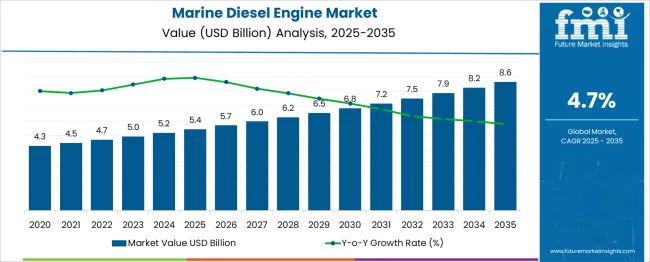

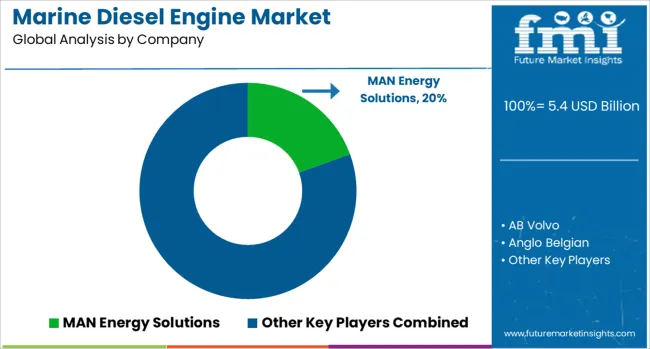

The Marine Diesel Engine Market is estimated to be valued at USD 5.4 billion in 2025 and is projected to reach USD 8.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

| Metric | Value |

|---|---|

| Marine Diesel Engine Market Estimated Value in (2025 E) | USD 5.4 billion |

| Marine Diesel Engine Market Forecast Value in (2035 F) | USD 8.6 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

Improvements in engine technology have enhanced fuel efficiency and reduced emissions, aligning with global regulations on maritime pollution. The merchant shipping sector continues to invest in medium-speed engines to balance power output and operational costs effectively. Increasing global trade volumes and expanding fleet sizes have further supported market growth.

Advances in engine design have also improved reliability and maintenance intervals, reducing downtime for vessels. As stricter environmental standards are enforced, engine manufacturers are innovating to meet emission targets while maintaining performance. The market outlook remains positive with a focus on sustainable marine propulsion solutions. Growth is expected to be led by medium-speed technology, the merchant shipping application, and engines within the 1,000 to 5,000 HP power range.

The marine diesel engine market is segmented by technology, application, and power and geographic regions. By technology of the marine diesel engine market is divided into Medium Speed, Low Speed, and High Speed. In terms of application of the marine diesel engine market is classified into Merchant, Offshore, Cruise & Ferry, Navy, and Others. Based on power of the marine diesel engine market is segmented into 1,000 - 5,000 HP, 1,000 HP, 5,001 - 10,000 HP, 10,001 - 20,000 HP, and > 20,000 HP. Regionally, the marine diesel engine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

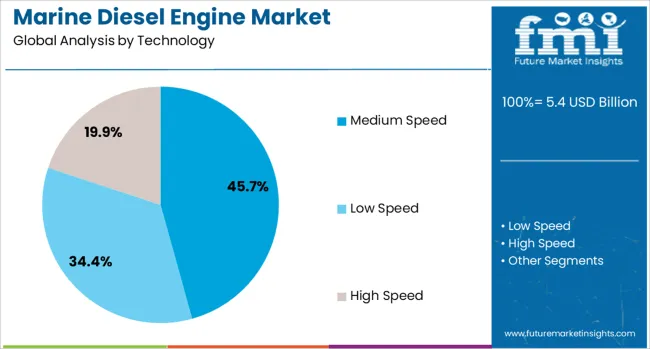

The medium-speed engine segment is projected to hold 45.7% of the marine diesel engine market revenue in 2025. This segment has gained prominence due to its ability to provide an optimal balance between fuel efficiency and power output for a wide range of vessels. Medium-speed engines are favored for their adaptability in merchant vessels, offering lower maintenance costs and longer service intervals compared to high-speed alternatives.

Their robust design suits various maritime operations while meeting emerging emission regulations. The segment benefits from its broad applicability, covering bulk carriers, container ships, and tankers.

With operators prioritizing cost-effectiveness and compliance, medium-speed engines are expected to remain the preferred choice in the marine propulsion market.

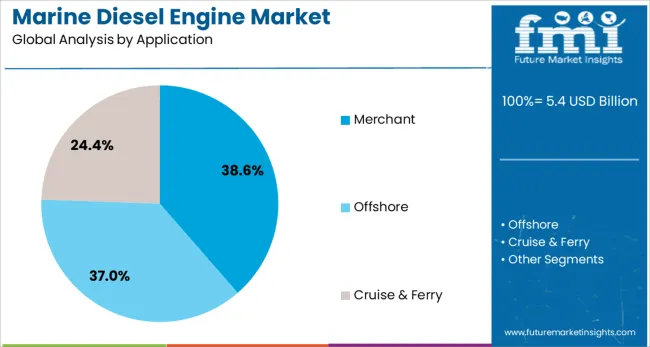

The merchant shipping segment is expected to account for 38.6% of the marine diesel engine market revenue in 2025. Growth in this segment is driven by the continued expansion of global trade and fleet modernization efforts. Merchant vessels require reliable and efficient propulsion systems capable of handling long voyages and variable cargo loads.

Engine manufacturers have focused on meeting the unique needs of the merchant segment by enhancing fuel efficiency and reducing emissions. Regulatory frameworks aimed at curbing shipping pollution have accelerated the adoption of advanced marine diesel engines in merchant fleets.

The sector's importance in global logistics and supply chains underpins its leading market position.

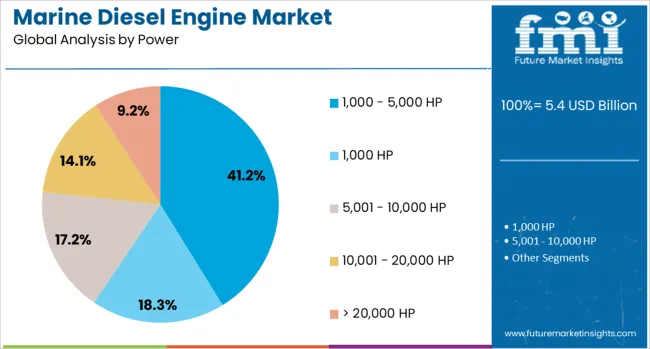

The 1,000 to 5,000 HP power segment is projected to contribute 41.2% of the market revenue in 2025. Engines within this power range are widely used in medium-sized vessels, offering sufficient propulsion for merchant ships while optimizing fuel consumption.

The segment's growth has been supported by the versatility of these engines, suitable for bulk carriers, container ships, and specialized cargo vessels. Operators have favored this power band for its balance of efficiency, durability, and compliance with environmental standards.

Additionally, the demand for engines in this range is boosted by fleet renewal and new shipbuilding projects focusing on mid-sized vessels. The segment is expected to remain critical to market growth as maritime trade evolves.

Marine diesel engines are being utilized across commercial shipping, offshore support vessels, and recreational boats due to their reliability, fuel efficiency and extended operating range. Systems offering improved fuel injection control, turbocharging and emissions after-treatment are now preferred to meet regulatory requirements and reduce operating costs. Integration with electronic engine management, remote diagnostics and hybrid propulsion compatibility has extended usage across fleet operators and boat manufacturers. Demand has been supported by newbuild orders and repowers intended to upgrade aging fleets for improved performance and compliance.

Marine diesel engine demand has been stimulated by the need to reduce fuel consumption and meet tightening emissions regulations on nitrogen oxides and particulate matter. Common-rail fuel injection systems coupled with turbocharging and electronic controls have delivered precise combustion, lowering consumption and improving torque output. Tier-specific exhaust after-treatment units including selective catalytic reduction and diesel particulate filters have enabled compliance with marine environmental standards. Engine manufacturers have collaborated with vessel OEMs to integrate propulsion systems that balance power, weight and in-service efficiency. Predictive engine monitoring and diagnostics tools have supported scheduled maintenance and reduced operational downtime on long hauls. These technological upgrades have been prioritized in fleet renewal projects focused on lifecycle cost optimization and environmental compliance.

Upgrade of marine engines has remained limited by high investment required for modern engines equipped with controlled fuel systems and exhaust after-treatment. Older fleet vessels have faced compatibility issues when retrofitting new engine models, requiring adjustments to shaft alignment, cooling systems and propulsion controls. Certification and seaworthiness inspections for repowered vessels have added administrative costs and dry-docking downtime. Maintenance teams have required training on electronic engine management, sensor calibration and emission system service procedures. Spare part availability has been inconsistent on some global shipping routes, leading to delays during critical engine repair events. As vessel operators have weighed fuel savings and compliance costs against upfront capital, modernization schedules have often been staged to align with charter cycles and asset life planning.

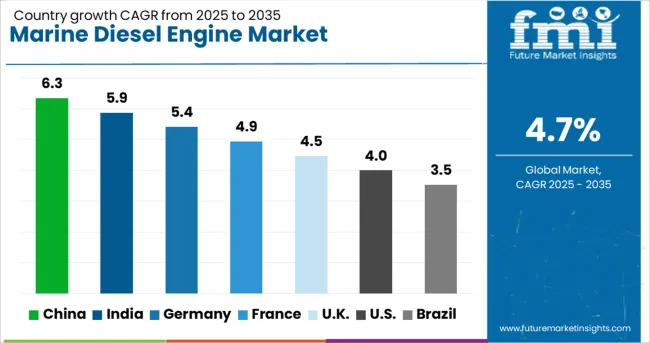

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

The global marine diesel engine market is forecast to grow at a 4.7% CAGR between 2025 and 2035, driven by demand for commercial shipping, naval modernization, and offshore support vessels. Among the 40 countries studied, China leads with 6.3%, followed by India at 5.9%, while Germany posts 5.4%, France records 4.9%, and the United Kingdom stands at 4.5%. Growth is supported by regulatory pressure for energy-efficient propulsion systems and hybrid integration. BRICS economies emphasize fleet expansion and cost-effective power units, whereas OECD countries invest in low-emission engines and LNG-compatible designs. The report includes an analysis of over 40 countries, with five profiled below for reference.

China is projected to grow at a 6.3% CAGR, supported by its strong shipbuilding sector and rising demand for container ships, bulk carriers, and LNG vessels. Major manufacturers in China invest in high-output marine engines equipped with advanced fuel injection systems for improved efficiency. Compliance with IMO Tier III emission norms accelerates the development of engines optimized for low-sulfur fuel and LNG dual-fuel operations. Coastal infrastructure expansion and offshore energy projects contribute to higher adoption of large-capacity diesel engines. Domestic brands collaborate with European technology firms to enhance electronic control systems and durability in harsh marine conditions.

India is expected to grow at a 5.9% CAGR, driven by naval modernization, port infrastructure development, and an expanding coastal shipping network. Government initiatives like Sagarmala boost demand for marine propulsion systems in domestic trade vessels. Shipyards prioritize compact, fuel-efficient engines for short-sea shipping and inland waterway transport. Investments in dual-fuel technology and emission-compliant designs gain traction under IMO regulations. Indigenous manufacturing is advancing with localized component production to reduce import reliance. Growth in offshore oil exploration also spurs demand for auxiliary diesel engines used in support vessels and platforms.

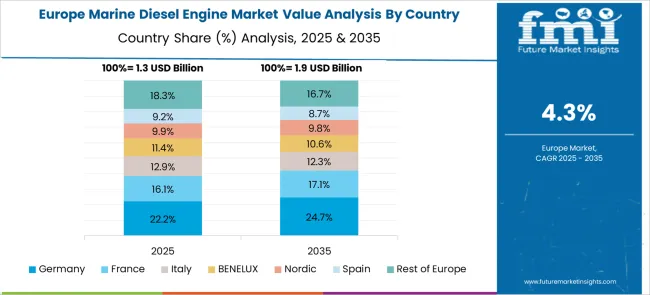

Germany is forecast to grow at a 5.4% CAGR, driven by demand for eco-friendly propulsion technologies and hybrid integration in cruise ships and cargo vessels. Leading engine manufacturers develop low-emission diesel engines compatible with biofuels and LNG. Adoption of electronic fuel control and exhaust after-treatment systems supports compliance with EU environmental directives. Shipbuilders prioritize compact engines for riverine transport and high-end passenger vessels. Public-private R&D programs under maritime innovation frameworks accelerate the development of dual-fuel and hybrid marine propulsion units. Export demand for German-built engines remains strong in European and Asian markets.

France is projected to grow at a 4.9% CAGR, supported by expansion in ferry services, naval procurement, and offshore wind projects. Shipyards integrate compact, emission-optimized diesel engines for coastal and inter-island transport vessels. IMO compliance fosters demand for low-sulfur fuel-compatible engines equipped with SCR and EGR technologies. French manufacturers collaborate with global technology firms for dual-fuel solutions, targeting LNG adoption in short-sea shipping. Increased investment in offshore support fleets for renewable energy installations further enhances the requirement for medium-speed marine engines with high load endurance.

The United Kingdom is anticipated to grow at a 4.5% CAGR, driven by modernizing commercial fleets, enhancing port infrastructure, and adopting cleaner propulsion solutions. Offshore energy projects in the North Sea create incremental demand for auxiliary engines in service vessels. Shipyards prioritize hybrid-ready diesel engines to align with decarbonization targets under the Clean Maritime Plan. OEMs focus on retrofitting older vessels with efficient engine systems to improve fuel economy and reduce NOx emissions. Collaborative programs with European partners strengthen access to advanced marine propulsion technologies for defense and commercial shipping segments.

The marine diesel engine market is defined by a mix of global OEMs and specialist manufacturers delivering robust propulsion solutions for commercial, naval, and leisure vessels. MAN Energy Solutions, Wärtsilä, and Rolls‑Royce lead in high-power engines tailored for container ships and cruise liners, integrating emission control and hybrid-ready designs. Cummins, AB Volvo, and Scania serve offshore and auxiliary power needs with versatile medium-speed engines. Caterpillar, DEUTZ, and Yanmar provide compact propulsion and generator sets for fishing and smaller commercial craft. Daihatsu Diesel, Hyundai, Kawasaki Heavy Industries, and STX Heavy Industries cater to Asian shipbuilders with locally produced engines that balance cost and performance. Siemens brings digital solutions like condition monitoring and remote diagnostics. Competition hinges on fuel efficiency, emission compliance, power-to-weight optimization, and after-sales network capability.

In June 2025, MAN Energy Solutions announced the upcoming delivery of the world’s most powerful two-stroke methanol engine. The engine, designated MAN B&W 12G95ME-C10.5-LGIM (Liquid Gas Injection Methanol), is rated at 82,440 kW @ 80 rpm.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.4 Billion |

| Technology | Medium Speed, Low Speed, and High Speed |

| Application | Merchant, Offshore, Cruise & Ferry, Navy, and Others |

| Power | 1,000 - 5,000 HP, 1,000 HP, 5,001 - 10,000 HP, 10,001 - 20,000 HP, and > 20,000 HP |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | MAN Energy Solutions, AB Volvo, Anglo Belgian, Caterpillar, Cummins, Daihatsu Diesel, Deere & Company, DEUTZ, Hyundai, IHI Corporation, Kawasaki Heavy Industries, Rolls-Royce, Scania, Siemens, STX Heavy Industries, Wartsila, Yanmar, and Yuchai International |

| Additional Attributes | Dollar sales by machine type (injection molding, stretch blow molding), regional adoption patterns, competitive landscape, buyer priorities for speed versus energy savings, integration with digital monitoring systems, innovations in multi-layer barrier technology, rPET processing capabilities, and hybrid automation solutions for enhanced production efficiency. |

The global marine diesel engine market is estimated to be valued at USD 5.4 billion in 2025.

The market size for the marine diesel engine market is projected to reach USD 8.6 billion by 2035.

The marine diesel engine market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in marine diesel engine market are medium speed, low speed and high speed.

In terms of application, merchant segment to command 38.6% share in the marine diesel engine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine Nanocoating Market Size and Share Forecast Outlook 2025 to 2035

Marine-grade Polyurethane Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Market Size and Share Forecast Outlook 2025 to 2035

Marine Toxin Market Size and Share Forecast and Outlook 2025 to 2035

Marine Thermal Fluid Heaters Market Size and Share Forecast Outlook 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Marine Extract Market Size and Share Forecast Outlook 2025 to 2035

Marine Squalene Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA