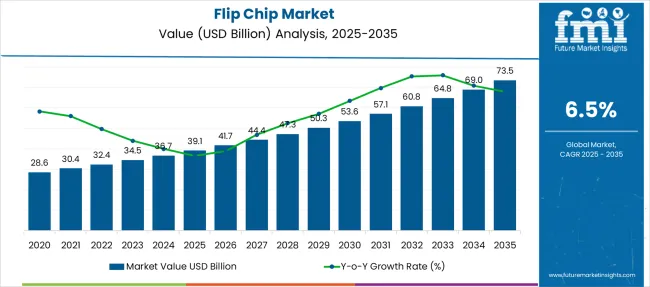

The Flip Chip Market is estimated to be valued at USD 39.1 billion in 2025 and is projected to reach USD 73.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period. Year-on-year (YoY) growth analysis reveals a consistent upward trajectory, with absolute annual increments expanding progressively. Between 2025 and 2026, the market adds USD 2.6 billion, followed by a USD 2.7 billion increase in 2027 and USD 2.9 billion in 2028. This steady rise continues as 2029 records a USD 3.0 billion increase and 2030 adds another USD 3.3 billion.

From 2031 onward, gains accelerate slightly, with USD 3.5 billion added that year, then rising to USD 3.7 billion in 2032, USD 4.0 billion in 2033, USD 4.2 billion in 2034, and USD 4.5 billion in 2035. This pattern reflects a stable but strengthening YoY expansion rate in absolute terms. While percentage-based growth rates gradually decline due to a larger base, the market continues to exhibit healthy momentum in actual dollar terms.

Demand is being shaped by growing complexity in packaging for AI processors, high-bandwidth memory modules, and RF components. Key suppliers such as TSMC, Intel, and ASE Technology are scaling bumping and underfill solutions. Yearly growth is underpinned by diversification across consumer, automotive, and industrial sectors.

| Metric | Value |

|---|---|

| Flip Chip Market Estimated Value in (2025 E) | USD 39.1 billion |

| Flip Chip Market Forecast Value in (2035 F) | USD 73.5 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The flip chip market accounts for approximately 32% of the consumer electronics segment, supported by growing demand for compact, high-speed devices. Around 25% of the market is tied to telecommunications, driven by the integration of flip chip packaging in base stations and network infrastructure. Automotive electronics hold nearly 11% share, influenced by rising usage in infotainment, safety systems, and electric vehicle control units. About 15% stems from industrial electronics and automation, including control circuits and high-reliability sensor systems.

The remaining 10% is captured by the aerospace, defense, and medical electronics segment, where packaging performance under harsh conditions is essential. These figures reflect the broad application of flip chip technology across both consumer and mission-critical sectors. The flip chip market is advancing rapidly due to rising demand for high-performance semiconductor packaging in 5G infrastructure, AI computing, and advanced driver-assistance systems. Flip chip technology enables higher I/O density, better thermal dissipation, and faster signal transmission compared to traditional wire bonding.

Adoption of copper pillar bumping and hybrid bonding techniques is enhancing electrical performance and reliability, particularly in data centers and automotive electronics. AI-integrated flip chip bonders are improving placement accuracy and production yield. The shift toward chiplet architectures and 2.5D or 3D integration is increasing reliance on flip chip methods, especially in high-bandwidth memory and multi-die applications.

The flip chip market is experiencing strong momentum, driven by the growing demand for high-performance, compact, and energy-efficient semiconductor packaging solutions. The increasing adoption of advanced consumer electronics, AI-enabled devices, and 5G infrastructure has amplified the need for high I/O density and enhanced thermal performance, requirements ideally met by flip chip technologies.

As chip architectures become more complex, manufacturers are leaning towards flip chip packaging for its superior electrical performance and reliability. The growth of data centers, automotive electronics, and high-performance computing systems further supports the market.

Rise of heterogeneous integration and chiplet architectures is expected to fuel further investments in flip chip innovations. With ongoing improvements in manufacturing techniques and material science, the market is projected to maintain a robust trajectory, offering scalability and design flexibility essential for next-generation semiconductor applications.

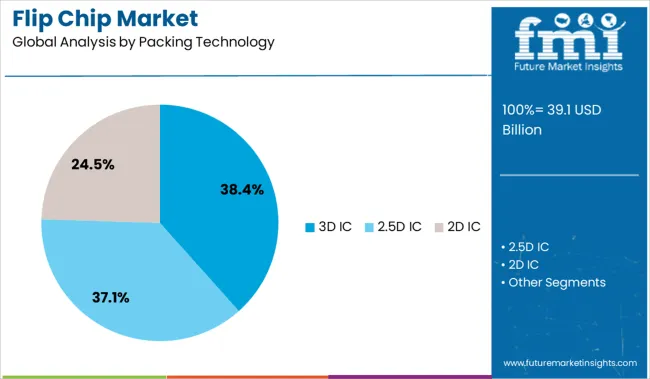

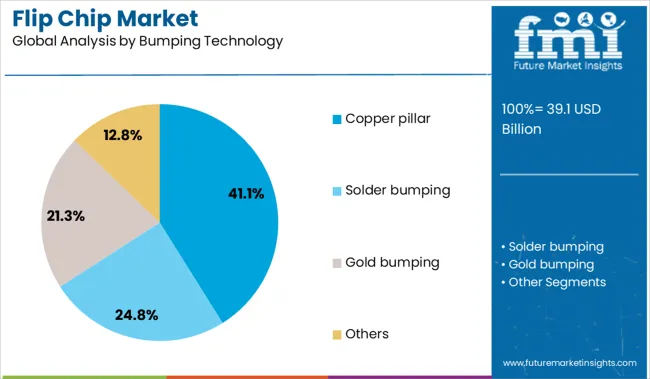

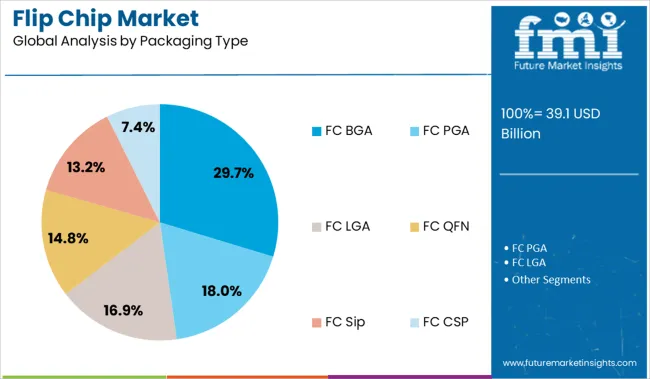

The flip chip market is segmented by packing technology, bumping technology, packaging type, end use, and region. By packing technology, the market includes 3D IC, 2.5D IC, and 2D IC configurations, enabling advanced integration for high-performance devices. In terms of bumping technology, the segmentation comprises copper pillar, solder bumping, gold bumping, and others, supporting diverse connectivity requirements. Based on packaging type, it includes FC BGA, FC PGA, FC LGA, FC QFN, FC SiP, and FC CSP solutions tailored for multiple applications. End-use sectors cover IT and telecommunication, industrial, electronics, automotive, healthcare, aerospace and defense, and other industries. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The 3D IC segment accounts for a leading 38.4% share under the packaging technology category, indicating its growing relevance in advanced chip designs that demand high performance, miniaturization, and energy efficiency. The stacking of multiple integrated circuits in a vertical configuration enables reduced signal delay, lower power consumption, and increased bandwidth, making 3D ICs highly suitable for AI, GPU, and high-end server applications.

As electronic devices become more compact and functionally rich, 3D IC packaging is increasingly adopted to meet design constraints without compromising speed or performance. Moreover, demand from sectors like aerospace, defense, and consumer electronics continues to bolster the segment.

Ongoing research in Through-Silicon Via (TSV) integration and thermal management solutions is expected to further strengthen the 3D IC segment’s position in the flip chip market over the coming years.

In the bumping technology category, the copper pillar segment holds a dominant 41.1% market share, reflecting its widespread use in high-density and fine-pitch applications. Copper pillar bumping offers superior electromigration resistance, better thermal conductivity, and enhanced mechanical strength compared to traditional solder bumping techniques.

These attributes make it ideal for supporting the miniaturization trends in mobile devices, wearable technology, and advanced computing systems. The segment has gained significant traction due to its compatibility with lead-free processes and its ability to facilitate lower bump height, enabling more compact package profiles.

As the demand for thinner and faster devices grows, copper pillar technology continues to gain preference among semiconductor manufacturers aiming to achieve higher performance with lower power loss. The segment’s future growth is likely to be fueled by advancements in wafer-level packaging and the proliferation of multi-chip integration.

The FC BGA (Flip Chip Ball Grid Array) segment leads the packaging type category with a 29.7% share, driven by its ability to support high-pin-count devices and provide excellent electrical and thermal performance. FC BGA packaging is widely adopted in high-end processors, gaming consoles, and enterprise networking equipment where performance and reliability are paramount.

The structure allows for efficient heat dissipation and reduced inductance, making it a preferred choice for applications demanding high-speed data transfer and power efficiency. As end-user industries increasingly prioritize compactness and functionality, the FC BGA segment is expected to benefit from ongoing investments in advanced substrate materials and interconnect designs.

The segment is well-positioned to grow as chipmakers adopt it for integrating multiple functional dies into a single package, catering to the evolving demands of high-performance and AI-driven devices.

The flip chip market is being driven by demand for high-density, performance-focused packaging in electronics, 5G devices, and automotive systems. Heterogeneous integration presents major growth opportunities as chipmakers shift toward multi-die packaging to meet computing demands. Providers offering advanced bumping and integration-ready platforms will lead in this evolving semiconductor landscape.

The surge in demand for compact, high-performance semiconductor devices has been identified as the key driver for the adoption of flip chip technology. In 2024, consumer electronics and data center components increasingly relied on flip chip packaging to improve signal integrity and heat dissipation. By 2025, automotive electronics and 5G-enabled devices will further accelerate the transition from traditional wire bonding to flip chip assembly, supporting advanced performance in smaller footprints. These developments indicate that efficiency-driven packaging requirements are reshaping semiconductor design priorities, making flip chip interconnects a default choice in high-power and high-speed applications. Providers delivering precision bumping and advanced substrate solutions are best positioned to capitalize on this surge.

In 2024, semiconductor manufacturers began exploring flip chip platforms for heterogeneous integration, enabling multiple chiplets to be packaged together for advanced computing functions. By 2025, these systems-in-package architectures were being deployed in AI accelerators and automotive ADAS modules, significantly reducing latency and power consumption. This trend highlights how flip chip technology is moving beyond single-die attachment to enabling complex multi-die solutions for performance-critical applications. Vendors that offer co-design capability, advanced redistribution layers, and packaging expertise for multi-chip modules are poised to capture substantial value as integrated computing becomes essential in edge devices, data centers, and high-speed connectivity systems.

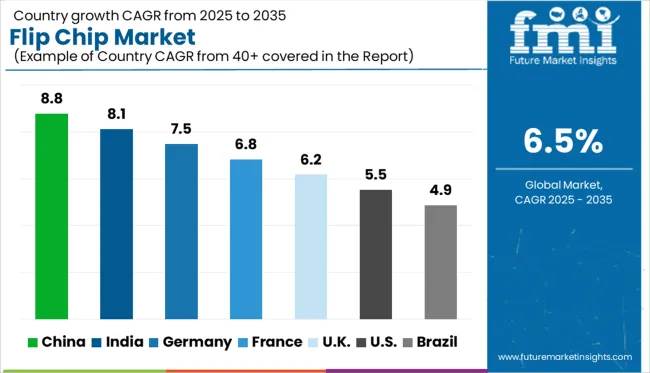

| Country | CAGR |

|---|---|

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

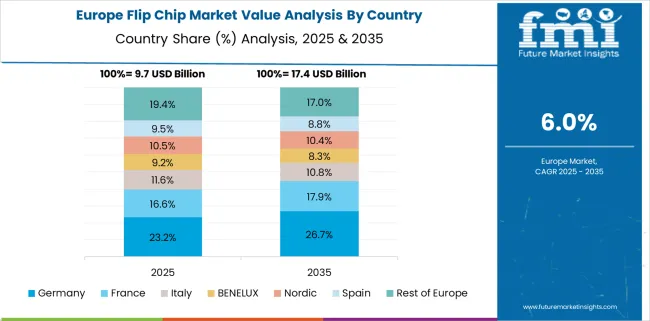

The global flip chip market is projected to expand at a CAGR of 6.5% between 2025 and 2035. China leads at 8.8%, followed by India at 8.1% and Germany at 7.5%. France records 6.8%, while the United Kingdom posts 6.2%. Growth in China and India is driven by semiconductor packaging capacity expansion and adoption of advanced interconnect technologies in AI and 5G hardware.

Germany accelerates with automotive electronics and industrial IoT demand, while France focuses on aerospace-grade applications. The UK shows moderate growth driven by R&D in defense, healthcare electronics, and chiplet-based architectures for high-performance computing.

China is projected to grow at 8.8% CAGR, supported by heavy investments in semiconductor fabs, OSAT capacity, and advanced packaging lines. Flip chip technology adoption is strong in AI chips, 5G base stations, and high-end consumer electronics. Domestic manufacturers are scaling under state-backed initiatives for chip sovereignty, focusing on copper pillar and bumping solutions for enhanced thermal performance.

India is expected to grow at 8.1% CAGR, driven by semiconductor ecosystem development and localization initiatives under the PLI scheme. Flip chip solutions are gaining traction in automotive ECUs, consumer electronics, and telecom hardware. Local OSAT firms are exploring partnerships with global packaging companies to deploy bumping and redistribution layer (RDL) technologies. Demand from data center expansion further supports adoption.

Germany is forecast to grow at 7.5% CAGR, with demand concentrated in automotive electronics, industrial automation, and medical device manufacturing. Flip chip technology ensures miniaturization and performance optimization in advanced driver assistance systems (ADAS) and EV platforms. German OSAT suppliers integrate copper pillar bumping and underfill materials to improve thermal reliability for mission-critical electronics.

France is projected to expand at 6.8% CAGR, supported by defense electronics, aerospace systems, and telecommunication networks. Flip chip packaging is essential in radar systems and avionics for space-constrained designs. French semiconductor firms are adopting advanced underfill technologies to address mechanical stress in aerospace environments. Collaborative programs with EU research institutions promote low-cost wafer-level chip-scale packaging innovations.

The UK is projected to grow at 6.2%, led by R&D-driven demand in defense electronics, quantum computing modules, and healthcare diagnostics. Flip chip technology adoption in medical imaging systems and implantable devices supports miniaturization. Government-backed semiconductor research hubs focus on hybrid bonding and chiplet integration to strengthen domestic capabilities in advanced packaging technologies.

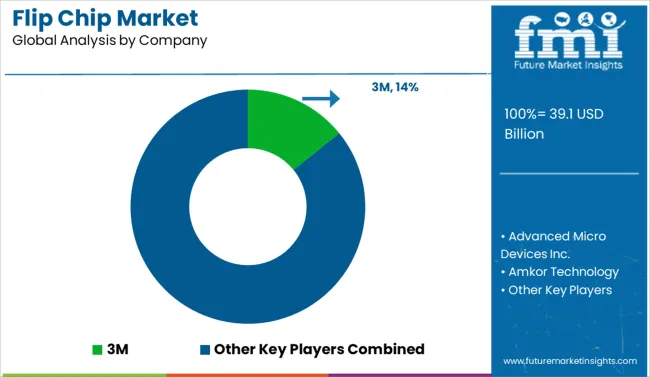

The global flip chip market is moderately consolidated, characterized by the dominance of integrated device manufacturers (IDMs) and outsourced semiconductor assembly and test (OSAT) providers. 3M maintains a leadership position with its advanced thermal interface materials, underfill chemistries, and high-reliability interconnect technologies, which are critical for performance optimization in next-generation semiconductor packaging. This position is reinforced by its expertise in managing thermal dissipation and mechanical stress in miniaturized, high-density designs.

Key industry players include Advanced Micro Devices Inc., Amkor Technology, ASE Technology Holdings, Intel Corporation, Samsung Electronics, TSMC, Texas Instruments, and Toshiba, along with specialist packaging firms such as Chipbond, ChipMOS, Powertech Technology, UMC, and UTAC. These companies deliver flip chip assembly, redistribution layers, and substrate technology solutions for high-performance computing, consumer electronics, and automotive electronics applications.

Entry for emerging firms remains highly constrained due to capital-intensive manufacturing requirements, long qualification cycles, and the dominance of established OSAT players. Market differentiation depends on scaling capabilities, adoption of advanced packaging technologies (e.g., 2.5D/3D IC integration), and material innovations that support thermal performance for AI-driven chip architectures.

Key Developments in the Flip Chip Market

Leading companies are investing in advanced interconnect designs and heterogeneous integration to support 5G, AI, and high-bandwidth memory solutions. 3M focuses on next-gen underfill materials that enhance reliability under thermal cycling stress. OSAT leaders such as ASE and Amkor are expanding capabilities in system-in-package (SiP) and 2.5D/3D IC packaging, enabling smaller form factors with higher I/O density. Intel and TSMC accelerate deployment of chiplet-based architectures and advanced bumping techniques for high-performance computing. Strategic partnerships with substrate suppliers and investments in wafer-level packaging automation remain critical to meet rising demand for miniaturization and energy efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 39.1 Billion |

| Packing Technology | 3D IC, 2.5D IC, and 2D IC |

| Bumping Technology | Copper pillar, Solder bumping, Gold bumping, and Others |

| Packaging Type | FC BGA, FC PGA, FC LGA, FC QFN, FC Sip, and FC CSP |

| End Use | IT & telecommunication, Industrial, Electronics, Automotive, Healthcare, Aerospace & defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Advanced Micro Devices Inc., Amkor Technology, ASE Technology Holdings, Chipbond Technology Corporation, ChipMOS Technologies Inc., Intel Corp, Jiangsu Changjiang Electronics Tech Co, Powertech Technology Inc., Samsung Electronics Co., Ltd., Taiwan Semiconductor Manufacturing Company Limited, Texas Instruments Incorporated, Toshiba Corporation, United Microelectronics Corp., and UTAC Holdings Ltd. |

| Additional Attributes | Dollar sales by package type, regional demand trends, competitive landscape, buyer preferences for size and bump pitch, integration with advanced substrates, innovations in thermal management and AI-ready packaging. |

The global flip chip market is estimated to be valued at USD 39.1 billion in 2025.

The market size for the flip chip market is projected to reach USD 73.5 billion by 2035.

The flip chip market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in flip chip market are 3D ic, 2.5d ic and 2d ic.

In terms of bumping technology, copper pillar segment to command 41.1% share in the flip chip market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flip Top Vials Market Size and Share Forecast Outlook 2025 to 2035

Flip Lip Bags Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Flip Top Caps and Closures Providers

Flip Top Caps and Closures Market by Polyethylene & Polypropylene Forecast 2024 to 2034

Flip-up Vacuum Pack Market

Chip-on-the-Tip Endoscopes Market Size and Share Forecast Outlook 2025 to 2035

Chipless RFID Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Chip Resistor Market Size and Share Forecast Outlook 2025 to 2035

Chip-On-Flex Market Size and Share Forecast Outlook 2025 to 2035

Chipboard Box Market Size and Share Forecast Outlook 2025 to 2035

Chip-On-Board (COB) Light Emitting Diode (LED) Market Analysis and Forecast 2025 to 2035, By Application and Region

Chip Warmers Market Growth – Trends & Forecast 2025 to 2035

Chip Scale Package LED Market Insights – Trends & Forecast 2025 to 2035

Industry Share & Competitive Positioning in Chipboard Box Industry

Chip Antenna Market

Biochips Market Size and Share Forecast Outlook 2025 to 2035

5G Chipset Market Analysis - Growth & Forecast through 2034

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

IoT Chip Market Size and Share Forecast Outlook 2025 to 2035

Microchip Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA