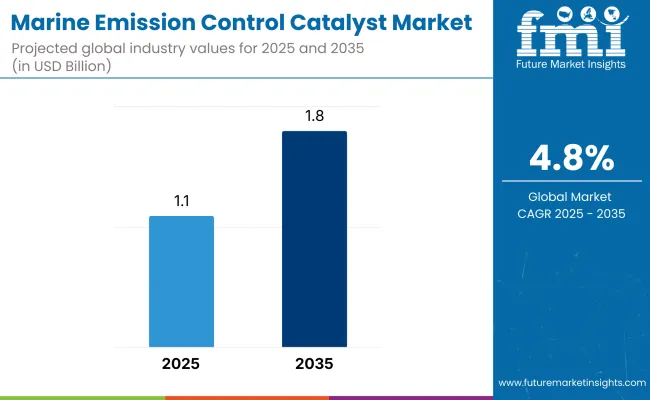

The marine emission control catalyst market is projected to grow from USD 1.1 billion in 2025 to USD 1.8 billion by 2035, expanding at a CAGR of 4.8%. Growth is underpinned by increasingly stringent IMO Tier III NOx and IMO 2020 sulphur limits, which compel shipowners to retrofit or install advanced after-treatment systems.

As global seaborne trade expands and newbuild orders shift toward dual-fuel and high-efficiency diesel engines, demand for selective catalytic reduction (SCR) and diesel oxidation catalysts (DOC) rises to curb nitrogen oxides, hydrocarbons, and particulate emissions. Coastal emission control areas (ECAs) across North America, Europe, and East Asia further accelerate adoption by levying penalties on non-compliant vessels.

Technological advancements are enhancing the efficiency and cost-effectiveness of marine emission control catalysts. Low-temperature SCR formulations that combine copper-zeolite with vanadium-titania coatings now dominate the market, achieving over 90 % NOₓ conversion even during slow-steaming.

Integrated catalyst blocks that merge SCR, diesel oxidation, and ammonia-slip functions onto a single honeycomb substrate cut back-pressure and installation space, while 3-D-printed metallic substrates lower production waste and weight. Digital exhaust-sensor networks feed adaptive urea dosing algorithms, extending catalyst life and trimming reagent costs.

Growing collaborations among engine OEMs, port authorities, and catalyst suppliers are fast-tracking drop-in retrofit kits for bulk carriers and container ships operating in emission control areas.

Regulatory frameworks worldwide are sharpening their focus on maritime decarbonisation and air-quality protection. The IMO 2020 sulphur cap, IMO Tier III NOₓ limits, and regional Emission Control Areas mandate drastic cuts in SOₓ, NOₓ, and particulate emissions, compelling vessel operators to adopt premium emission-control catalysts that minimise hazardous metal content and ammonia slip.

Authorities such as the EU under its “Fit for 55” package and the California Air Resources Board are encouraging low-temperature, copper-zeolite SCR formulations and integrated DOC-SCR blocks that meet stringent port-entry requirements without raising back-pressure.

Among the various product types in the marine emission control catalyst market, the selective catalytic reduction (SCR) catalyst segment is projected to be the most lucrative and register a CAGR of 6.1% through 2035. This dominance is due to SCR's unmatched NOx reduction efficiency, broad compatibility with both newbuilds and retrofit marine engines, and increasing installation mandates on large vessels, including cargo ships, tankers, and offshore platforms.

Broad compatibility with both newbuild and retrofit engines supports widespread adoption. High installation rates on cargo ships, tankers, and offshore platforms further reinforce its market leadership. Rising global fleet modernization and emission compliance initiatives will continue to drive its sustained growth.

Other segments, such as diesel oxidation catalysts (DOC) and diesel particulate filters (DPF), are gaining traction, especially in short-sea shipping and inland waterways. However, their impact remains more regional and application-specific.

Gasoline-based catalysts like palladium and rhodium variants are less relevant in marine applications, given the diesel-heavy engine landscape in the shipping industry. The continued expansion of global trade routes, stricter emissions caps, and public pressure on decarbonization further solidify SCR’s position as the market growth driver.

| Product Type Segment | CAGR (2025 to 2035) |

|---|---|

| SCR Catalyst | 6.1% |

The commercial vessel segment is projected to be the most lucrative application area through 2035, and is anticipated to grow at a CAGR of 5.6%. This dominance is rooted in high vessel tonnage, continuous operation over long distances, and stricter enforcement of emission regulations on international shipping lanes.

Each commercial vessel typically consumes higher volumes of emission catalysts due to large engine sizes and extended operational hours, translating into elevated demand for products like SCR and DOC systems. The expansion of global trade routes and the modernization of aging fleets will further amplify catalyst adoption across commercial vessels. Rising investments in green shipping technologies and stricter compliance checks at major ports are also accelerating the uptake of emission control systems in this segment.

Other segments, including Offshore Support Vessels and Passenger Vessels, contribute to niche but growing markets, especially in offshore drilling regions and cruise tourism, respectively. Power Boats and Fishing Boats, while sizable in number, are limited in per-unit catalyst demand and are often less regulated under emission control frameworks.

The continued tightening of maritime emission norms by the IMO and regional authorities reinforces the commercial vessel segment’s position as the key growth engine over the forecast period.

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| Commercial Vessel | 5.6% |

The retrofit segment is projected to be the most lucrative by 2035, and is forecasted to grow at a CAGR of 5.9%. The existing commercial vessels in operation globally, the regulatory pressure to meet IMO Tier III and regional emission standards is pushing a wave of retrofit demand. Retrofit systems often involve full-scale integration of SCR, DOC, and particulate filters into older engines, typically requiring higher catalyst volumes per vessel due to legacy system inefficiencies.

Additionally, the cost-per-retrofit is higher than OEM installations, further contributing to revenue dominance. By 2035, the retrofit segment is expected to increase retrofit funding programs, and mandatory compliance retrofitting deadlines are further accelerating segment growth. Fleet operators are prioritizing retrofits to extend vessel lifespans while avoiding penalties tied to non-compliance with evolving emission standards.

While the OEM segment remains critical for compliance in new vessel constructions, especially in regions like Europe and Asia Pacific, its volume is inherently tied to newbuild rates, which are cyclical and slower-growing. In contrast, the retrofit market is being aggressively driven by fleet modernization mandates and environmental retrofitting programs funded by both governments and private operators.

| End Use Segment | CAGR (2025 to 2035) |

|---|---|

| Retrofit | 5.9% |

Due to strict regulatory environments, increasing investment in clean shipping technologies, and extensive presence of large maritime operators, North America is expected to dominate the marine emission control catalyst market. EPA Tier III NOx regulations, California Air Resources Board (CARB) requirements and North American ECA put the United States and Canada at the forefront of the region.

Rising adoption of LNG-powered ships, adoption of hybrid marine propulsion units in marine vessels, and increasing adoption of advanced catalytic converters for transportation in cargo ships and passenger ships are some of the factors driving growth of the global marine propulsion engines market. Also, the latest government subsidies of green shipping and extending shore-to-ship power (cold ironing) establishments are harbinger on the usage of catalyst.

Several European nations such as Germany, Norway, the UK, and the Netherlands dominate the marine emission control catalyst market with respective adoption of progressive emission control technology and sustainability practices. Many low-emission marine fuels and SCR catalysts are encouraged by regulations such as the European Union Green Deal, FuelEU Maritime regulation, and IMO 2020 implementation.

The proliferation of electric and LNG-fueled ferries, the retrofitting of existing vessels with exhaust treatment systems, and the development of ammonia-based NOx reduction technologies are increasing the addressable market. In addition, demand for next-generation catalytic converters is being spurred by Norway's efforts to eliminate emissions from cruise vessels and to electrify short-sea shipping.

Marine emission control catalyst market in the Asia-Pacific region is projected to grow at the highest CAGR owing to high shipbuilding, growth of commercial marine trade, and increasing enforcement of emission rules. Including countries leading in adopting catalyst technologies, ship retrofitting projects, and green port infrastructure implementation China, Japan, South Korea, and Singapore.

The market growth is driven by China's adoption of domestic ECAs, stringent fuel quality requirements, and increasing investment in methanol and ammonia-powered vessels. Development of fuel cell-powered ships and marine exhaust after treatment technologies in Japan and dominance in LNG bunkering infrastructure by South Korea are also driving regional market growth.

The focus on uptake of alternative fuel and decarbonisation incentives in Singapore is also creating new opportunities for marine catalyst producers.

Challenges

High Retrofitting Costs and Operational Complexity

A major obstacle of the marine emission control catalyst market is the high cost of retrofitting a catalyst on older ships, which requires significant modifications to exhaust systems, integration with engines, and the addition of fuel treatment systems. However, designing and maintaining SCR and DOC systems in harsh marine conditions, coupled with catalyst deactivation from fuel contaminants, could lead to reduced long-term operational efficiency.

Moreover, the move toward alternative fuels (hydrogen, ammonia, and biofuels) also clouds the horizon for catalyst demand these technologies could reduce the need for exhaust after treatment solutions over the long haul.

Opportunities

AI-Optimized Catalyst Performance, Hybrid Exhaust Treatment Systems, and Alternative Fuel Integration

AI-Optimized Catalyst Performance, Hybrid Exhaust Treatment Systems, and Alternative Fuel Integration. The Marine Emission Control Catalyst Market presents immense growth opportunities. AI-based catalyst monitoring systems utilizing real-time emission data, predictive maintenance and fuel optimization algorithms are also improving catalyst performance and lifespan.

The combination of SCR, oxidation catalysts, and particulate filters in hybrid exhaust treatment technologies is also fostering the efficiency of multi-pollutant control. Plus, new ammonia-based and biofuel-burning marine engines catalyst formulations are providing more avenues for shipping emission decarbonisation.

Ocean vessel operators are developing new revenue streams for marine catalyst manufacturers and emissions control equipment providers by adopting alternative green port strategies, utilizing shore-side power and commissioning growing fleets of ammonia and methanol dependence ships.

For the years between 2020 and 2024, the marine emission control catalyst market showed continuous, steady growth. Maritime emissions regulations got stricter and environmental concerns further raised ahead of the ocean environment. Rising use of catalytic reduction technologies had a profound impact on the industry. Below: The International Maritime Organization’s (IMO) regulated sulfur oxides (SOx) and nitrogen oxides (NOx) emissions.

This drove demand for selective catalytic reduction (SCR) systems, diesel oxidation catalysts (DOCs) and advanced exhaust gas treatment solutions on commercial shipping, naval fleets and cruise liners. Low-carbon shipping projects and attempts to achieve carbon-neutral maritime operations further drove investment demand for low-emission propulsion methods as well as sustainable discharge technologies.

From 2025 to 2035, transformative changes within the marine emission control catalyst market will come to the fore with AI-driven emissions optimization, hydrogen-based catalytic converters and blockchain-based compliance tracking.

The development of a new generation of SCR systems, which will be able to adjust NOx reduction in real-time, features ammonia-free catalysis technologies and catalyst coatings enhanced using nanotechnology-this will boost efficiency, extend the life of catalysts and reduce costs. AI-driven autonomous exhaust gas testing will provide real-time control of emissions, predictive maintenance and dynamically adaptive regulatory compliance.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with IMO Tier III regulations, MARPOL Annex VI, and regional ECAs for SOx and NOx limits. |

| Technological Advancements | Growth in SCR technology, diesel oxidation catalysts (DOCs), and ammonia slip reduction systems. |

| Industry Applications | Used in commercial shipping, naval defense, cruise liners, and offshore platforms. |

| Adoption of Smart Equipment | Integration of real-time emissions tracking sensors, hybrid exhaust treatment systems, and cloud-based compliance reporting. |

| Sustainability & Cost Efficiency | Shift toward low-sulfur fuel compatibility, energy-efficient catalyst formulations, and optimized vessel fuel consumption. |

| Data Analytics & Predictive Modeling | Use of manual emissions tracking, SCADA-based exhaust monitoring, and scheduled compliance checks. |

| Production & Supply Chain Dynamics | Challenges in raw material price volatility, platinum-group metal (PGM) supply limitations, and catalyst disposal management. |

| Market Growth Drivers | Growth fueled by stricter IMO emissions limits, expanding ECAs, and increasing demand for low-emission maritime transport. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Blockchain-powered emissions compliance tracking, AI-driven regulatory adaptation, and hydrogen-based zero-emission catalyst approvals. |

| Technological Advancements | AI-powered real-time NOx control, ammonia-free catalytic reduction, and nanomaterial-based self-cleaning catalysts. |

| Industry Applications | Expanded into AI-integrated carbon-neutral maritime propulsion, autonomous emissions monitoring systems, and hydrogen-powered marine engine retrofits. |

| Adoption of Smart Equipment | AI-enhanced exhaust gas treatment, self-regulating emission control catalysts, and smart IoT-enabled maritime emissions monitoring. |

| Sustainability & Cost Efficiency | Carbon-neutral catalyst production, AI-optimized fuel conversion efficiency, and next-gen modular catalyst retrofitting solutions. |

| Data Analytics & Predictive Modeling | AI-driven predictive emissions modeling, blockchain-backed global emissions verification, and quantum-assisted exhaust gas analytics. |

| Production & Supply Chain Dynamics | Decentralized AI-driven supply chain optimization, recycled catalyst materials, and sustainable platinum-group metal sourcing strategies. |

| Market Growth Drivers | Future expansion driven by AI-powered emissions management, carbon-neutral catalyst innovations, and next-gen alternative fuel adoption in maritime fleets. |

The marine emission control catalyst market in the United States is steadily increasing due to stricter environmental regulations, increasing demand for low-emission marine technology, and increasing investment in environmentally friendly shipping technology.

Emission Control Areas (ECA) in the USA Environmental Protection Agency (EPA) and the International Maritime Organization (IMO) are just some of the standards that make new-age emission-reduction technologies attractive.

The growing implementation of selective catalytic reduction (SCR) systems, oxidation catalysts, and hybrid exhaust after-treatment solutions is improving the ability to comply with emissions standards. Moreover, increasing investments in LNG-fueled vessels and sustainable shipping practices are driving demand for next-generation marine emission control catalysts.

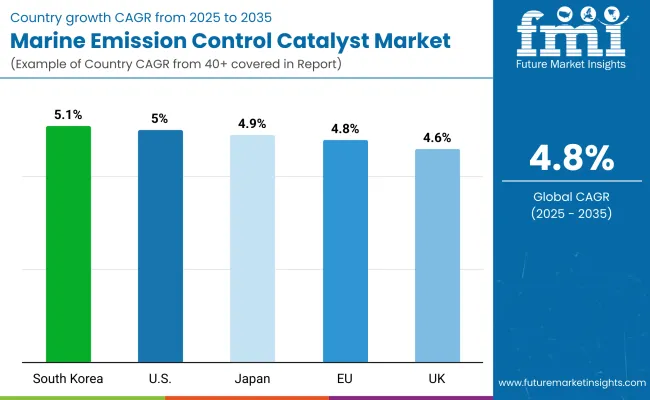

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.0% |

The United Kingdom marine emission control catalyst market is growing with the increasing government initiatives to decarbonize the shipping process, rising adoption of alternative fuels, and strict compliance of the IMO standards. The UK Maritime and Coastguard Agency (MCA) and the Clean Maritime Plan are promoting low-emission shipping technologies that are creating demand for sophisticated catalyst solutions.

A redefining trend is the increase in retrofitting projects on existing ships, along with investments in exhaust gas cleaning systems (EGCS) and hybrid catalyst technologies. Further, green marine emission control solutions are highly demanded due to funding and support from the governments for port refurbishment into green ports and vessel electrification.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.6% |

The transition to cleaner marine fuels and low-emission propulsion technologies is being driven by the European Green Deal and the European Maritime Safety Agency.Leading the way in adopting a technology for marine emission reduction are Germany, France and the Netherlands as seen with advanced SCR technology, diesel oxidation catalysts (DOC), and particulate filter technologies. Moreover, investing in hydrogen fuel cell-powered vessels and ammonia-based emission control catalysts opens market opportunity.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.8% |

The Japanese marine emission control catalyst market is growing owing to growing investments in green shipping solutions, rising government incentives for low-emission marine fuel, and improvements in catalytic converter effectiveness. The Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) of Japan is encouraging clean maritime projects, boosting demand for high-performance catalyst systems.

Japanese firms are creating advanced emission control catalysts, AI-driven exhaust gas monitoring systems, and hybrid catalyst solutions for shipping with reduced dimensions. The increasing marine fuel research involving ammonia and hydrogen is also affecting catalyst innovation in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.9% |

The South Korea marine emission control catalyst market is growing fast due to increasing shipbuilding activities, rising adoption rate for IMO Tier III compliance and extensive government support in emissions abatement technologies. The Korea Shipbuilding & Offshore Engineering (KSOE) and the South Korean Ministry of Oceans and Fisheries (MOF) make investments in reputable exhaust treatment solutions.

As the global shipbuilding make-up focuses on LNG-powered vessels, South Korea's advances in SOx & NOx reduction technologies and smart making emissions monitoring solutions are spurring innovation. The investment in carbon-neutral shipping along with alternative fuel-based catalysts drives future market trends as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

In response to higher emissions regulations and new catalyst technologies, the market for emission control catalysts in ships or marine exhaust purification will grow faster. By using shipboard selective catalytic reduction (SCR) and diesel oxidation catalysts (DOC), they are able to get rid of nitrogen oxides (NOx), sulfur oxides (SOx) as well as particulate matter (PM).

This year, business interests concentrate durable, corrosion-resistant catalysts; hybrid pollution abatement systems that allow flexibility in what fuels are used and long battery life for powering on board radio transmission equipment. This is meant to keep engines efficient while satisfying regulations with cheap solution that doesn't damage the environment (I-CAT integrated control, emission control and fuel metering system).

The market as a result contains leading catalyst manufacturers, marine smoke (exhaust) removal providers and ecological technology companies. Each have developed their own brand of ceramic catalysts, platinum-group metal formulations and ammonia-free NOx reduction technologies.

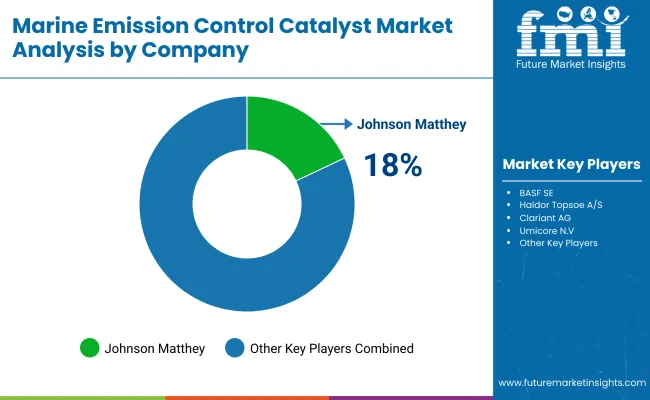

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Johnson Matthey | 18-22% |

| BASF SE | 12-16% |

| Haldor Topsoe A/S | 10-14% |

| Clariant AG | 8-12% |

| Umicore N.V. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Johnson Matthey | Develops SCR and DOC catalysts for marine engines, enhancing NOx and SOx reduction efficiency. |

| BASF SE | Specializes in platinum-group metal catalysts for marine exhaust treatment and hybrid after-treatment systems. |

| Haldor Topsoe A/S | Manufactures high-performance SCR catalysts with optimized ammonia slip control for ship emissions. |

| Clariant AG | Provides customized emission control catalysts, integrating zeolite-based NOx reduction technologies. |

| Umicore N.V. | Focuses on fuel-flexible catalytic converters and high-durability oxidation catalysts for marine vessels. |

Key Company Insights

Johnson Matthey (18-22%)

Johnson Matthey leads the marine emission control catalyst market, offering high-efficiency SCR and DOC catalysts for NOx, SOx, and particulate matter reduction in maritime applications.

BASF SE (12-16%)

BASF specializes in platinum-group metal catalysts and hybrid marine emission control systems, ensuring regulatory compliance with IMO standards.

Haldor Topsoe A/S (10-14%)

Haldor Topsoe provides advanced SCR solutions with optimized ammonia slip control, catering to commercial shipping and cruise liners.

Clariant AG (8-12%)

Clariant is known for its zeolite-based NOx reduction catalysts, ensuring long-term durability and fuel efficiency in marine engines.

Umicore N.V. (6-10%)

Umicore develops fuel-flexible catalytic converters, focusing on low-temperature oxidation catalysts for marine exhaust treatment.

Other Key Players (30-40% Combined)

Several emission control system manufacturers, catalyst technology providers, and maritime environmental solution firms contribute to advancements in SCR efficiency, low-maintenance catalytic solutions, and integrated exhaust treatment systems. These include:

The overall market size for the marine emission control catalyst market was USD 1.1 billion in 2025.

The marine emission control catalyst market is expected to reach USD 1.8 billion in 2035.

Stringent IMO regulations on sulfur and nitrogen oxide emissions, increasing adoption of eco-friendly shipping solutions, and rising investments in green marine technologies will drive market growth.

The USA, China, Germany, Japan, and South Korea are key contributors.

Selective catalytic reduction (SCR) catalysts are expected to dominate due to their high efficiency in reducing NOx emissions from marine engines.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Asia Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: MEA Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: MEA Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: MEA Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: MEA Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 107: MEA Market Attractiveness by Application, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine Electronics Market Size and Share Forecast Outlook 2025 to 2035

Marine Toxin Market Size and Share Forecast and Outlook 2025 to 2035

Marine Thermal Fluid Heaters Market Size and Share Forecast Outlook 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Marine Extract Market Size and Share Forecast Outlook 2025 to 2035

Marine Squalene Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA