In the Food Clamshells Market packages are widely used. It gives the product a higher visibility than a flat packed item and also has some protective features that other systems do not have. Because it is especially easy to use, it is the most popular among food service providers and consumers alike. The growth in ready-to-eat food services, expanded food delivery business, and single-use plastic restrictions being legislated by governments are all shaping dynamics of this market.

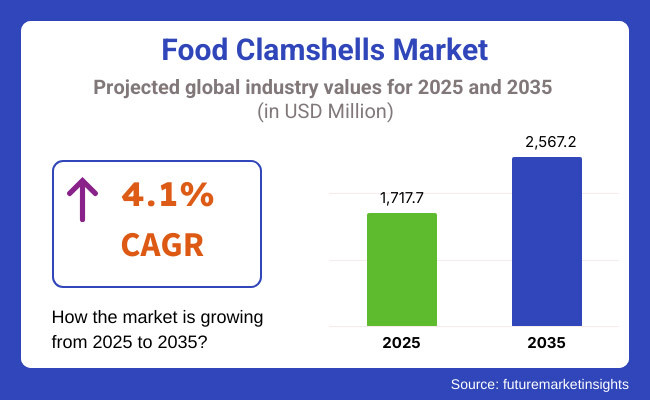

By 2035, though, that figure is expected to have risen to nearly USD 2,567.2 Million. Over the forecast period 2025 to 2035, industry growth will compound at an annual rate of 4.1%. It is expected that market expansion will get a push from the broadened use of sustainable packaging materials made of biodegradable and compostable substances, along with heightened consumer consciousness regarding environmentally acceptable packing options.

North America is the leading continent. This is due to the strong presence of food service industries more and more people are demanding takeout or delivery food in addition, many consumers clamor for eco-friendly wrapping of their restaurant meal boxes.

The United States is in the forefront of such movements with widespread development recycling and biodegradable package types. At this American Sustainability Forum, Inc. event in San Francisco last April, packaging companies showcased their latest products by calling attention to strict environmental protection standards combined with company commitment to sustainable packaging that further drive sales of eco-friendly takeout containers.

Europe ranks next, for the importance of integrating sustainable food packaging is growing high properties because recycling cardboard offshore not Lithuania needed locate where green space permits ituminum manufacturing sites.

Countries such as Germany, France, and Britain plastic clamshells industry is bright with an eco-friendly future set ahead and only early later than a half century ago we may be living biomass to soy the dream of self-sufficiency. Consumer demand for organic or fresh food products also drives the market, leading to packaging measures that maintain food freshness and are low in environmental impact.

The Asia-Pacific area of the world can expect an even greater increase in food clamshell system sales chiefly because urbanization is rising fast, food services expand more and more widely along major highways, and also disposable incomes are going up. Countries like China, India, and Japan have an ever-growing appetite for useful and cost-effective food service units.

Governments increasingly are trying to cut down on plastic rubbish of all kinds including clamshells, and consumers are becoming more aware of their options in terms of sustainable alternatives. All this is coming together to push food clamshell packaging into the mainstream across this region.

Regions such as Latin America, the Middle East, and Africa are beginning to take up food clamshell wraps, mostly based on the increasingly food eating habits of their populations and the rapid expansion in low cost, fast food. While cost allocations and regulatory problems remain, better supply chain logistics and the lucrative food service sector are both likely to mean gradual market expansion.

Challenge

Environmental Regulations and Sustainability Concerns

The Food Clamshells Market is imperilled by the environment factoring in contemporary society's elevated awareness about the damaging effects of packaging materials ideas for this type of product meet with resistance. Worldwide, governments are enforcing bans and restrictions on single-use plastics resulting in manufacturers developing eco-friendly products. Compliance with progressively stricter regulations pushes up prices and may serve to limit the availability of conventional plastic clamshells.

Raw Material Price Volatility

Fluctuations in raw material costs in plastics resins, biodegradable polymers and recycled products can lead to market turmoil. While outbreaks of swine fever or political events will force up the price of materials, supply chain interruptions can do so as well the very profitability a food processing market depends on will be affected.

Opportunity

Advancements in Sustainable Packaging Solutions

The rising popularity of green packaging offers the Food Clamshells Market room for development. Companies that develop biodegradable, compostable and recyclable clamshells can gain an edge over their competitors. Advances in plant-based and fiber materials are turning people's attention to sustainable food packaging.

Growth in Food Delivery and Takeout Services

The extension of online food delivery and takeout services has greatly increased demand for durable and convenient food-service products. In the next few years, both consumers' and area businesses' hunger for high-quality, leak-resistant, microwave-ready packaging will feed market growth even further A burgeoning market in sustainable food service packaging supports further market expansion even now.

During 2020, the Food Clamshells Market in Japan grew in response to diversified consumer demands with the development of convenient and safe food packaging. The explosion of e-commerce, food delivery services and people's new expectations for sustainable options drove up demand.

However, difficulties encountered by manufacturers with environmental regulations and raw material prices that were volatile pushed them to look for sustainable alternatives while also reorganizing production processes. Companies responded with compostable and recyclable clamshells compared to the traditional hard plastic ones they had been making they also invested in innovative packaging designs.

Looking forward to 2025 to 2035, the market will enter a new development stage based on continued innovations in biodegradable packaging, the automation of production and increasing customization.

The push for the circular economy means that fiber-based and compostable clam shells will have to be adopted new digital printing technologies together with 'intelligent packaging' that can communicate electronically with consumers directly on food packaging will provide branding which is more efficient and consumer engagement which reflects their current lifestyle brands too.

Companies with a track record in high efficiency production, advanced food safety technology and concern for future sustainability will lead the Food Clamshells Market during the next decade.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with plastic waste regulations and sustainability goals |

| Market Demand | Growth in food delivery and takeout packaging solutions |

| Industry Adoption | Increased use of plastic-based and foam clamshells |

| Supply Chain and Sourcing | Dependence on petroleum-based plastic materials |

| Market Competition | Presence of traditional plastic packaging manufacturers |

| Market Growth Drivers | Demand for convenient, secure, and leak-resistant food packaging |

| Sustainability and Energy Efficiency | Initial focus on recyclability and waste reduction |

| Integration of Digital Innovations | Limited customization and branding options |

| Advancements in Packaging Technology | Use of conventional plastic and foam clamshells |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter bans on single-use plastics, mandatory use of biodegradable materials, and increased investment in eco-friendly alternatives |

| Market Demand | Expansion of sustainable, compostable, and recyclable food clamshells |

| Industry Adoption | Shift towards fiber-based, biodegradable, and compostable clamshell packaging |

| Supply Chain and Sourcing | Integration of plant-based polymers, moulded fiber, and eco-friendly production methods |

| Market Competition | Growth of sustainable packaging firms and eco-conscious food packaging startups |

| Market Growth Drivers | Rising adoption of eco-friendly food clamshells and increasing regulatory support for sustainable alternatives |

| Sustainability and Energy Efficiency | Large-scale adoption of biodegradable, compostable packaging and carbon-neutral manufacturing practices |

| Integration of Digital Innovations | Expansion of smart packaging, digital printing, and QR code-enabled food safety tracking |

| Advancements in Packaging Technology | Evolution of lightweight, compostable, and microwave-safe clamshell packaging solutions |

USA clamshell food market is gradually growing. Now that widespread calls for convenience are becoming mandatory, a natural, ecology-friendly package which can go directly from refrigerator to dinner table seems about to hit the market. Meanwhile, consumer interest in packaging that is sustainable, in vibration damper papers, and in recycling criteria for shell packaging has been rising. Year in and year out the general trend, along with the clam-shell containers themselves, helps carry the industry forward.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.0% |

UK food clamshells market is gradually expanding. The popularity of ready-eating foods has increased demand for novel and composted clamshell solutions, while sustainable packaging materials are also undergoing a trend. Government policies promoting eco-friendly alternatives further support this market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.1% |

Due to strict sustainability rules and an increasing emphasis on reducing plastic waste, the European Union food clamshells market is intensifying. The food packaging industry is engaged in developing recyclable and biodegradable clamshells as research and development are expanded. Rising consumer preference for durable sustainable packaging drives market growth across its regions.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.2% |

South Korea’s food clamshells market is powered forward by the rising popularity of takeout food services. The government backs advanced packaging solutions in material science and biodegradable packaging. As urbanization gathers pace and consumer lifestyles change, the market finds further support.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

Plastic Clamshell is still one of the most popular choices in foodservice packaging. Clamshells means that contaminants cannot enter the food, when food is stored, this improves the preservation time of the product and for consumers-The more visibility provided Looking! It takes fresh produce, bakery items deli products and take-away meals all over in clamshells made of PET (Polyethylene Terephthalate) or PP (Polypropylene). Plastics' light weight and malleability are some of the reasons why it became a favourite material for use by foodservice providers to retailers.

This is the era for compacted, high-density packaging. Even though the adverse effects of plastic are being debated from all sides and sparrows singing in the city cannot receive back an echo, upon current of global conservation and environmental-protection trends that are increasingly moving toward becoming bacteriologically friendly alternatives, and this total trend is making itself felt as much in plastics as any other sector of the modern economy.

Paper and paperboard clamshells have now occupied a large market share. With these alternatives, both environmental sustainability becomes easier while also keeping up the required strength characteristic of hamburger boxes and other kinds of fast food containers. Thanks to advances in coating technology, paperboard clamshells have even greater resistance to grease and moisture than traditional plastic products.

This has naturally done much to enhance their appeal in the eyes of fast food restaurants increasingly favouring biodegradable or compostable packaging. Just as various countries’ governments all strive to decrease the use of plastic, the move towards paper and paperboard for packing will gain yet more momentum. Specifically, North America and East Asia are rated as the artificial production industry in the fastest growing markets and packaging materials are no exception.

Mock clamshells have seen wide use in the market now. These folded and foil-sealed containers imitate a regular clamshell design, requiring less material so they might be profitably manufactured. They are used commonly in supermarkets and grocery stores. The flat-pack design also provides a cheap way to deliver freshness.

Sealed inside an alvi nized plastic bag they do not spoil fruits and vegetables before they can be shipped from California or Florida all the way across the country to New York City supermarket shelves. There lightweight structure and environmental friendliness make them popular even today, especially in green packaging drives like the one by DuPont.

2-piece clamshells consist of a separate base and lid and are specifically designed for such delicate foods as desserts, confectionery items that are classed high cuisine quality meals like fresh seafood or cold soup. With secure closure mechanisms that prevent leakage and preserve the freshness of food, these containers are widely used in both retail and foodservice applications.

In addition to custom branding and decorative printing, two-piece clamshells allow food brands to enhance product display space on their packaging labels and thus attract consumers with greater visual effects.

The food clamshells market is witnessing significant growth due to increasing demand for convenient, sustainable, and secure food packaging solutions. Rising consumer preference for eco-friendly and biodegradable packaging, along with the expansion of the food delivery and takeout industry, is driving market expansion. Food clamshell containers offer durability, visibility, and protection, making them ideal for fresh produce, bakery items, and ready-to-eat meals.

Market Share Analysis by Key Players & Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Dart Container Corporation | 18-22% |

| Sabert Corporation | 12-16% |

| Genpak LLC | 10-14% |

| Anchor Packaging | 8-12% |

| Pactiv Evergreen Inc. | 5-9% |

| Other Manufacturers | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Dart Container Corporation | Wide range of foam and plastic clamshell containers, focusing on foodservice and convenience packaging. |

| Sabert Corporation | Sustainable, compostable, and recyclable food clamshells designed for eco-friendly packaging solutions. |

| Genpak LLC | High-performance hinged-lid containers for quick-service restaurants, grocery stores, and takeout businesses. |

| Anchor Packaging | Microwave-safe and heat-resistant food clamshells for fresh and hot food packaging applications. |

| Pactiv Evergreen Inc. | Customizable food clamshell packaging with a strong focus on recyclable and biodegradable materials. |

Key Market Insights

Dart Container Corporation (18-22%)

Dart Container Corporation is a leading supplier of foam and plastic, food clamshell packaging. Its offerings are used daily by many people around the world.

Sabert Corporation (12-16%)

The clamshell lunches of Sabert's Nittany Campus are designed keeping environment in mind. They use compostable or recyclable containers whenever possible.

Genpak LLC (10-14%)

Genpak LLC products extend further than hinged lids for clamshells, it also offers multifunction Whole Meal tray as a revolutionary solution for air catering.

Anchor Packaging (8-12%)

Anchor Packaging was created when fresh food couldn't be kept in good shape after it was purchased. The founder of this company perfectly solved that problem.

Pactiv Evergreen Inc. (5-9%)

Pactiv Evergreen is currently regarded as a leader in eco-friendly food packaging.

Other Key Players (30-40% Combined)

The market is evolving with multiple players offering innovative and sustainable food clamshell packaging solutions, including:

The overall market size for food clamshells market was USD 1,717.7 Million in 2025.

The food clamshells market is expected to reach USD 2,567.2 Million in 2035.

Rising demand for convenient, sustainable packaging, increasing food delivery services, and consumer preference for eco-friendly materials will drive growth.

The top 5 countries which drives the development of food clamshells market are USA, European Union, Japan, South Korea and UK.

Paper and Paperboard Clamshells demand supplier to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Product, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Product, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA