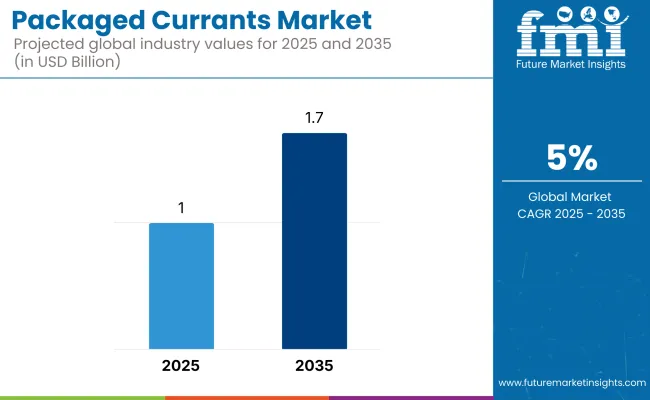

The global packaged currants market is estimated to be worth USD 1 billion in 2025. It is projected to reach a value of USD 1.7 billion by 2035, expanding at a CAGR of 5.0% over the assessment period of 2025 to 2035.

The global market for packaged currants is witnessing steady growth due to the increasing demand of consumers for healthier, naturally sweet foods. With health-conscious consumers looking towards convenient superfoods, currants are gaining popularity due to their being full of antioxidants, vitamins, and fiber, and they are a top functional food and dietary supplement option.

One of the major reasons for this market is the growing use of packaged currants in bakery, confectionery, and breakfast food. Food companies are using currants in cereals, granola bars, and baked foods to add flavor and nutrition. The shift towards cleaner-label and plant-based foods has also been a significant reason for driving growth.

Despite the growth, there are certain challenges. Amongst the new restraints lies the seasonality and price variation of currants as raw materials, affecting the production and supply chain. Competition also exists as there are other dried fruits, such as raisins and cranberries, replacing brands that demand quality sourcing and good marketing strategies.

However, there are sizeable opportunities within the premium and organic packaged currants category. Customers are willing to pay more for sustainably grown, organic, and non-GMO currants. Also, the shift to e-commerce and direct-to-consumer platforms has increased reach, and niche brands have been able to serve global health-conscious consumers.

Packaged currants are bought by companies or ventures producing currant-flavored foods, trail mixes, and functional beverages. Additionally, increasing consumer awareness regarding the health benefits of currants, including heart health and digestive support, is driving their incorporation into dietary supplements and health-conscious products.

The sales of packaged currants are growing with rising consumer demand for natural, healthy, and nutrient-dense food products. Companies emphasize high product quality and nutritional content, and currants are preserved with antioxidants, vitamins, and fiber content. Freeze-drying and vacuum-sealing processing methods ensure freshness while complying with food safety regulatory requirements.

Distributors are pivotal in supply reliability, providing retailers and wholesalers with a consistent stream of packaged currants. As the demand for organic and preservative-free items increases, distributors work with manufacturers to meet changing consumer tastes without compromising on costs.

End-users, including healthy consumers, domestic bakers, and food manufacturers, value nutritional content, flavor, and convenience. Numerous buyers look for packaged currants as a snack, for baking, and for use in breakfast cereals and salads.

There was a steady growth between 2020 and 2024, influenced by the growing consumer recognition of healthy benefits, their demand for natural sweeteners, and expanding applications in the food industry. Currants gained popularity as a healthier alternative to white sugar, and as a result, they were utilized in bakery items, snack bars, and breakfast cereal.

Major players like Sun-Maid and Whitworths added organic, unsulfured, and sustainably grown currants to their portfolios to meet the growing demand for clean-label products. Consumption of dried currants increased because of the growing popularity of vegan and plant-based diets, as they were an ingredient in vegan-friendly energy bars and dairy substitute products. Online shopping platforms experienced increased sales, with consumers looking for easy, preservative-free dried fruits.

Between 2025 and 2035, there will be innovation in packaging sustainability, introduction of functional foods, and diversification of regional sourcing. With consumers making gut health, immunity, and low-sugar diets their top priorities, producers will launch probiotic-enriched currants with antioxidants and plant protein.

Sales of single-serve, resealable, and biodegradable packaging will rise as consumers become increasingly aligned with sustainability trends. Improved freeze-drying and dehydration technologies will ensure enhanced nutrient preservation and shelf life, enhancing the attractiveness of the product. Furthermore, direct-to-consumer (DTC) subscription options will be on the rise, providing tailored currant mixtures with added superfoods such as chia seeds, flaxseeds, and nuts.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased demand for clean-label ingredients and natural sweeteners. | Continued mainstream popularity of currants in breakfast cereals and baked foods. |

| Penetration within functional foods supplemented with probiotics and antioxidants. | Increased demand for low-sugar, gut-friendly snacks. |

| Launch of organic and unsulfured currants. | Expansion in vegan and plant-based snacking. |

| Development of protein-enriched currant blends. | Utilization of freeze-dried currants for enhanced freshness. |

| Choice for preservative-free, non-GMO, and sustainably grown currants. | Increased buying from online platforms. |

| The transition towards individualized nutrition and subscription-dried fruit boxes. | Demand for portion-controlled, resealable packaging. |

| Focus on sustainable farming practices and fair-trade procurement. | Introduction of low-plastic packaging. |

| Uptake of compost and biodegradable packaging. | Expansion of local and regenerative currant farming. |

| Use of novel dehydration technologies to increase shelf life. | Sophisticated nutrient-retention processes in freeze-drying and processing. |

| Tighter labeling standards for added sugars and artificial ingredients. | Improved regulations on sustainability claims and carbon footprint labeling. |

There are multiple challenges, including climate-related agricultural risks, fluctuating consumer demand, pricing pressures, regulatory compliance, and supply chain vulnerabilities. Addressing these risks is crucial for sustainability and business growth.

Climate-based agricultural hazards greatly affect currant output. Unpredictability in weather patterns, drought, excessive rainfall, and infestations can reduce yields and result in supply deficiency. To combat this, companies should invest in climate-resilient agriculture techniques, diversify sources of procurement, and enter into contracts with several growers to have a guaranteed supply.

Raw material prices, transportation costs, and competition cause pricing pressures. As currant production is based on seasonal supply, price volatility can affect profitability. Cost-control strategies, maximizing production efficiency, and value-added packaging can stabilize pricing strategies.

Adherence to regulations of food safety, labeling, and organic certification varies by region. Non-compliance will lead to fines, product recalls, or reputational damage. Enterprises must be familiar with global food regulations, subject food to rigorous quality checking, and obtain vital certifications to be credible.

For achieving long-term success, packaged currant brands should give high importance to agricultural resilience, consumer involvement, cost minimization, compliance adherence, and supply chain optimization in keeping up with market realities and evolving consumer tastes.

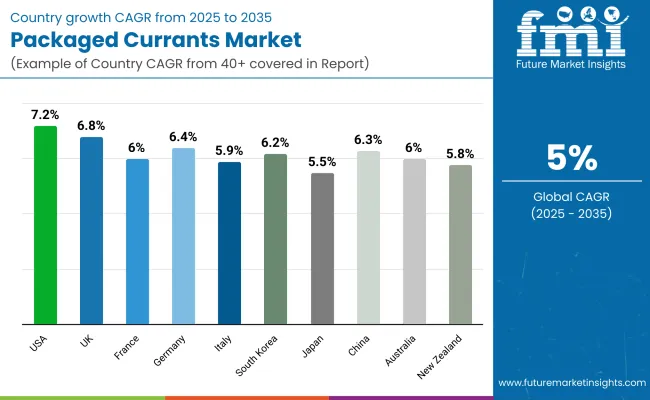

| Countries | CAGR (%) |

|---|---|

| USA | 7.2% |

| UK | 6.8% |

| France | 6.0% |

| Germany | 6.4% |

| Italy | 5.9% |

| South Korea | 6.2% |

| Japan | 5.5% |

| China | 6.3% |

| Australia | 6.0% |

| New Zealand | 5.8% |

The USA currant packaging industry is anticipated to grow at a robust CAGR of 7.2% between 2025 and 2035. Demand for currants, especially among the health and fitness sectors, is being driven by the increased demand for high-protein, low-sugar, and clean-label products. Currants are becoming an integral part of high-protein baking, including gluten-free and plant-based.

Social media influence, most notably fitness-based influencers and recipe bloggers, has created huge popularity for currants as a healthy, antioxidant-laden food product. Additionally, the culture of meal prep by younger consumers is driving demand for long-shelf-life foods, further strengthening the growth.

In the UK, the market for packaged currants is expected to grow at a CAGR of 6.8%. Demand for currants is driven primarily by the country's rapidly expanding vegan and plant-based markets that are revolutionizing bakery foods and snacks.

Vegan bakeries are increasingly reformulating traditional British desserts, such as mince pies and scones, using plant-based fats and currants. Consumers are also drawn to currants because of their no-added-sugar, allergen-free status. The UK's rich café culture and strong regulatory push for nutrition labeling also help to raise the profile and appeal of currants in the marketplace.

France is also predicted to have a CAGR of 6.0%. French consumers, who place a high value on quality ingredients and craft products, are ever more attracted to currants as an outstanding fruit for high-end, organic, and local products.

There is growing interest in provenance-driven currants, especially those from some French regions, retailed based on their typical taste and origin. Currants are also being employed in healthier French pastries and snacks as part of the general shift towards cleaner-label, additive-free foods.

Germanyis expected to grow at a CAGR of 6.4%. The German marketplace is being captured by the dominant trend for well-being and health as demand rises for increasingly organic, reduced-sugar-content, high-content products. The currants fall well into the trend because, increasingly, they are being incorporated in clean-label snacks, muesli, and baked goods.

The growing demand for plant-based and gluten-free baked products has also spurred demand for currants, as they are a natural sweetener and a source of fiber. Additionally, the country's emphasis on sustainability and organic farming is propelling the growth of currants as an eco-friendly premium product.

Italy is anticipated to grow at a CAGR of 5.9%. A heightened focus on provenance and regional authenticity overpowers the industry. Italian consumers, particularly those who shop in the high-end segments of the market, are increasingly attracted to currants that are grown in certain regions having unique flavor profiles.

Currants from areas such as Trentino-Alto Adige and Tuscany are increasing in popularity since they are marketed for their terroir-specific characteristics. Besides, Italian cooking culture is being adapted to include currants as ingredients in classic and innovative recipes, such as panettone and biscotti, to drive growth.

South Korea will grow at a CAGR of 6.2%. The market is witnessing rising demand for healthy ingredients and snacks, and currants are gaining popularity because of their rich antioxidant content and nutrient ratio. The country's craze for functional foods, including those of well-being and beauty, is bolstering the growth of currants.

South Korean consumers are increasingly incorporating currants into baked food, snack food, and even beverages as the hunger for clean and natural products increases among consumers. Further, the growth of online food retailers and subscription boxes is enhancing the exposure of the currant products.

Japan will grow at a CAGR of 5.5%. Functional food trends dominate the Japanese market, with consumers seeking ingredients that are both healthy and versatile. Currants are becoming an important ingredient in Japan's snacking and baking industry, where they are being incorporated into a range of products such as protein bars, cereals, and pastries.

The rising demand for plant-based and gluten-free food is also propelling the rise in currant consumption. Currants are also greatly valued for their very long shelf life, making them a popular choice among Japanese consumers who value the convenience and longevity of food products.

China is expected to grow at a CAGR of 6.3% during the forecast period. Increased use of health-oriented diets and increased knowledge of the function of antioxidants are driving demand for currants in China.

Currants are becoming more popular as a natural food in snack foods and baked products, particularly as consumers increasingly turn to plant-based and gluten-free diets. As the expanding middle class grows, so does demand for high-end, imported foods like currants. The convenience of using currants as a shelf-stable, easy-to-use ingredient is also fueling the growth.

The Australian packaged currants market is anticipated to register a CAGR of 6.0%. Australia is influenced by an increasing trend for clean-label, organic, and plant-based products. Currants are increasingly being added to health-nut snacks, baking mixes, and cereals as Australian consumers become more particular about nutrient-rich ingredients.

The need for natural, organic ingredient sourcing like currants is also driven by the country's emphasis on sustainable lifestyles and minimal, eco-friendly packaging. The fitness and wellness trend is also increasing the popularity of currants as a great addition to high-protein, low-glycemic diets.

New Zealand will register a CAGR of 5.8% during the forecast period. Here, consumers are also increasingly concerned with health, wellness, and sustainability when selecting food products, as they are in Australia. Currants are becoming more popular as a nutrient-dense snack and ingredient, particularly in the organic food industry.

The country's increasing demand for clean-label, low-processing foods is driving the application of currants in snacking and baking applications. New Zealand is further being propelled by a surging trend of locally produced food manufacturers introducing currants in new product development focused on consumers concerned with their health.

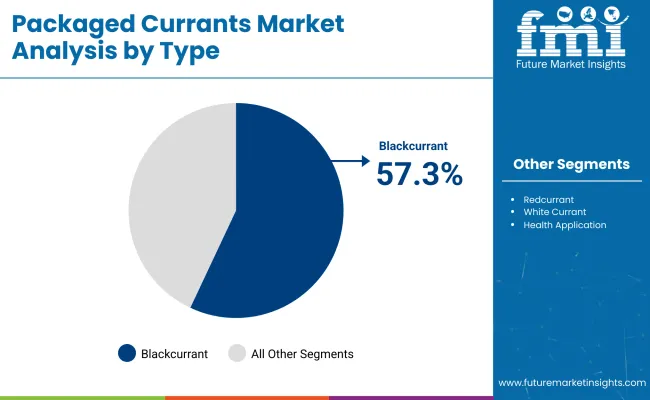

| Segment | Value Share (2025) |

|---|---|

| Blackcurrant (Product) | 57.3% |

By Product, blackcurrants hold 57.3% of the share in 2025, further by 25.2% redcurrants. Blackcurrants stand strong, as the segment accounts widely for their nutritional values paired with antioxidant properties and applications across multiple industries.

Being rich in vitamin C, anthocyanins, and polyphenols, blackcurrants find one of the largest uses in the food, beverage, and nutraceutical industries. An upper hand is extended to top blackcurrant producers around the globe, and countries like Poland, along with the UK, New Zealand, and France, supply processed and fresh blackcurrants.

Beverage manufacturers with Ribena (Suntory) in the UK and Svašek in Europe currently use blackcurrant concentrates in their juice production, and this ever-growing demand has indeed enhanced their marketability among functional drinks. The blackcurrant puree and powder ventures of Ariza and AGRANA made good sales for health drinks and dietary supplements due to the upward trend of immune-boosting products in Europe and Asia.

Current trends in natural superfoods and plant-based nutrition also provide stronger potential for blackcurrants in functional foods and nutraceuticals. On the other hand, redcurrants, accounting for a 25.2% industry share, are primarily sold in their fresh and frozen forms, largely dedicated to the gourmet, bakery, and dessert markets.

The redcurrants are very sour and, at the same time, quite sweet, so most traditional jams, preserves, and sweets include them in their recipes. Major companies like SVZ, Yummy Berries, and Tolsma-Grisnich are now focusing on providing high-grade frozen and dried redcurrant varieties for bakery and dessert applications.

In Europe, chefs are seeking these currants for cake dressing, gourmet sauces, and tart filling applications. They are also increasingly being chosen as a visually appealing ingredient by restaurants and artisans alike in France, Germany, and the Netherlands. The rise in demand for clean labels and organic and gourmet ingredients will boost the consumption of redcurrants with prospects in specialty food markets.

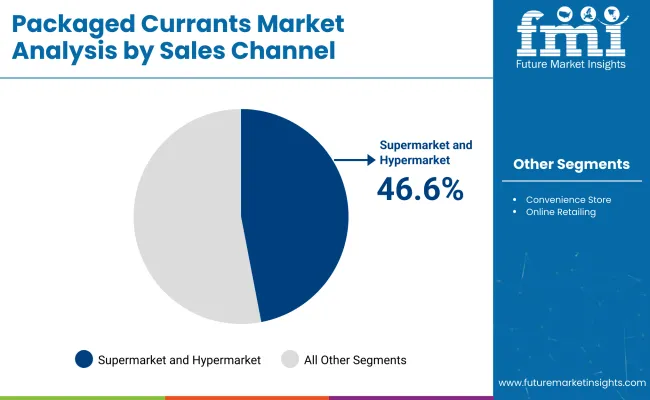

| Segment | Value Share (2025) |

|---|---|

| Supermarket and hypermarket ( Application ) | 46.6% |

Offline Retail Dominates Packaged Currants Sales Across Global Markets. Supermarkets and hypermarkets dominate the currant industry with a 46.6% share in 2025, while convenience stores are also taken into consideration at 32.4%.

Supermarkets and hypermarkets serve as the key players in the currant distribution, given their extended retail reach, modernity, and a wide variety of products, in addition to bulk purchasing benefits that they could generate over other channels. Major worldwide retailers such as Tesco, Carrefour, Walmart, and Aldi offer a very wide range of currants, which include fresh, frozen, and other processed forms.

Consumers preferred to buy currants from hypermarkets and supermarkets because of easy access to such options, the assurance of the quality of products, and even private-label offerings. Various supermarkets have also introduced in-house brands of blackcurrants and redcurrants, including juices, jams, fruit mixes, or dietary supplements. For example, Aldi has its Simply Nature range, and Carrefour has Bio Line, which carries updated healthy living lines that include organic currant-based products.

Moreover, the demand for frozen and dried currants has increased in supermarkets because of the growing popularity of smoothie-blending, baking, and high-antioxidant fruits. Currant-based superfoods, along with high-antioxidant fruits, are becoming more popular in premium grocery aisles as health-conscious consumers put a premium on immune health and functional nutrition.

Most retail chains, such as 7-Eleven, Circle K, and SPAR, tend to concentrate on ready-to-eat products such as snack bars, dried currants, and functional beverages. Their strategic placement is ideal for urban areas, transit points, and highly commercialized areas where health-conscious people are seeking quick and nutrient-dense options.

The ready-to-drink blackcurrant beverage segment is rapidly growing. Ribena, Robinsons, and Innocent Drinks are portable juice mixes with no added sugars. In the sports nutrition industry, currant extracts of the black variety are introduced in energy drinks and hydration formulas, thus keeping pace and strengthening the retail presence of currants in healthy convenience stores.

Currently, at the global scale, the industry is moderately consolidated, with major corporations competing primarily by focusing on product differentiation, sustainable activity, and industry expansion. The key brands adopt clean-label positioning to appeal to health-conscious consumers by offering organic, non-GMO, and preservative-free currants. The growing demand for nutrient-dense snacks and functional foods has driven innovation in currant-based products, including energy bars, breakfast cereals, and infused beverages.

Sustainable sourcing and ethical farming methods are quickly becoming competitive differentiators, with companies investing in fair trade alliances and eco-friendly packaging solutions. Leading players continue to fortify their standing in developing markets through direct-to-retail partnerships, private-label cooperation, and expansion of their e-commerce footprint.

The rise of online grocery shopping has spurred brands to enhance digital marketing, utilizing social media, influencer partnerships, and subscription-based platforms to improve consumer engagement. Premiumization, including single-origin currants, artisanal processing, and advanced nutritional fortification, has also gained traction, enabling brands to target high-end retail as well as specialty health stores.

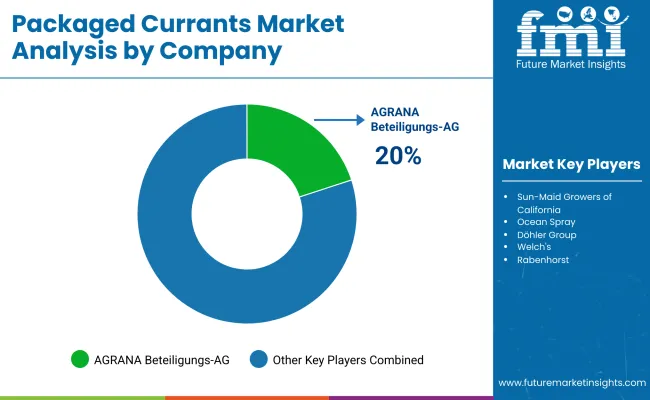

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| AGRANA Beteiligungs-AG | 20% |

| Sun-Maid Growers of California | 18% |

| Ocean Spray | 15% |

| Döhler Group | 12% |

| Welch's | 10% |

| Other Companies | 25% |

| Company Name | Key Offerings/Activities |

|---|---|

| AGRANA Beteiligungs-AG | Produces a range of fruit preparations and concentrates, emphasizing sustainable sourcing as well as production. |

| Sun-Maid Growers of California | Specializes in dried fruits, particularly raisins and currants, with a focus on natural and organic products. |

| Ocean Spray | Offers a variety of fruit-based products, including dried cranberries and currants, leveraging cooperative farming. |

| Döhler Group | Provides natural ingredients and solutions, including fruit concentrates and purees, for the food and beverage industry. |

| Welch's | Known for grape-based products, including juices and dried fruits, with an emphasis on quality and heritage. |

Key Company Insights

AGRANA Beteiligungs-AG (20%)

AGRANA is one of the world's top manufacturers of fruit preparations and concentrates, prioritizing sustainable sourcing as well as production. Its focus on environmental sustainability and innovation has entrenched its place in the packaged currants sector.

Sun-Maid Growers of California (18%)

Sun-Maid deals primarily in dried fruits, with raisins and currants being specialties. Sun-Maid concentrates on natural and organic products and has achieved a high industry share due to its extensive experience and strict adherence to quality standards.

Ocean Spray (15%)

Ocean Spray has a range of fruit-derived products, such as dried cranberries and currants, from its cooperative farm model. Ocean Spray's product emphasis on innovation and health benefits attracts a wide consumer base.

Döhler Group (12%)

Döhler offers natural ingredients and solutions, such as fruit concentrates and purees, to the food and beverage sectors. The company's natural and health-focused products align with the trends.

Welch's (10%)

Welch's is famous for its grape products, such as juices and dried grapes, and it has a strong focus on heritage as well as quality. Its industry presence can be attributed to the long-standing reputation and family-farming approach of the company.

Other Key Players (25% Combined)

The segmentation is into Blackcurrant, Redcurrant, and White Currant, catering to different uses in food, beverages, and health applications.

Currants are distributed through Supermarkets/Hypermarkets, Convenience Stores, and Online Retailing, ensuring availability across both traditional and digital platforms.

The segmentation is into North America, Latin America, Europe, Asia Pacific, and MEA (Middle East & Africa), reflecting regional consumption trends and growth opportunities.

The industry is expected to reach USD 1 billion in 2025.

The market is projected to grow to USD 1.7 billion by 2035.

The USA is anticipated to experience a 7.2% CAGR during the forecast period.

Blackcurrant products dominate the segment.

Major players include AGRANA Beteiligungs-AG, Sun-Maid Growers of California, Ocean Spray, Döhler Group, Welch's, Rabenhorst, Belvoir Fruit Farms, BerryWorld Ltd., Nichols plc (Vimto), and Vitabio (France).

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaged Coconut Water Market Size and Share Forecast Outlook 2025 to 2035

Packaged Food Market Growth - Consumer Preferences & Industry Trends 2025 to 2035

Packaged Milkshake Market Analysis by Flavor, Packaging Material, and Region through 2035

Packaged Fresh Fruits Market Analysis by Berries, Citrus, Tropical Fruits, Stone Fruits, and Others Through 2035

Packaged Bread Market Trends - Shelf-Stable Bakery Innovations 2025 to 2035

Packaged Sunflower Seeds Market – Growth, Demand & Consumer Trends

Pre-Packaged Medical Supplies Market

Reduced Salt Packaged Foods Market - Health-Conscious Eating Trends 2025 to 2035

Carbon Labeled Packaged Meal Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA