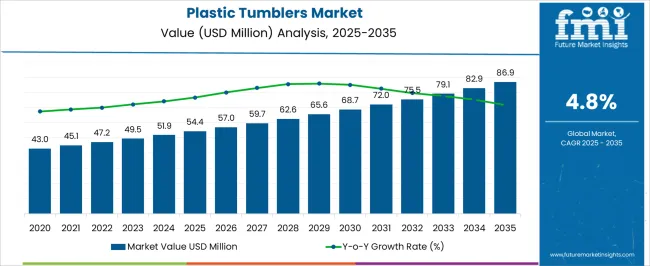

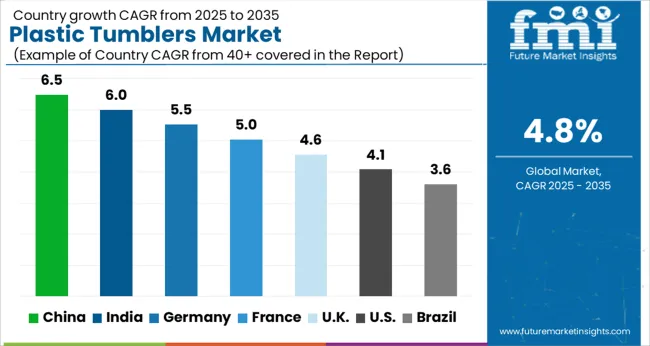

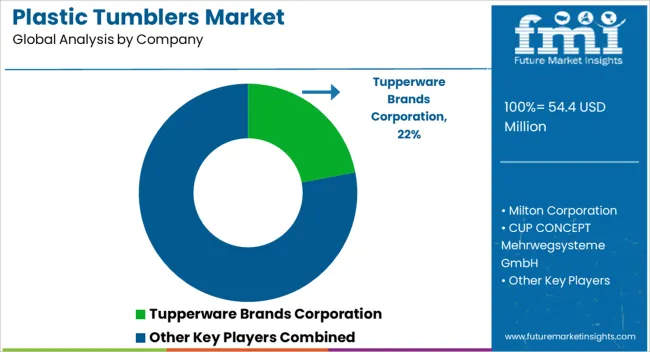

The Plastic Tumblers Market is estimated to be valued at USD 54.4 million in 2025 and is projected to reach USD 86.9 million by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Plastic Tumblers Market Estimated Value in (2025 E) | USD 54.4 million |

| Plastic Tumblers Market Forecast Value in (2035 F) | USD 86.9 million |

| Forecast CAGR (2025 to 2035) | 4.8% |

The plastic tumblers market is expanding steadily due to rising demand for lightweight, durable, and cost-effective drinkware solutions across multiple sectors. Increasing consumer preference for reusable and convenient beverage containers has been a key driver. Sustainability considerations alongside innovations in material technology are encouraging the shift towards recyclable and high-performance plastics.

The commercial sector’s growing focus on operational efficiency and hygiene standards has further accelerated adoption. Enhanced production capabilities and competitive pricing have widened accessibility to various capacity options, meeting diverse consumer needs.

Looking ahead, regulatory emphasis on reducing single-use plastics combined with rising disposable incomes in emerging markets is expected to fuel sustained growth. Strategic collaborations between manufacturers and end users to develop tailored tumblers that balance functionality and eco-friendliness are paving the way for future expansion.

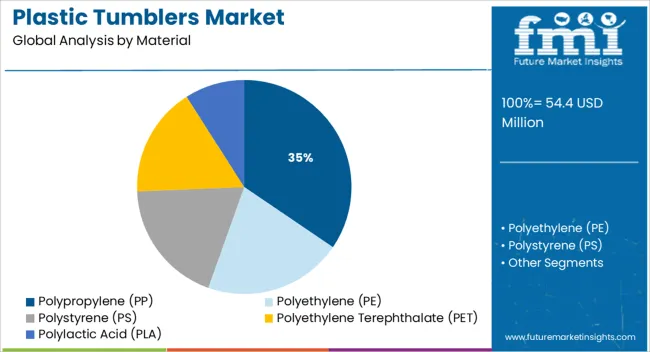

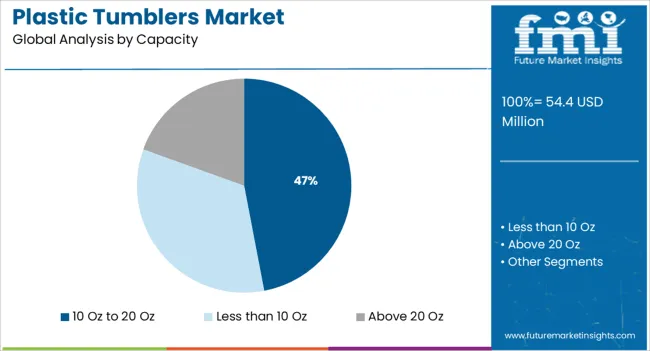

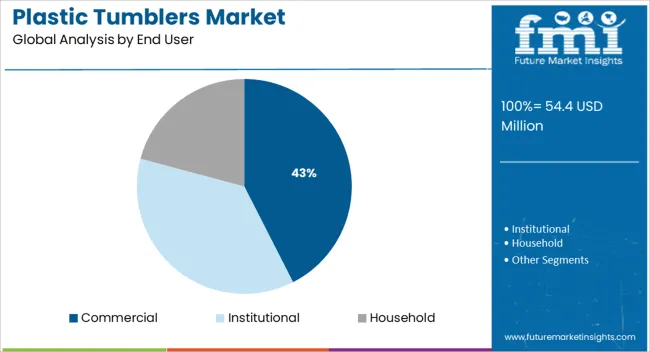

The market is segmented by Material, Capacity, and End User and region. By Material, the market is divided into Polypropylene (PP), Polyethylene (PE), Polystyrene (PS), Polyethylene Terephthalate (PET), and Polylactic Acid (PLA). In terms of Capacity, the market is classified into 10 Oz to 20 Oz, Less than 10 Oz, and Above 20 Oz. Based on End User, the market is segmented into Commercial, Institutional, and Household. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by material, polypropylene (PP) is projected to hold 34.5% of the total market revenue in 2025, establishing its leadership in the plastic tumblers market. This prominence is attributed to polypropylene’s favorable properties such as chemical resistance, lightweight nature, and cost efficiency.

The versatility of PP has enabled manufacturers to design tumblers that meet the stringent durability and hygiene requirements of commercial users. Additionally, the recyclability and ease of processing of polypropylene have aligned well with evolving environmental regulations and sustainability goals.

The widespread availability of PP and its adaptability to various manufacturing techniques have further reinforced its adoption. These factors combined have positioned polypropylene as the preferred material choice, driving its segmental dominance.

Segmented by capacity, the 10 Oz to 20 Oz tumblers are expected to capture 47.0% of the market revenue in 2025, making this size range the leading segment. This leadership stems from the balance it offers between portability and usability, catering effectively to both individual consumers and commercial establishments.

The 10 Oz to 20 Oz capacity range accommodates a wide variety of beverage types, including soft drinks, juices, and alcoholic beverages, which enhances its appeal across diverse consumption occasions. Manufacturers have focused on optimizing design and ergonomics within this capacity band to maximize user convenience and reduce material usage without compromising strength.

The segment’s broad compatibility with existing beverage service equipment has also contributed to its widespread adoption and revenue share leadership.

Segmenting by end user reveals that the commercial segment is projected to hold 42.5% of the plastic tumblers market revenue in 2025, asserting its position as the dominant user base. This is primarily driven by the demand from foodservice operators, hospitality chains, and event organizers who prioritize durability, ease of cleaning, and cost-effectiveness.

The commercial segment’s large volume requirements and stringent standards for food safety and material quality have incentivized manufacturers to innovate and customize products accordingly. Operational efficiencies gained through the use of standardized tumbler sizes and materials have also supported the commercial sector’s preference for plastic tumblers.

Additionally, the growing emphasis on sustainability in commercial operations has led to increased adoption of reusable tumblers, reinforcing this segment’s leading revenue contribution.

The global plastic tumblers market witnessed a CAGR of 4.5% during the historic period with a market value of USD 54.4 Million in 2025.

Plastic tumblers are one of the highly preferred consumer goods in the market now a day. Tumblers reduce the possibility of spillage and have various advantages over conventional cups. Consumers are moving towards convenient products with the changing lifestyle.

Manufacturers come up with various innovations in tumblers such as vacuum tumblers with double wall which allows consumers to keep their beverage hot or cold for an extended period of time. The beverages industry is focusing on protective packaging solutions for storage concerns, and plastic tumblers are seemed to be one of the prominent packaging solutions. Plastic tumblers can be Stacked and transported easily.

It is an economical solution in the long term run. Plastic tumblers are safe for hot and cold drink containers. The plastic tumblers market is strengthened by the strong demand received from the various end-users. The changed preference of the customers for packaging has affected the overall growth graph of the plastic tumblers market.

The increasing awareness regarding the benefits of using reusable products among consumers of young age groups has been a key factor for the growth in preference for products such as plastic tumblers. To engage specific consumer groups, key players in the market use the ‘reusable’ tag, to increase product appeal as well as sales.

Phrases such as “Save the earth” are printed on tumblers and are very popular among manufacturers. Furthermore, the landfill problems associated with disposable cups have created lucrative opportunities for a major shift in preference for reusable products.

Currently, branding and advertising are things that go hand in hand. Companies are demanding packaging solutions or such storage containers which depict their brand on its outer layer. The branding concept brought plastic tumblers into the limelight. As an effective packaging solution along with branding and advertising features attached to it, plastic tumblers are becoming the preferred choice for the beverage industry.

The features of the plastic tumblers meet up with current market trends creating a huge customer base for the product.

Based on the material segment, the polypropylene material segment holds the major portion of the global Plastic tumblers market. The targeted segment is projected to hold around 29% of the market share by the end of 2035.

Polypropylene material is used for tumblers, as it is a lightweight protective packaging material. Polypropylene is durable and easily recyclable. Thus, the benefits such as efficiency, low cost, biodegradability, and recyclability drive the global Plastic tumblers market.

Based on the capacity segment, the 10 Oz to 20 Oz capacity segment holds the major portion of the global plastic tumblers market. The 10oz to 20oz capacity segment is projected to expand at a CAGR of 3.9% during the forecast period.

The UK is expected to hold around 82% of the European plastic tumblers market by the end of the forecast period. According to Faood & Drink Federation, the food and drink sector are the largest sector in the United Kingdom and contributes more other than any industry. The export of food and drink is approximately USD 20 Billion.

The key players which are operating in the market are focusing on expansion and innovation. All of them are trying to capture a large market share. Big companies are focusing on USPs to increase sales. Companies are trying to provide good logistics facilities also to attract a mass customer base.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.8% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million, Volume in Units, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Material, Capacity, End Users, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East and Africa (MEA); Oceania |

| Key Countries Covered | The USA, Canada, Mexico, Brazil, Germany, The UK, France, Italy, Spain, Russia, China, Japan, India, GCC countries, Australia |

| Key Companies Profiled | Tupperware Brands Corporation; Milton Corporation; CUP CONCEPT Mehrwegsysteme GmbH; CamelBak Products, LLC; Tupperware Brand Corporation; Regalzone; Evans Manufacturing, Inc; Ee-Lian Enterprise (M) Sdn. Bhd; Rainbow Cups; Nature Packwell Pvt. Ltd.; Bubbles Plastics; Dynasty Products Private Ltd; Lock & Lock Co |

| Customization & Pricing | Available upon Request |

The global plastic tumblers market is estimated to be valued at USD 54.4 million in 2025.

The market size for the plastic tumblers market is projected to reach USD 86.9 million by 2035.

The plastic tumblers market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in plastic tumblers market are polypropylene (pp), polyethylene (pe), polystyrene (ps), polyethylene terephthalate (pet) and polylactic acid (pla).

In terms of capacity, 10 oz to 20 oz segment to command 47.0% share in the plastic tumblers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Tubes for Effervescent Tablets Market Size and Share Forecast Outlook 2025 to 2035

Plastic Banding Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tube Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA