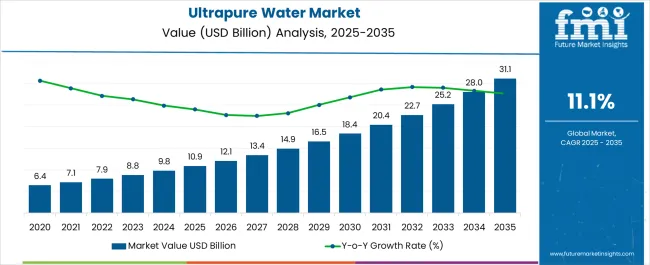

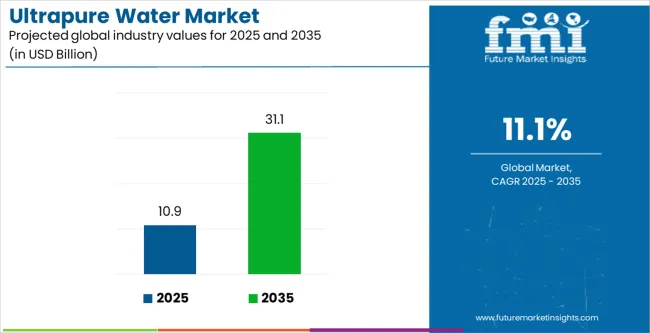

The Ultrapure Water Market is estimated to be valued at USD 10.9 billion in 2025 and is projected to reach USD 31.1 billion by 2035, registering a compound annual growth rate (CAGR) of 11.1% over the forecast period.

| Metric | Value |

|---|---|

| Ultrapure Water Market Estimated Value in (2025 E) | USD 10.9 billion |

| Ultrapure Water Market Forecast Value in (2035 F) | USD 31.1 billion |

| Forecast CAGR (2025 to 2035) | 11.1% |

The ultrapure water market is expanding steadily owing to rising demand from industries where water purity is critical for operations such as semiconductor manufacturing, pharmaceuticals, and power generation. The increasing sophistication of microelectronics and precision manufacturing processes has intensified the need for high quality water that meets stringent contamination standards.

Regulatory requirements governing water purity in drug production and biotechnology have also accelerated adoption across the healthcare and life sciences sectors. Technological advancements in purification systems including advanced membranes, ion exchange resins, and monitoring technologies are enhancing efficiency and lowering operational risks.

Growing environmental and sustainability concerns are further encouraging investment in water recycling and recovery systems that maintain ultrapure standards. The outlook remains strong as industrial dependence on ultrapure water continues to rise, supported by continuous innovation and the globalization of advanced manufacturing.

Robust growth of several end-use sectors such as electrical & electronics, biotechnology, and food & beverage processing have increased the consumption of ultrapure water over the past few years. The global market exhibited a CAGR of 4.6% in the historical period. It crossed a valuation of USD 10.9 billion in 2025.

Shift toward sustainability and robust technological advancements in water treatment process are set to push the global market forward. It would also be fueled by ongoing expansion of numerous sectors, especially in emerging economies.

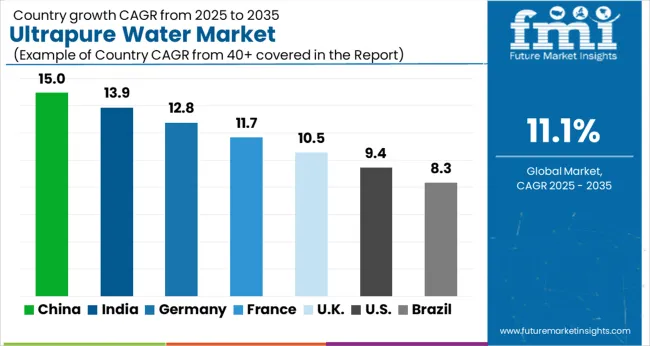

Emerging markets such as India, Brazil, and other Asian countries have been witnessing significant growth in sectors such as semiconductors, electronics, and pharmaceuticals. Significant expansion of these sectors in emerging markets has been a key factor in expansion of the ultrapure water industry.

Rising Demand from Semiconductor Sector Globally

Manufacturing procedures can get increasingly complicated as the semiconductor sector evolves. Higher degrees of purity in water used for various fabrication procedures are required for the development of smaller, more powerful semiconductor devices.

Ultrapure water is expected to be used for essential operations such as cleaning, washing, and etching, where even minor pollutants can degrade device performance and yield.

The semiconductor sector demands water with unparalleled purity to maintain strict quality control. Any contaminants, particles, or dissolved impurities in the water can lead to defects or failures in the final products, resulting in significant financial losses for manufacturers.

As a result, the sector places a strong emphasis on ultrapure water to ensure the integrity and reliability of semiconductor components.

Need for ultrapure water is also fueled by expanding use of semiconductors in numerous sectors, including automotive, consumer electronics, and healthcare.

Demand for high-quality semiconductors is on the rise due to surging popularity of electric vehicles, smart devices, and upcoming technologies such as 5G & artificial intelligence. This is further increasing demand for ultrapure water in the semiconductor manufacturing process.

Significant Demand from the Power Generation Sector

The power generation sector, comprising thermal power plants, nuclear facilities, and renewable energy installations, depends on highly efficient and reliable equipment.

Ultrapure water plays a critical role in power generation processes such as steam generation, turbine cooling, and boiler feed water. Increasing need to ensure the absence of impurities and contaminants, as well as maintain the efficiency and longevity of power generation systems would drive the market.

Power generation operations adhere to strict water quality standards to safeguard equipment performance and prevent corrosion or scaling issues. Ultrapure water, with its exceptional purity, meets these stringent requirements.

It can reduce the risk of equipment damage and minimize maintenance costs. Water treatment processes, including reverse osmosis and ion exchange, are set to be employed to achieve ultrapure water quality for power generation applications.

Growing global focus on sustainable energy sources such as renewables and nuclear power, would also drive the need for ultrapure water in these sectors.

Solar and wind power installations require ultrapure water for cleaning & maintaining photovoltaic panels and wind turbines, respectively. Nuclear power plants would soon rely on ultrapure water for cooling systems and steam generation, ensuring safe and efficient operations.

Increasing Sales among Pharmaceutical Companies

The pharmaceutical sector requires ultra-pure water for various applications such as drug formulation, drug delivery systems, and laboratory testing. Demand for ultra-pure water in this sector is driven by need for quality assurance and regulatory compliance.

Pharmaceutical companies need to ensure that the water used in their products and processes is free from impurities. As water can potentially affect the safety, efficacy, or stability of their products, demand for ultrapure water is projected to expand.

Advancements in technology are also driving ultrapure water demand across the global pharmaceutical sector. For instance, use of membrane filtration technology has significantly improved the efficiency and cost-effectiveness of producing ultrapure water.

Demand for ultrapure water in the pharmaceutical sector is expected to continue to surge, driven by need for quality assurance, regulatory compliance, and advancements in technology. This growth is creating new opportunities for the ultrapure water market, with increasing demand for high-quality water purification systems and services.

Establishing and maintaining ultrapure water production and purification systems requires significant capital investment. The technology and infrastructure needed to achieve & maintain high levels of water purity can be costly.

It can mainly impact small-scale companies or regions with limited financial resources. High initial investment and ongoing operational expenses can act as a restraint for market entry and expansion.

Ultrapure water production requires a reliable source of water, which can be a constraint in regions experiencing water scarcity or limited access to freshwater resources.

Ensuring a consistent and sustainable supply of water for ultrapure water production can be challenging, particularly in arid regions or areas facing water stress. Availability and quality of water sources might directly affect the scalability & feasibility of ultrapure water production facilities, thereby hampering demand.

Production of ultrapure water also involves energy-intensive processes such as reverse osmosis, distillation, or ion exchange. These processes consume substantial amounts of energy.

It might contribute to carbon footprint and environmental impact of the ultrapure water industry. Need for sustainable practices and energy-efficient solutions might also pose a challenge for companies operating in the market.

Implementation of Strict Quality Standards to Propel Demand for High-purity Water

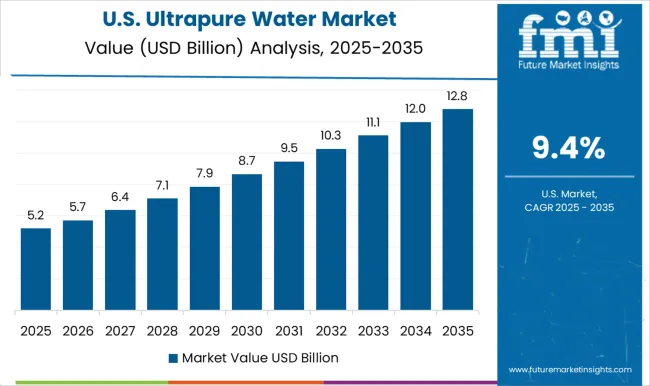

The United States is set to hold a significant position as a key country in the global ultrapure water industry in 2025. The country’s strong semiconductor sector, technological innovation, and diverse industrial applications are projected to influence the market.

Adherence to quality standards and research & development activities are also estimated to drive the market.

Diverse industrial applications of ultrapure water in the United States would contribute to robust growth in the market. Ultrapure water is set to be extensively used in pharmaceutical production, power generation, electronics manufacturing, and healthcare facilities.

The industries have stringent quality standards and regulations, necessitating the use of ultrapure water to ensure product quality, safety, and compliance. The United States market caters to the needs of these industries, providing ultrapure water solutions that meet specific purity requirements of each sector.

Investments in Water Treatment Facilities in China to Push Demand for Ultrapure Water Systems

China is estimated to dominate the global ultrapure water market in 2025, and is projected to continue its dominance during the forecast period. The country has witnessed significant growth in its semiconductor sector.

It is gradually becoming a global hub for semiconductor manufacturing. As semiconductors are a key application area for ultrapure water, expanding semiconductor sector in China would directly drive demand.

Rising government's support for infrastructure development and investment in water treatment technologies would further strengthen the country's position in the market. The country is investing in advanced water treatment facilities, including reverse osmosis systems, ion exchange systems, and ultraviolet disinfection, to meet increasing demand for ultrapure water.

High Manufacturing of Electronic Devices in India to Propel Sales of Ultrapure Water Filters

India is expected to create ample opportunities for ultrapure water manufacturers in the next ten years. The country is witnessing a significant growth in its semiconductor and electronics manufacturing sectors. It is increasingly becoming a leading manufacturing hub for electronic devices.

Various favorable government policies, a growing consumer base, and increasing investments in the electronics sector are a few key factors anticipated to boost the market. The country is also experiencing robust growth in its pharmaceutical sector. It is estimated to create innovative opportunities for ultrapure water manufacturers in India.

On-site Generation to be the Ideal Delivery Method for Ultrapure Water Systems

The on-site generation segment is anticipated to dominate the global ultrapure water market with a significant share of 53.4% in 2025. It is estimated to reach a valuation of USD 3.2 billion in the assessment period.

On-site generation (OSG) refers to the production of ultrapure water at the point of use, eliminating the need for transportation and storage of pre-treated water.

OSG systems are becoming increasingly popular in various sectors, including pharmaceuticals, electronics, power generation, and laboratories. This is due to their numerous advantages over traditional water supply methods. Increasing demand for cost-effective methods that can offer continuity & reliability for manufacturing processes requiring a constant and high-quality water supply would drive growth.

Semiconductor Companies to Look for Highly Purified Water All Over the Globe

The semiconductor segment is expected to lead the global ultrapure water market due to high demand for this type of water in manufacturing processes. The segment is estimated to consume around 10.9 billion gallon of ultrapure water in 2025. It is expected to surpass a market valuation of USD 1.1 billion in 2025.

Semiconductor manufacturing processes require exceptionally high levels of water purity to ensure the quality and reliability of semiconductor devices. Even minute impurities or particles can cause defects or failures in final products.

Ultrapure water is set to be essential for critical operations such as wafer cleaning, rinsing, etching, and photolithography, where stringent purity standards are necessary.

The ultrapure water market features a competitive landscape for both manufacturers and solution & technology providers operating globally. These companies would focus on delivering high-quality ultrapure water solutions.

They would aim to meet demanding requirements of sectors such as semiconductors, pharmaceuticals, power generation, and electronics manufacturing. While the market is diverse and dynamic, several prominent companies would play a significant role in the competitive landscape.

Key market participants are continuously investing in the development of advanced water treatment technologies. They want to improve the quality, efficiency, and sustainability of their systems & processes.

Development of smart monitoring & control systems, innovative membrane technologies, and energy-efficient systems are a few ongoing innovations in the ultrapure water industry.

For instance:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 10.9 billion |

| Projected Market Valuation (2035) | USD 31.1 billion |

| Value-based CAGR (2025 to 2035) | 11.1% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD billion) and Volume (billion gallons) |

| Market Segments Covered | Delivery Method, Technology, End-use Industry, Region |

| Regions Covered | North America; Latin America; East Asia; South Asia & Pacific; Western Europe; Eastern Europe; Central Asia; Russia & Belarus; Balkan & Baltic Countries; Middle East & Africa |

| Key Countries Covered | United States, Canada, Mexico, Brazil, China, Japan, South Korea, Indonesia, Malaysia, Germany, France, Italy, Spain, BENELUX, United Kingdom, Russia, The Gulf Cooperation Council Countries, Türkiye, South Africa |

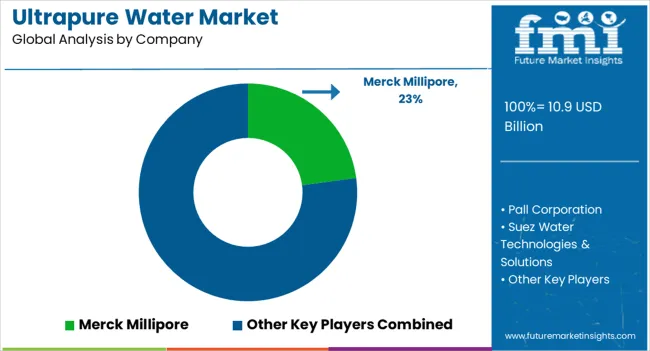

| Key Companies Profiled | Merck Millipore; Pall Corporation; Suez Water Technologies & Solutions; Veolia Water Technologies; ELGA LabWater; Aqua Solutions; Evoqua Water Technologies; Media Analytics Ltd; Agilent Technologies; Biobase Biodustry; Bio-Rad Laboratories; Bruker Daltonics; Calgon Carbon Corporation; EMD Millipore Corporation; Hach Company; Nanostone Water; Purolite Corporation |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

The global ultrapure water market is estimated to be valued at USD 10.9 billion in 2025.

The market size for the ultrapure water market is projected to reach USD 31.1 billion by 2035.

The ultrapure water market is expected to grow at a 11.1% CAGR between 2025 and 2035.

The key product types in ultrapure water market are .

In terms of technology, reverse osmosis (ro) segment to command 54.2% share in the ultrapure water market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA