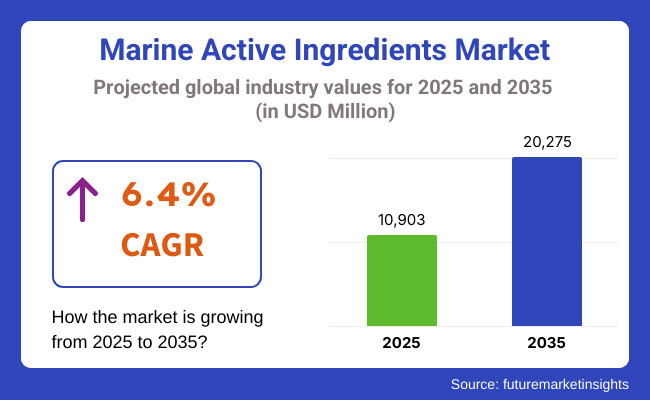

Value of world's marine active ingredients per annum in 2023 was USD 9,709 million. Sale of marine active ingredients increased with a compound annual growth rate (CAGR) of 6.4% in 2024 such that cumulative market would be USD 10,903 million in 2025. Overseas sales over the forecast period (2025 to 2035) will increase with a CAGR of 6.4% over the forecast period and, in 2035, their worth as sales would be USD 20,275 million.

Marine bioactive compounds, i.e., extracts of seaweed, algae, and other marine bioactive organisms, are also becoming rapidly popular across all food & beverage, nutraceutical, and personal care segments globally because they are extremely nourishing and enriched with new bioactive molecules. They are densely rich in omega-3 fatty acids, antioxidants, and various other nutrients and provide numerous beneficial health effects such as anti-inflammatory action, heart wellness, and enhanced skin care.

As natural and ecologic products have growing demand, marine actives market will grow with their large range of application and demand for their well-being properties. Marine actives are demanded more due to positive influence on the cardiovascular system safety, anti-aging, and immunity. Marine actives are trendier in personal care business due to moisturizing, anti-inflammatory, and skin renewal.

As the consumers are shifting towards cleaner and greener products, marine active ingredients like seaweed, fish, and algae are a cleaner and greener alternative to land-based ingredients. Increased customers' need for natural and clean-label ingredients is going to drive the market ahead.

Marine ingredient recovery and green source operations technology innovation will also propel the market growth due to the fact that companies are competing with one another to tap growing demand for green, clean-label ingredients. As the market is in infancy stage, new product formulation innovation and algae alternative application will be what will propel how the future of marine active ingredients will be.

The below is the six-month CAGR difference variation of the review period (2025) and the base period (2024) in the global marine active ingredients market. Variation is an indicator of good change performance and informs stakeholders on revenue realization trends, therefore informing stakeholders on the growth trend for the year. The period has been segmented into two phases: first half, H1, January-June and second half, H2, July-December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.0% |

| H2 (2024 to 2034) | 6.1% |

| H1 (2025 to 2035) | 6.2% |

| H2 (2025 to 2035) | 6.4% |

The industry will be 6.2% during the first half (H1) of the period 2025 to 2035 and in the second half (H2) of the period ever so slightly at 6.4%. Growth will be at superior growth rates towards the latter part of the period and natural and organic use of ingredients from the oceans will be the driving force behind the expansion day by day. During the first half of the year (H1), the company has seen 20 BPS growth, while during the second half (H2), the company will be able to see higher growth of 20 BPS.

This consistent growth pattern driven by health-driven demand and sustainability places the marine active ingredients market on a growth trajectory to profitable success in the forecast years. Consistently on the growth trajectory, the marine active ingredients market is gradually moving towards sustainable success with huge opportunities to be unlocked for industry players and nutraceutical, food & beverage, and personal care firms.

Tier 1 Players, They are worldwide market leaders with state-of-the-art research and development centres, huge high-volume manufacturing facilities, and globally aligned distribution networks. They have operations in North America, Europe, and Asia-Pacific and supply marine actives to commercial-scale business segments like the skincare, drug, and nutritionals business.

Tier 1 players are active fundraisers of the marine biodiversity for research and biotechnology as a stepping stone for the creation of high-value bioactive molecules. Their timely finance support allows them to address the regulatory requirements and patent sea products to ensure that they are marketable in the international market.

Tier 2 Players, They are focused in some regional markets to a large extent and engage in importing sea food ingredients from seacoast and sea-intensive areas such as the Mediterranean, the Nordic nations, and the Asia-Pacific. They provide low-cost quality marine extracts to mid-tier nutraceutical and cosmetic manufacturers.

Tier 2 players are interested in procurement sustainability and are beginning to work with research organizations as they venture into diversification of products. Without Tier 1 players' international presence, they are optimally placed in domestic sea products and technical expertise of the process of processing within the industry. They are mostly emerging through domestic acquisition and joint ventures.

Tier 3 Players, These include handmade manufacturers, sea resource gatherers, and specialty firms that offer organic and handmade sea ingredients. They distribute to local business houses, small cosmetic chain stores, and specialty nutrition companies.

Tier 3 members are based on traditional solvent extraction and possess knowledge in environmentally friendly scale of harvesting widespread. Even though wide scale of influence on total market is zero, Tier 3 members distribute sea uniqueness because such contain indigenous compounds of a specific ecosystem and environment-friendly customers demand it.

Increasing Demand for Marine-Origin Anti-Inflammatory Active Compounds

Shift: Incidences of inflammation-related diseases like arthritis, cardiovascular disease, and metabolic syndrome are on the increase in the global world, driving demand in the market for marine-origin drugs. Sea active compounds such as omega-3 fatty acids, bioactive peptides, and marine polyphenols are more in the spotlight now for their potential to reduce inflammation, enhance gastrointestinal health, and enhance brain intelligence.

North American and European consumers increasingly are seeking functional foods and supplements of marine-derived anti-inflammatory agents as an alternative to traditional NSAIDs.

Strategic Response: Aker BioMarine (Norway) launched a krill oil supplement containing phospholipid-bound omega-3s, boosting sales by 30% among heart-conscious consumers. BASF (Germany) introduced a new series of marine-derived omega-3 emulsions for the control of inflammation, boosting its distribution in Europe by 24%.

Nourish3 (USA) introduced a marine algal extract dietary supplement that boosted online subscriptions by 22% among customers with joint pain management. These firms are promoting ocean-derived anti-inflammatory products as a natural, safe alternative to traditional medication.

Source of Marine-Derived Peptides in Functional Foods & Beverages

Shift: As consumers look for more functional foods and drinks, marine-derived active ingredients such as peptides, omega-3 fatty acids, and astaxanthin are gaining traction. Interest in natural, marine-derived alternatives to traditional supplements based on growing interest in gut health, brain function, and metabolic health is on the increase. Global interest in holistic wellness is making marine-derived ingredients a mainstream solution for functional food and beverage products.

Strategic Response: Aqua Biome (USA) launched marine source omega-3 blends in functional drinks, expanding retail affiliation by 28% in 2024. KD Pharma (Germany) released a new line of water-soluble omega-3 emulsions for functional drinks, achieving a 31% sales increase in the European market. Astareal (Japan) achieved a 35% surge in astaxanthin-derived health shots demand, driven by higher consumers' request for antioxidant-containing liquid supplements.

Brands are exploring ocean bioactives for the formulations of tomorrow that are enhancing the appeal of health beverage and functional foods offerings in the high-growth marketplace.

Sustainability and Traceability Becoming Key Buying Drivers

Shift: Consumers are also increasingly aware of the ocean's environmental impact of marine-derived ingredients and demand end-to-end supply chain transparency. Overfishing, sea pollution, and microplastic pollution have challenged the sustainability of ocean-derived bioactives. Firms thus need to ensure responsible sourcing, traceability, and sustainability certifications to win consumer confidence.

Strategic Response: Aker BioMarine, headquartered in Norway, received Marine Stewardship Council (MSC) certification for responsibly sourced krill oil, stimulating a 28% sales surge and consumer confidence. Pharma Marine, headquartered in Norway, lengthened its vertically integrated value chain for full traceability of its ocean-sourced production of omega-3, increasing market exposure in global markets by 30%.

Sophy Biotech, headquartered in France, adopted blockchain-tracing for astaxanthin from the sea, delivering transparency and compliance risk mitigation. Brands are coming back to green processing, sustainable harvesting, and third-party certifications to secure customer confidence and follow regulatory norms.

Gaining Momentum on Marine-Derived Peptides for Sports Nutrition and Recovery

Shift: As the boom in the wellness and fitness market increases, markets for very bioavailable proteins as well as recuperation-inducing supplements are on the rise. Endurance sportsmen as well as bodybuilders require fast muscle recuperation, fewer inflammasomes, and joint protection, and so utilize seafood-sourced proteins, collagen peptides, and amino acids in place of conventional animal-derived whey and casein.

Strategic Response: Nitta Gelatin (Japan) introduced Wellnex marine collagen peptides for endurance athletes and sportsmen, leading to a 30% increase in sports nutrition sales. Vital Proteins (USA) developed marine collagen blends with electrolytes to support enhanced post-workout hydration and saw a 25% sales increase.

Nordic Naturals (Norway) developed a marine protein-fortified omega-3 powder, seeing a 22% increase in global e-commerce orders. Companies are marketing marine bioactives as a pure, green, and extremely powerful way of sport performance and muscle recovery.

Development of Personalized Nutrition and Marine Peptides for Longevity

Shift: The move towards personalized nutrition is transforming consumer demand, as consumers demand custom-designed dietary supplements and functional foods that address their specific needs. Personalized nutrition, informed by AI-driven health intelligence, is stimulating demand for marine-derived protein, peptides, and minerals focused on personal health goals like skin elasticity, heart health, and metabolic balance.

Strategic Response: Precision-fermented kelp protein was developed by Amai Proteins (Israel) for customized supplement solutions, with a 40% rise in demand. According to a survey carried out by NutraIngredients, DNA-personalized ocean-based collagen products rose by 27% in 2024.

Seppic, a French biotech company, partnered with digital health companies to create DNA-personalized omega-3 and ocean peptide supplement programs, growing its customer base by 32%. The leading brands are producing DNA-personalized supplements with marine bioactives to give the best possible nutrition and performance for certain health needs.

The following table shows the estimated growth rates of the top five territories expected to exhibit high consumption of marine active ingredients through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 7.5% |

| Germany | 4.0% |

| China | 5.3% |

| Japan | 8.6% |

| India | 6.8% |

The continuing growth of the USA marine active ingredients sector is driven by growth in consumer consciousness toward the potential for human health from marine bioactives. Demand for bioactive natural marine-derived ingredients for functional foods, cosmeceuticals and nutritional supplements is rising steadily with special emphasis on fish peptides and marine collagen and algae extracts. Such components find large-scale applications in anti-aging dermatology products, joint supplement formulas, and cognitive enhancement drugs, pushing sector innovation and product range.

In addition, advancements in sourcing sustainable marine ingredients and new extraction technologies are enabling high-purity marine bioactives. Responsible businesses are incorporating marine-derived eco compounds in skin health formulations, cellular rejuvenation and inflammatory response modulation. Clean-label and ethically sourced products are what consumers demand, so the shift towards traceable, sustainably sourced marine actives will also drive market growth.

This growth has established a defining trend in the German marine active ingredients market, supported by a powerful thrust from European Union regulations focused on the traceable, sustainably and environmentally friendly, and certified organic philosophy of marine ingredients. European consumers are ever more searching for sustainable products and thereby developing an ever greater need for marine-sourced antioxidants, algae-based omega-3, and fish collagen peptides featured in premium skin care, functional beverages, and nutraceuticals.

Premium skin care and wellness companies focused on ethical sourcing and sustainability are particularly well positioned with the German consumer. As a result, manufacturers are now prioritizing their efforts on marine biotechnology, eco-friendly fishery byproduct use and microalgae-derived bioactives. Advances in cold-water extraction and fermentation technologies in recent years are further increasing the bioavailability and efficacy of marine-derived ingredients, making them extremely coveted ingredients for luxury beauty and functional wellness products.

With that, it is able to keep up with the increased demand for marine drugs and functional beverages based on marine active ingredients around the globe. Consumers in China are embracing ingredients such as deep-sea fish peptides, chitosan extracts and seaweed-derived polysaccharides to promote skin health and immunity owing to a strong cultural propensity towards natural and traditional health remedies.

State-led investments in sea biotechnology are accelerating R&D into sea-originated enzymes, bioactive peptide and seaweed-derived immune energizers. It creates new threats and opportunities for local and overseas players in the growing medicinal plant business via integrating these products in traditional medicine as well as in functional foods and beverages. On top of this, China's e-commerce drive is demanding business in cosmeceutical and health food supplements sourced from the seas adding further impetus to the growth trend in the sector

| Segment | Value Share (2025) |

|---|---|

| Marine Collagen & Peptides (By Application) | 64.1% |

Due to the increasing interest in marine-derived hydrolyzed collagen, the marine collagen and peptide industry will continue to lead the marine active ingredients market with 64.1% market share in 2025. This leadership by marine-based peptides can be explained by the extremely bioavailable nature of peptides obtained from the ocean, which offers increased absorption than other collagen sources.

Joint support, improvement of skin elasticity, and anti-aging effects are some of the primary advantages behind the surging demand for these bioactive compounds. This segment includes enzymatically hydrolyzed collagen, marine collagen, deep-sea fish peptide, fish gelatin and bioactive elastin complexes employed in cosmeceuticals, nutraceuticals and functional food preparation.

Consumer choice is quickly shifting towards sustainably sourced, marine-derived collagen substitutes, causing manufacturers to tap into innovative processing methods, like fermentation, in order to enhance bioavailability. Marine Derived Peptides - Such products are experiencing increased popularity within the industry due to their absorption and skin renewal, as well as overall anti ageing advantages. Such innovation points towards the industry's emphasis on sustainability and innovative functional beauty gains.

| Segment | Value Share (2025) |

|---|---|

| Algae-Based Bioactives & Omega-3 Extracts (By Application) | 35.9% |

Raising awareness of heart health, brain function and immune health, algae-derived bioactives and omega-3 extract category at 35.9% market share in 2025. As consumers seek natural, sustainable and science-supported solutions to improve overall well-being, demand for new marine-derived ingredients continues to surge. Extracts from algae rich in astaxanthin, particularly, are starting to make waves for their potent antioxidant activity that combat oxidative stress that supports cardiovascular health.

In addition, biovailable DHA supplements are becoming part of the key cognitive function, as DHA is significant for brain development and support. In addition, polyphenols from marine sources have been also investigated because of their potential anti-inflammatory and immunosuppressive properties. With brewing sustainability concerns, companies are pushing for the adoption of microalgae-based omega-3 as the eco-friendly alternative to traditional, fish-derived sources.

Green marine antioxidant extracts were explored as potential candidates to promote longevity and cellular protection. Specialized marine lipid products are being developed to meet the rising need for functional nutrition and pharma applications. These developments reinforce the industry commitment to sustainability, innovation, and the supply of quality bioactive marine nutrients to the increasingly health-driven consumer.

Marine bioactives market is competitive, with key players including major marine active ingredient manufacturers, marine bioactive researchers, and marine active ingredient end-users, and is mainly driven by advanced marine bioactive extraction, the ability to sustainably source marine bioactives, and increase applications in nutraceutical, pharmaceutical and cosmetic applications. Innovations in marine biotechnology, bioavailable peptides formulations, and microalgae-based ingredient production are being developed by companies.

Top manufacturers in the market (Aker BioMarine, Seppic, Croda International, BioMarine Ingredients Ireland, Ashland Global) have traditionally focused on marine-based functional ingredients, omega-3 formulations, and bioactive peptides for marine-derived nutraceuticals. With demand for all things marine-based wellness and skincare on the rise, many players are expanding further into Asia-Pacific and Europe.

For example, relevant partnerships with nutraceutical and skincare brands, investments in marine bioprocessing technology research, and the extraction of algae-based bioactives for cognitive and metabolic health. Manufacturers are also focusing on low-carbon marine ingredient production and biodegradeable extraction methods.

For instance:

The market includes a range of marine-derived products such as Fish Meal, Fish Oil, and other specialized ingredients like Peptides and Marine Proteins, catering to diverse industry needs.

These products contain essential nutrients, including Protein, Ash, and Fatty Acids, along with other beneficial components such as Enzymes and Vitamins.

The products are available in two primary forms Powder and Liquid ensuring flexibility for various applications.

Marine-based ingredients are widely used across multiple industries, including Poultry Feed, Aquaculture, Food & Beverage, Animal/Pet Food, Cosmetics & Personal Care, Dietary Supplements & Sports Nutrition, Infant Formula, and Pharmaceuticals, with additional applications in Fertilizers, Emulsions, and other specialized sectors.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global marine active ingredients industry is projected to reach USD 10,903 million in 2025.

Key players include Hofseth BioCare ASA; Bio-marine Ingredients Ireland Ltd.; TripleNine Group A/S; Symrise AG; Scanbio SA.

Asia-Pacific is expected to dominate due to high demand for marine-derived functional foods, beauty products, and dietary supplements.

The industry is forecasted to grow at a CAGR of 6.4% from 2025 to 2035.

Key drivers include rising demand for marine-derived functional foods and cosmeceuticals, increasing use in pharmaceuticals, and advancements in sustainable marine ingredient extraction.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Ingredients Type, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Ingredients Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Ingredients Type, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Ingredients Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Ingredients Type, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Ingredients Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Ingredients Type, 2018 to 2033

Table 36: Europe Market Volume (MT) Forecast by Ingredients Type, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: East Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: East Asia Market Value (US$ Million) Forecast by Ingredients Type, 2018 to 2033

Table 46: East Asia Market Volume (MT) Forecast by Ingredients Type, 2018 to 2033

Table 47: East Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 48: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 50: East Asia Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 51: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 55: South Asia Market Value (US$ Million) Forecast by Ingredients Type, 2018 to 2033

Table 56: South Asia Market Volume (MT) Forecast by Ingredients Type, 2018 to 2033

Table 57: South Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 58: South Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 59: South Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 60: South Asia Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 61: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: Oceania Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: Oceania Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 65: Oceania Market Value (US$ Million) Forecast by Ingredients Type, 2018 to 2033

Table 66: Oceania Market Volume (MT) Forecast by Ingredients Type, 2018 to 2033

Table 67: Oceania Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 68: Oceania Market Volume (MT) Forecast by Form, 2018 to 2033

Table 69: Oceania Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 70: Oceania Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 71: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 73: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: MEA Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 75: MEA Market Value (US$ Million) Forecast by Ingredients Type, 2018 to 2033

Table 76: MEA Market Volume (MT) Forecast by Ingredients Type, 2018 to 2033

Table 77: MEA Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 78: MEA Market Volume (MT) Forecast by Form, 2018 to 2033

Table 79: MEA Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 80: MEA Market Volume (MT) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Form, 2023 to 2033

Figure 29: Global Market Attractiveness by End Use, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Form, 2023 to 2033

Figure 59: North America Market Attractiveness by End Use, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 105: Europe Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 109: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 113: Europe Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 116: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Form, 2023 to 2033

Figure 119: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: East Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 133: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 135: East Asia Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 136: East Asia Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 137: East Asia Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 138: East Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 139: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 140: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 141: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 142: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 143: East Asia Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 149: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 153: South Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 154: South Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 155: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: South Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 162: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 165: South Asia Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 166: South Asia Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 167: South Asia Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 168: South Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 169: South Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 180: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 181: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 182: South Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 183: South Asia Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 184: South Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 185: South Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 186: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 187: South Asia Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 188: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 189: South Asia Market Attractiveness by End Use, 2023 to 2033

Figure 180: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by Form, 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by End Use, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 191: Oceania Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 192: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: Oceania Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 195: Oceania Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 196: Oceania Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 197: Oceania Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 198: Oceania Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 199: Oceania Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 203: Oceania Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 204: Oceania Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 205: Oceania Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 208: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 209: Oceania Market Attractiveness by End Use, 2023 to 2033

Figure 220: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 221: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 222: MEA Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 223: MEA Market Value (US$ Million) by Form, 2023 to 2033

Figure 224: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 225: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 226: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 227: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 228: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 229: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 230: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 231: MEA Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 233: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 233: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 234: MEA Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 235: MEA Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 236: MEA Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 237: MEA Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 238: MEA Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 239: MEA Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 230: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 231: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 233: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 233: MEA Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 234: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 235: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 236: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 237: MEA Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 238: MEA Market Attractiveness by Form, 2023 to 2033

Figure 239: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 240: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine Thermal Fluid Heaters Market Size and Share Forecast Outlook 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Marine Extract Market Size and Share Forecast Outlook 2025 to 2035

Marine Squalene Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Marine Prebiotics Market Size and Share Forecast Outlook 2025 to 2035

Marine Collagen-Based Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA