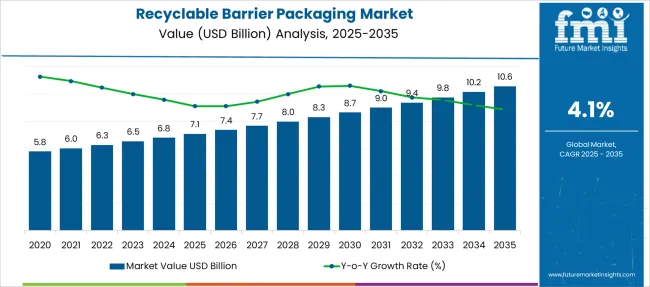

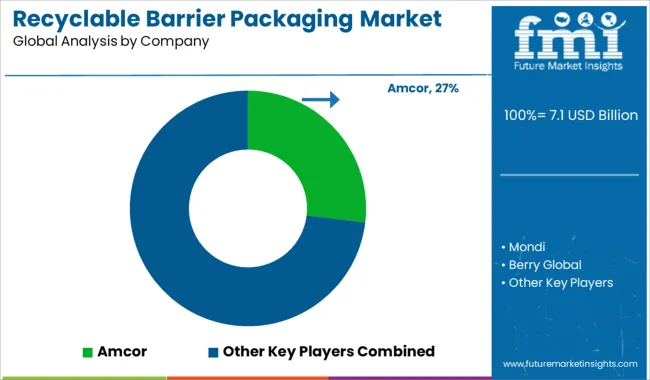

The Recyclable Barrier Packaging Market is estimated to be valued at USD 7.1 billion in 2025 and is projected to reach USD 10.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| Recyclable Barrier Packaging Market Estimated Value in (2025 E) | USD 7.1 billion |

| Recyclable Barrier Packaging Market Forecast Value in (2035 F) | USD 10.6 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The recyclable barrier packaging market is witnessing growth as industries shift towards sustainable packaging solutions that meet environmental regulations and consumer demand. Increased awareness about plastic waste and stricter government policies have accelerated the adoption of recyclable materials in packaging applications.

Advances in material science have enabled the development of plastics that provide effective barriers against moisture, oxygen, and other contaminants while remaining recyclable. Growing demand for flexible packaging is driven by its lightweight nature, versatility, and cost efficiency.

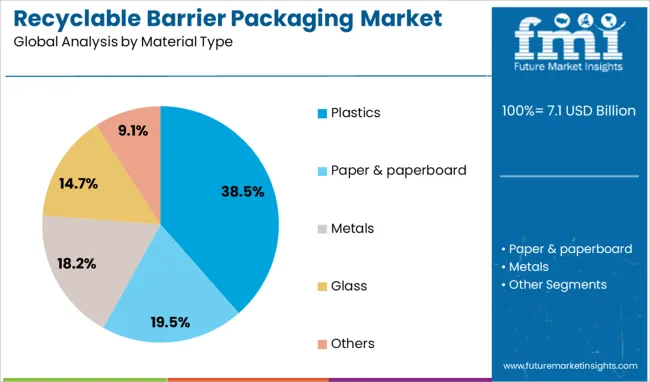

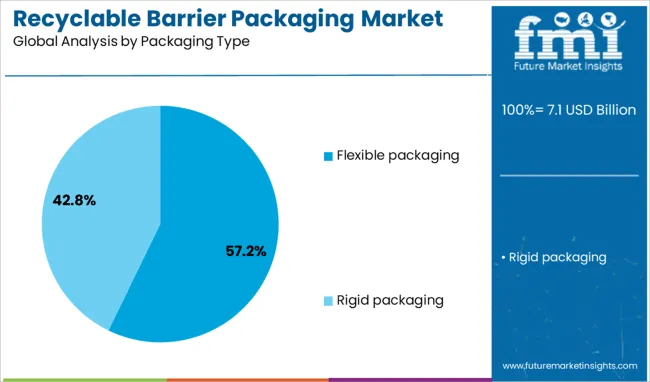

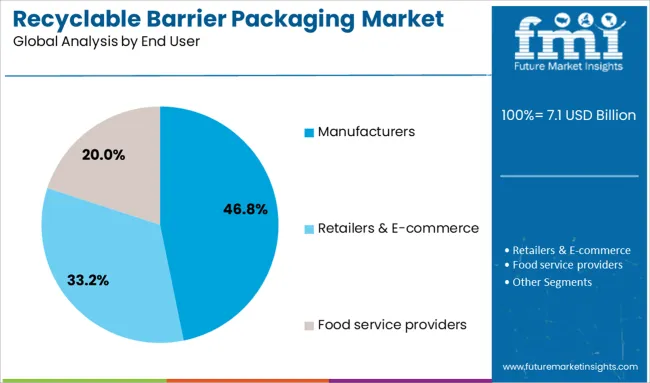

Manufacturers across sectors such as food and beverages, pharmaceuticals, and consumer goods are prioritizing recyclable packaging to reduce environmental impact and enhance brand reputation. The trend towards eco-friendly packaging and increasing consumer preference for sustainable products are expected to propel market growth. Segment expansion is anticipated to be led by plastics in material type, flexible packaging in packaging type, and manufacturers as the primary end user.

The recyclable barrier packaging market is segmented by material type, packaging type, end user, and end use industry and geographic regions. By material type of the recyclable barrier packaging market is divided into Plastics, Paper & paperboard, Metals, Glass, and Others. In terms of packaging type of the recyclable barrier packaging market is classified into Flexible packaging and Rigid packaging. Based on end user of the recyclable barrier packaging market is segmented into Manufacturers, Retailers & E-commerce, and Food service providers. By end use industry of the recyclable barrier packaging market is segmented into Food & beverages, Personal care & cosmetics, Pharmaceuticals, and Others. Regionally, the recyclable barrier packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastics segment is projected to hold 38.5% of the recyclable barrier packaging market revenue in 2025, positioning it as the dominant material type. This is due to its favorable barrier properties, adaptability, and compatibility with existing recycling systems. Innovations have improved the recyclability of plastic films while maintaining product protection.

Plastics are widely used for their balance between performance and cost, making them attractive for a variety of packaging applications. Growing investment in recycling infrastructure and circular economy initiatives supports the continued use of plastics in recyclable barrier packaging.

The segment is expected to maintain its strong market presence as demand for sustainable yet effective packaging solutions rises.

The flexible packaging segment is anticipated to account for 57.2% of the market revenue in 2025, remaining the leading packaging type. Flexible packaging’s popularity stems from its lightweight design, space efficiency, and ability to preserve product freshness.

Manufacturers value its versatility in accommodating different product shapes and sizes, making it suitable for food, pharmaceuticals, and personal care items. Additionally, flexible packaging contributes to reducing transportation costs and carbon footprints due to its compactness.

The ability to incorporate recyclable plastics and barrier layers has increased its sustainability profile. As consumer demand shifts toward convenience and environmental responsibility, flexible packaging is expected to continue its market dominance.

Manufacturers are projected to account for 46.8% of the recyclable barrier packaging market revenue in 2025, leading all end user segments. This growth is driven by their role in adopting sustainable packaging solutions to comply with regulatory requirements and meet consumer expectations.

Manufacturers in food, beverage, pharmaceutical, and consumer goods industries are increasingly integrating recyclable barrier packaging to enhance product shelf life while minimizing environmental impact. Their investment in sustainable supply chains and packaging innovations supports wider market penetration.

As sustainability becomes a key differentiator in product marketing, manufacturers’ demand for recyclable packaging is anticipated to sustain growth.

The recyclable barrier packaging market is growing strongly, propelled by rising demand for packaging that protects sensitive products while remaining recyclable. Market value was estimated at around USD 6.8 billion in 2024 and is projected to expand at roughly 4.1 percent CAGR. Expansion is supported by regulatory mandates for recyclable packaging, rising adoption in food and personal care segments, and innovation in mono-material and paper-based barrier formats. However, cost structures, complex recyclability requirements, and performance gaps versus non-recyclable films create challenges. Producers focusing on circular material design and application-specific barrier performance are expected to lead adoption through 2034.

Growth is being driven as governments enforce recycling targets and consumer preference shifts toward recyclable formats. In 2024, North American and European food and beverage brands increased uptake of recyclable barrier packaging solutions to comply with plastic reduction mandates. Asia-Pacific consumer goods companies followed suit as recyclable multi-material pouches and mono-polymer systems were adopted. It is widely believed that rising regulatory pressure combined with brand-level circular packaging targets will sustain demand for barrier solutions that meet both performance and end-of-life recovery expectations across key markets.

Opportunities are being created with development of paper-based barrier formats and mono-material plastics that simplify recycling. In 2025, several producers launched recyclable paperboard packaging with internal barrier coatings suited for beverage and dairy products. Mono-material PET jars with UV protection also emerged for sauces and personal care applications, allowing full recycling stream compatibility. It is considered that manufacturers offering integrated barrier solutions that would enable existing recycling infrastructure to handle end-of-life recovery will capture high-value contracts in FMCG, cosmetics, and food processing sectors.

A key trend through 2024 and 2025 is the shift toward material designs that balance barrier function with recyclability. Composite papers, tie layers, and removable coatings are being engineered to ensure recyclability within existing sorting facilities. Large packaging groups introduced recyclable MXD6-based resin systems for jars and tubes, improving barrier protection while enabling closed-loop recovery. It is strongly believed that competitive advantage will accrue to suppliers offering barrier packaging aligned with recycling streams and certified recovery standards, especially in regions where circular economy policies are increasingly enforced.

Major restraints include the elevated cost of barrier materials and the complexity of manufacturing recyclable designs. In 2024, producers reported higher expenses for specialty recyclable resins and coated paperboard compared to conventional multilayer films. Processing complexity and lack of recycling infrastructure in certain emerging regions further delayed adoption by smaller brands. Suppliers lacking efficient production models or regional material sourcing partnerships are considered likely to underperform if cost-optimized recycling-compatible solutions are not available. Evidence suggests that margin sustainability will depend on scale, supply resilience, and material innovation.

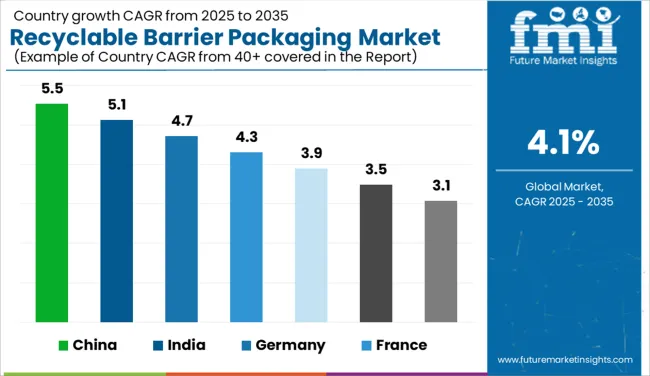

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

The global recyclable barrier packaging market is forecasted to grow at a 4.1% CAGR during 2025–2035. Among key markets, China dominates with 5.5% CAGR, reflecting demand from e-commerce and packaged foods. India follows at 5.1%, supported by government-led plastic reduction policies and rising FMCG consumption. Germany posts 4.7%, driven by stringent EU packaging directives. The UK grows at 3.9%, while the United States records 3.5%, largely from retrofitting packaging lines for recyclable material integration. Growth differentials highlight Asia’s accelerated transition to eco-friendly solutions, contrasted by gradual adoption in mature Western markets where recycling infrastructure is already developed but consumer compliance remains mixed.

China leads the recyclable barrier packaging market with a 5.5% CAGR through 2035. Strong government regulations targeting single-use plastics have pushed FMCG and food companies toward high-barrier, recyclable alternatives. E-commerce giants prioritize packaging sustainability, creating opportunities for flexible pouches and laminated films with recycling compatibility. Domestic converters are collaborating with global chemical companies to develop mono-material solutions that meet performance and recyclability standards. Expansion in packaged snacks, frozen food, and ready-to-drink beverages drives demand for oxygen and moisture-resistant packaging that retains environmental compliance.

The recyclable barrier packaging market in India is projected to rise at 5.1% CAGR between 2025 and 2035. The country’s packaging industry is experiencing a structural shift due to Extended Producer Responsibility (EPR) regulations and increasing consumer preference for eco-friendly formats. FMCG, dairy, and snack manufacturers are incorporating recyclable barrier laminates to maintain product freshness while meeting compliance. Domestic packaging firms collaborate with polymer producers to introduce recyclable pouches and films compatible with circular economy goals. Growth in organized retail and e-commerce reinforces large-scale adoption across flexible and semi-rigid formats.

Germany registers a 4.7% CAGR, backed by aggressive EU packaging waste reduction policies and increasing preference for recyclable flexible packaging. Brands are shifting toward mono-layer polyethylene or polypropylene structures to replace multi-material laminates. Adoption is strong in processed food, meat, and dairy segments due to higher shelf-life requirements. Major players invest in advanced recycling technologies such as chemical recycling to close the loop on plastic waste. Regulatory enforcement of minimum recycled content in packaging strengthens demand for recyclable barrier solutions across foodservice and retail sectors.

The United Kingdom is anticipated to grow at 3.9% CAGR, influenced by evolving sustainability legislation, plastic tax policies, and strong retailer commitments toward recyclable packaging. Packaged food manufacturers are moving toward lightweight films and barrier coatings that meet recyclability standards without compromising performance. While infrastructure for recycling exists, improving collection efficiency remains a key challenge. Demand for recyclable packaging in e-commerce and meal kit delivery is expanding, prompting suppliers to innovate with fiber-based and bio-composite barrier alternatives.

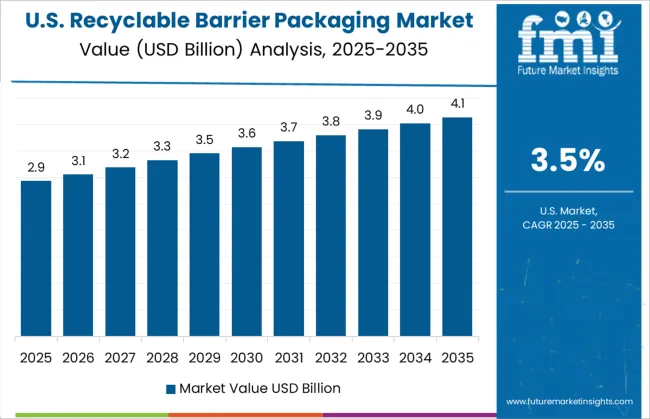

The United States posts a 3.5% CAGR, reflecting gradual adoption due to legacy systems and slow regulatory enforcement compared to Europe. However, increasing brand commitments to meet recyclability targets by 2030 drive innovation in mono-material and high-barrier solutions. Food and beverage companies focus on improving packaging compatibility with mechanical and chemical recycling streams. Major converters explore advanced coatings and barrier resins to enhance oxygen and moisture resistance without sacrificing recyclability. Growth opportunities exist in premium food packaging, personal care products, and high-value retail categories.

The recyclable barrier packaging market is moderately consolidated, with Amcor recognized as a leading player due to its advanced portfolio of recyclable, high-barrier packaging solutions for food, beverage, and healthcare sectors.

The company focuses on mono-material designs and innovations that maintain product shelf life while supporting circular economy goals, reinforcing its leadership in sustainable packaging. Key players include Mondi, Berry Global, Tetra Pak, and Sealed Air. These companies provide recyclable flexible and rigid packaging solutions that combine barrier performance with eco-friendly materials. Their offerings are widely used for perishable goods, dairy, beverages, pharmaceuticals, and personal care products, emphasizing moisture resistance, oxygen control, and extended shelf stability without compromising recyclability.

Market growth is driven by increasing regulatory pressure to reduce plastic waste, consumer demand for sustainable packaging, and brand commitments to environmental targets. Leading manufacturers are investing in mono-material structures, advanced coating technologies, and recyclable laminates that replace multi-layer plastic systems.

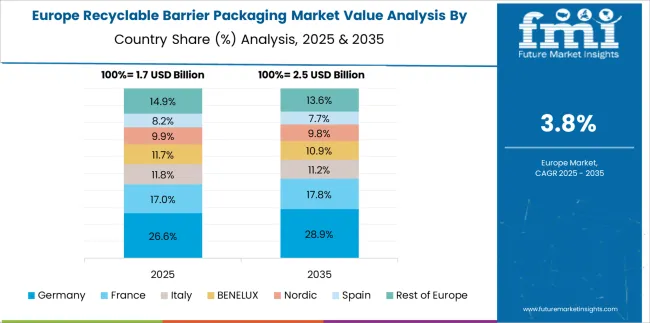

Emerging trends include bio-based films, integration of digital traceability for recycling streams, and lightweight packaging solutions to optimize logistics and reduce carbon footprint. Europe currently leads in adoption due to strict sustainability regulations, while Asia-Pacific is witnessing rapid growth driven by rising packaging demand and evolving waste management policies.

In July 2025, Dow introduced INNATE TF 220 Precision Packaging Resin for BOPE-based flexible films, incorporating about 10% post-consumer recycled content. Partnering with Liby in China, this innovation delivers one of the first fully recyclable detergent packages in the region, reinforcing efforts toward circular and sustainable packaging solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.1 Billion |

| Material Type | Plastics, Paper & paperboard, Metals, Glass, and Others |

| Packaging Type | Flexible packaging and Rigid packaging |

| End User | Manufacturers, Retailers & E-commerce, and Food service providers |

| End Use Industry | Food & beverages, Personal care & cosmetics, Pharmaceuticals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor, Mondi, Berry Global, Tetra Pak, and Sealed Air |

| Additional Attributes | Dollar sales segmented by material type (paper/paperboard, plastic, metal, glass) and packaging format (flexible vs rigid). Regional trends highlight North America and Europe as major markets, with Asia-Pacific witnessing fastest growth. Buyers favor recyclability with high-barrier properties. Innovations include mono-material barrier films, advanced coatings, and integration with FMCG and e-commerce logistics platforms. |

The global recyclable barrier packaging market is estimated to be valued at USD 7.1 billion in 2025.

The market size for the recyclable barrier packaging market is projected to reach USD 10.6 billion by 2035.

The recyclable barrier packaging market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in recyclable barrier packaging market are plastics, paper & paperboard, metals, glass and others.

In terms of packaging type, flexible packaging segment to command 57.2% share in the recyclable barrier packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Recyclable PE Pouch Market Size and Share Forecast Outlook 2025 to 2035

Recyclable Thermal Insulation Packs Market Size and Share Forecast Outlook 2025 to 2035

Recyclable Ovenable Trays Market Size and Share Forecast Outlook 2025 to 2035

Recyclable Plastic Films Market Analysis - Size, Share, and Forecast 2025 to 2035

Industry Share Analysis for Recyclable Cups Companies

Market Share Breakdown of Recyclable Thermal Insulation Packs Industry

Market Share Distribution Among Recyclable Ovenable Tray Providers

Recyclable Cups Market by PE & PP Materials Through 2034

Recyclable Packaging Market Forecast and Outlook 2025 to 2035

Market Share Distribution Among Recyclable Packaging Providers

Curbside Recyclable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in Curbside Recyclable Packaging

Barrier System Market Forecast Outlook 2025 to 2035

Barrier Coated Papers Market Size and Share Forecast Outlook 2025 to 2035

Barrier Resins Market Size and Share Forecast Outlook 2025 to 2035

Barrier Material Market Size and Share Forecast Outlook 2025 to 2035

Barrier Shrink Bags Market Analysis - Size, Share, and Forecast 2025 to 2035

Barrier Coated Paper Industry Analysis in Europe - Demand, Growth & Future Outlook 2025 to 2035

Market Share Insights for Barrier Shrink Bag Providers

Key Players & Market Share in the Barrier Coated Paper Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA