Chip warmers market includes the equipment best suited to fulfil need. Commonly used in quick-service restaurants (QSRs), concession stands, catering enterprises, and hospitality industries, these warmers hold food at ideal temperatures while extending food life.

Additionally, growing consumption of convenience food and fast food, alongside technological advancements in foodservice operation equipment, are driving the market. Moreover, the growing adoption of these systems is also being supported by a focus on food safety, hygiene, energy-efficient, and automated chip warming solutions.

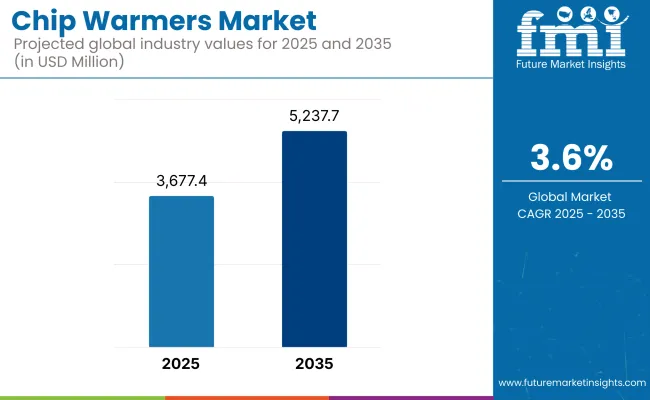

The global chip warmers market is projected to reach USD 3,677.4 million by 2025, at a CAGR of 3.6% during the forecast period USD 5,237.7 million in 2035.

This expected CAGR underscores the continued need for chip warmers, fueled by the growth of the foodservice industry, rising consumer preference for freshly prepared snacks, and the incorporation of smart temperature control technologies. Moreover, the increasing trend for takeout and delivery services is driving the adoption of effective food warming solutions.

The dominant market share of the chip warmers in North America is because the region is home to quick-service restaurants, convenience stores, and fast-food restaurants. The instant-food consumption among the customers is high, and the meal delivery services are increasing in popularity more and more, and thus it is the strongest driver of the use of the chip warmers.

Food safety laws are very stringent in Canada and the USA, and therefore it also needs to follow advanced food warming technology to enhance hygiene and regulatory adherence.

Europe dominates a vast majority of the chip warmer market, and the United Kingdom, Germany, and France are the countries that exercise dominance over the foodservice sector. The quality of food presentation and sustainability have driven the continent to adopt energy-efficient, automated warming technologies.

Secondly, growing demand for casual dining and gourmet fast food drives demand for new chip-warming technology.

The fastest growth in chip warmer appliance market is expected in the Asia-Pacific region. Rapid urbanization is the major reason, together with expansion of both quick-service restaurant chains and rising disposable incomes in countries like China India and Japan.

One factor propelling demand for efficient food-warming solutions are these changes in local markets towards street food culture as hotels catch up with investment to take care of their needs and help them stay alive and survive. Moreover, such improvements in manufacturing technology for food-related equipment as well as local government policy encouraging the issuance of food safety standards also help to expand market demand.

Challenge

High Energy Consumption and Uneven Heating Issues

Continuously used in food service establishments, fast-food chains and catering stands, chip warmers are high power consumption machines. The hefty energy requirement of conventional heating units eats into the business budgets and it is this factor which makes them least "sustainable". Furthermore, uneven heat distribution in some warming units means that customers get food of uneven quality. This affects customer satisfaction and also leads to bigger food wastage.

Opportunity

Smart Heating Technologies and Energy-Efficient Designs

The market is moving toward smart chip warmers that integrate infrared heating elements, advanced convection systems, and IoT-controlled temperature features so as to save energy. There is a growing demand for environmentally-friendly energy-efficient chip warmers.

Manufactured with automated heat sources and regional warming systems, these models are especially popular on today's market. In addition, wireless monitoring together with AI-based temp optimization brings together the dual role of waste reduction and quality maintenance for the food service provider.

There are also new types of chip warmers which are run by solar power or battery, both of these being environmentally friendly as well as helpful in outdoor settings and off-grid locations.

Between 2020 and 2024, the chip warmers market expanded steadily alongside rapid growth of the fast-food industry, home delivery services and quick-service restaurants (QSRs). At the same time, however, traditional models commonly encountered problems with energy inefficiency, uneven heating and high operating costs particularly in price-sensitive markets.

Between 2025 to 2035, the market will experience a technological revolution with automated chip warming solutions entering the mainstream, AI heat monitoring, and food warmers which can be linked together via IoT. None in turn, induction-based and infra-red technologies mark the way forward for warming down species.

But solar hybrid fuel powered chip warmers will also enjoy increasing popularity after selecting among the many sustainable warmers that are both friendly to the environment and globally advertising with other types of this energy provider.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with basic food safety and electrical efficiency regulations |

| Technology Innovations | Traditional heating elements with limited efficiency improvements |

| Market Adoption | Growing demand from fast-food chains and QSRs |

| Energy Efficiency | High power consumption and heat loss issues |

| Market Competition | Dominated by major foodservice equipment manufacturers |

| Sustainability Trends | Introduction of energy-efficient chip warmers |

| Food Waste Reduction | Manual heat monitoring leading to overheating or underheating |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter energy efficiency standards and sustainability-driven mandates for commercial kitchen appliances |

| Technology Innovations | Smart chip warmers with AI-based temperature control, infrared heating, and IoT integration |

| Market Adoption | Expansion into smart kitchens, food trucks, and automated vending solutions |

| Energy Efficiency | Integration of low-energy, eco-friendly warming systems using infrared and induction heating |

| Market Competition | Rise of specialized brands focusing on smart heating technologies and energy-efficient solutions |

| Sustainability Trends | Large-scale adoption of solar-powered, battery-operated, and biodegradable material-based warming units |

| Food Waste Reduction | Automated, AI-driven heat regulation for optimal food quality and reduced wastage |

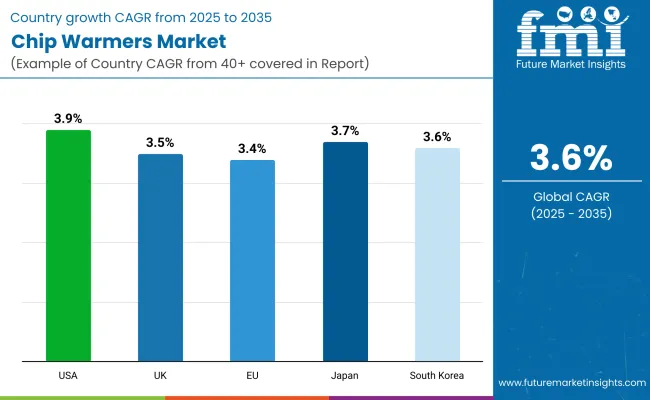

The market for chip warmers in the United States is growing at a steady pace. Its demand is coming from crowded restaurants and fast-food chains. As convenience food tastes better and better, pans have been finding wider applications in commercial kitchens, including quick service restaurants (QSRs).

Also, technically advanced factors like energy-efficient heat sources and successful temperature control systems are resulting in greater heating yields and less power use. Owing to better performance and excellent service, this product has gained a considerable share of the American market.

In addition, the increasing home cooking trend and food delivery service has led to higher demand for small, convenient chip warmers by end-user consumers. In this way, demand for household energy-saving appliances continues to grow.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.9% |

The market for UK chip warmers is growing, helped by the boom in fast food culture and food service infrastructure upgrades. More and more quick-service restaurants, catering companies and food trucks are in need of better food-warming solutions.

At the same time, advanced food warming techniques such as infrared radiation and environmentally friendly insulation are also making their way into the market. Furthermore, strict food safety regulations mandate that foodservice operators maintain optimum serving temperatures, thereby increasing the demand for dependable chip warmers.

Growing consumer preference for take-away and home-delivered meals is a further market driver.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.5% |

The European Union (EU) chip warmers market, moderate upturn is being witnessed. It is driven by the ever- stricter food safety regulations, initiatives for energy efficiency and the current proliferation of casual dining restaurants. The EU's strong emphasis on sustainable and environment-friendly food service equipment is leading to an uptake in energy-efficient pans which have much less carbon footprints.

Because of the flourishing hospitality industry foodservice sectors, chip warmers in particular are widely adopted in Germany, France and Italy. Meanwhile, the development of electronic kitchens and automated foodservice solutions has caused a favourable impact on market demand. In addition, in several EU countries the rising popularity of street food and outdoor catering services are also helping to expand the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 3.4% |

Japan’s Chip Warmers market is expanding steadily under the strong market demand for convenience foods, and vending machine-based food services have now become common. The country’s strong inclination to save labour and increase efficiency in food service led to the adoption of technologically advanced warm-keeping equipment.

Furthermore, with greater demand for chip warmers from the burgeoning popularity of bento dishes, convenience store snacks and restaurant-quality meals, international competitive step-up pressures further rise.

At the same time, energy-efficient kitchen appliances that are also space-saving are now promoted by Japan's focus on environment and health among other reasons, resulting in innovations in slimly styled but sturdily built high-performance food warmer cabinets. The addition of smart sensors and IoT-enabled heating solutions is a major feature for the Japanese market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.7% |

South Korea’s chip warmers market starts to pick up steam, food delivery service is being increasingly promoted and a booming fast-food culture found. The country's well-established food service industry with ever-expanding ranks of major international fast-food chains is helping to support demand for high quality chip warmers.

Meanwhile, advances in heating technology, for example induction-based food warmers and infra-red lamp models, also contribute to market growth. And other hot items of news has been South Korea's increasing emphasis on intelligent kitchen solutions plus automation of the food industry, which encourages the development of innovative chip warmers with real-time temperature control functions.

Rising customer patronage at local chain store for lunchtime meals and packaged food items is a growing reason-many parts of the mainland are now picking up chip warmers to have their place businesses.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.6% |

The countertop chip warmers constitute a prominent share in the chip warmers market as food service establishments and commercial kitchens favour space-efficient, energy-efficient solutions. With a compact design for maximum portability, they can be quickly deployed in high-traffic environments, including fast-food chains, food trucks, and concession stands.

Best countertop models are equipped with proper temperature control to maintain the perfect temperature, making food crunchy and fresh for a longer time, thereby enhancing the quality of food and customer satisfaction.

Advancements in technology, like infrared and forced-air heating and energy-saving features, have made for better heat distribution and less energy use.

For high volume establishments, however, their limited holding capacity can prove troublesome despite their many advantages. But manufacturers have continued to innovate, developing stackable and multi-compartment designs that make the most of the space available without sacrificing efficiency. The increasing demand among urban food service providers and commercial kitchens for countertop models contributes to the strong market presence of these appliances.

Chip warmers with built-in chips are becoming popular in large-scale commercial kitchens and restaurants, which have already been integrated into large-scale, high-octane kitchens. The advanced capacity these units offer ensures you maintain a steady temperature without fluctuation, allowing you to keep food warm for hours on end (perfect for operations that do so). Their hidden design beautifies both kitchen and workflow, a huge benefit to luxury restaurants and hotels.

Manufacturers are focused on smart heating technologies, including sensor-based heat regulation and energy-efficient insulation to maximize performance and cut electricity use. Moreover, the huge inclination of molded kitchen designs in the commercial sector is propelling the usage of built-in chip warmers as they add up to a well-organized kitchen setup.

Even though installation may prove to be expensive, and finding space for it can prove to also be an issue, built-in models become favourable for companies with high food production to benefit from high storage capacity and enhanced food preservation capabilities.

With the ever-growing expansion of restaurant chains and catering services on a global scale, the demand for these premium solutions is increasing, making built-in chip warmers an essential tool in modern commercial kitchens.

The commercial segment contributes the largest share of chip warmers wherever food service providers need efficient solution for maintaining quality and service speed. Restaurants with a fast-casual line, such as chip warmers, typical in a cafeteria setting, are highly dependent on chip warmer to keep food texture and temperature, maintaining a high level of customer satisfaction.

With the growing number of food establishments across the globe, particularly in emerging economies, the demand for commercial-grade chip warmers is expected to remain high within the market. The growing popularity of fast foods, convenience-oriented lifestyle of consumers and need for on-the-go consumption due to hectic schedules and working hours are other factors boosting demand for commercial-grade chip warmers across key markets.

Innovation in commercial chip warmers is being driven by growing emphasis on advanced temperature control mechanisms, multi-tiered warming systems, and energy-efficient design. Regulatory compliance with food safety standards in particular has driven the development of NSF-certified models with improved hygiene and food handling features by manufacturers.

While the maintenance and operational costs can be challenging, the growth of commercial food service industries means that there will always be demand for high-performance chip warmers. The growth of automated food warming system adoption also fortifies the commercial grade of chip warmer's position in their food establishment, enabling such food businesses to improve their energy usage while being more efficient in working operations.

Chip warmers in restaurants | Restaurants are any establishments that prepare and serve food, which plays a significant role in the growth of the chip warmers market, where fine dining, casual dining, and fast food outlets deploy these warmers to keep food fresh and to improve food service.

To keep fat fried conventionally cooked within 10 millimetres counters / to keep food waste minimum, full-extender honers will have far less potential for food waste than traditional frying in high volume restaurant settings.

Smart technologies, including automatic heat systems and moisture reserves, have greatly enhanced product performance, enabling restaurants to serve consistently high-quality food. With customer preferences migrating to speedy restaurant dining experiences, these establishments are now investing in high-capacity warmers that maximize food prepared and minimize waste.

Market trends are also influenced by sustainability considerations, with restaurant owners looking for energy-saving chip warmers that consume less electricity without compromising on food safety. Market demand is also spurred by franchises and chain stores (which are growing ever more prevalent), which require uniformity between the many kitchens in their establishments to save time and guarantee consistency.

Despite the high initial investment costs, the long term benefits of enhanced efficiency, reduced food waste, and improved service times continues to drive restaurant adoption of chip warmers. The growing preference for chip warmers among restaurants will see this sector be a major contributor to the evolution of dining trends and the demand for chip warmers in the future.

Chip warmers market is also being driven by the increasing need of the food & beverages industry such as restaurant, quick service restaurant (QSR), catering etc. Technological advancements related to heating, energy efficient ranging design, and rising food safety standards are major drivers of the market. Moreover, the growth of quick-service restaurants (QSRs) and food delivery services have further increased the demand for efficient chip warmers.

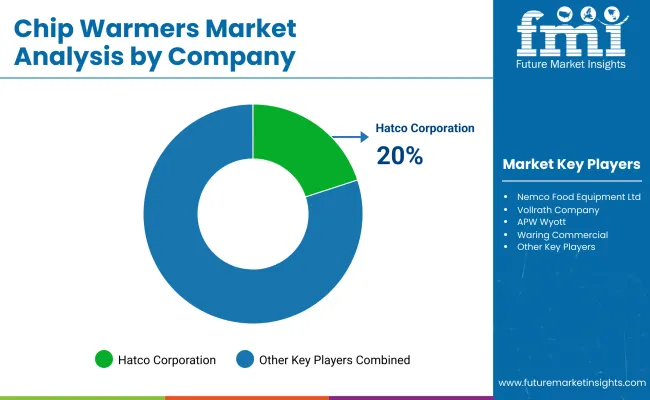

Market Share Analysis by Key Players

| Company Name | Estimated Market Share (%) |

|---|---|

| Hatco Corporation | 20-25% |

| Nemco Food Equipment Ltd. | 15-20% |

| Vollrath Company | 12-16% |

| APW Wyott (Star Holdings Group) | 10-14% |

| Waring Commercial | 8-12% |

| Others | 22-28% |

| Company Name | Key Offerings/Activities |

|---|---|

| Hatco Corporation | Manufactures high-performance chip warmers with precise temperature control and energy-efficient heating elements. |

| Nemco Food Equipment Ltd. | Offers countertop chip warmers with infrared heating technology for uniform heat distribution. |

| Vollrath Company | Specializes in compact and high-capacity chip warmers designed for fast-food restaurants and buffets. |

| APW Wyott (Star Holdings Group) | Provides conveyor-based and radiant heat chip warmers for high-volume foodservice operations. |

| Waring Commercial | Develops portable and space-saving chip warmers with user-friendly digital controls. |

Key Market Insights

Hatco Corporation (20-25%)

Hatco Corporation leads the chip warmers market with a broad range of commercial food-warming equipment. The company integrates cutting-edge heating elements with precise temperature management, ensuring prolonged freshness and crispness of chips. Hatco’s products are widely adopted by quick-service restaurants and catering businesses worldwide.

Nemco Food Equipment Ltd. (15-20%)

Nemco specializes in countertop chip warmers with advanced infrared heating technology, designed to maintain chips at optimal serving temperatures while preventing sogginess. Its presence in convenience stores and fast-casual dining chains contributes to its strong market position.

Vollrath Company (12-16%)

Vollrath focuses on energy-efficient and space-saving chip warming solutions. The company caters to high-traffic food establishments, ensuring durable stainless-steel construction and rapid heating technology for enhanced efficiency.

APW Wyott (Star Holdings Group) (10-14%)

APW Wyott is known for its conveyor-style chip warmers, ideal for large-scale food operations. The company emphasizes robust heating solutions, ensuring consistent heat distribution to preserve the texture and flavor of chips.

Waring Commercial (8-12%)

Waring Commercial offers innovative, user-friendly chip warmers equipped with digital controls and compact designs, making them popular among small-scale food vendors and mobile food businesses.

Other Key Players (22-28% Combined)

The overall market size for chip warmers market was USD 3,677.4 million in 2025.

The chip warmers market is expected to reach USD 5,237.7 million in 2035.

The growth of the chip warmers market will be driven by increasing demand in foodservice establishments, advancements in heating technology, and rising consumer preference for crispy and warm food preservation.

The top 5 countries which drives the development of chip warmers market are USA, European Union, Japan, South Korea and UK.

Restaurant sector to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chip-on-the-Tip Endoscopes Market Size and Share Forecast Outlook 2025 to 2035

Chipless RFID Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Chip Resistor Market Size and Share Forecast Outlook 2025 to 2035

Chip-On-Flex Market Size and Share Forecast Outlook 2025 to 2035

Chipboard Box Market Size and Share Forecast Outlook 2025 to 2035

Chip-On-Board (COB) Light Emitting Diode (LED) Market Analysis and Forecast 2025 to 2035, By Application and Region

Chip Scale Package LED Market Insights – Trends & Forecast 2025 to 2035

Industry Share & Competitive Positioning in Chipboard Box Industry

Chip Antenna Market

Biochips Market Size and Share Forecast Outlook 2025 to 2035

5G Chipset Market Analysis - Growth & Forecast through 2034

Gel Warmers Market Size and Share Forecast Outlook 2025 to 2035

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

IoT Chip Market Size and Share Forecast Outlook 2025 to 2035

Microchip Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

Flip Chip Market Size and Share Forecast Outlook 2025 to 2035

GNSS Chip Market Trends – Growth, Size & Forecast 2025 to 2035

Wood Chipper Market Growth – Trends & Forecast 2024 to 2034

Wi-Fi Chipset Market Growth - Trends & Forecast 2025 to 2035

Strip Warmers Market - Precision Heating for Commercial Kitchens 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA