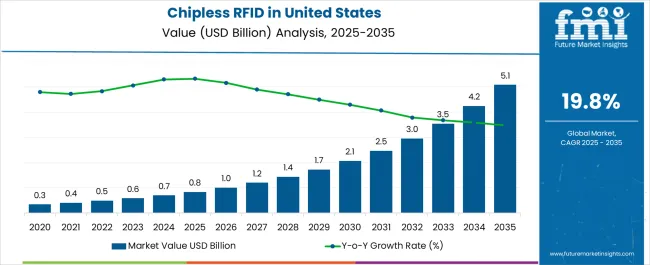

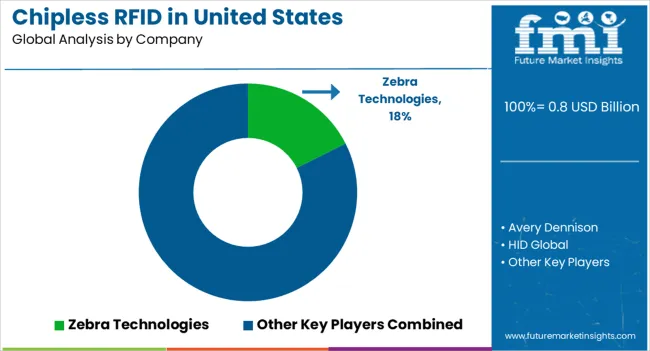

The Chipless RFID Industry Analysis in United States is estimated to be valued at USD 0.8 billion in 2025 and is projected to reach USD 5.1 billion by 2035, registering a compound annual growth rate (CAGR) of 19.8% over the forecast period.

| Metric | Value |

|---|---|

| Chipless RFID Industry Analysis in United States Estimated Value in (2025 E) | USD 0.8 billion |

| Chipless RFID Industry Analysis in United States Forecast Value in (2035 F) | USD 5.1 billion |

| Forecast CAGR (2025 to 2035) | 19.8% |

The chipless RFID industry in the United States is experiencing steady expansion driven by demand for cost-effective identification and tracking solutions across multiple sectors. Current market conditions reflect the growing adoption of chipless technology due to its lower manufacturing cost, scalability, and simplified integration compared to conventional RFID systems. Enterprises are increasingly focusing on efficiency in inventory management, supply chain visibility, and anti-counterfeiting measures, all of which are supporting broader deployment.

Regulatory alignment and the push for digitization in logistics and retail operations have strengthened adoption momentum. The future outlook is characterized by rapid advancements in printing technologies, sensor integration, and material sciences, which are enabling improved read accuracy and performance. Growth rationale is founded on the ability of chipless RFID to provide affordable mass tagging solutions, the rising need for real-time asset monitoring, and increasing industry-wide focus on automation and transparency.

These factors collectively are expected to secure consistent adoption across USA industries, positioning the market for sustainable growth over the forecast horizon.

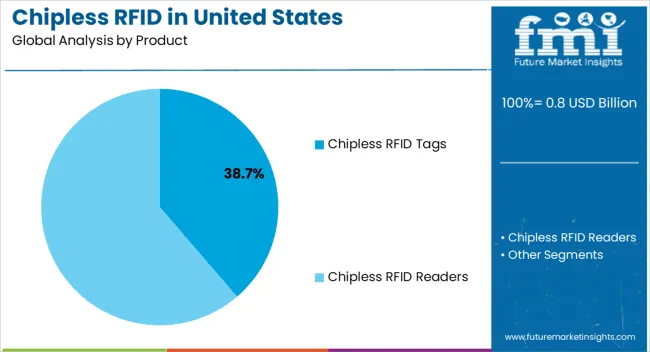

The chipless RFID tags segment, holding 38.70% of the product category, has established itself as the leading product due to its cost-effectiveness and adaptability across diverse applications. Its share has been reinforced by widespread usage in logistics, retail, and manufacturing, where bulk tagging at lower costs is essential. Advancements in printable electronics and conductive materials have enhanced production scalability, ensuring supply consistency and reducing dependency on traditional silicon-based tags.

The segment’s adoption has been strengthened by its compatibility with eco-friendly materials and ease of integration into existing workflows. Continuous innovation aimed at improving data storage capacity and read range is expected to sustain growth.

Strategic partnerships between technology developers and end-use industries are further supporting commercialization, ensuring that chipless RFID tags remain the cornerstone product of the USA market.

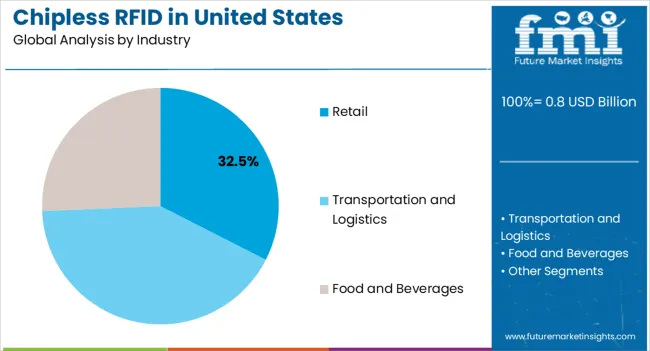

The retail industry, representing 32.50% of the industry category, has emerged as the dominant sector in chipless RFID adoption due to the high demand for efficient inventory management and product authentication. Its leading position has been supported by ongoing digitization of retail supply chains and the emphasis on real-time visibility across warehouses and outlets. The ability of chipless RFID to reduce shrinkage, improve stock accuracy, and enhance customer experience has reinforced its preference among major retailers.

Adoption has also been supported by compliance with sustainability objectives, as chipless tags reduce reliance on traditional plastic-based solutions. Future growth is expected to be influenced by omnichannel retailing, e-commerce expansion, and the continued integration of data-driven solutions that rely on accurate tagging.

As retailers invest in automation and smart store initiatives, the retail industry will continue to anchor demand within the USA market.

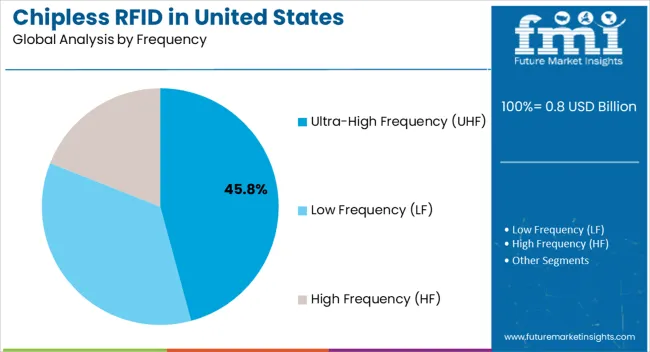

The ultra-high frequency (UHF) segment, accounting for 45.80% of the frequency category, has maintained its leadership due to superior read ranges, scalability, and compatibility with large-scale operations. Its dominance has been supported by efficiency in managing extensive inventories and enabling real-time data capture across supply chains. Adoption has been favored by its ability to handle bulk reads with minimal interference, making it highly suited for logistics, warehousing, and retail environments.

Advances in antenna design and material innovations have further improved UHF system performance, ensuring greater reliability and reduced implementation costs. Demand has been reinforced by the segment’s role in supporting automation, predictive analytics, and IoT-enabled applications.

Continued investments in UHF infrastructure and integration with cloud-based platforms are expected to sustain the segment’s leadership, positioning it as the most commercially viable frequency range in the USA chipless RFID industry.

Chipless RFID sales in the United States developed at an HCAGR of 17.4% from 2020 to 2025, reaching USD 0.8 million in 2025.

Growing adoption of chipless Radio Frequency Identification (RFID) technology in the United States resulted in a steady increase in demand from 2020 to 2025. Numerous chipless RFID companies in United States are using chipless RFID to improve asset tracking and inventory control due to the technology's cost-effectiveness, capacity to track and manage inventory.

| Attributes | Details |

|---|---|

| Demand Analysis for 2020 | USD 254.1 million |

| Demand Analysis for 2025 | USD 0.8 million |

| CAGR from 2020 to 2025 | 17.4% |

From 2025 to 2035, the United States chipless RFID sector is expected to develop at a CAGR of 20.8%. The United States chipless RFID industry is projected to expand to USD 3,796.9 million by 2035.

Chipless RFID technology presents a substantial opportunity for integration with the Internet of Things. Real-time data exchange and automation are made possible by the powerful synergy created when chipless RFID and IoT come together. Businesses can monitor assets, and environmental conditions by attaching sensors to RFID tags and connecting them to IoT networks surging the adoption of chipless RFID in United States.

The segmented analysis of chipless RFID in the United States shows how popular chipless RFID tags are within the product category. Numerous studies show that they are leaders in the product industry.

The ultra-high frequency (UHF) RFID segment is the dominant player in the frequency category. The current examination highlights the noteworthy significance of chipless RFID tags in the United States. It underscores the extensive implementation of UHF RFID, verifying its supremacy in the United States.

The outcomes point to a dynamic environment in which developments in chipless RFID support the growth of RFID in the retail industry of the United States.

The United States records increase in sales of chipless RFID tags, which mark a significant advancement in RFID technology. Chipless RFID tags function without a silicon chip, unlike conventional RFID tags that depend on integrated microchips.

The chipless RFID tag segment is likely to garner 82.5% of the share and stand at USD 0.8 million by 2025.

| Product | Value CAGR |

|---|---|

| Chipless RFID Tags | 21.1% |

| Chipless RFID Readers | 19.3% |

From supply chain optimization to inventory management, chipless RFID tags are progressively popular. Chipless RFID tags are a compelling option due to their affordability and versatility, leading to widespread adoption in the United States. The increasing preference of tags highlights the chipless radio-frequency identification in the United States dedication to developing effective and expandable tracking solutions.

UHF (Ultra High Frequency) RFID technology is the industry leader in the United States chipless RFID sales because of its extensive applicability and outstanding performance. UHF RFID is appropriate for various industries due to its increased efficiency. Its dominance in the chipless RFID sector results from its capacity to manage massive data volumes and support multiple tag readings at once.

| Enterprise Size | Value CAGR |

|---|---|

| Low Frequency (LF) RFID | 18.6% |

| High Frequency (HF) RFID | 20.2% |

| Ultra-high Frequency (UHF) RFID | 21.6% |

Due to its adaptability, affordability, and scalability, UHF RFID has become the technology of choice and has become widely used in the United States.

By 2035, the ultra-high frequency (UHF) RFID segment share is expected to surpass 67.1%, making it the dominant segment. In 2035, the ultra-high frequency (UHF) RFID segment is expected to be worth USD 2,548.83 million.

The United States chipless RFID sales in United States undergo a revolutionary change in 2025, driven by changes in the retail sector. Utilizing Radio-Frequency Identification (RFID) technology instead of conventional silicon chips is essential to transforming supply chain logistics, customer experiences, and inventory management.

The transformative market trends for chipless RFID in the United States are a reaction to demands of retail, where tracking and real-time data are critical. In 2035, the retail segment is expected to be worth USD 1,839.36 million, exhibitng a CAGR of 22.5%.

| Industry | Value CAGR |

|---|---|

| Transportation and Logistics | 20.1% |

| Retail | 22.5% |

| Food and Beverages | 18.9% |

| Healthcare | 21.2% |

| Industrial | 16.9% |

| Agriculture | 15.7% |

| Others | 13.7% |

The chipless RFID industry in United States experiences tremendous changes as the retail industry adopts chipless RFID solutions, signaling a paradigm shift for increased competition and customer satisfaction.

The retail segment is predicted to become dominant by 2035, with a share exceeding 48.4%. The retail sector is projected to be valued at USD 241.19 million in 2025.

For their United States chipless RFID solutions, major players are concentrating on enhancing the customer experience during payments. By considering the various demands of the end users, United States manufacturers of chipless RFID solutions are creating solutions specifically tailored to meet their needs.

Chipless RFID companies in United States are investing in research and development to expand the application of chipless RFID technology, catering to a broader range of industries. Chipless RFID companies in United States partner with technology providers, system integrators, and industry players to develop integrated RFID solutions that cater to various sectors.

Chipless RFID vendors in United States focus on expanding into emerging economies by forming strategic partnerships, investing in research and development for cost-effective solutions. This approach allows them to tap into the growth potential and gain a competitive edge in the chipless RFID industry of the United States.

Notable Strides

| Company | Details |

|---|---|

| Impinj | In Aug 2025, Impinj, a provider of RAIN RFID solutions, launched a new line of RAIN RFID tag chips to advance item connectivity for IoT deployments. It is designed to help businesses create IoT solutions that connect physical items to the cloud, providing data that helps analyze, optimize, and virtualize everything. |

| Molex | In March 2025, Molex unveiled the industry's first chip-to-chip 224G product portfolio to accelerate support for next-gen data centers and generative AI applications. It is designed to support next-gen data centers and productive AI applications, providing high-speed, low-latency interconnect solutions that can help improve performance and efficiency. |

| HID Global | In May 2025, HID Global acquired Vizinex RFID, a provider of high-performance RFID tags tailored to customers' requirements. The acquisition enhances HID Global's portfolio of asset tracking tags to now also include an RFID product platform based on printed circuit technology. This acquisition increases HID Global's presence and relevance in key verticals, including logistics, waste management, and manufacturing. |

The global chipless RFID industry analysis in United States is estimated to be valued at USD 0.8 billion in 2025.

The market size for the chipless RFID industry analysis in United States is projected to reach USD 5.1 billion by 2035.

The chipless RFID industry analysis in United States is expected to grow at a 19.9% CAGR between 2025 and 2035.

The key product types in chipless RFID industry analysis in United States are chipless RFID tags, _passive tags, _active tags, chipless RFID readers, _fixed RFID readers and _mobile RFID readers.

In terms of industry, retail segment to command 32.5% share in the chipless RFID industry analysis in United States in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DOAS Industry Analysis in the United States Forecast and Outlook 2025 to 2035

United States Countertop Market Trends - Growth, Demand & Forecast 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Infant Formula Industry Analysis in United States Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Degassing Valves Industry Analysis in United States & Canada - Size, Share, and Forecast 2025 to 2035

Solenoid Valve Market Growth – Trends & Forecast 2024-2034

US & Europe EndoAVF Device Market Analysis – Size, Share & Forecast 2024-2034

U.S. Laminated Tube Market Trends & Demand Forecast 2024-2034

Fava Bean Protein Industry in United States Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Periodontal Gel Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Merchandising Unit Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Paper Tubes & Core Industry Analysis in United States Trends, Size, and Forecast for 2025-2035

Stainless Steel IBC Industry Analysis in United States Insights - Trends & Forecast 2025 to 2035

Protective Packaging Industry Analysis in United States and Canada - Size, Share, and Forecast 2025 to 2035

Dialysis Equipment Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

Hangover Cure Product Industry Analysis in United States Growth, Trends and Forecast from 2025 to 2035

Construction Anchor Market Growth – Trends & Forecast 2024-2034

U.S. Phlebotomy Equipment Market Analysis – Trends, Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA