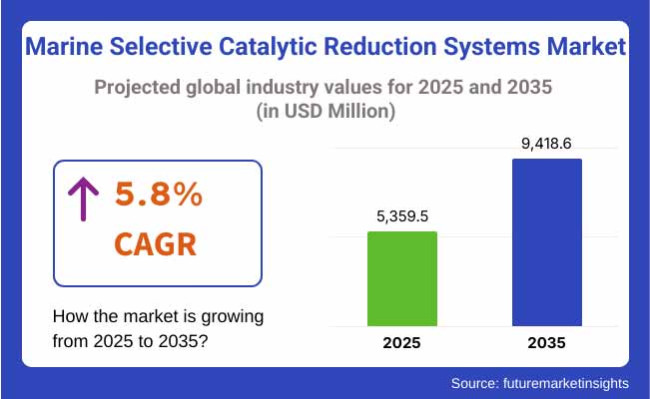

The marine selective catalytic reduction (SCR) systems market is projected to grow steadily between 2025 and 2035, driven by stringent IMO Tier III NOx emission regulations, increasing retrofitting of existing vessels, and rising investments in low-emission marine propulsion technologies. The market is expected to be valued at USD 5,359.5 million in 2025 and is anticipated to reach USD 9,418.6 million by 2035, reflecting a CAGR of 5.8% over the forecast period.

Marine selective catalytic reduction (SCR) systems use a urea based reductant to reduce nitrogen oxide (NOx) emissions from exhaust gases through injection of the reductant into the stream where it interacts with a catalyst.

Meanwhile, increasing pressure to decarbonize international shipping, combined with the rise of hybrid and LNG-fueled vessels, serves to accelerate the deployment of SCR units across commercial, naval, offshore and inland waterways vessels. But space limitations, urea storage logistics, and system integration costs still pose serious barriers to adoption.

Key trends include compact modular SCR units, integration with dual-fuel and LNG engines, remote emissions monitoring and urea consumption optimization systems.

The presence of ECA (Emission Control Area) compliance requirements on USA and Canadian coastlines has been one of the major factors contributing to North America being one of the leading adopters for marine SCR systems. SCR-equipped tugboats, ferries and coastal vessels that cross into IMO Tier III zones are in high demand in the United States.

Canada is also back fitting SCR units on its coastguard and civil fleets. Meanwhile, the region’s push for green maritime corridors and hydrogen-LNG hybrid propulsion systems will bolster further market growth."

Mandates for aggressive emissions reductions, EU Green Deal marine initiatives and emerging clean shipping infrastructure in ports support Europe’s market. SCR systems are being integrated into LNG-powered ferries, Baltic Sea container ships, and ice-class vessels in countries including Germany, Netherlands, Norway, France, and Finland. Government-supported incentives for retrofit programs and urea supply infrastructure development are speeding up adoption throughout inland waterways and short-sea shipping.

Asia-Pacific is the fastest-growing region driven by increasing number of shipbuilding activity, including ECA expansion and adoption of relevant IMO 2020 and Tier III compliance technologies in China, Japan, South Korea, Singapore and India.

China’s Strategy in Decarbonizing Domestic Shipping and Investing in Green Ports Opens Up Opportunities for SCR Manufacturers and Integrators LNG and ammonia-ready ships with SCR on board are already being integrated by the arguably world’s most advanced shipyards both in Japan and South Korea. Retrofitting programs are also proliferating across Southeast Asia.

Challenges

Retrofitting Complexity, Operational Costs, and Space Limitations

Retrofitting SCR systems into older ships with space-limited engine rooms is cost-prohibitive and complex. Operational barriers are also caused by urea logistics, especially for long-haul voyages, and maintenance requirements for catalysts and dosing systems. The pressure to implement NOx limits in some geographies outside the ECA is delayed as there is no standard global enforcement for all regions.

Opportunities

Green Shipping Mandates, Modular SCR Systems, and Engine Integration

Further opportunities exist for modular SCR designs that enable easy retrofit and low-space footprint, as well as dual-fuel and hybrid propulsion compatibility. The emerging incentives for carbon-neutral shipping corridors & scalable expansion of urea bunkering, alongside decarbonisation frameworks such as those led by IMO for GHG quantity reduction, will spur demand for integrated systems to control emissions.

Yards that provide factory-fitted SCR packages, which include remote diagnostics and urea optimization tools, are also expected to be in a better position to compete.

Marine selective catalytic reduction (SCR) systems market from 2020 to 2024 continued to grow and the factors driving it include IMO Tier III NOₓ emission regulations that have taken effect in Emission Control Areas (ECAs), growing pressure to decarbonize shipping and an increase in both new builds and retrofits.

SCR systems became the technology of choice for diesel-powered shipping lines with emissions targets, especially in LNG carriers, container ships and ferries. However system complexity, urea logistics, high capital costs and integration into existing engine platforms limited uptake across smaller fleets and older vessels.

Go in the 2025 to 2035 time frame the market will evolve with integration into hybrid propulsion systems, real-time emissions monitoring and AI-optimised dosing systems. As vessel designs move towards future-proof propulsion, SCR technology will evolve to work with alternative fuels such as methanol, ammonia and biofuels.

Other factors driving demand will include green shipping corridors, carbon taxation policies and fleet digitalization. SCR units become compact and modular; smart urea management; blockchain-backed emissions compliance tracing; all become widespread, especially in retrofitted tonnage and coastal vessels entering Tier III zones.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | IMO Tier III compliance in ECAs; national NOₓ emission standards in Europe, North America, and Asia-Pacific. |

| Technological Innovation | High-pressure urea injection systems, basic control modules, and steel-based reactor housings. |

| Industry Adoption | Primarily in new builds (especially in ECAs), LNG carriers, cruise ships, and ferries. |

| Smart & AI-Enabled Solutions | Manual urea dosing and engine integration; limited data logging capability. |

| Market Competition | Led by MAN Energy Solutions, Wärtsilä, Yara Marine, Mitsubishi Heavy Industries, and Alfa Laval. |

| Market Growth Drivers | IMO regulatory pressure, retrofitting initiatives, and demand for cleaner propulsion in ECAs. |

| Sustainability and Environmental Impact | Urea logistics and SCR waste management were key concerns in adoption. |

| Integration of AI & Digitalization | SCADA-level integration for diagnostics and system alerts. |

| Advancements in Product Design | Large, engine-specific units requiring custom integration and large engine room space. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Global adoption of NOₓ compliance across coastal zones, carbon emission credits for SCR deployment, and digital reporting mandates. |

| Technological Innovation | Compact modular SCR units, AI-based urea dosing, lightweight corrosion-resistant alloys, and real-time emissions monitoring systems. |

| Industry Adoption | Widespread retrofitting of aging fleets, adaptation in dual-fuel vessels, and integration with hybrid and ammonia-based marine engines. |

| Smart & AI-Enabled Solutions | AI-optimized urea injection, cloud-based compliance dashboards, predictive maintenance, and integration with vessel performance platforms. |

| Market Competition | Increased competition from modular SCR startups, AI-integrated emissions control system providers, and green propulsion OEM partnerships. |

| Market Growth Drivers | Growth driven by carbon intensity targets, green shipping corridor expansion, digital fleet compliance, and next-gen fuel-SCR integration. |

| Sustainability and Environmental Impact | Closed-loop urea systems, zero-spill dosing mechanisms, smart waste tracking, and integration with carbon-neutral vessel designs. |

| Integration of AI & Digitalization | AI-enhanced NOₓ detection, blockchain-verified emissions data, and ship-to-shore synchronization with regulatory platforms. |

| Advancements in Product Design | Scalable plug-and-play modules, vertical SCR systems for smaller vessels, and hybrid-compatible SCR units with real-time auto-calibration. |

Commercial applications such as marine SCR systems are expected to remain steady as a result of strict EPA Tier 4 requirements and increasing implementation of emissions control systems in the commercial shipping and inland waterways sector. The conversion of existing fleets and installation in new builds particularly tugs, ferries and offshore support vessels is driving steady demand.

Vehicle Piper Negates System Power Loss in Equipment Design collaboration with SCR solution providers, and the NOx limit that USA Shipbuilders and engine OEMs have been recognized to earn compliance. The market is also seeing the benefit of investment in green ports and cleaner marine fuels.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.0% |

The UK is implementing IMO Tier III standards within ECAs, and with the country's focus on maintaining cleaner marine operations, the marine SCR systems market is emerging in the UK. There is an increase in demand for coastal cargo vessels, passenger ferries and marine auxiliary engines working in UK and EU waters.

Government maritime decarbonisation roadmaps and grants for low-emission vessel upgrades are boosting SCR uptake. Ship-owners are choosing small, modular systems that can be retrofitted with a minimum of disruption to operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.6% |

Germany, the Netherlands and Denmark extend their lead in the EU marine SCR systems market due to proactive emissions legislation, early Tier III compliance and a strong maritime technology base. Short-sea shipping, Ro-Ro vessels and offshore service fleets exhibit a broad uptake of SCR solutions.

Fleet operators are integrating SCR with dual-fuel and hybrid systems due to the EU’s Fit for 55 climate package and subsidies for cleaner marine propulsion. A growing interest among manufacturers for NOx reduction efficiency through compact reactor design, system urea dosing accuracy, and real time monitoring has been observed.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.9% |

The commercial fleet, maritime sustainability, as well as alignment with IMO Tier III mandates, are some of the factors driving growth in Japan's marine SCR systems market. LNG carriers, bulk carriers, and coastal vessels are adopting SCR technology from Japanese shipbuilders.

Getting it to integrate with low-sulphur fuel systems and exhaust gas recirculation setups is making emissions-reducing compliance even easier. The dominance of Japanese companies in marine engine manufacturing is pressing domestic innovations to develop in SCR catalysts, thermal management, and space-efficient designs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.5% |

Driven by its preponderance in global shipbuilding and moves to implement next-generation emissions control systems on vessels, South Korea’s marine SCR systems market is booming. A variant of the six cylinder engine has been deployed in SCR-equipped propulsion packages for container ships, tankers and LNG vessels at major Korean shipyards.

Support from the government is accelerating adoption. Manufacturers, mainly based in South Korea, are introducing urea dosing systems and modular SCR units with automation features to boost fuel efficiency and operational compliance in international fleets.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

Commercial Application Market Share (2025)

| Commercial Vessel Type | Value Share (%) |

|---|---|

| Containers | 38.2% |

The marine selective catalytic reduction (SCR) systems market for commercial applications is estimated to be dominated by container vessels in 2025, with a value share of 38.2% As the international shipping sector faces more stringent regulatory pressure to cut NOx emissions, container ships as high-frequency, long-haul carriers are leading the SCR pack.

By implementing SCR systems on container vessels, compliance with the International Maritime Organization (IMO) Tier III regulation is guaranteed in emission control areas (ECA). These vehicles are well-suited for the SCR technologies due to operation at high engine loads and fuel volumes, where catalytic conversion of NOx emissions is the most effective method.

With global demand for sustainable logistics and land based e-commerce driven containerized freight continuing to grow, shipbuilders and fleet operators are focusing increasing attention on retrofitting and constructing new vessels with cutting-edge SCR systems to reduce emissions. Such developments further reinforce the container vessel segment's position at the top for the commercial marine SCR market.

Offshore Application Market Share (2025)

| Offshore Vessel Type | Value Share (%) |

|---|---|

| AHTS | 41.7% |

By 2025, Anchor Handling Tug Supply (AHTS) vessels are expected to constitute the largest share of the offshore segment in the marine SCR systems market, with a value share of 41.7%. These vessels are critical to offshore oil and gas operations and operate in high-load conditions and require rugged emission control with reliable performance in challenging environments.

As AHTS vessels are designed to perform heavy towing, anchor handling and supply operations, they are particularly burdened during operation with NOx emissions, thus prime candidates for SCR integration. Over time, their continued activity, particularly in regulated areas (e.g., North Sea and USA Gulf regions), has driven the adoption of the SCR system.

Increasing attention to environmentally sustainable offshore exploration along with emission caps for offshore support vessels market are driving operators towards investing in robust and efficient SCR solutions. Offshore energy operations have been around for many years and are still expanding for global market developments, which gives rise to demand for AHTS vessels, which is the main application responsible for growth in the offshore marine SCR systems market.

Driven by stricter IMO Tier III emissions legislation, stronger need to decarbonize marine transport, and higher deployment of aft treatment solutions across commercial vessels, offshore support vessels, and naval fleets, the marine SCR systems market is growing at a steady pace.

NOx reduction is achieved through the use of SCR systems that inject a urea-based reductant into combustion exhausts and utilize catalyst beds. Market drivers include meeting evolving global emission standards, retrofit opportunities, increasing LNG and hybrid propulsion integration, and port authority incentives for low-emission vessels.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Wärtsilä Corporation | 20-24% |

| MAN Energy Solutions SE | 17-21% |

| Yara Marine Technologies | 13-17% |

| H+H Umwelt- und Industrietechnik GmbH | 8-12% |

| Alfa Laval AB | 6-9% |

| Others | 18-24% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Wärtsilä Corporation | In 2024 , Wärtsilä enhanced its NOx Reducer SCR system , offering compact modular units integrated with 2-stroke and 4-stroke marine engines, fully compliant with IMO Tier III zones. |

| MAN Energy Solutions SE | As of 2023 , MAN upgraded its SCR High Efficiency (SCR-HP) solution , designed for large ocean-going vessels with minimal pressure loss and integration with dual-fuel engines. |

| Yara Marine Technologies | In 2025 , Yara Marine launched a next-gen Ammonia-Ready SCR system , featuring automated dosing control and remote monitoring for optimal performance across varying engine loads. |

| H+H Umwelttechnik GmbH | In 2023 , H+H expanded its H+H SCR-L Series , targeting inland waterway vessels and short-sea shipping with compact design and IMO/EU Stage V compliance. |

| Alfa Laval AB | As of 2024 , Alfa Laval introduced a hybrid-ready SCR system as part of its Pure NOx Plus suite , designed for compatibility with EGR, scrubbers, and LNG propulsion technologies. |

Key Market Insights

Wärtsilä Corporation (20-24%)

Market leader with robust SCR technology across vessel classes, Wärtsilä offers turnkey systems that integrate seamlessly with propulsion and automation platforms.

MAN Energy Solutions SE (17-21%)

Known for engine-integrated SCR systems, MAN delivers high-performance NOx reduction for large merchant fleets, supporting multi-fuel and high-pressure engine formats.

Yara Marine Technologies (13-17%)

A pioneer in urea dosing and maritime emissions control, Yara focuses on adaptable SCR unit’s compatible with retrofit and new build applications across global fleets.

H+H Umwelttechnik GmbH (8-12%)

Specializes in compact, low-maintenance SCR systems suited for short-sea, river, and ferry vessels, with rising demand across Europe and Asia.

Alfa Laval AB (6-9%)

Offers integrated environmental compliance packages, including SCR, EGR, and scrubbers, appealing to ship-owners investing in modular, future-ready retrofits.

Other Key Players (Combined Share: 18-24%)

Numerous regional suppliers and ship system integrators are contributing to innovation in hybrid SCR configurations, low-load compliance, and digital emission monitoring, including:

The overall market size for the marine selective catalytic reduction systems market was USD 5,359.5 million in 2025.

The marine selective catalytic reduction systems market is expected to reach USD 9,418.6 million in 2035.

The demand for marine selective catalytic reduction systems will be driven by tightening global maritime emission regulations, increasing adoption of cleaner propulsion technologies in shipping, rising focus on reducing nitrogen oxide emissions, and growing retrofit activity in commercial vessels and offshore fleets.

The top 5 countries driving the development of the marine selective catalytic reduction systems market are China, South Korea, Japan, the USA, and Germany.

The commercial vessels segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 13: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 15: South Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 19: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 21: Oceania Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Attractiveness by Application, 2023 to 2033

Figure 14: Global Market Attractiveness by Type, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 28: North America Market Attractiveness by Application, 2023 to 2033

Figure 29: North America Market Attractiveness by Type, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 58: Europe Market Attractiveness by Application, 2023 to 2033

Figure 59: Europe Market Attractiveness by Type, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 62: South Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 63: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: South Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 71: South Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 73: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 74: South Asia Market Attractiveness by Type, 2023 to 2033

Figure 75: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 77: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 78: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 85: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 89: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 92: Oceania Market Value (US$ Million) by Type, 2023 to 2033

Figure 93: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 100: Oceania Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 101: Oceania Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 103: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 104: Oceania Market Attractiveness by Type, 2023 to 2033

Figure 105: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 106: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 107: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 108: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 115: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 116: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 117: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 118: MEA Market Attractiveness by Application, 2023 to 2033

Figure 119: MEA Market Attractiveness by Type, 2023 to 2033

Figure 120: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Marine Extract Market Size and Share Forecast Outlook 2025 to 2035

Marine Squalene Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Marine Prebiotics Market Size and Share Forecast Outlook 2025 to 2035

Marine Collagen-Based Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Communication Market Size and Share Forecast Outlook 2025 to 2035

Marine Derived Proteins Market Size and Share Forecast Outlook 2025 to 2035

Marine Winch Motors Market Size and Share Forecast Outlook 2025 to 2035

Marine Biotech Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA