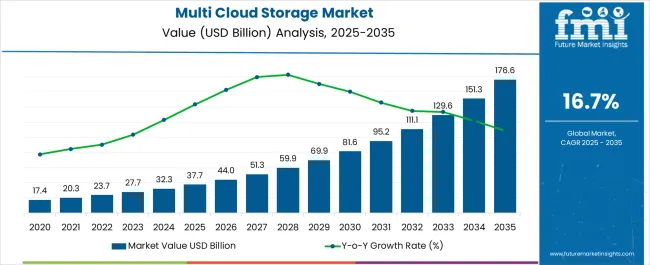

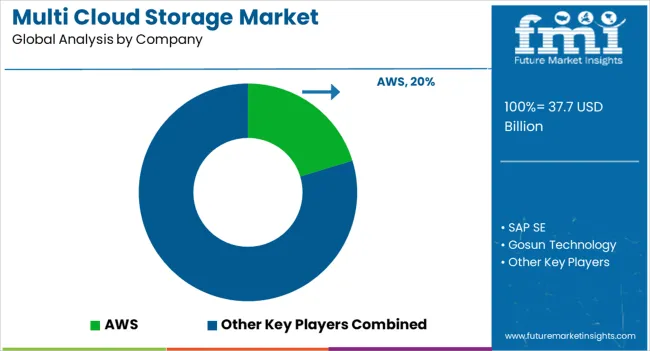

The Multi Cloud Storage Market is estimated to be valued at USD 37.7 billion in 2025 and is projected to reach USD 176.6 billion by 2035, registering a compound annual growth rate (CAGR) of 16.7% over the forecast period.

| Metric | Value |

|---|---|

| Multi Cloud Storage Market Estimated Value in (2025E) | USD 37.7 billion |

| Multi Cloud Storage Market Forecast Value in (2035F) | USD 176.6 billion |

| Forecast CAGR (2025 to 2035) | 16.7% |

The multi cloud storage market is evolving rapidly, fueled by enterprise demands for greater agility, operational resilience, and vendor diversification. The growing complexity of data management across geographies and compliance environments has encouraged organizations to adopt multi cloud frameworks that optimize performance and reduce single-point dependency. Hybrid deployment strategies are gaining prominence as businesses seek a balance between the flexibility of public cloud and the security of private infrastructure.

Increased workloads in AI, analytics, and edge computing are pushing organizations toward more dynamic storage architectures. Large enterprises are leading adoption due to their need for scale, integration across diverse platforms, and stringent data governance.

Industry-specific regulatory needs and rising cyber threats are also accelerating the use of decentralized yet unified storage models. In the coming years, strategic partnerships between hyperscalers and niche cloud providers are expected to shape innovation in data replication, cost optimization, and intelligent tiering.

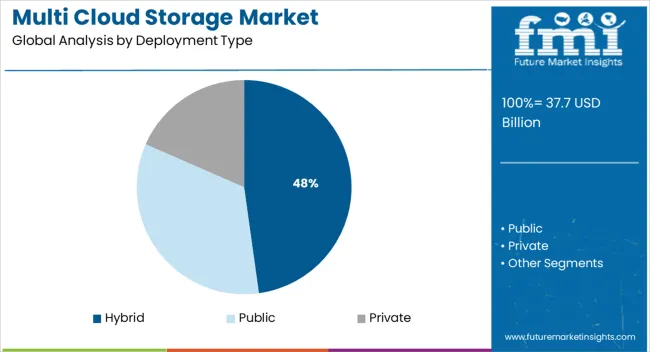

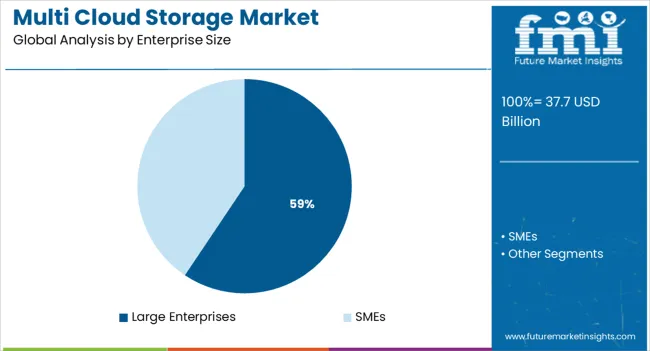

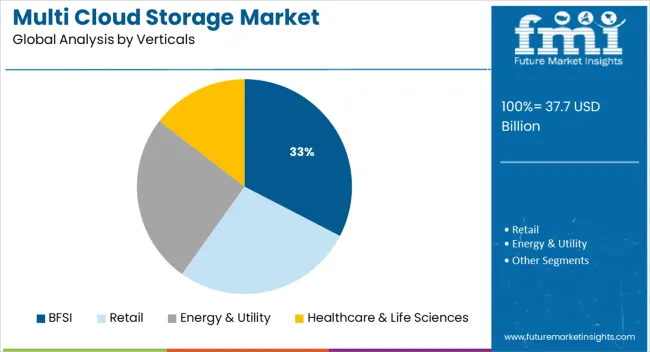

The market is segmented by Deployment Type, Enterprise Size, and Verticals and region. By Deployment Type, the market is divided into Hybrid, Public, and Private. In terms of Enterprise Size, the market is classified into Large Enterprises and SMEs. Based on Verticals, the market is segmented into BFSI, Retail, Energy & Utility, and Healthcare & Life Sciences. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Hybrid deployment is projected to account for 47.8% of the total revenue in the multi cloud storage market by 2025, establishing it as the dominant architecture. This preference is being driven by the need for organizations to retain control over sensitive data while leveraging public cloud scalability for less critical workloads.

Hybrid strategies allow firms to comply with regulatory requirements and latency constraints while optimizing storage costs. Integration of cloud orchestration tools and containerization has simplified the movement of data across on-premises and cloud environments.

The rise of edge computing and real-time processing demands has also made hybrid models more attractive, enabling localized storage while ensuring centralized governance. As industries prioritize data sovereignty and interoperability, hybrid deployments are expected to remain central to enterprise cloud transformation roadmaps.

Large enterprises are expected to contribute 59.4% of the market revenue in 2025, making them the leading customer segment. This dominance is being attributed to their complex IT infrastructures, massive data volumes, and heightened compliance obligations.

These organizations typically operate across multiple geographies, necessitating robust data redundancy and low-latency access. Large-scale digital transformation initiatives, including enterprise resource planning (ERP), customer relationship management (CRM), and analytics platforms, require scalable, resilient cloud storage solutions.

Their budgets also support multi-vendor strategies and investments in security, monitoring, and orchestration tools. As data becomes a strategic asset, large enterprises are investing heavily in architectures that ensure both agility and control, reinforcing their lead in multi cloud storage adoption.

The BFSI sector is projected to hold 32.6% of the overall market share in 2025, positioning it as the top vertical for multi cloud storage solutions. This leadership is driven by the sector’s stringent compliance requirements, high data sensitivity, and continuous demand for service availability.

Financial institutions are adopting multi cloud strategies to ensure data redundancy, meet disaster recovery mandates, and support real-time transaction processing. The need to integrate legacy systems with modern digital interfaces has pushed BFSI players toward flexible, interoperable storage environments.

Additionally, as cyber risk mitigation becomes a board-level priority, the ability to segment workloads and isolate threats across clouds is viewed as a critical safeguard. Ongoing digital banking adoption and customer-centric innovations are expected to sustain the BFSI sector’s strong reliance on multi cloud storage ecosystems.

Continuous changes presented by the cloud providers in multi-cloud and hybrid environments lead to loss of visibility and loss of synchronization. Therefore, the adoption of multi cloud storage platforms allows users to effectuate all the necessary changes introduced by different cloud and on-premise service providers under a single platform.

There has been increasing pressure to ensure compliance with various data security and privacy protection regulations. Moreover, there have also been concerns over the reliability of a single cloud, as well as a rising predisposition toward price-sensitive cloud installations. These factors are likely to expand the global market size.

End users can employ multi cloud management tools to manage complex applications across several heterogeneous cloud platforms for maximal independence. This removes vendor lock-ins and allows for smooth movement from one provider to another. This is expected to surge the demand for multi cloud storage.

While transferring workloads from one cloud ecosystem to another, cloud brokers may also face limitations. Hence, once they are designed for or transferred to it, workloads are then bound inside a single public cloud provider.

Moreover, cost reductions and moving workloads/applications from location to location in search of the greatest performance are expected to be key impediments to Cloud Services Brokerage (CBS) technology.

Conversely, ISVs are transitioning from software developers to software developers to software providers through the use of visualization and cloud computing to remain competitive. Furthermore, most on-premises suppliers are migrating to the cloud deployment paradigm in order to decrease IT expenses and provide cloud-based products and services.

North America is the largest multi cloud storage market growing at a notable profit of 41.7%. This is attributed to cloud services transitioning from isolated cloud services to platforms combining on-site, public, and private IaaS.

Furthermore, the growing adoption of connected and IoT-enabled devices has driven the demand for innovative solutions based on the latest technologies, as well as the continued rollout of the wireless community. This is likely to expand the global multi cloud storage market size.

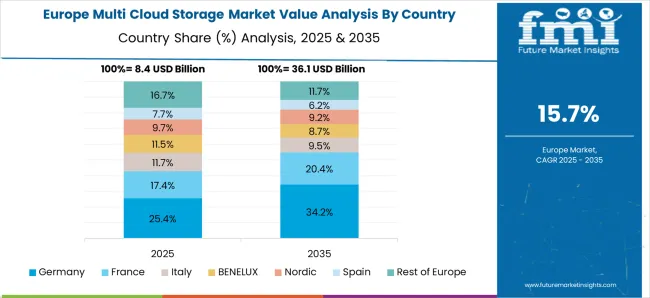

Europe is a growing multi cloud storage market with a revenue of 22.7%. This is owing to its robust connectivity infrastructure, which drives the deployment of cloud services.

In addition, to lower the expenses associated with the fixed capacity infrastructure and to leverage cloud-native services to roll out a highly scalable infrastructure using the cloud, a looming migration of workloads to the cloud is effective, particularly in this region.

Start-up companies have witnessed the growth of multi cloud storage market share, and are contributing to the growth with innovative strategies:

The multi cloud storage market share is bottom fragmented and top consolidated, which is attributed to the presence of some key players obtaining a major block of the market share.

The players are often involved in opting for both organic and inorganic growth strategies to expand their geographical presence and their product portfolio.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 16.7% from 2025 to 2035 |

| The base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments Covered | Deployment Type, Enterprise Size, Verticals, and Region. |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia; and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, United Arab Emirates(UAE), Iran, South Africa |

| Key companies profiled | IBM Corp.; Google Inc.; Microsoft Corporation; Dell Technologies Inc.; CloudBolt Software Inc.; SAP SE; AWS; Gosun Technology; Nasuni; Qumule; HPE; EMC; Flexera Software LLC; International Business Machines Corporation; Jamcracker Inc.; Concierto.cloud; UnityOneCloud; VMware Inc. etc. |

| Customization scope | Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global multi cloud storage market is estimated to be valued at USD 37.7 billion in 2025.

The market size for the multi cloud storage market is projected to reach USD 176.6 billion by 2035.

The multi cloud storage market is expected to grow at a 16.7% CAGR between 2025 and 2035.

The key product types in multi cloud storage market are hybrid, public and private.

In terms of enterprise size, large enterprises segment to command 59.4% share in the multi cloud storage market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Multifunctional Loader Market Size and Share Forecast Outlook 2025 to 2035

Multipurpose Goods Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Multichannel Electrochemical Workstation Market Size and Share Forecast Outlook 2025 to 2035

Multi Colored LED Beads Market Size and Share Forecast Outlook 2025 to 2035

Multi-Drug/Combination Injectable Market Forecast and Outlook 2025 to 2035

Multiplex Sepsis Biomarker Panels Market Size and Share Forecast Outlook 2025 to 2035

Multiplex Protein Profiling Market Size and Share Forecast Outlook 2025 to 2035

Multihead Weighers Market Size and Share Forecast Outlook 2025 to 2035

Multispectral Camera Market Size and Share Forecast Outlook 2025 to 2035

Multi-functional Packaging Market Size and Share Forecast Outlook 2025 to 2035

Multiplex Biomarker Imaging Market Forecast and Outlook 2025 to 2035

Multichannel Order Management Market Forecast and Outlook 2025 to 2035

Multiexperience Development Platform Market Forecast and Outlook 2025 to 2035

Multi Depth Corrugated Box Market Size and Share Forecast Outlook 2025 to 2035

Multilayer Flexible Packaging Market Size and Share Forecast Outlook 2025 to 2035

Multi Attachment Loaders Market Size and Share Forecast Outlook 2025 to 2035

Multi Pocket Holders Market Size and Share Forecast Outlook 2025 to 2035

Multi-Screen Super Glass Market Size and Share Forecast Outlook 2025 to 2035

Multichannel Reagent Reservoir Market Size and Share Forecast Outlook 2025 to 2035

Multi-Functional Point Of Care Testing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA