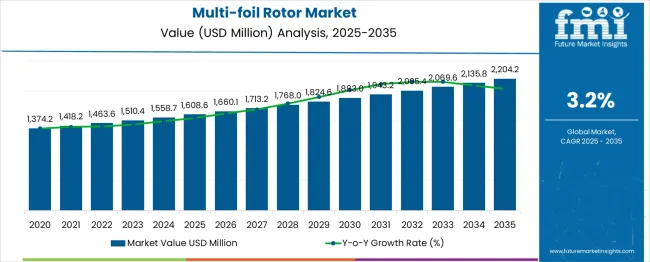

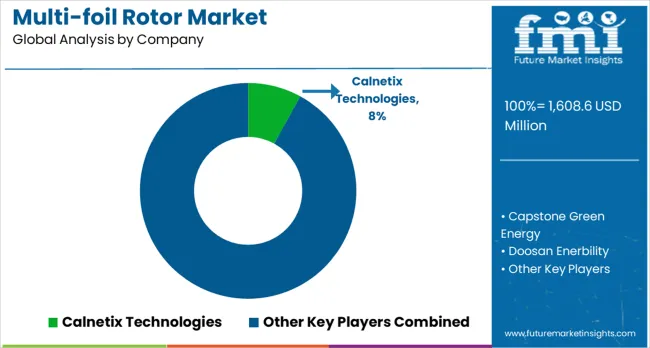

The global multi-foil rotor market is projected to grow from USD 1,608.6 million in 2025 to approximately USD 2,204.1 million by 2035, recording an absolute increase of USD 595.6 million over the forecast period. This translates into a total growth of 37.0%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.2% between 2025 and 2035. The overall market size is expected to grow by nearly 1.37X during the same period, supported by the rising adoption of advanced turbomachinery systems and increasing demand for high-efficiency rotating equipment across industrial applications.

Between 2025 and 2030, the multi-foil rotor market is projected to expand from USD 1,608.6 million to USD 1,883.0 million, resulting in a value increase of USD 274.4 million, which represents 46.1% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of advanced turbomachinery in power generation facilities, increasing industrial automation requiring precision rotating equipment, and growing awareness among operators about the importance of high-efficiency rotor systems. Equipment manufacturers are expanding their multi-foil rotor capabilities to address the growing complexity of modern industrial applications.

From 2030 to 2035, the market is forecast to grow from USD 1,883.0 million to USD 2,204.1 million, adding another USD 321.2 million, which constitutes 53.9% of the overall ten-year expansion. This period is expected to be characterized by expansion of specialized rotor manufacturing capabilities, integration of advanced materials and coating technologies, and development of standardized performance protocols across different industrial applications. The growing adoption of sustainable energy systems and advanced manufacturing processes will drive demand for more sophisticated multi-foil rotor solutions and specialized technical expertise.

Between 2020 and 2025, the multi-foil rotor market experienced steady expansion from USD 1,403.9 million to USD 1,608.6 million, driven by increasing adoption of advanced turbomachinery in industrial applications and growing awareness of efficiency requirements in rotating equipment. The market developed as industrial facilities recognized the need for specialized rotor technologies to achieve optimal performance and reliability. Equipment manufacturers and end-users began emphasizing advanced multi-foil rotor systems to maintain operational efficiency and reduce maintenance costs.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,608.6 million |

| Forecast Value in (2035F) | USD 2,204.1 million |

| Forecast CAGR (2025 to 2035) | 3.2% |

Market expansion is being supported by the rapid increase in advanced industrial applications requiring high-precision rotating equipment and the corresponding need for specialized multi-foil rotor systems. Modern industrial facilities rely on precise rotor performance and advanced bearing technologies to ensure proper functioning of critical equipment including turbines, compressors, and high-speed machinery. Even minor improvements in rotor design can result in significant performance gains and operational cost reductions.

The growing complexity of industrial processes and increasing efficiency requirements are driving demand for professional multi-foil rotor solutions from certified manufacturers with appropriate expertise and quality standards. Industrial operators are increasingly requiring advanced rotor documentation and performance guarantees to maintain operational reliability and meet regulatory compliance. Technical specifications and manufacturer requirements are establishing standardized rotor performance criteria that require specialized materials and precision manufacturing processes.

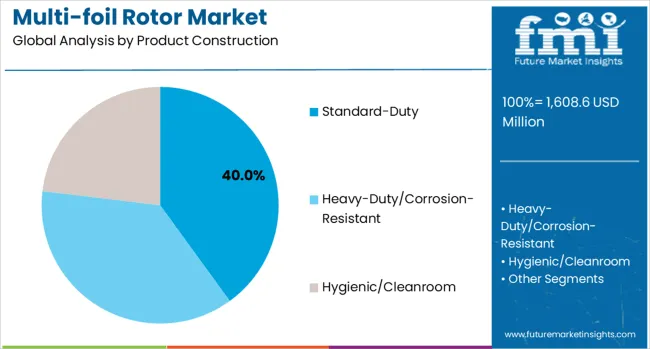

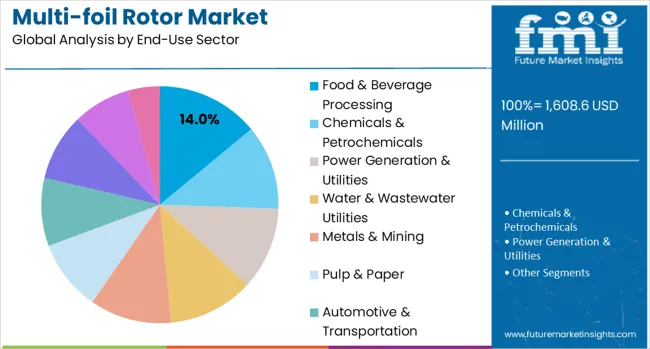

The market is segmented by product construction, capacity/size class, end-use sector, compliance/standard, and region. By product construction, the market is divided into standard-duty, heavy-duty/corrosion-resistant, and hygienic/cleanroom configurations. Based on capacity/size class, the market is categorized into small, medium, and large rotors. In terms of end-use sector, the market spans food & beverage processing, chemicals & petrochemicals, power generation & utilities, water & wastewater utilities, metals & mining, pulp & paper, automotive & transportation, electronics & semiconductors, oil & gas, and construction & building services. By compliance/standard, the market is classified into ISO/EN, ANSI/ASME, and customer/other specifications.

The standard-duty construction segment is projected to account for 40% of the multi-foil rotor market in 2025, reflecting its widespread use across conventional industrial environments. These rotors are designed using proven materials and established manufacturing processes, ensuring dependable performance under normal operating conditions. Their ability to deliver reliable results in general-purpose applications makes them the default choice for most industries, particularly where specialized or heavy-duty configurations are unnecessary.

This segment benefits from cost-effectiveness, easy availability, and well-established design frameworks that simplify both procurement and maintenance. Multiple suppliers provide standardized models, ensuring consistency and broad accessibility across regions. Standard-duty rotors also offer compatibility with a wide range of equipment, reinforcing their versatility. By balancing durability with affordability, they remain the most attractive option for facilities looking to optimize rotating equipment investments without over-specifying system requirements.

Medium-capacity/size class rotors are expected to represent 45% of market demand in 2025, establishing themselves as the dominant category. These rotors deliver an optimal balance between performance and cost-effectiveness, making them suitable for diverse industrial applications. Medium-sized units are often deployed in facilities where equipment must combine efficiency, flexibility, and manageable operating costs. Their versatility allows them to support a broad range of process requirements, ensuring wide applicability.

The segment also benefits from advancements in rotor design that improve energy efficiency and reliability while maintaining reasonable manufacturing costs. Medium-sized rotors are favored in new facility installations as well as retrofit projects, where scalability and adaptability are critical. Growing industrial development worldwide, particularly in food processing, chemicals, and utilities, continues to fuel demand for medium-capacity solutions that can handle varying workloads while maintaining consistent performance.

The food and beverage processing sector is projected to account for 14% of the multi-foil rotor market in 2025, making it the largest single end-use application. Facilities in this industry require rotor systems that ensure contamination-free operation, precise speed control, and long-term reliability across multiple production lines. Stainless steel construction and hygienic designs are often essential to meet stringent safety and regulatory standards.

This segment is also driven by the rise of automation and advanced process equipment in modern food plants. Multi-foil rotors are integrated into mixers, conveyors, and packaging systems, where consistent performance is vital to maintaining product quality. With global demand for processed foods and beverages continuing to rise, food manufacturers are investing in rotor technologies that combine efficiency with compliance. These factors secure food and beverage as a key growth driver for the market.

The ISO/EN compliance segment is forecasted to hold 40% of the multi-foil rotor market in 2025, reflecting its role as the benchmark for international quality standards. These certifications provide assurance of performance, safety, and environmental responsibility, making them widely preferred by both equipment manufacturers and industrial operators. Facilities adopting ISO/EN-compliant rotors benefit from reduced regulatory risks and simplified global procurement processes.

For suppliers, adherence to ISO/EN standards enables access to international markets while ensuring compatibility across diverse applications. Standardized documentation, testing procedures, and service requirements further strengthen their appeal, particularly in industries where consistency is essential. As cross-border trade and multinational operations expand, demand for ISO/EN-certified equipment continues to grow. This ensures the segment’s dominance, reinforcing its role in maintaining global quality assurance for industrial rotating equipment.

The multi-foil rotor market is advancing steadily due to increasing industrial automation and growing recognition of high-efficiency rotor system importance. However, the market faces challenges including high manufacturing costs, need for specialized materials and precision manufacturing processes, and varying performance requirements across different industrial applications. Standardization efforts and quality certification programs continue to influence manufacturing quality and market development patterns.

The growing deployment of advanced materials and precision manufacturing techniques is enabling enhanced rotor performance characteristics, improved operational reliability, and extended service life. Advanced materials including specialized alloys and surface coatings provide superior performance and reduced maintenance requirements for demanding industrial applications. These technologies are particularly valuable for high-temperature and corrosive environment applications that require exceptional durability and reliability.

Modern multi-foil rotor applications are incorporating advanced monitoring systems and predictive maintenance technologies that improve operational efficiency and reduce unplanned downtime. Integration of sensor technologies and real-time performance monitoring enables more precise operational control and comprehensive maintenance planning. Advanced monitoring systems also support optimization of next-generation rotor technologies including active magnetic bearings and intelligent control systems.

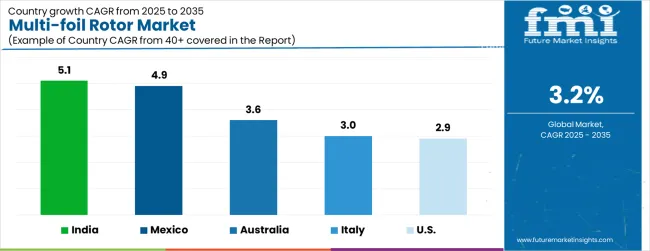

| Countries | CAGR (2025-2035) |

|---|---|

| India | 5.1% |

| Mexico | 4.9% |

| Australia | 3.6% |

| Italy | 3.0% |

| United States | 2.9% |

The multi-foil rotor market is growing rapidly, with India leading at a 5.1% CAGR through 2035, driven by strong industrial expansion, infrastructure development, and expanding manufacturing capabilities. Mexico follows at 4.9%, supported by rising industrial automation in manufacturing facilities and increasing adoption of advanced turbomachinery systems. Australia grows steadily at 3.6%, integrating advanced rotor technologies into its established mining and energy sectors. Italy records 3.0%, emphasizing precision manufacturing, quality standards, and specialized industrial applications. The USA shows steady growth at 2.9%, focusing on technological innovation, performance optimization, and advanced manufacturing processes. Overall, India and Mexico emerge as the leading drivers of global multi-foil rotor market expansion.

The report covers an in-depth analysis of 40+ countries; five top-performing countries are highlighted below.

Revenue from multi-foil rotors in India is projected to exhibit the highest growth rate with a CAGR of 5.1% through 2035, driven by rapid industrial expansion and increasing adoption of advanced manufacturing technologies in domestic production facilities. The country's expanding industrial infrastructure and growing process industries are creating significant demand for high-performance rotating equipment. Major industrial manufacturers and equipment suppliers are establishing comprehensive rotor manufacturing capabilities to support the growing population of advanced industrial facilities across urban and rural markets.

Revenue from multi-foil rotors in Mexico is expanding at a CAGR of 4.9%, supported by increasing industrial automation in manufacturing facilities and growing adoption of advanced process equipment technologies. The country's expanding manufacturing sector and increasing industrial investment are driving demand for professional rotor solutions. Industrial facilities and specialized equipment suppliers are gradually establishing capabilities to serve the growing population of advanced manufacturing operations.

Revenue from multi-foil rotors in Australia is growing at a CAGR of 3.6%, driven by established mining and energy sectors and growing recognition of advanced rotor technology importance in critical applications. The country's mature industrial infrastructure is gradually integrating advanced rotor capabilities to serve modern equipment requirements. Mining operations and energy facilities are investing in rotor technologies and maintenance programs to address growing performance demands.

Demand for multi-foil rotors in Italy is projected to grow at a CAGR of 3.0%, supported by the country's emphasis on precision manufacturing and advanced industrial technology development. Italian industrial manufacturers are implementing comprehensive rotor capabilities that meet stringent quality standards and application specifications. The market is characterized by focus on technical excellence, advanced materials integration, and compliance with comprehensive industrial quality regulations.

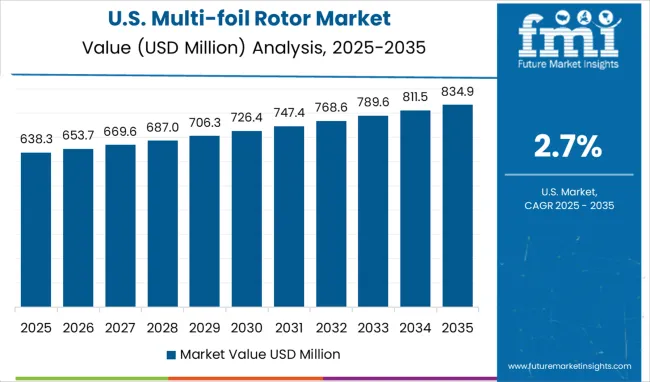

Demand for multi-foil rotors in the USA is expanding at a CAGR of 2.7%, driven by technological innovation and growing emphasis on performance optimization across industrial applications. Large industrial networks and specialized equipment manufacturers are establishing comprehensive rotor capabilities to serve diverse application needs. The market benefits from advanced research and development programs and manufacturer requirements for performance documentation and quality compliance following installation and commissioning activities.

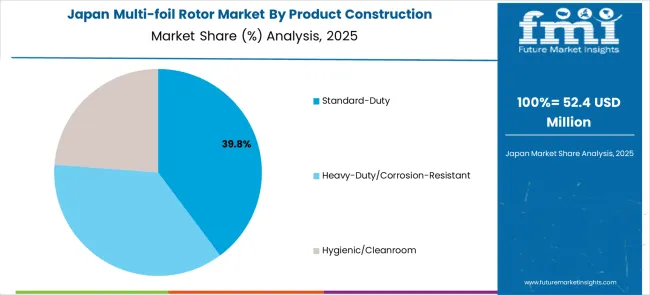

In Japan, the multi-foil rotor market is largely driven by power generation applications, which account for 39.8% of total service revenues in 2025. The high penetration of advanced turbomachinery in the domestic power sector and the stringent performance protocols mandated for critical rotating equipment are key contributing factors. Petrochemical applications follow with a 30% share, primarily in refining and chemical processing facilities that integrate precision rotating systems. Other industrial applications contribute 25% as advanced rotor adoption across diverse sectors continues to expand.

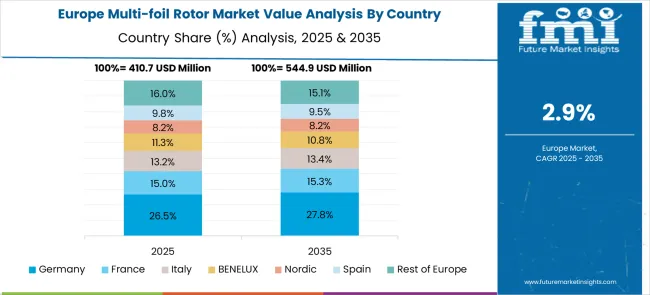

The European multi-foil rotor market demonstrates advanced development across major economies with the UK leading through its aerospace engineering expertise and turbomachinery innovation, supported by companies like Rolls-Royce (microturbines/R&D) and SKF pioneering cutting-edge rotor technologies for high-speed applications. Germany shows significant strength through TURBONIK GmbH, leveraging precision manufacturing capabilities and advanced materials engineering for specialized rotor solutions. The UK contributes through aerospace industry leadership and research excellence, while international players like Honeywell Aerospace and Parker Aerospace establish strong European presence.

France and Italy exhibit expanding adoption in power generation and industrial applications, driven by energy transition requirements and advanced manufacturing needs. Nordic countries emphasize sustainable energy solutions and high-efficiency turbomachinery, while Eastern European markets show growing interest in modern power generation infrastructure. The market benefits from strict performance standards, advanced materials research, and the region's leadership in turbomachinery technology, positioning Europe as a key innovation center for next-generation multi-foil rotor solutions across aerospace, power generation, and industrial applications requiring high-speed rotation, precision engineering, and advanced materials capabilities.

The multi-foil rotor market is defined by competition among specialized manufacturers, industrial equipment suppliers, and advanced technology companies. Companies are investing in advanced materials research, precision manufacturing capabilities, standardized quality procedures, and technical expertise development to deliver reliable, efficient, and cost-effective rotor solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

Calnetix Technologies, USA-based, offers advanced multi-foil rotor solutions with a focus on magnetic bearing systems, high-speed applications, and technical innovation. Capstone Green Energy, operating globally, provides comprehensive rotor systems integrated with microturbine technology and distributed energy solutions. Doosan Enerbility, South Korea, delivers technologically advanced rotor systems with standardized procedures and industrial integration. Honeywell Aerospace, USA, emphasizes aerospace-grade rotor technologies and high-reliability applications.

Mitsubishi Heavy Industries, Japan, offers rotor solutions integrated into comprehensive industrial equipment operations. Mohawk Innovative Technology, USA, provides specialized multi-foil bearing systems with advanced technical capabilities. Parker Aerospace, USA delivers rotor technologies for aerospace and industrial applications. Rolls-Royce, SKF, and TURBONIK GmbH offer specialized rotor expertise, standardized procedures, and service reliability across global and regional networks.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,608.6 million |

| Product Construction | Standard-Duty, Heavy-Duty/Corrosion-Resistant, Hygienic/Cleanroom |

| Capacity/Size Class | Small, Medium, Large |

| End-Use Sector | Food & Beverage Processing, Chemicals & Petrochemicals, Power Generation & Utilities, Water & Wastewater Utilities, Metals & Mining, Pulp & Paper, Automotive & Transportation, Electronics & Semiconductors, Oil & Gas, Construction & Building Services |

| Compliance/Standard | ISO/EN, ANSI/ASME, Customer/Other |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Calnetix Technologies, Capstone Green Energy, Doosan Enerbility, Honeywell Aerospace, Mitsubishi Heavy Industries, Mohawk Innovative Technology, Parker Aerospace, Rolls-Royce, SKF, and TURBONIK GmbH |

| Additional Attributes | Dollar sales by rotor size and foil configuration, regional demand trends, competitive landscape, buyer preferences for high-efficiency versus cost-optimized designs, integration with turbomachinery platforms, innovations in advanced alloys, aerodynamic optimization, and vibration-reduction technologies |

The global multi-foil rotor market is estimated to be valued at USD 1,608.6 million in 2025.

The market size for the multi-foil rotor market is projected to reach USD 2,204.2 million by 2035.

The multi-foil rotor market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in multi-foil rotor market are standard-duty, heavy-duty/corrosion-resistant and hygienic/cleanroom.

In terms of capacity/size class, medium segment to command 45.0% share in the multi-foil rotor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Multi-Drug/Combination Injectable Market Forecast and Outlook 2025 to 2035

Multiplex Sepsis Biomarker Panels Market Size and Share Forecast Outlook 2025 to 2035

Multiplex Protein Profiling Market Size and Share Forecast Outlook 2025 to 2035

Multihead Weighers Market Size and Share Forecast Outlook 2025 to 2035

Multi-Cloud Networking Market Forecast Outlook 2025 to 2035

Multispectral Camera Market Size and Share Forecast Outlook 2025 to 2035

Multi-functional Packaging Market Size and Share Forecast Outlook 2025 to 2035

Multiplex Biomarker Imaging Market Forecast and Outlook 2025 to 2035

Multichannel Order Management Market Forecast and Outlook 2025 to 2035

Multiexperience Development Platform Market Forecast and Outlook 2025 to 2035

Multi Depth Corrugated Box Market Size and Share Forecast Outlook 2025 to 2035

Multilayer Flexible Packaging Market Size and Share Forecast Outlook 2025 to 2035

Multi Attachment Loaders Market Size and Share Forecast Outlook 2025 to 2035

Multi Pocket Holders Market Size and Share Forecast Outlook 2025 to 2035

Multi-Screen Super Glass Market Size and Share Forecast Outlook 2025 to 2035

Multichannel Reagent Reservoir Market Size and Share Forecast Outlook 2025 to 2035

Multi-Functional Point Of Care Testing Market Size and Share Forecast Outlook 2025 to 2035

Multi-layer Film Recycling Market Size and Share Forecast Outlook 2025 to 2035

Multifunctional Household Robot Market Size and Share Forecast Outlook 2025 to 2035

Multistage Ring Section Pumps Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA