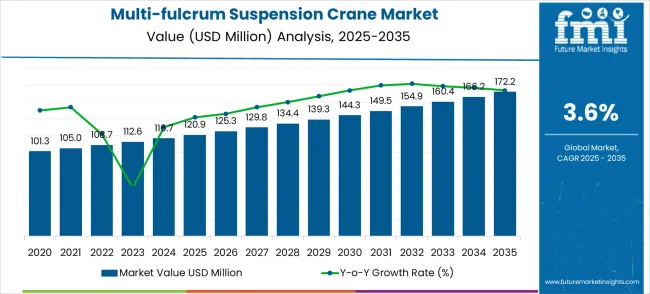

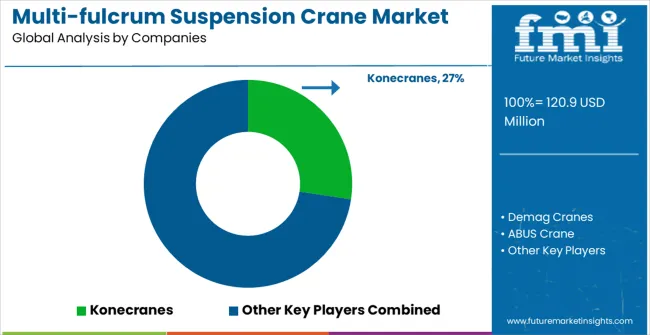

The multi-fulcrum suspension crane market is forecasted to grow from USD 120.9 million in 2025 to USD 172.2 million by 2035, representing a CAGR of 3.6%. The market demonstrates steady expansion with moderate growth momentum, reflecting incremental adoption across construction, industrial, and logistics sectors. In the initial phase from 2025 to 2027, the market increases from USD 120.9 million to USD 129.8 million, highlighting a period of gradual uptake. Early growth is driven by infrastructure modernization projects, mechanization of warehouses, and replacement of legacy crane systems. This phase lays the foundation for long-term revenue generation while establishing a baseline for incremental value across subsequent years.

From 2027 to 2030, the market reaches approximately USD 139.3 million, with momentum sustained by the integration of advanced load-handling technology and safety features in crane systems. Incremental growth in these years is supported by regional industrial expansion, including ports, factories, and high-rise construction projects, where precise material handling and efficiency improvements are critical. The moderate CAGR indicates a stable adoption curve, with market participants benefiting from long-term contracts and government-supported infrastructure development programs.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 120.9 million |

| Market Forecast Value (2035) | USD 172.2 million |

| Forecast CAGR (2025–2035) | 3.6% |

Between 2030 and 2033, the market rises to roughly USD 160.4 million, marking a phase of consistent incremental gains. The growth momentum in this period is reinforced by technological refinements, such as automation integration, real-time monitoring, and energy-efficient mechanisms. This period accounts for a substantial portion of the total market increase, signaling that market players are capitalizing on both replacement demand and new installations. The gradual acceleration during this phase emphasizes the reliance on steady industrial demand rather than rapid market spikes.

By 2035, the market attains USD 172.2 million, confirming a cumulative increase of USD 51.3 million over the decade. Growth momentum remains linear, with no significant volatility, reflecting market stability and predictable revenue trajectories. Companies focusing on performance optimization, service contracts, and regional penetration are likely to maximize value capture. The analysis highlights that while the market growth is moderate, the cumulative expansion over the decade presents a reliable and strategic opportunity for stakeholders seeking steady long-term returns in the multi-fulcrum suspension crane segment.

Market expansion is being supported by the increasing aerospace manufacturing activities across global economies and the corresponding need for specialized lifting equipment that provides precise positioning and flexible handling capabilities in complex assembly environments. Modern aerospace manufacturing requires sophisticated lifting systems that offer superior maneuverability and positioning accuracy while supporting diverse component handling requirements. The excellent versatility and precision characteristics of multi-fulcrum suspension cranes make them essential components in demanding manufacturing environments where accuracy and operational flexibility are critical.

The growing focus on manufacturing efficiency and workplace safety is driving demand for advanced lifting technologies from certified manufacturers with proven track records of reliability and safety performance. Industrial facilities are increasingly investing in specialized crane systems that offer improved operational efficiency and enhanced safety features over conventional lifting equipment. Safety standards and operational requirements are establishing performance benchmarks that favor precision-engineered suspension crane solutions with advanced positioning and control capabilities.

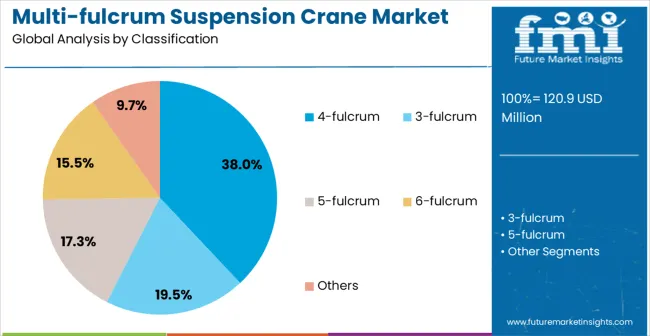

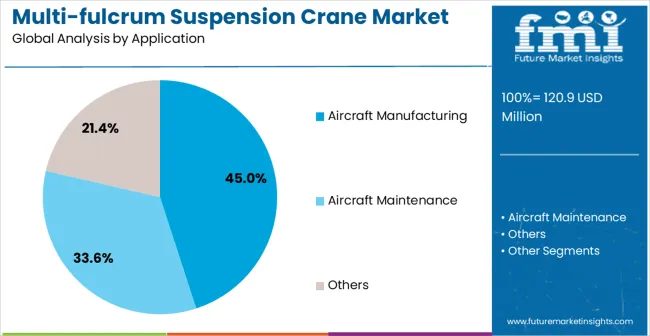

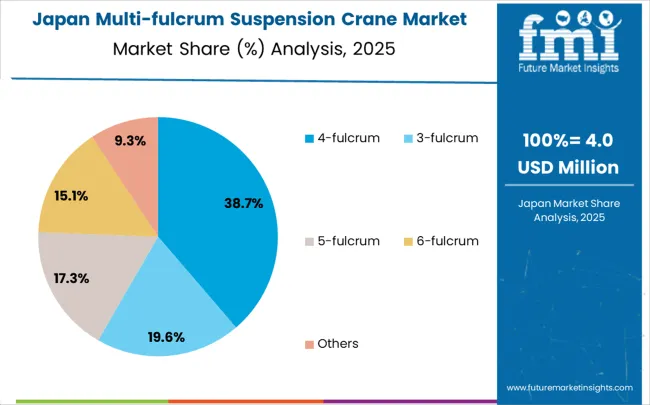

The market is segmented by crane type, application, and region. By fulcrum configuration, the market is divided into 3-fulcrum, 4-fulcrum, 5-fulcrum, 6-fulcrum, and other specialized configurations. Based on application, the market is categorized into aircraft manufacturing, aircraft maintenance, and other industrial applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

4-fulcrum suspension cranes are projected to account for 38% of the multi-fulcrum suspension crane market in 2025. This leading share is supported by the optimal balance between operational flexibility and structural stability that 4-fulcrum configurations provide in most industrial applications. 4-fulcrum cranes offer excellent maneuverability with sufficient load distribution, making them the preferred choice for aircraft assembly operations, component handling, and general manufacturing applications requiring precise positioning. The segment benefits from versatile application capabilities, proven reliability, and cost-effective operation that supports both aerospace and general industrial requirements.

Modern 4-fulcrum suspension cranes incorporate advanced control systems, precision positioning mechanisms, and sophisticated load management technologies that ensure optimal performance while maintaining operational safety and efficiency. These innovations have significantly improved positioning accuracy and operational reliability while reducing maintenance complexity through robust engineering design and user-friendly control systems. The aerospace manufacturing and maintenance sectors particularly drive demand for 4-fulcrum solutions, as these industries require dependable lifting systems that support diverse assembly operations without compromising precision or safety.

The general manufacturing and heavy industry sectors increasingly adopt 4-fulcrum suspension cranes for applications where operational flexibility and reliable performance are essential considerations. The integration of smart control systems and automated positioning capabilities creates opportunities for enhanced operational efficiency and reduced operator workload, further accelerating market adoption as facilities seek versatile yet precise lifting solutions.

Aircraft manufacturing applications are expected to represent 45% of multi-fulcrum suspension crane demand in 2025. This dominant share reflects the critical role of precision lifting equipment in aircraft assembly operations and the need for specialized crane systems capable of handling large, complex aircraft components with exceptional accuracy. Aircraft manufacturing facilities require advanced lifting systems for fuselage assembly, wing installation, engine mounting, and final assembly operations. The segment benefits from ongoing aerospace industry expansion globally and increasing production volumes for commercial and military aircraft programs.

Aircraft manufacturing applications demand exceptional precision and reliability to ensure assembly quality and operational safety across diverse aircraft types and production requirements. These applications require crane systems capable of handling variable component weights, maintaining precise positioning during assembly, and operating continuously in demanding manufacturing environments. The growing focus on aerospace production efficiency and quality assurance drives consistent demand for proven lifting equipment that demonstrates superior performance and safety characteristics. Major aerospace manufacturing centers in North America, Europe, and Asia-Pacific contribute significantly to market growth as aircraft producers invest in advanced manufacturing equipment to improve production capabilities and meet increasing aircraft demand.

The trend toward next-generation aircraft development and advanced manufacturing processes in aerospace operations creates opportunities for specialized crane systems equipped with enhanced automation and precision control capabilities. The segment also benefits from increasing commercial aircraft production and defense aerospace programs requiring sophisticated assembly equipment for complex aircraft manufacturing operations.

The multi-fulcrum suspension crane market is advancing steadily due to increasing aerospace manufacturing activities and growing recognition of precision lifting equipment importance in complex assembly operations. The market faces challenges including high initial equipment costs compared to conventional lifting solutions, specialized installation and maintenance requirements, and varying operational needs across different manufacturing applications. Standardization efforts and training programs continue to influence equipment adoption and operational efficiency optimization.

The growing deployment of IoT-enabled control systems and automated positioning technologies is enabling precise load handling and enhanced operational efficiency in multi-fulcrum suspension crane applications. Smart control interfaces and automated systems provide continuous monitoring of crane performance while optimizing positioning accuracy and operational safety. These technologies are particularly valuable for aerospace manufacturing facilities that require consistent precision and comprehensive operational data for quality assurance and process optimization.

Modern crane manufacturers are incorporating modular design approaches and application-specific configurations that optimize performance for particular manufacturing requirements while providing operational flexibility across diverse applications. Integration of customizable fulcrum arrangements and specialized lifting attachments enables precise handling capabilities and significant operational advantages compared to standard crane configurations. Advanced engineering and manufacturing techniques also support development of lightweight yet robust crane systems for demanding aerospace and industrial environments.

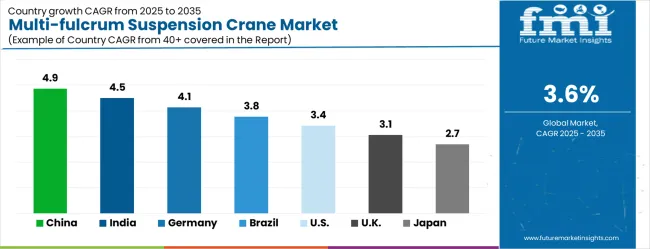

| Country | CAGR (2025–2035) |

|---|---|

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| Brazil | 3.8% |

| United States | 3.4% |

| United Kingdom | 3.1% |

| Japan | 2.7% |

The market is growing rapidly, with China leading at a 4.9% CAGR through 2035, driven by expanding aerospace manufacturing capabilities, growing industrial automation, and increasing investments in advanced manufacturing equipment. India follows at 4.5%, supported by rising aerospace industry development and growing demand for precision lifting equipment in manufacturing facilities. Germany records strong growth at 4.1%, focusing engineering excellence, quality standards, and advanced industrial manufacturing capabilities. Brazil grows steadily at 3.8%, integrating specialized lifting systems into expanding aerospace and industrial manufacturing operations. The United States shows moderate growth at 3.4%, focusing on aerospace manufacturing advancement and industrial equipment modernization. The United Kingdom maintains steady expansion at 3.1%, supported by aerospace industry development and advanced manufacturing programs. Japan demonstrates stable growth at 2.7%, focusing technological innovation and precision manufacturing excellence.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is expected to grow at a CAGR of 4.9% from 2025 to 2035, driven by rapid industrialization, large-scale infrastructure projects, and an increasing number of port and logistics operations. Multi-fulcrum suspension cranes are being adopted to meet the rising demand for high-capacity lifting, precise load handling, and enhanced safety in manufacturing, shipbuilding, and warehousing. Major industrial hubs such as Shanghai, Guangzhou, and Tianjin are witnessing high procurement rates due to the concentration of heavy industries, automotive assembly plants, and large warehouses. Domestic manufacturers are producing cost-effective and reliable models suitable for multiple industrial applications, while international suppliers are introducing advanced automated cranes with higher load capacities, enhanced safety features, and integration with digital monitoring systems. Government-supported infrastructure programs and export-oriented industrial projects are accelerating adoption across commercial and industrial sectors, ensuring long-term market growth.

India is projected to grow at a CAGR of 4.5% between 2025 and 2035, supported by the expansion of industrial clusters, heavy manufacturing facilities, and logistics networks. Adoption is concentrated in Maharashtra, Gujarat, and Tamil Nadu, where large-scale steel plants, shipyards, and warehouse facilities operate. Multi-fulcrum suspension cranes are increasingly used for lifting heavy components, improving operational efficiency, and ensuring workplace safety. Domestic manufacturers are providing cost-effective, durable, and flexible cranes for industrial operations, while international suppliers offer technologically advanced solutions with precise load management, automation, and monitoring features. The government-led push for infrastructure projects, including industrial corridors and port modernization, further reinforces adoption. Integration of these cranes into heavy manufacturing, shipping, and warehouse processes ensures operational efficiency and supports the long-term growth of the Indian market.

Germany is forecasted to expand at a CAGR of 4.1% between 2025 and 2035, driven by the automotive, aerospace, shipbuilding, and heavy machinery industries. Multi-fulcrum suspension cranes are required to support high-precision lifting, assembly, and material handling operations, particularly in export-oriented manufacturing units. Adoption is concentrated in Bavaria, Baden Württemberg, and North Rhine Westphalia, which host large-scale industrial complexes and research-intensive production hubs. German manufacturers are focusing on precision-engineered cranes that integrate with automated production lines and digital monitoring systems, while international suppliers provide specialized models capable of handling ultra-heavy loads. Strong focus on operational safety, efficiency, and compliance with industrial standards ensures steady demand, while export-driven production further reinforces procurement of advanced cranes for both domestic and international applications.

Brazil is expected to grow at a CAGR of 3.8% between 2025 and 2035, influenced by industrial expansion in steel, shipbuilding, logistics, and port operations. Adoption of multi-fulcrum suspension cranes is concentrated in São Paulo and Rio de Janeiro, where heavy industries and warehouses require precise and reliable lifting solutions. Domestic manufacturers are producing durable, cost-efficient cranes suitable for large-scale operations, while international suppliers offer automated and high-capacity systems with enhanced safety features. Infrastructure development projects, such as industrial park expansions and port modernizations, are reinforcing demand. Integration of cranes into industrial operations, shipping, and warehousing processes improves operational efficiency, reduces manual handling, and ensures compliance with safety standards, supporting long-term market growth.

The United States is projected to grow at a CAGR of 3.4% between 2025 and 2035, driven by industrial manufacturing, logistics, and port operations requiring efficient high-capacity lifting solutions. Adoption is concentrated in California, Texas, and New York, where automotive plants, shipyards, and warehouse facilities demand precise and reliable multi-fulcrum suspension cranes. Domestic manufacturers focus on operational safety, automation, and reliability, while international suppliers provide high-capacity cranes with advanced load monitoring, automated control systems, and remote operation features. Integration of cranes into industrial workflows enhances productivity and reduces manual labor risks. Federal and state infrastructure investments, along with expansion of industrial logistics networks, are contributing to steady adoption and reinforcing the long-term growth of the USA market.

The United Kingdom is forecasted to grow at a CAGR of 3.1% between 2025 and 2035, supported by industrial modernization, logistics expansion, and port infrastructure development. Adoption of multi-fulcrum suspension cranes is concentrated in London, Birmingham, and Manchester, where warehouses, manufacturing facilities, and shipyards require precise high-capacity lifting equipment. Domestic suppliers are producing flexible, reliable, and safe cranes for industrial use, while international suppliers are introducing automated and technologically advanced solutions for specialized lifting operations. Compliance with industrial safety regulations and operational efficiency requirements reinforces procurement. The increasing adoption of cranes for warehouse management, heavy machinery assembly, and port handling ensures steady market expansion across the country.

Japan is expected to grow at a CAGR of 2.7% between 2025 and 2035, influenced by advanced manufacturing, automotive assembly, and shipbuilding industries. Adoption is concentrated in Tokyo, Osaka, and Nagoya, where industrial plants and port facilities require precision, high-capacity lifting solutions integrated into automated production workflows. Domestic manufacturers focus on compact, reliable, and automated cranes, while international suppliers provide specialized models capable of handling extremely heavy components and complex lifting operations. Integration into industrial processes ensures efficiency, safety, and compliance with stringent operational standards. Continuous investments in industrial modernization, coupled with increasing automation in manufacturing and port logistics, maintain steady demand for multi-fulcrum suspension cranes across Japan.

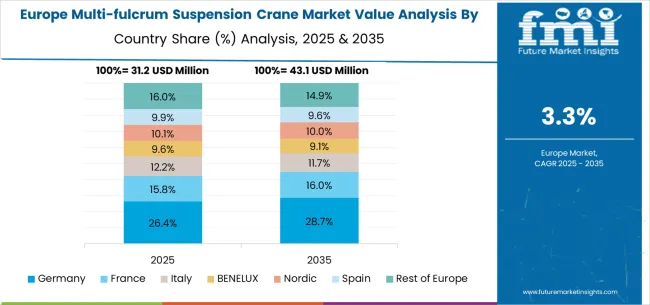

The multi-fulcrum suspension crane market in Europe is projected to grow from USD 32.6 million in 2025 to USD 46.4 million by 2035, registering a CAGR of 3.6% over the forecast period. Germany is expected to maintain its leadership with a 30.4% share in 2025, supported by its strong aerospace base and advanced manufacturing infrastructure. The United Kingdom follows with 18.7% market share, driven by aerospace industry development and advanced manufacturing programs. France holds 15.8% of the European market, benefiting from aerospace manufacturing expansion and industrial automation investments. Italy and Spain collectively represent 21.3% of regional demand, with growing focus on aerospace and industrial lifting applications. The Rest of Europe region accounts for 13.8% of the market, supported by manufacturing development in Eastern European countries and Nordic industrial sectors.

The market is defined by competition among established crane manufacturers, specialized lifting equipment companies, and regional industrial equipment suppliers. Companies are investing in advanced control technologies, precision engineering systems, safety enhancement features, and technical support capabilities to deliver reliable, accurate, and cost-effective lifting solutions. Strategic partnerships, technology development, and geographic expansion are central to strengthening product portfolios and market presence.

Demag Cranes, operating globally, offers comprehensive suspension crane solutions with focus on precision engineering, operational reliability, and technical support services. Konecranes provides advanced lifting systems with focus on automation integration and operational efficiency. ABUS Crane, specialized lifting equipment provider, delivers precision suspension crane technologies with focus on safety and performance reliability. Gorbel offers comprehensive crane solutions with proven industrial applications and customer support services.

Schmalz provides specialized lifting and handling equipment with focus on vacuum technology integration and industrial applications. Zasche Handling delivers precision lifting solutions with focus on aerospace and industrial applications. West Teli Intelligent Equipment offers advanced crane systems with automation and intelligent control capabilities. Henan Mining Crane provides comprehensive lifting equipment with regional manufacturing expertise.

KRC Crane, Nucleon Crane, Jianghe Crane, Oritcranes, Sinnone Crane, Hongsheng Crane, Arfa Cranes, Kunfeng Cranes, Dafang Heavy Machinery, Shandong Honfu Technology, and Changcheng Crane Equipment offer specialized crane manufacturing expertise, regional production capabilities, and technical support across global and regional industrial markets.

The market underpins manufacturing precision, aerospace production, industrial automation, and operational safety enhancement. With quality mandates, safety requirements, and demand for precision lifting solutions, the sector must balance cost competitiveness, operational performance, and technology advancement. Coordinated contributions from governments, industry bodies, manufacturers, research institutions, and investors will accelerate the transition toward precision-smart, automated, and safety-optimized lifting systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 120.9 million |

| Classification Type | 3-fulcrum, 4-fulcrum, 5-fulcrum, 6-fulcrum, Others |

| Application | Aircraft Manufacturing, Aircraft Maintenance, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | Demag Cranes, Konecranes, ABUS Crane, Gorbel, Schmalz, Zasche Handling, West Teli Intelligent Equipment, Henan Mining Crane, KRC Crane, Nucleon Crane, Jianghe Crane, Oritcranes, Sinnone Crane, Hongsheng Crane, Arfa Cranes, Kunfeng Cranes, Dafang Heavy Machinery, Shandong Honfu Technology, Changcheng Crane Equipment |

| Additional Attributes | Dollar sales by crane type and application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established crane manufacturers and emerging suppliers, buyer preferences for different fulcrum configurations and lifting capacities, integration with advanced control and automation technologies, innovations in precision positioning and safety enhancement for improved operational efficiency and workplace safety, and adoption of smart crane solutions with IoT connectivity and predictive maintenance capabilities for optimized manufacturing operations. |

The global multi-fulcrum suspension crane market is estimated to be valued at USD 120.9 million in 2025.

The market size for the multi-fulcrum suspension crane market is projected to reach USD 172.2 million by 2035.

The multi-fulcrum suspension crane market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in multi-fulcrum suspension crane market are 4-fulcrum, 3-fulcrum, 5-fulcrum, 6-fulcrum and others.

In terms of application, aircraft manufacturing segment to command 45.0% share in the multi-fulcrum suspension crane market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Suspension Bump Stopper Market Size and Share Forecast Outlook 2025 to 2035

Suspension & Retention Packaging Market

Air Suspension Systems Market Growth – Trends & Forecast 2025 to 2035

HCV Suspension System Market

Disc Suspension Porcelain Insulator Market Size and Share Forecast Outlook 2025 to 2035

Pure Suspension Cell Culture Medium Market Size and Share Forecast Outlook 2025 to 2035

Nano Suspension Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Suspension Seat Bases Market Growth - Trends & Forecast 2035 to 2035

Automotive Suspension System Market Growth - Trends & Forecast 2025 to 2035

Motorcycle Suspension System Market Growth - Trends & Forecast 2025 to 2035

Automotive Suspension Control Arms Market Growth – Trends & Forecast 2025 to 2035

Two Wheeler Suspension System Market Size and Share Forecast Outlook 2025 to 2035

Heel And Elbow Suspension Market Size and Share Forecast Outlook 2025 to 2035

Tablets for Oral Suspension Market Analysis Size and Share Forecast Outlook 2025 to 2035

Automotive Active Suspension System Market

Non-Sterile Liquids Suspensions Market Size and Share Forecast Outlook 2025 to 2035

Dual Air Chamber Hydro-pneumatic Suspension Market Size and Share Forecast Outlook 2025 to 2035

Single Air Chamber Hydro-pneumatic Suspension Market Forecast and Outlook 2025 to 2035

Crane Trucks Market Size and Share Forecast Outlook 2025 to 2035

Crane Cabin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA