The multiflex tubes market is projected to grow from USD 1.2 billion in 2025 to USD 2.3 billion by 2035, registering a CAGR of 6% during the forecast period. Sales in 2024 reached USD 1.1 billion, reflecting the sector's strong momentum in the flexible packaging industry.

This growth is driven by increasing demand across various industries, including personal care, pharmaceuticals, and cosmetics, where flexible, durable, and sustainable packaging solutions are essential. Multiflex tubes, known for their adaptability and barrier properties, are becoming the preferred choice for packaging applications that require both functionality and aesthetic appeal.

Multitubes, a leading manufacturer specializing in plastic tubes, emphasizes its commitment to quality and sustainability. In 2024, Multitubes launched a tube that will biodegrade in a few months in landfill, soil, or sea water or industrial composting. No micro or nano plastics, no costly PLA and no plastic fragmenting technology.

In an official statement, Roemer Zijp, Head of sustainability of Multitubes, highlighted “This innovations allows us to go full circle. It should not replace recycled content or stop you from designing your packaging for recyclability, but should be added to fully close the waste stream. It provides the ultimate solution for packs which are not recycled and avoids micro plastics. A must for every future pack.”

The shift towards eco-friendly and biodegradable materials is a significant driver in the multiflex tubes market. Manufacturers are investing in coating technologies that enhance the durability of tubes without compromising their recyclability. Additionally, the integration of digital printing allows for customization, catering to branding needs and consumer engagement. These innovations not only meet environmental standards but also offer functional benefits to end-users.

By 2035, the multiflex tubes market is expected to create an incremental opportunity of USD 1.0 billion, growing 1.9 times its current value. The market's expansion is supported by regulatory measures against single-use plastics and the increasing adoption of sustainable practices by businesses. Companies that prioritize innovation, sustainability, and customization are well-positioned to capitalize on emerging opportunities in this sector.

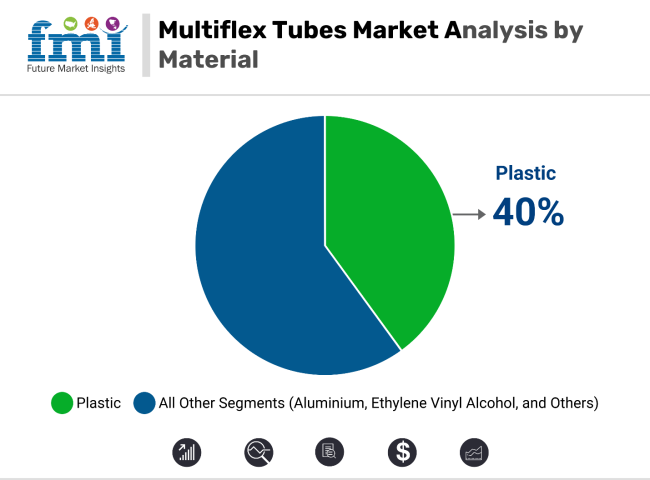

Plastic multiflex tubes are poised to command a 40% share of the material segment in the multiflex tubes market by 2025, driven by their versatility, lightweight properties, and cost-efficient production. Composed primarily of polyethylene (PE) or polypropylene (PP), these tubes offer excellent barrier protection against moisture and oxygen while maintaining squeeze-ability and aesthetic flexibility-key attributes in cosmetics, personal care, and pharmaceuticals.

The compatibility of plastic with various printing and labeling techniques makes it ideal for product differentiation in high-competition categories such as toothpaste, lotions, hair gels, and topical medications. Plastic multiflex tubes are also preferred for their tamper-evident closures and soft-touch finishes, enhancing consumer trust and usability.

Advancements in multilayer extrusion technology have further improved their barrier properties, allowing brands to replace more expensive metal alternatives without compromising product integrity. From a sustainability standpoint, many manufacturers now incorporate PCR (post-consumer recycled) plastics and mono-material designs to improve recyclability.

This aligns with growing regulatory and consumer demand for eco-conscious packaging. As brands seek packaging that balances performance, presentation, and environmental impact, plastic multiflex tubes remain a critical enabler of innovation and scalability across various end-use industries.

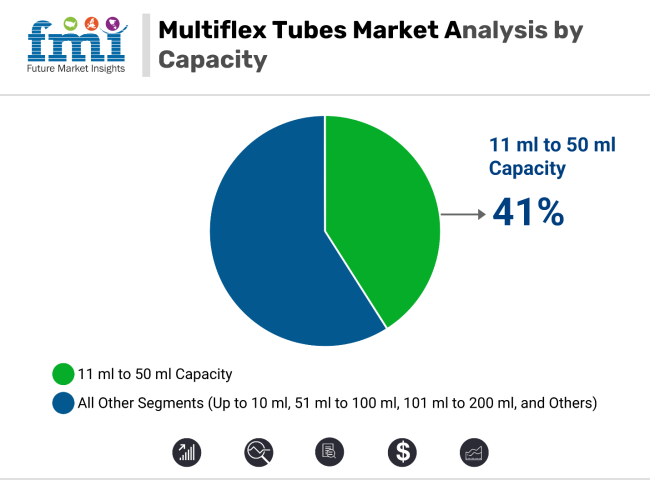

The 11 ml to 50 ml capacity range is projected to lead the multiflex tubes market by accounting for 41% of total demand in 2025, propelled by its ideal suitability for daily-use personal care products, travel-sized toiletries, and sample-sized healthcare applications.

This segment offers a balance between portability and sufficient product volume, making it highly adaptable for creams, gels, ointments, and serums across both mass-market and premium product lines. These mid-size tubes are extensively used in the cosmetics and pharmaceutical industries where dosage control, hygiene, and convenience are paramount. Their compact format supports single-handed application, improves shelf efficiency, and aligns with growing consumer preferences for minimalist and space-saving packaging.

Additionally, brands leverage this size category to create promotional packs, trial kits, and gift sets that encourage product sampling and cross-selling. As the demand for on-the-go, D2C (direct-to-consumer), and e-commerce-ready packaging continues to rise, the 11 ml to 50 ml tubes provide a practical solution for high-speed automated filling, customized branding, and tamper-resistant designs.

With urban consumers seeking convenience without sacrificing performance or aesthetics, this segment will remain pivotal in addressing the evolving needs of both established brands and indie players entering niche personal care and health markets.

Increasing Demand in Healthcare

These tubes are used to package ointments, creams, and pharmaceutical formulations in form products. These tubes offer a moisture and light barrier that protects delicate medical products so that they remain effective as well as retain their shelf life.

Their ability to provide a barrier against moisture and light ensures that sensitive medical products maintain their efficacy and shelf life. As the healthcare industry is now growing rapidly due to increased awareness of health and an aging population, the need for dependable and high-performance packaging solutions will increase significantly.

Growing Focus on Sustainable Packaging

With growing environmental concerns, consumers and manufacturers are both driving towards eco-friendly material use and practices. The tubes can be designed out of recyclable or biodegradable materials, which work in harmony with the sustainability goals of many companies. This shift towards environmentally responsible packaging meets consumer demand but also helps brands enhance their corporate social responsibility profiles, thereby boosting the adoption of the tubes in various sectors.

Competition from Alternative Packaging Solutions

With the increasing availability of collapsible aluminum tubes and flexible plastic pouches, it becomes a challenge for the tubes since these alternatives often provide similar protection at a lower cost. As manufacturers try to optimize their packaging processes, they may choose alternatives that are easier to produce and customize.

Additionally, the trend towards sustainable packaging has led some companies to explore biodegradable or recyclable materials that may not align with traditional Multiflex tube offerings, further limiting multiflex tubes market growth. This competitive landscape necessitates that Multiflex tube manufacturers innovate continuously to differentiate their products and maintain market relevance.

Growing Demand for Customization and Personalization

Multiflex tubes accommodate trends such as consumer demand for packaging customization/personalization as more consumers and firms are focused on unique packing designs that should convey their demands, preferences, or brand uniqueness. The tubes deliver different sizes and shapes and add diverse graphics through multiple designs where there is complete room for changes that may please individual consumers hence providing a route toward increased and greater brand relationships.

Growing Emphasis on Blood Safety

The highest mega consumer trend that presently influences the Blood Temperature Indicator market is blood safety. As awareness about the risks attached to blood transfusions increases, healthcare providers and patients are giving greater attention to the integrity and safety of blood products.

With increased cases of transfusion-related infections and the guideline that health care regulations should not be compromised with, this is the trend nowadays. Consequently, there is now a need to have accurate monitoring of temperature since blood products require safe temperatures for storage and transporting.

Consumers are Increasingly Shifting Towards Sustainable Packaging in The USA

The USA is expected to achieve a high CAGR during the forecast period. Consumer preferences in the USA have dramatically changed from 2023 to 2025. Consumers are increasingly shifting towards sustainable packaging, opting for eco-friendlier materials and design. This is because of growing awareness about environmental issues, which changes buying patterns and builds brand loyalty.

Increasing Demand for Buying Patterns and Per Capita Spending in India

India are poised to experience a CAGR of 7.3% till 2035. The increase in online shopping also influenced buying trends, with increased convenience and variety. This would lead to increasing per capita personal care products with multiflex packaging, as buyers are willing to pay for high-quality brands.

Emphasizing Quality and Sustainability Among Consumers’ in Germany

The market size in Germany will grow at around 5.7% CAGR till 2035. As consumers become more health-conscious and environmentally aware, there is an increase in per capita spending on premium products packaged. Brands that emphasize quality and sustainability are witnessing greater consumer loyalty, influencing overall spending patterns.

Consumer Focus on Purchases and Convenience in Japan

As per FMI analysis, The Japan consumers prefer brands that deliver multifunctional products, which represent desires for value and efficiency. This emerges from the on-the-go lifestyle that consumers prefer; as compact solutions result in purchases made on purchases that focus on convenience.

Move Towards Sustainability and Eco-friendly Packaging in the UK

UK is likely to reach a CAGR of 4.8% from 2025 to 2035. Consumer preference for multi-flex tubes in the UK has seen a tremendous shift from 2023 to 2025. The current focus on sustainability and eco-friendly packaging has been witnessed, with consumers choosing brands that emphasize environmental accountability in their product lines.Companies like Linhardt and Select Packaging are also leading the way by enhancing their portfolios with sustainable materials and innovative designs.

Growing focus on Personal Care and Wellness

During the forecast period, China is on course to experience a CAGR of 7.0%. The industry in China is witnessing an increase in per capita consumption owing to a heightened interest in personal care and wellness. The improving per capita spend is another factor as more spending results in a demand for quality and innovative products that add value to consumers' routines.

The competitive landscape is characterized by several key players, including Linhardt GmbH & Co. KG, Essel Propack Limited, and Albéa S.A. These companies are focusing on innovation and sustainability as primary growth strategies. For instance, Linhardt is enhancing its product line with eco-friendly materials, while Essel Propack is expanding its market reach through strategic partnerships and acquisitions, thus increasing its production capabilities.

Other companies, such as TUBAPACK and Auber Packaging Co., Ltd., are also using customized approaches to respond to different consumer requirements. TUBAPACK focuses on sector-specific tailormade solutions while Auber invests in new manufacturing technologies with more efficiency and higher quality products to remain competitive in highly dynamic markets.

A few start-ups are emerging in the multiflex tubes market, with novel approaches to attracting customers. EcoTube Innovations deals with sustainable materials and concentrates on biodegradable products for the eco-friendly consumer group. The company collaborates with organizations related to the environment to increase its brand value and spread the message of sustainability.

Another popular start-up company is FlexiPack Solutions. This company operates on the premise of customization: the client is able to customize tubes according to his or her needs. That way, diverse market requirements can be catered to, ensuring customer loyalty because of customized service. GreenWrap Technologies is going to invest in advanced manufacturing processes that will boost efficiency and decrease waste, allowing it to present itself as the innovation and sustainability leader.

In terms of material, the market is segmented into aluminium, plastic, ethylene vinyl alcohol, and vacuum metalized PET.

In terms of capacity, the market is segmented into up to 10 ml, 11 ml to 50 ml, 51 ml to 100 ml, 101 ml to 200 ml, and 200 ml above.

In terms of product type, the market is segmented into paper flex tubes, metflex tubes, and metflex light tubes.

By Closure Type, the market is segmented into Cones, Stand Up Caps, Nozzle Caps, Fez Caps, Flip Top Caps, Bubble Tube

In terms of end-users, the market is segmented into pharmaceuticals, cosmetics, personal care, chemicals, food, industrial, homecare, consumer goods, and others.

In terms of region, the market is segmented into North America, Europe, Asia Pacific, Oceania, and Middle-East and Africa.

The market is predicted to reach USD 1.2 billion by 2025.

The market is predicted to reach USD 2.3 billion by 2035.

The prominent companies in the market include LAGEENTUBES, Adelphi Healthcare Packaging, ALL TUBE, and others.

The USA is likely to create lucrative opportunities.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Value (US$ Million) Forecast by Material, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 4: Global Market Value (US$ Million) Forecast by Closure Type, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Capacity, 2017 to 2032

Table 6: Global Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 7: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 8: North America Market Value (US$ Million) Forecast by Material, 2017 to 2032

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 10: North America Market Value (US$ Million) Forecast by Closure Type, 2017 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Capacity, 2017 to 2032

Table 12: North America Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 14: Latin America Market Value (US$ Million) Forecast by Material, 2017 to 2032

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 16: Latin America Market Value (US$ Million) Forecast by Closure Type, 2017 to 2032

Table 17: Latin America Market Value (US$ Million) Forecast by Capacity, 2017 to 2032

Table 18: Latin America Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 20: Europe Market Value (US$ Million) Forecast by Material, 2017 to 2032

Table 21: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 22: Europe Market Value (US$ Million) Forecast by Closure Type, 2017 to 2032

Table 23: Europe Market Value (US$ Million) Forecast by Capacity, 2017 to 2032

Table 24: Europe Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: Asia Pacific Market Value (US$ Million) Forecast by Material, 2017 to 2032

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 28: Asia Pacific Market Value (US$ Million) Forecast by Closure Type, 2017 to 2032

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Capacity, 2017 to 2032

Table 30: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 32: MEA Market Value (US$ Million) Forecast by Material, 2017 to 2032

Table 33: MEA Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 34: MEA Market Value (US$ Million) Forecast by Closure Type, 2017 to 2032

Table 35: MEA Market Value (US$ Million) Forecast by Capacity, 2017 to 2032

Table 36: MEA Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Material, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Closure Type, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by Capacity, 2022 to 2032

Figure 5: Global Market Value (US$ Million) by End Use, 2022 to 2032

Figure 6: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 10: Global Market Value (US$ Million) Analysis by Material, 2017 to 2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 13: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 14: Global Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 15: Global Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 16: Global Market Value (US$ Million) Analysis by Closure Type, 2017 to 2032

Figure 17: Global Market Value Share (%) and BPS Analysis by Closure Type, 2022 to 2032

Figure 18: Global Market Y-o-Y Growth (%) Projections by Closure Type, 2022 to 2032

Figure 19: Global Market Value (US$ Million) Analysis by Capacity, 2017 to 2032

Figure 20: Global Market Value Share (%) and BPS Analysis by Capacity, 2022 to 2032

Figure 21: Global Market Y-o-Y Growth (%) Projections by Capacity, 2022 to 2032

Figure 22: Global Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 23: Global Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 24: Global Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 25: Global Market Attractiveness by Material, 2022 to 2032

Figure 26: Global Market Attractiveness by Product Type, 2022 to 2032

Figure 27: Global Market Attractiveness by Closure Type, 2022 to 2032

Figure 28: Global Market Attractiveness by Capacity, 2022 to 2032

Figure 29: Global Market Attractiveness by End Use, 2022 to 2032

Figure 30: Global Market Attractiveness by Region, 2022 to 2032

Figure 31: North America Market Value (US$ Million) by Material, 2022 to 2032

Figure 32: North America Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 33: North America Market Value (US$ Million) by Closure Type, 2022 to 2032

Figure 34: North America Market Value (US$ Million) by Capacity, 2022 to 2032

Figure 35: North America Market Value (US$ Million) by End Use, 2022 to 2032

Figure 36: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 37: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 40: North America Market Value (US$ Million) Analysis by Material, 2017 to 2032

Figure 41: North America Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 42: North America Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 43: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 44: North America Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 45: North America Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 46: North America Market Value (US$ Million) Analysis by Closure Type, 2017 to 2032

Figure 47: North America Market Value Share (%) and BPS Analysis by Closure Type, 2022 to 2032

Figure 48: North America Market Y-o-Y Growth (%) Projections by Closure Type, 2022 to 2032

Figure 49: North America Market Value (US$ Million) Analysis by Capacity, 2017 to 2032

Figure 50: North America Market Value Share (%) and BPS Analysis by Capacity, 2022 to 2032

Figure 51: North America Market Y-o-Y Growth (%) Projections by Capacity, 2022 to 2032

Figure 52: North America Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 53: North America Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 54: North America Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 55: North America Market Attractiveness by Material, 2022 to 2032

Figure 56: North America Market Attractiveness by Product Type, 2022 to 2032

Figure 57: North America Market Attractiveness by Closure Type, 2022 to 2032

Figure 58: North America Market Attractiveness by Capacity, 2022 to 2032

Figure 59: North America Market Attractiveness by End Use, 2022 to 2032

Figure 60: North America Market Attractiveness by Country, 2022 to 2032

Figure 61: Latin America Market Value (US$ Million) by Material, 2022 to 2032

Figure 62: Latin America Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 63: Latin America Market Value (US$ Million) by Closure Type, 2022 to 2032

Figure 64: Latin America Market Value (US$ Million) by Capacity, 2022 to 2032

Figure 65: Latin America Market Value (US$ Million) by End Use, 2022 to 2032

Figure 66: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 67: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 70: Latin America Market Value (US$ Million) Analysis by Material, 2017 to 2032

Figure 71: Latin America Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 72: Latin America Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 73: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 74: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 75: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 76: Latin America Market Value (US$ Million) Analysis by Closure Type, 2017 to 2032

Figure 77: Latin America Market Value Share (%) and BPS Analysis by Closure Type, 2022 to 2032

Figure 78: Latin America Market Y-o-Y Growth (%) Projections by Closure Type, 2022 to 2032

Figure 79: Latin America Market Value (US$ Million) Analysis by Capacity, 2017 to 2032

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Capacity, 2022 to 2032

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Capacity, 2022 to 2032

Figure 82: Latin America Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 83: Latin America Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 84: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 85: Latin America Market Attractiveness by Material, 2022 to 2032

Figure 86: Latin America Market Attractiveness by Product Type, 2022 to 2032

Figure 87: Latin America Market Attractiveness by Closure Type, 2022 to 2032

Figure 88: Latin America Market Attractiveness by Capacity, 2022 to 2032

Figure 89: Latin America Market Attractiveness by End Use, 2022 to 2032

Figure 90: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 91: Europe Market Value (US$ Million) by Material, 2022 to 2032

Figure 92: Europe Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 93: Europe Market Value (US$ Million) by Closure Type, 2022 to 2032

Figure 94: Europe Market Value (US$ Million) by Capacity, 2022 to 2032

Figure 95: Europe Market Value (US$ Million) by End Use, 2022 to 2032

Figure 96: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 97: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 100: Europe Market Value (US$ Million) Analysis by Material, 2017 to 2032

Figure 101: Europe Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 102: Europe Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 103: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 104: Europe Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 105: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 106: Europe Market Value (US$ Million) Analysis by Closure Type, 2017 to 2032

Figure 107: Europe Market Value Share (%) and BPS Analysis by Closure Type, 2022 to 2032

Figure 108: Europe Market Y-o-Y Growth (%) Projections by Closure Type, 2022 to 2032

Figure 109: Europe Market Value (US$ Million) Analysis by Capacity, 2017 to 2032

Figure 110: Europe Market Value Share (%) and BPS Analysis by Capacity, 2022 to 2032

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Capacity, 2022 to 2032

Figure 112: Europe Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 113: Europe Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 114: Europe Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 115: Europe Market Attractiveness by Material, 2022 to 2032

Figure 116: Europe Market Attractiveness by Product Type, 2022 to 2032

Figure 117: Europe Market Attractiveness by Closure Type, 2022 to 2032

Figure 118: Europe Market Attractiveness by Capacity, 2022 to 2032

Figure 119: Europe Market Attractiveness by End Use, 2022 to 2032

Figure 120: Europe Market Attractiveness by Country, 2022 to 2032

Figure 121: Asia Pacific Market Value (US$ Million) by Material, 2022 to 2032

Figure 122: Asia Pacific Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 123: Asia Pacific Market Value (US$ Million) by Closure Type, 2022 to 2032

Figure 124: Asia Pacific Market Value (US$ Million) by Capacity, 2022 to 2032

Figure 125: Asia Pacific Market Value (US$ Million) by End Use, 2022 to 2032

Figure 126: Asia Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 127: Asia Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Material, 2017 to 2032

Figure 131: Asia Pacific Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 132: Asia Pacific Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 133: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 134: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 135: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 136: Asia Pacific Market Value (US$ Million) Analysis by Closure Type, 2017 to 2032

Figure 137: Asia Pacific Market Value Share (%) and BPS Analysis by Closure Type, 2022 to 2032

Figure 138: Asia Pacific Market Y-o-Y Growth (%) Projections by Closure Type, 2022 to 2032

Figure 139: Asia Pacific Market Value (US$ Million) Analysis by Capacity, 2017 to 2032

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Capacity, 2022 to 2032

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Capacity, 2022 to 2032

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 143: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 144: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 145: Asia Pacific Market Attractiveness by Material, 2022 to 2032

Figure 146: Asia Pacific Market Attractiveness by Product Type, 2022 to 2032

Figure 147: Asia Pacific Market Attractiveness by Closure Type, 2022 to 2032

Figure 148: Asia Pacific Market Attractiveness by Capacity, 2022 to 2032

Figure 149: Asia Pacific Market Attractiveness by End Use, 2022 to 2032

Figure 150: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 151: MEA Market Value (US$ Million) by Material, 2022 to 2032

Figure 152: MEA Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 153: MEA Market Value (US$ Million) by Closure Type, 2022 to 2032

Figure 154: MEA Market Value (US$ Million) by Capacity, 2022 to 2032

Figure 155: MEA Market Value (US$ Million) by End Use, 2022 to 2032

Figure 156: MEA Market Value (US$ Million) by Country, 2022 to 2032

Figure 157: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 160: MEA Market Value (US$ Million) Analysis by Material, 2017 to 2032

Figure 161: MEA Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 162: MEA Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 163: MEA Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 164: MEA Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 165: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 166: MEA Market Value (US$ Million) Analysis by Closure Type, 2017 to 2032

Figure 167: MEA Market Value Share (%) and BPS Analysis by Closure Type, 2022 to 2032

Figure 168: MEA Market Y-o-Y Growth (%) Projections by Closure Type, 2022 to 2032

Figure 169: MEA Market Value (US$ Million) Analysis by Capacity, 2017 to 2032

Figure 170: MEA Market Value Share (%) and BPS Analysis by Capacity, 2022 to 2032

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Capacity, 2022 to 2032

Figure 172: MEA Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 173: MEA Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 174: MEA Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 175: MEA Market Attractiveness by Material, 2022 to 2032

Figure 176: MEA Market Attractiveness by Product Type, 2022 to 2032

Figure 177: MEA Market Attractiveness by Closure Type, 2022 to 2032

Figure 178: MEA Market Attractiveness by Capacity, 2022 to 2032

Figure 179: MEA Market Attractiveness by End Use, 2022 to 2032

Figure 180: MEA Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Companies & Market Share in Multiflex Tubes Production

Tubes, Bottles and Tottles Market

Cryotubes Market

Pump Tubes Market Size and Share Forecast Outlook 2025 to 2035

Paper Tubes & Core Industry Analysis in United States Trends, Size, and Forecast for 2025-2035

Key Companies & Market Share in Paper Tubes Industry

Paper Tubes Market Growth & Industry Insights 2021-2031

Lotion Tubes Market Size and Share Forecast Outlook 2025 to 2035

Bubble Tubes Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Bubble Tubes Suppliers

Postal Tubes Market

Cosmetic Tubes Market by Material Type & Application from 2025 to 2035

Market Share Insights of Cosmetic Tubes Product Providers

Tracheal Tubes and Airway Products Market Analysis - Growth & Forecast 2025 to 2035

Aluminum Tubes Market from 2023 to 2033

Laminated Tubes Market Size and Share Forecast Outlook 2025 to 2035

Unit Dose Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Trends and Growth 2035

Market Share Breakdown of Laminated Tubes Manufacturers

Market Share Insights of Leading Packaging Tube Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA