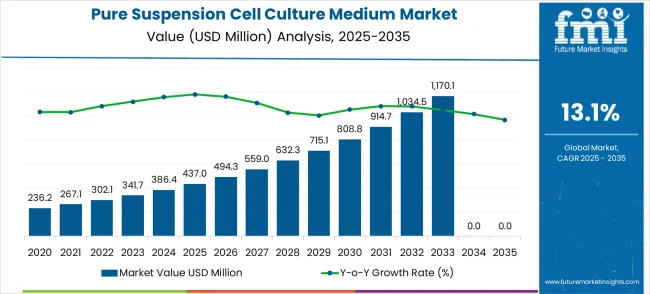

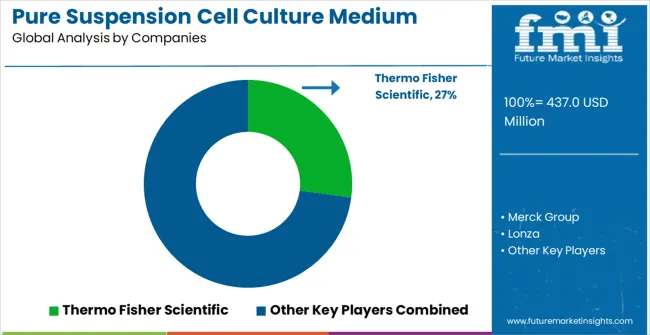

The pure suspension cell culture medium market is projected at USD 437.0 million in 2025 and is forecast to expand to USD 1,496.7 million by 2035, advancing at a CAGR of 13.1%. Over this period, the market experiences robust and accelerating growth with significant differences between peak and trough years.

The best performing years are observed toward the end of the forecast horizon, particularly between 2033 and 2035, when the market jumps from USD 1,170.1 million to USD 1,496.7 million, reflecting strong adoption of advanced culture media in biologics, vaccines, and gene therapy research. The weakest performance, though still healthy, is seen in the initial stages, such as 2025 to 2026, where the increase from USD 437.0 million to USD 494.3 million reflects a growth rate of around 13.1%, aligning with baseline projections.

Protein-based therapeutic applications are expected to contribute significantly to the market’s expansion. In the short term, monoclonal antibody production represents the fastest-growing sub-segment due to rising global approvals for antibody-based therapies. This segment is projected to maintain a higher-than-average YoY growth compared to vaccine development, which grows at a more moderate pace but still adds a steady share to overall demand. Gene therapy and cell therapy sub-segments show accelerated adoption after 2030, contributing disproportionately to the market’s later-stage surge. Such segment-level differentiation highlights how therapeutic pipeline expansion directly influences the adoption curve of suspension cell culture media.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 437.0 million |

| Forecast Value in (2035F) | USD 1,496.7 million |

| Forecast CAGR (2025 to 2035) | 13.1% |

From a regional comparison, North America remains the leading contributor due to advanced biologics manufacturing facilities and well-established pharmaceutical research infrastructure. The region consistently achieves higher growth during the early forecast years, benefiting from a steady pipeline of biologic approvals. In contrast, Asia Pacific demonstrates the steepest YoY growth in later years, particularly after 2030, as countries such as China, India, and South Korea expand their biosimilar and vaccine manufacturing bases. Europe records balanced growth, supported by stringent regulatory frameworks and increasing investments in cell-based research, while Latin America and the Middle East gradually strengthen their presence in biologics manufacturing.

The comparative analysis shows that the market’s peak years are concentrated in the final three years, driven by the compounding effect of high CAGR and accelerated regional adoption of cell-based therapies. Early years represent the trough in relative terms, but even then, double-digit YoY growth ensures robust performance. Segmental differences underline how biologics innovation drives adoption, while regional variation reflects the shifting global distribution of pharmaceutical R&D and manufacturing capacity. The market thus evolves from steady early-stage growth to accelerated late-stage expansion, offering opportunities for diversified strategic investments.

Market expansion is being supported by the increasing development of cell-based therapies and the corresponding demand for scalable cell cultivation technologies. Modern biotechnology companies are increasingly focused on suspension culture systems that can support high-density cell growth, maintain cell viability, and enable cost-effective large-scale production. The proven effectiveness of specialized medium formulations in optimizing cell productivity and maintaining cellular characteristics makes them essential components of competitive cell therapy manufacturing operations.

The growing focus on personalized medicine and regenerative therapeutics is driving demand for advanced cell culture medium systems that address specific cell type requirements and manufacturing scale needs. Biotechnology industry preference for standardized medium formulations that combine high performance with regulatory compliance is creating opportunities for innovative medium development. The rising influence of quality-by-design principles and process optimization strategies is also contributing to increased adoption of proven pure suspension cell culture media across different cell therapy applications and manufacturing environments.

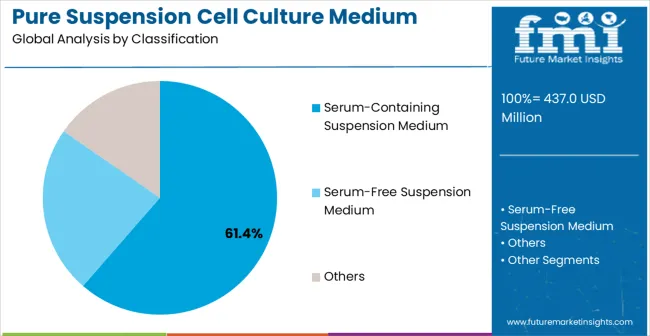

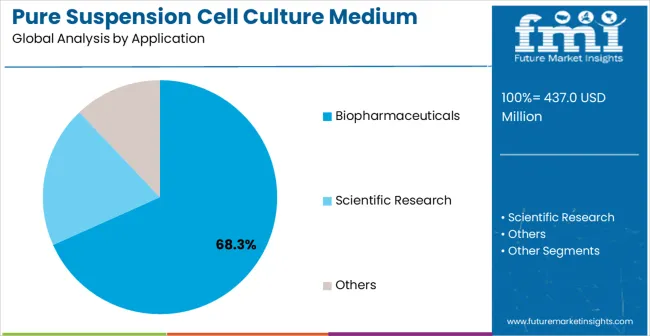

The market is segmented by classification, application, and region. By classification, the market is divided into serum-containing suspension medium, serum-free suspension medium, and others. Based on application, the market is categorized into biopharmaceuticals, scientific research, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

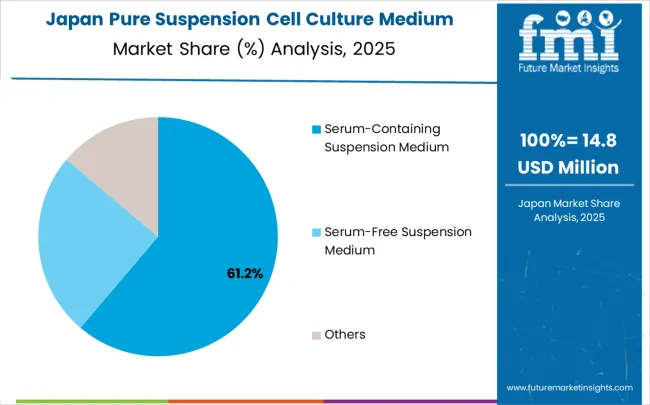

The serum-containing suspension medium segment is projected to account for 61.4% of the pure suspension cell culture medium market in 2025, reaffirming its position as the category's dominant classification. Biotechnology researchers and manufacturers increasingly recognize the proven performance characteristics of serum-containing formulations for supporting robust cell growth and maintaining cellular functionality in suspension culture systems. This medium type addresses both nutritional requirements and growth factor provision needs, providing comprehensive cell cultivation support coverage.

This classification forms the foundation of most established cell culture protocols, as it represents the most widely validated and historically proven medium approach in biotechnology applications. Technical validation studies and extensive performance data continue to strengthen confidence in serum-containing medium formulations. With increasing recognition of the importance of reliable cell culture requiring proven medium systems, serum-containing media align with both current manufacturing requirements and established regulatory pathways. Their broad compatibility across multiple cell types ensures sustained market dominance, making them the central growth driver of pure suspension cell culture medium demand.

Biopharmaceuticals applications are projected to represent 68.3% of pure suspension cell culture medium demand in 2025, highlighting their role as the primary application driving medium adoption. Cell therapy manufacturers and biotechnology companies recognize that biopharmaceutical production requires specialized medium systems that can effectively support therapeutic cell cultivation and maintain product quality standards. Pure suspension cell culture media offer optimal performance characteristics for monoclonal antibody production, cell therapy manufacturing, and vaccine development processes.

The segment is supported by the rapid expansion of cell-based therapeutics requiring proven culture systems and the growing recognition that suspension culture provides superior scalability for commercial production. Biopharmaceutical companies are increasingly adopting integrated manufacturing approaches that leverage suspension culture advantages for optimal production efficiency and cost-effectiveness. As cell therapy commercialization continues to accelerate toward higher production volumes and improved manufacturing economics, medium systems optimized for biopharmaceutical applications will continue to play a crucial role in competitive therapeutic development strategies, reinforcing their essential position within the biotechnology market.

The market is advancing rapidly due to increasing demand for cell-based therapies and growing adoption of scalable bioprocessing technologies. The market faces challenges including complex medium formulation requirements, high development and validation costs, and concerns about batch-to-batch variability and regulatory compliance. Innovation in medium optimization and quality control technologies continue to influence product development and market expansion patterns.

The growing commercialization of cell therapies is enabling more sophisticated medium system requirements and manufacturing scale optimization. Commercial cell therapy production requires comprehensive medium performance, including consistent quality, scalable production, and regulatory compliance, that advanced pure suspension cell culture media can provide effectively. Manufacturing expansion creates demand for medium technologies that can support large-scale production while maintaining therapeutic cell quality and functionality.

Modern biotechnology companies are incorporating automated bioprocessing technologies such as perfusion bioreactors, real-time monitoring systems, and process analytical technology to enhance cell culture medium performance. These technologies improve culture control, enable better process optimization, and provide enhanced medium utilization efficiency and productivity monitoring. Advanced bioprocess management also enables optimized medium feeding strategies and early identification of potential culture performance issues or contamination events.

| Country | CAGR (2025-2035) |

|---|---|

| China | 17.7% |

| India | 16.4% |

| Germany | 15.1% |

| Brazil | 13.8% |

| USA | 12.4% |

| UK | 11.1% |

| Japan | 9.8% |

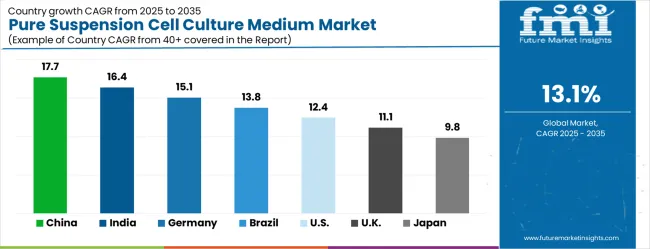

The market is experiencing varied growth globally, with China leading at a 17.7% CAGR through 2035, driven by expanding biotechnology sector, increasing investment in cell therapy research, and growing government support for biopharmaceutical development. India follows at 16.4%, supported by biotechnology industry expansion, increasing contract manufacturing capabilities, and expanding cell culture research infrastructure. Germany shows growth at 15.1%, focusing advanced bioprocessing technologies and established pharmaceutical industry expertise. Brazil records 13.8% growth, focusing on improved biotechnology infrastructure and cell culture technology adoption. The USA shows 12.4% growth, representing a mature market with established cell therapy companies and ongoing commercial manufacturing expansion.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is forecasted to grow at a CAGR of 17.7% during 2025–2035, supported by rapid advancements in biopharmaceutical production and cell-based research. The rising adoption of monoclonal antibodies and recombinant protein therapeutics has created strong demand for high-quality suspension cell culture media. Domestic manufacturers are upgrading capabilities to cater to both academic and industrial needs, while multinational firms are increasing collaborations with local companies. The government’s continued investments in biotechnology clusters and pharmaceutical industrial parks further boost market expansion. The transition toward cell-based vaccines and gene therapies adds to the requirement for reliable culture media that ensures consistency and scalability. With China becoming a hub for contract development and manufacturing services, the demand for specialized media formulations is expected to strengthen further.

India is projected to expand at a CAGR of 16.4% between 2025 and 2035, driven by increasing pharmaceutical manufacturing, biologics research, and vaccine development programs. The country’s strong position in generic drug production has gradually shifted toward biosimilars and advanced biologics, boosting the requirement for suspension cell culture media. Government support for biotechnology start-ups and R&D centers has accelerated adoption of high-quality culture products. Academic institutions are also increasing collaborations with private companies for cell-based studies, expanding the overall demand base. India’s biopharmaceutical exports continue to rise, enhancing the role of reliable upstream processing inputs. The growth of contract research and manufacturing organizations further strengthens the use of standardized cell culture solutions, positioning India as a major player in this market segment.

Germany is expected to record a CAGR of 15.1% during 2025–2035, supported by its strong biotechnology ecosystem, advanced pharmaceutical industry, and growing cell-based research initiatives. The country has a well-developed biopharma infrastructure, where suspension cell culture medium plays a critical role in bioprocessing and production of advanced therapies. Pharmaceutical companies are increasingly adopting scalable media formulations for monoclonal antibody and vaccine production. German research institutions are also pioneering work in regenerative medicine and stem cell research, further boosting demand. Compliance with stringent European quality standards drives adoption of high-purity and consistent cell culture inputs. Partnerships between German biopharma companies and global suppliers continue to expand, ensuring a robust supply chain for culture media in both research and commercial applications.

Brazil is forecasted to achieve a CAGR of 13.8% from 2025 to 2035, supported by rising investments in healthcare and biotechnology research. The pharmaceutical industry in Brazil is increasing adoption of advanced biologics and biosimilars, creating greater need for reliable suspension cell culture media. Universities and research centers are strengthening their cell biology programs, with growing collaboration with global pharmaceutical companies. The government’s initiatives to expand domestic drug manufacturing capacity are enhancing opportunities for culture media suppliers. Biopharmaceutical imports have also increased, highlighting the need for more localized production capabilities. As Brazil enhances its focus on vaccine development and precision medicine, the use of scalable and standardized suspension culture media is expected to expand, offering growth opportunities to both domestic and international players.

The United States is projected to advance at a CAGR of 12.4% during 2025–2035, driven by its leadership in biopharmaceutical innovation and advanced cell-based therapies. The country’s high investment in gene therapies, regenerative medicine, and cell-based vaccines has intensified the demand for specialized suspension culture media. Leading pharmaceutical companies and biotech firms are continuously expanding biologics production, supported by extensive FDA-approved clinical pipelines. Universities and research institutions also play a major role in expanding applications, as cell culture media form the backbone of experimental biology. The growing demand for contract development and manufacturing services has also expanded adoption, as these facilities increasingly rely on standardized and scalable culture solutions. With its innovation-driven ecosystem, the USA remains a critical market for advanced suspension cell culture products.

The United Kingdom is set to grow at a CAGR of 11.1% from 2025 to 2035, supported by a robust life sciences sector and expanding biotechnology research base. Suspension cell culture media are increasingly used in drug discovery, vaccine development, and regenerative medicine studies. The government’s focus on fostering innovation in life sciences and strengthening academic-industry partnerships has accelerated adoption. Several biotech start-ups are investing in scalable upstream processing technologies that depend on reliable culture media. Pharmaceutical exports also play a key role in sustaining demand, as international markets rely on UK manufactured biologics. The country’s expanding clinical trial base has further encouraged higher usage of culture media in both research and pre-commercialization phases, strengthening its role in the global market.

Japan is anticipated to register a CAGR of 9.8% between 2025 and 2035, supported by its strong focus on high-value pharmaceutical and biotech innovations. Suspension cell culture media are widely adopted in advanced biologics production, with focus on oncology and regenerative medicine applications. Japan’s pharmaceutical companies are increasingly investing in cutting-edge therapies that require highly reliable and consistent media formulations. Domestic production facilities are being modernized to align with global standards, while collaborations with international suppliers bring new technologies into the local market. Strong government support for cell and gene therapy research further enhances the role of advanced media. With precision medicine gaining momentum, the demand for standardized culture products is expected to rise significantly, reinforcing Japan’s competitive role in the sector.

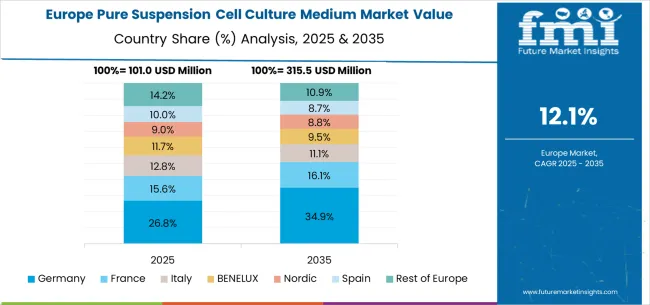

The pure suspension cell culture medium market in Europe is projected to expand robustly through 2035, supported by increasing adoption of cell-based therapies, rising investment in biotechnology research, and ongoing innovation in bioprocessing technologies. Germany will continue to lead the regional market, accounting for 28.7% in 2025 and rising to 29.4% by 2035, supported by strong pharmaceutical industry infrastructure, advanced biotechnology research capabilities, and robust cell therapy development programs. The United Kingdom follows with 21.2% in 2025, increasing to 21.8% by 2035, driven by comprehensive biotechnology research excellence, cell therapy innovation initiatives, and expanding commercial manufacturing capabilities.

France holds 17.8% in 2025, edging up to 18.3% by 2035 as pharmaceutical companies expand cell culture utilization and demand grows for advanced therapeutic development technologies. Italy contributes 14.1% in 2025, remaining broadly stable at 14.5% by 2035, supported by growing biotechnology sector investment and increasing cell therapy research adoption. Spain represents 10.2% in 2025, inching upward to 10.6% by 2035, underpinned by strengthening pharmaceutical research infrastructure and biotechnology development initiatives.

BENELUX markets together account for 5.4% in 2025, moving to 5.7% by 2035, supported by advanced biotechnology requirements and pharmaceutical innovation initiatives. The Nordic countries represent 3.8% in 2025, marginally increasing to 4.0% by 2035, with demand fueled by comprehensive research excellence and early adoption of advanced cell culture technologies. The Rest of Western Europe moderates from 2.8% in 2025 to 0.7% by 2035, as larger core markets capture a greater share of biotechnology investment, therapeutic development projects, and cell culture medium adoption.

The market is characterized by competition among established life sciences companies, specialized cell culture technology providers, and comprehensive biotechnology solution suppliers. Companies are investing in medium research and development, quality assurance, strategic partnerships, and technical support services to deliver reliable, high-performance, and regulatory-compliant cell culture medium solutions. Product innovation, performance validation, and market access strategies are central to strengthening product portfolios and market presence.

Thermo Fisher Scientific leads the market with comprehensive cell culture solutions focusing on quality and performance optimization across diverse applications. Merck Group provides extensive life sciences portfolios with focus on innovation and technical excellence. Lonza focuses on specialized cell culture systems and custom medium development for biopharmaceutical applications. Cytiva delivers established bioprocessing solutions with strong industry expertise and regulatory support.

FUJIFILM Irvine Scientific operates with focus on advanced medium formulations and application-specific solutions for therapeutic development. Sartorius, Corning, and Bio-Techne provide innovative cell culture technologies with focus on performance optimization and manufacturing scalability. Xell AG, STEMCELL Technologies, and OPM Biosciences deliver specialized solutions for specific cell types and applications. Sino Biological, Biocytogen, Suzhou Womei Biotechnology, and Shanghai Duoning Biotechnology provide comprehensive medium portfolios including research support, technical consulting services, and custom formulation capabilities to enhance market accessibility and customer satisfaction across diverse biotechnology applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 437.0 million |

| Classification | Serum-Containing Suspension Medium, Serum-Free Suspension Medium, Others |

| Application | Biopharmaceuticals, Scientific Research, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Thermo Fisher Scientific, Merck Group, Lonza, Cytiva, FUJIFILM Irvine Scientific, Sartorius, Corning, Bio-Techne, Xell AG, STEMCELL Technologies, OPM Biosciences, Sino Biological, Biocytogen, Suzhou Womei Biotechnology, Shanghai Duoning Biotechnology |

| Additional Attributes | Dollar sales by medium type and application, regional demand trends, competitive landscape, biotechnology company preferences for specific formulations, integration with bioprocessing systems, innovations in medium design, quality assurance strategies, and performance optimization |

The global pure suspension cell culture medium market is estimated to be valued at USD 437.0 million in 2025.

The market size for the pure suspension cell culture medium market is projected to reach USD 1,496.7 million by 2035.

The pure suspension cell culture medium market is expected to grow at a 13.1% CAGR between 2025 and 2035.

The key product types in pure suspension cell culture medium market are serum-containing suspension medium, serum-free suspension medium and others.

In terms of application, biopharmaceuticals segment to command 68.3% share in the pure suspension cell culture medium market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pure Visual Perception Solution Market Size and Share Forecast Outlook 2025 to 2035

Pure Steam Generators Market

Pure Red Cell Aplasia Market

Ultrapure Water Market Size and Share Forecast Outlook 2025 to 2035

Mango Puree Market Size and Share Forecast Outlook 2025 to 2035

Guava Puree Market Size and Share Forecast Outlook 2025 to 2035

Banana Puree Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fruit Concentrate Puree Market Growth - Trends & Forecast 2025 to 2035

Analyzing Not From Concentrated (NFC) Puree Market Share & Industry Leaders

Suspension Bump Stopper Market Size and Share Forecast Outlook 2025 to 2035

Suspension & Retention Packaging Market

Air Suspension Systems Market Growth – Trends & Forecast 2025 to 2035

HCV Suspension System Market

Disc Suspension Porcelain Insulator Market Size and Share Forecast Outlook 2025 to 2035

Nano Suspension Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Suspension Seat Bases Market Growth - Trends & Forecast 2035 to 2035

Automotive Suspension System Market Growth - Trends & Forecast 2025 to 2035

Motorcycle Suspension System Market Growth - Trends & Forecast 2025 to 2035

Automotive Suspension Control Arms Market Growth – Trends & Forecast 2025 to 2035

Two Wheeler Suspension System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA