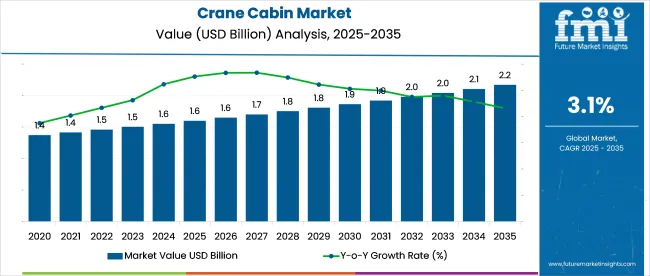

The crane cabin market is projected to grow from USD 1.6 billion in 2025 to USD 2.1 billion by 2035, reflecting a CAGR of 3.1% over the forecast period. The market is evolving as buyers prioritize comfort, safety, and better visibility for operators in sectors like ports, mining, and heavy manufacturing.

OEMs are moving toward modular cabin designs using steel-aluminum frames, with upgrades like 270-degree viewing angles and air suspension seating. Suppliers are seeing more orders for joystick controls, noise-reducing panels, and insulated glass suited for extreme climates.

Retrofitting companies are also gaining ground, especially in Southeast Asia and Eastern Europe, offering certified upgrade kits for older crane fleets. Distributors are shifting to stock pre-assembled units that speed up installation at job sites.

At the project level, engineering firms are including cabin upgrades in crane automation packages. This supply chain is increasingly focused on operator performance, quick deployment, and flexible retrofits to meet rising safety and efficiency standards.

As of 2025, the crane cabin market holds a modest but essential share across its parent industries. Within the global crane market, crane cabins contribute around 6-8%, driven by demand for operator safety, visibility, and ergonomic enhancements. In the construction equipment market, the share stands at 2-3%, since cabins represent a key but relatively small component of total machinery value.

Within the material handling equipment market, crane cabins account for approximately 3-4%, particularly in overhead and gantry crane systems used in ports and factories. In the industrial vehicle components market, their share is about 2-2.5%, tied to specialized operator enclosures. In the heavy equipment operator safety systems market, crane cabins make up around 4-5%, as safety-compliant designs gain prominence.

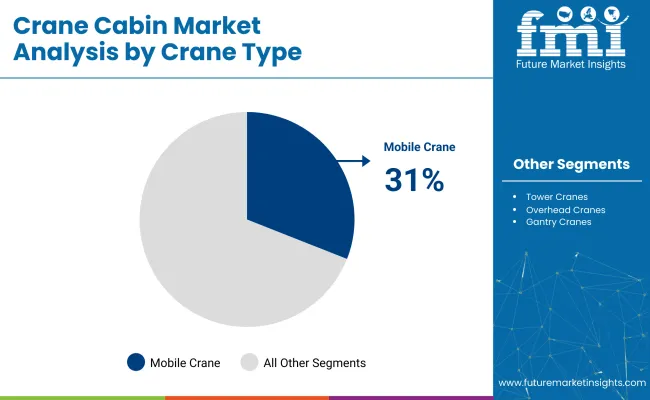

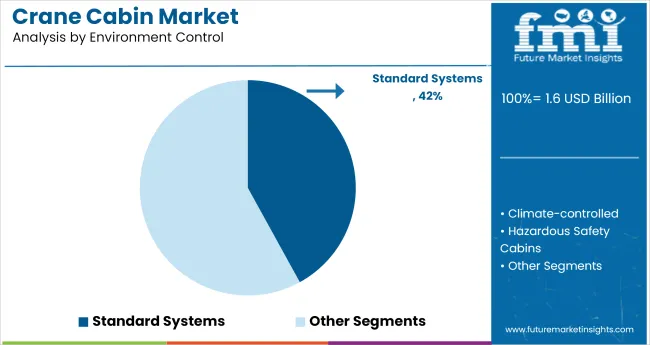

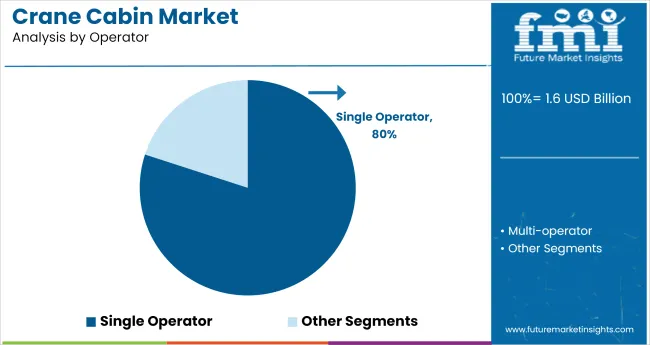

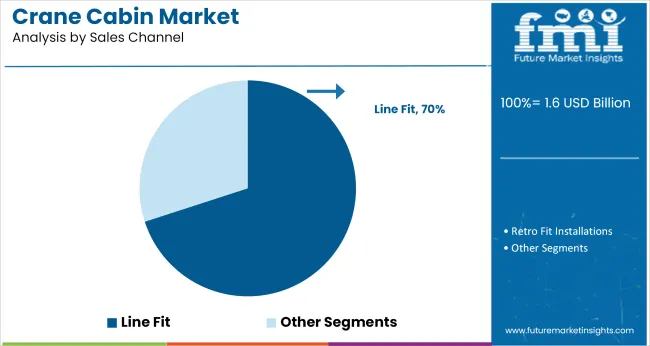

Enclosed platforms are projected to lead the platform segment with a 60% share by 2025, while mobile cranes will dominate by crane type at 31%. Standard environment control systems will command 42% of market share, and cabins designed for single-operator use are anticipated to reach 80%. Line fit will remain the dominant sales channel, contributing 70%.

Enclosed platforms are expected to account for 60% of the global market share by 2025, driven by the increasing focus on operator safety and climate resilience. Demand is growing across port terminals and construction sites where operators require protection from wind, dust, and temperature fluctuations.

Mobile cranes are projected to lead by crane type, securing 31% of the market share by 2025 due to their flexibility and widespread usage across industries. Infrastructure projects and urban development are boosting the need for highly maneuverable crane systems fitted with efficient operator cabins.

Standard environment control systems are expected to hold 42% of the market share by 2025, offering practical functionality without premium cost. Industrial operators prefer cabins equipped with standard climate features such as fans, air vents, and window sunshades for daily shifts.

Single-operator crane cabins are expected to dominate the operator segment with an 80% share by 2025, reflecting the industry trend toward individualized control. Centralized cockpit designs are being optimized to accommodate solo operation without compromising visibility or functional access.

Line fit is projected to capture 70% of the sales channel market share by 2025 as OEM integration becomes the preferred procurement route. Manufacturers are standardizing cabin installation within production lines, reducing aftermarket retrofitting costs for end users.

The market is experiencing steady growth as automation, safety mandates, and operator ergonomics become central to industrial equipment design. In 2024, over 138,000 new cranes were commissioned globally, with nearly 72% requiring upgraded cabins built to ANSI/ASME and ISO 10245 standards. Demand is especially strong in high-capacity port cranes, mining operations, and precast concrete handling systems.

Strong Uptake in Ports, Construction, and Heavy Manufacturing Sectors

Cabin retrofits are being prioritized in maritime logistics, where panoramic visibility and anti-vibration platforms improve operator precision. In Asia Pacific alone, 61 port terminals invested in modular crane cabins last year. In construction, enclosed HVAC-equipped cabins are replacing older open-frame types to meet new safety norms and climate resilience requirements.

Emphasis on Operator Comfort, Visibility, and Human-Machine Interface

Ergonomics now drive cabin design, with joystick-integrated armrests, shock-absorbing seats, and 360° laminated glass becoming standard. In 2023, nearly 68% of cabin-related operator injuries were linked to poor seat design and limited visibility. Manufacturers are responding with FOPS-certified cabins, glare-free lighting, and integrated display panels for real-time load metrics.

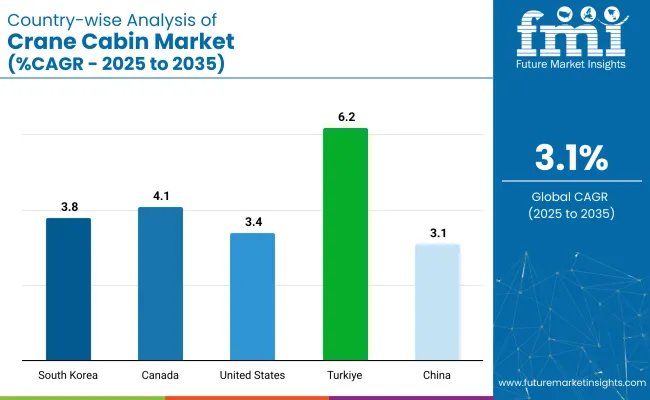

| Countries | CAGR (2025 to 2035) |

|---|---|

| Turkiye | 6.2% |

| Canada | 4.1% |

| United States | 3.4% |

| South Korea | 3.8% |

| China | 3.1% |

The global market is projected to grow at a modest 3.1% CAGR from 2025 to 2035, but country-level momentum varies sharply. Turkiye, a non-OECD manufacturing hub, leads with 6.2%, more than twice the global average. This growth is driven by its expanding role in EU-adjacent heavy equipment supply chains and increased investments in shipyards and steel production.

Cabin OEMs are targeting export-compliant designs and responding to retrofitting demand from CIS and MENA buyers. Canada follows at 4.1%, supported by demand for climate-adapted cabins suited for harsh mining and petrochemical environments in Alberta and Saskatchewan. South Korea registers 3.8%, underpinned by government-backed smart port initiatives and a robust domestic manufacturing base centered in Busan.

The USA shows moderate growth at 3.4%, primarily driven by delayed infrastructure renewal and gradual rail yard fleet upgrades. China remains flat at 3.1% due to market saturation and limited greenfield activity.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

Turkiye’s crane cabin market is projected to grow at a CAGR of 6.2%, the highest among profiled nations. The expansion of port infrastructure under the "Middle Corridor" logistics strategy and rapid growth in industrial zones like Dilovası are increasing demand for overhead and gantry cranes.

Local OEMs such as Çemtaş and Bofimak are producing cost-competitive modular cabins with advanced HVAC, anti-vibration mounts, and wide-vision glass panels. Public-private investments in steel, logistics, and shipbuilding facilities are creating recurring demand for cabin retrofits and replacements.

Canada is forecast to grow at a CAGR of 4.1% through 2035, supported by mining sector modernization and Arctic port upgrades. Cabins are being upgraded in cranes used for potash, copper, and rare earth mineral handling in Saskatchewan and Quebec.

Occupational safety reforms under CSA standards are pushing manufacturers to include ergonomic seating, visibility enhancement, and noise control systems. Canadian crane integrators are importing insulated and climate-controlled cabins for use in sub-zero environments, particularly in Yukon and Nunavut resource sites.

The USA crane cabin market is expected to grow at a CAGR of 3.4% through 2035. Large-scale warehouse automation and inland port expansions are increasing demand for bridge cranes and corresponding cabin units. OSHA and ANSI B30 standards are shaping design requirements including temperature regulation, field visibility, and anti-fatigue flooring.

Ports in Georgia and California are upgrading ship-to-shore cranes with smart-enabled cabins offering joystick controls and monitoring displays. Demand is being driven by the logistics, steel recycling, and aerospace fabrication industries.

South Korea’s crane cabin market is projected to grow at a CAGR of 3.8% through 2035, supported by shipyard innovation and automation in container terminals. Companies like Doosan Heavy Industries are incorporating touchscreen-based control panels and AI-assisted load sensors into cabin designs.

Cabins are also being adapted for autonomous crane operations in Busan and Incheon ports, where operators remotely monitor real-time load metrics. Strict health and safety protocols have prompted demand for enclosed, pressurized cabins in dust- and fume-heavy environments.

China is expected to grow at a CAGR of 3.1% through 2035. State-backed industrial zone developments in Inner Mongolia and Guangxi are creating steady demand for bridge and overhead crane installations.

As part of safety reforms under GB/T 3811 to 2021 standards, crane manufacturers are offering enclosed cabins with heat-resistant materials, shock isolation, and air filtration. Growth is also linked to manufacturing upgrades in Tier 2 cities, where automated crane cabins are being installed for efficiency and worker safety.

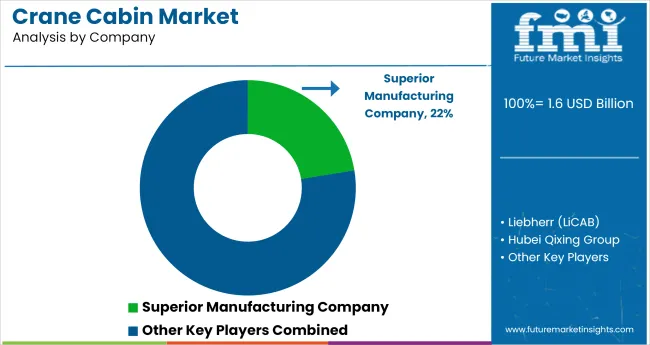

The market is moderately fragmented, with key players offering customized operator cabins for various crane types including tower, overhead, and gantry cranes. Superior Manufacturing Company and Liebherr (LiCAB) lead the space with ergonomically designed, climate-controlled cabins aimed at enhancing operator comfort and safety in heavy-duty applications.

Liebherr’s modular cabin systems are widely adopted in construction and port operations for their reliability and visibility optimization. Henan Seven Industry Co., Ltd. and Hubei Qixing Group cater to industrial and infrastructure projects with tailored cabin solutions for OEM and aftermarket use. Ralf Teichmann GmbH and DGCRANE specialize in retrofitting and supplying cabins for overhead cranes used in steel and logistics facilities.

Recent Crane Cabin Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.6 billion |

| Projected Market Size (2035) | USD 2.2 billion |

| CAGR (2025 to 2035) | 3.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for market value |

| Platforms Analyzed (Segment 1) | Open, Enclosed |

| Crane Types Analyzed (Segment 2) | Overhead Cranes, Tower Cranes, Mobile Cranes, Gantry Cranes |

| Environment Controls Analyzed (Segment 3) | Standard, Climate-Controlled, Hazardous Safety Cabins |

| Operator Types Analyzed (Segment 4) | Single-Operator, Multi-Operator |

| Sales Channels Analyzed (Segment 5) | Line Fit, Retro Fit |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Key Players | Superior Manufacturing Company, Liebherr ( LiCAB ), Hubei Qixing Group, Henan Seven Industry Co., Ltd., Ralf Teichmann GmbH, Grúas Sáez, S.L., Henan FineWork Cranes Co., Ltd., DGCRANE |

| Additional Attributes | Dollar sales by crane and platform type, increasing preference for operator safety features, demand for climate-controlled cabins, and rising installations in the construction and logistics sectors. |

The market is segmented by platform into open and enclosed configurations.

By crane type, the industry includes overhead cranes, tower cranes, mobile cranes, and gantry cranes.

Based on environmental control, the market is categorized into standard, climate-controlled, and hazardous safety cabins.

In terms of operator type, the market comprises single-operator and multi-operator cabins.

Sales channels include line fit and retrofit installations.

Regionally, the market covers North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The market is valued at USD 1.6 billion in 2025.

The market is expected to expand at a CAGR of 3.1% from 2025 to 2035.

Mobile cranes dominate with a 31% market share in 2025.

Standard systems hold the top position with 42% share in 2025.

Turkiye is the fastest-growing country with a CAGR of 6.2% through 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cabin Air Heater Market Size and Share Forecast Outlook 2025 to 2035

Crane Trucks Market Size and Share Forecast Outlook 2025 to 2035

Crane Rental Market Analysis by Product Type, End-Use Industry, and Region through 2035

Crane Aftermarket Growth – Trends & Forecast 2025 to 2035

Crane Motors Market Growth – Trends & Forecast 2025 to 2035

Crane Market Growth - Trends & Forecast 2025 to 2035

Key Companies & Market Share in Crane Scales Industry

Crane Scales Market Analysis – Growth, Demand & Forecast 2024-2034

Mini Cranes Market Size and Share Forecast Outlook 2025 to 2035

Yard Crane Market Size and Share Forecast Outlook 2025 to 2035

Global Mini Cranes Market Share Analysis – Growth, Trends & Forecast 2025–2035

Fixed Cranes Market Size and Share Forecast Outlook 2025 to 2035

Tower Crane Rental Market Growth – Trends & Forecast 2025 to 2035

Tower Crane Market Growth - Trends & Forecast 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Marine Cranes Market Growth - Trends & Forecast 2025 to 2035

Spider Cranes Market Analysis based on Lifting Capacity, Operation, Control System, Application, Ownership and Region: A Forecast from 2025 to 2035

Airport Cabin Baggage Scanner Market Size and Share Forecast Outlook 2025 to 2035

Stacker Crane Market Growth – Trends & Forecast 2025 to 2035

Banquet Cabinets Market – Storage & Heating Solutions 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA