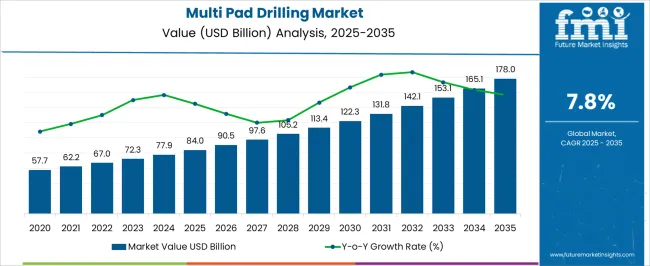

The multi pad drilling market is projected to grow from USD 84 billion in 2025 to USD 178 billion by 2035, reflecting a compound annual growth rate (CAGR) of 7.8%. The annual values indicate a consistent expansion, with the market expected to reach USD 97.6 billion by 2027 and USD 113.4 billion by 2029. This growth is being driven by the rising demand for efficient offshore and onshore extraction methods that can optimize reservoir utilization while minimizing operational downtime.

From an industry perspective, the adoption of multi pad drilling is being encouraged as a strategic approach to maximize output from complex fields and enhance production reliability. The steady CAGR suggests that companies investing in advanced drilling platforms, well planning, and field management solutions are positioned to secure a competitive edge in this evolving sector. By 2035, the market value is projected to touch USD 178 billion, demonstrating that multi pad drilling systems are becoming a standard practice in hydrocarbon exploration and extraction.

The growth trajectory indicates that operators and service providers prioritizing operational efficiency, reduced well interference, and cost-effective pad layouts are likely to capture significant market share. In this opinion, the CAGR emphasizes that while the market is influenced by fluctuating crude prices and regulatory frameworks, long-term demand for high-yield drilling methods is expected to remain robust. Companies that focus on integrating modular drilling solutions, predictive maintenance, and resource optimization will benefit from the ongoing expansion, making the multi pad drilling market a critical segment for stakeholders seeking sustainable revenue streams and operational excellence over the next decade.

| Metric | Value |

|---|---|

| Multi Pad Drilling Market Estimated Value in (2025 E) | USD 84.0 billion |

| Multi Pad Drilling Market Forecast Value in (2035 F) | USD 178.0 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The multi pad drilling market holds a significant share within its parent markets, reflecting its growing adoption and efficiency in hydrocarbon extraction. In the oil & gas drilling services market, multi pad drilling accounts for approximately 10% of the total market share, driven by its cost-effectiveness and reduced environmental footprint. Within the exploration & production (E&P) market, it represents about 15%, as operators seek methods to enhance recovery rates and optimize drilling operations. The unconventional resource extraction market sees multi pad drilling comprising roughly 20%, particularly in shale and tight oil plays where access to multiple formations from a single location is advantageous. In the horizontal drilling market, multi pad drilling contributes approximately 25%, as it aligns with the trend towards longer horizontal wellbores and increased drilling density.

The well services market, encompassing activities like cementing, stimulation, and completion, has multi pad drilling constituting around 30%, due to the increased demand for these services in multi-well pad operations. These figures highlight the strategic importance of multi pad drilling in modern oil and gas operations, offering enhanced efficiency, reduced surface disturbance, and improved economic returns. Despite challenges such as initial capital investment and logistical complexities, the market share distribution underscores a clear industry preference for multi pad drilling techniques across various segments.

The multi pad drilling market is experiencing robust expansion, supported by its efficiency advantages in hydrocarbon extraction and the operational cost savings it delivers compared to single well sites. Current market momentum is being reinforced by heightened exploration and production activity, particularly in resource-rich regions with established drilling infrastructure.

The ability to drill multiple wells from a single pad has reduced land disturbance, minimized environmental impact, and improved logistical efficiency, making it an attractive option for operators seeking to optimize production timelines. Technological advancements in directional and horizontal drilling techniques are enhancing output rates and well longevity, further driving adoption.

Global energy demand stability, coupled with continued investment in upstream oil and gas projects, is expected to sustain market growth Over the forecast horizon, the sector is anticipated to benefit from expanded application in unconventional reserves, the modernization of drilling equipment, and strategic collaborations between operators and service providers to maximize operational efficiency and cost competitiveness.

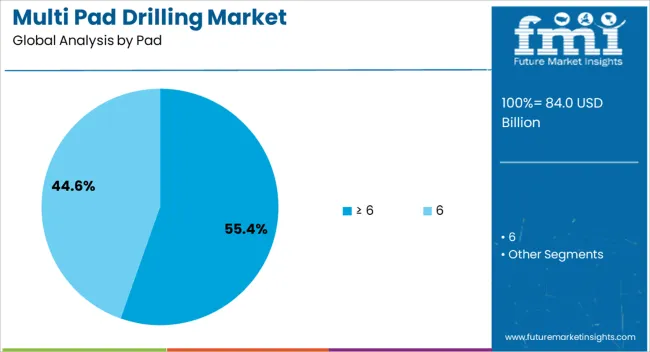

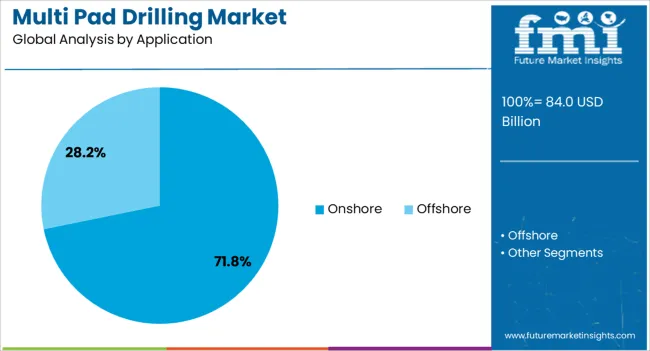

The multi pad drilling market is segmented by pad, application, and geographic regions. By pad, multi pad drilling market is divided into ≥ 6 and 6. In terms of application, multi pad drilling market is classified into Onshore and Offshore. Regionally, the multi pad drilling industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ≥ 6 pad configuration, accounting for 55.40% of the pad category, has emerged as the leading choice due to its superior drilling efficiency and significant reduction in per-well development costs. This configuration allows multiple wells to be drilled from a single location, optimizing land use and infrastructure deployment. The segment’s dominance is supported by its ability to maximize reservoir contact, improve production rates, and shorten project timelines, which has been crucial in competitive oil and gas environments.

Operators are increasingly adopting ≥ 6 pad setups in mature and unconventional fields to enhance economic returns and streamline supply chain requirements. Continuous advancements in drilling rig mobility and automation have further reduced operational downtime, enabling faster pad-to-pad transitions.

Regulatory emphasis on minimizing environmental footprint has also favored larger pad sizes, as they require fewer surface disturbances compared to multiple smaller sites. This operational and environmental balance is expected to secure the segment’s strong position in the market over the forecast period.

The onshore application segment, holding 71.80% of the application category, remains the dominant area for multi pad drilling due to its favorable accessibility, infrastructure availability, and lower operational risks compared to offshore environments. Onshore projects benefit from reduced logistical complexity, allowing faster mobilization of rigs and equipment while lowering transportation and maintenance costs. The segment’s high share is also attributed to the vast reserves accessible via onshore drilling, particularly in North America, the Middle East, and parts of Asia-Pacific.

Adoption is being driven by shale and tight oil developments, where multi pad drilling significantly improves well economics and production efficiency. Enhanced drilling technologies, such as extended-reach laterals and real-time reservoir monitoring, are further boosting output from onshore pads.

Additionally, onshore operations face fewer regulatory barriers and weather-related constraints than offshore sites, allowing for more predictable project execution. These combined advantages are anticipated to maintain the segment’s leading position and drive sustained investment in onshore multi-pad drilling projects.

The multi pad drilling market is growing due to rising demand for efficient oil and gas extraction techniques. Opportunities exist in deepwater and shale exploration, while trends focus on automation and data-driven operations. Challenges include high capital costs and operational complexity. Overall, the market is expected to expand steadily as energy companies adopt multi pad drilling to optimize resource recovery, reduce operational costs, and enhance productivity across mature and unconventional fields globally.

The multi pad drilling market is experiencing growth due to the increasing need for optimized oil and gas extraction. Operators are turning to multi pad drilling to access multiple wells from a single location, reducing surface disruption and operational costs. The method enhances productivity while minimizing environmental impact, making it highly appealing for shale and tight oil formations. As energy companies focus on maximizing output from mature fields, multi pad drilling has become a preferred technique, driving consistent demand across North America, Europe, and Asia-Pacific regions.

Significant opportunities are emerging from ongoing deepwater and shale exploration projects. Energy companies are increasingly investing in advanced drilling infrastructure to enhance recovery rates and operational efficiency. Multi pad drilling allows simultaneous access to multiple reservoirs, reducing rig time and boosting ROI. Partnerships with technology providers for digital monitoring, real-time data analytics, and automated drilling operations further expand growth potential. Expanding unconventional energy exploration in regions such as the USA, Brazil, and Russia provides a lucrative platform for manufacturers and service providers to capitalize on high-value contracts.

A key trend shaping the market is the integration of automation, real-time monitoring, and data-driven drilling techniques. Digital sensors, remote control systems, and predictive analytics are being deployed to enhance precision, reduce downtime, and improve safety. Multi pad drilling is increasingly combined with horizontal drilling and hydraulic fracturing, maximizing resource extraction. Adoption of Industry 4.0 practices and intelligent well-planning software is enabling operators to monitor multiple pads simultaneously. These technological trends are transforming traditional drilling methods into efficient, safer, and highly productive operations globally.

Despite its advantages, the multi pad drilling market faces challenges due to high capital investment, technological complexity, and skilled workforce requirements. Establishing multi pad layouts, integrating advanced monitoring systems, and ensuring proper well spacing require extensive planning and expertise. Initial setup costs are significant, limiting adoption for smaller operators or in regions with limited financial support. Additionally, logistical challenges, regulatory compliance, and environmental scrutiny can delay project execution. Overcoming these barriers requires optimized project planning, advanced training, and strong collaboration between technology providers and operators.

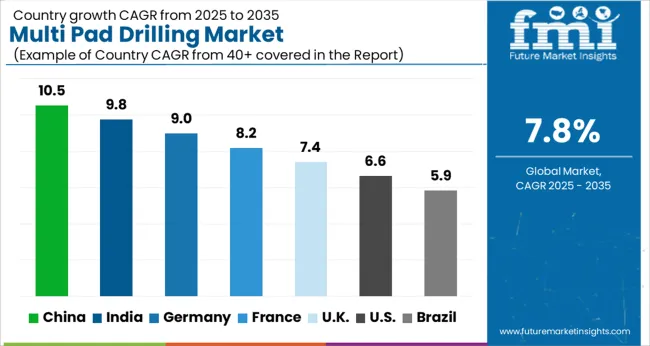

| Country | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

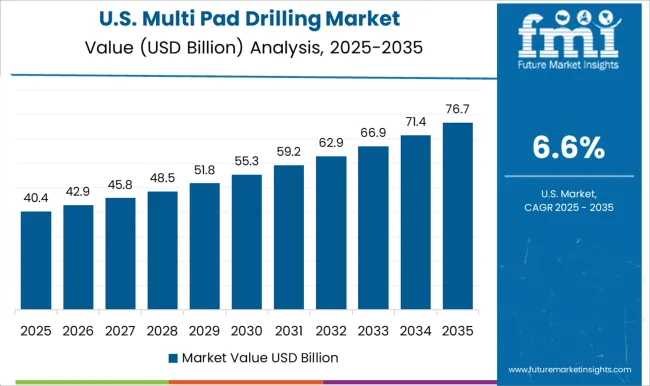

| USA | 6.6% |

| Brazil | 5.9% |

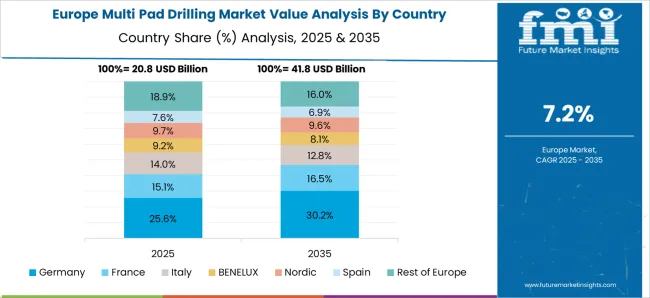

The global multi pad drilling market is projected to grow at a CAGR of 7.8% from 2025 to 2035. China leads with a growth rate of 10.5%, followed by India at 9.8% and France at 8.2%. The United Kingdom is expected to grow at 7.4%, while the United States shows a CAGR of 6.6%. Rising energy demand, exploration of unconventional oil and gas reserves, and increased investment in advanced drilling technologies are driving market growth. China and India are witnessing rapid expansion due to increased energy consumption and offshore exploration activities. European and North American markets focus on improving operational efficiency, safety, and environmental compliance. Collectively, these trends highlight the increasing adoption of multi pad drilling solutions across mature and emerging markets. This report includes insights on 40+ countries; the top markets are shown here for reference.

The multi pad drilling market in China is projected to expand at a CAGR of 10.5%, driven by growing energy consumption and extensive offshore oil and gas exploration. Chinese operators are deploying multi pad drilling technologies to increase well productivity and reduce operational costs. Investment in modern drilling rigs, automated control systems, and enhanced reservoir management supports adoption. Environmental regulations are encouraging the use of advanced drilling techniques to minimize footprint and emissions. Domestic equipment manufacturers are scaling production to meet rising demand, while global technology providers are forming partnerships with local operators. Overall, China’s combination of strong energy demand, government-backed investments, and technological adoption positions it as the fastest-growing market for multi pad drilling globally.

The multi pad drilling market in India is expected to grow at 9.8% CAGR. The country is expanding oil and gas exploration activities, particularly in offshore and unconventional reserves. Adoption of multi pad drilling systems helps optimize production, reduce drilling time, and improve cost efficiency. India is witnessing increased investments in domestic drilling infrastructure and technology upgrades. International collaborations are also enabling the transfer of expertise and advanced equipment. Rising energy demand and government support for exploration projects further enhance the market outlook. India’s rapid industrialization, coupled with growing focus on operational efficiency, is strengthening the adoption of multi pad drilling systems across both onshore and offshore fields.

The multi pad drilling market in France is forecast to grow at 8.2% CAGR. French operators are adopting multi pad drilling technologies to increase efficiency and reduce the environmental impact of oil and gas operations. The country’s emphasis on regulatory compliance encourages safer and more efficient drilling methods. Domestic service providers are focusing on integrating digital monitoring and predictive maintenance solutions to improve operational outcomes. Investment in infrastructure modernization, along with partnerships with global drilling technology firms, is driving the adoption of multi pad drilling systems. France’s market growth reflects a combination of technological integration, regulatory enforcement, and operational efficiency in mature European oil and gas fields.

The multi pad drilling market in the United Kingdom is projected to grow at a CAGR of 7.4%. UK operators are modernizing offshore North Sea facilities, adopting multi pad drilling to maximize recovery and reduce downtime. Environmental standards and regulatory compliance drive the selection of advanced drilling techniques. Investment in automation, predictive maintenance, and digital monitoring helps optimize production and reduce costs. International technology providers collaborate with local companies to deploy modern multi pad systems. While growth is moderate compared to Asia, UK operators focus on operational efficiency, safety, and sustainability, ensuring steady market expansion and strengthening their position in the European drilling landscape.

The multi pad drilling market in the United States is expected to expand at a CAGR of 6.6%. USA operators are increasingly using multi pad drilling for shale and unconventional oil and gas production to optimize output and reduce costs. Advanced drilling technologies, including digital control systems and automated rigs, are widely adopted. Regulatory requirements for environmental protection are influencing drilling strategies, pushing for safer and more efficient methods. Domestic manufacturers and service providers are enhancing capabilities to meet high demand from shale basins. While growth is slower than in Asian markets, the USA market remains critical due to its technological leadership, large-scale production, and high operational efficiency in both onshore and offshore fields.

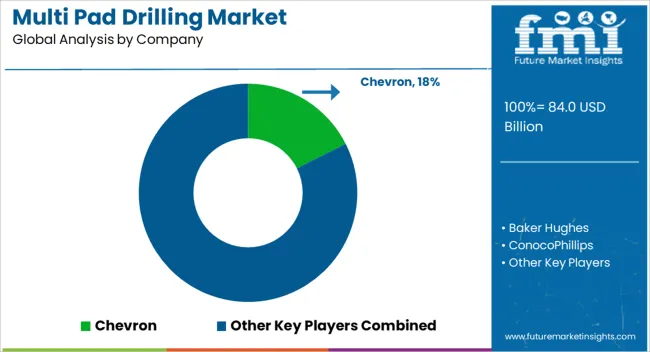

The multi pad drilling market is being shaped by major oilfield service companies and integrated energy producers focusing on efficiency, cost reduction, and reservoir optimization. Chevron, ExxonMobil, and ConocoPhillips are leveraging multi pad drilling techniques to access multiple wells from a single surface location, reducing surface footprint and accelerating production timelines. Their brochures emphasize enhanced well productivity, operational flexibility, and environmental compliance. Service providers such as Baker Hughes, Halliburton, and Schlumberger highlight advanced drilling technologies, automated drilling rigs, and real-time monitoring systems that improve drilling accuracy and safety. Weatherford, NOV, and Nabors focus on rig equipment, drilling tools, and support services that enable operators to maximize efficiency across multiple pads simultaneously.

Other companies, including Hess, Petrofac, Devon, Continental, and Nostra Terra, differentiate through regional expertise, turnkey drilling solutions, and integrated project management. Their marketing materials highlight multi well pad strategies that reduce operational costs, minimize environmental impact, and optimize production schedules. Schlumberger and Halliburton stress data-driven analytics and predictive maintenance to support continuous drilling operations. Brochures consistently focus on enhanced recovery rates, reliability, and technological integration. Competition in the multi pad drilling market is driven by technical expertise, operational efficiency, and the ability to deliver scalable solutions for complex oil and gas reservoirs worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 84.0 Billion |

| Pad | ≥ 6 and 6 |

| Application | Onshore and Offshore |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Chevron, Baker Hughes, ConocoPhillips, Continental, Devon, ExxonMobil, Halliburton, Hess, Nabors, NOV, Nostra Terra, Petrofac, Schlumberger, and Weatherford |

| Additional Attributes | Dollar sales by rig type (land, offshore, jack-up) and drilling capacity (shallow, medium, deepwater) are key metrics. Trends include rising demand for efficient multi-well operations, adoption of automated drilling technologies, and growth in oil and gas exploration. Regional adoption, technological advancements, and regulatory compliance are driving market growth. |

The global multi pad drilling market is estimated to be valued at USD 84.0 billion in 2025.

The market size for the multi pad drilling market is projected to reach USD 178.0 billion by 2035.

The multi pad drilling market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in multi pad drilling market are ≥ 6 and 6.

In terms of application, onshore segment to command 71.8% share in the multi pad drilling market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Multiplex Biomarker Imaging Market Forecast and Outlook 2025 to 2035

Multi-Cloud Networking Market Size and Share Forecast Outlook 2025 to 2035

Multispectral Camera Market Size and Share Forecast Outlook 2025 to 2035

Multi-functional Packaging Market Size and Share Forecast Outlook 2025 to 2035

Multichannel Order Management Market Forecast and Outlook 2025 to 2035

Multiexperience Development Platform Market Forecast and Outlook 2025 to 2035

Multi Depth Corrugated Box Market Size and Share Forecast Outlook 2025 to 2035

Multilayer Flexible Packaging Market Size and Share Forecast Outlook 2025 to 2035

Multi Attachment Loaders Market Size and Share Forecast Outlook 2025 to 2035

Multi Pocket Holders Market Size and Share Forecast Outlook 2025 to 2035

Multi-Screen Super Glass Market Size and Share Forecast Outlook 2025 to 2035

Multichannel Reagent Reservoir Market Size and Share Forecast Outlook 2025 to 2035

Multi-Functional Point Of Care Testing Market Size and Share Forecast Outlook 2025 to 2035

Multi-layer Film Recycling Market Size and Share Forecast Outlook 2025 to 2035

Multifunctional Household Robot Market Size and Share Forecast Outlook 2025 to 2035

Multistage Ring Section Pumps Market Size and Share Forecast Outlook 2025 to 2035

Multi-photon Microscopic System Market Size and Share Forecast Outlook 2025 to 2035

Multi-axis Truss Robot Market Size and Share Forecast Outlook 2025 to 2035

Multi-Modal Biometric Cabin Sensors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Multivitamin-Infused Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA