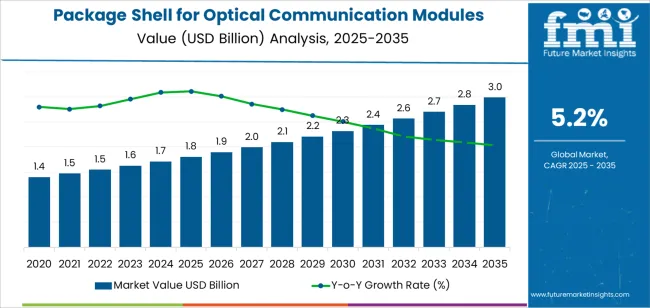

The package shell for optical communication modules market is expected to grow from USD 1.8 billion in 2025 to USD 3 billion by 2035, reflecting a CAGR of 5.2%. The package shell is a crucial component in optical communication modules, providing the structural integrity and protection for the delicate optical transceivers used in telecommunications and data communication. The package shell for optical communication modules market growth is driven by the increasing demand for high-speed internet, 5G networks, and cloud computing, which require high-performance optical communication modules for fast and reliable data transmission.

The continued rise of data consumption, the rollout of 5G networks, and the growing need for advanced telecommunication infrastructure will continue to drive the demand for optical communication modules, and subsequently, for the package shells that protect and house these modules. Advancements in optical fiber technology and the push for more energy-efficient, compact communication solutions will further contribute to the market’s growth. The package shell for optical communication modules market is also supported by innovations in manufacturing technologies and materials that enhance the reliability and performance of package shells used in optical communication systems.

The 10-year growth comparison for the package shell for optical communication modules market reflects steady, incremental growth from 2025 to 2035. Starting at USD 1.8 billion in 2025, the market is expected to grow to USD 3 billion by 2035, adding USD 1.2 billion over the 10-year period.

Between 2025 and 2030, the market will expand from USD 1.8 billion to USD 2.4 billion, contributing USD 600 million in growth. This phase will be primarily driven by the increasing deployment of 5G networks, growing demand for high-speed data transmission, and the expansion of data centers. The need for efficient and reliable optical communication modules will boost demand for package shells during these early years.

From 2030 to 2035, the market will grow from USD 2.4 billion to USD 3 billion, adding USD 600 million over the next five years. This phase will see further acceleration in demand as advanced optical communication technologies become more widespread in telecommunications and broadband infrastructure.

The continued expansion of smart cities, the internet of things (IoT), and high-capacity network systems will ensure that demand for optical communication modules, and therefore package shells, remains strong throughout the forecast period. The steady CAGR of 5.2% indicates that while the market will continue to expand at a consistent pace, it will be driven by the continued advancements in telecommunications and data networking.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.8 billion |

| Market Forecast Value (2035) | USD 3 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The package shell for optical communication modules market is growing as demand for high-speed data transmission, next-generation networking (such as 100 Gbps, 400 Gbps, and beyond), and dense optical module deployments in data centers and telecommunication networks increase. Package shells serve as critical enclosures that provide thermal management, electromagnetic shielding, mechanical protection, and precise alignment of active optical and optoelectronic components. These shells must accommodate increasingly compact designs, enable miniaturization, sustain high reliability, and meet performance demands of evolving optical communication standards. The market is projected to see substantial growth in the coming years.

Growth in cloud computing, hyperscale data centers, 5G/6G infrastructure rollouts, and edge computing deployments is also contributing to the market's expansion. These environments require optical modules with higher fiber counts, lower latency, and greater power efficiency, all of which place heavier demands on packaging solutions. Innovations in materials, such as ceramic composites or advanced metal alloys, and manufacturing technologies like precision stamping, hermetic sealing, and automated assembly help meet thermal, corrosion, and signal integrity requirements for high-performance modules. However, challenges remain, including margin pressure from cost-sensitive module makers, supply chain disruptions for specialty materials, and the need to keep pace with rapid optical standard evolution and module miniaturization.

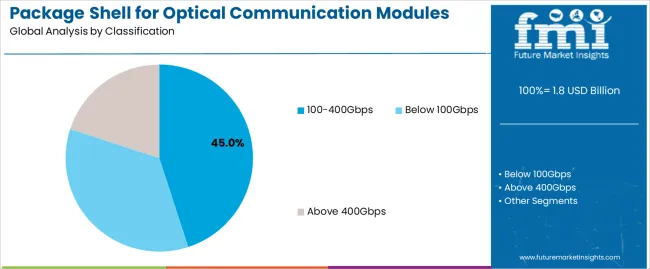

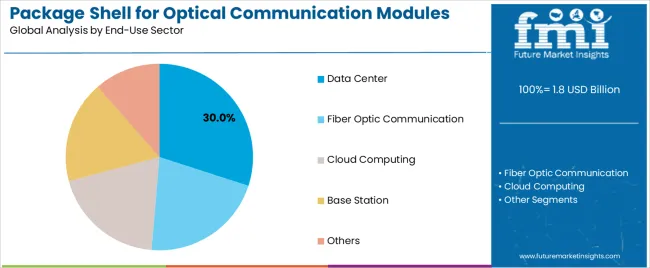

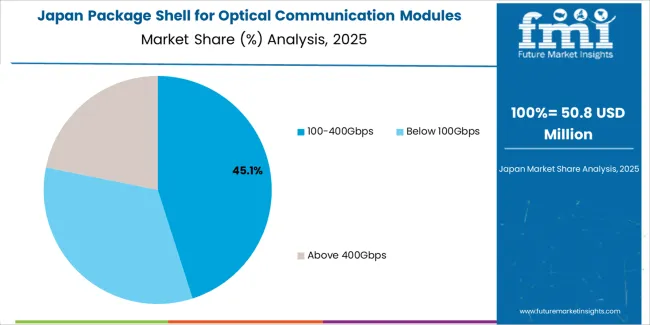

The package shell for optical communication modules market is segmented by classification and end-use sector. The leading classification is 100-400Gbps, which holds 45% of the market share, while the dominant end-use sector is data center, accounting for 30% of the market. These segments are driving the market’s growth, influenced by the increasing demand for high-speed data transmission and the rapid expansion of data centers and cloud-based services.

The 100-400Gbps classification leads the package shell for optical communication modules market, capturing 45% of the market share. Optical communication modules with data rates between 100 and 400Gbps are highly sought after for their ability to deliver fast, reliable data transmission over long distances, which is critical for modern communication infrastructure. These modules are increasingly used in high-demand applications, including data centers, cloud services, and telecommunications, where high-speed data transfer is essential.

As the demand for faster internet speeds, real-time data processing, and large-scale data storage continues to grow, the need for optical communication modules that can handle higher bandwidths has become increasingly important. The 100-400Gbps modules provide a balance between cost and performance, making them ideal for applications that require substantial bandwidth but do not necessarily need the extreme data rates of above 400Gbps systems. This classification is expected to maintain its dominance in the market due to the widespread adoption of optical communication solutions in both data centers and telecommunications networks.

The data center end-use sector is the largest segment in the package shell for optical communication modules market, accounting for 30% of the market share. Data centers are the backbone of the digital economy, and as the demand for cloud services, streaming, and large-scale data storage continues to surge, the need for high-performance communication modules that can handle massive amounts of data efficiently is increasing. Optical communication modules, particularly those with high data transfer rates, are essential for ensuring fast, reliable communication between servers, storage devices, and other components within data centers.

The growing trend of digitalization, along with the expansion of cloud computing and internet services, is driving the demand for faster and more efficient data transmission in data centers. Optical communication modules in the 100-400Gbps range are particularly well-suited for meeting the growing bandwidth demands of these environments. As data centers continue to scale to support massive amounts of data traffic, the data center sector will remain a key driver of the package shell for optical communication modules market, solidifying its position as the leading end-use sector.

The package shell for optical communication modules market is driven by the rising demand for high-speed optical modules in data centres, telecommunications networks, cloud computing and 5G infrastructure. The shell acts as a critical structural component that must deliver thermal management, hermetic sealing, electromagnetic shielding and mechanical protection for optical transceivers and modules. The global market size was estimated at approximately USD 1,755 million in 2024 and is projected to reach around USD 2,508 million by 2031, reflecting a compound annual growth rate of about 5.2%.

Several key drivers support this market’s expansion. First, the proliferation of fibre-optic networks, data-centre build-out, FTTH deployments and rollout of 5G and beyond increase the requirement for optical modules, which in turn drives demand for high-performance module shells. The need for high data-rates (for example 100 Gbps, 400 Gbps and beyond) places stronger demands on shells in terms of miniaturisation, high thermal conductivity and signal integrity. Second, manufacturers are seeking materials and processes that enable increased module density and smaller form-factor transceivers, which raises the importance of advanced shell design. Third, geographic expansion of network infrastructure in regions such as Asia-Pacific accelerates demand for locally produced module shells and supports global volume growth. The cumulative effect of these drivers underpins robust demand for module-shell products.

Despite positive growth prospects, the market faces several constraints. Manufacturing of shells with precise dimensional tolerances, high thermal performance and reliable hermetic sealing involves high material and tooling cost, which may limit adoption especially in cost-sensitive segments. Rapid changes in optical module standards and form-factors (such as new transceiver speeds and modules) pose risk of obsolescence for shell designs and tooling investment. Supply-chain dependencies for specialised alloys or ceramics, and competition from integrated module architectures that reduce shell complexity, may also restrict growth or margin expansion for shell suppliers.

Key emerging trends in this market include increasing use of higher-speed module classes (above 400 Gbps) which drives demand for shells with improved thermal management and higher reliability. Another trend is the development of new materials and composite shells (including ceramic-metal hybrids) that improve performance in terms of heat dissipation, signal isolation and miniaturisation. There is also a move toward plug-and-play or modular packaging where shell suppliers provide pre-qualified, scalable assemblies improving time-to-market. Regionalisation of production, particularly in Asia-Pacific, is increasing capacity to meet regional network roll-out. Finally, sustainability concerns are driving manufacturers to explore shells with lower weight, fewer components and recyclable materials to support eco-friendly module design.

The package shell for optical communication modules market is experiencing steady growth due to the increasing demand for optical communication systems in sectors such as telecommunications, data centers, and networking. Package shells are crucial components in the manufacturing of optical communication modules, providing protection, stability, and heat dissipation for optical fibers and electronic components. With the expansion of 5G networks, data transmission infrastructure, and growing data traffic, the need for optical communication modules and their components, including package shells, is rising.

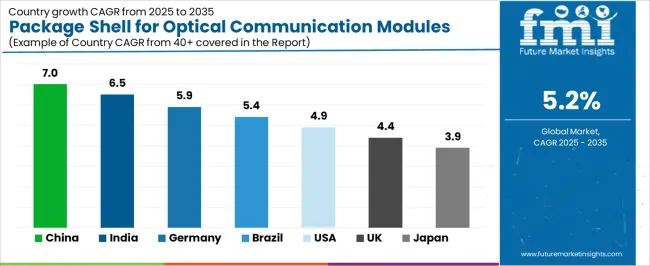

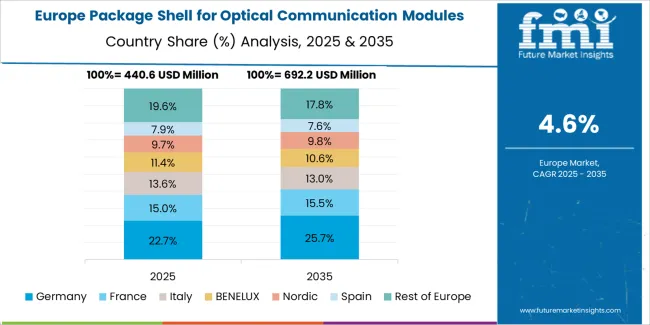

Countries with strong telecommunications sectors, such as China and India, are seeing significant growth, while developed economies like the USA and Germany are also investing heavily in optical communication infrastructure. This analysis explores the factors driving the growth of the package shell for optical communication modules market across various countries.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7% |

| India | 6.5% |

| Germany | 5.9% |

| Brazil | 5.4% |

| USA | 4.9% |

| United Kingdom | 4.4% |

| Japan | 3.9% |

China leads the package shell for optical communication modules market with a growth rate of 7.0%. The country’s rapid expansion of telecommunications infrastructure, driven by the deployment of 5G networks and growing data traffic, is a major factor propelling market growth. China’s increasing demand for high-speed data transmission and the development of data centers are fueling the need for optical communication modules, and by extension, package shells that house these modules.

China’s growing internet user base and its investment in smart cities and industrial automation are also contributing to the rise in demand for optical communication technology. The government’s initiatives to enhance digital infrastructure, including fiber optic networks, further support the need for efficient package shells in optical communication modules. As the country continues to innovate in 5G, IoT, and smart devices, the demand for optical communication components, including package shells, will continue to grow.

India’s package shell for optical communication modules market is growing at a rate of 6.5%. As India continues to expand its telecommunications networks, particularly with the rollout of 5G technology, the demand for high-quality optical communication modules is rising. Package shells, which ensure the safety and reliability of these modules, are becoming increasingly important in the country’s growing digital ecosystem.

The Indian government’s focus on expanding broadband access and improving data transmission infrastructure is fueling the demand for optical communication components. Additionally, the country’s expanding IT and telecommunications industries, along with the increasing reliance on cloud computing and data centers, are contributing to the market growth. As India pushes forward with its digital transformation and 5G adoption, the demand for optical communication modules and their components, including package shells, will continue to rise.

Germany’s package shell for optical communication modules market is projected to grow at a CAGR of 5.9%. Germany’s strong telecommunications and industrial sectors are contributing to the increasing demand for optical communication systems. The country’s investments in 5G networks, data centers, and smart manufacturing are driving the demand for optical communication modules, and package shells are a critical component in ensuring the reliability and performance of these systems.

Germany’s focus on maintaining a competitive edge in technology and innovation, particularly in the development of next-generation communication systems, is also fueling the growth of the optical communication module market. As the country continues to upgrade its telecommunications infrastructure and invest in high-speed data networks, the demand for package shells for optical communication modules will continue to expand.

Brazil’s package shell for optical communication modules market is expected to grow at a CAGR of 5.4%. Brazil’s growing telecommunications industry, driven by the need for improved internet access and faster data transmission, is a key factor fueling the demand for optical communication modules. With the expansion of broadband networks and the ongoing rollout of 4G and 5G technologies, the market for optical communication components, including package shells, is expected to rise.

In addition to telecommunications, Brazil’s expanding IT sector and growing demand for cloud computing and data storage services contribute to the need for reliable optical communication systems. As Brazil continues to modernize its digital infrastructure, the demand for high-quality package shells to support these systems will continue to grow, supporting the market’s expansion.

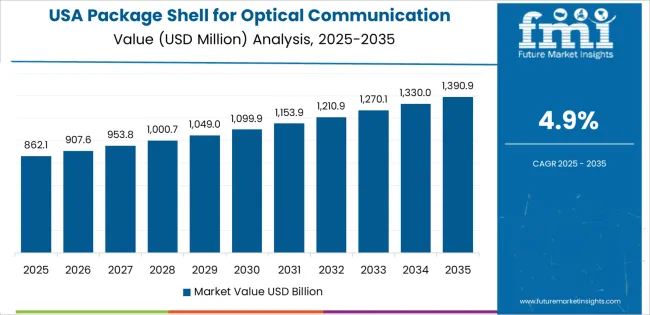

The United States has a projected CAGR of 4.9% for the package shell for optical communication modules market. The USA continues to be a leader in telecommunications and data transmission technology, with a strong focus on the development of 5G networks, data centers, and high-speed broadband infrastructure. The need for optical communication modules is rising as industries across the country increasingly rely on high-performance data transmission for applications ranging from telecommunications to smart devices.

The USA government’s focus on expanding 5G coverage, along with ongoing investments in cloud computing and data storage, is driving demand for optical communication systems. Package shells, which ensure the durability and reliability of these systems, are becoming more essential as the country continues to innovate in communications and technology. As demand for high-speed internet and data transmission increases, the need for package shells for optical communication modules will continue to grow.

The United Kingdom’s package shell for optical communication modules market is projected to grow at a CAGR of 4.4%. The UK’s telecommunications infrastructure is undergoing modernization, with a focus on 5G networks and high-speed broadband expansion. As the country continues to embrace the digital age, the demand for optical communication modules, and the package shells that protect these components, is rising.

The UK’s commitment to digital transformation, along with the government’s focus on increasing broadband access and improving mobile connectivity, is contributing to the market’s growth. The expanding use of optical communication technology in telecommunications, data centers, and IoT applications ensures that the demand for package shells will continue to increase in the UK. The ongoing rollout of 5G networks further drives the need for high-performance components in communication systems.

Japan’s package shell for optical communication modules market is expected to grow at a CAGR of 3.9%. Japan’s advanced telecommunications sector, supported by ongoing investments in 5G technology and data infrastructure, is contributing to the increasing demand for optical communication modules. Package shells, which provide essential protection and stability for these components, are becoming more critical as Japan modernizes its communication systems.

The country’s focus on technological innovation, particularly in high-speed internet and smart devices, is driving the need for reliable optical communication solutions. As Japan continues to expand its 5G networks and digital infrastructure, the demand for optical communication modules and package shells will grow, albeit at a slower rate compared to other regions. Japan’s strong technology sector ensures continued market demand for these critical components.

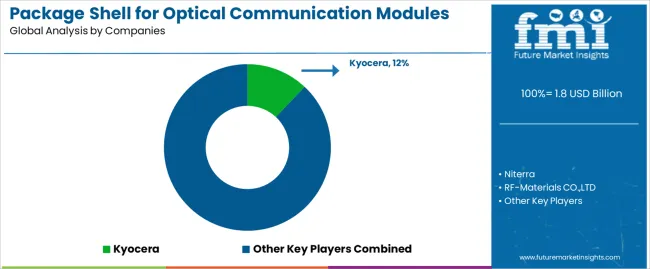

In the package shell for optical communication modules market, companies such as Kyocera (with about 12% share) compete alongside other manufacturers including Niterra, RF-Materials CO.,LTD, EGIDE, Ametek, AdTech Ceramics, Hebei Sinopack, CCTC, and others. The market was valued at approximately USD 1,755 million in 2024 and is projected to reach about USD 2,508 million by 2031, growing at a compound annual growth rate (CAGR) of roughly 5.2%.

These companies compete across multiple strategic fronts. One key dimension is material and structural innovation: package shells must offer high thermal performance, precise mechanical tolerances, and effective shielding for optical modules that support high speed transmission and harsh environments. Another dimension is manufacturing scale and geographic reach: firms with global production or regional factories near major optical-module makers can supply faster and respond quickly to changes in demand.

A third strategic aspect is targeting application segments such as data centers, 5G base stations, cloud infrastructure, and metro networks. Shells that support higher data rates (for example, above 100 Gbps) or compact form factors for dense deployments gain an edge.

Marketing materials and product brochures tend to highlight features such as shell material (ceramic, metal-plated plastics), maximum thermal dissipation, protective coating, hermetic sealing options, form-factor compliance (for QSFP, OSFP, etc.), and compatibility with module-assembly processes. By aligning their offerings with the evolving needs for miniaturized, reliable optical communication hardware and strong supply-chain support, companies aim to capture a larger share of the package shell market for optical communication modules.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Classification | Below 100Gbps, 100-400Gbps, Above 400Gbps |

| End-Use Sector | Data Center, Fiber Optic Communication, Cloud Computing, Base Station, Others |

| Key Companies Profiled | Kyocera, Niterra, RF-Materials CO., LTD, EGIDE, Ametek, AdTech Ceramics, Hebei Sinopack, CCTC, Hefei Shengda Electronics Technology, Jiaxing Glead Electronics (BOStar), China Electronic Technology Group, Shenzhen Honggang Optoelectronic Packaging Technology, Anhui Optispac Technology, Wuhan Fingu Electronic Technology, Shenzhen Cijin Technology, Jiangsu Yixing Electronic Devices Factory, Shenzhen TOP Precision Technology, Fujian Minhang Electronics, Shanghai Xintaowei New Materials |

| Additional Attributes | The market analysis includes dollar sales by classification and end-use sector categories. It also covers regional adoption trends across major markets such as Asia Pacific, Europe, and North America. The competitive landscape highlights key manufacturers in the optical communication module packaging market, focusing on innovations in optical packaging technologies for data centers, fiber optic communication, and cloud computing applications. Trends in the growing demand for high-speed optical communication modules in base stations and other sectors are explored, along with advancements in packaging materials and production processes. |

The global package shell for optical communication modules market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the package shell for optical communication modules market is projected to reach USD 3.0 billion by 2035.

The package shell for optical communication modules market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in package shell for optical communication modules market are 100-400gbps, below 100gbps and above 400gbps.

In terms of end‑use sector, data center segment to command 30.0% share in the package shell for optical communication modules market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Package Pumping Station Market Size and Share Forecast Outlook 2025 to 2035

Package Testing Silicone Rubber Socket Market Size and Share Forecast Outlook 2025 to 2035

Packaged Coconut Water Market Size and Share Forecast Outlook 2025 to 2035

Packaged Food Market Growth - Consumer Preferences & Industry Trends 2025 to 2035

Packaged Currants Market Analysis by Type, Sales Channel, and Region through 2035

Packaged Milkshake Market Analysis by Flavor, Packaging Material, and Region through 2035

Packaged Fresh Fruits Market Analysis by Berries, Citrus, Tropical Fruits, Stone Fruits, and Others Through 2035

Packaged Bread Market Trends - Shelf-Stable Bakery Innovations 2025 to 2035

Packaged Sunflower Seeds Market – Growth, Demand & Consumer Trends

Package Closing Machines Market

Pre-Packaged Medical Supplies Market

3D TSV Packages Market Analysis by Process Realization, Application, End Users, and Region through 2035

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Chip Scale Package LED Market Insights – Trends & Forecast 2025 to 2035

Reduced Salt Packaged Foods Market - Health-Conscious Eating Trends 2025 to 2035

Carbon Labeled Packaged Meal Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Modular Process Skid Packages Market Forecast and Outlook 2025 to 2035

Shell Vials Market Size and Share Forecast Outlook 2025 to 2035

Shell & Tube Heat Exchangers Market

Shellac Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA