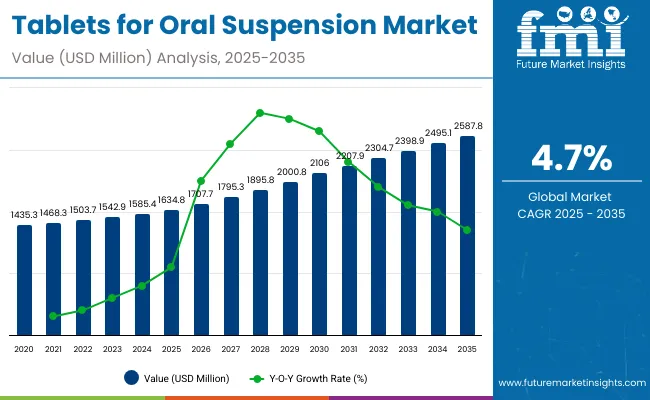

The global Tablets for Oral Suspension (ToOS) Market is projected to reach a valuation of USD 1,634.8 million by 2025 and USD 2,587.8 million by 2035. This indicates a decade-long increase of USD 953.0 million between 2025 and 2035. The market is expected to expand at a compound annual growth rate (CAGR) of 4.7%, representing a 1.58X increase over the ten-year period.

During the first five-year period from 2025 to 2030, the total market value is projected to expand from USD 1,634.8 million to USD 2,056.8 million, adding USD 471.2 million which contributes to 49.4% of the total decade growth. The Immediate-Release ToOS segment will remain dominant, holding around 51.7% share of the category by 2030 due to its widespread use in pediatric and infectious disease treatments. Flavored/Pediatric ToOS will strengthen to above 23.9% share, reflecting global efforts by UNICEF and national health programs to improve pediatric adherence, while Extended-Release ToOS maintains stable demand at approximately 18%.

The second half from 2030 to 2035 contributes USD 481.8 million, equal to 50.6% of the total growth, as the market jumps from USD 2,056.8 million to USD 2,587.8 million. This acceleration is powered by the rising adoption of ToOS formulations across Asia and emerging economies where cold-chain challenges favor solid dispersible formats. Anti-Infectives/Antibiotics and Gastrointestinal disorder treatments together capture nearly 65.0% of therapeutic share by the end of the decade, while Pain & Fever Management grows its share to 14.6%. Distribution remains led by institutional channels, which consistently account for over 58.0% of global demand, followed by retail pharmacies and a gradually expanding online pharmacy presence.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,634.8 million |

| Industry Value (2035F) | USD 2,587.8 million |

| CAGR (2025 to 2035) | 4.7% |

From 2020 to 2024, the overall Tablets for Oral Suspension (ToOS) Market expanded from USD 1,435.3 million to USD 1,585.4 million, registering a historical CAGR of 3.6%. Growth was largely supported by leading pharmaceutical manufacturers such as Pfizer Inc., Merck & Co., Novartis AG, AstraZeneca plc, and Johnson & Johnson, which collectively account for a significant share of the market through their pediatric anti-infective and gastrointestinal portfolios. Key strategies deployed by these players include expanding dispersible and flavored pediatric formulations, integrating taste-masking technologies, and aligning with global health procurement programs such as UNICEF and WHO essential medicine lists.

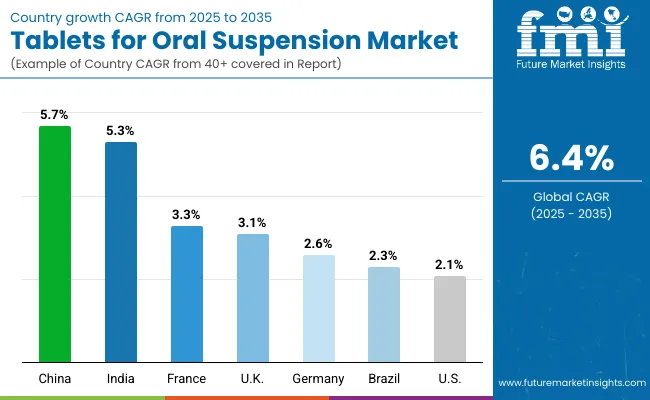

In 2025, the Tablets for Oral Suspension market is expected to reach a value of approximately USD 1,634.8 million, driven by the continued shift from liquid suspensions and powders toward solid dispersible formats that improve dosing accuracy, portability, and shelf stability. Market growth is reinforced by large-scale institutional demand, as institutional sales are projected to account for 58.2% of distribution in 2025, reflecting adoption in national immunization, deworming, and infectious disease programs. Therapeutically, anti-infectives/antibiotics will remain the leading segment with 48.3% share, while flavored/pediatric ToOS captures over 21.0% of the product mix, signaling global prioritization of child-friendly formulations. The category’s resilience is also supported by regional dynamics China and India are expected to record the highest growth rates at 5.7% and 5.3% CAGR respectively, while mature markets such as the USA and Europe will expand more modestly.

The Tablets for Oral Suspension (ToOS) Market is witnessing strong growth as global healthcare systems prioritize child-friendly and accessible dosage forms that ensure accurate administration, stability, and portability. Major drivers include the WHO and UNICEF push for dispersible formulations on essential medicine lists, rising prevalence of pediatric infectious diseases, and the need for alternatives to liquid suspensions that often require cold chain and reconstitution.

Innovations such as taste-masked flavored tablets, effervescent dispersible formats, and extended-release profiles are reducing compliance challenges, particularly among children and elderly patients with swallowing difficulties. Public health programs, including school-based deworming campaigns and antibiotic distribution, are generating sustained institutional demand, while retail pharmacies and e-pharmacies expand availability for home care.

The pandemic further amplified the importance of convenient solid-dosage therapies, accelerating adoption in low-resource settings where liquid storage is limited. With governments and procurement agencies emphasizing cost efficiency, stability, and dosing safety, manufacturers delivering robust dispersibility, palatability, and WHO prequalification are achieving accelerated growth. In high-growth regions such as Asia and Africa, expanding pediatric healthcare infrastructure and mass-drug-administration initiatives are further propelling demand.

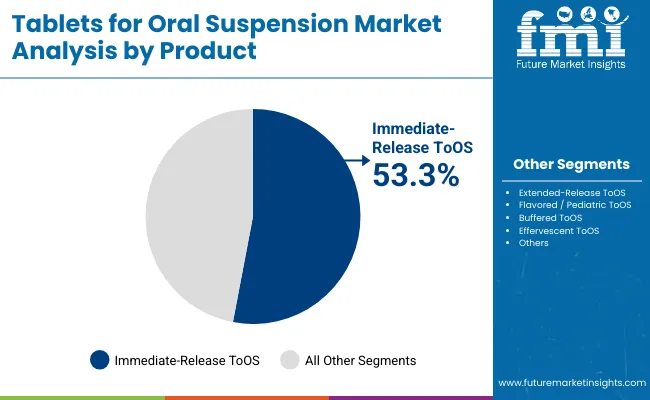

The market is segmented by product type, therapeutic area, distribution channel, and region. Product categories include Immediate-Release ToOS, Extended-Release ToOS, Flavored/Pediatric ToOS, Buffered ToOS, and Effervescent ToOS, highlighting the key dosage innovations driving adoption. Therapeutic segmentation covers Anti-Infectives/Antibiotics, Gastrointestinal Disorders, Pain & Fever Management, Allergies & Respiratory, Neurological/Psychiatric, and Others, reflecting the broad clinical application base. Based on distribution channel, the market is classified into Institutional Sales, Retail Pharmacy, Online Pharmacies, and Others. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa.

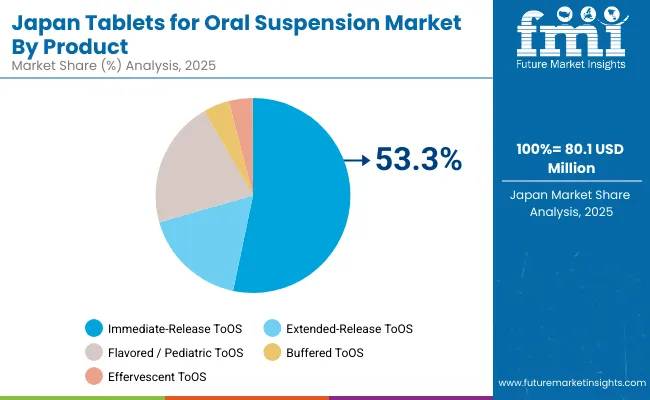

Immediate-Release Tablets for Oral Suspension are expected to retain a dominant position, contributing 53.3% in 2025, driven by their widespread use in pediatric and infectious disease treatments where rapid dispersion and reliable dosing are critical. Their adoption has been accelerated by global health initiatives, particularly UNICEF and WHO programs, which prioritize dispersible antibiotics and antiparasitics for child-friendly administration. These formulations are preferred for their ease of use, fast disintegration in water, and ability to deliver immediate therapeutic effect without complex dosing schedules. Growing procurement by institutional buyers, coupled with rising caregiver preference for simple and effective pediatric formats, has ensured sustained demand for Immediate-Release ToOS over other product types.

| Product | Market Share (%) |

|---|---|

| Immediate-Release ToOS | 53.3% |

| Extended-Release ToOS | 17.3% |

| Flavored / Pediatric ToOS | 21.1% |

| Buffered ToOS | 4.3% |

| Effervescent ToOS | 4.0% |

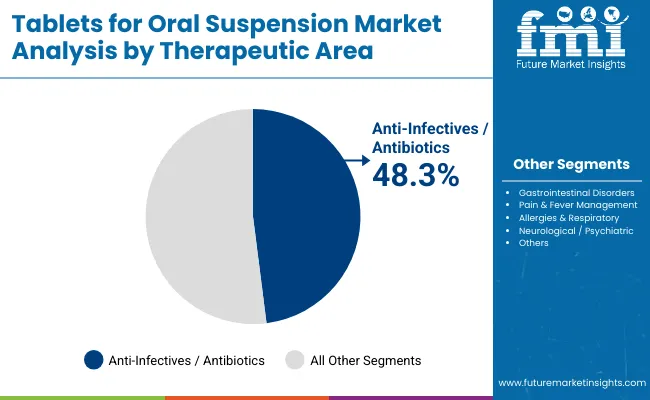

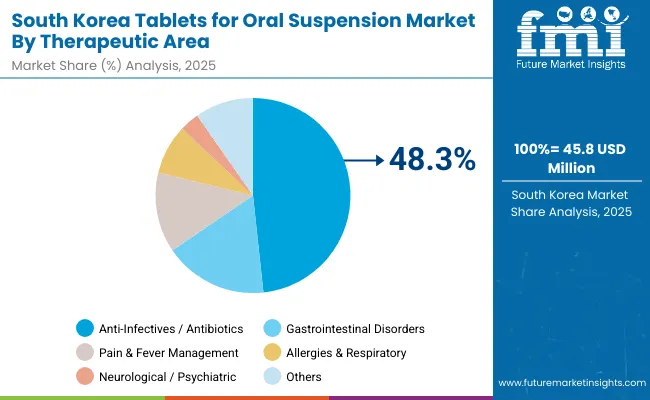

Anti-Infectives and Antibiotics have emerged as the leading therapeutic application, projected to account for 48.3% of demand in 2025. Their dominance is driven by the high global burden of pediatric and community-acquired infections, alongside large-scale public health initiatives such as school-based deworming and UNICEF-supported antibiotic programs.

Tablets for Oral Suspension in this category are favored due to their ease of administration, stable shelf-life compared to liquid suspensions, and suitability for mass drug administration in low-resource settings. With increasing antimicrobial stewardship and a focus on child-friendly formulations, dispersible antibiotics continue to anchor institutional procurement, making this segment the backbone of the market compared to other therapeutic areas.

| By Therapeutic Area | Market Share (%) |

|---|---|

| Anti-Infectives / Antibiotics | 48.30% |

| Gastrointestinal Disorders | 17.20% |

| Pain & Fever Management | 13.32% |

| Allergies & Respiratory | 8.20% |

| Neurological / Psychiatric | 3.30% |

| Others | 9.7% |

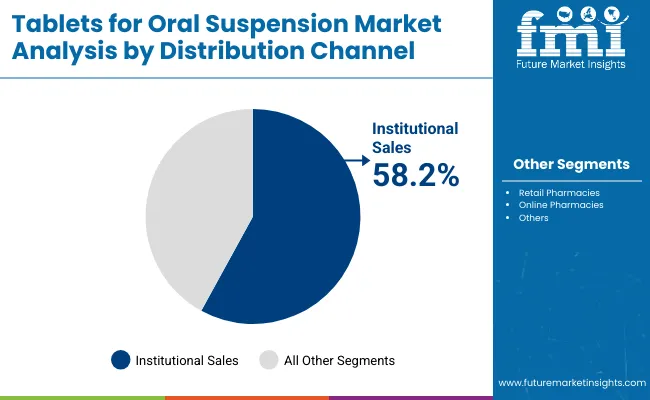

Institutional Sales are expected to remain the largest distribution channel, contributing around 58.2% in 2025, owing to large-scale government procurement programs and public health initiatives. National immunization drives, school-based deworming campaigns, and UNICEF-supported antibiotic distribution have reinforced the dominance of institutional supply over other channels. Hospitals and public healthcare networks prefer Tablets for Oral Suspension due to their cost efficiency, stability, and ease of administration in high-volume settings.

While Retail Pharmacies account for 32.3% and remain significant for household purchases, Online Pharmacies at 6.4% are steadily growing as digital platforms gain traction. The “Others” category, at 3.0%, covers distribution through NGOs and community-based health programs, adding incremental but vital demand.

| Distribution Channel | Market Share (%) |

|---|---|

| Institutional Sales | 58.2% |

| Retail Pharmacies | 32.3% |

| Online Pharmacies | 6.4% |

| Others | 3.0% |

A major growth driver in the Tablets for Oral Suspension (ToOS) market is the global prioritization of pediatric-friendly formulations endorsed by WHO and UNICEF. Programs promoting dispersible antibiotics, antimalarials, and antiparasitics have accelerated demand for ToOS, particularly in low- and middle-income countries where liquid suspensions are difficult to transport and store. Immediate-release and flavored/pediatric tablets are being procured in bulk for school-based deworming and infectious disease control programs, accounting for over 50% share of product use.

In addition, regulatory bodies increasingly require child-appropriate dosage forms in national formularies, compelling manufacturers to innovate with taste-masking, effervescent, and buffered technologies. This regulatory and public health push ensures a long-term anchor for ToOS adoption across institutional supply chains.

Price Pressure and Tender-Driven Procurement as Key Barrier

A critical restraint for the ToOS market is the price sensitivity of institutional tenders that dominate global demand. Large-scale procurement by UNICEF, GAVI, and national health ministries focuses heavily on cost efficiency, often awarding contracts to suppliers offering the lowest bids. This dynamic places immense pressure on pharmaceutical companies to sustain margins while investing in quality improvements such as taste-masking or stability enhancement.

Furthermore, stringent WHO prequalification standards increase compliance costs, which many small or mid-tier manufacturers struggle to meet. As a result, innovation in premium segments like extended-release or effervescent ToOS is often deprioritized, limiting broader portfolio diversification.

Rising Role of Digital Pharmacies and E-Health Platforms

A defining trend in the ToOS market is the growing integration with digital pharmacies and e-health platforms, especially in Asia-Pacific and urban regions of Europe. Online channels are projected to rise from 6.4% in 2025 to 7.3% by 2035, supported by expanding telehealth consultations and home delivery of pediatric and geriatric medicines.

Parents increasingly prefer online purchases of flavored and pediatric dispersible tablets due to convenience, while subscription-based e-pharmacy models offer recurring delivery of chronic-use formulations. This shift is also encouraging global manufacturers like Pfizer and Novartis to expand distribution partnerships with e-commerce leaders and regional pharmacy apps. The trend signals a gradual but strategic transition where digital platforms become a recognized procurement pathway for child-appropriate oral formulations, complementing traditional retail and institutional sales.

| Country | CAGR |

|---|---|

| USA | 2.1% |

| Brazil | 2.3% |

| China | 5.7% |

| India | 5.3% |

| Europe | 2.8% |

| Germany | 2.6% |

| France | 3.3% |

| UK | 3.1% |

Asia Pacific is set to emerge as the fastest-growing region in the Tablets for Oral Suspension (ToOS) market, projected to expand at a CAGR of 5.7% in China and 5.3% in India between 2025 and 2035. China’s growth is supported by large-scale government procurement of dispersible antibiotics and antiparasitics, while India’s expansion is driven by school-based deworming programs and inclusion of dispersible pediatric formulations in national health initiatives. Both markets benefit from the high pediatric population base, cost-sensitive procurement policies, and growing alignment with WHO/UNICEF essential medicines programs. Mass drug administration campaigns across Southeast Asia are further amplifying regional demand.

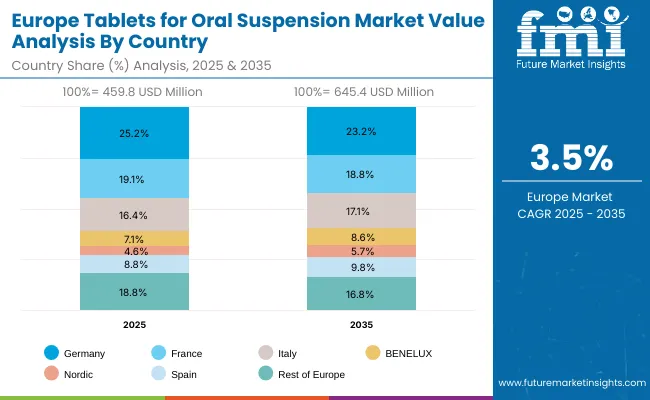

Europe is expected to grow steadily at a 2.8% CAGR through 2035, with Germany is expected to grow at 2.6% CAGR and with 3.1% CAGR for the UK due to expanded pediatric healthcare infrastructure and adoption of flavored dispersible tablets to improve compliance. France is projected to grow at 3.3% CAGR, supported by public hospital procurement reforms. The European market benefits from harmonized EMA guidelines promoting child-appropriate dosage forms, and manufacturers are increasingly targeting flavored and buffered ToOS for better patient adherence.

North America remains a mature but stable market, with the USA projected to grow at a 2.1% CAGR between 2025 to 2035. Growth is anchored by replacement of legacy pediatric liquid formulations with solid dispersible formats that ensure accurate dosing and improved stability. Institutional procurement continues to dominate, but retail and online pharmacy channels are steadily expanding, reflecting caregiver preference for flavored pediatric ToOS. Federal pediatric health initiatives and rising chronic disease management in geriatric populations are expected to sustain long-term demand.

The USA ToOS market is forecasted to grow at a 2.1% CAGR, driven by rising pediatric demand for dispersible antibiotics and antipyretics. Hospitals and pediatric clinics are gradually replacing conventional syrups with flavored and immediate-release dispersible formats, supported by FDA encouragement of child-appropriate dosage forms. Institutional procurement remains dominant, but retail and e-pharmacy distribution are expanding as caregivers prefer portable, spill-free alternatives.

The ToOS market in the United Kingdom is projected to grow at a 3.1% CAGR through 2035, supported by NHS programs prioritizing child-friendly formulations in essential medicine lists. Public procurement under NHS England’s modernization programs is boosting adoption of dispersible antibiotics and antiparasitics in pediatric care. Compliance initiatives to reduce dosing errors and improve treatment adherence are reinforcing demand.

The German ToOS market is expected to grow at a 2.6% CAGR, underpinned by inclusion of dispersible pediatric medicines in statutory health insurance coverage. Germany’s strong pediatric and primary care infrastructure supports consistent procurement of immediate-release and flavored ToOS. Regulatory pressure for child-appropriate medicines under EMA guidelines is pushing pharmaceutical manufacturers to expand dispersible product lines.

The Tablets for Oral Suspension (ToOS) market in India is projected to grow steadily at a CAGR of 5.3% through 2035, supported by large-scale public health programs, expanding pediatric care, and rising private hospital adoption. A shift away from liquid syrups toward dispersible tablets is reshaping the prescribing landscape, driven by their portability, stability, and ease of administration.

Domestic manufacturers are innovating with flavored and taste-masked dispersibles, while e-pharmacies and retail chains expand reach to Tier 2 and Tier 3 cities. Multinational firms are also entering via partnerships, introducing advanced immediate-release technologies.

The ToOS market in China is projected to grow at a CAGR of 5.7% through 2035, supported by Healthy China 2030 priorities for pediatric adherence and primary-care access. Class-A urban hospital is leading bulk procurement of flavored and effervescent dispersibles to improve compliance, while county hospitals deploy immediate-release ToOS for high-volume antibiotic regimens. Longer shelf-life and easier storage versus liquids are key advantages for centralized pharmacy operations. Domestic manufacturers are scaling localized production and integrating digital prescribing and e-pharmacy fulfillment to meet provincial tender requirements.

The ToOS market in Japan is projected to reach USD 80.1 million in 2025 and grow at a 3.3% CAGR to USD 110.8 million by 2035, reflecting Japan’s focus on patient-friendly dosing for pediatrics and geriatrics. Flavored and buffered tablets are increasingly prescribed to mitigate swallowing difficulties and dosing errors in care homes and pediatric wards. MHLW emphasis on adherence, combined with high quality standards, is prompting local manufacturers to prioritize taste-masking and rapid dispersion performance.

Government insurance coverage and universal healthcare ensure widespread reimbursement, while pharmaceutical companies invest in flavor-masked and rapidly dispersing formulations for oncology, cardiovascular, and infectious disease therapies.

The ToOS market in South Korea is estimated at USD 45.8 million in 2025, with growth projected at a 4.6% CAGR through 2035. MOHW programs to improve pediatric adherence and broaden community access are pushing hospitals to procure immediate-release and flavored dispersible for antibiotics, fever, and GI therapies. Retail and online pharmacies are widening availability in urban centers, while specialty clinics evaluate extended-release options for chronic care. Stable storage, accurate dosing, and caregiver preference are reinforcing uptake across channels. The country’s strong digital hospital infrastructure and early adoption of patient-centric drug delivery formats make dispersible a natural fit for compliance improvement.

Leading local firms and multinationals are introducing flavored dispersible for pediatrics and chronic disease management, while government reimbursement policies support wider access.

The Tablets for Oral Suspension (ToOS) market is moderately fragmented, with global pharmaceutical leaders, established innovators, and diversified healthcare giants competing across both primary therapies and adjacent specialty segments. Pfizer Inc. holds a dominant position, supported by its robust R&D engine, broad therapeutic coverage, and consistent product launches. The company’s leadership is reinforced through strong biologics and specialty drug portfolios, complemented by strategic partnerships and co-development agreements that expand pipeline strength and commercial reach. Its approach increasingly integrates digital health platforms and real-world evidence to strengthen competitive advantage.

Other established leaders such as Merck & Co., Novartis AG, AstraZeneca plc, and Johnson & Johnson maintain significant global presence. Merck leverages immuno-oncology and vaccine leadership, while Novartis emphasizes specialty and rare disease segments supported by deep investments in advanced therapies. AstraZeneca has gained traction in oncology and respiratory markets with its biologics-driven pipeline, and Johnson & Johnson combines pharmaceutical strength with a diversified healthcare ecosystem, enabling cross-segment synergies. These players differentiate through scale, therapeutic depth, and strong geographic penetration, making them formidable competitors.

Emerging differentiation in the market is shifting away from traditional drug portfolios toward advanced biologics, precision medicine, and digital health integration. Leaders are also focusing on sustainability in manufacturing, value-based pricing models, and patient-centric therapy access programs, ensuring long-term positioning in a competitive and innovation-driven environment.

Key Developments:

In August 2025, Lupin Limited, in partnership with NATCO Pharma, launched Bosentan Tablets for Oral Suspension (32 mg) in the USA with 180-day exclusivity following FDA approval. The product, bioequivalent to Tracleer®, targets pediatric pulmonary arterial hypertension (PAH) and addresses a USA market valued at USD 10 million annually.

In January 2025, Amneal Pharmaceuticals received USA FDA approval for memantine/donepezil extended-release capsules (with 180-day exclusivity) and everolimus tablets for oral suspension, plus tentative approval for rifaximin. These launches expand Amneal’s dementia, oncology, and gastrointestinal portfolio, reinforcing its strategy in complex generics and specialty medicines.

| Item | Value |

|---|---|

| Market Value (2025) | USD 1,312.0 million |

| Product type | Immediate-Release ToOS, Extended-Release ToOS, Flavored/Pediatric ToOS, Buffered ToOS, and Effervescent ToOS |

| Therapeutic | Anti-Infectives/Antibiotics, Gastrointestinal Disorders, Pain & Fever Management, Allergies & Respiratory, Neurological/Psychiatric, and Others |

| Distribution channel | Institutional Sales, Retail Pharmacy, Online Pharmacies |

| Regions Covered | North America, Latin America, Western & Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Germany, France, UK etc. |

| Key Companies Profiled | Pfizer Inc., Merck & Co., Novartis AG, AstraZeneca plc, Johnson & Johnson |

| Additional Attributes | Dollar sales by therapeutic area and regions, adoption trends of Immediate-Release and Flavored/Pediatric ToOS, rising demand in public health & school-based programs (antibiotics, deworming), growing demand across Institutional Sales, Retail Pharmacy, and Online Pharmacies. |

The global Tablets for Oral Suspension (ToOS) market is estimated to be valued at USD 1,634.8 million in 2025.

The market size for Tablets for Oral Suspension is projected to reach USD 2,587.8 million by 2035.

The Tablets for Oral Suspension market is expected to grow at a CAGR of 4.7% during this period.

Key product types include Immediate-Release ToOS, Extended-Release ToOS, Flavored/Pediatric ToOS, Buffered ToOS, and Effervescent ToOS.

The Anti-Infectives / Antibiotics segment is projected to command 48.3% of the market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oral Bone Implant Material Market Size and Share Forecast Outlook 2025 to 2035

Oral Solid Dosage Pharmaceutical Formulation Market Size and Share Forecast Outlook 2025 to 2035

Oral Dosing Cup Market Forecast AND Outlook 2025 to 2035

Oral Care Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oral Irrigator Market Size and Share Forecast Outlook 2025 to 2035

Suspension Bump Stopper Market Size and Share Forecast Outlook 2025 to 2035

Oral Antiseptics Market Size and Share Forecast Outlook 2025 to 2035

Oral Food Challenge Testing Market Analysis Size and Share Forecast Outlook 2025 to 2035

Oral Care Market Growth – Demand, Trends & Forecast 2025–2035

Oral Dosage Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Oral Clinical Nutrition Desserts Market Analysis - Size, Growth, and Forecast 2025 to 2035

Oral Dose Packaging Market Trends & Growth Forecast 2025 to 2035

Oral Immunostimulant Market – Demand, Growth & Forecast 2025 to 2035

Oral Clinical Nutritional Cream and Pudding Market Analysis by Product Type and Distribution Channel Through 2035

Competitive Breakdown of Oral Clinical Nutrition Supplements

Market Share Distribution Among Tablets And Capsules Packaging Companies

Market Share Insights for Oral Care Providers

Key Companies & Market Share in the Oral Dosage Powder Packaging Machines Sector

Tablets and Capsules Packaging Market Growth, Trends, Forecast 2025-2035

Oral Controlled Release Drug Delivery Technology Market Trends – Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA