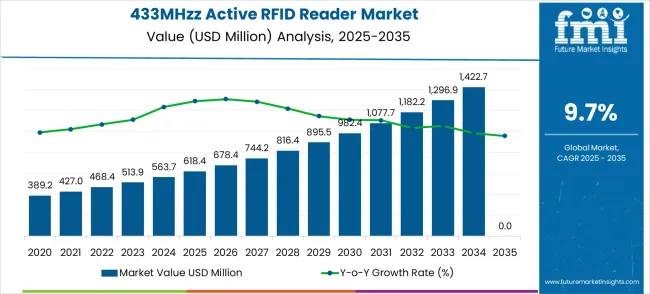

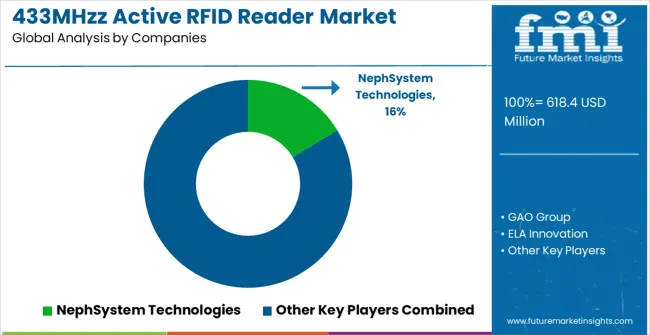

The 433MHz active RFID reader market is expected to expand from USD 618.4 million in 2025 to USD 1,560.7 million by 2035, reflecting a CAGR of 9.7%. The absolute dollar opportunity over this decade amounts to USD 942.3 million, representing the incremental revenue potential for manufacturers, distributors, and solution providers. The growth is driven by increasing adoption across logistics, supply chain management, asset tracking, and industrial automation, where real-time location tracking and monitoring are critical. Rising demand for higher operational efficiency, reduced human error, and improved inventory management supports the market’s revenue expansion.

Early adoption in transportation, healthcare, and manufacturing sectors contributes a significant portion of the absolute dollar opportunity, as organizations prioritize accuracy, security, and traceability in high-value asset management. Mid-decade, incremental gains arise from adoption in emerging economies, fueled by industrialization, warehouse modernization, and smart infrastructure projects. Additionally, technological enhancements such as extended read ranges, improved battery life, and integration with IoT platforms amplify the revenue potential. By 2035, the market captures further opportunity through system upgrades, interoperability with cloud-based platforms, and expansion into new verticals such as retail and cold chain logistics. The absolute dollar opportunity underscores both immediate and long-term prospects for market participants, prioritizing the value of innovation, scalability, and strategic regional expansion in capturing the full growth potential of the 433MHz active RFID reader sector.

The 433MHz Active RFID Reader market is distributed across logistics and supply chain management (36%), industrial automation (27%), asset tracking in healthcare and IT (18%), retail inventory management (12%), and specialty applications including smart cities and security (7%). Logistics drives adoption as active RFID readers enable real-time tracking, reduce inventory errors, and enhance operational efficiency. Industrial automation uses them for process monitoring and predictive maintenance, while healthcare and IT sectors rely on asset management and equipment tracking. Retail applications improve inventory accuracy and reduce stockouts. Specialty uses include secure access control and smart infrastructure monitoring.

Current trends include IoT integration, cloud-based monitoring, and edge computing for faster, real-time data processing. Manufacturers are developing compact, rugged, and energy-efficient readers with extended ranges and improved connectivity. Adoption is expanding in automated warehouses, smart factories, and secure facilities. Focus on operational efficiency, real-time decision-making, and compliance with RFID standards continues to support global market growth, while technological advancements enhance reliability and scalability across industries.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 618.4 million |

| Market Forecast Value (2035) | USD 1,560.7 million |

| Forecast CAGR (2025–2035) | 9.7% |

Market expansion is being supported by the rapid digitalization of supply chain operations across global enterprises and the corresponding need for real-time asset visibility and automated tracking solutions in complex operational environments. Modern industrial operations require advanced identification technologies that can provide accurate location data, extended read ranges, and reliable performance in challenging environments. The superior range capabilities and battery-powered operation characteristics of 433MHz Active RFID systems make them essential components in large-scale tracking applications where passive RFID limitations restrict deployment effectiveness.

Enterprise operators are increasingly investing in active RFID systems that offer real-time data collection capabilities while enabling comprehensive analytics and reporting functionalities. Regulatory requirements and industry standards are establishing performance benchmarks that favor advanced active RFID solutions with extended range capabilities and intelligent data processing features.

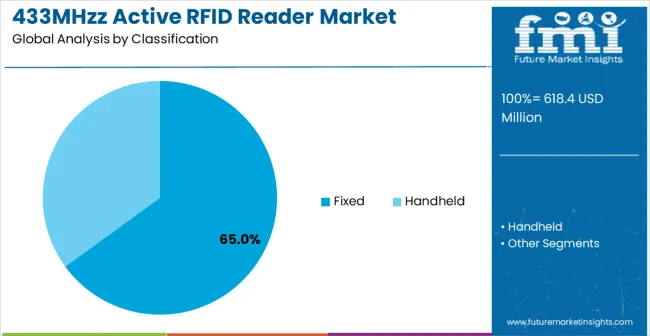

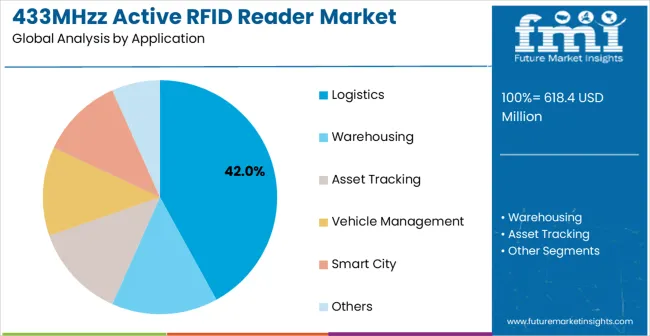

The market is segmented by reader type, application, and region. By reader type, the market is divided into fixed and handheld configurations. Based on application, the market is categorized into logistics, warehousing, asset tracking, vehicle management, smart city, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Fixed reader configurations are projected to account for 65% of the 433MHz Active RFID Reader market in 2025. This leading share is supported by the excellent performance characteristics, installation stability, and comprehensive coverage that fixed reader systems offer for permanent monitoring applications. Fixed readers provide continuous scanning capabilities, extended range coverage, and integration with existing enterprise systems, making them the preferred choice for warehouses, logistics centers, manufacturing facilities, and smart city infrastructure. The segment benefits from technological advancements that have improved reader sensitivity, data processing capabilities, and network integration features.

Modern fixed RFID reader systems incorporate advanced antenna technologies, sophisticated signal processing algorithms, and comprehensive connectivity options that deliver exceptional reading performance while minimizing false reads and maximizing coverage areas. These innovations have significantly improved operational reliability while maintaining compatibility with enterprise information systems and reducing total cost of ownership through automated data collection and processing. The logistics sector particularly drives demand for fixed reader solutions, as this industry requires reliable tracking systems that can operate continuously while supporting high-volume tag processing requirements.

Logistics applications are expected to represent 42% of 433MHz Active RFID Reader demand in 2025. This dominant share reflects the critical role of real-time tracking in modern supply chain operations and the need for reliable identification systems capable of supporting complex logistics workflows across multiple facilities and transportation networks. Logistics organizations require robust and scalable RFID systems for shipment tracking, container monitoring, and supply chain visibility applications. The segment benefits from ongoing e-commerce growth and increasing complexity of global supply chains requiring real-time visibility and automated tracking capabilities.

Logistics applications demand exceptional RFID performance to ensure accurate tracking of goods, containers, and vehicles moving through complex distribution networks with varying environmental conditions and operational requirements. These applications require reader systems capable of handling high tag densities, maintaining reliable communication in challenging environments, and providing real-time data integration with enterprise resource planning systems.

The 433MHz Active RFID Reader market is advancing steadily due to increasing automation adoption and growing recognition of real-time tracking system importance in operational efficiency improvement. The market faces challenges including higher system costs compared to passive RFID solutions, need for battery maintenance in active tags, and varying performance requirements across different deployment environments. Standardization efforts and certification programs continue to influence system quality and market development patterns.

The growing deployment of Internet of Things integration and cloud-based data analytics platforms is enabling real-time monitoring capabilities and comprehensive business intelligence extraction from RFID tracking data. Advanced connectivity options and cloud processing systems provide continuous data synchronization while enabling predictive analytics and operational optimization across distributed enterprise operations. These technologies are particularly valuable for large organizations that require comprehensive visibility and data-driven decision making capabilities.

Modern RFID system manufacturers are incorporating artificial intelligence algorithms and machine learning capabilities that improve tracking accuracy while enabling predictive maintenance and automated anomaly detection. Integration of advanced data processing and intelligent filtering techniques enables significant improvement in data quality and reduces false readings compared to traditional RFID systems. Advanced sensor integration and multi-parameter monitoring also support development of more comprehensive tracking solutions for demanding industrial environments.

| Country | CAGR (2025–2035) |

|---|---|

| China | 13.1% |

| India | 12.1% |

| Germany | 11.2% |

| Brazil | 10.2% |

| United States | 9.2% |

| United Kingdom | 8.2% |

| Japan | 7.3% |

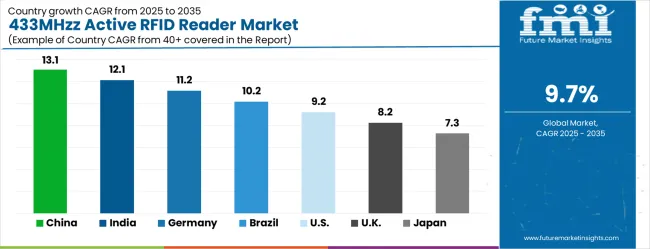

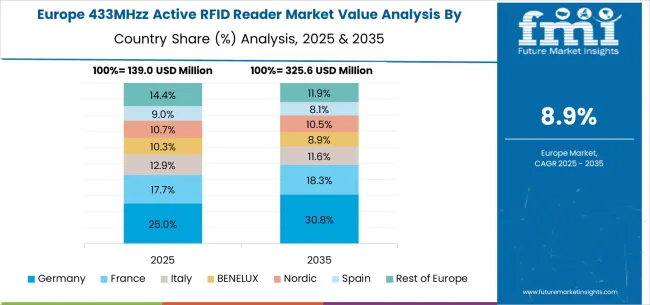

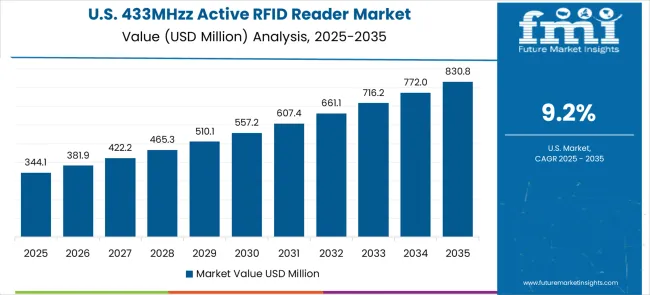

The 433MHz Active RFID Reader market is growing rapidly, with China leading at a 13.1% CAGR through 2035, driven by massive manufacturing sector expansion, government support for smart manufacturing initiatives, and growing e-commerce logistics infrastructure development. India follows at 12.1%, supported by rapid industrialization across manufacturing and logistics sectors and increasing investments in digital infrastructure supporting automated tracking systems. Germany records strong growth at 11.2%, prioritizing Industry 4.0 applications, precision manufacturing, and advanced automotive supply chain management. Brazil grows steadily at 10.2%, integrating RFID systems into expanding logistics networks and smart city infrastructure projects. The United States shows robust growth at 9.2%, focusing on supply chain optimization and warehouse automation technologies. The United Kingdom maintains solid expansion at 8.2%, supported by retail modernization and logistics efficiency programs. Japan demonstrates steady growth at 7.3%, prioritizing technological innovation and manufacturing excellence.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

China is expected to grow at a CAGR of 13.1% from 2025 to 2035, well above the global average for the market. This growth is driven by rapid adoption of asset tracking systems in logistics, manufacturing, and retail sectors. Integration of IoT-enabled RFID solutions is expanding efficiency in inventory management, warehouse operations, and supply chain visibility. Domestic technology providers are developing high-performance RFID readers compatible with multiple frequencies and rugged environments. Strategic partnerships between logistics companies and tech firms are accelerating deployment across smart warehouses and distribution centers. Major players such as Huawei and Zebra Technologies are actively providing scalable solutions to support large-scale operations while improving real-time monitoring and data analytics.

India is projected to grow at a CAGR of 12.1%, above the global average, supported by rising demand for real-time inventory tracking and logistics automation. The manufacturing, retail, and pharmaceutical sectors are increasingly using active RFID readers to monitor assets and prevent operational losses. Companies are investing in rugged and long-range readers suitable for harsh industrial conditions. Pilot projects in e-commerce warehouses are demonstrating efficiency improvements and faster order fulfillment. Local technology providers are partnering with global suppliers to introduce cost-effective, high-performance readers. Bharat Electronics Limited and Godrej are actively supplying solutions designed for large-scale deployment, while training programs are improving adoption rates across industrial and commercial sectors.

Germany is expected to grow at a CAGR of 11.2%, driven by adoption in automotive manufacturing, logistics, and industrial automation. Active RFID readers are being integrated with warehouse management and production line systems to enable real-time asset monitoring and improve operational efficiency. Companies are focusing on precision, reliability, and compatibility with automated guided vehicles and robotics. Leading suppliers such as Siemens and Zebra Technologies are providing customized solutions tailored to high-tech manufacturing requirements. Research collaborations with universities and technology institutes are driving innovation in multi-frequency and smart RFID solutions that reduce downtime and enhance productivity in complex industrial setups.

Brazil is projected to grow at a CAGR of 10.2% between 2025 and 2035, supported by adoption in manufacturing, logistics, and retail distribution. Active RFID readers are helping companies improve inventory visibility and track assets across warehouses and industrial sites. Demand is influenced by a need for affordable yet durable readers capable of functioning in tropical and humid conditions. International and local partnerships are enabling technology transfer and deployment in large-scale warehouses. Key suppliers such as Metalúrgica Vanzin and Zebra Technologies are focusing on durable designs and reliable data transmission for tracking high-value assets. Pilot projects demonstrate operational improvements and reduced losses across multiple sectors.

The United States is expected to grow at a CAGR of 9.2%, reflecting steady adoption in logistics, retail, healthcare, and manufacturing. Active RFID readers are integrated into supply chain management, inventory tracking, and hospital asset monitoring systems. Companies prioritize readers with long-range performance, rugged construction, and compatibility with cloud-based analytics. Major players including Honeywell and Impinj are providing modular solutions suitable for large-scale deployment across warehouses and industrial facilities. The market is driven by automation trends and the need for real-time data to reduce errors and optimize operations in both public and private sectors.

The United Kingdom is projected to grow at a CAGR of 8.2%, supported by adoption in logistics, retail, and industrial sectors. Active RFID readers are being deployed to improve inventory management, reduce operational losses, and support real-time asset monitoring. Companies are focusing on compact, durable, and high-performance solutions capable of functioning in both warehouse and industrial environments. Collaboration between technology providers and logistics firms is expanding deployment, while pilots in e-commerce and manufacturing facilities demonstrate improved efficiency. Leading players including Zebra Technologies and Impinj are driving innovation in multi-frequency and modular reader designs that can be easily upgraded or expanded.

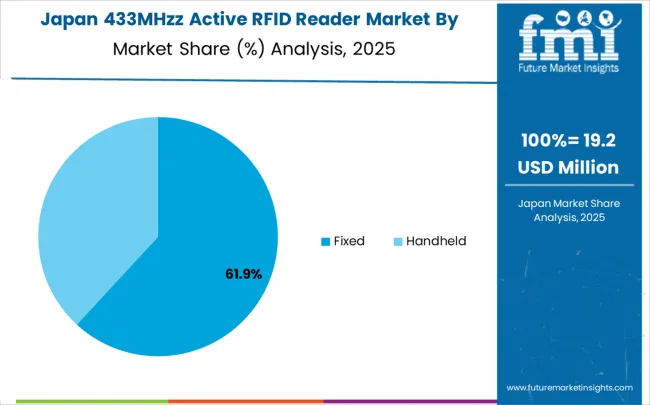

Japan is expected to grow at a CAGR of 7.3%, reflecting moderate adoption compared to other countries. Growth is driven by industrial automation, manufacturing, and logistics applications requiring high-precision tracking and asset monitoring. Active RFID readers are integrated with automated guided vehicles, production lines, and inventory management systems. Companies emphasize durability, compact designs, and precision performance in high-density warehouse environments. Key suppliers such as Panasonic and Omron are focusing on smart reader solutions compatible with IoT and industrial control systems. Government-supported pilot programs in smart factories are encouraging wider adoption and demonstrating operational benefits in supply chain and manufacturing efficiency.

The 433MHz Active RFID Reader market is defined by competition among established technology companies, specialized RFID solution providers, and emerging IoT infrastructure firms. Companies are investing in advanced reader technologies, system integration capabilities, standardized deployment solutions, and technical support services to deliver reliable, scalable, and cost-effective tracking solutions. Strategic partnerships, technological advancement, and geographic expansion are central to strengthening product portfolios and market presence.

NephSystem Technologies, operating globally, offers comprehensive active RFID solutions with focus on long-range tracking, system reliability, and technical support services. GAO Group, multinational, provides advanced RFID systems with focus on industrial applications and integrated monitoring solutions. ELA Innovation, Europe-based, delivers specialized active RFID solutions for asset tracking with focus on battery life optimization and performance reliability. HID offers comprehensive identification technologies with standardized procedures and global service support.

Syris Technology Corp provides industrial RFID systems with focus on healthcare and asset tracking applications. Kimaldi delivers specialized RFID equipment with focus on access control and tracking integration. RFID INC offers comprehensive tracking solutions for demanding industrial environments. Cisper provides advanced RFID systems with innovative antenna and reader technologies.

MDT Innovations, Zebra Technologies, Identec Solutions, Shenzhen Marktrace Co, Etag IOT Technology, Gaote Electronic, Jietong Technology, and Vanch Intelligent Technology offer specialized RFID expertise, regional manufacturing capabilities, and technical support across global and regional networks.

The 433MHz Active RFID Reader market underpins supply chain digitalization, asset management automation, smart city development, and operational efficiency improvement. With digitalization mandates, stricter tracking requirements, and demand for real-time visibility, the sector must balance cost competitiveness, system reliability, and deployment scalability. Coordinated contributions from governments, industry bodies, technology providers, system integrators, and investors will accelerate the transition toward intelligent, connected, and highly automated tracking systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 618.4 million |

| Reader Type | Fixed, Handheld |

| Application | Logistics, Warehousing, Asset Tracking, Vehicle Management, Smart City, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | NephSystem Technologies, GAO Group, ELA Innovation, HID, Syris Technology Corp, Kimaldi, RFID INC, Cisper, MDT Innovations, Zebra Technologies, Identec Solutions, Shenzhen Marktrace Co, Etag IOT Technology, Gaote Electronic, Jietong Technology, Vanch Intelligent Technology |

| Additional Attributes | Dollar sales by reader type and application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established RFID providers and emerging solution specialists, deployment preferences for fixed versus handheld reader systems, integration with enterprise resource planning and warehouse management systems, innovations in antenna design and signal processing technologies for enhanced performance and reliability, and adoption of IoT-connected RFID solutions with cloud-based analytics and real-time monitoring capabilities for improved operational visibility and efficiency. |

The global 433mhzz active rfid reader market is estimated to be valued at USD 618.4 million in 2025.

The market size for the 433mhzz active rfid reader market is projected to reach USD 1,560.7 million by 2035.

The 433mhzz active rfid reader market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key product types in 433mhzz active rfid reader market are fixed and handheld.

In terms of application, logistics segment to command 42.0% share in the 433mhzz active rfid reader market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Active Wear Market Size and Share Forecast Outlook 2025 to 2035

Active, Smart, and Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Active Charcoal Complexes Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Active & Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Active Network Management Market Analysis by Component, End Users, and Region Through 2025 to 2035

Active Oxygens Market Analysis by Product Type, Application and Region: Forecast for 2025 to 2035

Competitive Overview of Active and Modified Atmospheric Packaging Companies

Market Share Insights for Active Packaging Providers

Market Share Distribution Among Active, Smart, and Intelligent Packaging Manufacturers

Active Spoiler Market Growth - Trends & Forecast 2025 to 2035

Active Optical Cable Market Insights - Growth & Forecast 2025 to 2035

Active Damping Smartphone Case Market Growth - Demand & Trends 2025 to 2035

Active Humidifier Devices Market - Demand & Forecast 2025 to 2035

Active Packaging Market Analysis - Demand, Growth & Future Outlook 2024 to 2034

Active & Modified Atmospheric Packaging Market Trends & Forecast 2024-2034

Reactive Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Reactive Hot Melt Adhesive Market Forecast Outlook 2025 to 2035

Reactive Arthritis Treatment Market Size and Share Forecast Outlook 2025 to 2035

Reactive Tire Bladder Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Inactive Dried Yeast Market Analysis – Demand, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA