The chip scale package (csp) led market is driven by a strong need for compact, high-efficiency lighting solutions in automotive, industrial and other end use industries. Due to the efficient management of heat, optical advantages, and lower cost, CSP (chip scale packages) LEDs have increasingly been applied to automotive, consumer electronics, and other general illumination areas.

The growth in the market is primarily attributed to the miniaturization trend in electronics, increasing adoption of smart devices with LED technology, and increasing demand for energy-saving lighting solutions. CSP LEDs are also benefiting from advances in chip-scale packaging technology such as phosphor deposition methods and substrate materials.

Increasing investments in micro-LED and mini-LED display technologies, mainly for high-end TVs, smartphones, and AR Devices is expected to drive the market. A significant contributor to this comes from the automotive sector, where CSP LEDs are more in use within adaptive headlights, interior ambient lighting, and advanced display panels.

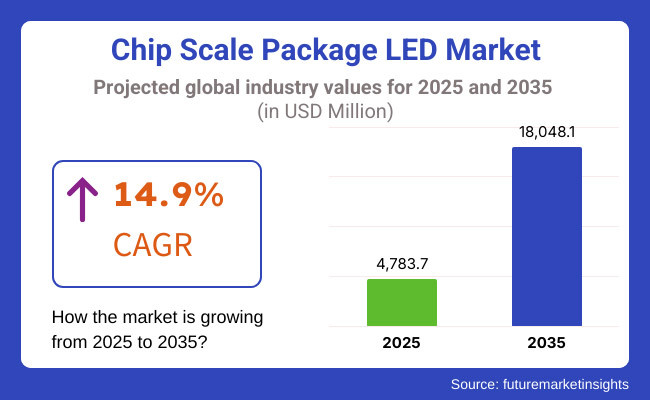

The chip scale package led market accounted for USD 4,783.7 million in 2025 and is projected to reach USD 18,048.1 million by 2035, growing at a CAGR of 14.9% during the forecast period.

North America dominates the market due to the early adoption of CSP LED technology in consumer electronics, smart lighting solutions, and automotive applications. High investments in R&D, strong semiconductor manufacturing capabilities, and a strong presence of LED manufacturers, have been the key factors for the countries such as the United States and Canada.

Germany, the UK, and France all being major economies are widening their focus towards energy-efficient lighting solutions and automotive applications. Industrial and residential sector demand for smart lighting and high-resolution displays is stimulating market growth.

Its fastest-growing region, with China, Japan, South Korea, and India in the lead. The market growth can be attributed to the presence of strong semiconductor ecosystem and increasing demand for smart devices, as well as growing investments in LED manufacturing. Meanwhile, government programs encouraging energy-efficient lighting help drive uptake.

Challenge

High Initial Costs and Thermal Management Issues

The CSP LED market has one of the biggest hurdles which is the cost barrier owing to higher production costs and higher investment costs. The advanced design and miniaturization need an accurate semiconductor processing, which is making the manufacturing harder. CSP LEDs also have thermal management challenges due to their small size, which can cause excessive temperatures and a shorter operating life.

This can restrict their use in high-power apps, leading to novel cooling methods to improve performance and stability.

Opportunity

Growth in Miniaturization and Integration with Smart Lighting Solutions

As the trends towards higher density and high efficiency luminaires rise, CSP LEDs are becoming more widespread in applications such as automotive, display backlighting and smart lighting. In light of this, CSP LEDs with GaN-on-Si technology are experiencing tremendous development in high efficiency and robustness due to material progress.

Moreover, growing integration of CSP LEDs with smart lighting products, and IoT-based controls is opening new business opportunities. The advancements in CSP LEDs comprising high-luminance capacity, low-energy usage, and a cost-effective setup would drive more market penetration in emerging areas.

During Oct 2020 to Oct 2024, the CSP LED market expanded rapidly for the application of display backlighting, automotive lighting and high-brightness applications. The miniaturization of light-emitting diodes with high efficacy and low power consumption is a trend rising in demand across the industry. However, thermal management issues and high manufacturing costs limited broad-market applications, especially in price-sensitive markets.

Forecasting the CSP LED technology for market size from 2025 to 2035, revolutionary advances in CSP technology will enable more CSP LED use, generating great market growth. Developments in quantum dot-based CSP LEDs, MicroLED technology, and sophisticated phosphor coatings will improve efficiency and color rendering.

Increased adoption of AI-enabled lighting arrangements, smart adaptive headlights, ultra-thin versatile CSP LEDs in wearable displays will drive the market. LED manufacturers, semiconductor firms, and display technology companies should make further alliances activities that will further facilitate the growth of CSP LED adoption.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with energy efficiency and photobiological safety standards |

| Treatment Innovations | Development of high-luminance CSP LEDs for automotive and display backlighting |

| Market Adoption | Adoption in premium TVs, smartphones, and high-end automotive lighting |

| Performance Enhancements | Improvements in heat dissipation and power efficiency |

| Market Competition | Dominated by major LED manufacturers such as Nichia, Samsung, and Cree |

| Healthcare & Consumer Applications | Use in medical lighting and wearable devices |

| Sustainability Trends | Development of energy-efficient CSP LEDs |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter regulations on hazardous materials, improved efficiency standards for sustainability |

| Treatment Innovations | Advancements in quantum dot-based CSP LEDs and integration with MicroLEDs |

| Market Adoption | Widespread adoption in smart lighting, IoT-based controls, and flexible display technologies |

| Performance Enhancements | AI-driven adaptive lighting and self-cooling CSP LED technologies |

| Market Competition | Rise of new entrants specializing in MicroLEDs and next-generation CSP technologies |

| Healthcare & Consumer Applications | Growth in CSP LED-based smart wearables, AR/VR displays, and biometric lighting |

| Sustainability Trends | Large-scale adoption of eco-friendly, lead-free, and recyclable CSP LEDs |

The forthcoming United States chip scale package (CSP) LED market scenario is based on the existing market situation, such as inherent characteristics, and current affairs to offer realistic segment anticipations with the help of cumulative methodologies, enabling companies within the region, including end-users, to take a step ahead of their existing competitors.

Market growth is driven by the rapid proliferation of CSP LEDs in automotive headlights, smart displays, and high-brighteness lighting solutions.

Government guidelines encouraging efficient lighting, along with the presence of major LED manufacturers and continued R&D investments are propelling CSP LED adoption. With the trend towards miniaturization in the electronics and display technologies coupled with the growing adoption of CSP LEDs in micro LED displays, the market will also experience growth.

CSP LEDs are also witnessing significant growth in the high-lumen output applications, such as stadium lighting and architectural lighting that is fueling the growth. Moreover, increasing spending on sophisticated manufacturing processes, such as flip-chip and GaN-on-Si technology, is further improving the production efficiency for CSP LEDs in the USA.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 15.2% |

Strong demand for adopters of smart lighting solutions and increasing applications in automotive and consumer electronics are expected to drive solid growth in the CSP LED market in the United Kingdom. One of the main drivers for this growth comes from the push for energy-efficient and sustainable lighting technologies in the country, under government-led green initiatives.

This CSP die gets high-potential applications in high-end sectors, such as automotive adaptive headlights, medical devices, and display backlighting. Furthermore, the United Kingdom is home to leading research institutions, which are working towards the development of microLEDs and miniaturized lighting solutions, thereby boosting innovation in the CSP LED segment.

Moreover, implementation of strict energy efficiency regulations and policies like the gradual removal of conventional light sources is the other major factor responsible for driving the CSP LED adoption in the commercial and residential applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 14.7% |

The European Union CSP LED market is driven by the regions increasing implementation of energy-efficient lighting systems and rising automotive and industrial lighting sectors. The market is also being driven by various initiatives and policies across sectors to promote the adoption of LEDs in line with the European Green Deal and EU energy policies, both strong contributing factors to market growth.

Germany, France, and Italy dominate the development and use of CSP LED technologies, including automotive lights and smart city applications. Moreover, the increasing demand for CSP LEDs for various high-power lighting applications, including street lighting, commercial displays, and architectural illumination, is also aiding the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 14.5% |

Japan chip scale packaged LED market is greatly benefited from the recent developments related to semiconductors and miniaturized lighting technologies in Japan. Demand for CSP (Chip Scale Package) LEDs is driven by their increasing adoption in applications including automotive lighting, wearable devices and micro LED displays.

The presence of Japan in the consumer electronics and display technology industries, along with government-supported initiatives for energy-efficient lighting are driving the market growth. Another major trend in the country is the development of advanced CSP (Chip-on-Board) LED solutions featuring improved thermal management first-in-class high-lumen efficiency.

Japan’s strong investment in next-generation display technology, such as MicroLEDs for AR/VR applications and automotive HUDs, is further fueling the growth of CSP LEDs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 15.0% |

The market in South Korea includes a high share of display technology and semiconductors. It also indicates that the country’s leading position in the production of OLED and micro LED displays is spurring growth for CSP LEDs used in high-performance lighting applications.

Advanced R&D capabilities in LED technology in South Korea drive the growing implementation of CSP LEDs in automotive, consumer electronics, and industrial applications. Moreover, government funding for smart lighting infrastructure and energy-efficient solutions is expected to drive the market growth.

This progress will be propelled by sourcing technologies from South Korea, which already excels in miniaturized semiconductor production and micro LED innovation (for next-generation display panels); this will aid CSP LED implementation in high-resolution displays and smart lighting materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 14.8% |

The chip of the Package (CSP) LED demand for backlighting units and general lighting applications remains strong, and CSP LED market continues to do fairly well. The advantages of CSP LEDs, like miniaturization, better thermal management, and higher efficiency, are popular in these segments.

The backlighting unit segment continues to be the largest consumer for CSP LEDs, as they are widely used in TV screens, mobile phones, tablets, laptop displays, and various other applications. CSP LEDs offer a compact form factor that allows for thinner and lightweight electronic display designs, making them preferred by consumer electronics manufacturers.

Complementing their superior energy efficiency, CSP LEDs also provide a much higher uniform light output with more lifelike colors than conventional LED backlighting technologies.

The rise of mini-LED and micro-LED backlighting has expedited the uptake of CSP LEDs, especially for high-end displays. Furthermore, with the rising demand for high dynamic range (HDR) and 4K/8K resolution displays, CSP LED solutions have become essential for manufacturers to establish high brightness control properties alongside low power consumption.

In anticipation of increasingly demanding visual experiences from consumers, electronics brands have transitioned to direct-lit backlighting technologies with full-array local dimming (FALD); CSP LEDs are an important factor for forward luminance control.

Moreover, CSP LEDs have high thermal dissipation properties, contributing to long lifetime and stable operation at high brightness. This aspect becomes especially important in the case of televisions and monitors, where they typically function for long hours and hence need highly durable and efficient lighting components.

Globally, the growing demand for energy-efficient and eco-friendly display technologies stimulation in use of CSP LEDs with manufacturers reducing dependency on power-hungry CCFL (cold cathode fluorescent lamp) and conventional LED (light-emitting diode) solutions.

The general lighting segment is one of the prominent application areas for CSP LEDs, as industry is increasingly moving towards compact and maximum performance lighting solutions. As CSP LEDs can provide enhanced brightness, uniform light distribution and high color rendering, these LEDs are well-suited for residential, commercial and industrial lighting applications.

The growing adoption of smart and connected lighting systems is driving demand for CSP LEDs for general lighting. The miniaturized size and enhanced thermal management make them well suited for embedding in smart bulbs, LED downlights or architectural lighting fixtures. CSP LEDs do away with conventional packaging elements as well, resulting in more lightweight and less-expensive lighting systems paired with higher energy output.

Lighting technologies implemented through CSP LEDs are also powering significant developments in tunable white light and human-centric lighting applications that allow users to modify color temperature and brightness levels according to their exact requirements. Offering precision dimming and flicker-free performance, CSP LEDs have emerged as the preferred lighting choice in offices, healthcare, and hospitality applications.

Outdoor and industrial lighting segments are progressively moving to CSP LEDs that can endure harsh environmental situations and still have higher luminous efficacy. Additionally, the accelerated implementation of street lighting, stadium lighting, and high-bay lighting solutions based on CSP LED technology is expected to drive the market during the forecast period.

However, owing to cost sensitivity and market favourability for traditional SMD LED packages, CSP LEDs can, nevertheless, encounter obstacles to initial adoption in general lighting. However, continuing cost reductions, improved energy efficiency in chips due to new stopping structures, and government bodies advocating energy-efficient lighting alternatives will hasten the shift to CSP LED based general lighting solutions.

High power CSP LED segment in automotive lighting, industrial lighting and outdoor illumination applications continue a steady increase. These LEDs exhibit high brightness level, enhanced thermal emission, and longer lifespan making them the first option for high-output lighting applications.

Car makers are progressively deploying high-power CSP LEDs in the construction of headlamps, daytime running lights (DRLs) and adaptive lighting systems to improve visibility and energy efficiency. Through its compact package design, CSP LEDs enable designers to implement modern, attractive lighting designs with optimum illuminative performance.

Because CSP LEDs can withstand vibration and environmental conditions much better than high-power LEDs, they are used in both moto-travel and aviation used lighting systems.

For industrial and outdoor lighting, the high-power CSP LEDs serve as premium candidates for high-mast lighting, floodlighting, and warehouse lighting designs. Their high luminous efficacy and low heat generation help reduce energy consumption and therefore improve the maintenance required for large-scale lighting. These projects focusing on energy-efficient, high-lumen-output interior and exterior lighting have generated demand for high-power CSP LED modules.

The rising use of CSP LEDs in consumer electronics (like TV's, peripheral devices, and monitor screens), automotive lighting, as well as display backlighting will drive a rise in the market. Demand is mainly driven by higher energy efficiency, compact size, and cost-effectiveness. Smart lighting solutions and miniaturization technology are also driving market expansion.

Market Share Analysis by Key Players

| Company Name | Estimated Market Share (%) |

|---|---|

| Nichia Corporation | 20-24% |

| Samsung Electronics | 16-20% |

| OSRAM Opto Semiconductors | 12-16% |

| Cree LED (Wolfspeed) | 10-14% |

| Seoul Semiconductor | 8-12% |

| Others | 22-28% |

| Company Name | Key Offerings/Activities |

|---|---|

| Nichia Corporation | Develops high-performance CSP LEDs for automotive, general lighting, and backlighting applications. |

| Samsung Electronics | Offers CSP LEDs with enhanced thermal management for mobile devices, TV backlighting, and automotive lighting. |

| OSRAM Opto Semiconductors | Specializes in high-power CSP LEDs for industrial, automotive, and smart lighting solutions. |

| Cree LED (Wolfspeed) | Provides ultra-high brightness CSP LEDs for architectural, automotive, and general illumination. |

| Seoul Semiconductor | Focuses on miniaturized CSP LED solutions for wearable devices, microdisplays, and general lighting. |

Key Market Insights

Nichia Corporation (20-24%)

Nichia leads the CSP LED market with its expertise in phosphor and LED chip technology. The company supplies advanced CSP LEDs for high-luminance automotive headlights, display backlighting, and industrial lighting applications. Strong partnerships with display manufacturers contribute to its dominant position.

Samsung Electronics (16-20%)

Samsung leverages its semiconductor expertise to produce highly efficient CSP LEDs for high-end televisions, mobile devices, and automotive applications. Its LED division is focused on expanding into mini-LED and micro-LED markets.

OSRAM Opto Semiconductors (12-16%)

OSRAM specializes in high-intensity CSP LEDs tailored for automotive and smart lighting. The company’s innovations in spectral tuning and digital lighting are strengthening its market presence.

Cree LED (Wolfspeed) (10-14%)

Cree LED, now under Wolfspeed, focuses on high-brightness CSP LEDs for premium lighting solutions. The company is driving advancements in high-power LED applications, including commercial and outdoor lighting.

Seoul Semiconductor (8-12%)

Seoul Semiconductor is known for its compact CSP LED solutions, particularly in consumer electronics and microdisplay applications. The company emphasizes innovation in WICOP technology, eliminating the need for traditional packaging.

Other Key Players (22-28% Combined)

The overall market size for chip scale package LED market was USD 4,783.7 million in 2025.

The chip scale package LED market is expected to reach USD 18,048.1 million in 2035.

The growth of the chip scale package LED market will be driven by increasing demand for energy-efficient lighting, advancements in miniaturization technology, and rising adoption in consumer electronics and automotive applications.

The top 5 countries which drives the development of chip scale package LED market are USA, European Union, Japan, South Korea and UK.

High-Power CSP LED to command significant share over the assessment period.

Table 1: Global Market Value (US$ billion) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ billion) Forecast by Application, 2017 to 2032

Table 4: Global Market Volume (Units) Forecast by Application, 2017 to 2032

Table 5: Global Market Value (US$ billion) Forecast by Power Range, 2017 to 2032

Table 6: Global Market Volume (Units) Forecast by Power Range, 2017 to 2032

Table 7: North America Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 8: North America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 9: North America Market Value (US$ billion) Forecast by Application, 2017 to 2032

Table 10: North America Market Volume (Units) Forecast by Application, 2017 to 2032

Table 11: North America Market Value (US$ billion) Forecast by Power Range, 2017 to 2032

Table 12: North America Market Volume (Units) Forecast by Power Range, 2017 to 2032

Table 13: Latin America Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 14: Latin America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 15: Latin America Market Value (US$ billion) Forecast by Application, 2017 to 2032

Table 16: Latin America Market Volume (Units) Forecast by Application, 2017 to 2032

Table 17: Latin America Market Value (US$ billion) Forecast by Power Range, 2017 to 2032

Table 18: Latin America Market Volume (Units) Forecast by Power Range, 2017 to 2032

Table 19: Europe Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 20: Europe Market Volume (Units) Forecast by Country, 2017 to 2032

Table 21: Europe Market Value (US$ billion) Forecast by Application, 2017 to 2032

Table 22: Europe Market Volume (Units) Forecast by Application, 2017 to 2032

Table 23: Europe Market Value (US$ billion) Forecast by Power Range, 2017 to 2032

Table 24: Europe Market Volume (Units) Forecast by Power Range, 2017 to 2032

Table 25: Asia Pacific Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 26: Asia Pacific Market Volume (Units) Forecast by Country, 2017 to 2032

Table 27: Asia Pacific Market Value (US$ billion) Forecast by Application, 2017 to 2032

Table 28: Asia Pacific Market Volume (Units) Forecast by Application, 2017 to 2032

Table 29: Asia Pacific Market Value (US$ billion) Forecast by Power Range, 2017 to 2032

Table 30: Asia Pacific Market Volume (Units) Forecast by Power Range, 2017 to 2032

Table 31: Middle East and Africa Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 32: Middle East and Africa Market Volume (Units) Forecast by Country, 2017 to 2032

Table 33: Middle East and Africa Market Value (US$ billion) Forecast by Application, 2017 to 2032

Table 34: Middle East and Africa Market Volume (Units) Forecast by Application, 2017 to 2032

Table 35: Middle East and Africa Market Value (US$ billion) Forecast by Power Range, 2017 to 2032

Table 36: Middle East and Africa Market Volume (Units) Forecast by Power Range, 2017 to 2032

Figure 1: Global Market Value (US$ billion) by Application, 2022 to 2032

Figure 2: Global Market Value (US$ billion) by Power Range, 2022 to 2032

Figure 3: Global Market Value (US$ billion) by Region, 2022 to 2032

Figure 4: Global Market Value (US$ billion) Analysis by Region, 2017 to 2032

Figure 5: Global Market Volume (Units) Analysis by Region, 2017 to 2032

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 8: Global Market Value (US$ billion) Analysis by Application, 2017 to 2032

Figure 9: Global Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 10: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 11: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 12: Global Market Value (US$ billion) Analysis by Power Range, 2017 to 2032

Figure 13: Global Market Volume (Units) Analysis by Power Range, 2017 to 2032

Figure 14: Global Market Value Share (%) and BPS Analysis by Power Range, 2022 to 2032

Figure 15: Global Market Y-o-Y Growth (%) Projections by Power Range, 2022 to 2032

Figure 16: Global Market Attractiveness by Application, 2022 to 2032

Figure 17: Global Market Attractiveness by Power Range, 2022 to 2032

Figure 18: Global Market Attractiveness by Region, 2022 to 2032

Figure 19: North America Market Value (US$ billion) by Application, 2022 to 2032

Figure 20: North America Market Value (US$ billion) by Power Range, 2022 to 2032

Figure 21: North America Market Value (US$ billion) by Country, 2022 to 2032

Figure 22: North America Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 23: North America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 26: North America Market Value (US$ billion) Analysis by Application, 2017 to 2032

Figure 27: North America Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 28: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 29: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 30: North America Market Value (US$ billion) Analysis by Power Range, 2017 to 2032

Figure 31: North America Market Volume (Units) Analysis by Power Range, 2017 to 2032

Figure 32: North America Market Value Share (%) and BPS Analysis by Power Range, 2022 to 2032

Figure 33: North America Market Y-o-Y Growth (%) Projections by Power Range, 2022 to 2032

Figure 34: North America Market Attractiveness by Application, 2022 to 2032

Figure 35: North America Market Attractiveness by Power Range, 2022 to 2032

Figure 36: North America Market Attractiveness by Country, 2022 to 2032

Figure 37: Latin America Market Value (US$ billion) by Application, 2022 to 2032

Figure 38: Latin America Market Value (US$ billion) by Power Range, 2022 to 2032

Figure 39: Latin America Market Value (US$ billion) by Country, 2022 to 2032

Figure 40: Latin America Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 44: Latin America Market Value (US$ billion) Analysis by Application, 2017 to 2032

Figure 45: Latin America Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 48: Latin America Market Value (US$ billion) Analysis by Power Range, 2017 to 2032

Figure 49: Latin America Market Volume (Units) Analysis by Power Range, 2017 to 2032

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Power Range, 2022 to 2032

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Power Range, 2022 to 2032

Figure 52: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 53: Latin America Market Attractiveness by Power Range, 2022 to 2032

Figure 54: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 55: Europe Market Value (US$ billion) by Application, 2022 to 2032

Figure 56: Europe Market Value (US$ billion) by Power Range, 2022 to 2032

Figure 57: Europe Market Value (US$ billion) by Country, 2022 to 2032

Figure 58: Europe Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 59: Europe Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 62: Europe Market Value (US$ billion) Analysis by Application, 2017 to 2032

Figure 63: Europe Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 64: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 66: Europe Market Value (US$ billion) Analysis by Power Range, 2017 to 2032

Figure 67: Europe Market Volume (Units) Analysis by Power Range, 2017 to 2032

Figure 68: Europe Market Value Share (%) and BPS Analysis by Power Range, 2022 to 2032

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Power Range, 2022 to 2032

Figure 70: Europe Market Attractiveness by Application, 2022 to 2032

Figure 71: Europe Market Attractiveness by Power Range, 2022 to 2032

Figure 72: Europe Market Attractiveness by Country, 2022 to 2032

Figure 73: Asia Pacific Market Value (US$ billion) by Application, 2022 to 2032

Figure 74: Asia Pacific Market Value (US$ billion) by Power Range, 2022 to 2032

Figure 75: Asia Pacific Market Value (US$ billion) by Country, 2022 to 2032

Figure 76: Asia Pacific Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 77: Asia Pacific Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 80: Asia Pacific Market Value (US$ billion) Analysis by Application, 2017 to 2032

Figure 81: Asia Pacific Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 84: Asia Pacific Market Value (US$ billion) Analysis by Power Range, 2017 to 2032

Figure 85: Asia Pacific Market Volume (Units) Analysis by Power Range, 2017 to 2032

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Power Range, 2022 to 2032

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Power Range, 2022 to 2032

Figure 88: Asia Pacific Market Attractiveness by Application, 2022 to 2032

Figure 89: Asia Pacific Market Attractiveness by Power Range, 2022 to 2032

Figure 90: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 91: Middle East and Africa Market Value (US$ billion) by Application, 2022 to 2032

Figure 92: Middle East and Africa Market Value (US$ billion) by Power Range, 2022 to 2032

Figure 93: Middle East and Africa Market Value (US$ billion) by Country, 2022 to 2032

Figure 94: Middle East and Africa Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 95: Middle East and Africa Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 96: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 97: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 98: Middle East and Africa Market Value (US$ billion) Analysis by Application, 2017 to 2032

Figure 99: Middle East and Africa Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 100: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 101: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 102: Middle East and Africa Market Value (US$ billion) Analysis by Power Range, 2017 to 2032

Figure 103: Middle East and Africa Market Volume (Units) Analysis by Power Range, 2017 to 2032

Figure 104: Middle East and Africa Market Value Share (%) and BPS Analysis by Power Range, 2022 to 2032

Figure 105: Middle East and Africa Market Y-o-Y Growth (%) Projections by Power Range, 2022 to 2032

Figure 106: Middle East and Africa Market Attractiveness by Application, 2022 to 2032

Figure 107: Middle East and Africa Market Attractiveness by Power Range, 2022 to 2032

Figure 108: Middle East and Africa Market Attractiveness by Country, 2022 to 2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carbon Labeled Packaged Meal Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Chip-On-Board (COB) Light Emitting Diode (LED) Market Analysis and Forecast 2025 to 2035, By Application and Region

Package Shell for Optical Communication Modules Market Size and Share Forecast Outlook 2025 to 2035

LED Solder Paste Market Size and Share Forecast Outlook 2025 to 2035

Package Pumping Station Market Size and Share Forecast Outlook 2025 to 2035

Package Testing Silicone Rubber Socket Market Size and Share Forecast Outlook 2025 to 2035

LED and OLED lighting Products and Display Market Size and Share Forecast Outlook 2025 to 2035

LED Digital Speed Limit Sign Market Size and Share Forecast Outlook 2025 to 2035

LED Light Market Size and Share Forecast Outlook 2025 to 2035

Chip-on-the-Tip Endoscopes Market Size and Share Forecast Outlook 2025 to 2035

Chipless RFID Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

LED Loading Dock Light Market Size and Share Forecast Outlook 2025 to 2035

LED Modules and Light Engines Market Size and Share Forecast Outlook 2025 to 2035

LED Control Unit Market Size and Share Forecast Outlook 2025 to 2035

LED Lamp Market Size and Share Forecast Outlook 2025 to 2035

LED Light Tower Market Size and Share Forecast Outlook 2025 to 2035

LED Displays, Lighting and Fixtures Market Size and Share Forecast Outlook 2025 to 2035

Chip Resistor Market Size and Share Forecast Outlook 2025 to 2035

LED Tube Market Size and Share Forecast Outlook 2025 to 2035

LED Backlight Driver Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA