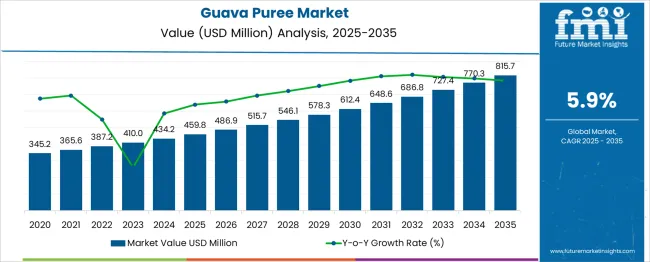

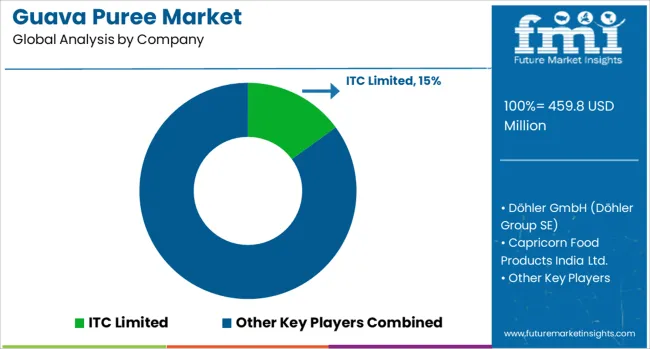

The guava puree market is estimated to be valued at USD 459.8 million in 2025. It is projected to reach USD 815.7 million by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period. Between 2025 and 2030, the market is expected to increase from USD 459.8 million to USD 612.4 million, driven by rising applications in beverages, baby foods, and bakery products. Year-on-year analysis shows steady gains, reaching USD 486.9 million in 2026 and USD 515.7 million in 2027, supported by growing demand for natural fruit-based ingredients and consumer preference for tropical flavors in processed food products.

By 2028, the market is forecasted to hit USD 546.1 million, advancing to USD 578.3 million in 2029 and USD 612.4 million by 2030. This growth trajectory is reinforced by increasing usage of guava puree in nutraceutical formulations due to its high vitamin C content and antioxidant properties. Expansion of online retail and the rising popularity of clean-label and minimally processed fruit products are expected to boost adoption further. These dynamics position guava puree as a valuable ingredient in functional foods and beverages, creating opportunities for manufacturers to innovate with flavor blends and fortified product offerings.

| Metric | Value |

|---|---|

| Guava Puree Market Estimated Value in (2025 E) | USD 459.8 million |

| Guava Puree Market Forecast Value in (2035 F) | USD 815.7 million |

| Forecast CAGR (2025 to 2035) | 5.9% |

The guava puree market holds a niche but growing position within multiple fruit-based and ingredient-driven sectors. In the tropical fruit puree market, it accounts for approximately 8–10%, as mango, banana, and papaya purees dominate this segment. Within the food & beverage ingredients market, its share is relatively small at 2–3%, given the wide range of ingredients including flavors, colors, and stabilizers. In the beverage ingredients market, guava puree contributes around 4–5%, driven by its increasing use in juices, smoothies, and flavored drinks due to its unique taste and high vitamin content.

For the infant food and baby food ingredients market, its share is about 3–4%, as guava puree is gaining traction in fortified and natural baby food products. Within the bakery and confectionery ingredients market, the share remains modest at 1–2%, as it serves as a specialty ingredient for fillings and flavoring in premium products. Growth is supported by rising consumer preference for natural fruit-based products, clean-label formulations, and tropical flavors in global markets. Guava puree’s functional benefits, including its vitamin C content and antioxidant properties, further enhance its appeal in health-oriented beverages and snacks. As demand for exotic flavors continues to rise, guava puree is expected to strengthen its presence across these parent markets.

Rising demand from the beverage and foodservice industries is being complemented by growing awareness of guava’s high vitamin and antioxidant content. Industry observations indicate that product development focusing on clean labels and exotic flavors has further enhanced market attractiveness. Expansion of export opportunities, particularly in North America and Europe, is also supporting growth as supply chains become more organized and production techniques improve.

Future opportunities are expected to arise from innovations in processing technology to preserve flavor and nutrition while extending shelf life, coupled with increasing incorporation of guava puree in functional beverages and baby food. The interplay of health consciousness, global culinary trends, and improved logistics is paving the way for sustained market expansion.

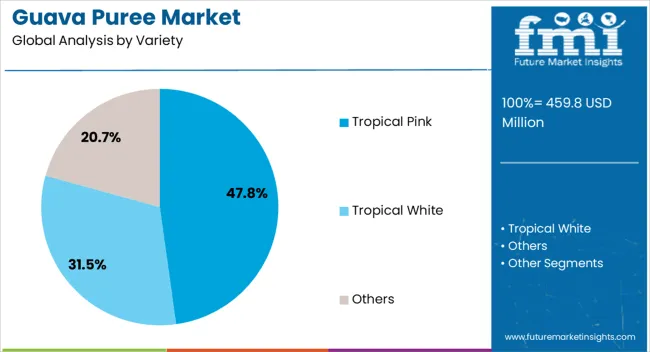

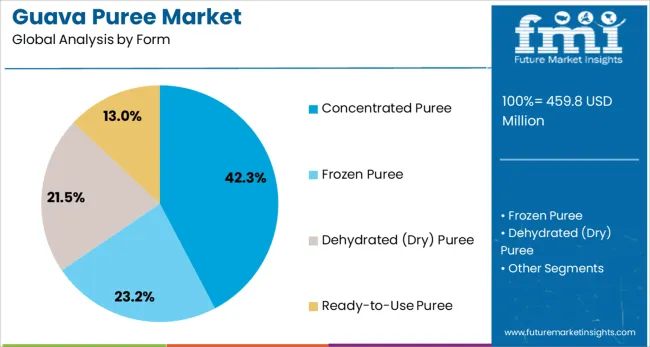

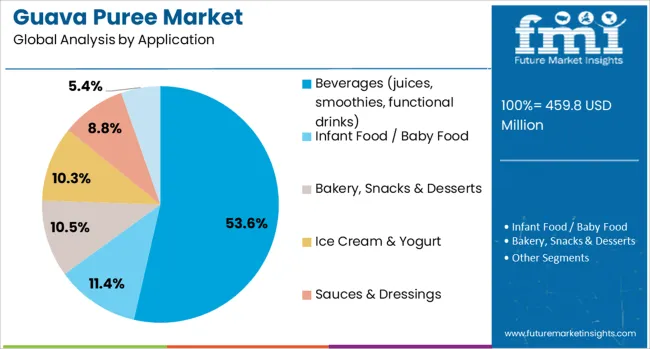

The guava puree market is segmented by variety/type, form, application, and geographic regions. The guava puree market is divided by variety into Tropical Pink, Tropical White, and Others. The guava puree market is classified into Concentrated Puree, Frozen Puree, Dehydrated (Dry) Puree, and Ready-to-Use Puree. Based on the application of the guava puree market, it is segmented into Beverages (juices, smoothies, functional drinks), Infant Food / Baby Food, Bakery, Snacks & Desserts, Ice Cream & Yogurt, Sauces & Dressings, and Others (pharma/nutraceutical cosmetics). Regionally, the guava puree industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by variety or type, the tropical pink segment is anticipated to hold 47.80% of the total market revenue in 2025, making it the leading variety. This dominance is being attributed to its appealing color, distinctive sweet-tart flavor, and higher lycopene content compared to other varieties.

Industry practices have favored tropical pink for premium beverage formulations and baby food products due to its superior visual and nutritional profile. Its versatility in blending with other fruits and ability to impart an exotic taste have enhanced its preference among formulators targeting health-conscious and adventurous consumers.

Enhanced cultivation practices and consistent supply availability have also reinforced its position as the preferred choice across both domestic and export markets. The segment’s ability to meet aesthetic, nutritional, and sensory expectations has cemented its leadership in the variety landscape.

Segmenting by form reveals that concentrated puree is expected to account for 42.3% of the guava puree market revenue in 2025, positioning it as the leading form. This prominence has been supported by its extended shelf life, reduced transportation and storage costs, and higher processing efficiency.

Food and beverage manufacturers have increasingly opted for concentrated puree to optimize logistics and production, particularly in large-scale operations where consistency and economy are crucial. The ability of concentrated puree to retain key nutritional and sensory attributes after reconstitution has made it a preferred input for juices, nectars, and functional drinks.

Its compatibility with industrial blending processes and ease of handling in bulk formats have further strengthened its appeal among producers seeking cost-effective and high-quality solutions.

In terms of application, beverages including juices, smoothies, and functional drinks are projected to command 53.6% of the guava puree market revenue in 2025, establishing it as the top application segment. This leadership has been driven by growing consumer interest in healthier drink options that combine taste with perceived functional benefits.

The use of guava puree in beverages has been reinforced by its ability to deliver natural sweetness, vibrant color, and a high content of vitamins and antioxidants. Beverage manufacturers have increasingly integrated guava puree into both mainstream and niche products to cater to diverse consumer segments, ranging from wellness-focused individuals to those seeking novel flavors.

Its adaptability to both dairy and non-dairy formulations, along with strong acceptance in both retail and foodservice channels, has solidified its position as the most significant application area within the market.

The guava puree market is influenced by rising applications in beverages, dairy blends, and confectionery products. Growth drivers include increasing demand from juice processors and baby food manufacturers in Asia and Latin America. Opportunities exist in flavored puree combinations and frozen packaging solutions for export markets. Emerging trends center on organic-certified puree sourcing and pulp standardization for premium product positioning. However, restraints such as seasonal yield fluctuations, high processing costs, and strict export regulations affect supply stability. Companies focusing on value-added variants and extended shelf-life packaging are viewed as better positioned to maintain competitiveness in 2024 and 2025.

Growth in the guava puree market has been attributed to its rising utilization in juices, smoothies, and flavored yogurts across emerging and developed economies. In 2024, beverage companies in India and Brazil integrated guava-based blends to diversify flavor portfolios, while dairy brands introduced tropical yogurt lines. The puree’s natural sweetness and vitamin-rich profile have made it a preferred base in low-sugar formulations. It is believed that increased demand from baby food manufacturers in Asia-Pacific, coupled with large-scale procurement by beverage giants, has amplified production and processing investments for guava puree across regional markets.

Opportunities are observed in organic-certified guava puree and frozen variants targeting premium buyers and export channels. In 2025, European importers showed strong interest in single-strength frozen puree blocks to maintain texture and freshness for high-end applications. Manufacturers investing in HACCP-compliant processing facilities gained traction with multinational food brands emphasizing clean sourcing. The growth of e-commerce-based ingredient trade platforms has created additional distribution opportunities. It is considered that suppliers integrating organic certification with innovative packaging formats are positioned to capture untapped segments across nutraceuticals, desserts, and ready-to-drink functional beverages.

The guava puree market is witnessing an emerging trend toward multi-fruit blends, with guava combined with mango, passion fruit, and citrus variants for premium flavor differentiation. In 2024, beverage formulators in North America launched guava-citrus blends for sports hydration products, while bakery brands experimented with guava fillings in frozen desserts. Value-added puree fortified with natural fibers and antioxidants is gaining interest among functional beverage developers. It is strongly viewed that companies introducing standardized Brix levels for guava puree will maintain strong appeal to processors seeking consistency in taste and quality across global manufacturing lines.

One of the primary restraints in the guava puree market is seasonal production, which affects raw material availability and pricing stability. In 2024, procurement delays in Latin America due to weather disruptions caused significant supply chain imbalances. High processing costs, driven by the need for aseptic packaging and cold storage, add to pricing pressure for exporters. Stringent import regulations in key destinations like the EU further complicate trade compliance. It is considered that these factors collectively challenge smaller processors lacking financial strength to invest in infrastructure or negotiate long-term sourcing contracts with growers.

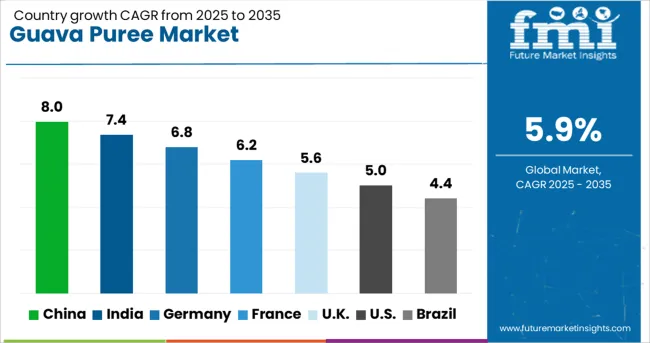

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

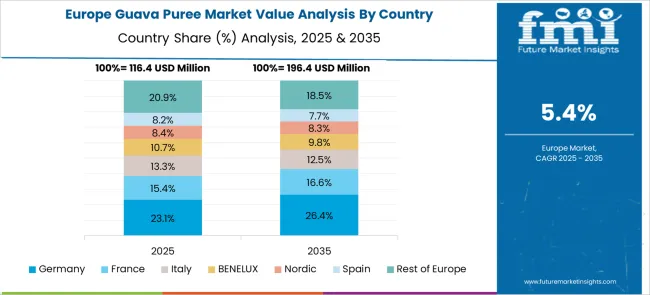

The global guava puree market is projected to grow at a CAGR of 5.9% from 2025 to 2035. China leads with 8.0%, followed by India at 7.4% and Germany at 6.8%. France records 6.2%, while the United Kingdom posts 5.6%. Growth is driven by rising demand in beverages, baby food, and bakery applications, coupled with increasing interest in natural fruit-based ingredients. China and India dominate supply and processing capacities due to strong agricultural output, while Germany focuses on premium organic variants. France and the UK prioritize clean-label formulations and guava puree in fortified functional beverages.

The guava puree market in China is forecast to grow at 8.0%, driven by increasing applications in juice blends and packaged smoothies. Frozen guava puree dominates demand due to extended shelf life and large-scale exports. Manufacturers invest in advanced aseptic processing to retain flavor and nutrients. Rising popularity of tropical fruit-based beverages accelerates domestic and international consumption.

The guava puree market in India is projected to grow at 7.4%, supported by strong consumption of guava-based drinks and baby food products. Pink guava puree dominates due to its high antioxidant content and appealing color. Manufacturers introduce fortified purees to target nutrition-conscious consumers. Expansion of quick-service restaurants and packaged beverage brands boosts industrial demand.

The guava puree market in Germany is expected to grow at 6.8%, driven by demand for exotic fruit ingredients in functional beverages and confectionery products. Organic guava puree dominates premium retail segments. Manufacturers integrate sustainable sourcing practices to align with EU regulations. Growth of clean-label and sugar-reduced formulations further supports demand from health-conscious buyers.

The guava puree market in France is projected to grow at 6.2%, supported by its use in gourmet desserts, smoothies, and bakery fillings. Aseptic guava puree dominates adoption in industrial-scale food processing. Manufacturers develop allergen-free and additive-free products for clean-label compliance. Partnerships with premium patisserie brands expand guava puree penetration in luxury foodservice channels.

The guava puree market in the UK is forecast to grow at 5.6%, driven by demand for guava-based cocktails, smoothies, and plant-based dessert recipes. Concentrated guava puree dominates beverage and foodservice applications for cost efficiency. Manufacturers introduce sustainable packaging formats for retail packs. Expansion of online grocery platforms accelerates premium tropical fruit puree availability.

The guava puree market is moderately fragmented, with ITC Limited recognized as a prominent player due to its strong presence in processed fruit products, well-established sourcing networks, and advanced processing facilities that ensure consistent quality for food and beverage applications. The company’s offerings cater to juices, nectars, and blended beverages, giving it a competitive edge in both domestic and export markets. Key players include Döhler GmbH (Döhler Group SE), Capricorn Food Products India Ltd., Citrofrut S.A. de C.V. (Proeza Corporation), Superior Foods, Inc., Aditi Foods India Pvt. Ltd., and Kiril Mischeff.

These companies provide guava puree in aseptic and frozen forms for applications in beverages, baby food, dairy, confectionery, and bakery products. They emphasize maintaining natural flavor and nutritional integrity through advanced processing techniques and strict quality control measures. Market growth is driven by rising demand for tropical fruit-based beverages, increasing popularity of natural ingredients in packaged food, and expanding export opportunities for guava-derived products.

Leading suppliers are investing in value-added processing, innovative packaging formats, and partnerships with beverage manufacturers to strengthen their market position. Asia-Pacific, particularly India, remains a key production hub due to abundant guava cultivation, while North America and Europe represent growing markets for clean-label and exotic fruit-based formulations.

| Item | Value |

|---|---|

| Quantitative Units | USD 459.8 Million |

| Variety / Type | Tropical Pink, Tropical White, and Others |

| Form | Concentrated Puree, Frozen Puree, Dehydrated (Dry) Puree, and Ready‑to‑Use Puree |

| Application | Beverages (juices, smoothies, functional drinks), Infant Food / Baby Food, Bakery, Snacks & Desserts, Ice Cream & Yogurt, Sauces & Dressings, and Others (pharma/nutraceutical cosmetics) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ITC Limited, Döhler GmbH (Döhler Group SE), Capricorn Food Products India Ltd., Citrofrut S.A. de C.V. (Proeza Corporation), Superior Foods, Inc., Aditi Foods India Pvt. Ltd., and Kiril Mischeff |

| Additional Attributes | Dollar sales by ingredient type (frozen, concentrated, organic) and application (beverages, baby food, bakery/sauces), regional demand trends (Asia-Pacific fastest growth, Latin America strong base), competitive landscape, consumer preference for clean-label and functional ingredients, integration with plant-based and infant food systems, innovations in high-lycopene pink guava and sustainable packaging solutions. |

The global guava puree market is estimated to be valued at USD 459.8 million in 2025.

The market size for the guava puree market is projected to reach USD 815.7 million by 2035.

The guava puree market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in guava puree market are tropical pink, tropical white and others.

In terms of form, concentrated puree segment to command 42.3% share in the guava puree market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mango Puree Market Size and Share Forecast Outlook 2025 to 2035

Banana Puree Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fruit Concentrate Puree Market Growth - Trends & Forecast 2025 to 2035

Analyzing Not From Concentrated (NFC) Puree Market Share & Industry Leaders

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA