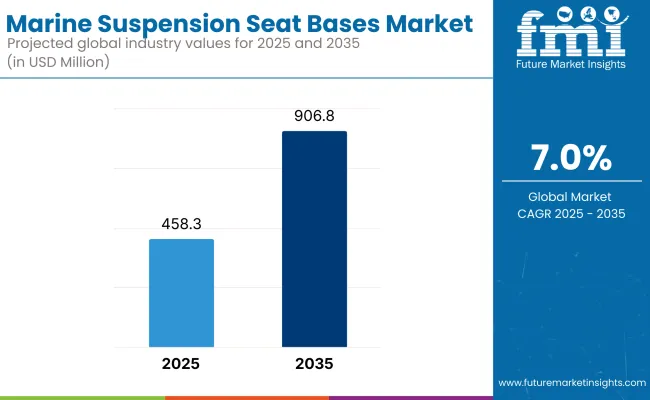

Increasing demand for comfort, safety, and ergonomic design will spur the growth of the marine suspension seat bases market around the world in the next decade. Following an estimate of USD 458.3 million worth in 2025, the marine suspension seat bases market is anticipated to reach USD 906.8 million by 2035 at a CAGR of 7%. The rising demand, being driven by the focus on reducing shock and vibrations for commercial and recreational marine applications, must be considered, as recent evidence suggests.

Marine suspension seat bases are built and designed specifically in a manner that they will absorb and dampen waves, vessel movement, and fast operations, thus providing safety and comfort for occupants. These special seats are extremely important in fast-response crafts, patrol boats, fishing vessels, offshore service vessels, and luxury yachts, where prolonged exposure to vibrations and shocks from waves can be fatiguing, cause injury, and diminish operator performance. So, it increasingly becomes clear that the demand for good seating solutions is realized alongside the increasing development of maritime activities worldwide.

The industry is chiefly driven by rising crew safety concerns and health regulations found in marine environments. For many years, sustained exposure to shocks from waves and high-frequency vibrations was believed to be the cause of lower back injuries and musculoskeletal disorders, resulting in a plethora of long-term health consequences for marine operators.

Consequently, maritime safety authorities in regions such as North America and Europe started either encouraging or mandating the installation of ergonomically optimized and shock-absorbing seating systems. This regulatory reinforcement is urging shipbuilders and fleet operators to consider marine suspension seat bases as a standard application in new vessels and retrofitting projects.

The recreation operational mode is another important pillar in the demand boost. The segment, which includes boating with yachts, speedboats, and sportfishing vessels, has shown a tendency to grow steadily around the world with increasing disposable incomes and lifestyle changes.

White and good manufacturers of boats are taking on marine suspension seats as a value addition to create comfort for and attract the attention of this demanding set of clients. Through manufacturing, design, aesthetic, and customization developments, the trend is enhanced further to combine functionality with high-end compatibility.

Technological innovation is yet another important driver. Further, manufacturers have been developing new suspension systems with better shock absorption, adjustability, and load-carrying capacity. With air-, hydraulic-, and mechanical-based suspension systems that utilize aluminum and marine-grade stainless steel construction as well as other lightweight and corrosion-resistant materials, these seats can offer extended life and versatility. The increasing prevalence of digital controls, height adjustability, and lumbar support features only increases their desirability across all segments.

On a regional basis, Europe and North America dominate the industry, supported by mature commercial fleets, strict labor-safety regulations, and a decent culture of recreational boating. In contrast, the Asia-Pacific region is anticipated to grow at an accelerated rate, driven by the growth in marine trade, naval modernization programs, and increasing coastal tourism across member nations such as China, Japan, Australia, and South Korea.

Market Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 458.3 million |

| Industry Value (2035F) | USD 906.8 million |

| CAGR (2025 to 2035) | 7% |

Indeed, the industry is growing as the commercial, military, and recreational sectors demand standards of comfort, shock absorption, and ergonomic safety. These seat bases are made with the intent to absorb the shocks created by waves and thereby reduce fatigue as well as injury risk to the power operators or passengers during extended or high-speed travel.

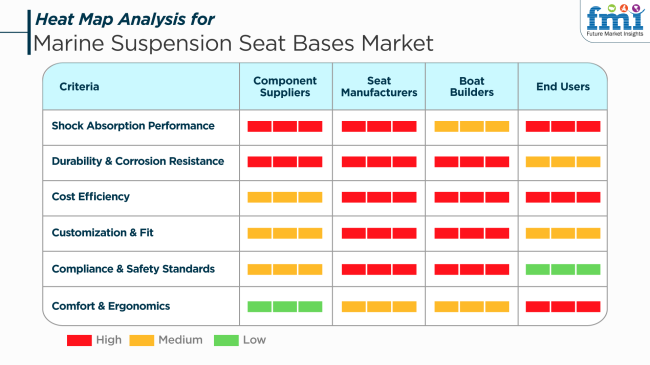

Component suppliers focus on developing materials and mechanisms, such as hydraulic or air suspension systems, that are superior in shock absorption and resistance to corrosion, which matters a lot for marine environments. The priority of seat manufacturers is to comply with safety, modularity, and cost-effective production rules, adhering to international marine standards and being adaptable to different types of vessels.

Boatbuilders emphasize durability, fit, and ease of integration when selecting seat bases designed to complement vessel design for long-term performance. End users, whether commercial operators or recreational boaters, care most about comfort, safety, and value for money (red), especially when operating in rough sea conditions or over long distances.

Factors driving this development have been a global increase in high-speed marine transport, defense naval upgrades, and the use of ergonomic safety solutions in workboats, patrol boats, and yachts. The expectation is that those improved conditions will lead to increased demand for an advanced suspension seating mechanism for North America, Northern Europe, and Asia-Pacific rough water operations as the climate intensifies and increases maritime activities.

From 2020 to 2024, the industry witnessed consistent growth as a result of a growing focus on occupant safety and comfort within marine boats. Factories such as SHOCKWAVE and Shoxs developed sophisticated suspension seating technology solutions designed for recreational and professional mariners.

For instance, SHOCKWAVE's S5 product line had a variety of suspension bases that reduce wave contact, thus boating becomes more comfortable for the clients. Similarly, Shoxs developed the 4800 model, a suspension seat that can be converted into a standing bolster, perfect for interceptors operated at high speeds and warships.

Forward to 2025 to 2035, the industry is projected to develop exponentially with growth fueled by technological advancements and evolving consumer behavior. Technology utilization, including the use of intelligent technologies like sensors that give immediate feedback on seat condition, is projected to increase user experience and safety.

In addition, the growing popularity of recreational boating and water sports is driving demand for advanced seating solutions that increase overall comfort and safety. Yet, factors such as high production costs linked to sophisticated suspension systems and poor awareness in the emerging industries could affect the rate of growth

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Focus on comfort and safety; compliance with regulations; technology advancements in suspensions. | Smart integration of technologies; increasing recreational boating; rising disposable incomes. |

| Utilization of high-performance materials; improved shock absorption mechanisms. | Development of adjustable suspension systems; real-time feedback systems; utilization of lightweight and robust materials. |

| High cost of production; requirement of fulfilling safety standards. | Sustained innovation to keep pace with changing safety requirements; balancing the cost of production with the use of cutting-edge technologies. |

| North America and Europe were the leaders due to tight safety regulations and heavy use of sophisticated marine technology. | Asia-Pacific to experience strong growth driven by increasing maritime tourism and investment in sea-based infrastructure. |

| Need for ergonomic and long-lasting seating solutions; enhanced demand for bespoke solutions. | Enhanced demand for intelligent and networked seating solutions; focus on sustainability and eco-friendly materials. |

| International maritime safety regulations compliance; focus on minimizing workplace accidents. | Stringent environmental protection laws; focus on minimizing carbon footprint during production. |

| Corrosion-resistant metals and marine-grade fabrics usage; emphasis on longevity. | Uptake of composite materials and high-performance polymers for lightweight and enhanced performance. |

| Sales predominantly through specialized marine equipment retailers and direct manufacturer stores. | Penetration into internet-based retailing websites; joint ventures with boat builders for coordinated seating systems. |

| Mainly commercial ships and military use. | Increasing use of recreational boating; more extensive use in offshore wind energy support vessels. |

| Presence of entrenched players such as SHOCKWAVE and Shoxs; emphasis on product differentiation based on quality and performance. | New entry by new players with emphasis on smart technologies; more collaborations and partnerships for driving technological innovation. |

While the industry shows prospects for growth in all three traditional domains (the defense, commercial, and recreational boating sectors), several potential risks can hinder its long-term scalability and profitability. The costs of these advanced suspension systems may inhibit their adoption in economically sensitive segments, such as small commercial fleets or recreational boats. Although technology offers clear comfort and safety benefits, the high cost may lead to relinquishing modern designs in favor of traditional seating options unless a sizable incentive encourages a switch.

Another important risk related to environmental durability must be considered. Products have to survive harsh marine settings, including salt corrosion, UV exposure, and constant vibration. Any inadequacies in the quality of the materials used, whether it be a matter of requisites towards the quality of the material or the design robustness-would lead to failure on the early side with warranty claims along with loss of goodwill against the manufacturers. Hence, it becomes imperative to ensure quality with material sourcing, but it is potentially expensive.

Regulatory compliance and safety standards are increasing, especially in the case of government and defense contracts, where specs are tightly structured. Suppliers and manufacturers will need to have assurance that products meet ISO standards and other local maritime safety regulations, posing a compliance risk if not rigorously managed. To complicate matters, international variability in regulations restricts quick industry expansion for global players.

Supply chain risks are also prevalent in the domain of this industry, especially when it comes to special components like dampers and corrosion-resistant alloys. Any disruption, be it owing to geopolitical tensions, raw material shortages, or delays in transport, will affect production timelines and escalate costs. Then, technological obsolescence silently stands rejected; with smart seats or adaptive suspension technologies competing for shelf space, these innovations may challenge the integration of existing designs into the industry as small players put themselves at stake with continuous R&D investments.

Demand fluctuation could result in lumpy order flows, in turn affecting inventory management, forecasting, and business stability, especially for smaller manufacturers or those concentrating on a specific region. Demand in this respect is dependent upon the cycles of the marine industry, weather patterns, fuel prices, and the overall global economic conditions.

The demand for fountains remains strong for industry sides seeking safer, ergonomic-style marine solutions. By investing in quality, innovation, and regulatory compliance, the stakeholders will navigate the risk landscape and grab the opportunities being thrown at them.

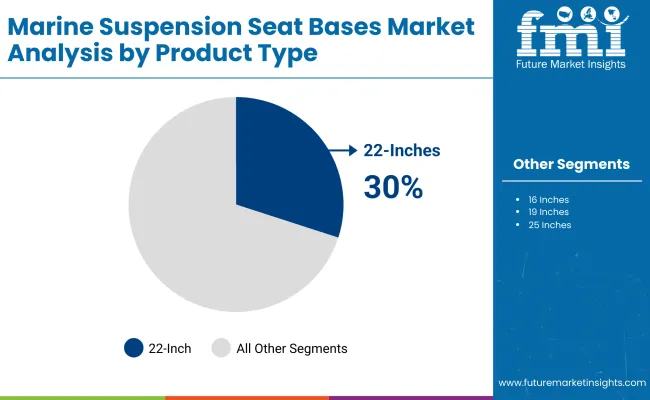

The industry is segmented by product type into 19- and 22-inch seat bases by end application, which will see the 22-inch get the largest share of approximately 30%, with the 19-inch being next at 28% by 2025. Related to increasing demands in ergonomic marine seating, the requirements for comfort and shock absorption for operators in commercial and recreational maritime settings will continue to grow.

Such bases include the 22-inch seat variants, as they display strong construction to provide better support and shock mitigation for larger vessels like offshore service boats, patrol boats, and military crafts. In high-impact marine environments, with long operational hours and exposure to rough waters, the bases are a better option.

Major manufacturers like SHOXS (Canada), Ullman Dynamics (Sweden), and SCOT SEATS (UK) produce heavy-duty 22-inch marine suspension bases equipped with damping systems, adjustable heights, and corrosion-resistant materials. For example, Ullman’s Patrol and Atlantic series utilize a progressive shock mitigation function specifically for high-speed military vessels. At the same time, the USA Navy and Special Operations Forces mainly use the SHOXS 2000 series. Very important applications are those that require increased crew survivability, injury reduction, and long-lasting operational use.

Similarly, the other category is the 19-inch base seats, which account for 28% of the total industry. They are common among smaller vessels such as recreational boats, pilot boats, and light commercial vessels. These provide good shock attenuation and comfort in low-intensity marine environments while being compact.

Ergonomically designed 19-inch bases are manufactured by Bostrom Seating and GRAMMER Marine, a Germany-based company. Their seat bases come with features such as swivel mounts, flip-up features, and high-quality memory foam cushions. Their designs mainly target marine leisure craft, harbor patrol, and water taxis; build specifications are important considering the space and budgets available.

Similar to GRAMMER Marine, the MSG95 series carries the load or stress of compressing in an area and still maintains comfort and compactness, with most often air suspension or mechanical damping incorporated as attached equipment. Such arrangement is best utilized in moderate wave conditions, proving less severe shock loads, but is still impactful to operators during long hours of navigation.

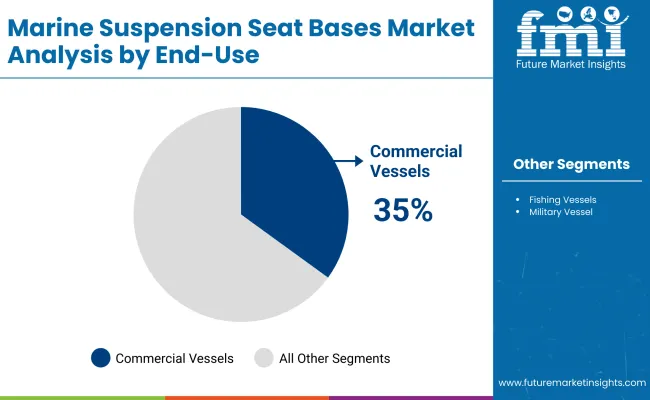

In 2025, the industry by end-use would be predominantly led by commercial vessels, with 35% of the total industry share, followed by military vessels at 25%. Segmentation reflects different operations that take place in maritime sectors that require specialized ergonomic solutions for operator safety and performance in variable sea conditions.

Apart from these, suspension seating systems have been adopted in various commercial vessels, including offshore service vessels (OSVs), fishing boats, ferries, pilot boats, and cargo support vessels, for improving the comfort of crew members during long hours of operations and limiting fatigue while work is done. Seats would be most important in certain areas of intensive offshore activity, such as the Gulf of Mexico, the North Sea, and Southeast Asia.

This is an industry predominantly owned by manufacturers such as SHOXS (Canada), SCOT SEATS (UK), and Ullman Dynamics (Sweden), producing high-performance seats integrated with shock-absorbing suspension, adjustable dampers, and corrosion-resistant materials. Their end products are widely championed by offshore oil & gas companies, coastal transport industries, and pilotage firms due to crew well-being and reduced injury risk.

25% of military vessels in the industry will consist of suspension seat bases, which include applications such as patrol boats, RHIBs (rigid-hulled inflatable boats), fast attack crafts, and landing crafts. Most of these applications belong to military navies and coastguards.

Most of the seats are intended for very high-speed and high-impact operations where prevention of spinal injuries and better responsiveness to the situation are major considerations. Suppliers such as SHOXS, Ullman Dynamics, and Allsalt Maritime specialize in military-grade seats that comply with NATO standards and offer modular integration with body armor as well as tactical gear. An example of standard seating in many fast interceptors and special ops crafts would be SHOXS X8 and Ullman Patrol Jockey seats.

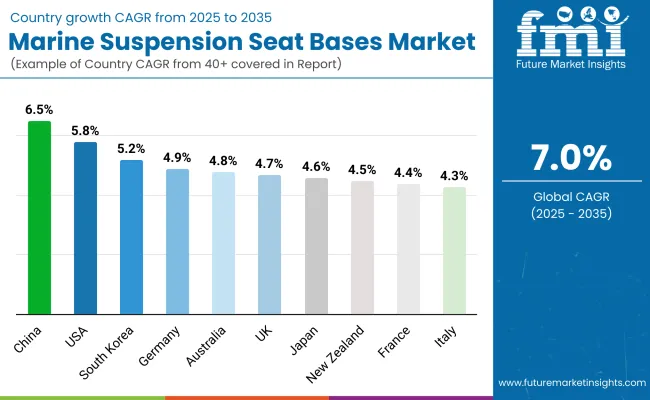

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.8% |

| UK | 4.7% |

| France | 4.4% |

| Germany | 4.9% |

| Italy | 4.3% |

| South Korea | 5.2% |

| Japan | 4.6% |

| China | 6.5% |

| Australia | 4.8% |

| New Zealand | 4.5% |

The USA industry is anticipated to record a healthy CAGR of 5.8% over the forecast period. Increased defense spending, more so in naval modernization projects, has driven demand for superior marine seating systems to a large extent. The commercial marine industry, including passenger ferries and offshore service ships, is also driving the growth trajectory.

Advanced shock mitigation technologies are in high demand to ensure enhanced security and reduce fatigue for personnel operating in high-sea conditions. Key industry players in the USA are SHOXS (a subsidiary of The Entwistle Company), Ullman Dynamics, and Shockwave Seats.

These manufacturers are investing in ergonomic layouts and material science innovations to support evolving regulatory and safety needs. In addition, USA shipbuilders increasingly use modular and adaptable seat base solutions to accommodate varying vessel layouts and operational requirements.

In the UK, during the forecast period of 2025 to 2035, the industry will grow at 4.7% CAGR. Increasing fleet modernization programs, as well as coastal patrol and maritime patrol ship demand, are driving growth. The application of next-generation marine seating in high-speed ships that operate for defense and law enforcement agencies is particularly notable.

Key manufacturers in the UK industry include Scot Seat Group and KPM Marine, both of which are reputed to manufacture high-resilience suspension seats capable of withstanding harsh marine conditions. Focus on local manufacturing and compliance with maritime safety regulations enhances industry credibility. Additionally, growing interest in marine tourism and offshore wind operations ensures sustained demand for durable and flexible seat base systems.

The French industry is expected to grow at a CAGR of 4.4% during the 2025 to 2035 period. The growth in naval shipbuilding as part of country defense initiatives is driving demand for advanced marine suspension seating systems. The increase in commercial marine shipping and recreational boating segments is also driving investment in comfort-centric and shock-absorbing seat-based technologies.

Local distributors and French manufacturers are increasingly collaborating with foreign suppliers to expand product lines and serve shifting demand. Advances in materials resisting corrosion and light construction are becoming the area of focus for product strategy development. Energy demand offshore and marine research vessel demand is also driving growth in this niche but essential sector of the maritime equipment industry.

Germany's industry will increase at 4.9% CAGR from 2025 to 2035. The country's strong ship manufacturing industry, primarily in commercial vessels and niche shipping, continues to propel industry growth. Emphasis on crew safety, as well as operational efficiency, has led to the growing adoption of heavy-duty, collision-resistant suspension seats in naval fleets and civil transport fleets.

Key German producers and OEM suppliers are focusing on integrating smart features, such as dynamic suspension adjustment and vibration monitoring. Interoperability between maritime engineering firms and seat technology developers is enhancing innovation in this sector. Demand from patrol boats, rescue boatsas well as inland shipping companies provides a solid foundation for long-term industry growth.

The industry in Italy is anticipated to expand at 4.3% CAGR through the forecast period. Italy's extensive coastline and traditional shipbuilding tradition provide a favorable environment for long-term industry growth. Increased investment in coast guard vessels and search-and-rescue ships has spurred greater utilization of shock-absorbing seating systems.

Italian industry players are emphasizing ergonomic innovation and compliance with international safety standards. Recreational marine demand, particularly in the luxury and high-performance classes of boats, is another key driver. Domestic shipyards working in association with specialized component manufacturers are enabling greater customization and system integration across the different classes of vessels.

South Korea is expected to register a CAGR of 5.2% in the industry between 2025 to 2035. Growth is propelled by robust naval modernization initiatives and shipbuilding expansion for defense and commercial purposes. The domestic shipbuilding equipment production industry is greatly technology-oriented and export-focused.

South Korean manufacturers are turning their focus toward enhancing seat life, employing composite materials, and reducing system weight. Orders from coastal defense boats and fast ferry operators are both fueling demand higher. End-user operational necessity has a direct correlation with product development and supports steady increases in levels of uptake.

Japan's industry is anticipated to experience a CAGR of 4.6% over the forecast period of 2025 to 2035. Japan's focus on maritime security, particularly disaster relief and coastal patrol operations, is fueling demand in the segment. Government and private sector ships are modernizing at a rate that is revolutionizing the industry with more advanced and ergonomic seating solutions.

Japanese companies have a reputation for precision engineering and consistent product quality and are thus well-placed in the domestic and export industries. A combination of energy-absorbing materials and anti-corrosion treatments is enhancing seat base performance and lifecycle. The industry is also being fueled by increasing recreational marine use and government-sponsored vessel upgrade programs.

China is also estimated to lead growth with a CAGR of 6.5% between 2025 and 2035 in the industry. Continuous naval capabilities, coast guard fleets, and commercial marine logistics have highly driven demand in the industry. Government-driven maritime infrastructure projects and fleet upgrades are key drivers in this category. Domestic shipbuilders are increasing production and emphasizing R&D of high-impact resistance and modular construction.

Joint ventures with global technology partners have also aided development in seating dynamics. The growth industry in fast ferries, patrol boats, and offshore service vessels provides diversified opportunities across several end-use applications. China's competitive pricing strategy and vertical integration model also support industry position.

The Australian industry is expected to grow at a CAGR of 4.8% during the forecast period. Coastal surveillance programs, rescue operations, and environmental patrol vessels are among the key drivers for the growth of the industry. The need for strength and weather resistance in the seating system is prominently dominant due to the extensive marine operating areas in Australia.

Australian distributors and suppliers collaborate with international brands to offer customized seating solutions that address regional requirements. The recreational boating industry, driven by tourism and sport fishing, also sustains industry demand. Product adjustability and ergonomic support advancements enhance user experience in line with increased safety and performance expectations.

New Zealand's industry will grow at 4.5% CAGR from 2025 to 2035. Maritime defense investments and emphasis on search-and-rescue capability are creating a steady demand for high-performance seat bases. New Zealand's geographical situation, relying on naval transport and patrol coverage, provides steady utilization of cutting-edge marine seating systems.

Local industry demand is supported by partnerships with foreign manufacturers offering advanced suspension seat technologies. Marine leisure and tourism vessel expansion further stimulates demand for shock-absorbing, comfort-enhancing seating technologies. New Zealand's focus on sustainability and operational safety is leading procurement trends and technology adoption in the industry.

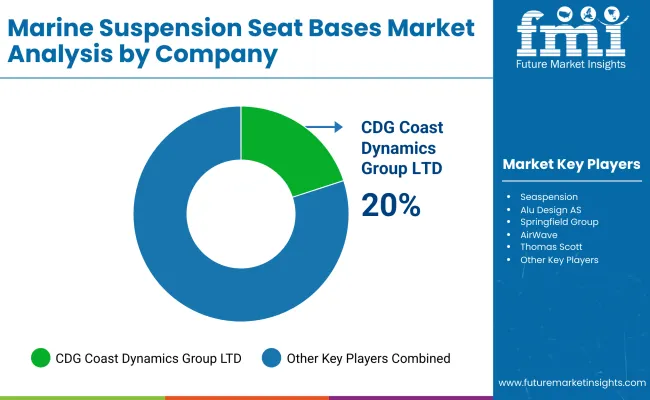

Innovations in shock absorption technology, ergonomic design, and materials of high durability have characterized the industry. Hydraulic dampening and air suspension systems combined with the use of advanced composite materials to support maximum seating comfort, as well as safety in maritime environments, are the main focuses of leading companies in the industry, such as CDG Coast Dynamics Group, Seaspension, and Alu Design AS. There has been a growing demand from military commercial and recreational boating industries. Thus, manufacturers are employing corrosion-resistant alloys and smart suspension systems to enhance efficiency in different marine environment conditions.

Materials, suspension efficiency, and adaptability to vessel types are factors that create strategic differentiation within the industry. CDG Coast Dynamics Group builds a niche for shock mitigation in fast vessels, using military-grade aluminum and skillfully applying dynamic motion compensation.

Seaspension specializes in patented pedestal systems with tunable damping for offshore and recreational applications. Alu Design AS uses lightweight aluminum frames and precision milling for long-term durability and user comfort. Smaller manufacturers such as Professional Components Ltd. and AirWave specialize in customized as well as modular seat-based solutions for specialized maritime applications.

These technology breakthroughs include air- and hydraulic-assisted suspension systems, weight-adaptive shock mitigation, and integration of smart sensors to separate the industry leaders. Multi-axis dampening technology for rider stability in turbulent waters is the Springfield Group's priority.

Thomas Scott (Seating) Ltd. and H2O On The Go, Inc. are building low-cost but robust suspension systems for leisure boats, and small commercial vessel applications. The advent of electric and autonomous vessels generates demand for lightweight seat bases with active response systems to dampen vibrations for comfort.

Supply chain consolidation, regulations, and offshore industry growth are shaping a competitive landscape. Major players are investing in the expansion of their production facilities whilst partnering with marine defense and commercial fleet operators for long-term contracts. AI-assisted fatigue analysis, anti-corrosion solutions, and customizable seat base configurations represent direct investments to ensure readiness for the changing industry requirements.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| CDG Coast Dynamics Group LTD. | 20-25% |

| Seaspension | 15-20% |

| Alu Design AS | 12-16% |

| Springfield Group | 10-14% |

| AirWave | 8-12% |

| Combined Others | 25-35% |

| Company Name | Offerings & Activities |

|---|---|

| CDG Coast Dynamics Group LTD. | High-speed vessel shock mitigation seats with military-grade aluminum as well as dynamic motion compensation. |

| Seaspension | Patented pedestal suspension systems with tunable damping for offshore and recreational applications. |

| Alu Design AS | Precision-milled aluminum seat bases with ergonomic designs and corrosion-resistant coatings. |

| Springfield Group | Multi-axis dampening seat bases optimized for commercial and high-performance maritime use. |

| AirWave | Air-assisted suspension systems with customizable shock absorption settings for varying marine conditions. |

Key Company Insights

CDG Coast Dynamics Group LTD. (20-25%)

CDG Coast Dynamics leads in military and high-speed marine suspension systems, offering shock-mitigating seat bases with advanced aluminum construction as well as adaptive dampening technology.

Seaspension (15-20%)

Seaspension specializes in patented pedestal seat systems with tunable hydraulic dampening, catering to offshore recreational and commercial marine industries.

Alu Design AS (12-16%)

Alu Design AS focuses on lightweight, precision-engineered aluminum seat bases with corrosion-resistant coatings, ensuring durability in harsh marine environments.

Springfield Group (10-14%)

Springfield Group develops multi-axis dampening seat bases, optimizing shock absorption and rider stability for commercial and high-performance marine applications.

AirWave (8-12%)

AirWave offers air-assisted suspension systems with customizable dampening settings, enhancing seating comfort and impact resistance in variable marine conditions.

Other Key Players

By product type, the industry is categorized into 16 inches, 19 inches, 22 inches, and 25 inches.

By end use, the industry is divided into commercial vessel, fishing vessels, military vessel, and recreational and leisure boats.

By market channel, the industry is segmented into OEM and aftermarket.

By region, the industry is segmented into North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Central Asia, Russia & Belarus, Balkan & Baltic Countries, and Middle East & Africa.

The industry is estimated to reach USD 458.3 million in 2025.

By 2035, the industry is projected to grow significantly, reaching USD 906.8 million as marine safety and comfort solutions gain traction globally.

China is at the forefront with a projected growth rate of 6.5%, supported by growing naval and commercial marine activity.

The 22-inch seat base variant remains dominant, offering optimal shock absorption and ergonomic benefits for high-impact marine environments.

Key players include CDG Coast Dynamics Group LTD., Seaspension, Alu Design AS, Springfield Group, AirWave, Professional Components Ltd., h2O On The Go, Inc., and Thomas Scott (Seating) Ltd.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Marine Extract Market Size and Share Forecast Outlook 2025 to 2035

Marine Squalene Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Marine Prebiotics Market Size and Share Forecast Outlook 2025 to 2035

Marine Collagen-Based Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Communication Market Size and Share Forecast Outlook 2025 to 2035

Marine Derived Proteins Market Size and Share Forecast Outlook 2025 to 2035

Marine Winch Motors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA