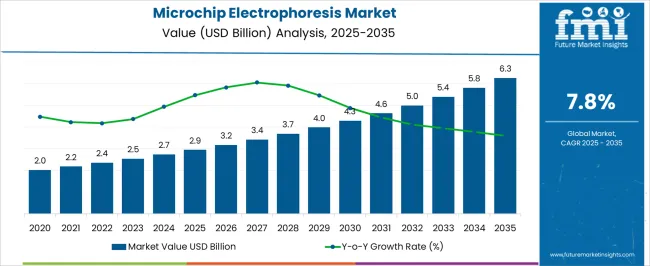

The Microchip Electrophoresis Market is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 6.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period.

| Metric | Value |

|---|---|

| Microchip Electrophoresis Market Estimated Value in (2025 E) | USD 2.9 billion |

| Microchip Electrophoresis Market Forecast Value in (2035 F) | USD 6.3 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The Microchip Electrophoresis market is experiencing notable growth due to the increasing adoption of miniaturized and automated separation techniques across pharmaceutical, clinical, and research applications. The current market environment is shaped by the demand for faster, high-throughput, and low-sample-volume analytical solutions that improve efficiency and reduce operational costs.

Technological advancements in microfluidics and chip design have enhanced separation precision and reproducibility, making microchip electrophoresis an attractive alternative to traditional gel and capillary electrophoresis methods. The growth is further supported by the rising focus on personalized medicine, biomarker discovery, and quality control in pharmaceutical production.

Investments in laboratory automation and the integration of microchip electrophoresis with analytical instruments have strengthened its applicability across drug development and molecular diagnostics Looking ahead, the market is expected to expand as pharmaceutical companies continue to prioritize efficiency, accuracy, and high-throughput analysis in their workflows, while the ongoing miniaturization of analytical tools opens new avenues for adoption in research and development laboratories.

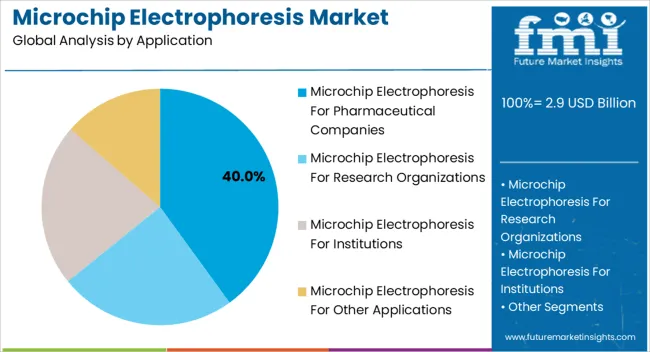

The microchip electrophoresis market is segmented by application, and geographic regions. By application, microchip electrophoresis market is divided into Microchip Electrophoresis For Pharmaceutical Companies, Microchip Electrophoresis For Research Organizations, Microchip Electrophoresis For Institutions, and Microchip Electrophoresis For Other Applications. Regionally, the microchip electrophoresis industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The application segment of Microchip Electrophoresis for Pharmaceutical Companies is projected to account for 40.0% of the total market revenue in 2025, making it the leading application area. This dominance is driven by the growing need for high-throughput screening, quality control, and efficient biomolecule separation in drug development and manufacturing processes. Adoption has been accelerated due to the ability of microchip electrophoresis to deliver rapid, reproducible, and highly precise results while consuming minimal sample volumes and reagents.

Pharmaceutical laboratories benefit from its integration with automated workflows, which allows consistent analysis across multiple samples, reducing human error and operational time. The segment’s growth is also supported by the increasing complexity of biologics and small molecule therapeutics that require advanced analytical techniques for characterization.

Furthermore, the rising demand for regulatory compliance and stringent quality standards has positioned microchip electrophoresis as a preferred solution for pharmaceutical companies The ability to quickly adapt to new assays and streamline laboratory operations ensures that this segment maintains a leading position in the market while offering future opportunities for expanded adoption across drug discovery and production processes.

North America has been the market leader in microchip electrophoresis, but demand is increasing in developing regions such as Asia-Pacific. Microchip electrophoresis (MCE) is an analytical technique that is the result of miniaturizing capillary electrophoresis onto a planar microfabricated separation device.

Microanalytical systems, such as microchip electrophoresis, have received a lot of attention because they can analyze small amounts of sample while also lowering the cost of testing by improving the rate and throughput of chemical and biochemical analysis. Microchip electrophoresis is a high-performance separation technique that allows for rapid analytical separations of complex samples. Microchip electrophoresis has a high resolution and a large peak capacity.

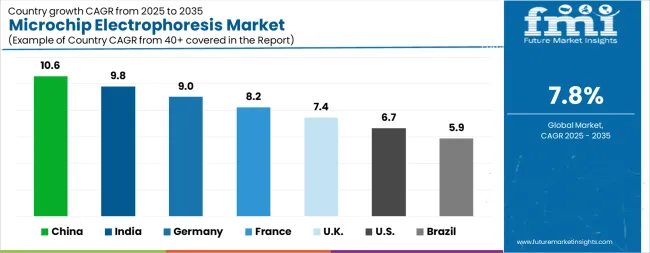

| Country | CAGR |

|---|---|

| China | 10.6% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

| USA | 6.7% |

| Brazil | 5.9% |

The Microchip Electrophoresis Market is expected to register a CAGR of 7.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 10.6%, followed by India at 9.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.9%, yet still underscores a broadly positive trajectory for the global Microchip Electrophoresis Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 9.0%. The USA Microchip Electrophoresis Market is estimated to be valued at USD 1.1 billion in 2025 and is anticipated to reach a valuation of USD 2.1 billion by 2035. Sales are projected to rise at a CAGR of 6.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 136.8 million and USD 83.1 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 Billion |

| Application | Microchip Electrophoresis For Pharmaceutical Companies, Microchip Electrophoresis For Research Organizations, Microchip Electrophoresis For Institutions, and Microchip Electrophoresis For Other Applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

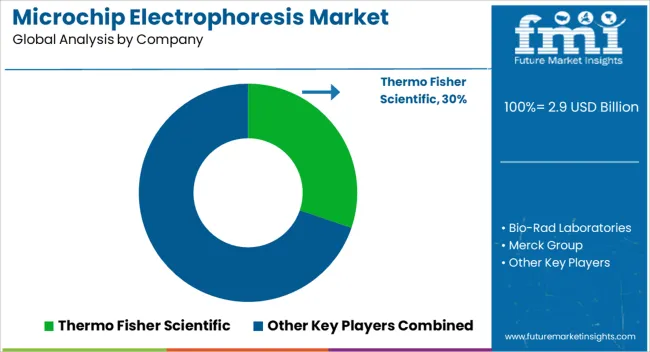

| Key Companies Profiled | Thermo Fisher Scientific, Bio-Rad Laboratories, Merck Group, Agilent Technologies, Danaher Corporation, GE Healthcare, PerkinElmer, QIAGEN N.V., Harvard Bioscience, Shimadzu Corporation, Lonza Group, and Sebia Group |

The global microchip electrophoresis market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the microchip electrophoresis market is projected to reach USD 6.3 billion by 2035.

The microchip electrophoresis market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in microchip electrophoresis market are microchip electrophoresis for pharmaceutical companies, microchip electrophoresis for research organizations, microchip electrophoresis for institutions and microchip electrophoresis for other applications.

In terms of , segment to command 0.0% share in the microchip electrophoresis market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal Microchip Implant Market Growth - Trends & Future Outlook 2025 to 2035

Computer Microchips Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Microchips Market Size and Share Forecast Outlook 2025 to 2035

Electrophoresis Reagents Market Size and Share Forecast Outlook 2025 to 2035

Electrophoresis Market Trends - Growth, Demand & Forecast 2025 to 2035

Electrophoresis Equipment and Supplies Market Analysis

Electrophoresis Transilluminator Market

Capillary Electrophoresis Market Size, Growth, and Forecast 2025 to 2035

Sequencing Electrophoresis Systems Market Size and Share Forecast Outlook 2025 to 2035

Nucleic acid electrophoresis and blotting market

DNA Sequencing Electrophoresis Systems Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA