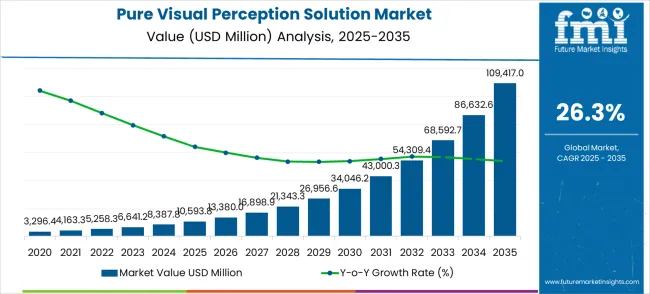

The pure visual perception solution market is experiencing significant growth, expanding from USD 3,296.4 million in 2021 to USD 10,593.8 million in 2025, with a remarkable CAGR of 26.3%. Between 2021 and 2025, the market’s growth accelerates steadily, with annual increases observed across the forecasted years, from USD 4,163.3 million in 2022 to USD 8,387.8 million in 2024. This strong early growth is driven by innovations in visual perception technologies across sectors such as augmented reality (AR), virtual reality (VR), and advanced imaging solutions for healthcare, defense, and entertainment industries.

From 2025 onward, the market shows continued acceleration, reaching USD 13,380.0 million by 2026 and expanding to USD 109,417.0 million by 2035. This period sees the market entering a phase of more aggressive growth, with annual increments rising substantially from USD 16,898.9 million in 2027 to USD 34,046.2 million in 2030. Factors such as further advancements in visual AI, immersive experience technologies, and a growing need for enhanced perception solutions across industries like automotive, healthcare, and entertainment will sustain the market’s high CAGR. The market’s rolling CAGR indicates that the increasing adoption and application of pure visual perception technologies are driving consistent, compound growth over the forecasted period.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 10,593.8 million |

| Forecast Value in (2035F) | USD 1,09,417 million |

| Forecast CAGR (2025 to 2035) | 26.3% |

The artificial intelligence (AI) and machine learning market is the largest driver, accounting for approximately 35–40% of the market share. AI-driven visual perception solutions are at the core of many applications, from autonomous vehicles to security systems, where AI is used to process and interpret visual data for decision-making. The computer vision market plays a significant role, contributing about 30–35%, as pure visual perception solutions are integral to computer vision technologies used in industries like robotics, surveillance, and manufacturing for object detection, recognition, and tracking.

The augmented reality (AR) and virtual reality (VR) market influences the demand for visual perception solutions, with approximately 15–18% of the market share, as AR and VR applications require highly accurate visual perception to create immersive environments. The automotive industry contributes around 10–12%, as visual perception solutions are crucial for the development of advanced driver-assistance systems (ADAS) and autonomous driving technologies. The healthcare market, accounting for about 5–8%, uses visual perception solutions in medical imaging, diagnostics, and robotic surgery systems to assist in precise analysis and decision-making.

The pure visual perception solution market is on the cusp of transformation, fueled by autonomous driving, embodied intelligence, and AI-powered visual recognition. By 2035, these pathways together unlock USD 95–105 billion in incremental revenue opportunities.

Pathway A – Autonomous Driving Platforms. Camera-based perception systems provide cost-effective alternatives to LiDAR while enabling full-scene understanding for Level 3–5 autonomy. The largest near-term opportunity worth USD 35–40 billion.

Pathway B – Advanced Driver Assistance Systems (ADAS). Integration of pure visual perception into next-generation ADAS (lane keeping, pedestrian detection, emergency braking) is accelerating OEM adoption. Expected pool: USD 18–22 billion.

Pathway C – Robotics & Embodied Intelligence. Industrial, service, and humanoid robots are deploying camera-only vision for navigation, manipulation, and interaction. Incremental pool: USD 10–15 billion.

Pathway D – Smart City & Infrastructure Integration. Deployment of visual AI in traffic monitoring, public safety, and mobility-as-a-service platforms represents USD 8–12 billion.

Pathway E – Edge AI & On-Device Processing. Specialized processors and edge computing enable low-latency visual decision-making for vehicles and robotics. Opportunity estimated at USD 7–9 billion.

Pathway F – Consumer Electronics & AR/VR. Smartphones, AR glasses, and XR devices embedding camera-only perception expand use cases. Adds USD 5–7 billion.

Pathway G – Cloud-Connected Perception & Data Services. Subscription models for perception-as-a-service, digital twins, and fleet learning enhance scalability. Expected pool: USD 4–6 billion.

Pathway H – Digital Trust, Compliance & Transparency. Blockchain-based validation, explainable AI, and regulatory-certified safety frameworks create a smaller but critical opportunity of USD 3–4 billion.

Market expansion is being supported by the revolutionary advancement in autonomous vehicle technology and the corresponding demand for sophisticated visual perception systems capable of interpreting complex driving environments. Modern autonomous vehicles require advanced computer vision capabilities that can process visual information in real-time, identify objects, predict behavior patterns, and make critical driving decisions based solely on camera inputs. Pure visual perception solutions offer cost-effective alternatives to expensive LiDAR systems while providing comprehensive environmental understanding through advanced AI algorithms.

The growing emphasis on sustainable transportation and smart city development is driving demand for scalable autonomous vehicle solutions that can operate efficiently in diverse urban environments. Consumer acceptance of autonomous driving features and regulatory support for self-driving technology deployment is creating opportunities for innovative visual perception systems. The rising influence of artificial intelligence breakthroughs and deep learning innovations is also contributing to rapid performance improvements and cost reductions in pure visual perception technologies across different automotive and robotics applications.

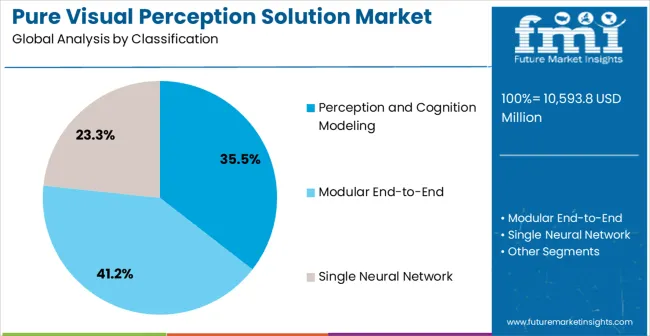

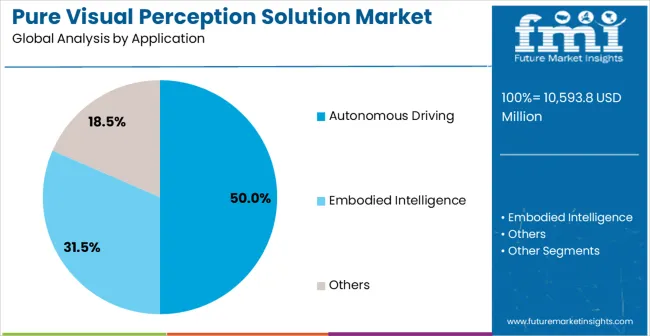

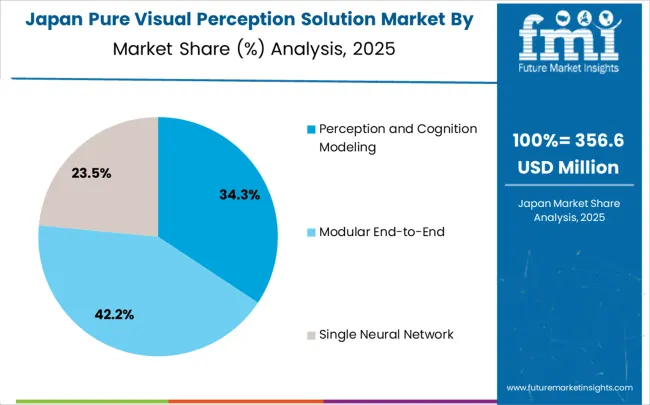

The market is segmented by solution type, end-use, and region. By solution type, the market is divided into perception and cognition modeling, modular end-to-end systems, and single neural network. Based on end-use application, the market is categorized into autonomous driving, embodied intelligence, and others. Regionally, the market is divided into North America, East Asia, Europe, South Asia & Pacific. Latin America, and Middle East & Africa.

The modular end-to-end segment is expected to account for 41.2% of the pure visual perception solution market in 2025, establishing itself as the leading technology approach in autonomous driving. This solution type leverages integrated, end-to-end learning architectures to streamline perception, prediction, and decision-making within a unified framework. Its strength lies in minimizing the need for handcrafted modules, enabling faster adaptation to diverse driving conditions and reducing system complexity. Modular end-to-end solutions are increasingly favored by developers for their scalability, efficiency, and ability to continuously learn from real-world data. As autonomous vehicle platforms mature, these systems gain momentum, driven by their potential to deliver more flexible, reliable, and cost-effective autonomous navigation capabilities.

The autonomous driving segment is projected to account for 50% of the pure visual perception solution market in 2025, reinforcing its dominant position in the automotive industry. As self-driving technology advances, the demand for advanced visual perception solutions increases, enabling vehicles to accurately interpret their surroundings in real-time. These solutions are crucial for detecting obstacles, recognizing road signs, and making decisions that ensure safety and efficiency. The growing reliance on AI-powered perception systems for autonomous vehicles underpins the segment's rapid growth, providing the necessary visual data processing for safe navigation in complex environments. As regulatory frameworks evolve and autonomous driving becomes more mainstream, visual perception solutions remain critical to vehicle autonomy.

The pure visual perception solution market is advancing rapidly due to breakthrough developments in computer vision technology and growing investment in autonomous vehicle development. The market faces challenges including computational complexity requirements, safety validation processes, and regulatory compliance frameworks for autonomous vehicle deployment. Innovation in neural network architectures and edge computing solutions continue to influence system performance and market expansion patterns.

The growing adoption of transformer-based architectures is enabling superior performance in visual scene understanding through advanced attention mechanisms and sequential data processing capabilities. Multi-head attention systems equipped with spatial and temporal reasoning provide comprehensive environmental analysis while maintaining computational efficiency. These technologies offer exceptional accuracy in object detection, behavior prediction, and scene interpretation, particularly beneficial for complex urban driving scenarios and autonomous vehicle safety requirements.

Modern visual perception solution providers are incorporating edge computing platforms and specialized AI processors to achieve real-time performance requirements for autonomous vehicle applications. Advanced hardware acceleration enables low-latency processing, reduced power consumption, and improved system reliability for critical safety applications. These technologies support deployment of sophisticated neural networks in vehicle environments while providing the computational performance necessary for safe autonomous operation.

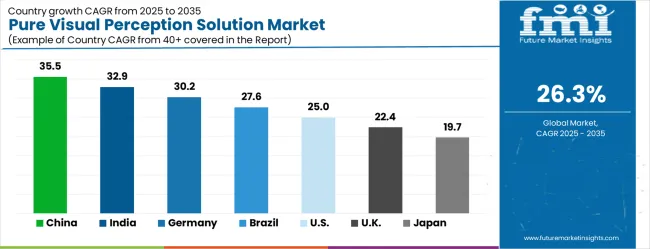

| Country | CAGR (2025-2035) |

|---|---|

| China | 35.5% |

| India | 32.9% |

| Germany | 30.2% |

| Brazil | 27.6% |

| United States | 25.0% |

| United Kingdom | 22.4% |

| Japan | 19.7% |

The pure visual perception solution market is experiencing explosive growth globally, with China leading at 35.5% CAGR through 2035, driven by massive investment in autonomous vehicle technology, government support for AI development, and rapid deployment of smart transportation infrastructure. India follows at 32.9%, supported by growing automotive manufacturing, increasing technology investment, and expanding digital infrastructure capabilities. Germany shows strong growth at 30.2%, emphasizing automotive innovation excellence and advanced autonomous vehicle development programs. Brazil records 27.6%, focusing on smart city development and transportation modernization initiatives. The United States demonstrates 25.0% growth, prioritizing autonomous vehicle commercialization and AI technology leadership. The United Kingdom shows 22.4% expansion, supported by AI research excellence and regulatory framework development. Japan maintains 19.7% growth, leveraging precision technology leadership and automotive manufacturing expertise.

The report covers an in-depth analysis of 40+ countries withtop-performing countries highlighted below.

The pure visual perception solution market is projected to grow at a remarkable CAGR of 35.5% from 2025 to 2035. The demand for visual perception technologies in China is being driven by rapid advancements in AI, machine vision, and deep learning algorithms. The push toward autonomous vehicles, smart cities, and industrial automation is accelerating the need for highly sophisticated visual analytics solutions. The Chinese government’s emphasis on technological innovation and digital transformation is further boosting the market’s growth. Chinese companies are focusing on providing affordable yet highly advanced visual perception solutions, while international players are increasing their presence in China to cater to the growing market. With a substantial rise in industrial and consumer applications, China is positioning itself as a dominant player in the visual perception solution industry.

The pure visual perception solution market is expected to experience a CAGR of 32.9% from 2025 to 2035, as industries across the country continue to adopt automation and digitalization technologies. With an increasing focus on AI and machine vision solutions, industries like manufacturing, agriculture, and retail are driving market growth. India’s rapidly growing middle class and urban population are leading to more demand for automation, particularly in sectors like e-commerce, logistics, and healthcare. The adoption of visual perception technologies in the automotive sector is also gaining traction with the rise of autonomous vehicles and advanced driver assistance systems (ADAS). Manufacturers are developing cost-effective, scalable systems that cater to the diverse needs of Indian businesses while ensuring alignment with international market trends.

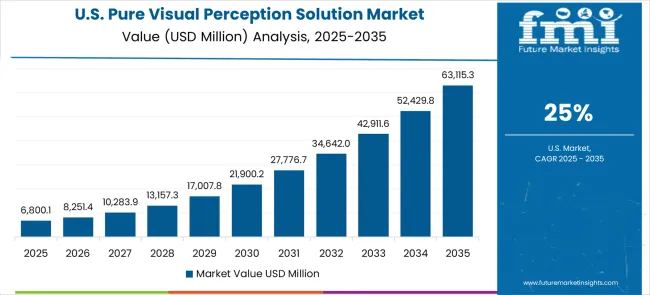

The pure visual perception solution market in the United States is expected to grow at a CAGR of 25.0% from 2025 to 2035, driven by technological advancements in AI, machine vision, and computer vision. The USA is at the forefront of innovation in autonomous systems, particularly in sectors such as automotive, defense, and healthcare. The demand for visual recognition technologies in the USA is rising, with applications across surveillance, security, and smart homes. The growing trend of digitalization in industries such as retail, logistics, and manufacturing is propelling the market, along with increasing adoption of visual systems in healthcare for patient monitoring. The USA government’s support for AI and automation technologies is further accelerating the adoption of visual perception solutions.

The pure visual perception solution market is projected to grow at a CAGR of 30.2% from 2025 to 2035, largely driven by the country’s leadership in the automotive, industrial automation, and robotics sectors. The German market’s demand for visual perception solutions is increasing, especially with advancements in autonomous driving, AI-powered manufacturing, and robotics. The country’s strong emphasis on Industry 4.0 and smart factories is also contributing to the rise in demand for visual recognition systems, with applications spanning from quality control in production to automated sorting in logistics. Germany’s robust healthcare and security sectors are increasingly adopting visual perception technologies for patient monitoring and surveillance. The combination of government support, strong industrial base, and technological innovation positions Germany as a key player in the visual perception market.

The pure visual perception solution market in Brazil is set to grow at a CAGR of 27.6% from 2025 to 2035, propelled by an increase in the adoption of automation technologies and AI systems across various sectors. As one of the largest markets in South America, Brazil’s manufacturing, agriculture, and retail sectors are rapidly adopting visual perception solutions to improve efficiency and optimize operations. The rapid expansion of e-commerce and retail logistics is also increasing the need for real-time visual analytics, improving customer experience and operational efficiency. Local and international players are leveraging the growing market potential by providing tailored solutions that fit local industry needs while keeping pace with global technological trends.

The pure visual perception solution market in the United Kingdom is projected to grow at a CAGR of 22.4% from 2025 to 2035, driven by the UK’s strong focus on innovation and technology integration across various industries. The UK automotive sector’s push for autonomous vehicles is contributing to a rising demand for visual perception solutions, particularly in areas like driver assistance systems. The retail and security sectors are also major adopters of visual recognition technologies, with applications ranging from inventory management to public surveillance. The UK government is investing in digital transformation projects, including smart cities and infrastructure development, which are boosting demand for these technologies. British companies are focusing on developing more accurate and cost-effective visual perception solutions to cater to both domestic and international markets.

The pure visual perception solution market in Japan is expected to grow at a CAGR of 19.7% from 2025 to 2035. The country’s technological leadership in robotics, AI, and automation is driving demand for advanced visual recognition systems. Japan’s automotive sector, known for its innovation, is adopting autonomous vehicle technologies, fueling the need for precise visual perception solutions. The healthcare and retail industries are increasingly utilizing these technologies for patient monitoring and customer experience improvement. The Japanese government’s initiatives to integrate digital technologies into public services and infrastructure are also boosting the adoption of visual solutions. Japanese companies are focusing on R&D to create high-performance, energy-efficient systems tailored to the unique needs of domestic and international markets.

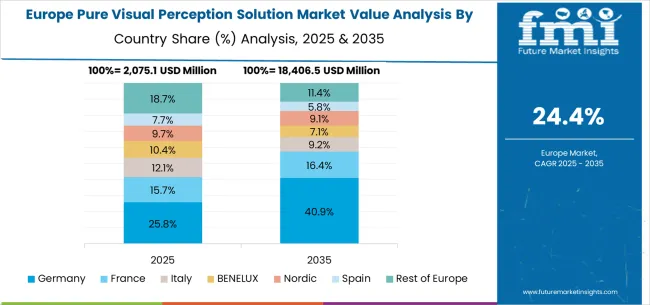

The pure visual perception solution market in Europe is projected to grow from USD 2,075.1 million in 2025 to USD 18,406.5 million by 2035, registering a CAGR of 24.4% over the forecast period. Germany will dominate, rising from 25.8% in 2025 to 40.9% by 2035, supported by its automotive manufacturing strength, AI-driven perception systems, and autonomous vehicle development leadership. France will hold 15.7% in 2025, softening to 16.4% by 2035, reflecting steady adoption in automotive and AI sectors. Italy will capture 12.1% in 2025, declining to 9.1% by 2035, showing moderate uptake relative to Germany and France.

The BENELUX region will contribute 10.4% in 2025, falling to 7.2% by 2035, reflecting market concentration in larger Western European AI hubs. The Nordic countries will hold 9.7% in 2025, declining to 9.1% by 2035, supported by smart city and autonomous vehicle programs but growing slower than Germany. Spain will account for 7.7% in 2025, dropping to 5.8% by 2035, reflecting slower adoption in AI-driven automotive infrastructure. Meanwhile, the Rest of Europe will decline significantly from 18.7% in 2025 to 11.4% by 2035, as leadership in visual perception systems consolidates in Germany and France.

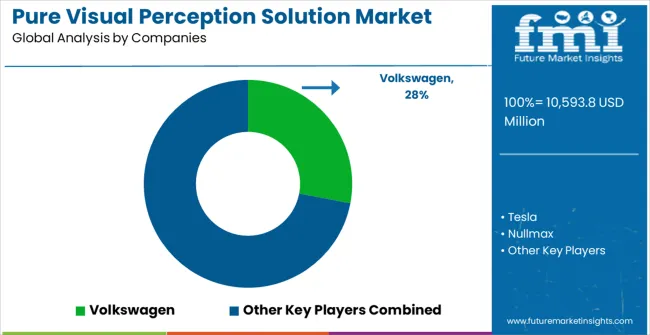

The pure visual perception solution market is characterized by intense competition among established automotive manufacturers, technology companies, and emerging AI specialists. Companies are investing in advanced neural network research, comprehensive testing programs, edge computing platforms, and strategic partnerships to deliver reliable, accurate, and scalable visual perception solutions for autonomous vehicle applications. Technology innovation, regulatory compliance, and commercial deployment capabilities are central to strengthening product portfolios and market positioning.

Volkswagen, Germany-based, is developing comprehensive visual perception systems integrated with autonomous vehicle platforms, focusing on safety validation and regulatory compliance for commercial deployment. Tesla, USA, provides advanced neural network-based perception solutions with emphasis on real-world performance optimization and continuous learning capabilities. Nullmax, China, delivers specialized visual perception technologies designed for urban autonomous driving applications with focus on computational efficiency. XPeng Inc., China, offers integrated autonomous driving solutions combining visual perception with comprehensive vehicle control systems.

Huawei, China, provides edge computing platforms and AI processors optimized for visual perception applications in autonomous vehicles and robotics systems. NIO, Li Auto Inc., and Horizon Robotics offer specialized visual perception solutions with focus on electric vehicle integration and advanced driver assistance systems. Geely Global, DeepRoute.ai, and Gigaai provide comprehensive autonomous driving platforms incorporating advanced visual perception capabilities, while BYD, Shenzhen Zhuoyu Technology Co., Ltd., Haomo Technology Co., Ltd., IM Motors, CHERY, Xiaomi, GAC Group, PhiGent, and UDEER.AI offer specialized solutions across diverse autonomous vehicle and intelligent transportation applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 10,593.8 million |

| Solution Type | Perception and Cognition Modeling, Modular End-to-End, Single Neural Network |

| End-Use | Autonomous Driving, Embodied Intelligence, Others |

| Regions Covered | North America, Europe, East Asia, Latin America, South Asia & Pacific. Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Volkswagen, Tesla, Nullmax, XPeng Inc., Huawei, NIO, Li Auto Inc., Horizon Robotics, Geely (Zhejiang Geely Holding Group), DeepRoute.ai, GigaAI, BYD, Shenzhen Zhuoyu Technology Co., LtdZhuoyu Technology (Shenzhen)., Haomo Technology Co., Ltd., IM Motors (Zhiji Auto), CHERY, Xiaomi, GAC Group, PhiGent, UDEER AI |

| Additional Attributes | Dollar sales by solution type and neural network architecture, regional adoption trends across autonomous vehicle markets, competitive landscape analysis with established automotive manufacturers and emerging AI companies, developer preferences for transformer-based versus convolutional neural network architectures |

The global pure visual perception solution market is estimated to be valued at USD 10,593.8 million in 2025.

The market size for the pure visual perception solution market is projected to reach USD 109,417.0 million by 2035.

The pure visual perception solution market is expected to grow at a 26.3% CAGR between 2025 and 2035.

The key product types in pure visual perception solution market are perception and cognition modeling, modular end-to-end and single neural network.

In terms of application, autonomous driving segment to command 50.0% share in the pure visual perception solution market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pure Suspension Cell Culture Medium Market Size and Share Forecast Outlook 2025 to 2035

Pure Red Cell Aplasia Market

Pure Steam Generators Market

Ultrapure Water Market Size and Share Forecast Outlook 2025 to 2035

Mango Puree Market Size and Share Forecast Outlook 2025 to 2035

Guava Puree Market Size and Share Forecast Outlook 2025 to 2035

Banana Puree Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fruit Concentrate Puree Market Growth - Trends & Forecast 2025 to 2035

Analyzing Not From Concentrated (NFC) Puree Market Share & Industry Leaders

Visual Electrophysiology Market Size and Share Forecast Outlook 2025 to 2035

Visual Analytics Market Size and Share Forecast Outlook 2025 to 2035

Visual Computing Market Size and Share Forecast Outlook 2025 to 2035

Visualiser Market Size and Share Forecast Outlook 2025 to 2035

Surgical Visualization Market

Endoscopy Visualization Systems Market Size and Share Forecast Outlook 2025 to 2035

Endoscopy Visualization System And Component Market Analysis – Trends & Forecast 2024-2034

Logistics Visualization System Market

Arthroscopy Visualization Systems Market Size and Share Forecast Outlook 2025 to 2035

Audible and Visual Signaling Devices Market Analysis by Product Type, End-Use Industry, and Region through 2035

Advanced (3D/4D) Visualization Systems Market Analysis by Platform, End User, Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA