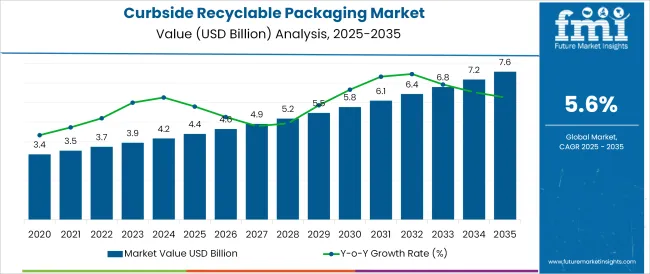

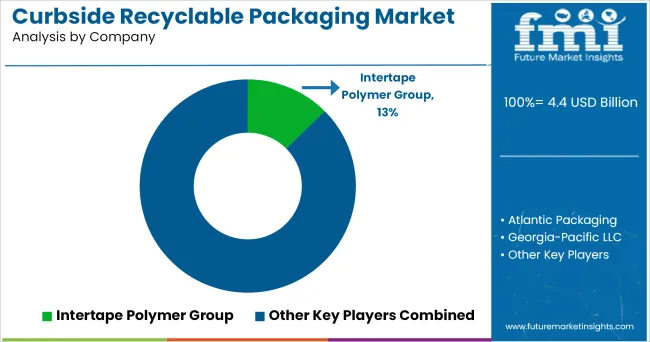

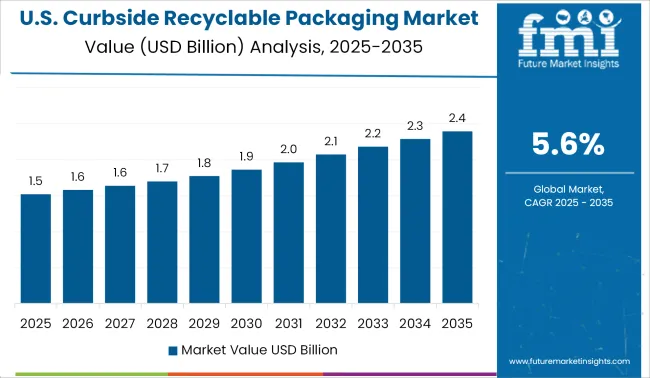

The Curbside Recyclable Packaging Market is estimated to be valued at USD 4.4 billion in 2025 and is projected to reach USD 7.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

The curbside recyclable packaging market is gaining strong traction as governments, businesses, and consumers increasingly prioritize packaging formats that align with circular economy principles. Rising regulatory mandates banning non-recyclable materials in urban municipal waste streams have accelerated demand for curbside-compatible solutions. Key innovations in water-based coatings, fiber-reinforced barriers, and mono-material design are ensuring that packaging maintains both recyclability and performance.

Consumer pressure on brands to reduce their environmental footprint is encouraging widespread transition from multi-layer plastics to paper-based and fiber-compatible formats. In parallel, retailers and e-commerce platforms are reengineering fulfillment operations to minimize landfill waste and optimize curbside recovery.

As extended producer responsibility (EPR) frameworks continue to tighten across North America and Europe, brands are increasingly investing in packaging that is easily sorted and recycled through household curbside systems. With its potential to satisfy both environmental and operational benchmarks, the market outlook remains promising-particularly for applications that demand sustainability without compromising functionality or branding.

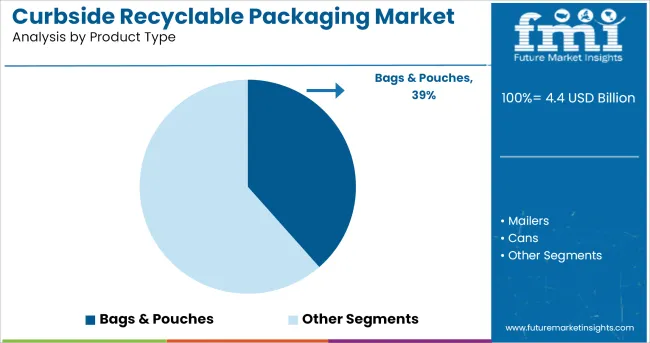

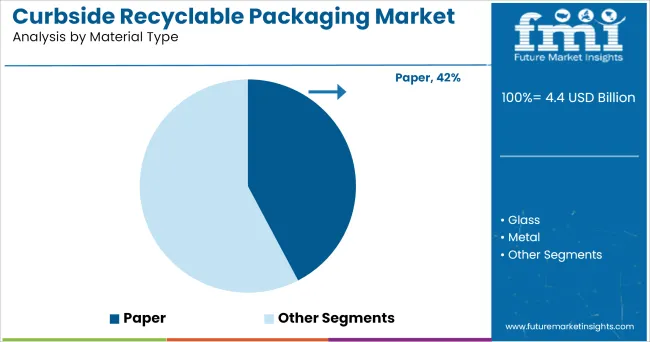

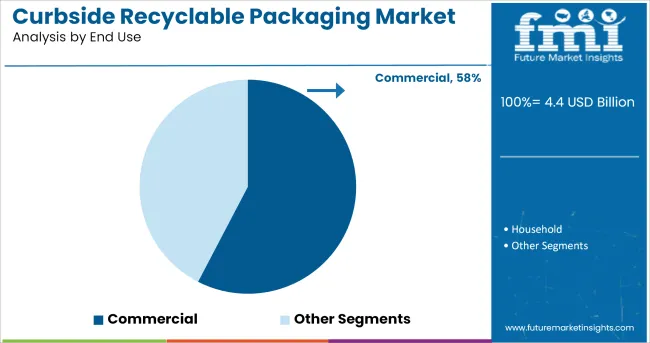

The market is segmented by Product Type, Material Type, and End Use and region. By Product Type, the market is divided into Bags & Pouches, Mailers, Cans, Bottles & Jars, and Others (cartons, etc.). In terms of Material Type, the market is classified into Paper, Glass, Metal, and Plastic. Based on End Use, the market is segmented into Commercial and Household.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

It has been observed that bags and pouches represent 38.50% of total market revenue in 2025, making them the leading product type in curbside recyclable packaging. This dominance is driven by their wide applicability across food, personal care, and e-commerce segments, where lightweight, flexible, and protective packaging is essential.

With advancements in fiber-based structures and water-resistant coatings, these formats now meet recyclability criteria while maintaining product integrity. Their compatibility with automated sorting systems used in municipal recycling facilities has supported broader adoption.

Additionally, the reduced material usage, compared to rigid formats, contributes to lower carbon footprints and shipping costs. As consumers seek convenience coupled with environmental responsibility, brands have increasingly shifted toward recyclable bags and pouches, reinforcing their leadership within the product category.

Paper is projected to hold a 42.30% revenue share within the material type category in 2025, establishing it as the preferred substrate in curbside recyclable packaging. Its dominance is attributed to its inherent recyclability, widespread infrastructure compatibility, and ease of processing in curbside collection systems.

Technological enhancements in barrier coatings and structural reinforcement have allowed paper to replace conventional plastic in numerous applications without sacrificing durability or moisture resistance.

The material’s favorable environmental perception among consumers and compliance with EPR schemes have made it the material of choice for many brands. Additionally, its printability and branding flexibility allow for high-impact visual communication without compromising sustainability. These factors combined have solidified paper’s leadership in the recyclable packaging material segment.

The commercial segment accounts for 57.60% of market revenue by 2025, making it the dominant end use category in curbside recyclable packaging. This leadership is driven by businesses aiming to align with ESG goals and comply with corporate sustainability mandates.

Industries such as food service, hospitality, and retail are phasing out single-use plastics in favor of curbside-compatible formats to meet both regulatory and consumer expectations.

Commercial entities benefit from the scalability of recyclable packaging solutions, enabling large-scale deployment across distribution and consumption channels. Additionally, brand reputation and risk mitigation have motivated procurement teams to prioritize recyclable solutions that demonstrate environmental accountability. As commercial operations expand their role in driving sustainable procurement and packaging reform, their adoption of curbside recyclable packaging continues to lead the market’s growth trajectory.

Curbside recyclable packaging is considered a sustainable packaging solution as it reduces the waste and lowers carbon footprints. Curbside recyclable packaging offers protection to the product and it is weather as well as water resistance.

Curbside recyclable packaging is one of the best solutions for consumers who always look for a sustainable and eco-friendly packaging solution, thereby it increases the demand for curbside recyclable packaging.

Several key players in the e-commerce sector are shifting towards curbside recyclable packaging. E-commerce industry requires a major portion of packaging to protect the products which include mailers, boxes, bags and others.

These all products are made of paper, kraft, and glassine which is light in weight, an excellent alternative for non-recyclable materials, and environmentally friendly. The aforesaid feature is anticipated to play a significant role in supplementing the sales of curbside recyclable packaging in the forecasted period.

Extracting and processing raw resources to make them usable materials requires a lot of energy. Manufacturers use recycled materials because recycling often saves energy as the products being recycled usually require much less processing to turn them into usable materials.

While recycling the products such as aluminium cans, plastic bottles and others the energy is saved which has become a trend for the production of curbside recyclable packaging among manufacturers. This energy saving process will boost the growth of curbside recyclable packaging.

Lack of recycling facilities across the globe may hinder the growth of curbside recyclable packaging. Also, not having proper technology and infrastructure for the process of recyclability in the market will lower the sales and demand for curbside recyclable packaging.

Global Players:

Asian Players:

The key players adopt various strategies such as product launch, merger & acquisition, innovation and others to survive the competition in the market.

In the USA, the key manufacturers in the market are choosing curbside recyclable packaging materials due to the shift from single-use plastic packaging to recyclable packaging by consumers.

Additionally, avoid adding to the environmental burden caused by producing and disposing of unnecessary materials consumers are considering curbside recyclable packaging. In the USA at least 50% of the curbside recyclable materials are collected from homes and 25% of all waste are sent to recycling centres and maximum materials are technically recycled. Thus, increasing the collection of recyclable materials will boost the sales and demand for curbside recyclable packaging in the USA.

The global curbside recyclable packaging market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the curbside recyclable packaging market is projected to reach USD 7.6 billion by 2035.

The curbside recyclable packaging market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in curbside recyclable packaging market are bags & pouches, mailers, cans, bottles & jars and others (cartons, etc.).

In terms of material type, paper segment to command 42.3% share in the curbside recyclable packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Leading Providers & Market Share in Curbside Recyclable Packaging

Recyclable PE Pouch Market Size and Share Forecast Outlook 2025 to 2035

Recyclable Thermal Insulation Packs Market Size and Share Forecast Outlook 2025 to 2035

Recyclable Ovenable Trays Market Size and Share Forecast Outlook 2025 to 2035

Recyclable Plastic Films Market Analysis - Size, Share, and Forecast 2025 to 2035

Industry Share Analysis for Recyclable Cups Companies

Market Share Breakdown of Recyclable Thermal Insulation Packs Industry

Market Share Distribution Among Recyclable Ovenable Tray Providers

Recyclable Cups Market by PE & PP Materials Through 2034

Recyclable Packaging Market Forecast and Outlook 2025 to 2035

Market Share Distribution Among Recyclable Packaging Providers

Recyclable Barrier Packaging Market Size and Share Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA