The recyclable plastic films market is expected to grow from USD 26.74 billion in 2025 to USD 51.56 billion by 2035, growing at 5.1% CAGR. This expansion is propelled by increasing demand for eco-friendly flexible packaging, regulatory action against single-use plastics, and rising investment in circular economy frameworks. The European Union’s Packaging and Packaging Waste Regulation (PPWR), updated in 2024, has catalyzed the shift to mono-material recyclable films across food, personal care, and household segments.

Parallel policy momentum in the USA, including the EPA’s National Recycling Strategy, is incentivizing brand owners and converters to adopt polyethylene- and polypropylene-based recyclable solutions. Environmental coalitions such as the Ellen MacArthur Foundation continue to champion recyclable films as pivotal to eliminating packaging waste.

Innovation is accelerating across the value chain. Dow Packaging’s 2023 initiative to commercialize high-barrier PE films that can be recycled through store-drop programs was a landmark shift. Nestlé’s packaging head Philippe Blank stated in late 2024, “Recyclable plastic films help us advance net-zero goals while safeguarding product quality.”

Growth in use cases-especially in frozen food, snacks, and hygiene products- is encouraging fast-moving consumer goods (FMCG) firms to scale recyclable film deployment. Amazon’s Climate Pledge and Walmart’s recyclable packaging mandate further signal institutional backing for this transition.

Traceability and recycling compatibility are becoming strategic imperatives. In 2024, Sealed Air launched its RE-CODE system, embedding digital watermarks into film substrates to facilitate sorting and identification during mechanical recycling. Berry Global’s closed-loop pilot in North America uses AI-integrated recyclers to ensure feedstock purity. In recognition of such strides, the Flexible Packaging Association awarded Huhtamaki the 2024 Sustainability Innovation Gold Award.

Polyethylene films are projected to hold over 50% share by 2035, with significant adoption in pouch, wrap, and overwrap formats. As supply chains prioritize recyclability and carbon transparency, recyclable plastic films are emerging as foundational to next-generation packaging systems.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 26.74 billion |

| Industry Value (2035F) | USD 51.56 billion |

| CAGR (2025 to 2035) | 5.1% |

The global recyclable plastic films industry has been comprehensively analyzed across several key segments to provide a detailed outlook from 2020 to 2024 and forecast through 2025 to 2035. The material types assessed include polyethylene terephthalate (PET), polyethylene (PE), poly vinyl chloride (PVC), polypropylene (PP), polystyrene (PS), bio-based plastic, and others such as PA, PVDC, and EVOH.

Product formats covered in the analysis include bags, pouches, sachets, stick packs, wraps, and other packaging formats. Distribution insights are provided across online and offline sales channels. The end-use industries examined include food, beverages, pharmaceuticals, cosmetics and personal care, homecare and toiletries, electronics, and others like chemicals and fertilizers. Regionally, the analysis spans North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa (MEA).

Polyethylene (PE) is set to emerge as the most financially attractive material in the recyclable plastic films segment, projected to reach USD 21.4 billion by 2035, compounding at a CAGR of 5.6% from its estimated 2025 base of USD 12.3 billion. Its dominance stems from high adaptability across food, personal care, and retail sectors, along with compatibility with mono-material recyclable packaging. PE’s recyclability via mechanical processes also aligns with upcoming EPR (Extended Producer Responsibility) compliance mandates in North America and the EU.

Polyethylene Terephthalate (PET) will continue to hold a strong position, growing at 5.2% CAGR, driven by its superior barrier properties and recyclability in closed-loop bottle-to-film systems. PET films are expected to generate USD 8.6 billion in revenue by 2035, fueled by demand in beverages and cosmetics.

Bio-based plastics are forecast to grow fastest at 6.3% CAGR, though from a smaller base of USD 1.9 billion in 2025. With sustainability-led mandates tightening, brands are integrating these materials for green labeling and regulatory credits. However, cost-to-value constraints and processing limitations temper widespread adoption.

Polypropylene (PP) is projected to expand at a 4.8% CAGR, led by flexible packaging innovations in snacks and pharmaceuticals. PP’s heat resistance makes it a preferred substrate, yet recycling stream complexity and multi-layer construction slightly limit upside.

Polystyrene (PS), despite technical recyclability, remains a laggard at 2.1% CAGR due to low collection rates and increasing bans across Europe and California. PVC is forecast to shrink at a negative CAGR of -0.5%, with usage curtailed due to chlorine content and poor recycling infrastructure.

The “Others” category, including PA, PVDC, and EVOH, will grow modestly at 3.4% CAGR, mostly driven by niche applications requiring advanced barrier properties.

| Material Type | CAGR (2025 to 2035) |

|---|---|

| Polyethylene (PE) | 5.60% |

| Polyethylene Terephthalate (PET) | 5.20% |

| Polypropylene (PP) | 4.80% |

| Bio-based Plastic | 6.30% |

| Polystyrene (PS) | 2.10% |

| Others (PA, PVDC, EVOH, etc.) | 3.40% |

Pouches will be the most lucrative product format in the recyclable plastic films industry, projected to scale from USD 7.2 billion in 2025 to USD 14.0 billion by 2035, compounding at a CAGR of 6.8%. Their high-volume demand across food, beverage, and personal care categories, coupled with design adaptability for mono-material recyclability, makes them central to brand-level packaging transitions. Pouches also align with source-reduction goals due to their low material-to-volume ratio, reinforcing adoption in both developed and emerging economies.

Wraps follow closely, expected to reach USD 11.3 billion by 2035, growing at 5.4% CAGR. Dominant in foodservice, retail, and industrial unit-load applications, wraps benefit from broad-scale compatibility with PE and PP substrates and ongoing e-commerce expansion that favors high-speed, recyclable overwraps.

Bags, while large in volume, show moderate growth at 4.3% CAGR, reaching USD 10.9 billion by 2035. Demand persists across grocery, trash liner, and textile packaging categories, though regulatory friction around lightweight bag formats in Europe and North America caps further upside.

Stick packs and sachets-both commonly used in single-dose pharma, food, and personal care-are expected to grow at 4.6% and 4.2% CAGR, respectively. Despite strong functional utility, their multi-laminate nature complicates recyclability. Efforts are underway to engineer mono-material recyclable versions, but adoption remains uneven.

The “Other Formats” segment (including lidding films, sleeves, and blister wraps) will grow at a 3.5% CAGR, driven by niche use cases with tighter regulatory oversight, particularly in pharmaceuticals and high-barrier food preservation.

| Product Format | CAGR (2025 to 2035) |

|---|---|

| Pouches | 6.80% |

| Wraps | 5.40% |

| Bags | 4.30% |

| Stick Packs | 4.60% |

| Sachets | 4.20% |

| Other Formats | 3.50% |

The offline channel will continue to dominate the distribution landscape of recyclable plastic films, with projected revenues rising from USD 19.7 billion in 2025 to USD 34.8 billion by 2035, translating to a CAGR of 5.7%. This sustained momentum is supported by strong institutional procurement from FMCG brands, pharmaceutical manufacturers, and industrial bulk buyers who engage in long-term B2B contracts. Offline channels benefit from integrated supply chain partnerships, physical quality checks, and just-in-time inventory models-especially vital for high-specification applications in food-grade and healthcare-grade films.

However, the online segment is emerging as the growth leader, expected to grow at a CAGR of 6.4%, expanding from USD 7.0 billion in 2025 to USD 13.1 billion by 2035. This surge is driven by the increasing digitization of procurement workflows, particularly among SMEs and D2C brands seeking agile sourcing. The rise of digital B2B marketplaces and procurement platforms, paired with an expanding portfolio of customizable, recyclable SKUs, supports traction. Moreover, enhanced traceability, lower minimum order quantities, and transparent pricing models make online channels more appealing to sustainability-driven enterprises.

That said, offline still contributes over 70% of total value in 2025, and its entrenched presence in regulated industries like pharma and food manufacturing ensures long-term relevance. Online is likely to cannibalize smaller offline volumes in packaging for cosmetics, startups, and regional private labels, but is unlikely to fully displace established procurement contracts in the near term.

| Sales Channel | CAGR (2025 to 2035) |

|---|---|

| Offline | 5.70% |

| Online | 6.40% |

The food segment is projected to remain the dominant and most lucrative end-use sector, forecasted to grow from USD 11.8 billion in 2025 to USD 22.7 billion by 2035, reflecting a CAGR of 6.5%. This growth is underpinned by sustained demand for shelf-stable, visually transparent, and recyclable flexible films across frozen meals, snacks, bakery goods, and ready-to-eat formats. Regulatory mandates pushing for mono-material packaging in Europe and parts of Asia further accelerate food brand conversions to recyclable substrates.

Pharmaceuticals follow as the second-highest growth segment with a CAGR of 6.2%, climbing from USD 3.6 billion in 2025 to USD 6.6 billion in 2035. Rising demand for tamper-evident and sterile-compliant recyclable films, especially in unit-dose packaging and medical sachets, drives adoption. Formulation-sensitive barriers, however, require innovation in recyclable laminates-pushing R&D investments.

Cosmetics and personal careare another strong performer, expected to grow at a CAGR of 5.9%, led by sustainability commitments from leading beauty brands. From face mask sachets to tube laminates, recyclable plastic film is becoming a baseline requirement in premium segments.

Beverages will expand at a more modest 4.7% CAGR, reaching USD 5.1 billion by 2035, as PET recyclability in labels, shrink films, and overwraps gains ground. Yet structural constraints in liquid packaging remain a bottleneck for full recyclability integration.

Homecare and toiletries are set to grow at 5.0% CAGR, with demand driven by wipes, refill pouches, and detergent films. Recyclable PE and PP films dominate the segment, but chemical compatibility limits full conversion.

Electronics, growing at 4.3% CAGR, and others (chemical & fertilizers), at 3.9%, contribute niche demand where antistatic and chemically resistant recyclable films are required, although volume share remains low.

| End Use | CAGR (2025 to 2035) |

|---|---|

| Food | 6.50% |

| Pharmaceuticals | 6.20% |

| Cosmetics and Personal Care | 5.90% |

| Beverages | 4.70% |

| Homecare and Toiletries | 5.00% |

| Electronics | 4.30% |

| Others (Chemical & Fertilizers) | 3.90% |

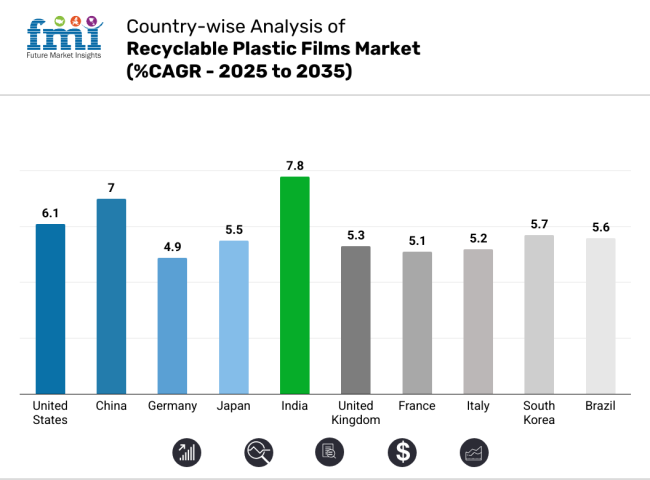

The United States will anchor global expansion in the recyclable plastic films industry, benefitting from synchronized regulatory enforcement, corporate sustainability mandates, and innovation in film materials and recycling technologies. Following the USA Environmental Protection Agency’s National Recycling Strategy, state-level mandates in California, New York, and Oregon have laid out Extended Producer Responsibility (EPR) frameworks, compelling producers to ensure end-of-life recyclability.

Federal incentives under the Infrastructure Investment and Jobs Act have increased funding for local recycling modernization, particularly AI-enabled sorting for film-grade materials. Concurrently, major retailers like Walmart and Target have started rejecting multilayer, non-recyclable film packaging from suppliers, accelerating the shift to mono-material formats.

FMCG players are redesigning secondary and tertiary packaging using recyclable PE and PP films, while B2B e-commerce operators increasingly demand curbside-compatible packaging formats to meet ESG benchmarks. Public-private partnerships have also spurred chemical recycling pilots in Ohio, Texas, and Georgia. From USD 6.2 billion in 2025, the USA industry is expected to scale to USD 11.2 billion by 2035, growing at a 6.1% CAGR. With infrastructure support, consumer awareness, and brand leadership, the USA will remain the cornerstone for recyclable plastic film innovation and commercialization.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.1% |

China’s recyclable plastic films industry is undergoing accelerated transformation amid sweeping sustainability mandates and industrial reform. Since implementing its "National Sword" policy, which banned the import of plastic waste, China has redirected its recycling strategy toward domestic efficiency and circularity.

Policies issued by the National Development and Reform Commission (NDRC) require businesses to eliminate non-recyclable plastic film from their supply chains by 2025. E-commerce leaders like Alibaba and JD.com have committed to using recyclable packaging for over 90% of their outbound shipments by 2030.

China's vast manufacturing capacity across electronics, food, and pharmaceuticals makes it a high-volume consumer of flexible films. As global brands demand compliance across their Chinese operations, the incentive to localize recyclable film production has intensified. Local governments in Guangdong, Zhejiang, and Jiangsu provinces are offering tax rebates and financing to converters transitioning to recyclable mono-material films.

From USD 5.5 billion in 2025, the industry is expected to reach USD 10.8 billion by 2035, growing at a CAGR of 7.0%. China will be pivotal not only as a high-growth consumer industry but also as a scalable production and technology base for recyclable plastic films.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.0% |

Germany remains a cornerstone of Europe’s circular economy movement, with a fully integrated packaging waste management framework under the VerpackG legislation. The country’s Dual System for packaging licensing links recycling fees directly to material type and design, encouraging the use of recyclable mono-material films. Germany’s recycling rates exceed 65% for plastic packaging, driven by both regulatory enforcement and citizen compliance. This environment incentivizes local and international packaging producers to adopt low-barrier, high-recovery film formats.

Leading retailers such as Aldi and Lidl now require suppliers to certify recyclability through recognized frameworks such as RecyClass or the German Central Packaging Registry (ZSVR). Local innovation centers in Frankfurt and Munich are pioneering PE-EVOH-PE laminates and digital watermark sorting. From USD 2.1 billion in 2025, Germany’s industry is projected to reach USD 3.4 billion by 2035, reflecting a CAGR of 4.9%. Germany’s influence extends beyond national borders through its role in setting EU standards and exporting circular packaging technology across Europe.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.9% |

Japan’s approach to recyclable plastic films is shaped by its deeply ingrained waste-sorting culture, technological precision, and strong regulatory backing. The Ministry of the Environment’s Plastic Resource Circulation Strategy mandates design-for-recyclability principles and encourages industrial partnerships to reduce multilayer laminate usage. Japanese manufacturers are at the forefront of chemical recycling methods, enabling the recovery of high-performance films otherwise considered unrecyclable.

The food and electronics industries, Japan’s largest consumers of flexible packaging, are increasingly adopting recyclable PE-based films for microwaveable trays, snack pouches, and component wraps. Household brands like Shiseido and Ajinomoto have pledged to eliminate non-recyclable plastics from their product lines by 2030.

From USD 1.8 billion in 2025, the recyclable plastic films industry is forecast to grow to USD 3.1 billion by 2035, posting a 5.5% CAGR. Japan’s integration of design innovation and recycling infrastructure sets it apart as a model for high-performance, recyclable packaging systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.5% |

India is emerging as one of the fastest-growing recyclable plastic film industries, driven by regulatory pressure and consumer demand for eco-conscious packaging. The Indian Government’s Plastic Waste Management Rules mandate producers to achieve recyclability targets across their packaging by 2026. Complementary policies like the Swachh Bharat Mission have heightened public awareness, while state-level bans on multilayer plastics have forced rapid redesign across sectors.

India’s dynamic FMCG sector, especially in snacks, dairy, and personal care, is migrating to recyclable films made of PE and PP. Startups and regional converters are experimenting with digital printing, smart labels, and low-barrier films that meet the recyclability threshold for decentralized recovery systems. From USD 1.5 billion in 2025, the industry is expected to double to USD 3.2 billion by 2035, growing at 7.8% CAGR. India’s demographic size, digital supply chains, and government incentives position it as a global volume engine for recyclable film packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.8% |

The UK’s recyclable plastic films industry is set for steady growth, fueled by its upcoming Extended Producer Responsibility scheme and the implementation of a Plastic Packaging Tax. These legislative tools are reshaping corporate behavior across retail, food, and healthcare supply chains. British supermarkets like Tesco and Sainsbury’s have shifted to mono-material flexible films for private-label products and are using certified recyclability labels to educate consumers.

Recyclable films are being rapidly adopted in frozen food, pet care, and pharmaceuticals, driven by both compliance and ESG reporting pressures. Local recyclers and film manufacturers are working closely to enhance mechanical recycling capabilities that handle flexible substrates. From USD 1.2 billion in 2025, the UK industry is projected to expand to USD 2.1 billion by 2035, with a CAGR of 5.3%. The UK’s regulatory agility and brand commitment to recyclability metrics will ensure a resilient and sustainable transition in packaging materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.3% |

France is advancing recyclable plastic films through its Anti-Waste Law for a Circular Economy, which mandates recyclability labeling and 100% recyclable packaging for all consumer products by 2025. These standards are pushing major brands and retailers to reformulate packaging portfolios with PE- and PP-based recyclable films. Local converters are pioneering recyclable laminates that meet shelf-life and barrier requirements for dairy, meat, and cosmetics sectors.

Retailers like Carrefour and Intermarket have initiated supply chain audits, penalizing non-compliant packaging and promoting bulk purchasing options that reduce film waste. France’s eco-modulation of recycling fees further incentivizes the use of certified recyclable substrates. From USD 1.0 billion in 2025, the French industry is expected to reach USD 1.7 billion by 2035, at a CAGR of 5.1%. With EU alignment and national resolve, France stands out as a regulatory leader in harmonizing recyclability with product performance.

| Country | CAGR (2025 to 2035) |

|---|---|

| France | 5.1% |

Italy’s recyclable plastic films sector is seeing traction due to its high per capita packaging consumption and recent reforms under its Circular Economy Strategy. The country’s implementation of EU packaging directives, including mandatory recyclability labeling, is driving demand for films that can be easily sorted and processed in national facilities. Italy’s agro-food and luxury packaging industries are investing in premium recyclable laminates that meet brand aesthetics and regulatory standards.

Film producers in regions like Emilia-Romagna and Lombardy are receiving EU funding to develop bio-based and PE mono-material alternatives to multi-layer structures. From USD 0.9 billion in 2025, Italy’s industry is expected to expand to USD 1.5 billion by 2035, growing at a 5.2% CAGR. Italy’s niche in premium recyclable design, combined with regional circularity hubs, gives it a competitive edge in Southern Europe.

| Country | CAGR (2025 to 2035) |

|---|---|

| Italy | 5.2% |

South Korea is becoming a model for recyclable plastic film adoption through its high-tech waste collection infrastructure and regulatory clarity. The Ministry of Environment mandates that packaging must be easily sortable into designated recycling streams, pushing brands toward transparent, mono-layer designs. South Korea’s leading conglomerates, including Lotte and Samsung, are embedding recyclability as a core procurement criterion.

Demand for recyclable films is increasing in household cleaning, electronics, and frozen food categories. The government’s digital labeling initiatives and public deposit systems make material recovery efficient and transparent. From USD 0.8 billion in 2025, South Korea’s industry will grow to USD 1.4 billion by 2035, recording a 5.7% CAGR. As an early mover in digitized circularity, South Korea offers lessons in both infrastructure integration and consumer participation.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.7% |

Brazil’s recyclable plastic films industry is expanding steadily, supported by national recycling goals and state-level plastic reduction policies. The National Solid Waste Policy (PNRS) requires reverse logistics programs and targets for packaging recyclability. Municipalities in São Paulo, Curitiba, and Belo Horizonte are investing in sorting and collection upgrades to accommodate flexible film recovery.

Agribusiness, food processing, and personal care brands are leading adopters of recyclable PE and PP films, especially for bulk and shelf-stable formats. Brazil’s private sector is also engaging in circular economy innovation through closed-loop pilots in urban areas. From USD 0.7 billion in 2025, the industry is projected to reach USD 1.2 billion by 2035, with a 5.6% CAGR. Brazil’s evolving regulatory landscape and scale of domestic consumption position it as a key recyclable film growth industry in Latin America.

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 5.6% |

| Company Name | Estimated Market Share (%) |

|---|---|

| Amcor Plc | 10-12% |

| Berry Global Inc | 9-11% |

| Sonoco Products Company | 7-9% |

| WestRock LLC | 6-8% |

| Sealed Air Corporation | 5-7% |

| Indorama Ventures | 4-6% |

Amcor Plc

Amcor Plc stands as a global leader in sustainable packaging solutions, particularly within the recyclable and paper-based product segments. The company’s flagship initiative, the AmFiber™ platform, is a critical part of its strategy to achieve 100% recyclability or reusability of all its products by 2025. AmFiber leverages high-barrier paper technologies to deliver functional packaging alternatives to plastic films, aimed at the food, beverage, healthcare, and personal care industries.

Berry Global Inc

Berry Global Inc. continues to pivot its strategy toward high-growth, consumer-centric packaging while maintaining a focused presence in adhesive technologies. The company’s decision to divest its specialty tapes division in 2023 highlights a streamlined approach aimed at core verticals such as healthcare, hygiene, and foodservice. Despite this shift, its Adchem® brand remains a cornerstone for technical adhesive solutions, including custom-engineered tapes and double-coated films used in automotive, electronics, and construction applications.

Sonoco Products Company

Sonoco Products Company is a century-old global packaging leader with a dedicated focus on fiber-based and recyclable materials. Its EnviroSense® Fiber Max™ product line demonstrates Sonoco’s strategy of combining strength, sustainability, and customizability in packaging for high-value and heavy products. These fiber-based tape and core solutions are fully recyclable and offer alternatives to traditional plastic packaging. Sonoco’s recent acquisition of Eviosys, a leading European metal packaging company, expands its material diversification and geographic footprint across 20 countries.

WestRock LLC

WestRock LLC, now merged with Smurfit Kappa under the new entity Smurfit WestRock, is one of the largest paper and packaging producers globally, with operations in more than 40 countries. The company has a strong track record in sustainable corrugated and paper-based packaging, and its acquisition of Plymouth Packaging significantly strengthened its on-demand box manufacturing capabilities. WestRock’s solutions are aligned with EPR and compost ability regulations in the EU and North America.

Sealed Air Corporation

Sealed Air Corporation is well-known for its innovations in protective packaging and has progressively expanded its portfolio to include paper-based solutions made from 100% recycled content. The company’s EcoSystem™ packaging platform supports circularity by focusing on materials that are both curbside recyclable and optimized for e-commerce logistics. Sealed Air’s products serve high-volume sectors such as electronics, foodservice, and retail fulfillment.

Indorama Ventures Public Co., Ltd

Indorama Ventures (IVL) is a diversified global chemical company based in Thailand, best known for its leadership in PET and polyester production. While traditionally focused on resins, IVL has strategically expanded its scope to include fiber-based packaging and tape substrates, integrating sustainability across its manufacturing footprint.

Plastipak Holdings, Inc.

Plastipak Holdings, Inc. is a global leader in rigid plastic packaging and recycling, with increasing investments in flexible and recyclable packaging formats. Its strategic pillars include sustainability, vertical integration, and material science innovation. Plastipak operates state-of-the-art recycling centers in North America and Europe and provides PET preforms and film-grade resins to converters producing paper-reinforced and multilayer packaging.

UFlex Limited

UFlex Limited is India’s largest multinational in the flexible packaging domain, offering an end-to-end portfolio across films, adhesives, laminates, and now, recyclable paper-based tapes. The company is vertically integrated with in-house film extrusion, ink formulation, and holography capabilities, giving it a strategic edge in delivering customizable, high-performance tapes. UFlex’sProject Plastic Fix demonstrates its commitment to sustainable innovation, targeting chemical recycling and compostable substrates.

Placon Corp

Placon Corp is a prominent USA-based manufacturer specializing in custom plastic thermoformed and injection-molded packaging, with a growing footprint in paper-integrated formats. The company’s EcoStar® line utilizes post-consumer PET and is expanding into paper-reinforced flexible packaging to meet retail and medical segment sustainability requirements. Placon serves large-scale grocery, electronics, and pharmaceutical clients with lightweight, recyclable packaging formats, including tray-seal solutions that incorporate paper laminate structures.

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 26.74 billion |

| Projected Market Size (2035) | USD 51.56 billion |

| CAGR (2025 to 2035) | 5.1% |

| Base Year for Estimation | 2025 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion |

| By Material | Polyethylene Terephthalate (PET), Polyethylene (PE), Poly Vinyl Chloride (PVC), Polypropylene (PP), Polystyrene (PS), bio-based plastics, and an “others” category that covers specialty resins such as polyamides (PA), polyvinylidene chloride (PVDC), and ethylene vinyl alcohol (EVOH). |

| By Product | Bags, Pouches, Sachets, Stick Packs, Wraps, and Other Formats |

| By Sales Channel | Online and Offline |

| By End Use | Food, Beverages, Pharmaceuticals, Cosmetics and Personal Care, Homecare and Toiletries, Electronics, and Others (Chemical & Fertilizers, etc.) |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, and MEA |

| Countries Covered | United States, China, Germany, Japan, India, United Kingdom, France, Italy, South Korea |

| Key Players | Amcor Plc, Berry Global Inc., Sonoco Products Company, WestRock LLC, Sealed Air Corporation, Indorama Ventures Public Co., Ltd, ALPLA Werke Alwin Lehner GmbH & Co KG, Plastipak Holdings, Inc., UFlex Limited, Pactiv Corporation, Genpak, LLC, Phoenix Technologies, Anchor Packaging Inc., Placon Corp, Retal Industries LTD., and Alpha Packaging. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The industry is poised to reach USD 26.74 billion in 2025.

The industry is slated to register USD 51.56 billion by 2035.

The product is widely used in the food industry.

India, slated to grow at 7.8% CAGR during the study period, is poised for the fastest growth.

Key companies include Amcor Plc, Berry Global Inc., Sonoco Products Company, WestRock LLC, Sealed Air Corporation, Indorama Ventures Public Co., Ltd, ALPLA Werke Alwin Lehner GmbH & Co KG, Plastipak Holdings, Inc., UFlex Limited, Pactiv Corporation, Genpak, LLC, Phoenix Technologies, Anchor Packaging Inc., Placon Corp, Retal Industries LTD., and Alpha Packaging.

Table 1: Global Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Value (US$ Million) Forecast by Material, 2018 to 2033

Table 4: Global Volume (Tons) Forecast by Material, 2018 to 2033

Table 5: Global Value (US$ Million) Forecast by Product, 2018 to 2033

Table 6: Global Volume (Tons) Forecast by Product, 2018 to 2033

Table 7: Global Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 9: Global Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Global Volume (Tons) Forecast by End Use, 2018 to 2033

Table 11: North America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Volume (Tons) Forecast by Country, 2018 to 2033

Table 13: North America Value (US$ Million) Forecast by Material, 2018 to 2033

Table 14: North America Volume (Tons) Forecast by Material, 2018 to 2033

Table 15: North America Value (US$ Million) Forecast by Product, 2018 to 2033

Table 16: North America Volume (Tons) Forecast by Product, 2018 to 2033

Table 17: North America Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 18: North America Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 19: North America Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 20: North America Volume (Tons) Forecast by End Use, 2018 to 2033

Table 21: Latin America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Volume (Tons) Forecast by Country, 2018 to 2033

Table 23: Latin America Value (US$ Million) Forecast by Material, 2018 to 2033

Table 24: Latin America Volume (Tons) Forecast by Material, 2018 to 2033

Table 25: Latin America Value (US$ Million) Forecast by Product, 2018 to 2033

Table 26: Latin America Volume (Tons) Forecast by Product, 2018 to 2033

Table 27: Latin America Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 28: Latin America Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 29: Latin America Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Latin America Volume (Tons) Forecast by End Use, 2018 to 2033

Table 31: Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: Europe Value (US$ Million) Forecast by Material, 2018 to 2033

Table 34: Europe Volume (Tons) Forecast by Material, 2018 to 2033

Table 35: Europe Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Europe Volume (Tons) Forecast by Product, 2018 to 2033

Table 37: Europe Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 38: Europe Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 39: Europe Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Europe Volume (Tons) Forecast by End Use, 2018 to 2033

Table 41: East Asia Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: East Asia Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: East Asia Value (US$ Million) Forecast by Material, 2018 to 2033

Table 44: East Asia Volume (Tons) Forecast by Material, 2018 to 2033

Table 45: East Asia Value (US$ Million) Forecast by Product, 2018 to 2033

Table 46: East Asia Volume (Tons) Forecast by Product, 2018 to 2033

Table 47: East Asia Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: East Asia Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 49: East Asia Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 50: East Asia Volume (Tons) Forecast by End Use, 2018 to 2033

Table 51: South Asia Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia Volume (Tons) Forecast by Country, 2018 to 2033

Table 53: South Asia Value (US$ Million) Forecast by Material, 2018 to 2033

Table 54: South Asia Volume (Tons) Forecast by Material, 2018 to 2033

Table 55: South Asia Value (US$ Million) Forecast by Product, 2018 to 2033

Table 56: South Asia Volume (Tons) Forecast by Product, 2018 to 2033

Table 57: South Asia Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 58: South Asia Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 59: South Asia Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 60: South Asia Volume (Tons) Forecast by End Use, 2018 to 2033

Table 61: Oceania Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: Oceania Volume (Tons) Forecast by Country, 2018 to 2033

Table 63: Oceania Value (US$ Million) Forecast by Material, 2018 to 2033

Table 64: Oceania Volume (Tons) Forecast by Material, 2018 to 2033

Table 65: Oceania Value (US$ Million) Forecast by Product, 2018 to 2033

Table 66: Oceania Volume (Tons) Forecast by Product, 2018 to 2033

Table 67: Oceania Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 68: Oceania Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 69: Oceania Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 70: Oceania Volume (Tons) Forecast by End Use, 2018 to 2033

Table 71: MEA Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: MEA Volume (Tons) Forecast by Country, 2018 to 2033

Table 73: MEA Value (US$ Million) Forecast by Material, 2018 to 2033

Table 74: MEA Volume (Tons) Forecast by Material, 2018 to 2033

Table 75: MEA Value (US$ Million) Forecast by Product, 2018 to 2033

Table 76: MEA Volume (Tons) Forecast by Product, 2018 to 2033

Table 77: MEA Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 78: MEA Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 79: MEA Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 80: MEA Volume (Tons) Forecast by End Use, 2018 to 2033

Table 1: Global Plantable Packaging Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Plantable Packaging Volume (Tonnes) Forecast by Region, 2018 to 2033

Table 3: Global Plantable Packaging Value (US$ Million) Forecast by Material, 2018 to 2033

Table 4: Global Plantable Packaging Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 5: Global Plantable Packaging Value (US$ Million) Forecast by Packaging Formats, 2018 to 2033

Table 6: Global Plantable Packaging Volume (Tonnes) Forecast by Packaging Formats, 2018 to 2033

Table 7: Global Plantable Packaging Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Plantable Packaging Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 9: North America Plantable Packaging Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Plantable Packaging Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 11: North America Plantable Packaging Value (US$ Million) Forecast by Material, 2018 to 2033

Table 12: North America Plantable Packaging Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 13: North America Plantable Packaging Value (US$ Million) Forecast by Packaging Formats, 2018 to 2033

Table 14: North America Plantable Packaging Volume (Tonnes) Forecast by Packaging Formats, 2018 to 2033

Table 15: North America Plantable Packaging Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Plantable Packaging Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 17: Latin America Plantable Packaging Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Plantable Packaging Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 19: Latin America Plantable Packaging Value (US$ Million) Forecast by Material, 2018 to 2033

Table 20: Latin America Plantable Packaging Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 21: Latin America Plantable Packaging Value (US$ Million) Forecast by Packaging Formats, 2018 to 2033

Table 22: Latin America Plantable Packaging Volume (Tonnes) Forecast by Packaging Formats, 2018 to 2033

Table 23: Latin America Plantable Packaging Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Plantable Packaging Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 25: Europe Plantable Packaging Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Plantable Packaging Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 27: Europe Plantable Packaging Value (US$ Million) Forecast by Material, 2018 to 2033

Table 28: Europe Plantable Packaging Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 29: Europe Plantable Packaging Value (US$ Million) Forecast by Packaging Formats, 2018 to 2033

Table 30: Europe Plantable Packaging Volume (Tonnes) Forecast by Packaging Formats, 2018 to 2033

Table 31: Europe Plantable Packaging Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Europe Plantable Packaging Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 33: East Asia Plantable Packaging Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: East Asia Plantable Packaging Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 35: East Asia Plantable Packaging Value (US$ Million) Forecast by Material, 2018 to 2033

Table 36: East Asia Plantable Packaging Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 37: East Asia Plantable Packaging Value (US$ Million) Forecast by Packaging Formats, 2018 to 2033

Table 38: East Asia Plantable Packaging Volume (Tonnes) Forecast by Packaging Formats, 2018 to 2033

Table 39: East Asia Plantable Packaging Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: East Asia Plantable Packaging Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 41: South Asia Plantable Packaging Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia Plantable Packaging Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 43: South Asia Plantable Packaging Value (US$ Million) Forecast by Material, 2018 to 2033

Table 44: South Asia Plantable Packaging Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 45: South Asia Plantable Packaging Value (US$ Million) Forecast by Packaging Formats, 2018 to 2033

Table 46: South Asia Plantable Packaging Volume (Tonnes) Forecast by Packaging Formats, 2018 to 2033

Table 47: South Asia Plantable Packaging Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: South Asia Plantable Packaging Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 49: Oceania Plantable Packaging Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Oceania Plantable Packaging Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 51: Oceania Plantable Packaging Value (US$ Million) Forecast by Material, 2018 to 2033

Table 52: Oceania Plantable Packaging Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 53: Oceania Plantable Packaging Value (US$ Million) Forecast by Packaging Formats, 2018 to 2033

Table 54: Oceania Plantable Packaging Volume (Tonnes) Forecast by Packaging Formats, 2018 to 2033

Table 55: Oceania Plantable Packaging Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 56: Oceania Plantable Packaging Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 57: MEA Plantable Packaging Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: MEA Plantable Packaging Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 59: MEA Plantable Packaging Value (US$ Million) Forecast by Material, 2018 to 2033

Table 60: MEA Plantable Packaging Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 61: MEA Plantable Packaging Value (US$ Million) Forecast by Packaging Formats, 2018 to 2033

Table 62: MEA Plantable Packaging Volume (Tonnes) Forecast by Packaging Formats, 2018 to 2033

Table 63: MEA Plantable Packaging Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 64: MEA Plantable Packaging Volume (Tonnes) Forecast by End Use, 2018 to 2033

Figure 1: Global Value (US$ Million) by Material, 2023 to 2033

Figure 2: Global Value (US$ Million) by Product, 2023 to 2033

Figure 3: Global Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Value (US$ Million) by End Use, 2023 to 2033

Figure 5: Global Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Volume (Tons) Analysis by Region, 2018 to 2033

Figure 8: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 11: Global Volume (Tons) Analysis by Material, 2018 to 2033

Figure 12: Global Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 13: Global Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 14: Global Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 15: Global Volume (Tons) Analysis by Product, 2018 to 2033

Figure 16: Global Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 17: Global Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 18: Global Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 20: Global Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 21: Global Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 22: Global Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 23: Global Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 24: Global Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 25: Global Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 26: Global Attractiveness by Material, 2023 to 2033

Figure 27: Global Attractiveness by Product, 2023 to 2033

Figure 28: Global Attractiveness by Sales Channel, 2023 to 2033

Figure 29: Global Attractiveness by End Use, 2023 to 2033

Figure 30: Global Attractiveness by Region, 2023 to 2033

Figure 31: North America Value (US$ Million) by Material, 2023 to 2033

Figure 32: North America Value (US$ Million) by Product, 2023 to 2033

Figure 33: North America Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 34: North America Value (US$ Million) by End Use, 2023 to 2033

Figure 35: North America Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Volume (Tons) Analysis by Country, 2018 to 2033

Figure 38: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 41: North America Volume (Tons) Analysis by Material, 2018 to 2033

Figure 42: North America Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 43: North America Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 44: North America Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 45: North America Volume (Tons) Analysis by Product, 2018 to 2033

Figure 46: North America Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 47: North America Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 48: North America Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 49: North America Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 50: North America Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 51: North America Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 52: North America Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 53: North America Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 54: North America Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 55: North America Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 56: North America Attractiveness by Material, 2023 to 2033

Figure 57: North America Attractiveness by Product, 2023 to 2033

Figure 58: North America Attractiveness by Sales Channel, 2023 to 2033

Figure 59: North America Attractiveness by End Use, 2023 to 2033

Figure 60: North America Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Value (US$ Million) by Material, 2023 to 2033

Figure 62: Latin America Value (US$ Million) by Product, 2023 to 2033

Figure 63: Latin America Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 64: Latin America Value (US$ Million) by End Use, 2023 to 2033

Figure 65: Latin America Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Volume (Tons) Analysis by Country, 2018 to 2033

Figure 68: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 71: Latin America Volume (Tons) Analysis by Material, 2018 to 2033

Figure 72: Latin America Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 73: Latin America Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 74: Latin America Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 75: Latin America Volume (Tons) Analysis by Product, 2018 to 2033

Figure 76: Latin America Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 77: Latin America Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 78: Latin America Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 79: Latin America Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 80: Latin America Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 81: Latin America Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 82: Latin America Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 83: Latin America Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 84: Latin America Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 85: Latin America Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 86: Latin America Attractiveness by Material, 2023 to 2033

Figure 87: Latin America Attractiveness by Product, 2023 to 2033

Figure 88: Latin America Attractiveness by Sales Channel, 2023 to 2033

Figure 89: Latin America Attractiveness by End Use, 2023 to 2033

Figure 90: Latin America Attractiveness by Country, 2023 to 2033

Figure 91: Europe Value (US$ Million) by Material, 2023 to 2033

Figure 92: Europe Value (US$ Million) by Product, 2023 to 2033

Figure 93: Europe Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 94: Europe Value (US$ Million) by End Use, 2023 to 2033

Figure 95: Europe Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Volume (Tons) Analysis by Country, 2018 to 2033

Figure 98: Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 101: Europe Volume (Tons) Analysis by Material, 2018 to 2033

Figure 102: Europe Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 103: Europe Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 104: Europe Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 105: Europe Volume (Tons) Analysis by Product, 2018 to 2033

Figure 106: Europe Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 107: Europe Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 108: Europe Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 109: Europe Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 110: Europe Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 111: Europe Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 112: Europe Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 113: Europe Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 114: Europe Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 115: Europe Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 116: Europe Attractiveness by Material, 2023 to 2033

Figure 117: Europe Attractiveness by Product, 2023 to 2033

Figure 118: Europe Attractiveness by Sales Channel, 2023 to 2033

Figure 119: Europe Attractiveness by End Use, 2023 to 2033

Figure 120: Europe Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Value (US$ Million) by Material, 2023 to 2033

Figure 122: East Asia Value (US$ Million) by Product, 2023 to 2033

Figure 123: East Asia Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: East Asia Value (US$ Million) by End Use, 2023 to 2033

Figure 125: East Asia Value (US$ Million) by Country, 2023 to 2033

Figure 126: East Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: East Asia Volume (Tons) Analysis by Country, 2018 to 2033

Figure 128: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: East Asia Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 131: East Asia Volume (Tons) Analysis by Material, 2018 to 2033

Figure 132: East Asia Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 133: East Asia Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 134: East Asia Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 135: East Asia Volume (Tons) Analysis by Product, 2018 to 2033

Figure 136: East Asia Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 137: East Asia Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 138: East Asia Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 139: East Asia Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 140: East Asia Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 141: East Asia Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 142: East Asia Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 143: East Asia Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 144: East Asia Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 145: East Asia Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 146: East Asia Attractiveness by Material, 2023 to 2033

Figure 147: East Asia Attractiveness by Product, 2023 to 2033

Figure 148: East Asia Attractiveness by Sales Channel, 2023 to 2033

Figure 149: East Asia Attractiveness by End Use, 2023 to 2033

Figure 150: East Asia Attractiveness by Country, 2023 to 2033

Figure 151: South Asia Value (US$ Million) by Material, 2023 to 2033

Figure 152: South Asia Value (US$ Million) by Product, 2023 to 2033

Figure 153: South Asia Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 154: South Asia Value (US$ Million) by End Use, 2023 to 2033

Figure 155: South Asia Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia Volume (Tons) Analysis by Country, 2018 to 2033

Figure 158: South Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 161: South Asia Volume (Tons) Analysis by Material, 2018 to 2033

Figure 162: South Asia Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 163: South Asia Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 164: South Asia Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 165: South Asia Volume (Tons) Analysis by Product, 2018 to 2033

Figure 166: South Asia Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 167: South Asia Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 168: South Asia Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 169: South Asia Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 170: South Asia Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 171: South Asia Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 172: South Asia Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 173: South Asia Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 174: South Asia Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 175: South Asia Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 176: South Asia Attractiveness by Material, 2023 to 2033

Figure 177: South Asia Attractiveness by Product, 2023 to 2033

Figure 178: South Asia Attractiveness by Sales Channel, 2023 to 2033

Figure 179: South Asia Attractiveness by End Use, 2023 to 2033

Figure 180: South Asia Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Value (US$ Million) by Material, 2023 to 2033

Figure 182: Oceania Value (US$ Million) by Product, 2023 to 2033

Figure 183: Oceania Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 184: Oceania Value (US$ Million) by End Use, 2023 to 2033

Figure 185: Oceania Value (US$ Million) by Country, 2023 to 2033

Figure 186: Oceania Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: Oceania Volume (Tons) Analysis by Country, 2018 to 2033

Figure 188: Oceania Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 191: Oceania Volume (Tons) Analysis by Material, 2018 to 2033

Figure 192: Oceania Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 193: Oceania Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 194: Oceania Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 195: Oceania Volume (Tons) Analysis by Product, 2018 to 2033

Figure 196: Oceania Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 197: Oceania Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 198: Oceania Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 199: Oceania Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 200: Oceania Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 201: Oceania Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 202: Oceania Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 203: Oceania Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 204: Oceania Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 205: Oceania Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 206: Oceania Attractiveness by Material, 2023 to 2033

Figure 207: Oceania Attractiveness by Product, 2023 to 2033

Figure 208: Oceania Attractiveness by Sales Channel, 2023 to 2033

Figure 209: Oceania Attractiveness by End Use, 2023 to 2033

Figure 210: Oceania Attractiveness by Country, 2023 to 2033

Figure 211: MEA Value (US$ Million) by Material, 2023 to 2033

Figure 212: MEA Value (US$ Million) by Product, 2023 to 2033

Figure 213: MEA Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 214: MEA Value (US$ Million) by End Use, 2023 to 2033

Figure 215: MEA Value (US$ Million) by Country, 2023 to 2033

Figure 216: MEA Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: MEA Volume (Tons) Analysis by Country, 2018 to 2033

Figure 218: MEA Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: MEA Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: MEA Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 221: MEA Volume (Tons) Analysis by Material, 2018 to 2033

Figure 222: MEA Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 223: MEA Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 224: MEA Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 225: MEA Volume (Tons) Analysis by Product, 2018 to 2033

Figure 226: MEA Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 227: MEA Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 228: MEA Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 229: MEA Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 230: MEA Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 231: MEA Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 232: MEA Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 233: MEA Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 234: MEA Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 235: MEA Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 236: MEA Attractiveness by Material, 2023 to 2033

Figure 237: MEA Attractiveness by Product, 2023 to 2033

Figure 238: MEA Attractiveness by Sales Channel, 2023 to 2033

Figure 239: MEA Attractiveness by End Use, 2023 to 2033

Figure 240: MEA Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Dielectric Films Market Size and Share Forecast Outlook 2025 to 2035

Craft Plastic Films Market

Printed Plastic Films Market Insights - Growth & Forecast 2025 to 2035

Cold Seal Plastic Films Market Size and Share Forecast Outlook 2025 to 2035

Thermoplastic Adhesive Films Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tubes for Effervescent Tablets Market Size and Share Forecast Outlook 2025 to 2035

Plastic Banding Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tube Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Recyclable Packaging Market Forecast and Outlook 2025 to 2035

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA