The Two Wheeler Suspension System Market is expected to grow from USD 1.8 billion in 2025 to USD 2.90 billion in 2035, reflecting a CAGR of 4.9%. Compound absolute growth analysis indicates a cumulative increase of USD 1.08 billion over the forecast period. Expansion is likely to be supported by rising two-wheeler production, growing focus on ride comfort and safety, and adoption of advanced suspension technologies, including hydraulic and adjustable systems. Manufacturers offering durable, lightweight, and high-performance components are expected to capture a larger portion of the market.

From 2025 to 2030, absolute growth is projected to be steady, driven by replacement demand and routine maintenance requirements. Incremental adoption of enhanced suspension systems in mid-range and premium two-wheelers will contribute to value accumulation during this phase. Between 2030 and 2035, growth may increase moderately as improved damping systems and electronically controlled suspension solutions gain wider acceptance. The cumulative effect of annual growth results in a consistent upward trajectory, reflecting stable market expansion. The compound absolute growth analysis shows a reliable pattern, supported by rising demand for improved ride quality, safety, and performance, offering sustained revenue potential for manufacturers and suppliers in the global Two Wheeler Suspension System Market.

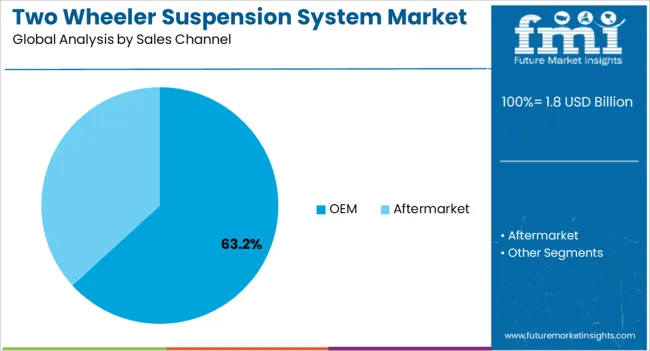

The OEMs hold a significant share, accounting for about 71% of the market, driven by the increasing production of motorcycles integrated with advanced suspension systems as standard features. The aftermarket segment captures the remaining 29%, catering to consumers seeking to upgrade their vehicles with advanced suspension technologies for improved performance and aesthetics.

Recent developments in the Two Wheeler Suspension System Market indicate a shift towards advanced suspension technologies and increased demand for energy-efficient solutions. Manufacturers are focusing on developing suspension systems that offer improved performance while minimizing energy consumption. The integration of smart technologies, such as automated control systems and real-time monitoring, is gaining traction to enhance the efficiency and effectiveness of suspension systems. There is a growing emphasis on lightweight and compact designs to accommodate space constraints on modern vehicles.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.8 billion |

| Market Forecast (2035) | USD 2.90 billion |

| Growth Rate | 4.9% CAGR |

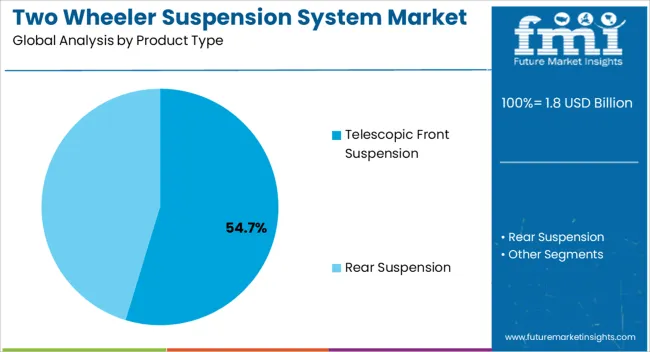

| Leading Suspension Type | Telescopic Front Suspension (54.7%) |

| Primary Sales Channel | OEM Direct Supply (63.2%) |

The market demonstrates robust fundamentals with Telescopic Front Suspension maintaining dominant position through proven reliability, cost-effective manufacturing, and universal compatibility across diverse motorcycle and scooter platforms. OEM sales channel drives primary revenue through direct supply relationships with two-wheeler manufacturers globally. Geographic expansion concentrates in Asia-Pacific representing largest market share through massive two-wheeler production volumes in China, India, and Southeast Asian markets, while developed regions show steady growth driven by premium motorcycle demand and technology advancement.

Market expansion rests on three fundamental shifts driving adoption across the two-wheeler manufacturing and aftermarket sectors.

The growth faces headwinds from intense price competition in high-volume Asian markets limiting suspension component pricing and profit margins. Raw material costs for steel, aluminum, and hydraulic oil impact manufacturing expenses and profitability. Technology complexity increases development costs for advanced suspension systems with electronic control, requiring significant R&D investments that particularly challenge smaller suspension manufacturers with limited scale.

The Two Wheeler Suspension System Market represents a resilient growth opportunity, expanding from USD 1.8 billion in 2025 to USD 2.90 billion by 2035 at a 4.9% CAGR. As global two-wheeler production continues expanding in emerging markets, premium motorcycle segment grows in developed regions, and electric two-wheeler adoption accelerates worldwide, suspension systems have evolved from basic mechanical components to sophisticated ride quality enablers, providing essential vehicle dynamics, rider comfort, and handling precision across diverse two-wheeler platforms from economy commuter scooters to high-performance superbikes.

The convergence of Asian market motorization, premium motorcycle demand growth, electric two-wheeler technology maturation, and advanced suspension technology development creates substantial adoption momentum. Advanced suspension solutions offering electronic damping adjustment, lightweight construction, and superior ride quality will capture premium market positioning, while cost-effective telescopic systems optimized for high-volume production will drive volume leadership. OEM partnerships and integrated suspension development aligned with vehicle platform strategies provide competitive advantages.

Leading with 54.7% market share through proven reliability, cost-effective manufacturing, and universal application across motorcycle and scooter segments, telescopic front suspension enables comprehensive ride quality and handling characteristics without premium pricing requirements. Technology advantages including established manufacturing processes, extensive supplier base, and proven durability supporting diverse operating conditions maintain dominant market position while serving replacement aftermarket through wear-related component replacement cycles. Expected revenue pool: USD 1.55-1.70 billion.

Dominating with 63.2% market share, OEM direct supply relationships drive primary revenue through integrated suspension development programs with two-wheeler manufacturers, just-in-time delivery systems supporting efficient production operations, and long-term partnership agreements providing business stability and volume commitments. Specialized capabilities for platform-specific suspension tuning, quality consistency meeting automotive standards, and technical support throughout vehicle development cycles command sustained OEM preferences and market positioning. Opportunity: USD 1.80-2.00 billion.

Capturing 58.6% market share, motorcycle applications drive primary demand through diverse segment requirements spanning commuter motorcycles, sport bikes, touring motorcycles, and off-road applications each requiring specialized suspension specifications optimized for intended usage. Premium motorcycle segments including superbikes, adventure touring, and luxury cruisers support sophisticated suspension technologies with adjustable damping, inverted forks, and performance-oriented specifications commanding significant component value. Revenue opportunity: USD 1.65-1.85 billion.

Germany (7.1% CAGR) leads country-level growth through premium motorcycle market strength including BMW Motorrad leadership, strong aftermarket demand for performance suspension upgrades, and advanced suspension technology development supporting high-performance motorcycle applications. Strategic positioning serving European motorcycle manufacturing and export-oriented production enables technology leadership and premium pricing supporting profitability despite moderate volume characteristics. Geographic expansion upside: USD 180-220 million.

India and China combined representing largest two-wheeler production volumes globally create extensive suspension system demand through economy commuter motorcycles and scooters requiring cost-effective suspension solutions balancing performance with affordability. Market opportunities emphasizing local manufacturing capabilities, high-volume production optimization, and competitive pricing aligned with domestic market requirements capture mass market demand supporting revenue scale despite lower per-unit values compared to premium segments. Asian volume pool: USD 800-950 million.

Emerging electric motorcycle and scooter market requiring specialized suspension development addressing unique vehicle characteristics including battery weight distribution, instant torque delivery, and revised center of gravity creates differentiated opportunity. Advanced solutions supporting electric vehicle platforms with optimized suspension geometries, enhanced damping capabilities, and lightweight construction expand addressable market as EV two-wheeler adoption accelerates globally. EV suspension opportunity: USD 200-280 million.

Beyond OEM supply, aftermarket replacement demand for worn suspension components and performance upgrade market serving enthusiasts seeking enhanced suspension capabilities provide supplementary revenue streams. Opportunities in premium aftermarket brands offering adjustable suspension systems, racing-specification components, and complete front end upgrades expand market beyond OEM channels with higher margin potential through direct consumer sales and specialty retailer distribution. Aftermarket pool: USD 280-350 million.

The market segments by suspension type into Telescopic Front Suspension, Inverted Front Forks, Mono Shock Rear Suspension, Twin Shock Rear Suspension, and Linkage Suspension Systems, representing the evolution from basic twin shock designs to advanced mono shock and inverted fork technologies optimizing ride quality and handling performance.

Vehicle type segmentation divides the market into Motorcycles, Scooters, Mopeds, and Electric Two-Wheelers, reflecting distinct suspension requirements, price points, and performance characteristics across two-wheeler categories serving diverse consumer preferences and usage applications.

Sales channel segmentation encompasses OEM Direct Supply serving two-wheeler manufacturers through integrated development partnerships and just-in-time delivery versus Aftermarket distribution through independent dealers, online retailers, and specialty suspension shops serving replacement and performance upgrade demand.

Geographic distribution covers Asia-Pacific (largest and fastest growing), North America, Europe, Latin America, and Middle East & Africa, with Asian markets dominating through massive two-wheeler production volumes while developed regions show sustained demand for premium suspension technologies and aftermarket performance components.

The segmentation structure reveals technology progression from conventional twin shock rear suspension toward advanced mono shock systems and inverted front forks optimizing performance characteristics, while distribution evolution emphasizes OEM partnership strength balanced with emerging aftermarket opportunities in established motorcycle markets and performance enthusiast segments.

Market Position: Telescopic Front Suspension commands the leading position in the Two Wheeler Suspension System Market with approximately 54.7% market share through universal application across diverse motorcycle and scooter platforms, cost-effective manufacturing supporting competitive pricing requirements, and proven reliability delivering consistent performance across varied operating conditions from urban commuting to highway touring applications without requiring complex maintenance procedures or specialized service expertise.

Value Drivers: The segment benefits from established manufacturing processes enabling high-volume production with consistent quality standards, extensive supply base providing component availability and competitive sourcing opportunities for OEM customers, and design flexibility accommodating diverse fork tube diameters, travel specifications, and damping characteristics optimized for specific vehicle applications and target market segments. Telescopic suspension architecture provides fundamental advantages including simple construction, straightforward service procedures, and proven durability supporting extended service intervals important to cost-conscious consumers in emerging markets.

Competitive Advantages: Telescopic front suspension differentiates through lowest total cost of ownership combining affordable initial equipment pricing with minimal maintenance requirements and readily available replacement parts supporting aftermarket service accessibility. Manufacturing economies of scale enable competitive pricing while maintaining profitability for suspension suppliers serving high-volume OEM programs in Asia-Pacific markets where price sensitivity drives component selection and procurement decisions.

Key market characteristics:

Market Context: OEM Direct Supply dominates the Two Wheeler Suspension System Market with approximately 63.2% market share due to integrated suspension development programs with two-wheeler manufacturers, just-in-time delivery requirements supporting efficient production operations, and long-term partnership agreements providing business stability through multi-year supply commitments tied to specific vehicle platforms and production volumes.

Appeal Factors: Two-wheeler manufacturers prioritize suspension suppliers offering comprehensive engineering support throughout vehicle development cycles, quality consistency meeting automotive industry standards and warranty requirements, and manufacturing flexibility accommodating production volume fluctuations and platform variants without compromising delivery performance. The segment benefits from OEM consolidation trends favoring established global suppliers with proven track records, financial stability, and technical capabilities supporting complex development programs from initial concept through production ramp-up and ongoing series supply.

Growth Drivers: Expanding two-wheeler production in Asia-Pacific markets creates sustained OEM demand for suspension systems aligned with vehicle manufacturing growth. New model introductions and platform renewals provide opportunities for suspension suppliers to secure new business wins and establish supply relationships supporting extended production cycles. Electric two-wheeler adoption drives OEM engagement for specialized suspension development addressing unique vehicle characteristics and performance requirements.

Market Challenges: Intense OEM pricing pressure particularly in high-volume Asian markets limits profit margins and requires continuous cost reduction efforts. Long development cycles and significant upfront engineering investments create financial risks for suspension suppliers pursuing new OEM programs. Platform consolidation and global vehicle architectures may reduce supplier diversity as OEMs standardize suspension specifications across model ranges and geographic markets.

Application dynamics include:

Growth Accelerators: Two-wheeler production expansion drives primary demand as rapidly growing motorcycle and scooter manufacturing in India, Indonesia, Vietnam, Thailand, and other Asian markets creates sustained suspension system requirements aligned with vehicle production volumes, supporting established OEM supply relationships and providing business stability through long-term platform commitments. Premium motorcycle segment growth accelerates value realization as rising middle-class incomes enable consumers to purchase higher-specification motorcycles with advanced suspension technologies including adjustable damping, inverted forks, and premium materials, commanding significant component price premiums and improving suspension supplier profitability through value-added content and technology differentiation. Electric two-wheeler adoption creates new development opportunities as battery-electric motorcycles and scooters require specialized suspension engineering addressing unique vehicle characteristics including revised weight distribution, instant torque delivery, and battery pack integration, enabling suspension suppliers to establish early positioning in rapidly growing EV two-wheeler segment through technology leadership and OEM development partnerships.

Growth Inhibitors: Intense price competition in high-volume Asian markets creates margin pressure as cost-conscious OEM customers prioritize affordable suspension solutions for economy motorcycle and scooter segments, limiting pricing flexibility and requiring continuous cost reduction efforts through manufacturing efficiency improvements and strategic material sourcing. Raw material cost volatility for steel, aluminum, and hydraulic components impacts manufacturing expenses and profitability, with commodity price fluctuations potentially outpacing ability to transfer costs to OEM customers through established supply agreements with fixed pricing provisions. Technology development complexity increases investment requirements as advanced suspension systems with electronic damping control, connectivity integration, and lightweight materials require substantial R&D spending, potentially limiting smaller suspension manufacturers' ability to compete for premium segment programs and technology leadership positioning.

Market Evolution Patterns: Technology migration continues toward premium suspension features including adjustable damping and electronic control expanding from superbike and luxury motorcycle segments into mid-range platforms as manufacturing costs decline and consumer expectations rise for advanced ride quality technologies. Regional manufacturing expansion accelerates as global suspension suppliers establish production facilities in major two-wheeler manufacturing hubs including India, Indonesia, Thailand, and Vietnam, supporting OEM proximity requirements, reducing logistics costs, and enabling competitive positioning in high-volume Asian markets through localized supply chains. Electric two-wheeler focus intensifies as battery-electric motorcycle and scooter production scales rapidly in China, India, and European markets, requiring suspension suppliers to develop specialized capabilities addressing unique EV characteristics while maintaining competitive positioning in conventional two-wheeler segment representing majority of near-term business volumes.

The Two Wheeler Suspension System Market demonstrates varied regional dynamics with Growth Leaders including Germany (7.1% CAGR) driving expansion through premium motorcycle market strength and technology leadership. High-Growth Markets encompass India (6.3% CAGR), Japan (6.2% CAGR). Steady Performers feature China (5.4% CAGR) maintaining large volume base, and United States (4.8% CAGR) showing moderate growth through premium motorcycle demand and aftermarket strength.

| Country | CAGR (2025-2035) |

|---|---|

| Germany | 7.1% |

| India | 6.3% |

| Japan | 6.2% |

| China | 5.4% |

| United States | 4.8% |

Regional synthesis reveals Asian markets dominating through massive two-wheeler production volumes and expanding domestic demand, while developed regions maintain substantial value through premium motorcycle sales and advanced suspension technology adoption. Emerging Southeast Asian markets show strong momentum driven by motorization trends and growing two-wheeler ownership supporting economic development and mobility enhancement.

Germany establishes European market leadership through premium motorcycle manufacturing strength including BMW Motorrad commanding luxury touring and adventure motorcycle segments with sophisticated suspension technologies, advanced engineering capabilities supporting development of electronic suspension control and adaptive damping systems, and strong aftermarket demand from performance enthusiasts seeking suspension upgrades for sport riding and track day applications. The country's 7.1% CAGR through 2035 reflects sustained premium motorcycle market growth, technology innovation leadership in advanced suspension development, and export-oriented production serving global markets with German-engineered suspension solutions. Manufacturing excellence and engineering precision culture support premium positioning and technology differentiation.

German suspension technology development emphasizes comprehensive vehicle integration with suspension systems coordinated with ABS, traction control, and riding mode selections providing optimized damping characteristics for diverse riding conditions. Established automotive supply chain expertise transfers to motorcycle suspension manufacturing supporting quality standards and advanced production capabilities. Premium aftermarket segment generates significant revenue through performance suspension brands serving enthusiast market seeking handling improvements and ride quality enhancement beyond OEM specifications.

India establishes fastest-growing major market position through rapidly expanding two-wheeler production exceeding 20 million units annually, massive domestic market with over 200 million motorcycles and scooters in operation, and growing middle-class consumer base upgrading from economy commuter vehicles to mid-range motorcycles with enhanced suspension specifications. The country demonstrates an estimated 6.3% CAGR through 2035, supported by domestic two-wheeler manufacturing strength from Hero MotoCorp, Bajaj Auto, TVS Motor, and Honda Motorcycle & Scooter India, and expanding premium motorcycle segment as rising incomes enable consumers to purchase higher-specification vehicles with advanced suspension technologies.

Manufacturing operations concentrate in automotive clusters including Pune, Chennai, and Gujarat regions where two-wheeler production facilities and suspension component suppliers establish integrated supply chains supporting just-in-time delivery and cost-competitive manufacturing. Market dynamics emphasize cost-effective suspension solutions balancing performance requirements with affordability expectations for price-sensitive Indian consumers while maintaining quality standards supporting vehicle safety and durability in diverse operating conditions including congested urban environments and challenging rural road infrastructure.

The two-wheeler suspension market in Japan demonstrates sophisticated technology deployment with documented engineering excellence in motorcycle suspension design through legacy of Japanese manufacturers including Honda, Yamaha, Kawasaki, and Suzuki establishing global standards for suspension performance and reliability. The country leverages precision manufacturing capabilities and comprehensive quality control to maintain an estimated 6.2% CAGR through 2035. Manufacturing facilities throughout Japanese industrial regions showcase advanced production incorporating automation, stringent quality standards, and continuous improvement methodologies establishing performance benchmarks for global motorcycle suspension industry.

Japanese suspension specialists including Showa Corporation and KYB Corporation command global market leadership through decades of development experience, extensive OEM relationships with Japanese and international motorcycle manufacturers, and proven track records delivering high-performance suspension systems for diverse applications from economy commuters to Grand Prix racing motorcycles. Technology development emphasizes progressive damping characteristics, lightweight construction, and exceptional reliability supporting Japanese motorcycle industry reputation for quality and performance.

The two-wheeler suspension market in China demonstrates substantial scale serving the world's largest motorcycle and scooter production volumes and extensive domestic vehicle fleet, while transitioning toward premium segment growth and electric two-wheeler leadership creating new suspension technology requirements. The country maintains a 5.4% CAGR through 2035, reflecting mature market characteristics with continued growth driven by premium motorcycle adoption, electric two-wheeler production scaling, and export manufacturing supporting global motorcycle supply chains. Manufacturing capabilities span numerous Chinese suspension producers serving domestic OEM requirements alongside international suppliers establishing Chinese production facilities accessing cost-competitive manufacturing and supporting proximity to major two-wheeler manufacturing operations.

Domestic two-wheeler production historically dominated by economy commuter motorcycles and scooters increasingly incorporates mid-range and premium segments as rising incomes enable consumers to upgrade to higher-specification vehicles with enhanced suspension technologies. Electric two-wheeler adoption accelerates rapidly with Chinese manufacturers including Niu, Yadea, and others leading global electric scooter and motorcycle production, requiring suspension suppliers to develop specialized solutions addressing unique EV characteristics while maintaining cost-competitive positioning serving price-sensitive Chinese market.

The United States demonstrates market characteristics emphasizing premium motorcycle segment including Harley-Davidson touring motorcycles, sport bikes from Japanese and European manufacturers, and growing adventure touring category, creating demand for sophisticated suspension technologies with adjustable damping, premium materials, and performance-oriented specifications. The country shows an estimated 4.8% CAGR through 2035, reflecting mature market with sustained demand through premium motorcycle sales, strong aftermarket presence serving performance enthusiast segment, and expanding electric motorcycle adoption including Zero Motorcycles, Harley-Davidson LiveWire, and emerging EV brands. Market distribution emphasizes OEM supply relationships with major motorcycle manufacturers alongside extensive aftermarket channels serving modification and performance upgrade demand.

American motorcycle market prioritizes ride quality, handling performance, and comfort characteristics supporting long-distance touring and recreational riding applications common in USA geography and riding culture. Suspension technology preferences emphasize adjustability enabling riders to customize damping characteristics for diverse riding styles and passenger/cargo configurations, air suspension systems providing convenient ride height adjustment, and electronic control enabling automated suspension adjustment responding to riding conditions and rider preferences.

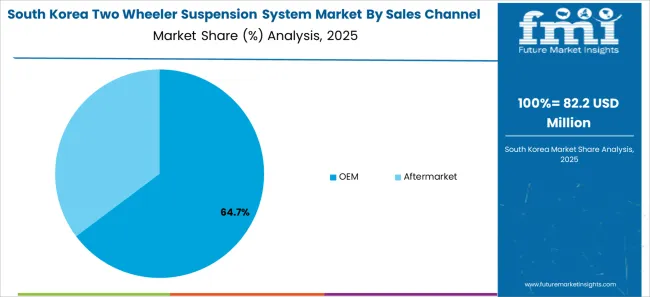

South Korea's two-wheeler suspension market benefits from domestic motorcycle manufacturing capabilities, component supply expertise supporting automotive and motorcycle industries, and growing premium motorcycle adoption as rising incomes enable discretionary spending on larger displacement motorcycles for recreational riding and lifestyle applications. The country maintains an estimated 6.3% CAGR through 2035, reflecting expanding motorcycle enthusiasm among younger demographics and growing market for imported premium motorcycles complementing domestic production from Korean manufacturers.

Manufacturing infrastructure and engineering capabilities developed through automotive industry success transfer to two-wheeler suspension production supporting quality standards and technical sophistication. Market opportunities emphasize serving domestic OEM requirements, developing export capabilities for regional markets, and capturing premium aftermarket segment through performance suspension products and technology leadership positioning.

Indonesia's two-wheeler market demonstrates strong growth trajectory through expanding motorcycle ownership supporting economic development and mobility requirements in archipelago geography where motorcycles provide essential transportation across urban and rural environments. The country maintains an estimated 6.3% CAGR through 2035, driven by large population, growing middle-class, and established two-wheeler manufacturing operations from Japanese and Chinese manufacturers serving domestic and export markets. Manufacturing operations from Honda, Yamaha, Suzuki, and others establish Indonesia as significant regional production hub creating extensive suspension system demand aligned with vehicle manufacturing volumes.

Market characteristics emphasize cost-effective suspension solutions meeting affordability requirements for price-sensitive Indonesian consumers while maintaining quality standards supporting vehicle durability in diverse operating conditions including tropical climate, varied road infrastructure, and demanding usage patterns. Growing premium segment represents emerging opportunity as rising incomes enable consumers to upgrade from basic commuter motorcycles to mid-range models with enhanced suspension specifications.

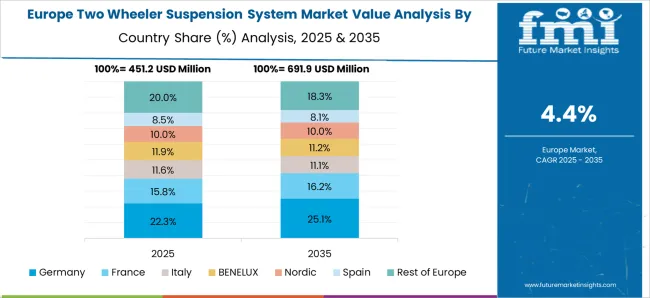

The Two Wheeler Suspension System Market in Europe is valued at USD 1.8 billion in 2025 and is projected to grow at a CAGR of 4.9% to reach USD 2.90 billion by 2035. Germany leads the European market, driven by its premium motorcycle manufacturing strength with brands like BMW Motorrad, capturing a significant share due to advanced suspension technology development and strong aftermarket demand. Germany grows at a CAGR of 7.1%, enjoying a position as the technology leader in electronic suspension control and adaptive damping.

The United Kingdom holds a notable share, supported by a mature motorcycle culture and high demand for sophisticated suspension systems for touring and sport motorcycles. France also contributes with urban scooter growth and expanding touring motorcycle segments, while Italy's market benefits from its motorcycle manufacturing heritage and brand loyalty. Spain and the Nordic region have smaller but stable shares in the market. The Rest of Europe sees a minor share with slight decline expected.

Germany stands as the dominant market with significant aftermarket and OEM demand, the UK and France follow with steady growth driven by consumer preferences for premium and performance suspension systems, and Italy and Spain maintain shares through robust local manufacturing and consumer base.

The Two Wheeler Suspension System Market operates with moderate concentration, featuring approximately 10-15 major global participants alongside numerous regional suppliers, where leading companies control roughly 55-65% of the global market share through established OEM relationships with major two-wheeler manufacturers, comprehensive product portfolios spanning diverse suspension technologies, and global manufacturing footprints supporting regional production requirements. Competition emphasizes OEM partnership strength, engineering capabilities supporting integrated suspension development, and manufacturing quality consistency meeting automotive standards rather than pure price competition.

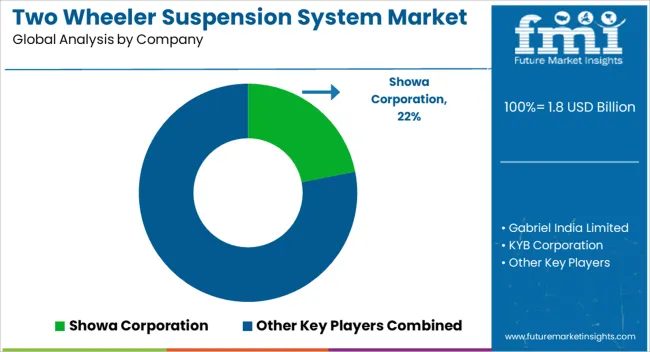

Market Leaders encompass Showa Corporation (Japanese subsidiary of Hitachi Astemo), Gabriel India Limited, KYB Corporation, BMW Group (through premium motorcycle manufacturing), and ZF Friedrichshafen AG, which maintain competitive advantages through decades of suspension development experience, extensive OEM supply relationships with major motorcycle manufacturers globally, and comprehensive technical capabilities spanning design engineering, prototype development, testing validation, and series production. These companies leverage integrated suspension development partnerships with two-wheeler manufacturers, global manufacturing networks enabling regional production proximity, and continuous technology advancement maintaining competitive positioning through performance improvements and cost optimization.

Technology Challengers include specialized suspension manufacturers and emerging suppliers focusing on specific geographic markets or technology segments through competitive pricing strategies serving cost-sensitive Asian OEM programs, innovative suspension designs addressing electric two-wheeler requirements, and premium aftermarket positioning serving performance enthusiast demand for suspension upgrades beyond OEM specifications. These companies differentiate through rapid development cycles, flexible manufacturing approaches, and targeted marketing strategies.

Regional Specialists feature companies focusing on specific geographic markets with strong local OEM relationships, cost structures optimized for regional market requirements, and manufacturing capabilities supporting domestic two-wheeler production. Market dynamics favor participants combining engineering excellence with manufacturing efficiency, quality consistency meeting OEM warranty requirements, and collaborative development approaches aligning with two-wheeler manufacturer platform strategies and product development cycles. Competitive pressure intensifies as electric two-wheeler adoption creates new entrants developing specialized suspension solutions for EV platforms, while traditional suspension technologies face commoditization pressure in high-volume commuter motorcycle segment driving continuous cost reduction requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 billion (2025), USD 2.90 billion (2035) |

| Suspension Type | Telescopic Front Suspension, Inverted Front Forks, Mono Shock Rear Suspension, Twin Shock Rear Suspension, Linkage Suspension Systems |

| Vehicle Type | Motorcycles, Scooters, Mopeds, Electric Two-Wheelers |

| Sales Channel | OEM Direct Supply, Aftermarket Distribution |

| Technology Level | Conventional Hydraulic, Adjustable Damping, Electronic Suspension Control |

| Damper Type | Twin-Tube, Mono-Tube, Cartridge Type |

| Regions Covered | Asia-Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | Germany, India, Japan, China, United States, South Korea, Indonesia, Thailand, Vietnam, Italy, and 15+ additional countries |

| Key Companies Profiled | Showa Corporation, Gabriel India Limited, KYB Corporation, BMW Group, ZF Friedrichshafen AG, Öhlins, WP Suspension, and others |

| Additional Attributes | Dollar sales by suspension type, vehicle category, and sales channel, regional adoption trends across Asia-Pacific, North America, and Europe, competitive landscape with established suspension specialists and emerging EV-focused suppliers, OEM preferences for integrated development partnerships and quality consistency, technology advancement toward electronic damping control and lightweight materials, electric two-wheeler suspension requirements and specialized development opportunities, and aftermarket performance upgrade segment serving enthusiast demand. |

The global Two Wheeler Suspension System Market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the Two Wheeler Suspension System Market is projected to reach USD 2.9 billion by 2035.

The Two Wheeler Suspension System Market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in Two Wheeler Suspension System Market are telescopic front suspension, inverted front forks (usd forks), mono shock rear suspension, twin shock rear suspension, linkage suspension systems and air suspension systems.

In terms of technology level, conventional hydraulic suspension segment to command 35.0% share in the Two Wheeler Suspension System Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Two Winding Air Insulated Transformer Market Size and Share Forecast Outlook 2025 to 2035

Two Winding Cast Resin Transformer Market Size and Share Forecast Outlook 2025 to 2035

Two Winding Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Two-wheeled Containers Market

Two Piece Metal Containers Market

Two-Wheeler Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Rental Market Size and Share Forecast Outlook 2025 to 2035

Two-Wheeler Aftermarket Components & Consumables Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Safety Solutions Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Handlebars Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Crash Guard Market Size and Share Forecast Outlook 2025 to 2035

Two-Wheeler Lead Acid Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Two Wheeler Accessories Aftermarket Growth - Trends & Forecast 2025 to 2035

Two Wheeler Crankshaft Market Growth – Trends & Forecast 2024-2034

Two Wheeler Backrest Market

Two Wheeler Electric Starter Magnet Market

Two Wheeler Chain Sprocket Kit Market

Two Wheeler Footrest Market

Two-wheeler ECU Market

Two Wheeler Fenders Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA