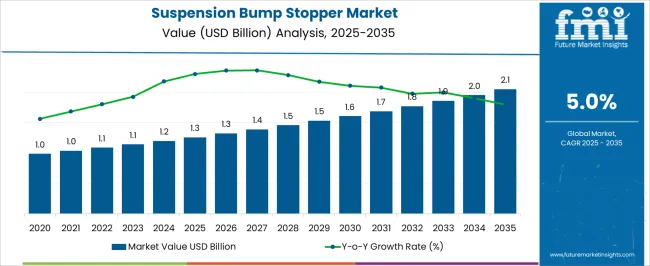

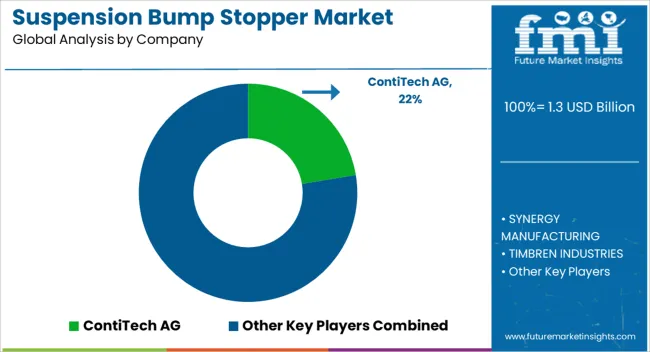

The Suspension Bump Stopper Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Suspension Bump Stopper Market Estimated Value in (2025 E) | USD 1.3 billion |

| Suspension Bump Stopper Market Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The Suspension Bump Stopper market is witnessing steady growth due to the increasing demand for enhanced vehicle safety, ride comfort, and durability across passenger and commercial vehicles. In 2025, the market is primarily driven by rising automotive production, modernization of suspension systems, and growing consumer preference for vehicles equipped with advanced safety features.

The adoption of suspension bump stoppers is being influenced by stricter safety and vehicle performance regulations, particularly in regions with high automotive manufacturing and sales. Technological advancements in materials and design have allowed bump stoppers to deliver better shock absorption, noise reduction, and vibration control, thereby extending vehicle lifespan and reducing maintenance costs.

Furthermore, increasing investment by original equipment manufacturers to integrate high-quality suspension components and meet customer expectations is supporting market expansion With the shift towards electric and hybrid vehicles, suspension bump stoppers are becoming more critical in managing dynamic loads and enhancing passenger comfort, making the market poised for continued growth over the coming decade.

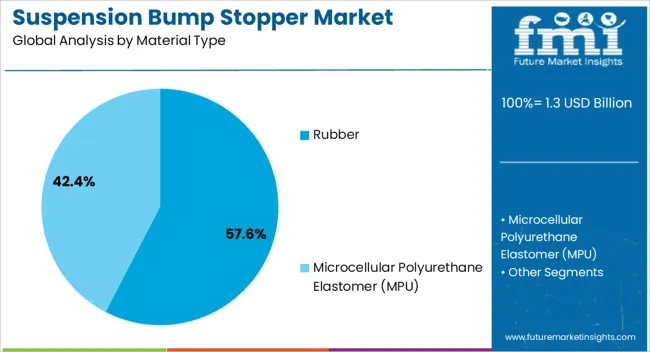

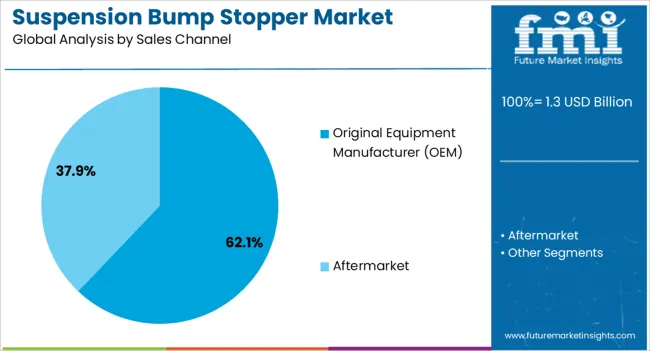

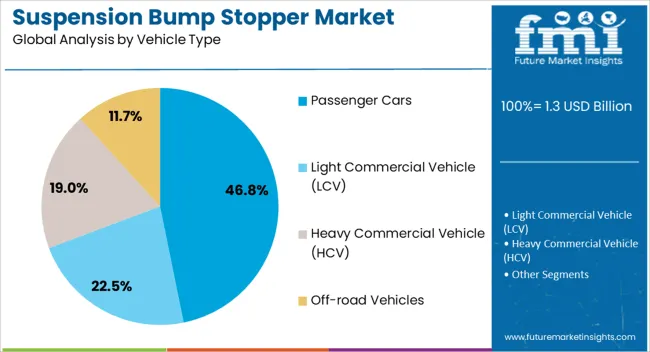

The suspension bump stopper market is segmented by material type, sales channel, vehicle type, and geographic regions. By material type, suspension bump stopper market is divided into Rubber and Microcellular Polyurethane Elastomer (MPU). In terms of sales channel, suspension bump stopper market is classified into Original Equipment Manufacturer (OEM) and Aftermarket. Based on vehicle type, suspension bump stopper market is segmented into Passenger Cars, Light Commercial Vehicle (LCV), Heavy Commercial Vehicle (HCV), and Off-road Vehicles. Regionally, the suspension bump stopper industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The rubber material type segment is projected to hold 57.60% of the Suspension Bump Stopper market revenue share in 2025, making it the leading material category. This dominance is being driven by rubber’s inherent elasticity, durability, and superior shock absorption capabilities, which are essential for protecting suspension systems and improving ride comfort. Rubber bump stoppers can effectively dampen vibrations and resist wear and tear under varying driving conditions, making them suitable for a wide range of passenger vehicles.

The high adaptability of rubber to extreme temperatures and mechanical stress has facilitated widespread adoption across both passenger and commercial vehicle applications. Additionally, manufacturing processes for rubber components have become cost-efficient, supporting large-scale production without compromising performance.

As automotive manufacturers increasingly prioritize long-term vehicle reliability and passenger safety, rubber bump stoppers are being favored for their consistent performance and ease of integration into modern suspension systems Future growth is expected to continue as vehicles demand materials that combine resilience with long service life and minimal maintenance requirements.

The Original Equipment Manufacturer (OEM) sales channel is anticipated to capture 62.10% of the total Suspension Bump Stopper market revenue in 2025, establishing it as the primary distribution route. This segment’s growth is being driven by the preference for directly installed suspension components during vehicle manufacturing, which ensures quality compliance, warranty coverage, and optimized system performance.

OEM channels are favored because they enable manufacturers to deliver fully tested and certified bump stoppers that meet precise vehicle specifications. Additionally, the integration of OEM components into assembly lines allows for cost-effective production planning, reduced logistical complexity, and streamlined post-sale maintenance.

The rising focus on vehicle safety standards and enhanced ride comfort has further reinforced the OEM channel’s significance, as manufacturers increasingly seek reliable, high-quality materials that perform consistently across different models With growing automotive production and expansion of passenger vehicle fleets globally, the OEM sales channel is expected to maintain leadership, supported by manufacturer preference for trusted, factory-installed components that deliver long-term reliability.

The passenger cars vehicle type segment is projected to account for 46.80% of the Suspension Bump Stopper market revenue in 2025, making it the dominant vehicle category. This leadership is being influenced by the high global production and sales of passenger vehicles, which require reliable suspension systems to ensure comfort, safety, and performance under diverse road conditions.

Passenger cars are increasingly equipped with advanced suspension technologies that rely on high-quality bump stoppers to absorb shocks, minimize vibrations, and prevent damage to the suspension assembly. The growing consumer expectation for smooth ride quality and reduced maintenance costs has contributed to the widespread adoption of suspension bump stoppers in this vehicle category.

Additionally, OEMs are integrating robust bump stopper solutions into standard and premium models to enhance ride comfort, cabin stability, and vehicle longevity As urbanization and vehicle ownership rise, particularly in emerging markets, the demand for passenger cars with improved suspension components is expected to support sustained growth of the segment, solidifying its leading position in the market.

The whole bunch of smaller systems and different parts working together comprises of the car suspension system. This suspension system runs the risk of bottoming up when hits rocky trails really hard, or during the slamming down of the vehicle to its limit with a lowering kit.

The bottoming up not only damages suspension components and axles, but also give on-board passenger's back a hefty dose of pain. Therefore, the introduction of suspension bump stopper with different designs are mounted in different places to absorb the shocks. Furthermore, suspension bump stopper adds an extra level of absorption when the shock reaches its limit when placed in line with the piston rods of the shocks.

The suspension bump stopper were conventionally and originally made up of rubber, with few companies still using it. But, microcellular polyurethane elastomer or MPU material exhibit high volume compressibility, excellent durability, and do not set easily. Furthermore, MPU are lighter than rubber, and maintain their flexibility at low temperature with exhibiting consistent performance over time.

Moreover, suspension bump stopper other than preventing suspension from bottoming out, acts as a powerful tuning tool to affect vehicle's handling and riding behavior. Furthermore, the suspension bump stopper also helps in controlling the balance at a limit and influencing the steady-state of the car.

Suspension bump stopper helps in improving the vehicle ride and thus protecting the suspension system from collisions and damage which is expected to drive the global suspension bump stopper market. Furthermore, the rising awareness amongst passengers for enhanced safety with more smooth drive to further augment the growth of the suspension bump stopper market.

The availability of suspension bump stopper in the market in different shapes and sizes to meet the desired application or use to attribute towards growth of the market over the forecast period. The application of new and advanced materials majorly MPU exhibit favorable properties for flexibility maintenance with enhanced performance of the vehicle.

Moreover, the installation of suspension bump stopper at the rear of the vehicle helps in managing, balancing, and supporting the extra load and thus maintaining a safe handling balance and level ride.

The suspension bump stopper are estimated to gain traction in the Asia Pacific region owing to significant demand expected from China, India, Japan, and Australia. Furthermore, the rising awareness to enhance safety related features in the vehicle, more comfort to the passenger among others to drive the growth of suspension bump stopper market in the region.

On the other hand, Europe, followed by North America is estimated to witness relatively steady growth during the forecast period. The significant vehicle fleet and steadily growing vehicle production in Europe and North America are expected to augment the growth of the suspension bump stopper market during the forecast period.

Moreover, Latin America and Middle East & Africa (MEA) regions are estimated to register significant growth during the forecast period owing to increasing production of commercial as well as passenger cars in the near future. Also, the increasing sales of luxury cars across the region is estimated to register substantial growth of suspension bump stopper with increasing consumer spending and demand for cars with advanced features. These factors are estimated to drive the global suspension bump stopper market.

Some of the participants in the global suspension bump stopper market are:

The research report on suspension bump stopper market presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated suspension bump stopper market data. It also contains projections using a suitable set of assumptions and methodologies. The suspension bump stopper market research report provides analysis and information according to market segments such as geographies, application, and industry.

The report on suspension bump stopper market is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The suspension bump stopper market report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The suspension bump stopper report also maps the qualitative impact of various market factors on suspension bump stopper market segments and geographies.

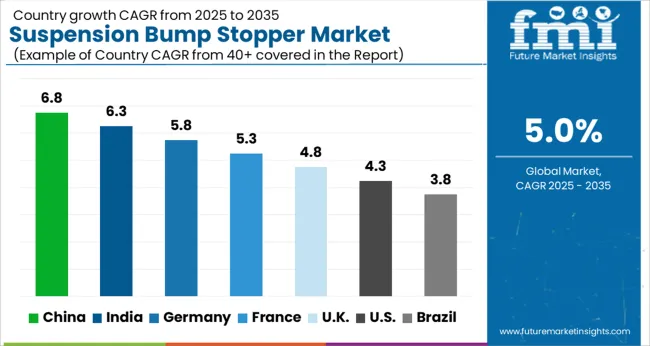

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The Suspension Bump Stopper Market is expected to register a CAGR of 5.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.8%, followed by India at 6.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.8%, yet still underscores a broadly positive trajectory for the global Suspension Bump Stopper Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.8%. The USA Suspension Bump Stopper Market is estimated to be valued at USD 462.2 million in 2025 and is anticipated to reach a valuation of USD 700.7 million by 2035. Sales are projected to rise at a CAGR of 4.3% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 63.1 million and USD 35.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Material Type | Rubber and Microcellular Polyurethane Elastomer (MPU) |

| Sales Channel | Original Equipment Manufacturer (OEM) and Aftermarket |

| Vehicle Type | Passenger Cars, Light Commercial Vehicle (LCV), Heavy Commercial Vehicle (HCV), and Off-road Vehicles |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ContiTech AG, SYNERGY MANUFACTURING, TIMBREN INDUSTRIES, Heinrich Eibach GmbH, RC Plast srl, FOX Factory, Inc., Keyser Manufacturing, THYSSENKRUPP BILSTEIN GMBH, and AL-KO |

The global suspension bump stopper market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the suspension bump stopper market is projected to reach USD 2.1 billion by 2035.

The suspension bump stopper market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in suspension bump stopper market are rubber and microcellular polyurethane elastomer (mpu).

In terms of sales channel, original equipment manufacturer (oem) segment to command 62.1% share in the suspension bump stopper market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Suspension & Retention Packaging Market

Air Suspension Systems Market Growth – Trends & Forecast 2025 to 2035

HCV Suspension System Market

Pure Suspension Cell Culture Medium Market Size and Share Forecast Outlook 2025 to 2035

Nano Suspension Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Suspension Seat Bases Market Growth - Trends & Forecast 2035 to 2035

Automotive Suspension System Market Growth - Trends & Forecast 2025 to 2035

Motorcycle Suspension System Market Growth - Trends & Forecast 2025 to 2035

Automotive Suspension Control Arms Market Growth – Trends & Forecast 2025 to 2035

Two Wheeler Suspension System Market Size and Share Forecast Outlook 2025 to 2035

Multi-fulcrum Suspension Crane Market Size and Share Forecast Outlook 2025 to 2035

Heel And Elbow Suspension Market Size and Share Forecast Outlook 2025 to 2035

Tablets for Oral Suspension Market Analysis Size and Share Forecast Outlook 2025 to 2035

Automotive Active Suspension System Market

Non-Sterile Liquids Suspensions Market Size and Share Forecast Outlook 2025 to 2035

Bumper Beam Market

Car Bumper Guard Market Size and Share Forecast Outlook 2025 to 2035

Smart Bumper Market Size and Share Forecast Outlook 2025 to 2035

Automotive Bumper Market Size and Share Forecast Outlook 2025 to 2035

Plunger Stopper Market Insights – Trends & Growth Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA