The multi-functional packaging market is expanding rapidly as brands across industries seek packaging that offers enhanced protection, sustainability, and interactive consumer engagement. Industry bulletins and corporate sustainability disclosures have emphasized the shift from conventional packaging to intelligent formats that offer features such as moisture control, temperature responsiveness, antimicrobial surfaces, and traceability.

With consumers increasingly prioritizing safety, freshness, and transparency, manufacturers have integrated multi-functionality into packaging as a value differentiator. Regulatory trends favoring recyclable, lightweight, and material-efficient solutions have further accelerated demand for advanced packaging technologies.

Additionally, innovations in nanocoatings, active packaging materials, and smart sensors are reshaping packaging design for improved shelf life and logistics efficiency. Businesses in food, healthcare, and personal care sectors have shown strong uptake of multi-functional packaging to meet compliance, hygiene, and convenience expectations. Looking ahead, growth is projected to continue with the widespread adoption of flexible and recyclable materials and the integration of IoT-enabled features for product tracking and consumer engagement.

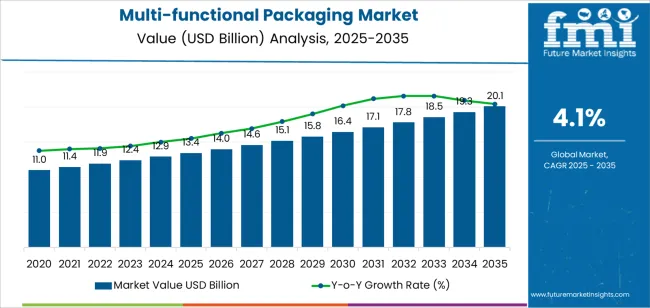

| Metric | Value |

|---|---|

| Multi-functional Packaging Market Estimated Value in (2025 E) | USD 13.4 billion |

| Multi-functional Packaging Market Forecast Value in (2035 F) | USD 20.1 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

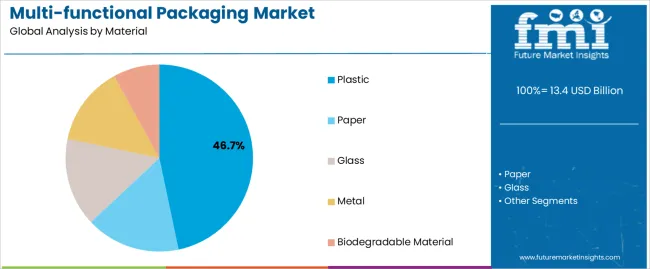

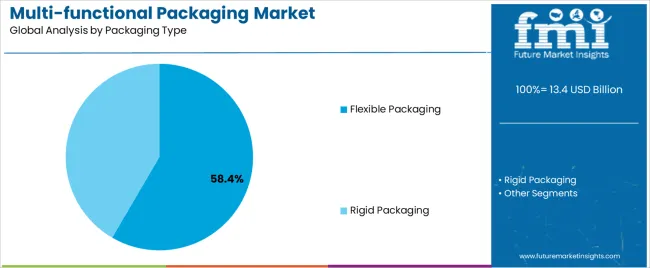

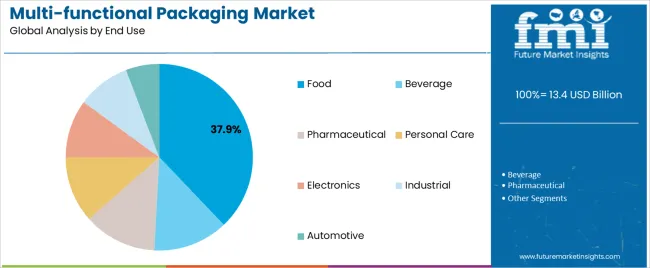

The market is segmented by Material, Packaging Type, and End Use and region. By Material, the market is divided into Plastic, Paper, Glass, Metal, and Biodegradable Material. In terms of Packaging Type, the market is classified into Flexible Packaging and Rigid Packaging. Based on End Use, the market is segmented into Food, Beverage, Pharmaceutical, Personal Care, Electronics, Industrial, and Automotive. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Plastic segment is projected to account for 46.7% of the multi-functional packaging market revenue in 2025, maintaining its dominance due to versatility, low cost, and compatibility with advanced packaging functions. Growth in this segment has been supported by the adaptability of plastic to various barrier properties, mechanical strengths, and sealing capabilities required for active and intelligent packaging.

Manufacturers have favored plastics such as polyethylene and polypropylene for their ability to incorporate moisture barriers, oxygen scavengers, and antimicrobial agents. Additionally, the emergence of recyclable and biodegradable plastic formulations has addressed growing regulatory and consumer concerns over environmental sustainability.

Industry announcements have noted the development of smart plastics embedded with sensors or QR code integration, further expanding use cases in food safety and traceability. With continued R&D in lightweight and functionally enhanced plastic packaging, the segment is expected to retain its leading market position amid the broader transition to more sustainable material usage.

The Flexible Packaging segment is expected to contribute 58.4% of the market revenue in 2025, positioning it as the leading packaging type in the multi-functional packaging landscape. This segment’s growth has been propelled by rising demand for lightweight, space-saving, and easily transportable packaging formats that cater to both B2C and B2B applications.

Flexible packaging has enabled the integration of multiple functionalities such as reclosability, puncture resistance, and environmental responsiveness. Supply chain insights and packaging innovations have emphasized the benefits of flexible formats in extending shelf life, reducing material usage, and lowering transportation costs.

Moreover, flexible packaging formats such as pouches and sachets have provided an ideal platform for embedding active components like desiccants and temperature indicators. As food safety, portability, and waste reduction remain top priorities for manufacturers and consumers alike, flexible packaging is anticipated to remain the most favored format for delivering multi-functional capabilities.

The Food segment is projected to account for 37.9% of the multi-functional packaging market revenue in 2025, establishing itself as the leading end-use sector. This growth has been driven by heightened focus on food safety, shelf-life extension, and packaging that supports freshness and traceability.

Retail and logistics stakeholders have prioritized packaging that provides visual indicators of spoilage, maintains optimal atmospheric conditions, and supports tamper-evidence to assure consumers. Food companies have increasingly adopted intelligent packaging solutions to comply with regulatory labeling requirements and reduce food waste through condition-responsive packaging.

Press releases from major food brands have announced integration of QR-enabled and antimicrobial features into everyday packaging formats to improve consumer trust and supply chain transparency. Additionally, the growing popularity of ready-to-eat meals, perishable foods, and e-commerce grocery deliveries has heightened the need for protective, functional, and sustainable packaging. As innovation in active food-grade materials continues to accelerate, the Food segment is expected to remain the largest consumer of multi-functional packaging technologies.

QR Codes, RFID Tags, and NFC Chips to Increase the Adoption

The incorporation of smart technologies like QR codes, RFID tags, and NFC chips is a significant trend driving the adoption of multi-functional packaging. These technologies enhance product information accessibility, traceability, and authenticity. These additions to the packaging are highly sought after by consumers. Consumers in the developed parts of the world are also willing to pay extra for these facilities.

Sustainability Drive to Influence the Sales of Multi-functional Packaging

Consumers are constantly shifting toward sustainability and eco-friendly packaging alternatives. This has significantly benefitted the multi-functional packaging industry as companies in this market are increasingly using biodegradable, recyclable, or compostable materials to cater to the demands of eco-conscious consumers and businesses. Several governments have also imposed bans on single-use plastic for packaging, which has also prompted brands and businesses to turn towards environmentally viable multi-functional packaging.

Limited Consumer Awareness and Acceptance to Slow Down Market Growth

While there is an increasing trend towards sustainable packaging solutions, there is still a significant portion of the market that is unaware or skeptical of the benefits of multi-functional packaging. This trend is observed in economically disadvantaged parts of the world where the per capita income of people is generally below the world average. Industry giants must tap into these regions to make the people more aware and thus drive the adoption of multi-functional packaging.

The multi-functional packaging market heavily relies on the performance of various sectors across sectors such as packaging, e-commerce, gift retail, consumer goods and products, etc. Besides this, the market is also influenced by sustainability trends and the integration of smart technologies. The industry has seen a series of ups and downs in the past few years. Before the pandemic, the market showcased a decent growth rate.

When the pandemic hit, the world faced sudden shutdowns and closures. Economies were closed to mitigate the spread of the virus. This affected a wide spectrum of industries, including multi-functional packaging. Supply chain disruptions also meant that the production and distribution of multi-functional packaging were severely impacted. Raw material shortages, logistical challenges, and workforce constraints led to delays and increased costs.

During the period of 2020 to 2025, the multi-functional packaging market reported a CAGR of 3.1%. With the opening of the economies, the industry also began to recover, showing signs of resilience and adaptation. The market also benefited from a renewed focus on sustainability and hygiene. The pandemic accelerated consumer demand for packaging that ensures product safety and minimizes environmental impact.

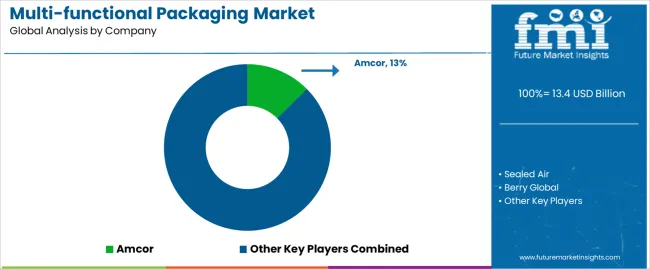

Tier one companies in the multi-functional packaging market, such as Amcor, Sealed Air, Berry Global, Mondi, and Ball Corporation are focusing on sustainability and innovation to stand out. They are investing heavily in eco-friendly materials and advanced packaging technologies.

For instance, Amcor and Mondi are developing recyclable and biodegradable packaging solutions, while Sealed Air and Berry Global are enhancing smart packaging features. Ball Corporation is leading in sustainable aluminum packaging, catering to growing environmental concerns.

Sonoco, WestRock, and Graphic Packaging Holding Company, some of the few examples of tier-two companies in the industry, are leveraging strategic acquisitions and partnerships to expand their market reach and capabilities. These companies are enhancing their product portfolio through innovative packaging designs while focusing on integrating digital printing and automation technologies.

They are also prioritizing sustainable packaging solutions, particularly in the food and beverage sectors, to meet consumer demand for environmentally friendly products.

Tier-three companies such as are distinguishing themselves by specializing in flexible packaging solutions and emphasizing customization and innovation. These companies are expanding their presence in niche markets by offering tailored packaging solutions that meet specific customer needs.

The following segment delves into an industry analysis of the multi-functional packaging market across various countries. It offers insights into the market outlook across prominent countries, encompassing North America, Asia Pacific, Europe, and other areas.

India is projected to maintain its leading position within the Asian region, with an anticipated Compound Annual Growth Rate (CAGR) of 4.3% extending to 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| Canada | 3.8% |

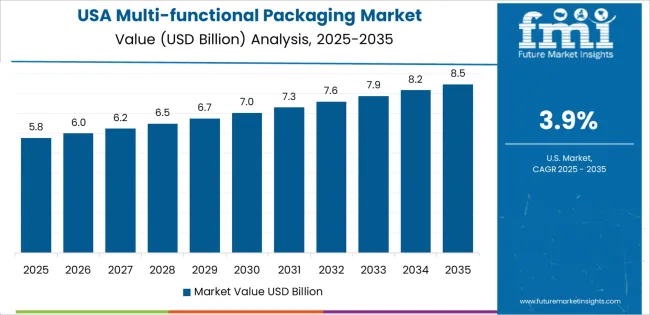

| The United States | 3.9% |

| Germany | 3.7% |

| India | 4.3% |

| Thailand | 4.2% |

| South Korea | 4.1% |

| China | 4.2% |

The multi-functional packaging industry in India is slated to show a 4.3% CAGR for the forecast period of 2025 to 2035. The market is experiencing significant expansion, primarily due to the rapid urbanization and changing lifestyles of the burgeoning middle class.

This growth is boosting the demand for packaged goods, including food, beverages, and personal care products. The demographic shift is also increasing the need for packaging that offers convenience, safety, and extended shelf life, thus driving the adoption of multi-functional packaging solutions.

The growing awareness of environmental sustainability is also prompting consumers and businesses to seek eco-friendly packaging options. Multi-functional packaging that incorporates recyclable materials and reduces waste aligns with these preferences and is further fuelling market growth.

The expansion of eCommerce platforms and online retailing is driving demand for packaging solutions that can protect products during transit while providing an engaging unboxing experience.

China also is a promising country in this industry. Over the next ten years, the multi-functional packaging industry is projected to rise at 4.2% CAGR.

China’s booming eCommerce sector is driving demand for packaging solutions that ensure product safety, convenience, and visual appeal during shipping and delivery.

Multi-functional packaging with features like resealability, tamper-evidence, and easy-open mechanisms is in high demand to meet the needs of online retailers and consumers. China's rapidly expanding food and beverage industry is also fueling demand for packaging that extends shelf life, enhances product freshness, and complies with stringent food safety regulations.

Smart multi-functional packaging that includes active and intelligent packaging solutions is also in high demand throughout the supply chain. Also, the government's initiatives to promote sustainable development are encouraging the adoption of eco-friendly packaging materials and practices, further driving market growth.

The United States global multi-functional packaging industry is anticipated to exhibit a CAGR of 3.9% through 2035. The country holds a diverse and affluent consumer base. This demographic demands packaging solutions that offer convenience, safety, and sustainability.

Multi-functional packaging addresses these needs by providing features such as easy-open seals, resealable closures, and eco-friendly materials. Besides this, the rise of e-commerce and online shopping has led to increased demand for packaging that can protect products during shipping and enhance the unboxing experience.

The growing emphasis on health and wellness is driving demand for packaging solutions that preserve product freshness and integrity, particularly in the food and pharmaceutical sectors. Multi-functional packaging with active and intelligent features is increasingly adopted to meet these requirements, thus driving market growth in the United States.

The multi-functional packaging industry is categorized on the basis of material, end-use, packaging type, and region. The section discusses the top two categories in this industry.

Based on end use, the multi-functional packaging industry is classified into food, beverage, pharmaceutical, personal care, electronics, industrial, and automotive. Among these, the food segment accounts for a majority share of 24% in the global marketplace.

| End-use | Food |

|---|---|

| Value Share (2025) | 24% |

The demand for multi-functional packaging in the food industry is primarily due to the need for enhanced food preservation and safety. Multi-functional packaging solutions, such as those with oxygen scavengers, moisture absorbers, and antimicrobial coatings, help extend the shelf life of perishable items by maintaining optimal conditions within the packaging.

Multi-functional packaging solutions are also sought after as they offer features like tamper-evident seals and secure closures that provide an extra layer of protection. These functionalities are particularly important in the era of global food distribution, where products may travel long distances and be exposed to various environmental conditions. This is one of the significant factors driving the adoption of multi-functional packaging in the food industry.

A wide spectrum of materials are used in multi-functional packaging such as plastic, paper, glass, metal, and biodegradable material. Plastic multi-functional packaging solutions hold a market valuation of 28%, as of 2025.

| Material | Plastic |

|---|---|

| Value Share (2025) | 28% |

Plastic is highly preferred in the multi-functional packaging industry due to its versatility and durability. It offers excellent barrier properties that protect against moisture, oxygen, and contaminants, ensuring product freshness and safety. Plastic packaging is lightweight, reducing transportation costs and carbon footprint.

The demand for plastic multi-functional packaging is also touching the skies as it is cost-effective and provides a high degree of design flexibility, allowing manufacturers to create attractive, user-friendly packaging solutions. The material's recyclability and advancements in biodegradable plastics are pushing businesses to turn towards plastic for their packaging needs.

The multi-functional packaging market consists of a multitude of companies, all vying to spread their market reach beyond international borders. These companies are prioritizing sustainability to stand out by developing eco-friendly materials, such as biodegradable and recyclable plastics, and reducing the carbon footprint of their production processes.

These companies are also incorporating advanced technologies into packaging solutions. For this, they are including smart packaging features like QR codes, RFID tags, and NFC chips that provide consumers with real-time information, and track product authenticity.

Companies are also exploring active packaging technologies that extend shelf life and maintain product quality. Features such as easy-open mechanisms, resealable closures, and portion control are significantly utilized to enhance consumer satisfaction.

Recent Developments:

The multifunctional packaging market is segmented by end-use, material, and packaging type.

The packaging type segmentation consists of flexible packaging and rigid packaging.

The end-user segments include food, beverage, pharmaceutical, personal care, electronics, industrial, and automotive.

The multi-functional packaging market is also divided by material type, comprising plastic, paper, glass, metal, and biodegradable materials.

Key countries of North America, Latin America, Europe, East Asia, South Asia, Middle East and Africa (MEA), and Oceania have been covered in the report.

The global multi-functional packaging market is estimated to be valued at USD 13.4 billion in 2025.

The market size for the multi-functional packaging market is projected to reach USD 20.1 billion by 2035.

The multi-functional packaging market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in multi-functional packaging market are plastic, paper, glass, metal and biodegradable material.

In terms of packaging type, flexible packaging segment to command 58.4% share in the multi-functional packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Packaging Bins Market Trends - Growth & Demand 2025 to 2035

Packaging Inserts Market Insights - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA