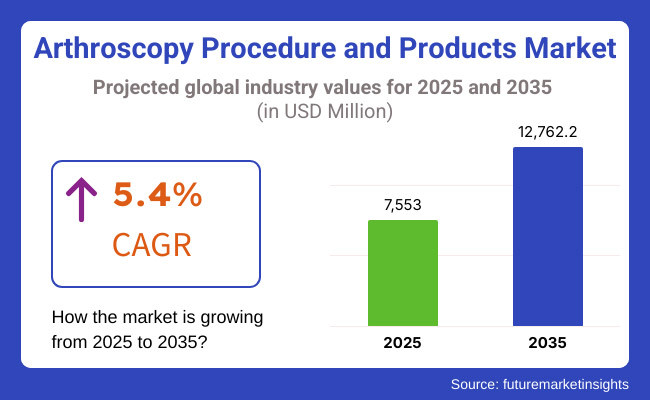

The global Arthroscopy Procedure and Products Market is projected to grow from USD 7,553 million in 2025 to approximately USD 12,762.2 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.4% over the forecast period. This robust growth is attributed to the rising prevalence of joint disorders, increasing demand for minimally invasive orthopedic procedures, and continuous advancements in arthroscopic technologies.

The aging global population-particularly in developed regions-is a major driver, as it correlates with a higher incidence of degenerative joint diseases. Moreover, the surge in sports-related injuries among younger demographics has contributed significantly to the increase in arthroscopy volumes. Procedures targeting the knee and shoulder joints remain the most commonly performed, given their high injury rates and the clinical efficacy of arthroscopic intervention in these regions.

Manufacturers are continuously evolving the arthroscopy landscape through the development of high-precision imaging systems and miniaturized instruments that enhance procedural outcomes. One of the most significant breakthroughs has been the emergence of in-office nano-arthroscopy, a minimally invasive technique that utilizes a needle-sized camera to provide real-time, high-resolution visualization of joint structures.

This approach is increasingly being adopted for shoulder, knee, and small joint procedures, particularly due to its benefits in patient comfort, diagnostic accuracy, and reduced recovery times. Arthrex, Inc., a global leader in orthopedic innovation, has spearheaded the adoption of this technology through the launch of TheNanoExperience.com, a patient-centered educational platform.

According to Reinhold Schmieding, President and Founder of Arthrex, “Our latest educational tool, TheNanoExperience.com, provides patients with the resources to learn more about this innovative technology and make informed choices about less-invasive treatments than traditional open or arthroscopic methods.” These developments underscore the industry’s shift toward precision-guided, patient-focused surgical solutions

North America holds the largest share of the global arthroscopy market, supported by advanced healthcare infrastructure, high procedural volumes, and early adoption of surgical innovations. In the USA, growth is further propelled by favorable reimbursement policies, rising consumer awareness of minimally invasive options, and the presence of key device manufacturers.

Investments in outpatient surgical centers and the integration of digital imaging into orthopedic workflows have significantly improved access and procedural efficiency. In Europe, countries such as Germany, France, and the UK are leading the transition toward next-generation arthroscopic techniques.

These regions benefit from supportive government initiatives, growing demand for same-day joint surgeries, and the modernization of surgical suites with 4K imaging and AI-assisted guidance systems. The regional market is also being shaped by academic-medical partnerships that foster R&D and validate the clinical utility of emerging arthroscopy platforms.

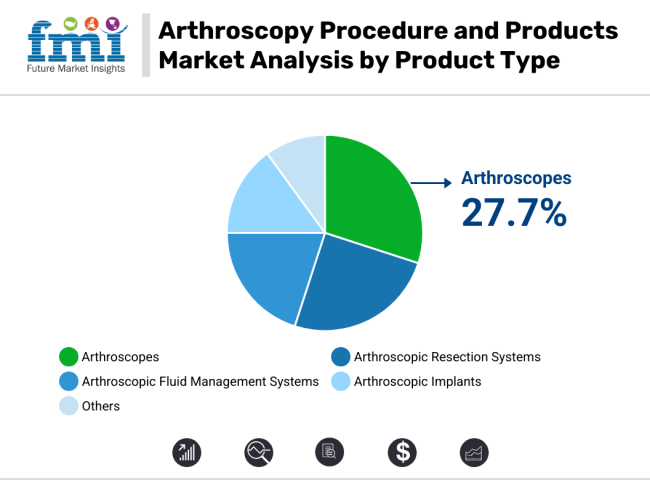

In 2025, Arthroscopes are projected to contribute over 27.7% of total market revenue, reinforcing their central role in visualization during arthroscopic surgeries. These devices are integral to orthopedic interventions involving the knee, shoulder, hip, and ankle, and are used across both diagnostic and therapeutic workflows.

The ongoing evolution of arthroscope technology including 4K ultra-HD resolution, integrated light sources, and autoclavable camera systems-has enhanced the surgeon’s ability to identify pathologies, perform precise repairs, and improve patient outcomes.

The shift toward ergonomic, sterilizable, and image-enhanced devices has also contributed to reduced infection risk and procedure times. Given their utility across a wide range of joint procedures and specialties, arthroscopes are expected to retain their leadership position as surgical volumes grow and hospitals upgrade to more advanced visualization systems.

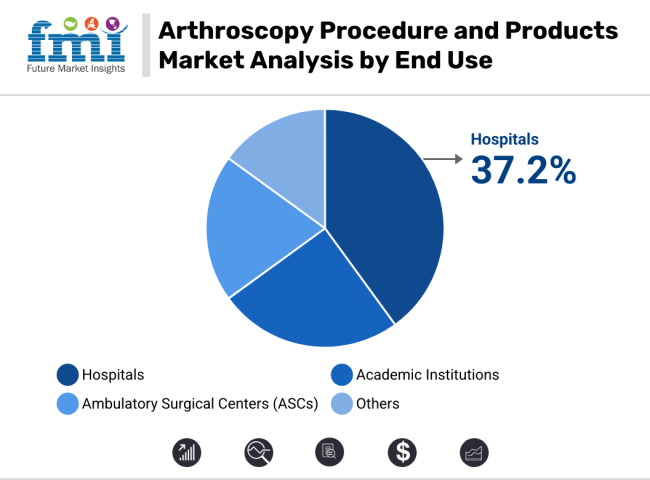

Hospitals are projected to account for more than 37.2% of total market revenue in 2025, largely due to their ability to support high-volume, technology-intensive arthroscopy procedures. These institutions offer access to specialized surgical teams, advanced imaging infrastructure, and post-operative rehabilitation services, making them the preferred setting for both elective orthopedic repairs and emergency trauma cases.

Procedures such as anterior cruciate ligament (ACL) repair, rotator cuff reconstruction, and meniscal tear treatment are routinely performed in hospital settings, where complex cases can be managed with greater care coordination. The adoption of bundled payment models and value-based care protocols has incentivized hospitals to adopt minimally invasive techniques that reduce complications, hospital stay durations, and recovery time.

As a result, hospitals remain at the forefront of arthroscopy utilization, with continued investment in tower-based arthroscopy suites, AI-assisted surgical tools, and outcome-tracking technologies.

Rising osteoarthritis cases, high presence of top orthopedic device manufacturers and a greater adoption of advanced minimally invasive procedures are the primary growth drivers for the North American arthroscopy procedure and products market. The USA holds the largest piece of the pie in the region, thanks to a developed healthcare ecosystem, growing investments in sports medicine, and increasing demand for outpatient invasive arthroscopic procedures.

But the expensive arthroscopic implants, reimbursement challenges, and post-surgical infection risks are hindering market growth. The growing adoption of AI-integrated arthroscopy systems, expansion of ambulatory surgical centers specializing in orthopedic procedures, and increasing preference for bioabsorbable implants are expected to drive further market growth in North America.

Europe holds a major market for arthroscopy procedures and products, owing to a growing geriatric population and rising preference for minimally invasive surgical options, and advancement in 3D arthroscopic imaging. The PDP market in countries including Germany, France and the UK is majorly driven by strong healthcare policies, growing importance of sports injury rehabilitation and improving adoption of regenerative medicine in orthopedic therapies.

Challenges such as stringent regulatory requirements under the European Medicines Agency (EMA), high costs of arthroscopic equipment, and disparity in healthcare access in different regions might hinder the growth of the market.

The European market is witnessing increasing adoption of robotics in arthroscopic surgeries, growing government-funded research in cartilage regeneration and increasing partnerships between biotech companies and orthopedic centers. Summary: Tomorrow’s healthcare delivery in orthopedics will be facilitated by Operations on Demand, a concept enabled by advanced technologies and deeply embedded patient-centered care.

Asia-Pacific is growing at a swift pace in the arthroscopic procedure and products market thanks to increasing incidences of joint disorders, rising healthcare investments, and growing adoption of minimally invasive orthopedic surgeries. This study has identified key markets in China, Japan, and India, where growth in the orthopedic market has been stimulated by expanding medical device manufacturing capabilities, increased government initiatives to provide orthopedic care, and a knockout rate of injuries resulting from high participation in sports.

But affordability limits and absence of skilled arthroscopic surgeons and lack of proper awareness of new arthroscopy technique may discourage the penetration of the arthroscopy market. Further, forces like the introduction of international orthopedic device manufacturers, increase in medical tourism for low-cost arthroscopic surgeries, and adoption of telemedicine for postoperative rehabilitation are driving market growth.

In addition, innovations in biodegradable implants and enhanced research in the area of stem-cell-based cartilage repair protocol undoubtedly are improved for better treatment outcomes and long-term joint health fastened in the region.

High cost of arthroscopic equipment and procedures is a major challenge

Among the key problems challenging the arthroscopy products and procedure market is that arthroscopic equipment and procedures are costly. Extremely high-tech arthroscopic equipment like high-definition scopes, robot assistance systems, and specialized implants is extremely expensive and thus is beyond the reach of small health clinics and patients of low- and middle-income countries. Furthermore, training surgeons for arthroscopic procedures also imposes an additional cost, and hence the total bill increases.

Reimbursement constraints in most countries also hinder market growth since not all insurance providers fully cover arthroscopy operations, and therefore patients pay out-of-pocket for the procedure. This might dissuade individuals from availing themselves of minimally invasive operations despite their benefits.

To counter this difficulty, businesses are focusing on low-cost product innovation, and the government and healthcare facilities are attempting to expand insurance coverage and payment systems. Nevertheless, cost continues to be relevant so that arthroscopy operations can gain increased usage throughout the world.

Robotic-assisted systems present lucrative growth opportunity

The integration of AI and robotic-assisted systems in arthroscopic procedures stands as one of the defining opportunities in this market. The AI-powered imaging and navigation systems facilitate on-the-spot decision-making that enhances surgical accuracy and decreases complications. Robotic-assisted arthroscopy, on the other hand, provides control and precision, thereby improving patient outcomes and minimizing recovery time.

Furthermore, more preoperative and postoperative rehabilitation are automated by AI-assisted analytics to become cost-and-time-efficient means for medical practitioners, which could open new avenues of accessibility and effectiveness for arthroscopy procedures. Therefore, rising investments in digital health technologies and smart surgical instruments present lucrative growth avenues for industry players.

In developed nations, the rise of AI-and-robotics innovation ensures the brighter future of conventional arthroscopy with increased acceptance while the budding economies steadily build their healthcare infrastructures. Hence, the applicability of AI and robotics will expand, in turn boosting high growth potential for this market.

These implants are creating a paradigm shift in arthroscopy. Bioabsorbable materials will solve these issues, thereby reducing costs and discomfort. PLA and PGA bioabsorb gradually in the body to facilitate natural healing with minimum long-term complications. These implants lower infections and reduce recovery time. The continuous research to enhance their strength and biocompatibility will make bioabsorbable implants even more desirable in arthroscopy and eventually lead to technological advancement and growth in this market segment.

Growth of Robotics and AI in Arthroscopy

The utilization of robotic-assisted arthroscopies together with AI-assisted surgical navigation systems is redefining the precision paradigm within minimally invasive surgery. Surgical robots provide unparalleled dexterity and control, allowing algorithms to improve the accuracy and effectiveness of complex procedures.

AI-and image navigation systems aid real-time decision-making while minimizing errors and improving surgical outcomes. Furthermore, AI-assisted rehabilitation pathways augment recovery processes for patients, thereby increasing compliance and sustaining function in the affected joint over the long term.

Accessibility and integration of robotic and AI technologies into orthopedic practice will consequently lead to wider adoption, thereby transforming the arthroscopy environment and creating patient-beneficial surgical interventions.

The market for arthroscopy procedures and products globally blossomed from 2020 through to 2024, mainly due to the growing incidence of joint-related conditions, sports injuries, and these new-age minimally invasive techniques that are majorly being embraced.

Advances in arthroscopic instruments such as high-definition visualization systems, fluid management devices, and specialized suturing techniques led to accuracy and improvement of the patient outcomes. The growth of the outpatient and ambulatory surgical centers lured patients because patient-related costs and efficiencies were highlighted in strategies compared with inpatient surgeries.

Between the years of 2025 and 2035, the most-critical market would include the robotic-assisted therapies for arthroscopy, followed by the AI-driven diagnostic tools, and lastly, the biodegradable implants. Investment of a lot in research and development is likely to encourage the advent of many personalized and regenerative treatment options such as bioengineered cartilage and tissue scaffolds.

Furthermore, the acceleration in the healthcare infrastructure of the emerging economies along with the demand for early intervention of orthopedic conditions to keep the patients from getting worse generally will rally the chances of development in the market.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Regulatory approvals focused on safety and efficacy of arthroscopy products. |

| Technological Advancements | Adoption of high-definition visualization systems and fluid management technologies. |

| Consumer Demand | Growing demand for minimally invasive procedures for faster recovery and reduced complications. |

| Market Growth Drivers | Rise in sports-related injuries, osteoarthritis cases, and improved surgical instruments. |

| Sustainability | Initial steps towards eco-friendly manufacturing and single-use instrument reduction. |

| Supply Chain Dynamics | Reliance on hospital-based distribution networks for arthroscopic devices. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of guidelines for AI-driven and robotic-assisted arthroscopy, ensuring precision. |

| Technological Advancements | Integration of robotic-assisted arthroscopy, AI-powered diagnostics, and biodegradable implants. |

| Consumer Demand | Increased preference for outpatient procedures and AI-assisted post-operative rehabilitation. |

| Market Growth Drivers | Expansion of regenerative medicine applications and personalized orthopedic solutions. |

| Sustainability | Greater adoption of biodegradable materials and energy-efficient surgical technologies. |

| Supply Chain Dynamics | Digital supply chain optimization and direct-to-consumer surgical kit models for ambulatory care. |

Market Overview

Currently undergoing incremental progress is the arthroscopy products and procedures market in the USA, which is gaining momentum due to an increased incidence of disorders affecting the joints and the growing inclination towards minimally invasive surgery. Add to this an elderly geriatric population and quite a number of sports injuries, and, by those, the entire cause for arthroscopic procedures is built. Advances in sutureless high-definition visualization systems with specialized arthroscopic instruments boost efficiency and outcome in procedures.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.7% |

Market Outlook

Market Outlook Germany's arthroscopy market is dominated by a strong focus on precision engineering and high-quality medical device production. The advanced healthcare infrastructure of the country and research and development focus enable the implementation of leading-edge medical technologies, including arthroscopic surgery. An aging population and high quality of life contribute to the demand for minimally invasive surgical procedures.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.3% |

Market Outlook

Greatly depending on the huge Chinese populace and healthcare investment, the arthroscopy market in China is on the verge of a great boom. Significant government support for healthcare infrastructure and access has resulted in a rising demand for modern medical procedures, including arthroscopy. This increase is also supported by rising awareness regarding minimally invasive surgeries and a prosperous middle-class population.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.3% |

Market Outlook

India's sad is an arthroscopy product and procedure market that is flourishing, with an increase in healthcare units and better emphasis on minimally invasive surgical procedures. The affordable availability of medical solutions, with government efforts towards healthcare access, is growing the market. Awareness regarding sports injuries and joint health creates demand for arthroscopic procedures.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.1% |

Market Overview

A notable growth in Brazil's arthroscopy procedural and product market can be perceived due to advances in healthcare infrastructure and an ever-increasing focus on advanced medical treatment options. The government's efforts to improve healthcare services and rising acceptance among physicians for minimally invasive procedures are also contributing factors in the rise of this particular market. Sports-related injuries due to a young and healthy lifestyle with active participation in sports activities have resulted in a further demand for arthroscopy.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 5.3% |

This arthroscopy procedure and products market is witnessing stiff competition propelled by the needs of minimally invasive surgical techniques, advancements in arthroscopic devices, and growing incidences of joint-related disorders. The companies are now investing in advanced arthroscopy systems, high-definition imaging technologies, and AI-assisted surgical navigation to give themselves an edge over the competition.

The market is characterized by mature medical device companies, manufacturers of orthopedic equipment, and emerging providers of arthroscopy technology, all of which play a part in the changing nature of arthroscopic surgery.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Arthrex, Inc. | 22-26% |

| Stryker Corporation | 18-22% |

| Smith & Nephew plc | 10-14% |

| Johnson & Johnson | 8-12% |

| CONMED Corporation | 5-9% |

| Other Companies (combined) | 25-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| Arthrex, Inc. | Market leader offering advanced arthroscopy devices, including implants, visualization systems, and surgical instruments. |

| Stryker Corporation | Develops innovative arthroscopy solutions such as 4K endoscopic visualization systems and powered resection tools. |

| Smith & Nephew PLC | Specializes in minimally invasive joint repair technologies, including robotic-assisted arthroscopic surgery. |

| Johnson & Johnson | Provides high-performance arthroscopy instruments and suture anchor systems for sports medicine applications. |

Key Company Insights

Arthrex, Inc.

Arthrex, Incorporated, is a very well-known global leader in arthroscopically assisted orthopaedic surgical procedures and products. It offers very advanced implantable solutions towards minimally invasive surgical procedures in orthopaedic applications.

Known for its high-end arthroscopic implants, suture anchors, and state-of-the-art visualization systems, the company pours a large chunk of capital into R&D along with innovation in its work towards surgical instruments like one-time-use device and biodegradable implant-based approaches, which aim to enhance efficiency in procedures and patient results.

Arthrex provides functional solutions on sports medicine with a robust presence in the market to hospitals, ambulatory surgery centers, and orthopedic clinics. The company further widened its product portfolio with digital health solutions integrated with AI-assisted surgical instruments to improve and optimize arthroscopic procedures.

Stryker Corporation

This is a comprehensive company in terms of developing arthroscopy procedures and products. Its entire line includes arthroscopic instruments, visualization systems, and implants. One of its most established products is an advanced 4K- surgical imaging, along with a very efficient motorized shaver system, and precision-engineered arthroscopic implants.

Stryker's primary focus on robotic-assisted surgery and AI-driven navigation application has placed it in a strategic advantage among the companies at the forefront of minimally invasive orthopedic surgeries. Stryker's global distribution network enhances its ability to attend insufficiently serving hospitals, specialty clinics, and outpatient surgical centers. According to its initiatives for continued technology expansion, Stryker will only be extending its skills to surgeons and improving their patients' recovery outcomes in arthroscopic procedures.

Smith & Nephew plc

Smith & Nephew plc's competency is really that of a leading class manufacturer of arthroscopic surgical solutions and basically derives its reputation from highly complex sports medicine implants and instruments. Among the innovations in its product line are surgical systems with bioabsorbable anchors along with knee as well as shoulder repair systems as well as next-gen devices for suture fixation. In fact, Smith & Nephew has developed a robust pioneering strand in advanced arthroscopic surgical techniques that facilitate minimally invasive orthopedic surgery.

Added to these are the beneficial implications of its artificial intelligence based imaging and applications in robotic assistance and regenerative medicine technology on surgery efficiency and patient-related outcomes in the long term. Smith & Nephew continues to establish influence over arthroscopic innovation by the geographical expansion of emerging markets, along with the consolidation of partnerships and aid networks with healthcare providers.

Johnson & Johnson

Essentially, Johnson & Johnson, via its DePuy Synthes division, becomes another major player in the arthroscopy procedures and products segment, offering the most complete solution in arthroscopic joint repair and reconstruction operations. Its list of products includes very high-precision arthroscopic implants and suture anchors, as well as motorized shaver systems made for knee, shoulder, and hip operations. Digital health application of DePuy Synthes is transforming the way surgery accuracy and efficiency are achieved with an emphasis on robotic-assisted procedures combined with AI-powered surgical planning.

CONMED Corporation

CONMED Corporation is a dominant maker of arthroscopic surgical products with specialty in high-performance visualization systems, fluid management systems, and precision-based arthroscopic implants. The organization is well recognized for its advanced electromechanical instruments and suture-based fixation products, which are most suitable for complex surgeries on joints.

Most of the funds used in R&D activities at CONMED are directed toward improvement in ergonomics of surgeons, enhancement of healing of tissues, as well as reduced patient recovery time. The company indeed serves many hospitals and surgical outpatient facilities with most emphasis placed on digital integration and AI-smart imaging for arthroscopy procedures.

This way, CONMED continues to present itself in the dynamic obtaining market of products and services related to arthroscopies by continuously innovating and updating product lines and improving efficiencies in surgery itself.

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

Arthroscopes, arthroscopic resection systems, arthroscopic fluid management systems, arthroscopic implants, and others

Shoulder arthroscopy, hip arthroscopy, knee arthroscopy, elbow arthroscopy, small joints arthroscopy, and others

Hospitals, academic institutions, ASC and others

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The global Arthroscopy Procedure and Products industry is projected to witness CAGR of 5.4% between 2025 and 2035.

The global Arthroscopy Procedure and Products market stood at USD 7,193.9 million in 2024.

The global Arthroscopy Procedure and Products market is anticipated to reach USD 12,762.2 million by 2035 end.

China is expected to show a CAGR of 6.3% in the assessment period.

The key players operating in the global Arthroscopy Procedure and Products industry are Arthrex, Inc., Stryker Corporation, Smith & Nephew plc, Johnson & Johnson, CONMED Corporation, Medtronic plc, Zimmer Biomet Holdings, Inc., KARL STORZ SE & Co. KG, Olympus Corporation, Richard Wolf GmbH and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Procedure Type, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Procedure Type, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Procedure Type, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by Procedure Type, 2018 to 2033

Table 13: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 15: South Asia Market Value (US$ Million) Forecast by Procedure Type, 2018 to 2033

Table 16: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: East Asia Market Value (US$ Million) Forecast by Procedure Type, 2018 to 2033

Table 19: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Oceania Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 21: Oceania Market Value (US$ Million) Forecast by Procedure Type, 2018 to 2033

Table 22: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: MEA Market Value (US$ Million) Forecast by Procedure Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Procedure Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Procedure Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Procedure Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Procedure Type, 2023 to 2033

Figure 13: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 14: Global Market Attractiveness by Procedure Type, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Procedure Type, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Procedure Type, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Procedure Type, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Procedure Type, 2023 to 2033

Figure 28: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 29: North America Market Attractiveness by Procedure Type, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Procedure Type, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Procedure Type, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Procedure Type, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Procedure Type, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Procedure Type, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by Procedure Type, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by Procedure Type, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by Procedure Type, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by Procedure Type, 2023 to 2033

Figure 58: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 59: Europe Market Attractiveness by Procedure Type, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: South Asia Market Value (US$ Million) by Procedure Type, 2023 to 2033

Figure 63: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 70: South Asia Market Value (US$ Million) Analysis by Procedure Type, 2018 to 2033

Figure 71: South Asia Market Value Share (%) and BPS Analysis by Procedure Type, 2023 to 2033

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by Procedure Type, 2023 to 2033

Figure 73: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 74: South Asia Market Attractiveness by Procedure Type, 2023 to 2033

Figure 75: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 77: East Asia Market Value (US$ Million) by Procedure Type, 2023 to 2033

Figure 78: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: East Asia Market Value (US$ Million) Analysis by Procedure Type, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Procedure Type, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Procedure Type, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 89: East Asia Market Attractiveness by Procedure Type, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Oceania Market Value (US$ Million) by Procedure Type, 2023 to 2033

Figure 93: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Oceania Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 100: Oceania Market Value (US$ Million) Analysis by Procedure Type, 2018 to 2033

Figure 101: Oceania Market Value Share (%) and BPS Analysis by Procedure Type, 2023 to 2033

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by Procedure Type, 2023 to 2033

Figure 103: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 104: Oceania Market Attractiveness by Procedure Type, 2023 to 2033

Figure 105: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 106: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 107: MEA Market Value (US$ Million) by Procedure Type, 2023 to 2033

Figure 108: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 113: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 115: MEA Market Value (US$ Million) Analysis by Procedure Type, 2018 to 2033

Figure 116: MEA Market Value Share (%) and BPS Analysis by Procedure Type, 2023 to 2033

Figure 117: MEA Market Y-o-Y Growth (%) Projections by Procedure Type, 2023 to 2033

Figure 118: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 119: MEA Market Attractiveness by Procedure Type, 2023 to 2033

Figure 120: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Arthroscopy Devices Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Arthroscopy Visualization Systems Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Teff Products Market

Detox Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pulse Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Vacuum Products for Emergency Services Market Size and Share Forecast Outlook 2025 to 2035

Almond Products Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Products Market Analysis – Trends & Growth 2025 to 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Chicory Products Market Size and Share Forecast Outlook 2025 to 2035

Crystal Products Market Size and Share Forecast Outlook 2025 to 2035

Make-Up Products Packaging Market Size and Share Forecast Outlook 2025 to 2035

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Ziplock Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA