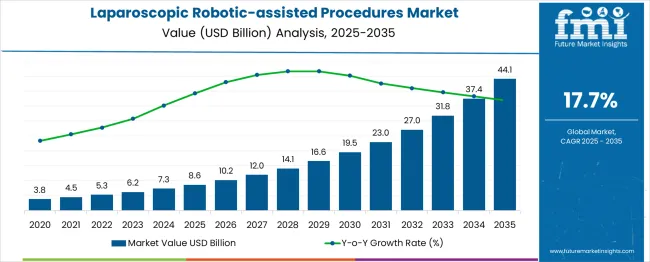

The laparoscopic robotic-assisted procedures market, valued at USD 8.6 billion in 2025, is projected to grow to USD 44.1 billion by 2035, with a CAGR of 17.7%. This growth is driven by continuous innovations in robotic surgery technologies, which enhance precision, reduce recovery time, and improve patient outcomes. Between 2025 and 2027, the market expands from USD 8.6 billion to USD 10.2 billion, with annual increments of USD 4.5 billion, 5.3 billion, and 6.2 billion. The adoption of robotic systems in hospitals and clinics is accelerating as medical professionals increasingly recognize their benefits, pushing the market toward steady, incremental growth.

From 2027 to 2032, the market sees a more pronounced rise, growing from USD 10.2 billion to USD 23.0 billion. This surge is fueled by broader adoption across diverse medical specialties such as gynecology, urology, and general surgery. As robotic systems become more advanced, they are also being integrated into more healthcare settings globally, especially in emerging markets. By the final phase, from 2032 to 2035, the market reaches USD 44.1 billion, driven by enhanced technologies, greater surgical volumes, and increasing patient demand for minimally invasive procedures. The absolute dollar opportunity is significant in this phase, marking the market’s strong and long-term growth.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 8.6 billion |

| Forecast Value in (2035F) | USD 44.1 billion |

| Forecast CAGR (2025 to 2035) | 17.7 % |

The seasonal fluctuations are typically influenced by factors like healthcare budgets, elective surgery scheduling, and physician availability. One predictable peak is observed during the winter months, particularly in the first quarter of the year, as hospitals and surgical centers often have a higher throughput following the holiday period when elective surgeries are frequently postponed. As the new fiscal year begins, there is often a surge in both public and private healthcare budgets, which leads to an increase in robotic-assisted surgeries, especially in regions with high demand.

The market tends to experience a dip in the summer months due to vacations, reduced physician availability, and lower hospital admissions. Many elective surgeries, including those requiring advanced robotic assistance, are rescheduled or postponed during this time, as patients and healthcare staff take time off. This seasonal reduction in activity could slightly slow the market's growth during the summer months, though the trend is expected to be less pronounced as robotic surgery becomes more integrated into daily healthcare operations, reducing dependency on specific timeframes. these predictable peaks and dips offer valuable insights for industry stakeholders in terms of resource planning, budgeting, and patient management during various parts of the year.

Market expansion is being supported by the increasing adoption of minimally invasive surgical techniques and the corresponding demand for advanced robotic systems that enhance surgical precision and patient outcomes. Modern healthcare providers are increasingly focused on procedures that reduce patient trauma, minimize complications, and accelerate recovery times. Robotic-assisted laparoscopic systems provide superior visualization, enhanced dexterity, and improved ergonomics for surgeons, making them essential tools in contemporary surgical practice.

The growing focus on value-based healthcare and improved patient satisfaction is driving demand for robotic surgical systems that demonstrate measurable clinical benefits. Healthcare institutions recognize that robotic-assisted procedures often result in shorter hospital stays, reduced readmission rates, and better long-term patient outcomes. The rising influence of patient awareness and surgeon preferences for advanced technology is also contributing to increased adoption across different medical specialties and healthcare facilities.

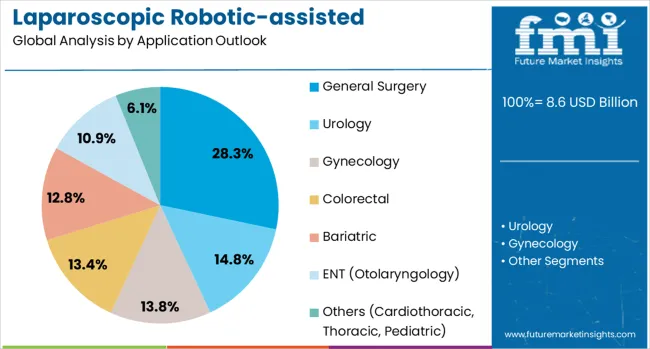

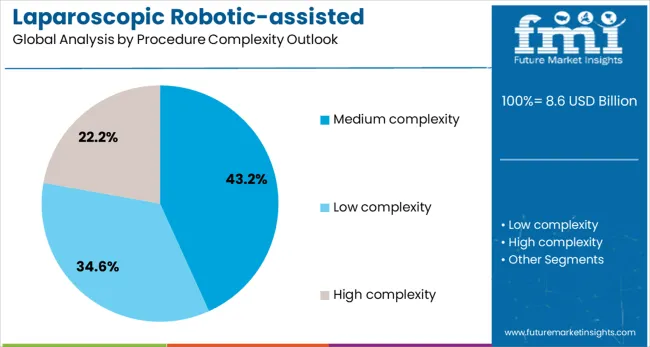

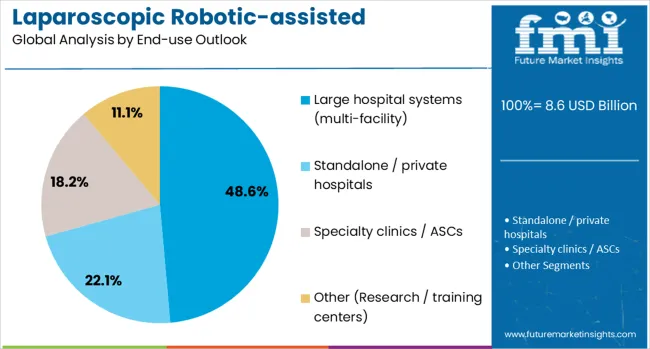

The market is segmented by application, procedure complexity, end-use, and region. By application, the market is divided into general surgery, urology, gynecology, colorectal, bariatric, ENT (otolaryngology), and others (cardiothoracic, thoracic, pediatric). Based on procedure complexity, the market is categorized into low complexity, medium complexity, and high complexity. In terms of end-use, the market is segmented into large hospital systems (multi-facility), standalone/private hospitals, specialty clinics/ASCs, and others (research/training centers). Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The general surgery application is projected to account for 28% of the laparoscopic robotic-assisted procedures market in 2025, reaffirming its position as the category's leading segment. General surgery encompasses a broad range of procedures including hernia repair, gallbladder removal, appendectomy, and bowel resection, all of which benefit significantly from robotic assistance. The precision and control offered by robotic systems enable surgeons to perform complex procedures with greater accuracy while minimizing patient trauma.

This application forms the foundation of most robotic surgery programs, as it represents the most common and accessible entry point for hospitals implementing robotic surgical capabilities. The versatility of robotic systems in general surgery procedures allows for efficient utilization of expensive capital equipment across multiple surgical specialties. With the growing prevalence of conditions requiring surgical intervention and increasing surgeon familiarity with robotic techniques, general surgery applications continue to drive the core demand for laparoscopic robotic-assisted procedures.

Medium complexity procedures are projected to represent 43% of laparoscopic robotic-assisted procedure demand in 2025, underscoring their role as the primary application for robotic surgical systems. These procedures require moderate technical skill and benefit significantly from robotic assistance without the extensive training required for high-complexity interventions. Medium complexity procedures strike an optimal balance between clinical benefit and procedural accessibility, making them ideal candidates for widespread robotic adoption.

The segment is supported by the growing number of procedures that can be effectively performed using robotic systems with manageable learning curves for surgeons. Healthcare institutions favor medium complexity procedures as they demonstrate clear value proposition while remaining cost-effective and accessible to a broader range of surgical teams. As robotic technology continues to advance and surgeon training programs expand, medium complexity procedures will continue to dominate utilization patterns, reinforcing their central position within the robotic surgery market.

The large hospital systems (multi-facility) segment is forecasted to contribute 49% of the laparoscopic robotic-assisted procedures market in 2025, reflecting the capital-intensive nature of robotic surgical equipment and the economies of scale required for successful implementation. Large hospital systems possess the financial resources, patient volume, and infrastructure necessary to support comprehensive robotic surgery programs across multiple locations and specialties.

These institutions can justify the significant investment in robotic systems through high procedure volumes and the ability to leverage shared resources across multiple facilities. Large hospital systems also benefit from centralized training programs, standardized protocols, and specialized support staff that enhance the efficiency and safety of robotic procedures. With their established referral networks and comprehensive service offerings, large hospital systems serve as primary drivers of robotic surgery adoption, making them the dominant end-use segment in the market.

The laparoscopic robotic-assisted procedures market is advancing rapidly due to increasing adoption of minimally invasive surgical techniques and growing demand for precision surgical interventions. The market faces challenges including high capital costs, extensive surgeon training requirements, and concerns about return on investment for healthcare institutions. Innovation in robotic platforms and expanding clinical applications continue to influence market development and adoption patterns.

The growing development of comprehensive surgeon training programs is enabling broader adoption of robotic-assisted procedures across healthcare institutions. Medical schools and residency programs are increasingly incorporating robotic surgery training into their curricula, while continuing education programs provide experienced surgeons with opportunities to develop robotic surgical skills. Simulation-based training systems and virtual reality platforms are enhancing the efficiency and safety of robotic surgery education.

The integration of artificial intelligence (AI) and advanced imaging technologies into robotic surgical systems is enhancing the precision and effectiveness of surgeries. AI algorithms and machine learning models are being used to provide real-time guidance, tissue recognition, and predictive analytics, helping surgeons make more informed decisions during procedures. These technologies improve the accuracy of surgical maneuvers while simultaneously reducing the time required for complex surgeries. Advanced imaging systems, including 3D visualization and augmented reality (AR), offer surgeons enhanced depth perception and better anatomical awareness.

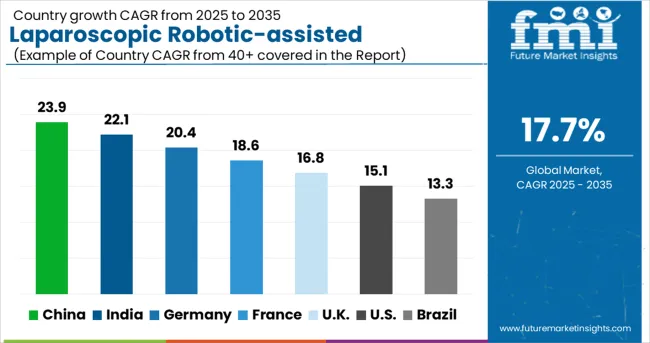

| Countries | CAGR (2025-2035) |

|---|---|

| China | 23.9% |

| India | 22.1% |

| Germany | 20.4% |

| France | 18.6% |

| UK | 16.8% |

| USA | 15.1% |

| Brazil | 13.3% |

The laparoscopic robotic-assisted procedures market is experiencing robust growth globally, with China leading at a 23.9% CAGR through 2035, driven by massive healthcare infrastructure investments, growing middle-class healthcare spending, and government support for medical technology adoption. India follows closely at 22.1%, supported by expanding healthcare access, increasing medical tourism, and rising awareness of minimally invasive surgical benefits. Germany shows strong growth at 20.4%, emphasizing precision engineering and medical technology innovation. France records 18.6%, focusing on healthcare excellence and surgical technology advancement. The UK shows 16.8% growth, prioritizing evidence-based surgical practices and technology integration.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

Revenue from laparoscopic robotic-assisted procedures in China is projected to exhibit strong growth with a CAGR of 23.9% through 2035.he country’s healthcare infrastructure is expanding rapidly, supported by substantial government investment in medical technology. Leading hospitals across China are adopting robotic surgery technologies to meet the growing demand for minimally invasive procedures. As the country’s middle class expands, so does the demand for high-quality healthcare, further driving the need for robotic-assisted surgeries. International and domestic companies are increasingly investing in China’s healthcare sector, creating a strong distribution and support network for robotic systems. The country’s involvement in medical tourism is also supporting the adoption of these advanced technologies.

Demand for laparoscopic robotic-assisted procedures in India is expanding at a CAGR of 22.1% due to increased investments in healthcare infrastructure and rising demand for advanced surgical technologies. The middle class is experiencing growth, leading to higher medical spending, which is driving the adoption of precision surgical solutions, particularly in major urban centers. Robotic surgery is becoming a popular choice for minimally invasive procedures as more healthcare institutions, including hospital chains and specialty surgical centers, implement robotic surgery programs. The country is also experiencing a rise in medical tourism, with patients seeking advanced surgical procedures from India’s world-class healthcare facilities. The growing focus on medical education and the training of robotic surgeons is enhancing the expertise in robotic-assisted procedures.

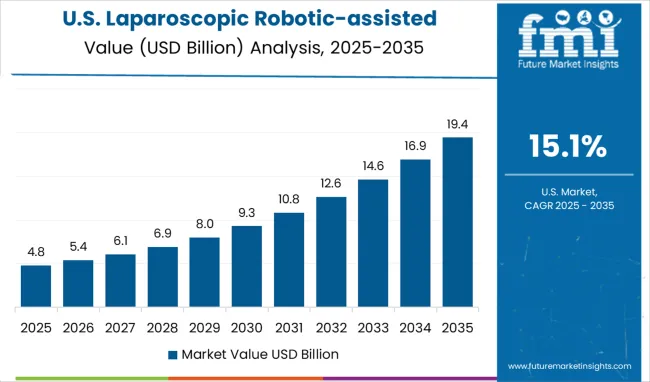

The USA laparoscopic robotic-assisted procedures market is growing at a CAGR of 15.1% through 2035, supported by established healthcare infrastructure and robust reimbursement frameworks. The healthcare system continues to prioritize patient outcomes and cost-effectiveness, making robotic surgery a preferred option for hospitals and surgery centers. USA healthcare institutions emphasize precision, patient safety, and reduced recovery time, which are key benefits of robotic-assisted surgeries. The demand for advanced surgical systems is further driven by continuous technological innovation and research in robotic systems. Strong competition among robotic system manufacturers has led to constant advancements in capabilities, including integration with artificial intelligence (AI) for more accurate surgeries. The USA benefits from extensive surgeon training programs and research initiatives, which enhance the adoption and expertise in robotic-assisted procedures

Revenue from laparoscopic robotic-assisted procedures in Germany is projected to grow at a CAGR of 20.4% through 2035. Known for its strong engineering capabilities and focus on high-quality healthcare, Germany has seen a steady rise in the adoption of robotic-assisted surgeries. German healthcare institutions prioritize precision and safety, making robotic systems a key choice for minimally invasive procedures. With a deep commitment to innovation, Germany continues to invest in the development of next-generation robotic surgery systems. German engineering excellence, combined with clinical innovation, ensures that robotic systems meet the highest standards. Hospitals and medical centers are adopting robotic systems to improve patient outcomes, reduce recovery times, and enhance surgical accuracy.

The laparoscopic robotic-assisted procedures market in the United Kingdom is expected to expand at a CAGR of 16.8% through 2035. British healthcare institutions value robotic surgery for its proven clinical benefits, including improved patient outcomes and reduced recovery times. The adoption of robotic-assisted surgeries in both the National Health Service (NHS) and private healthcare institutions is expanding as these systems demonstrate significant cost-effectiveness. The UK’s focus on enhancing surgical efficiency and patient satisfaction is pushing healthcare providers to incorporate advanced robotic systems into their surgical offerings. Increasing collaboration between medical facilities and technology providers is accelerating the availability of robotic systems in diverse healthcare settings.

In France, the laparoscopic robotic-assisted procedures market is projected to grow at a CAGR of 18.6% through 2035. The healthcare system is committed to high standards of surgical excellence, with a strong focus on precision surgery. French hospitals and medical institutions are increasingly adopting robotic-assisted surgeries to offer superior clinical outcomes. With robust investments in medical technology and surgeon training, France is fostering an environment of growth for robotic surgery. The integration of robotic systems into medical facilities enhances both surgical capabilities and patient care. France also benefits from collaborations between healthcare institutions and technology companies to improve the accessibility of robotic surgery. The government’s focus on advancing healthcare technologies is expected to continue driving the demand for robotic-assisted procedures.

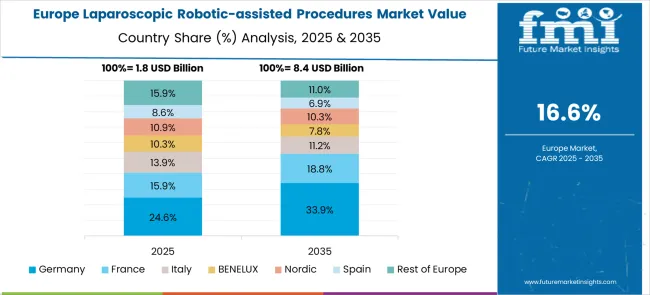

The laparoscopic robotic-assisted procedures market in Europe demonstrates mature development across major economies with Germany showing strong presence through its advanced healthcare infrastructure and significant investment in surgical technology, supported by leading medical institutions leveraging robotic systems to deliver precision surgical care and improve patient outcomes across multiple specialties. France represents a significant market driven by its commitment to healthcare innovation and comprehensive medical education programs, with major healthcare networks and surgical centers pioneering advanced robotic procedures that combine French medical expertise with cutting-edge surgical technology.

The UK exhibits considerable growth through its focus on evidence-based medicine and technology adoption, with the National Health Service and private healthcare providers increasingly implementing robotic surgical systems to enhance surgical capabilities and improve patient care quality. Italy and Spain show expanding adoption of robotic surgery solutions, particularly in specialized surgical centers focusing on minimally invasive procedures and precision surgical interventions. BENELUX countries contribute through their focus on healthcare innovation and technology integration, while Eastern Europe and Nordic regions display growing potential driven by increasing healthcare modernization and expanding access to advanced surgical technologies across diverse medical institutions

Companies in the robotic surgical solutions market are focusing on advancing technology and improving accessibility by investing in robotic platforms, artificial intelligence integration, surgeon training programs, and comprehensive service support. These investments aim to enhance the effectiveness, reliability, and accessibility of robotic surgical systems. Key market drivers include technological innovation, clinical evidence generation, and global market expansion. As companies innovate and expand, their product portfolios grow stronger, enabling them to secure a more prominent position in the market.

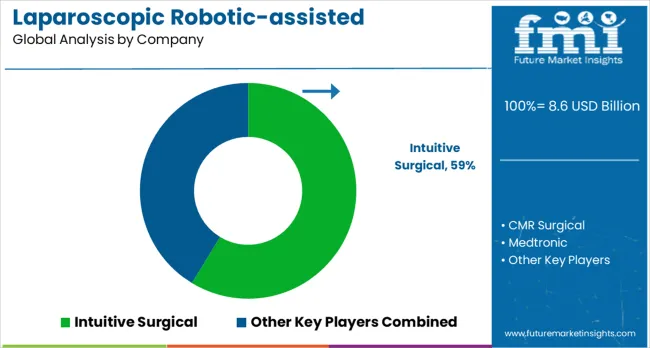

Intuitive Surgical, Inc., based in the USA, dominates the market with a 59% global value share. The company is recognized for its comprehensive robotic surgical systems, which focus on minimally invasive procedures and offer extensive surgeon training programs. Intuitive Surgical's robust market leadership is built on its ability to provide high-quality, efficient, and user-friendly systems for a variety of surgical specialties. CMR Surgical, based in the UK, offers next-generation robotic platforms that emphasize accessibility and cost-effectiveness, catering to hospitals and clinics that seek affordable yet advanced solutions. Medtronic, another USA-based company, integrates robotic surgical systems with advanced visualization and navigation technologies, delivering comprehensive surgical solutions that enhance precision and efficiency.

Asensus Surgical US Inc., also based in the USA, focuses on performance-guided surgery with augmented intelligence capabilities, offering systems designed to enhance surgical decision-making. MicroPort (Shanghai MicroPort Medical Group Co., Ltd.), headquartered in China, provides robotic surgical systems tailored to Asian markets, with an importance on cost-effective solutions. Stryker Corporation specializes in robotic platforms for orthopedic and spine procedures, addressing the growing demand for robotic-assisted surgeries in these fields. Emerging players such as Titan Medical Inc., Vicarious Surgical, Distalmotion SA, and Virtual Incision are developing innovative robotic platforms with specialized capabilities and next-generation technologies, further expanding the competitive landscape of the market.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 8.6 billion |

| Application | General Surgery, Urology, Gynecology, Colorectal, Bariatric, ENT (Otolaryngology), Others (Cardiothoracic, Thoracic, Pediatric) |

| Procedure Complexity | Low complexity, Medium complexity, High complexity |

| End-use | Large hospital systems (multi-facility), Standalone/private hospitals, Specialty clinics/ASCs, Others (Research/training centers) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Intuitive Surgical, Inc., CMR Surgical, Medtronic, Asensus Surgical US Inc., MicroPort (Shanghai MicroPort Medical Group Co.Ltd.), Stryker Corporation, Titan Medical Inc., Vicarious Surgical, Distalmotion SA, and Virtual Incision |

| Additional Attributes | Dollar revenue by procedure type and surgical specialty, regional adoption trends, competitive landscape, hospital purchasing preferences for robotic systems versus traditional surgical methods, integration with AI and machine learning capabilities, innovations in surgical training and simulation, and development of specialized robotic platforms for specific medical procedures |

The global laparoscopic robotic-assisted procedures market is estimated to be valued at USD 8.6 billion in 2025.

The market size for the laparoscopic robotic-assisted procedures market is projected to reach USD 44.1 billion by 2035.

The laparoscopic robotic-assisted procedures market is expected to grow at a 17.7% CAGR between 2025 and 2035.

The key product types in the laparoscopic robotic-assisted procedures market are general surgery, urology, gynecology, colorectal, bariatric, ENT (otolaryngology) and others (cardiothoracic, thoracic, pediatric).

In terms of procedure complexity outlook, medium complexity segment to command 43.2% share in the laparoscopic robotic-assisted procedures market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Laparoscopic Device Market Size and Share Forecast Outlook 2025 to 2035

Laparoscopic Gynecological Procedures Market – Growth & Trends 2024-2034

Reusable Laparoscopic Instruments Market is segmented by Reusable Laparoscopic Scissors and Reusable Hand Instruments from 2025 to 2035

Disposable Laparoscopic Instruments Market Analysis – Size, Share & Forecast 2025-2035

Hysteroscopy Procedures Market Size and Share Forecast Outlook 2025 to 2035

Surgical Robot Procedures Market Size and Share Forecast Outlook 2025 to 2035

Dental Repair Membranes for Implant Procedures Market Size and Share Forecast Outlook 2025 to 2035

Hysteroscopic Endometrial Resection Procedures Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA