purpose machines with multi-functional platforms. The remaining 57.7% growth through 2035 reflects rising adoption of hybrid, electric, and telematics-enabled systems designed for higher productivity and lower operating costs.

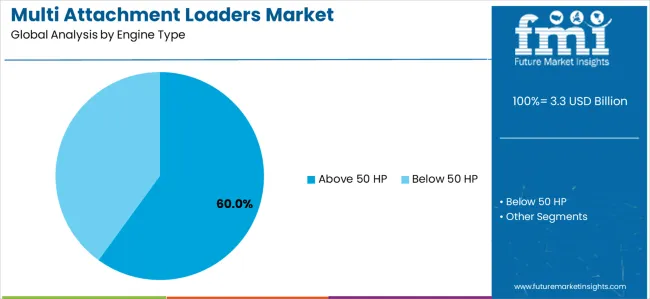

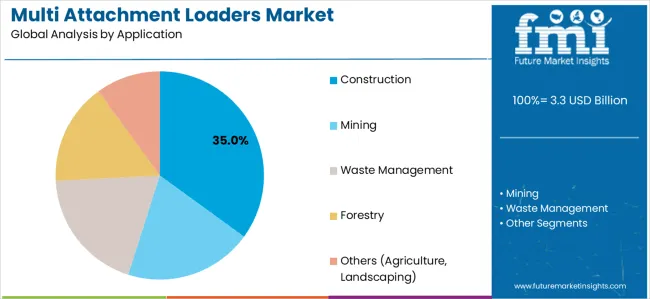

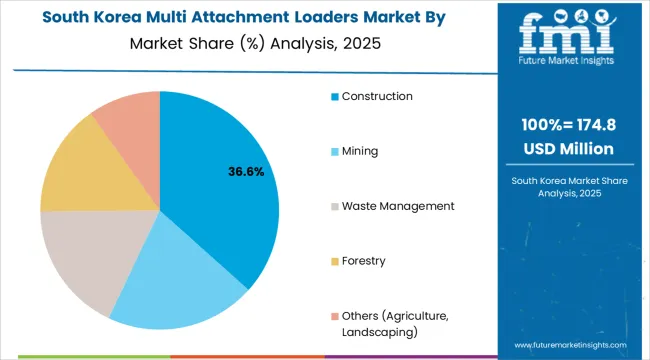

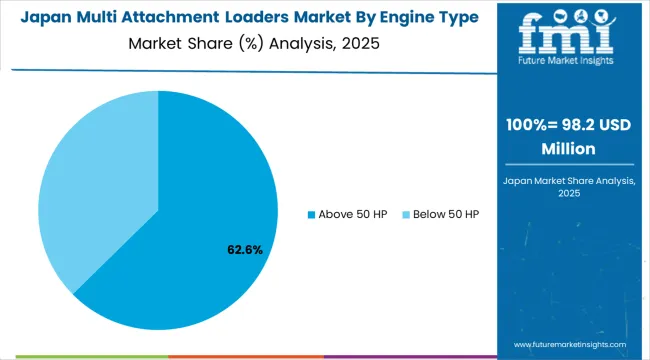

The above 50 HP segment leads with 60% market share, driven by demand in heavy construction, mining, and large farm operations where higher torque, duty cycle capacity, and attachment compatibility influence equipment selection. Compact units below 50 HP continue to serve landscaping, municipal, and residential construction markets but grow at a slower pace. By application, construction dominates with 35% share, supported by global investment in transportation corridors, urban redevelopment, and utility infrastructure. Mining and waste management follow as operators modernize fleets and standardize equipment versatility across varied tasks.

Technological advancements are also contributing significantly to market expansion. Modern multi attachment loaders are increasingly equipped with improved hydraulic systems, enhanced lifting capacities, ergonomic cabins, telematics integration, and quick-attach mechanisms that reduce downtime between tasks. The development of electric and hybrid models is gradually emerging, driven by the global shift toward sustainability and the need for low-emission machinery in urban work environments. Additionally, digital monitoring systems that support predictive maintenance and fleet management are improving machine reliability and lifecycle efficiency.

The market faces challenges such as high initial investment costs and the need for regular maintenance of both the loader and its attachments. Smaller contractors or operators in cost-sensitive regions may find it difficult to invest in advanced models, particularly when multiple attachments are required. Additionally, improper maintenance or the use of incompatible attachments can reduce equipment performance, highlighting the need for operator training and standardized attachment systems.

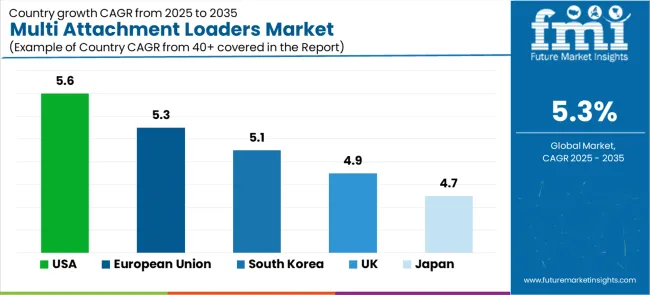

Regionally, the United States posts the fastest growth at 5.6% CAGR, supported by large-scale infrastructure programs and strong equipment financing availability. The European Union grows at 5.3%, driven by environmental compliance and modernization of construction fleets. South Korea, the United Kingdom, and Japan show steady uptake through automation initiatives and high-precision construction needs. Competitive dynamics concentrate around equipment versatility, attachment ecosystems, automation integration, and lifecycle service capabilities. Leading manufacturers—Caterpillar, Bobcat, Deere & Company, Kubota, and JCB—reinforce their advantage through expanded attachment portfolios, hybrid powertrains, and telematics-driven fleet optimization, while Komatsu, CNH Industrial, Hitachi Construction Machinery, Doosan, and Liebherr compete with specialized designs, regional customization, and advanced digital platforms.

Between 2025 and 2030, the multi attachment loaders market is projected to expand from USD 3.3 billion to USD 4.4 billion, resulting in a value increase of USD 1.1 billion, which represents 42.3% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for mechanization in agriculture and construction sectors, product innovation in hydraulic system technologies and automation features, as well as expanding integration with telematics and IoT solutions for enhanced operational efficiency. Companies are establishing competitive positions through investment in electric and hybrid loader platforms, advanced attachment compatibility systems, and strategic market expansion across construction, mining, and agricultural applications.

From 2030 to 2035, the market is forecast to grow from USD 4.4 billion to USD 5.5 billion, adding another USD 1.5 billion, which constitutes 57.7% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized loader systems, including advanced electric and autonomous formulations and intelligent control solutions tailored for specific industry requirements, strategic collaborations between equipment manufacturers and end-user industries, and an enhanced focus on operational efficiency and environmental compliance. The growing emphasis on automation in construction and agricultural operations and smart machinery integration will drive demand for advanced, high-performance multi attachment loader solutions across diverse industrial applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3.3 billion |

| Market Forecast Value (2035) | USD 5.5 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The multi attachment loaders market grows by enabling operators to achieve superior operational versatility and efficiency in diverse construction and agricultural applications, ranging from small-scale landscaping projects to large infrastructure development sites. Industrial and construction operators face mounting pressure to improve productivity and reduce labor costs, with advanced multi attachment loader solutions typically providing enhanced operational flexibility and equipment utilization compared to single-purpose machines, making versatile loading equipment essential for competitive operations. The construction industry's need for adaptable machinery creates demand for advanced loader solutions that can minimize equipment investment requirements, enhance operational efficiency, and ensure reliable performance across multiple application types. Government initiatives promoting infrastructure modernization and agricultural mechanization drive adoption in construction, mining, and farming applications, where operational versatility has a direct impact on project efficiency and cost-effectiveness. However, high capital investment requirements and the complexity of maintaining multiple attachment systems may limit adoption rates among smaller operators and developing regions with limited technical support infrastructure.

The market is segmented by engine type, application, and region. By engine type, the market is divided into below 50 HP and above 50 HP categories. Based on application, the market is categorized into mining, construction, waste management, forestry, and others (agriculture, landscaping). Regionally, the market is divided into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East &Africa.

The above 50 HP segment represents the dominant force in the multi attachment loaders market, capturing the largest market share in 2025. This advanced engine category encompasses systems featuring superior power characteristics, including enhanced load-bearing capacity and optimized performance capabilities that enable superior operational reliability and enhanced productivity characteristics. The above 50 HP segment's market leadership stems from its exceptional suitability for heavy-duty applications, with loaders capable of handling demanding construction and mining tasks while maintaining consistent performance and operational precision across challenging working conditions.

The below 50 HP segment maintains substantial market share, serving operators who require compact and maneuverable solutions for urban construction and landscaping applications. These loaders offer reliable performance for tight workspace operations while providing sufficient capability to meet standard requirements in residential projects and maintenance applications.

Key technological advantages driving the above 50 HP segment include:

Construction applications dominate the multi attachment loaders market with the largest market share in 2025, reflecting the critical role of versatile loading equipment in serving infrastructure development requirements and supporting project optimization initiatives. The construction segment's market leadership is reinforced by increasing urbanization trends, standardized equipment deployment procedures, and rising demand for operational efficiency that directly correlates with project completion timelines and cost management requirements.

The mining segment represents significant market opportunity, capturing substantial market share through specialized requirements for material handling operations, bulk excavation projects, and mineral extraction activities. This segment benefits from growing demand for high-performance equipment that meets stringent operational standards in demanding mining environments.

Key market dynamics supporting application growth include:

The market is driven by three concrete demand factors tied to industrial modernization and operational efficiency outcomes. First, global infrastructure development and construction industry expansion create increasing demand for versatile loading equipment, with aging infrastructure in developed countries and rapid urbanization in emerging markets requiring advanced machinery for maximum operational efficiency. Second, agricultural mechanization initiatives and productivity enhancement requirements drive the adoption of multi-functional loader technologies, with operators seeking attachment versatility and operational cost reduction through improved equipment utilization. Third, technological advancements in hydraulic systems and automation enable more effective and intelligent loader solutions that optimize operational performance while improving long-term reliability and cost-effectiveness.

Market restraints include high initial investment costs that can impact project economics and equipment acquisition decisions, particularly for smaller construction companies and agricultural operators with limited capital budgets for advanced machinery. Environmental regulations and emission compliance requirements pose another significant challenge, as meeting strict standards across different regions requires ongoing investment in clean technology solutions and regulatory compliance systems, potentially causing implementation delays and increased operational costs. Technical complexity in attachment integration and maintenance requirements create additional challenges for operators, demanding specialized training and technical support capabilities across diverse operational environments.

Key trends indicate accelerated adoption in emerging infrastructure markets, particularly in Asia Pacific and developing regions, where rapid construction growth and agricultural modernization drive comprehensive loader system development. Technology advancement trends toward electric and hybrid powertrains with enhanced automation features, remote monitoring capabilities, and intelligent attachment management enable next-generation product development that addresses multiple performance requirements simultaneously. However, the market thesis could face disruption if alternative construction methods or significant changes in agricultural practices minimize reliance on traditional loader-based material handling solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.6% |

| European Union | 5.3% |

| South Korea | 5.1% |

| United Kingdom | 4.9% |

| Japan | 4.7% |

The multi attachment loaders market is gaining momentum worldwide, with the United States taking the lead thanks to extensive infrastructure development programs and government-backed construction modernization initiatives. Close behind, the European Union benefits from growing focus on advanced construction equipment and environmental compliance requirements, positioning itself as a strategic growth hub in the regional market. South Korea shows strong advancement, where integration of smart construction technologies strengthens its role in the East Asian industrial equipment supply chains. The United Kingdom is focusing on urban redevelopment projects and agricultural mechanization, signaling an ambition to capitalize on growing opportunities in equipment modernization markets. Meanwhile, Japan stands out for its precision engineering excellence in construction equipment applications, recording consistent progress in automation technology advancement. Together, the United States and European Union anchor the global expansion story, while the rest build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries;5 top-performing countries are highlighted below.

The United States demonstrates the strongest growth potential in the Multi Attachment Loaders Market with a CAGR of 5.6% through 2035. The country's leadership position stems from extensive infrastructure development projects, government-backed construction modernization programs, and aggressive agricultural mechanization targets, driving the adoption of advanced loader systems. Growth is concentrated in major construction regions, including Texas, California, Florida, and the Midwest, where construction companies and agricultural operators are implementing advanced loader solutions for enhanced operational performance and productivity optimization. Distribution channels through established equipment dealers and direct manufacturer relationships expand deployment across construction sites, agricultural facilities, and industrial processing centers. The country's infrastructure investment strategy provides policy support for advanced equipment adoption, including high-performance loader system implementation.

Key market factors:

South Korea's advanced construction industry demonstrates sophisticated implementation of multi attachment loader systems, with documented case studies showing efficiency improvements in infrastructure applications through optimized equipment solutions. The country's industrial infrastructure in major construction centers, including Seoul, Busan, Incheon, and Daegu, showcases integration of advanced loader technologies with existing construction systems, leveraging expertise in precision manufacturing and automation capabilities. Korean operators emphasize smart technology integration and operational efficiency, creating demand for high-performance loader solutions that support export competitiveness initiatives and regulatory requirements. The market maintains strong growth through focus on automation development and construction optimization, with a CAGR of 5.1% through 2035.

Key development areas:

The United Kingdom's market expansion is driven by diverse construction demand, including urban redevelopment in London and Manchester regions, infrastructure development in Scotland and Wales areas, and comprehensive construction modernization across multiple industrial sectors. The country demonstrates promising growth potential with a CAGR of 4.9% through 2035, supported by net-zero emission targets and regional construction development initiatives. British operators face implementation challenges related to environmental compliance requirements and technical standardization, requiring advanced loader solutions and regulatory alignment support. However, growing construction efficiency targets and automation competitiveness requirements create compelling business cases for loader system adoption, particularly in urban regions where operational efficiency has a direct impact on project competitiveness.

Market characteristics:

Japan's market leads in advanced precision applications based on integration with next-generation construction technologies and sophisticated automation applications for enhanced performance characteristics. The country shows solid potential with a CAGR of 4.7% through 2035, driven by infrastructure modernization programs and advanced manufacturing initiatives across major industrial regions, including Tokyo, Osaka, Nagoya, and Fukuoka. Japanese manufacturers are adopting advanced loader systems for technology development and precision construction applications, particularly in regions with urban mandates and advanced construction facilities requiring superior product differentiation. Technology deployment channels through established equipment distributors and direct manufacturer relationships expand coverage across construction sites and industrial facilities.

Leading market segments:

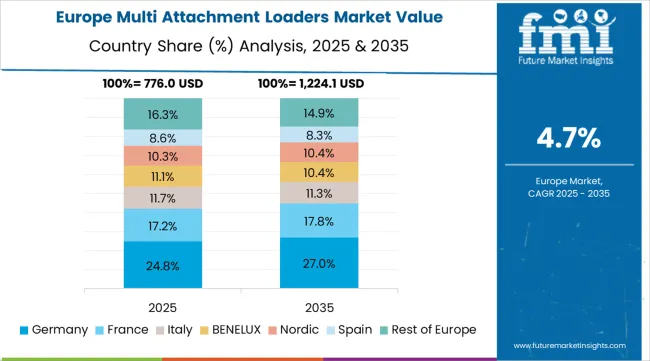

The multi attachment loaders market in Europe is projected to grow from USD 892.4 million in 2025 to USD 1,413.7 million by 2035, registering a CAGR of 4.7% over the forecast period. Germany is expected to maintain its leadership position with a 28.2% market share in 2025, declining slightly to 27.9% by 2035, supported by its extensive construction infrastructure and major industrial equipment centers, including Bavaria, North Rhine-Westphalia, and Baden-Württemberg manufacturing facilities.

France follows with a 18.4% share in 2025, projected to reach 18.7% by 2035, driven by comprehensive infrastructure development programs and advanced construction equipment initiatives implementing loader technologies. United Kingdom holds a 16.3% share in 2025, expected to maintain 16.1% by 2035 through ongoing urban redevelopment and agricultural modernization development. Italy commands a 14.2% share, while Spain accounts for 11.8% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 11.1% to 11.6% by 2035, attributed to increasing loader adoption in Nordic countries and emerging Eastern European construction projects implementing advanced equipment programs.

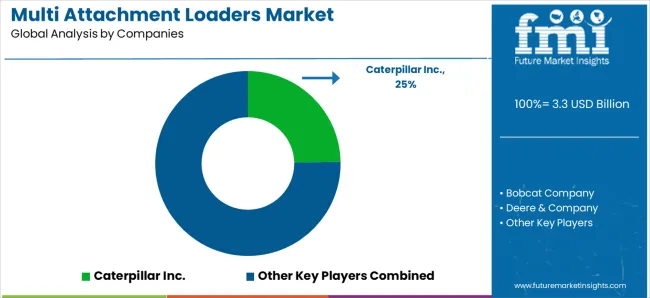

The multi-attachment loaders market consists of 12–16 major players, with the top five companies accounting for roughly 55–60% of global market share, supported by their broad equipment portfolios, strong dealer networks, and deep penetration in construction, agriculture, landscaping, and material-handling sectors. Competition centers on machine versatility, hydraulic performance, attachment compatibility, operator comfort, and aftersales service strength, rather than price alone. Caterpillar Inc. leads the market with an 25% share, driven by its robust loader platforms, extensive attachment ecosystem, and strong brand presence across infrastructure and industrial applications.

Other leading players such as Bobcat Company, Deere & Company, Kubota Corporation, and J.C. Bamford Excavators Ltd. (JCB) maintain dominant positions by offering highly adaptable loaders capable of handling a wide array of attachments including buckets, grapples, augers, trenchers, forks, and snow implements. Their engineering capabilities, advanced hydraulic systems, and superior operator interfaces enhance productivity and reduce operating costs for end users.

Challengers including CNH Industrial N.V., Komatsu Ltd., Hitachi Construction Machinery Co., Ltd., and Wacker Neuson SE focus on specialized loader categories, improved fuel efficiency, and region-specific variants tailored for agriculture, rental fleets, and compact construction markets. Additional competitors such as Doosan Infracore Co., Ltd., Liebherr Group, and Manitou Group strengthen their market position through strong European and Asian footprints, expanding attachment catalogs, and investments in electric and hybrid loader platforms to address emerging sustainability demands and evolving jobsite requirements.

Multi attachment loaders represent specialized construction and agricultural equipment that enable operators to achieve superior operational versatility and efficiency compared to single-purpose machines, delivering enhanced productivity and cost-effectiveness with advanced attachment compatibility in demanding industrial applications. With the market projected to grow from USD 3.3 billion in 2025 to USD 5.5 billion by 2035, these loader systems are projected to reach a billion at a 5.3% CAGR, offering compelling advantages such as enhanced operational flexibility, customizable attachment configurations, and reliable performance. This makes them essential for construction projects, agricultural operations, and industrial facilities seeking alternatives to inefficient single-purpose equipment that compromises productivity due to limited versatility. Scaling market adoption and technological advancement requires coordinated action across industrial policy, equipment standards development, loader manufacturers, end-user industries, and construction technology investment capital.

| Items | Values |

|---|---|

| Quantitative Units | USD 3.3 billion |

| Engine Type | Below 50 HP, Above 50 HP |

| Application | Mining, Construction, Waste Management, Forestry, Others (Agriculture, Landscaping) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East &Africa |

| Country Covered | United States, European Union, South Korea, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Caterpillar Inc., Bobcat Company, Deere & Company, Kubota Corporation, J.C. Bamford Excavators Ltd. (JCB), CNH Industrial N.V., Komatsu Ltd., Hitachi Construction Machinery Co., Ltd., Wacker Neuson SE, Doosan Infracore Co., Ltd., Liebherr Group, and Manitou Group |

| Additional Attributes | Dollar sales by engine type and application categories, regional adoption trends across Asia Pacific, North America, and Western Europe, competitive landscape with equipment providers and technology integrators, construction facility requirements and specifications, integration with construction automation and agricultural mechanization systems, innovations in loader technology and attachment systems, and development of specialized configurations with performance and versatility capabilities. |

The global multi attachment loaders market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the multi attachment loaders market is projected to reach USD 5.5 billion by 2035.

The multi attachment loaders market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in multi attachment loaders market are above 50 hp and below 50 hp.

In terms of application, construction segment to command 35.0% share in the multi attachment loaders market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Multi-Attachment Loaders Market - Size, Share, and Forecast 2025 to 2035

Multifunctional Loader Market Size and Share Forecast Outlook 2025 to 2035

Multipurpose Goods Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Multichannel Electrochemical Workstation Market Size and Share Forecast Outlook 2025 to 2035

Multi Colored LED Beads Market Size and Share Forecast Outlook 2025 to 2035

Multi-Drug/Combination Injectable Market Forecast and Outlook 2025 to 2035

Multiplex Sepsis Biomarker Panels Market Size and Share Forecast Outlook 2025 to 2035

Multiplex Protein Profiling Market Size and Share Forecast Outlook 2025 to 2035

Multihead Weighers Market Size and Share Forecast Outlook 2025 to 2035

Multi-Cloud Networking Market Forecast Outlook 2025 to 2035

Multispectral Camera Market Size and Share Forecast Outlook 2025 to 2035

Multi-functional Packaging Market Size and Share Forecast Outlook 2025 to 2035

Multiplex Biomarker Imaging Market Forecast and Outlook 2025 to 2035

Multichannel Order Management Market Forecast and Outlook 2025 to 2035

Multiexperience Development Platform Market Forecast and Outlook 2025 to 2035

Multi Depth Corrugated Box Market Size and Share Forecast Outlook 2025 to 2035

Multilayer Flexible Packaging Market Size and Share Forecast Outlook 2025 to 2035

Multi Pocket Holders Market Size and Share Forecast Outlook 2025 to 2035

Multi-Screen Super Glass Market Size and Share Forecast Outlook 2025 to 2035

Multichannel Reagent Reservoir Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA