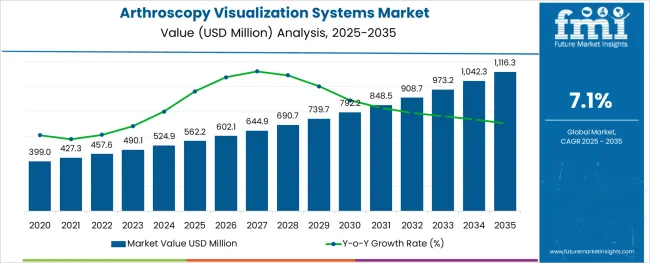

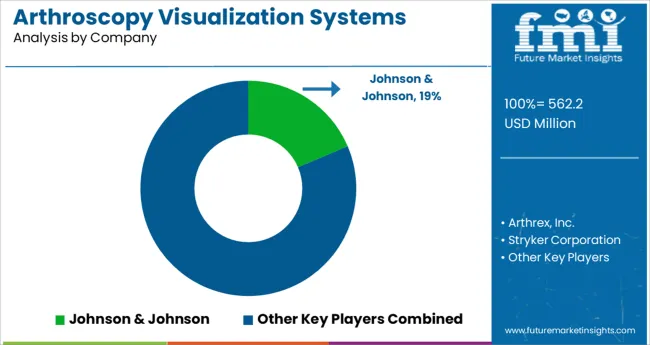

The Arthroscopy Visualization Systems Market is estimated to be valued at USD 562.2 million in 2025 and is projected to reach USD 1116.3 million by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period.

The arthroscopy visualization systems market is experiencing steady advancement driven by the rise in minimally invasive orthopedic procedures and the increasing prevalence of joint disorders such as osteoarthritis and sports-related injuries. Hospitals and surgical centers are prioritizing high-definition visualization tools to improve diagnostic accuracy and procedural outcomes, leading to increased adoption of integrated arthroscopic imaging systems.

Technological innovation in optics, light sources, and camera systems has significantly enhanced visualization precision, enabling better intraoperative control and improved post-operative recovery. The demand for faster rehabilitation, lower surgical risk, and reduced hospital stay has accelerated the shift toward arthroscopic techniques. Additionally, the aging global population and a rising incidence of lifestyle-related musculoskeletal disorders have contributed to the expanding procedural volume.

As healthcare systems adopt value-based care models and invest in surgical efficiency, the arthroscopy visualization systems market is expected to witness continued growth, particularly in regions with rising orthopedic surgery volumes and evolving reimbursement landscapes.

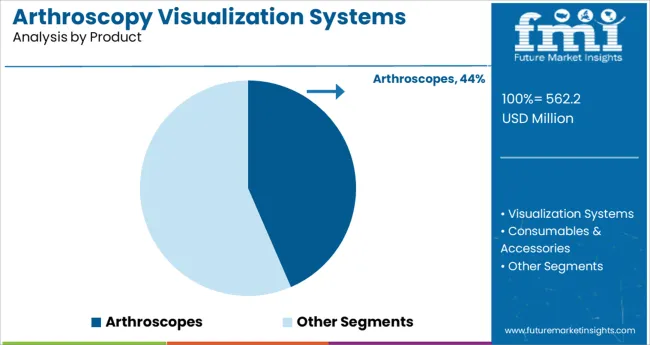

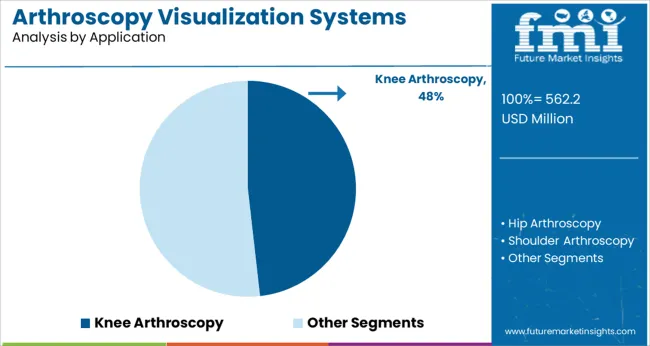

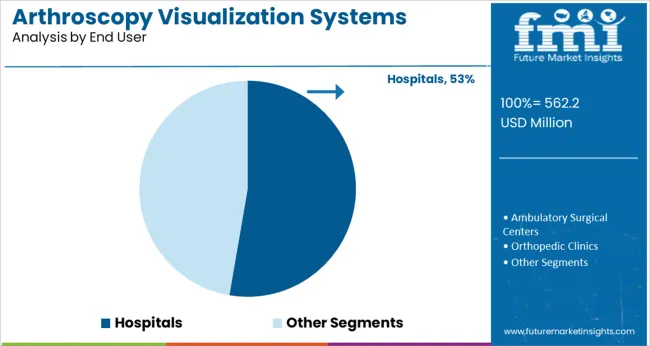

The market is segmented by Product, Application, and End User and region. By Product, the market is divided into Arthroscopes, Visualization Systems, and Consumables & Accessories. In terms of Application, the market is classified into Knee Arthroscopy, Hip Arthroscopy, Shoulder Arthroscopy, and Others. Based on End User, the market is segmented into Hospitals, Ambulatory Surgical Centers, Orthopedic Clinics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

It is observed that the arthroscopes segment accounts for 43.50% of total market revenue within the product category, establishing itself as the leading sub-segment. This prominence is attributed to the critical role arthroscopes play in enabling minimally invasive visualization of joint spaces. Continued advancements in optical clarity, image resolution, and fiberoptic technology have supported the transition from open surgeries to arthroscopic interventions.

The integration of HD and 4K video support has further elevated surgeon preference for advanced arthroscopes. Moreover, increased demand for reusable and sterilizable scopes across hospitals and ambulatory centers has reinforced cost-effectiveness and reduced equipment downtime.

As the foundational tool for visualization in orthopedic procedures, the arthroscopes sub-segment has maintained its dominant position, supported by sustained clinical reliance and technological evolution.

The knee arthroscopy segment holds 48.20% of total market revenue, making it the dominant application area. This growth has been driven by the high incidence of knee-related conditions such as meniscal tears, ligament injuries, and cartilage degradation. The knee joint’s anatomical complexity and susceptibility to sports and age-related damage have contributed to its procedural volume.

Surgeons have increasingly adopted arthroscopic techniques to reduce post-operative complications and accelerate patient recovery. Additionally, the availability of procedure-specific visualization equipment has enabled tailored treatment planning and enhanced procedural accuracy.

Hospitals and clinics have prioritized knee arthroscopy due to its predictable outcomes and reduced operative risks. As such, the knee remains the most frequently treated joint through arthroscopic visualization systems, ensuring its continued leadership in application-based segmentation.

Hospitals constitute 52.70% of the total market revenue in the end user category, affirming their leading role in this segment. This dominance is primarily influenced by their infrastructural capacity to invest in advanced visualization systems and their role as referral centers for complex orthopedic surgeries.

The preference for in-house minimally invasive procedures has been increasing in hospitals due to better patient monitoring, access to multidisciplinary care, and cost amortization over high surgical volumes. Furthermore, hospitals often serve as training grounds for orthopedic residents and specialists, necessitating the availability of state-of-the-art arthroscopic systems.

Institutional procurement processes, supported by capital budgets and strategic supplier partnerships, have allowed hospitals to maintain an edge in technology adoption. As such, their position as the primary setting for arthroscopy procedures continues to secure their lead in the end user segment.

Overall, arthroscopy visualization systems market sales account for approximately 6.6% revenue share in the global arthroscopy products market, which was valued at around USD 524.9 Billion, in 2024.

The global arthroscopy visualization systems market recorded a historic CAGR of 5.1% in the last nine years from 2012 to 2024.

One of the main factors driving the growth of the global market for arthroscopy visualization systems is the increase in the elderly population, who are considerably more susceptible to trauma, osteoarthritis, and other knee and joint-related disorders. Soft tissue degeneration and associated problems, particularly those of the knee, are influenced by aging. The elderly population makes up more than one-third of all hip and shoulder injuries worldwide.

For instance, the World Health Aging 2024 highlights published by the UN Department of Economic and Social Affairs indicated that there were 524.9 million individuals who were either 65 or older worldwide in October 2024, making up 9.3% of the entire world's population. By 2050, the aging population is projected to grow by 16% or over 1.5 billion people.

Furthermore, the development of technologically advanced instruments, implants, and equipment for arthroscopy surgeries with arthroscopy visualization systems will foster growth worldwide, as will the rising number of arthroscopic procedures as a result of the rise in sports injuries, ligament tears, meniscus tears, and other similar reasons.

Osteoarthritis is more common in the elderly and obese population, which will raise the demand for arthroscopy visualization systems. The Centers for Disease Control and Prevention (CDC) estimated that in 2020, osteoarthritis impacted 32.5 million individuals in the United States and about 54.4 million people overall.

By 2040, this figure is projected to increase to 78 million. Obesity triples the likelihood of developing knee osteoarthritis, making it a significant risk factor.

The aforementioned factors are expected to serve as probable market drivers for the global arthroscopy visualization systems market and help the market to expand significantly in the forecast period.

Due to the numerous advantages that minimally invasive surgical procedures have over open surgeries, including small surgical incisions, lower hospitalization costs, and fewer post-operative complications, minimally invasive surgeries are becoming increasingly popular among surgeons.

The market for arthroscopy visualization systems is likely to see significant growth potential due to rising preference and acceptance of minimally invasive and cost-effective procedures employing arthroscopic instruments.

Opportunities for developing technologies like improvised visualization equipment in the form of high-definition cameras or autoclavable cameras, and improved suturing techniques, are projected to arise from the growth of sports injuries and medicine, particularly arthroscopy.

Additionally, advanced technologies in hip arthroscopies, such as computer-assisted surgeries and virtual reality surgical simulation training before actual operations, have increased the precision of pre-operative planning and are anticipated to broaden the scope of hip arthroscopy, which will favorably impact the market for arthroscopy visualization systems.

The abovementioned factors are capable of acting as lucrative opportunities for manufacturers operating in the arthroscopy visualization systems market.

The market for arthroscopy visualization systems and products was negatively impacted by the coronavirus outbreak. Due to cancellations of planned operations at various medical facilities, due to travel limitations that have an impact on logistics and product supply, there has been an increase in interruptions at production sites, in the supply chain, and in other commercial activities.

A rise in product recalls is one of the reasons restricting the market for arthroscopy visualization systems. A product recall is a process of collecting every faulty item that has been sold or is currently on the market.

The expenses of all repairs and replacements must be covered by the manufacturer when it recalls a product because of a problem. The replacement cost for many products could be in the millions of dollars, which limits the market's growth as well as that of a company.

For instance, in Jan 2025, the FDA recalled a product called Camera Control Unit (CCU) of Stryker Corporation on the charge of medical safety notification January. The images on the monitor obtained were upside-down in the wrong position due to a software flaw in the camera control unit (CCU). Conversion to an open operation, extra medical treatment, or revision surgery all included the risk of negative outcomes.

The USA accounted for USD 524.9 Million withholding the majority of the global market share of about 32.1% by the end of 2024. The American Orthopedic Society for Sports Medicine, the Arthritis Foundation, and the Arthroscopy Association of USA are a few of the organizations that receive major funding and assistance from the USA Federal Government for orthopedic care and treatment.

Due to the USA FDA's supportive environment and the country's manufacturers' extensive Drivers, Restraints, Opportunities, and Threats efforts, the USA is the largest market in the world for arthroscopy visualization systems.

Germany has driven the European market by holding the majority of the regional market share of about 33.9% and achieving a valuation of USD 45.9 Million at end of 2024. The market is being driven by an increase in the number of urgent care patients with long-term illnesses, an increase in Level 3 grade injuries among the aging population & athletes, and an increase in the number of accidents countrywide.

The market for arthroscopy visualization systems is anticipated to develop as a result of the increasing incidence of hip and spine surgeries.

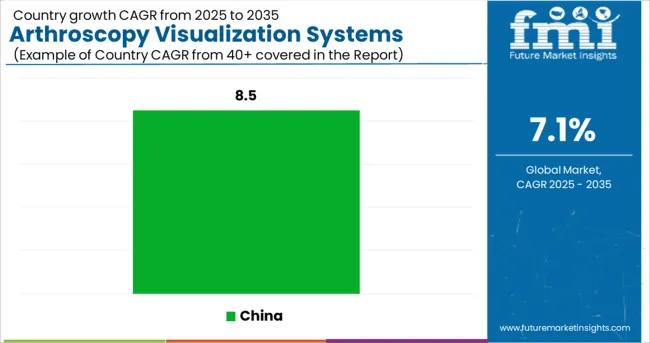

China dominated the regional market by reaching a valuation of USD 22.66 Million and is expected to grow over a CAGR of 8.5% over the forecast period. The market’s expansion can be attributed to the country's growing medical tourism industry.

The market in China is also anticipated to be driven by a rising aging population, increased awareness of sports-related injuries, and rising disposable income. The global market for arthroscopy visualization is expanding as a result of rising demand for minimally invasive procedures and low levels of postoperative complications.

By product, the visualization systems have driven the global market by holding the majority of the market share of about 48.8% as of 2024. Smaller incisions, lower soft tissue trauma, less post-operative discomfort, quicker healing times, and lower infection rates are some of the aspects that contribute to the product’s market expansion.

By application, knee arthroscopy is leading the segment for the global market by accounting for USD 524.9.0 Million by the end of 2024. With the increasing geriatric population, bone-related issues are also emerging, especially the rising prevalence of osteoarthritis, as well as an increasing number of sports-related injuries, which have driven this segment.

By end user, orthopedic clinics have led the global market by holding a majority of the market share of about 31.1% as of 2024. The availability of advanced healthcare infrastructure and the presence of a large patient pool are some of the major factors contributing to the market growth of orthopedic centers.

The expansion of manufacturing facilities is a top priority for manufacturers of arthroscopy visualization systems since it will increase their production capacity. the exploration of new markets and access to a sizable customer base, will offer companies prospects for expansion on a global scale.

To strengthen their position in the global market for arthroscopy visualization systems, the major manufacturers are launching a variety of products and doing research and development activities that concentrate on orthopedic surgical procedures.

For instance:

Similarly, recent developments related to companies manufacturing arthroscopy visualization systems, have been tracked by the team at Future Market Insights, which are available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2012 to 2024 |

| Market Analysis | million for Value |

| Key Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East & Africa (MEA). |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, United Kingdom, Germany, Italy, Russia, Spain, France, BENELUX, Japan, China, South Korea, India, Thailand, Indonesia, Malaysia, Australia, New Zealand, Turkey, GCC Countries, South Africa, and North Africa |

| Key Market Segments Covered | Product, Application, End User, and Regions |

| Key Companies Profiled | Arthrex, Inc., Stryker Corporation, Smith & Nephew Plc., CONMED Corporation, KARL STORZ GmbH & Co. KG, Olympus Corporation, Richard Wolf GmbH, and Johnson & Johnson |

| Pricing | Available upon Request |

The global arthroscopy visualization systems market is estimated to be valued at USD 562.2 million in 2025.

It is projected to reach USD 1,116.3 million by 2035.

The market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types are arthroscopes, visualization systems and consumables & accessories.

knee arthroscopy segment is expected to dominate with a 48.2% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Arthroscopy Devices Market Size and Share Forecast Outlook 2025 to 2035

The Arthroscopy Procedure and Products Market is segmented by product type, application, and end user from 2025 to 2035

Surgical Visualization Market

Endoscopy Visualization System And Component Market Analysis – Trends & Forecast 2024-2034

Logistics Visualization System Market

Endoscopy Visualization Systems Market Size and Share Forecast Outlook 2025 to 2035

Advanced (3D/4D) Visualization Systems Market Analysis by Platform, End User, Application, and Region through 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

Cough systems Market

Backpack Systems Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Systems Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Catheter Systems Market

Reporter Systems Market

Aerostat Systems Market

Cryogenic Systems Market Size and Share Forecast Outlook 2025 to 2035

Air Brake Systems Market Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA