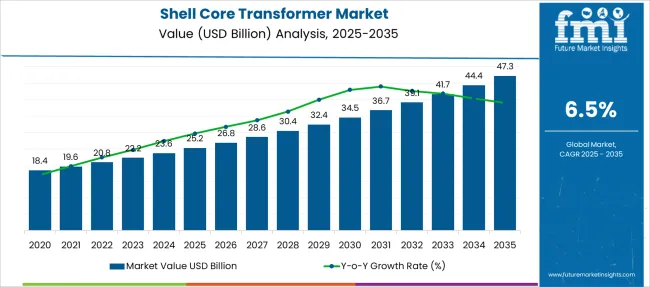

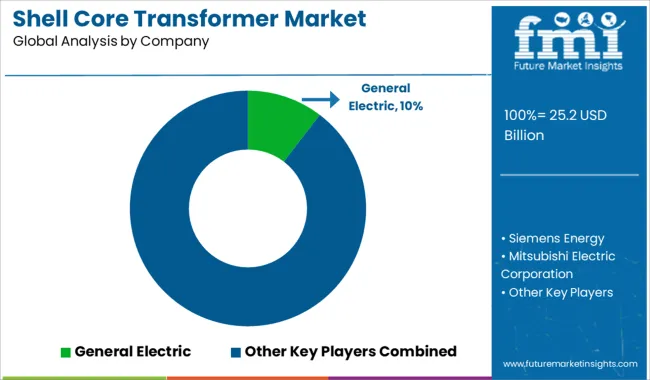

The Shell Core Transformer Market is estimated to be valued at USD 25.2 billion in 2025 and is projected to reach USD 47.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Shell Core Transformer Market Estimated Value in (2025 E) | USD 25.2 billion |

| Shell Core Transformer Market Forecast Value in (2035 F) | USD 47.3 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The shell core transformer market is experiencing sustained growth driven by increasing electricity demand, modernization of grid infrastructure, and a growing emphasis on energy-efficient transmission and distribution systems. The unique structural design of shell core transformers, which offers enhanced short-circuit strength, compactness, and mechanical durability, has positioned them as a preferred choice for both utility and industrial applications.

Rising urbanization and expansion of commercial infrastructure are contributing to steady deployment of these transformers across distribution networks. Moreover, the transition to renewable energy and smart grid solutions is fostering demand for reliable and high-performance transformers.

Future growth is expected to be propelled by regulatory mandates for energy efficiency, the proliferation of distributed energy resources, and investments in grid resilience. Manufacturers are focusing on developing low-loss, eco-friendly transformer models to align with sustainability goals, reinforcing the positive long-term outlook for the shell core transformer market.

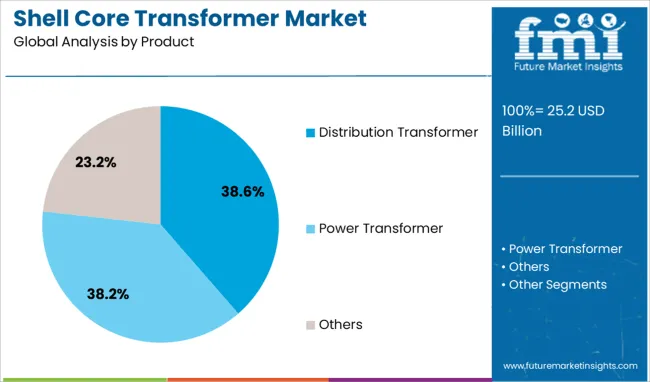

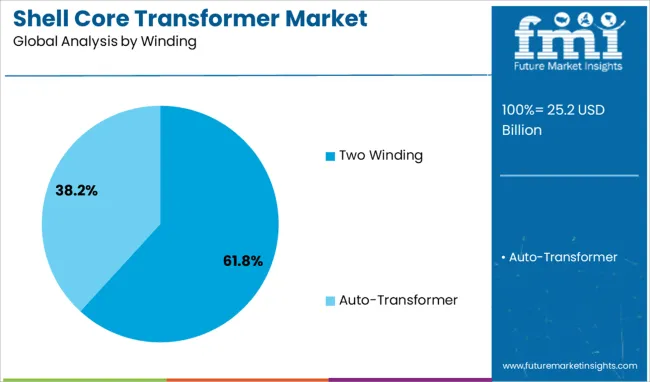

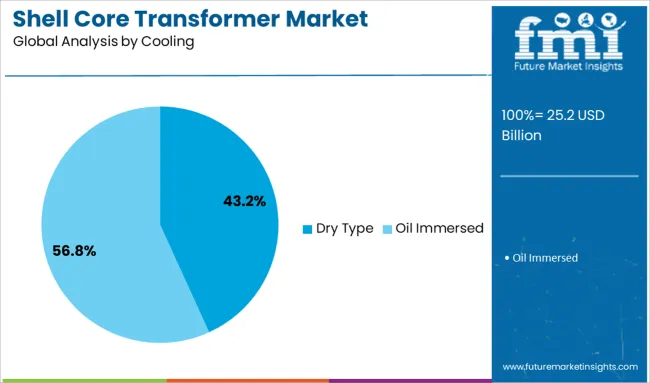

The shell core transformer market is segmented by product, winding, cooling, insulation, mounting, and application and geographic regions. By product of the shell core transformer market is divided into Distribution Transformer, Power Transformer, and Others. In terms of winding of the shell core transformer market is classified into Two Winding and Auto-Transformer. Based on cooling of the shell core transformer market is segmented into Dry Type and Oil Immersed. By insulation of the shell core transformer market is segmented into Gas, Oil, Solid, Air, and Others. By mounting of the shell core transformer market is segmented into Pad, Pole, and Others. By application of the shell core transformer market is segmented into Residential, Commercial & Industrial, and Utility. Regionally, the shell core transformer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The distribution transformer segment accounts for 38.6% of the shell core transformer market, driven by its critical role in final-stage voltage conversion and power distribution to end users. These transformers are widely adopted across urban and rural networks due to their ability to ensure consistent voltage regulation and reduced transmission losses.

The segment has gained traction amid rapid infrastructure development and the expansion of residential and commercial projects that require localized, efficient power delivery. Shell core design enhances the performance of distribution transformers by providing robust mechanical support and better heat dissipation, which increases operational life and reliability.

Government-led electrification programs and utility grid upgrades are further supporting the segment’s growth. As electricity demand rises and distribution networks expand, this segment is expected to maintain strong momentum within the broader transformer market.

The two winding segment leads the shell core transformer market with a significant 61.8% share, attributed to its effective separation of primary and secondary circuits, which enhances electrical isolation and safety. This configuration is preferred in a wide range of applications, including power distribution, industrial machinery, and commercial facilities, where circuit protection and voltage transformation are essential.

The widespread use of two winding transformers is further supported by their straightforward design, ease of maintenance, and cost-efficiency, making them suitable for standard utility applications. Enhanced performance under fluctuating load conditions and increased compatibility with diverse voltage levels reinforce the segment’s dominance.

As energy infrastructure grows more complex and the need for stable voltage regulation intensifies, demand for two winding shell core transformers is projected to remain strong across global markets.

The dry type segment commands 43.2% of the shell core transformer market, owing to its environmental safety, low maintenance, and suitability for indoor and environmentally sensitive installations. These transformers eliminate the risk of oil leakage, making them an ideal solution for locations such as hospitals, schools, data centers, and high-rise buildings where fire safety and operational reliability are critical.

The segment has gained momentum with increased adoption in renewable energy installations and energy-efficient building designs, where space and cooling constraints are a concern. Innovations in resin encapsulation and thermal management have improved the performance and durability of dry type transformers, enhancing their appeal in modern infrastructure projects.

With growing regulatory focus on environmental standards and fire prevention, the segment is expected to experience continued growth as users seek sustainable and safe transformer alternatives.

The shell core transformer market is expected to grow steadily due to accelerating investment in grid upgrades and renewable energy integration. Growth drivers include rising electrification and replacement of aging infrastructure. Significant opportunities arise in smart grid modernization and expanded utility projects. Emerging trends show increasing adoption of solid insulation, oil-cooled units, and preference for medium‑voltage compact designs. Restraints are posed by fluctuating raw material prices and production bottlenecks causing supply delays. Market strength in 2024–2025 is notably from Asia-Pacific and North America, with a projected CAGR above 6% through the early 2030s.

Strong power network expansion and aging infrastructure replacement have fueled demand for shell core transformers in 2024 and 2025. USA and European utilities have prioritized upgrades, driven by increased electricity use across industrial and commercial sectors. The shell core segment accounted for nearly 42% of power transformer revenues in 2024 and continues to outperform alternative designs thanks to high efficiency and compactness. Demand from Asia-Pacific markets is also contributing significantly, backed by rapid infrastructure rollout and grid reinforcement plans.

Major opportunities are present where smart grid rollouts and renewable energy deployment are underway in 2025. Integration of solar and wind farms in regions such as India and China has prompted utilities to seek shell core transformers with advanced voltage regulation and reliable power delivery. Upgrading distribution networks in North America and Europe has further allowed automation-ready shell core units to find traction. Utility companies and EPC firms are investing in transformers suitable for integration with energy management systems, offering long-term supply contracts for established manufacturers.

A key emerging trend is increased adoption of solid insulated shell core transformers, which recorded the highest CAGR among insulation categories through 2024–2032. Oil-immersed cooling remains dominant in 2024 and 2025, especially for high-capacity designs in industrial segments, but dry-type units are gaining popularity in urban installations for safety and compactness. Design innovation has led to more compact medium-voltage shell core units tailored for emerging grid requirements in tight urban environments. This approach is positioning manufacturers to cater to both industrial and utility demands effectively.

Market growth has been constrained by raw material price volatility and limited manufacturing capacity in 2024 and 2025. Transformer makers have reported multi-year supply bottlenecks that could delay grid projects until at least late 2026. Initial high investment costs for shell core designs and competition from alternative core types have also limited adoption in cost-sensitive regions. Limited availability of high-grade electrical steel and insulation materials has raised per-unit costs and impacted vendor margins, adding further complexity to procurement strategies and contract negotiations.

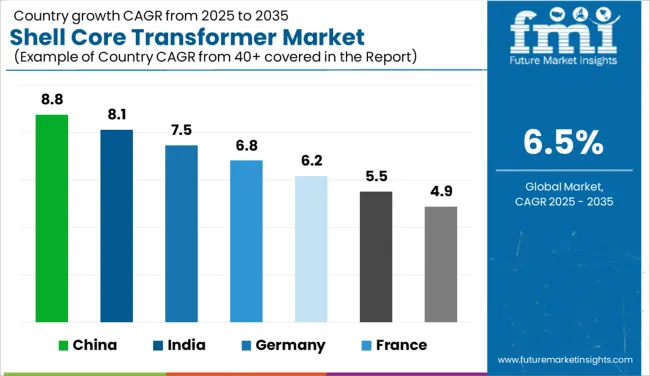

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

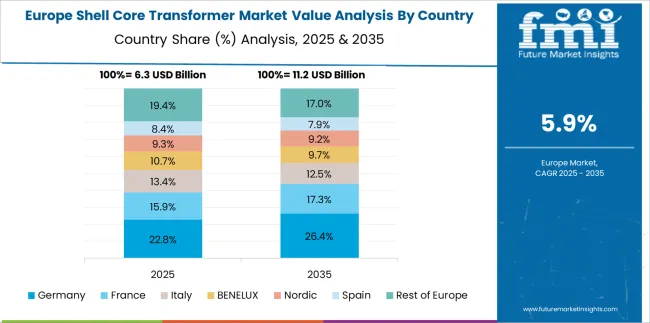

The global shell core transformer market is projected to grow at a 6.5% CAGR between 2025 and 2035. China leads at 8.8% CAGR, driven by large-scale grid modernization projects and renewable energy integration. India follows with 8.1%, supported by rising industrial load demands and government-backed electrification programs. Germany records 7.5%, influenced by expansion in industrial automation and renewable infrastructure. The UK stands at 6.2%, focusing on replacing aging grid infrastructure with energy-efficient transformers. The United States grows at 5.5%, supported by incremental upgrades and resilience improvements in power distribution systems. Growth divergence highlights Asia’s aggressive investment in transmission and distribution capacity, compared to modernization-driven demand in mature Western economies.

China dominates the shell core transformer market with an anticipated 8.8% CAGR through 2035. Market growth is driven by state-funded projects targeting power grid expansion and stability, essential for integrating renewable energy from wind and solar plants. The demand for high-capacity shell core transformers is particularly strong in urban and industrial corridors, where power reliability is a critical factor. Local manufacturers deliver cost-effective designs, while global suppliers provide advanced insulation and energy-efficient units for high-voltage applications. Continuous investment in ultra-high-voltage transmission networks and expansion of smart grid infrastructure ensures sustained market momentum.

The shell core transformer market in India is forecast to expand at 8.1% CAGR, driven by ambitious power infrastructure development plans and rural electrification programs. Industrial growth, along with rapid expansion in metro rail and renewable energy projects, is increasing the need for efficient transformers with low transmission losses. Domestic manufacturers emphasize cost-optimized production, while partnerships with global firms introduce advanced shell core designs for high-reliability performance. Favorable government schemes like “Revamped Distribution Sector Scheme” and large-scale transmission upgrades create strong opportunities for EPC contractors and equipment suppliers.

Germany posts a 7.5% CAGR, supported by rising investment in renewable energy and advanced automation within industrial facilities. The energy transition strategy focuses on grid optimization, requiring efficient shell core transformers for stable load balancing and smart substation integration. Demand is particularly strong from offshore wind power projects and electric vehicle charging infrastructure. Manufacturers are introducing shell core units with reduced noise levels and enhanced thermal performance to comply with EU energy efficiency regulations. Replacement of aging transformers in industrial plants and distribution networks further accelerates market growth.

The United Kingdom market is projected to grow at 6.2% CAGR, supported by ongoing grid reliability upgrades and energy security measures. The transition toward renewable energy and electrification of transportation drives the installation of modern shell core transformers in substations. Demand also emerges from data center expansions requiring uninterrupted and stable power supply. While large-scale adoption is slower than in Asia, the UK focuses on high-specification, low-loss transformers compatible with digital monitoring systems. The replacement cycle for older transformers in urban distribution grids presents steady market opportunities.

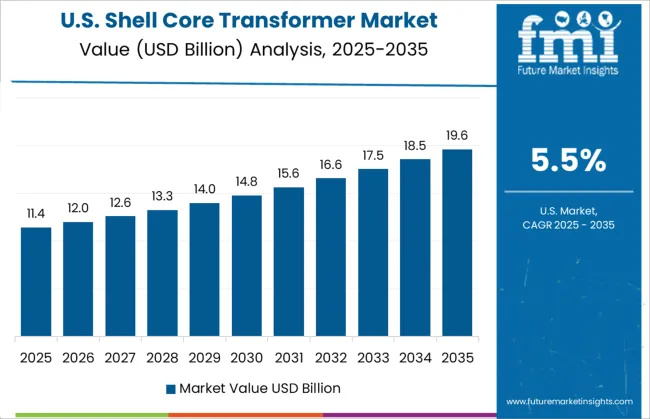

The United States registers a 5.5% CAGR, reflecting moderate growth due to a mature power grid and gradual replacement initiatives. However, resilience projects addressing extreme weather impacts and modernization of aging infrastructure are boosting demand. Increasing renewable integration and expansion of EV charging networks create opportunities for shell core transformers with higher load flexibility. Manufacturers are introducing advanced insulation systems and IoT-enabled monitoring features to meet performance and safety standards set by regulatory bodies such as DOE and IEEE.

The shell core transformer market is moderately consolidated, with General Electric recognized as a leading player due to its advanced design capabilities, high-performance insulation systems, and expertise in manufacturing transformers for power transmission and industrial applications. The company’s focus on energy efficiency and reliability positions it strongly in utility and heavy industrial sectors. Key players include Siemens Energy, Mitsubishi Electric Corporation, ABB, Schneider Electric, Toshiba International Corporation, Elsewedy Electric, Eaton, CG Power & Industrial Solutions Ltd, Voltamp, Ormazabal, ARTECHE, Kirloskar Electric Company, Hyosung Heavy Industries, and Celme S.r.l. These manufacturers offer shell core transformers optimized for high-voltage and extra-high-voltage applications, ensuring low losses, robust thermal performance, and compliance with global standards such as IEC and ANSI. Market growth is driven by increasing investments in grid modernization, renewable energy integration, and industrial expansion requiring high-efficiency power distribution solutions. Manufacturers are focusing on incorporating advanced insulation materials, digital monitoring systems for predictive maintenance, and eco-friendly fluids to reduce environmental impact. Trends include the development of smart transformers integrated with IoT-enabled sensors and advanced cooling technologies to enhance operational reliability. Asia-Pacific leads in demand due to rapid power infrastructure development, while North America and Europe focus on replacing aging grid assets and adopting digital transformer solutions for enhanced grid resilience.

In November 2023, Hitachi Energy introduced liquid-filled distribution transformers integrated with Transient Voltage Protection (TVP®) Technology, revealed during the launch of its new factory in Bac Ninh, Vietnam. This innovation enhances protection against switching-induced anomalies, improving transformer resilience in data centers, renewables, and rail infrastructure.

| Item | Value |

|---|---|

| Quantitative Units | USD 25.2 Billion |

| Product | Distribution Transformer, Power Transformer, and Others |

| Winding | Two Winding and Auto-Transformer |

| Cooling | Dry Type and Oil Immersed |

| Insulation | Gas, Oil, Solid, Air, and Others |

| Mounting | Pad, Pole, and Others |

| Application | Residential, Commercial & Industrial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | General Electric, Siemens Energy, Mitsubishi Electric Corporation, ABB, Schneider Electric, Toshiba International Corporation, Elsewedy Electric, Eaton, CG Power & Industrial Solutions Ltd, Voltamp, Ormazabal, ARTECHE, Kirloskar Electric Company, Hyosung Heavy Industries, and Celme S.r.l. |

| Additional Attributes | Dollar sales segmented by transformer type (power, distribution, specialty) and insulation (oil-immersed, dry-type). Asia-Pacific leads with large-scale grid upgrades, while North America prioritizes renewable integration. Buyers prefer compact, energy-efficient designs with digital monitoring. Innovations include amorphous metal cores, IoT-based predictive maintenance, and advanced fire-resistant insulation to meet safety and sustainability standards. |

The global shell core transformer market is estimated to be valued at USD 25.2 billion in 2025.

The market size for the shell core transformer market is projected to reach USD 47.3 billion by 2035.

The shell core transformer market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in shell core transformer market are distribution transformer, power transformer and others.

In terms of winding, two winding segment to command 61.8% share in the shell core transformer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Shell Vials Market Size and Share Forecast Outlook 2025 to 2035

Shell & Tube Heat Exchangers Market

Shellac Market

Eggshell Membrane Powder Market Size and Share Forecast Outlook 2025 to 2035

Clamshell Packaging Market Size and Share Forecast Outlook 2025 to 2035

Clamshell Sealer Market Analysis Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Clamshell Packaging Providers

Clamshell Labelling Machines Market Growth - Trends & Forecast 2022 to 2032

Yacht Shell Doors Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Shell Fiber Market Analysis - Size, Share & Forecast 2025 to 2035

Package Shell for Optical Communication Modules Market Size and Share Forecast Outlook 2025 to 2035

ESD Clamshell Market Size and Share Forecast Outlook 2025 to 2035

PET Clamshell Market

Food Clamshells Market Trends – Demand, Growth & Future Outlook 2025 to 2035

Cashew Nutshell Liquid Market Size and Share Forecast Outlook 2025 to 2035

Stock Clamshell Packaging Market

Paperboard Clamshell Boxes Market

Core Plate Varnishes Market Size and Share Forecast Outlook 2025 to 2035

Core Drill Automatic Feeding Machine Market

Core Banking Solution Market Report – Growth & Forecast 2017-2027

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA