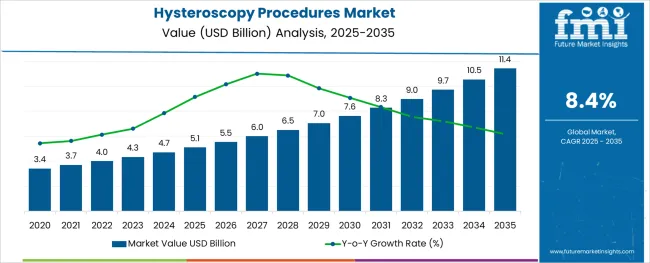

The Hysteroscopy Procedures Market is estimated to be valued at USD 5.1 billion in 2025 and is projected to reach USD 11.4 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

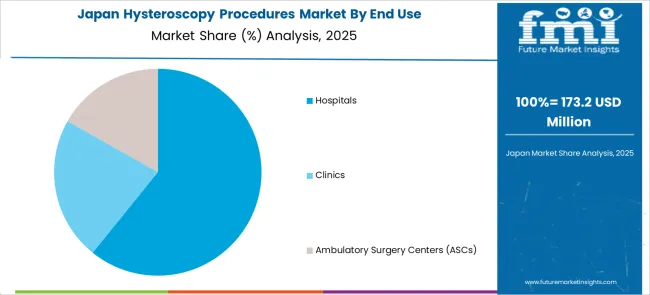

The market is segmented by End Use and region. By End Use, the market is divided into Hospitals, Clinics, and Ambulatory Surgery Centers (ASCs). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by End Use and region. By End Use, the market is divided into Hospitals, Clinics, and Ambulatory Surgery Centers (ASCs). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by salts, sodium alginate is expected to command 27.5 % of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

As per the Global Hysteroscopy Procedures Market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, the market value of the Hysteroscopy Procedures Market increased at around 7.7% CAGR.

The key revenue drivers which affected the market are the increasing incidence of gynecological diseases like ovarian cancer, uterine fibroids, and ovarian cysts, and the growing trend for minimally invasive surgery worldwide. Ovarian cysts are very commonly encountered in females, wherein 7% of women worldwide are reported to have ovarian cysts. In the United States, there are 15 cases per 100 thousand women annually.

Women ovarian cysts are encountered in all premenopausal women and they are also found in 18% of postmenopausal women. Due to the rise in the number of gynecological diseases, the use of Hysteroscopy Procedures is increased in Hospitals, clinics, and ambulatory surgical centers.

With the increasing prevalence of gynecological diseases like uterine fibroids, menstrual disorders, ovarian cysts, and ovarian cancer, there was an increase in hysteroscopy procedures.

Health uterine fibroids affect 20-25% of reproductive-age women by the age of 50 and the prevalence of uterine fibroid disease varies by age group, ranging from 5.4% to 23.6%. As a result, there is an increase in demand for hysteroscopy procedures as these procedures are used in the diagnosis of gynecological diseases.

Another factor increasing the demand for hysteroscopy procedures is the growing trend for minimally invasive surgery. Minimally invasive surgery has been the standard procedure for treating gynecological diseases over the last two decades. The advantage of minimally invasive surgery in gynecological diseases are less pain, reduced hospital stays, less loss of blood, and reduced risk of scaring.

Diagnostic procedures like hysteroscopy are used to identify anomalies like excruciating stomach cramps, heavy bleeding, repeated miscarriages, or trouble conceiving.

Due to an increase in the use of minimally invasive surgery demand for hysteroscopy procedures is on the rise. The rising cases of uterine cancer have also increased the number of hysteroscopy procedures. According to the report of the American Cancer Society, more than 65 thousand cases are anticipated to be diagnosed in 2025. Therefore, these factors are driving the growth of the market.

The rising prevalence of polycystic ovarian syndrome. It is a syndrome in which the ovaries create an abnormally large amount of androgens, male sex hormones that are normally present in lower amounts in women. According to the National Library of Medicine, polycystic ovarian syndrome (PCOS) affects 4% to 20% of women who are of reproductive age worldwide.

As a result, there is a rise in cases of polycystic ovarian syndrome cases globally and in the diagnosis of polycystic ovarian syndrome there is the use of hysteroscopy procedures. Which is increasing demand for hysteroscopy procedures worldwide.

According to the report of the World Ovarian Cancer Coalition more than 300 thousand cases of ovarian cancer were diagnosed and from which 200 thousand women died due to ovarian cancer. The number is anticipated to rise at a rate of 37% by 2040. In the United States, there are 15 cases of ovarian cancer per 100 thousand women annually. Due to rising cases of ovarian cancer, there is a rise in the number of hysteroscopy procedures performed around the world.

The use of diagnostic methods such as complete blood count, drug therapies, and ultrasound, is limiting the number of hysteroscopy procedures. Physicians and doctors prescribe drug therapies as the first line of treatment for gynecological diseases. The hysteroscopy procedure is only recommended by physicians only when other diagnostic procedures fail to properly diagnose a specific condition.

In hysteroscopy procedures, a few adverse effects can occur like vaginal bleeding, cramping, and severe abdominal pain, which reduces the demand for hysteroscopy procedures this adverse effect of hysteroscopy act as a restraint for market growth.

Another factor restraining the growth of the market is the high cost of hysteroscopy procedures. In the United States average cost of a hysteroscopy procedure ranges from USD 750 to USD 3,500. All these factors are impacting the demand for hysteroscopy procedures and acting as a restraint for the hysteroscopy procedures market.

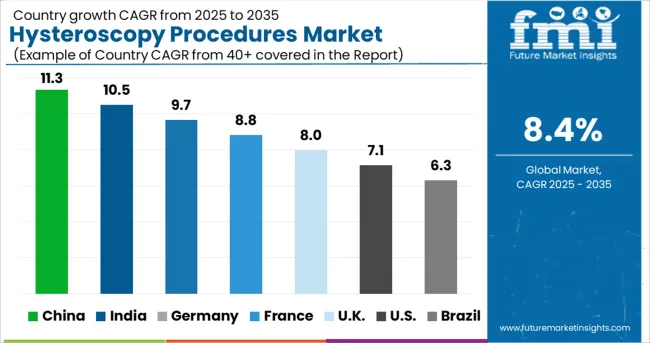

During the projection period, the North American Hysteroscopy Procedures Market is predicted to be the leading market for Hysteroscopy Procedures. The value of Hysteroscopy Procedures in North America increased at a CAGR of around 8% from 2020 to 2024.

In the United States from the 8th to the 14th of May is observed as National Women's Health Week. Which motivates women to prioritize their health and take care of themselves. This is rising awareness about women’s health in North America and thus increasing demand for hysteroscopy procedures.

Uterine cancer accounts for 3.4% of all new cancer cases in the United States, according to National Cancer Institute research. Hence, due to the prevalence of cases of uterine cancer in the region, the demand for diagnostics. Consequently, the cost of research and development is very high in the United States. These factors are likely to increase the demand for hysteroscopy procedures in the region.

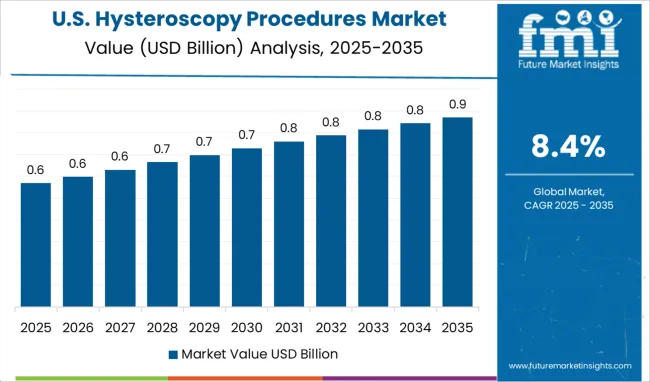

The United States is expected to account for the highest market of USD 11.4 billion by the end of 2035. Also, the market in the country is projected to account for an absolute dollar growth of USD 1.8 billion.

This is attributable to a number of variables, including growth in the prevalence of gynecological illnesses, increased understanding of various medical alternatives, developed healthcare facilities, and the existence of skilled physicians.

Government policies and regulations are favoring the market. The healthcare system in the United States includes both commercial and governmental health insurance. Medicare and Medicaid are the two largest The USA government-funded programs.

According to the report of the Congressional Research Service the United States government spends more than USD 3.9 Trillion on various types of health consumption expenditures which are increasing the number of hysteroscopy procedures in the country.

The increase in the cases of endometriosis is directly increasing the number of hysteroscopy procedures in the United States. Endometriosis currently affects more than 5.5 million women in the United States and the number is expected to rise in the future.

The existence and development of new healthcare facilities in the United States are helping boost the growth of the hysteroscopy procedures market. As per the report of the USA Bureau of Labor Statistics, there are more than 13 thousand hospitals in the United States. The skilled employees in the hospital also play important role in carrying out hysteroscopy procedures.

In 2020, there were around 22 million hospital employees in the United States, according to the United States Census Bureau. Hence, due to the presence of a developed healthcare system and skilled hospital employees in the United States. The demand for hysteroscopy procedures is increasing. As a result, these factors are driving the hysteroscopy procedures market in the United States.

The market for hysteroscopy procedures in the United Kingdom is projected to reach a valuation of USD 349 million by 2035. The market in the country is projected to garner an absolute dollar opportunity of USD 5.1 million from 2025 to 2035, at a CAGR of 7.6%.

The market for hysteroscopy procedures in Japan is projected to reach a valuation of USD 336 million by 2035. The market in the country is projected to garner an absolute dollar opportunity of USD 195 million from 2025 to 2035, at a CAGR of 9.1%.

The market for hysteroscopy procedures in Japan is projected to reach a valuation of USD 185.2 million by 2035. The market in the country is projected to garner an absolute dollar opportunity of USD 102 million from 2025 to 2035, at a CAGR of 8.3%.

Market revenue through hospitals is forecasted to grow at a CAGR of over 9.3% from 2025 to 2035. Due to a higher volume of patients for gynecological procedures than other healthcare facilities, the market value through hospitals increased at a CAGR of around 8.2% from 2020 to 2024.

According to the report of the National Library of Medicine, more than 30 thousand myomectomies surgeries for fibroids are performed in the United States annually. Furthermore, because hospitals provide primary healthcare facilities in the majority of nations, the number of hysteroscopy operations performed in hospitals is higher than in other healthcare facilities.

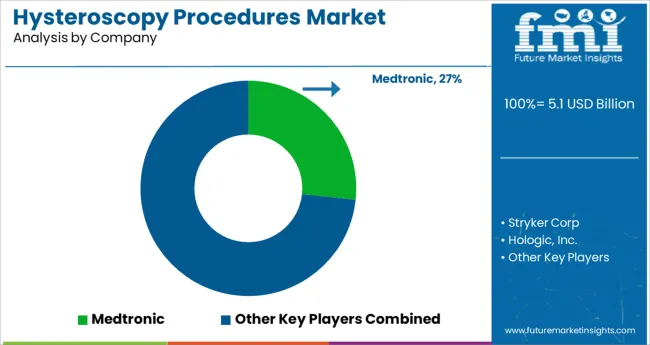

The companies in the Hysteroscopy Procedures market are focused on their alliances, and collaborations. The key companies in the hysteroscopy procedures market include Medtronic, Stryker Corporation, Hologic Inc., KARL STORZ SE & Co. KG, Medical Devices Business Services Inc., Olympus Corporation, Delmont Imaging, CooperCompanies, Richard Wolf GmbH, B. Braun Melsungen AG, Maxer Endoscopy GmbH, Boston Scientific Corp., MedGyn Products, Inc., Meditrina, Inc., Lina Medical APS, and Luminelle.

Some of the recent developments of key Hysteroscopy Procedures market providers are as follows:

Similarly, recent developments related to companies in Hysteroscopy Procedures Market have been tracked by the team at Future Market Insights, which are available in the full report.

The global hysteroscopy procedures market is estimated to be valued at USD 5.1 billion in 2025.

It is projected to reach USD 11.4 billion by 2035.

The market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types are hospitals, clinics and ambulatory surgery centers (ascs).

segment is expected to dominate with a 0.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Surgical Robot Procedures Market Size and Share Forecast Outlook 2025 to 2035

Laparoscopic Gynecological Procedures Market – Growth & Trends 2024-2034

Laparoscopic Robotic-assisted Procedures Market Size and Share Forecast Outlook 2025 to 2035

Hysteroscopic Endometrial Resection Procedures Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA