The clamshell packaging market is experiencing robust growth driven by rising demand for protective, transparent, and tamper-evident packaging solutions. Increasing adoption across food, electronics, and consumer goods sectors is supporting consistent revenue generation. Current market dynamics are influenced by growing consumer preference for convenience packaging and heightened emphasis on product visibility and durability.

Manufacturers are investing in material innovation, including recyclable and biodegradable options, to meet evolving sustainability standards. Technological advancements in thermoforming and sealing processes are enhancing production efficiency and design flexibility. The future outlook remains positive as e-commerce expansion and retail modernization continue to stimulate the need for secure and visually appealing packaging formats.

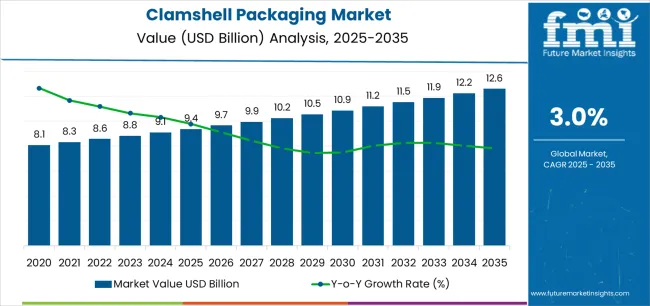

| Metric | Value |

|---|---|

| Clamshell Packaging Market Estimated Value in (2025 E) | USD 9.4 billion |

| Clamshell Packaging Market Forecast Value in (2035 F) | USD 12.6 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

Growth rationale is based on the increasing importance of product safety, extended shelf life, and brand differentiation Continuous improvements in packaging functionality, coupled with cost-effective manufacturing practices, are expected to sustain steady market expansion and reinforce clamshell packaging as a preferred solution across multiple end-use industries.

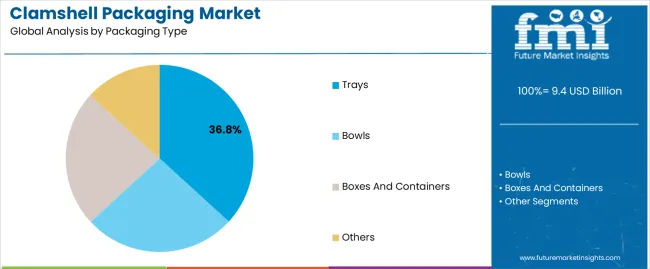

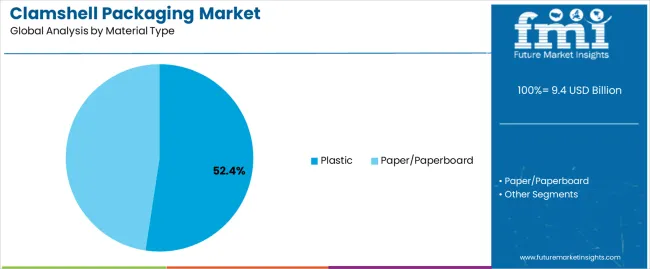

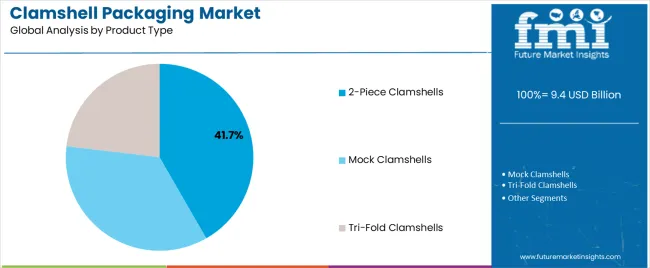

The market is segmented by Packaging Type, Material Type, Product Type, and End Use and region. By Packaging Type, the market is divided into Trays, Bowls, Boxes And Containers, and Others. In terms of Material Type, the market is classified into Plastic and Paper/Paperboard. Based on Product Type, the market is segmented into 2-Piece Clamshells, Mock Clamshells, and Tri-Fold Clamshells. By End Use, the market is divided into Food, Electrical And Electronics, Cosmetics And Personal Care, Household Goods, Gifts, Toys And Stationery, Pharmaceuticals, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

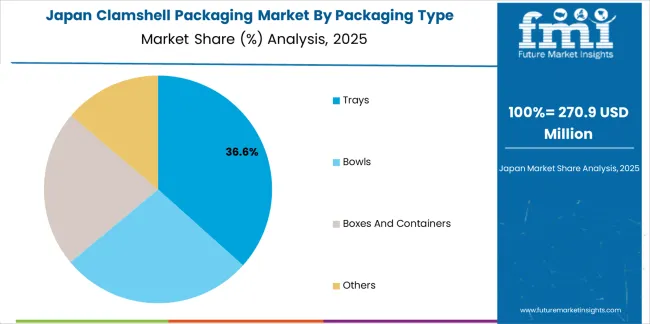

The trays segment, accounting for 36.8% of the packaging type category, has established dominance due to its versatile design, durability, and suitability for both food and non-food applications. Its widespread use in ready-to-eat meals, bakery products, and consumer electronics has reinforced steady demand.

The segment benefits from easy handling, stackability, and strong protective features that minimize product damage during storage and transport. Manufacturers are focusing on enhancing material efficiency and incorporating eco-friendly polymers to reduce environmental impact.

Growth is being supported by the expansion of organized retail and food delivery services that rely heavily on secure and presentable packaging Continued innovation in tray formats, including resealable and compartmentalized variants, is expected to sustain the segment’s share and promote adoption across both commercial and retail distribution channels.

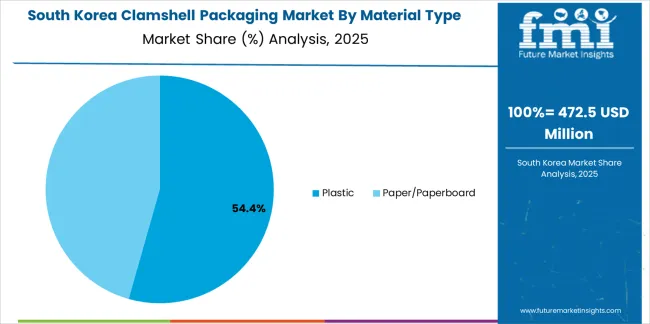

The plastic segment, holding 52.4% of the material type category, remains the leading choice due to its cost-effectiveness, lightweight properties, and high adaptability to complex designs. It provides superior clarity and impact resistance, making it ideal for retail displays and product protection.

Demand has been supported by advances in thermoforming technologies that enhance design precision and material utilization. Regulatory focus on sustainability has prompted producers to develop recyclable and bio-based plastic alternatives, balancing performance with environmental compliance.

The segment’s resilience is maintained through its compatibility with mass production and global supply chain networks Over the forecast period, innovations in post-consumer recycled plastics and circular economy initiatives are expected to reinforce the plastic segment’s dominance within the clamshell packaging market.

The 2-piece clamshells segment, representing 41.7% of the product type category, has emerged as the leading format due to its convenience, strong sealing capability, and ease of customization. It offers enhanced protection against contamination and tampering, which has driven widespread adoption across food packaging, electronics, and personal care industries.

Manufacturers are optimizing designs for improved aesthetic appeal and functional efficiency while incorporating user-friendly opening mechanisms. The segment benefits from growing retail activity and consumer inclination toward transparent packaging that highlights product quality.

Advances in automation and tooling technologies have also enabled cost-efficient mass production Future growth is expected to be driven by the increasing use of recyclable and biodegradable materials, ensuring the 2-piece clamshells segment continues to hold a leading position in the market.

Adherence to packaging standards and regulations primarily governs the market growth of clamshell packaging. Clamshell packaging manufacturers work hard to meet regulatory criteria for safety, hygiene, and product information to guarantee that their packaging solutions comply with industry standards.

As consumer habits change, convenient and user-friendly clamshell packaging is in higher demand. Clamshell packaging's easy opening and closing characteristics add to consumer convenience, which fosters market expansion of clamshell packaging.

In October 2025, the United States-based thermoformed end-user manufacturer Jamestown Plastics developed a durable and eco-friendly replacement for clamshell packaging. The container, called Clamtainer, has a one-snap closing mechanism because of patented Click-It Closure technology.

The need for environmentally friendly packaging solutions has grown as people's understanding and concern about environmental sustainability have increased. The market acceptability of clamshell packaging is inhibited by criticism that it contributes to plastic waste and pollution because it is frequently composed of non-biodegradable materials.

Packaging design trends and consumer preferences are always changing. Flexible packaging is one such alternative that is preferred because it is more cost-effective, lighter, and more flexible. Due to this shift in preference, the clamshell packaging solution market faces an obstacle in staying competitive.

| Attributes | Details |

|---|---|

| Market Value for 2020 | USD 8.1 billion |

| Market Value for 2025 | USD 8.8 billion |

| Market CAGR from 2020 to 2025 | 1.8% |

The preceding subsection includes the segmented clamshell packaging market analysis. Based on exhaustive analysis, the 2-piece clamshells sector controls the product type category, and the food segment dominates the end use category.

| Segment | Food |

|---|---|

| Market Share (2025) | 62.8% |

Clamshell packaging designs provide enough space for product labeling and branding components, improving visibility and identification on crowded store shelves. Food packaging sector frequently use this type of packaging as a branding strategy.

Easy access to pre-packaged food products and accessibility and handling are essential for busy individuals and families. This makes clamshell packaging a convenient option for fast-paced consumers. The food segment takes precedence over the clamshell packaging sales. This is due to the steady need for packaged goods that meet the needs of consumers who are always on the go and for everyday household necessities.

| Segment | 2-Piece Clamshells |

|---|---|

| Market Share (2025) | 54.2% |

Users like to utilize 2-piece clamshells because of their simple, handy design, which makes opening them a pleasure. In response to the growing demand for sustainable packaging, there are increasingly environmentally friendly 2-piece clamshell packaging solutions that satisfy both commercial and environmental goals. For clamshell packaging vendors concerned with optimizing their profit margins, 2-piece clamshells are an economical packaging option.

The subsequent tables focus on the clamshell packaging market in leading regions, which includes North America, Europe, and Asia Pacific. A comprehensive evaluation demonstrates that Asia Pacific has enormous market opportunities for clamshell packaging.

A Holistic Outlook on the Clamshell Packaging Market in Asia Pacific

| Countries | Forecasted CAGR (2025 to 2035) |

|---|---|

| India | 6.1% |

| China | 4.7% |

| Thailand | 4.3% |

| South Korea | 2.3% |

| Japan | 1.8% |

The India clamshell packaging market is shaped by government programs that support environmentally friendly packaging techniques. The food and beverage industry's reliance on creative packaging solutions compels the demand for clamshell packaging in India. The booming eCommerce sector in India is generating opportunities to expand the clamshell packaging market.

China is an integral provider of packaging materials, and its manufacturing dominance is influencing the market dynamics of clamshell packaging. The China clamshell packaging industry is changing due to strict laws on food safety and packaging standards, emphasizing quality and compliance.

In Thailand, there is a growing demand for portable and convenient clamshell packaging solutions due to consumers' inclination to eat on the go. Changes in consumer lifestyles and Thailand's expanding retail sector accelerate the demand for clamshell packaging.

Technological developments in packaging equipment and materials strengthen the effectiveness and quality of clamshell packaging in South Korea. Strict government laws governing the management of packaging trash promote the adoption of recyclable and biodegradable materials in clamshell packaging.

Japan's elderly population positively affects trends in packaging design, particularly when it comes to senior-friendly and easily opened clamshell packaging options. A growing focus on eco-friendly and simple packaging designs is transforming the Japan clamshell packaging market.

Dynamics of the North American Clamshell Packaging Sector

| Countries | Forecasted CAGR (2025 to 2035) |

|---|---|

| United States | 1.8% |

| Canada | 1.2% |

Innovation in clamshell package designs is stimulated by the United States market's growing inclination toward convenience and on-the-go consumption. The United States clamshell container market is expanding due to increased eCommerce and online shopping, emphasizing safe and durable packaging options.

Clamshell packaging is becoming progressively prevalent for online retail, highlighting ease and product safety during transit due to Canada's booming eCommerce industry. The Canada clamshell packaging solution market is shaped by developments in sustainable packaging materials, which are prompted by customer demands for green solutions.

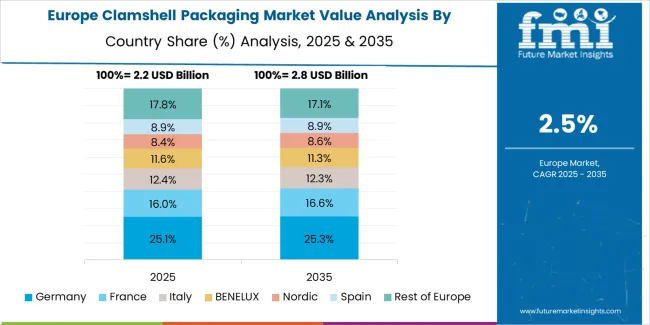

Opportunities for Clamshell Packaging in Europe

| Countries | Forecasted CAGR (2025 to 2035) |

|---|---|

| Spain | 2.1% |

| Italy | 1.7% |

| United Kingdom | 1.6% |

| Germany | 1.5% |

| France | 1.3% |

Spain's tourism industry propels the demand for single-serving clamshell packaging for snacks and on-the-go meals. The thriving retail sector in Spain, which encompasses fashion and electronics, plays a significant role in expanding the applications of clamshell packaging beyond food items.

In the Italy luxury goods market, cosmetics, fragrances, and fashion accessories require high-end, aesthetically beautiful clamshell packaging. Due to the growth of online food delivery services in Italy, opportunities for safe and tamper-evident clamshell packaging for takeaway and delivery meals have arisen.

The growth of online grocery shopping in the United Kingdom spurs the need for robust and safe clamshell packaging for fresh produce and meal packages. Due to the United Kingdom's thriving pet care industry, there is also a growing need for sturdy, pet-safe clamshell packaging for treats and accessories.

The pharmaceutical industry in Germany is booming, so clamshell packaging that is both child- and tamper-proof is required for pharmaceuticals and healthcare items. In Germany's competitive market scenario, the retail premiumization trend drives the use of aesthetically pleasing and customizable clamshell packaging solutions.

Premium and aesthetically pleasing clamshell packaging solutions are in high demand in France due to the country's cosmetics and personal care industry. Consumers' convenience-driven preferences escalate the demand for portion-controlled, resealable clamshell packaging in France for fresh fruit and gourmet goods.

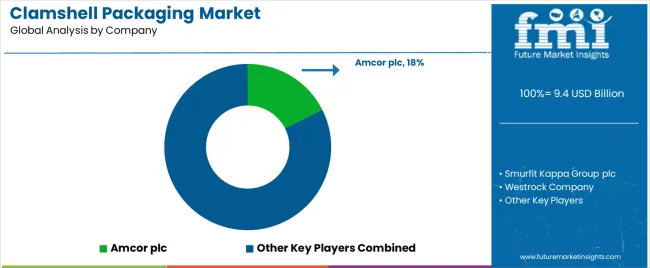

Several key clamshell packaging vendors vie for prominence and market share. Notable clamshell packaging manufacturers form the backbone of the industry, bringing unique expertise and capabilities to the market.

Smurfit Kappa Group plc and Westrock Company are leaders, leveraging their extensive experience and innovative solutions to propel the market growth of clamshell packaging. Parksons Packaging Ltd. and VisiPak Inc. also play significant roles, offering diverse packaging options customized to meet customer needs.

With their specialized solutions and dedication to quality, Prime Packaging LLC, Sonoco Products Company, and Universal Plastics Corporation add to the competitive scene. Amcor plc and Placon Corporation Inc. prioritize their technological innovations and global reach, while Dordan Manufacturing Company, Footprint US, and Novolex Company concentrate on sustainability and environmentally friendly solutions.

The market is distinguished by fierce rivalry and inventiveness, and these major clamshell packaging vendors are paving the path for its future development. As consumer preferences change and the need for effective packaging solutions rises, these clamshell packaging producers are going to be essential to meet industry expectations and thrust the market expansion.

Latest Advancements

| Company | Details |

|---|---|

| Sustainable Packaging Coalition (SPC) | In November 2025, The Sustainable Packaging Coalition (SPC) released its "Clamshell Recycling Guide" to strengthen the clamshell packaging recycling infrastructure. This project aims to improve the circularity of these materials and solve recycling issues. |

| Huhtamaki | Major packaging solutions provider Huhtamaki debuted Forma paper-based clamshell packaging for fresh fruit in October 2025. Because of its compostability and recyclability, this paper-based solution appeals to environmentally aware customers. |

| NatureWorks | Leading biopolymer manufacturer NatureWorks announced in August 2025 that it is going to collaborate with PAC Packaging to create bio-based clamshell packaging for fruits and vegetables. This action attempts to lessen packaging's negative environmental effects and our reliance on fossil fuels. |

| WestRock Company | WestRock Company announced in February 2025 that it built a new corrugated box manufacturing facility in the Pacific Northwest. The new plant helped the company better meet the growing demand for corrugated packaging, particularly corrugated clamshells. |

The global clamshell packaging market is estimated to be valued at USD 9.4 billion in 2025.

The market size for the clamshell packaging market is projected to reach USD 12.6 billion by 2035.

The clamshell packaging market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in clamshell packaging market are trays, bowls, boxes and containers and others.

In terms of material type, plastic segment to command 52.4% share in the clamshell packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights of Clamshell Packaging Providers

Stock Clamshell Packaging Market

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Clamshell Sealer Market Analysis Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA