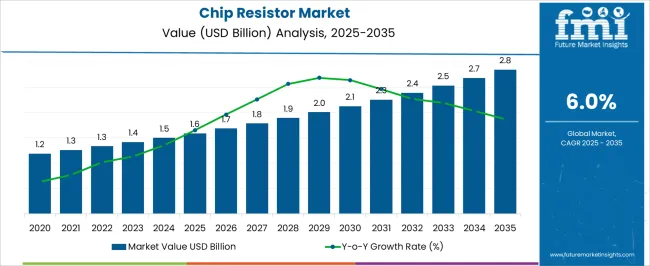

The Chip Resistor Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. The growth curve for the chip resistor market reflects a steady but gradual increase over the forecast period, with early growth characterized by incremental annual rises. Between 2025 and 2027, the market sees steady, small increases from USD 1.6 billion to USD 1.8 billion, driven by rising adoption of chip resistors in consumer electronics, automotive applications, and industrial machinery. Growth during these initial years will be moderate, with annual gains of around 6–7%, as the market begins to expand its application base.

From 2028 to 2030, the growth curve steepens slightly, with the market reaching USD 2.1 billion by 2030. This period marks increased demand from industries such as telecommunications, energy, and IoT devices, as the need for precision resistors in miniaturized electronics intensifies. Between 2030 and 2035, the market will experience a steady but more pronounced increase, reaching USD 2.8 billion. The expansion during this phase will be driven by the ongoing evolution of high-performance electronics and the integration of chip resistors in emerging technologies like autonomous vehicles and 5G infrastructure.

Production facilities face competing priorities between automation efficiency and precision tolerances required for miniaturized electronic components. Quality assurance departments navigate testing protocols that must verify electrical specifications while maintaining throughput targets for high-volume consumer electronics applications. Calibration requirements for resistance values, temperature coefficients, and power ratings create ongoing operational tension between production speed and accuracy verification.

Supply chain dynamics involve complex sourcing relationships for precious metals including silver and palladium used in conductive films, creating vulnerability to commodity price volatility. Procurement teams must balance inventory costs with the risk of supply disruptions that could halt production lines serving automotive, telecommunications, and consumer electronics manufacturers with tight delivery schedules.

Material science departments coordinate with production teams to optimize film deposition processes while maintaining consistent electrical characteristics across different substrate batches. Ceramic substrate suppliers often operate on longer lead times than electronic assembly schedules require, creating inventory management challenges that affect cash flow and production planning.

Manufacturing facilities serving different technology segments encounter distinct operational requirements. Automotive applications demand AEC-Q200 qualification standards and extended temperature range testing, while consumer electronics focus on cost optimization and high-volume throughput. Medical device applications require additional documentation and traceability systems that affect production complexity and cost structures.

| Metric | Value |

|---|---|

| Chip Resistor Market Estimated Value in (2025 E) | USD 1.6 billion |

| Chip Resistor Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The chip resistor market is experiencing sustained growth, supported by the accelerating pace of miniaturization in electronic components and the proliferation of connected devices. With increasing deployment of smart consumer electronics, electric vehicles, and industrial automation systems, the demand for highly stable and compact surface-mounted resistors has risen considerably. The transition from through-hole to surface-mount technology in high-volume production environments is playing a critical role in shaping the market’s dynamics.

Additionally, the ongoing push toward power efficiency, signal integrity, and thermal stability across PCBs has elevated the importance of chip resistors in circuit design. Industry advancements in thin and thick film technologies, along with demand for automated placement in SMT lines, are further reinforcing adoption.

Regulatory emphasis on RoHS compliance and long lifecycle performance is also influencing procurement patterns among OEMs. In the forecast period, the market is expected to benefit from increasing penetration of electronics in emerging sectors such as renewable energy systems, medical wearables, and automotive driver-assistance platforms.

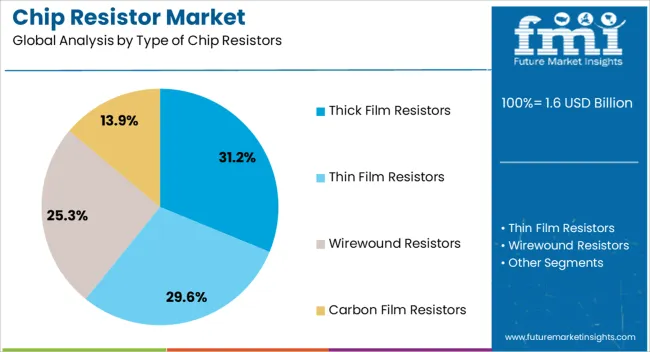

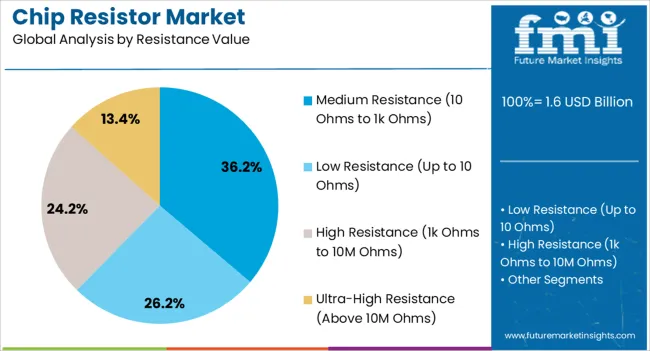

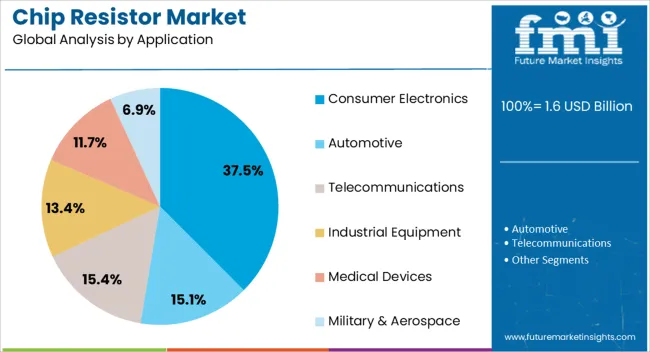

The chip resistor market is segmented by type of chip resistors, resistance value, application, packaging type, power rating, and geographic regions. By type of chip resistors, chip resistor market is divided into Thick Film Resistors, Thin Film Resistors, Wirewound Resistors, and Carbon Film Resistors. In terms of resistance value, chip resistor market is classified into Medium Resistance (10 Ohms to 1k Ohms), Low Resistance (Up to 10 Ohms), High Resistance (1k Ohms to 10M Ohms), and Ultra-High Resistance (Above 10M Ohms). Based on application, chip resistor market is segmented into Consumer Electronics, Automotive, Telecommunications, Industrial Equipment, Medical Devices, and Military & Aerospace. By packaging type, chip resistor market is segmented into Surface Mount Technology (SMT), Chip-on-Board (CoB), and Through-Hole Mounted Resistors.

By power rating, chip resistor market is segmented into Medium Power (0.1W to 0.5W), Low Power (Up to 0.1W), High Power (0.5W to 5W), and Ultra-High Power (Above 5W). Regionally, the chip resistor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The thick film resistor subsegment is projected to account for 31.2% of the chip resistor market’s revenue share in 2025, marking it as a key contributor within the type category. This leadership position is being driven by the cost-effectiveness and wide availability of thick film technologies, which are preferred in mass-market applications such as consumer gadgets, lighting systems, and power supplies.

Their suitability for high-volume production with stable performance characteristics has made them the preferred choice for designers requiring resistance tolerances within commercial-grade thresholds. The simplified manufacturing process involving screen printing and firing on ceramic substrates has enabled rapid scalability for global demand.

Moreover, thick film resistors exhibit excellent resistance to environmental stresses, which enhances their longevity in diverse operating conditions. The segment’s relevance continues to be reinforced by ongoing innovations in material composition and chip packaging that support automated SMT integration, allowing manufacturers to meet high-density design requirements without compromising on cost or quality.

The medium resistance subsegment is expected to represent 36.2% of the total chip resistor market share in 2025, emerging as the dominant resistance value category. This segment’s strength lies in its broad applicability across analog circuits, digital interfaces, and mixed-signal environments where moderate current control and voltage regulation are required. Medium resistance values have become the standard choice for signal conditioning, voltage dividers, and biasing applications in smartphones, laptops, televisions, and communication modules.

Their optimal balance between power dissipation and tolerance levels supports performance reliability in densely packed PCBs. The segment’s growth is further encouraged by its compatibility with high-frequency designs and minimal thermal drift under varying load conditions.

Widespread adoption of medium resistance ranges in both AC and DC circuits has ensured consistent demand from global electronics OEMs Additionally, the ability to integrate these resistors in automated pick-and-place assembly lines has further elevated their use in fast-moving consumer and industrial electronics.

The consumer electronics segment is projected to account for 37.5% of the total chip resistor market revenue share in 2025, maintaining its position as the largest application area. This segment’s dominance is underpinned by the explosive growth of mobile devices, wearable technologies, gaming systems, and smart home products that require precise and stable resistance components. Chip resistors serve critical roles in power regulation, signal conditioning, EMI suppression, and voltage division within compact device architectures.

As OEMs aim to deliver higher performance with reduced size and weight, the demand for low-profile, thermally stable, and RoHS-compliant chip resistors has intensified. The increasing functionality of modern gadgets, including features like wireless connectivity and fast charging, necessitates robust and reliable passive components at the board level.

Mass production capabilities, combined with advancements in film deposition and automated testing, have supported consistent quality and supply reliability for high-volume consumer brands. Continued innovation in product miniaturization and battery management technologies is expected to reinforce the segment’s growth trajectory.

As electronic devices continue to shrink in size, the need for compact, high-performance components like chip resistors is growing. Technological advancements in thick and thin film technologies are further enhancing the performance, durability, and reliability of these resistors. The expansion of 5G networks, the rise of electric vehicles (EVs), and the increase in data center infrastructure are also contributing to the robust growth of the chip resistor market. As the demand for more advanced and reliable electronic components continues to rise, the chip resistor market is expected to see continued innovation and expansion in the coming years.

The chip resistor market is experiencing significant growth due to several key drivers. A primary factor is the growing demand for miniaturized electronic components, particularly in the consumer electronics sector. As devices become more compact, the need for smaller, more efficient components like chip resistors is increasing. In addition, the automotive industry is driving demand due to the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), which require high-performance electronic components. The telecommunications industry, fueled by the expansion of 5G networks, is also contributing to market growth as it requires reliable, efficient components for network infrastructure. Furthermore, the increasing adoption of industrial automation and the demand for precision electronics across various sectors are key factors propelling the growth of chip resistors, with their high accuracy and durability being essential in advanced manufacturing processes.

The growth of the chip resistor market faces several challenges that could hinder its development. One significant challenge is the fluctuation in raw material prices, which can disrupt the pricing structure and affect profitability for manufacturers. Materials used in the production of chip resistors, particularly in thin and thick film technologies, can experience supply chain volatility, leading to price instability. Regulatory compliance is another challenge, as manufacturers must adhere to increasingly stringent environmental and safety regulations, which can drive up production costs and complexity. Supply chain disruptions, particularly in the availability of raw materials or transportation delays, can affect production schedules and lead to shortages of chip resistors. Keeping pace with technological advancements in the electronics industry requires continuous investment in research and development, posing a challenge for manufacturers striving to maintain a competitive edge.

The chip resistor sector presents numerous opportunities for growth and innovation. One of the key opportunities lies in the development of high-precision resistors, particularly for emerging applications that require tighter tolerances and greater reliability. Innovations in film technologies, such as the development of new materials for thick and thin film resistors, are enhancing the performance and stability of chip resistors, making them suitable for a broader range of applications. Another growth opportunity lies in the integration of chip resistors with emerging technologies, such as the Internet of Things (IoT) devices and wearable electronics. These devices require small, durable, and efficient components, driving the demand for chip resistors. Furthermore, expanding into emerging markets with growing electronics manufacturing industries presents an opportunity for global growth. Collaborations with other technology providers to create innovative, high-performance resistor solutions can also contribute to market expansion and drive innovation.

The miniaturization of electronic components continues to be a major driver, as smaller devices require increasingly compact and efficient components. This trend is leading to an increase in the demand for chip resistors that are both reliable and miniaturized. Advancements in thick and thin film technologies are also enhancing the performance and reliability of chip resistors, improving their durability and efficiency. Environmental regulations are influencing the development of lead-free and eco-friendly resistors, as companies aim to meet sustainability standards. Additionally, customization of chip resistors for specific applications is becoming more prevalent, as manufacturers tailor products to meet the unique needs of industries such as automotive, telecommunications, and industrial automation. These trends are likely to shape the future direction of the chip resistor market, leading to the development of innovative and highly specialized products.

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

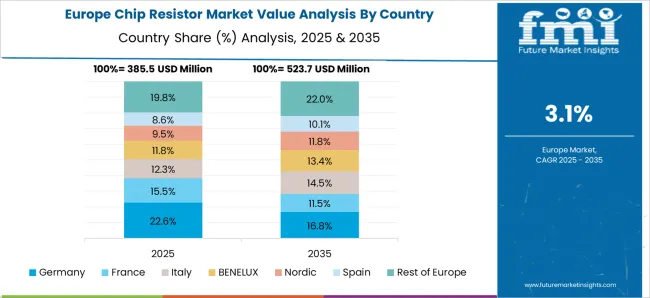

The global chip resistor market is projected to grow at a CAGR of 6.0% from 2025 to 2035. Among the key markets, China leads with a growth rate of 8.1%, followed by India at 7.5%, and France at 6.3%. The United Kingdom and the United States show more moderate growth rates of 5.7% and 5.1%, respectively. This growth is driven by the increasing demand for high-performance electronic components in industries such as automotive, telecommunications, and consumer electronics. Emerging markets like China and India are experiencing faster growth due to industrial expansion and rising consumer electronics adoption, while developed markets such as the USA and the UK are seeing steady demand driven by advancements in high-tech industries. The analysis spans over 40+ countries, with the leading markets shown below.

China is expected to be the leading market for chip resistors, growing at a projected rate of 8.1% CAGR from 2025 to 2035. The rapid development of China’s electronics and automotive sectors is significantly driving this growth. The demand for chip resistors is mainly fueled by the increasing adoption of high-performance consumer electronics and the growth of industries like telecommunications, automotive, and industrial automation. As China continues to enhance its semiconductor manufacturing infrastructure, the demand for electronic components, including chip resistors, will increase. The continued investments in advanced technologies such as 5G, autonomous vehicles, and AI are also expected to create new opportunities for the chip resistor market.

The chip resistor market in india is expected to experience strong growth, projected to expand at a CAGR of 7.5% from 2025 to 2035. The country’s rapidly growing electronics manufacturing sector, particularly in consumer electronics and automotive industries, is driving the demand for chip resistors. India’s increasing focus on improving its semiconductor manufacturing capabilities will contribute to market growth by providing a consistent supply of chip resistors for high-performance applications. The government's initiatives to support electronic manufacturing and the rising adoption of electric vehicles (EVs) will also contribute to the need for advanced components like chip resistors.

Demand for chip resistor in France is expected to grow steadily, projected to expand at a CAGR of 6.3% from 2025 to 2035. The country’s strong focus on automotive electronics, industrial automation, and telecommunications is driving the demand for chip resistors. With the automotive industry adopting more advanced electronic components for electric vehicles (EVs) and autonomous driving technologies, the need for chip resistors is expected to increase. The telecommunications sector’s continuous evolution, especially with the deployment of 5G infrastructure, will require more electronic components. France’s ongoing focus on technological innovation and industrial automation will further contribute to the expansion of the chip resistor marke

The chip resistor market in the United Kingdom is projected to experience moderate growth, with demand driven by advancements in consumer electronics, automotive, and telecommunications. The UK’s shift toward adopting more advanced electronic components in high-tech industries will continue to support the need for chip resistors. The growing trend of miniaturization in consumer electronics and the rise in connected devices are further fueling market demand. As the UK continues to focus on technological innovation and infrastructure development, the market for chip resistors is expected to expand steadily, supported by rising demand for electronic components.

The chip resistor market in the United States is projected to grow at a steady pace, driven by high demand in the automotive, telecommunications, and consumer electronics industries. The USA focus on upgrading infrastructure in telecommunications and expanding its automotive sector is expected to significantly boost the market. The rise in smart devices and the continued trend of miniaturization in consumer electronics are also anticipated to increase demand for chip resistors in the USA With ongoing investments in infrastructure and high-tech manufacturing, the USA chip resistor market is expected to continue expanding, supporting the broader electronics industry.

The Chip Resistor Market is growing steadily, driven by the rapid expansion of the consumer electronics industry, rising adoption of electric vehicles (EVs), and increasing demand for compact, high-performance electronic components in industrial and automotive applications. Chip resistors, essential for controlling electrical current and ensuring circuit stability, are widely used in smartphones, laptops, automotive control systems, and communication devices. Market growth is being propelled by ongoing miniaturization trends, advancements in surface-mount technology (SMT), and the integration of IoT and AI-enabled devices across industries.

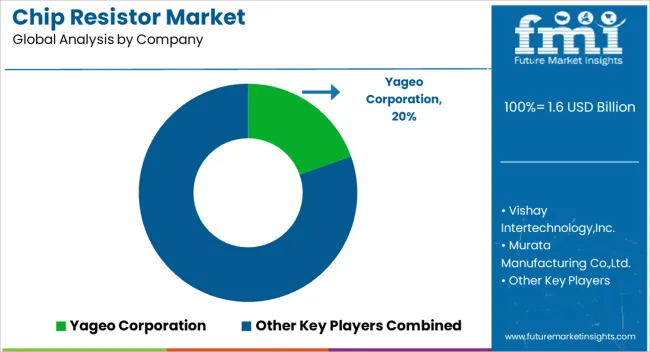

Leading manufacturers such as Yageo Corporation, Vishay Intertechnology Inc., and Murata Manufacturing Co. Ltd. dominate global production with extensive product portfolios offering thick-film, thin-film, and precision chip resistors for a wide range of voltage and temperature requirements. Yageo Corporation continues to lead with cost-efficient, high-reliability resistors tailored for automotive and industrial electronics. Vishay Intertechnology focuses on high-precision, low-noise resistors designed for power management and signal processing applications, while Murata Manufacturing leverages advanced ceramic materials for ultra-miniature and high-frequency resistor solutions.

Samsung Electro-Mechanics Co. Ltd. and Panasonic Corporation are key players in Asia, developing miniaturized chip resistors with enhanced heat dissipation and high-surge tolerance to meet growing demand from 5G, EV, and smart device manufacturers. TE Connectivity Ltd. contributes through high-performance resistors integrated into harsh-environment systems for aerospace and industrial automation. Bourns Inc. and CTS Corporation specialize in precision and power resistors optimized for circuit protection, energy efficiency, and sensor applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Type of Chip Resistors | Thick Film Resistors, Thin Film Resistors, Wirewound Resistors, and Carbon Film Resistors |

| Resistance Value | Medium Resistance (10 Ohms to 1k Ohms), Low Resistance (Up to 10 Ohms), High Resistance (1k Ohms to 10M Ohms), and Ultra-High Resistance (Above 10M Ohms) |

| Application | Consumer Electronics, Automotive, Telecommunications, Industrial Equipment, Medical Devices, and Military & Aerospace |

| Packaging Type | Surface Mount Technology (SMT), Chip-on-Board (CoB), and Through-Hole Mounted Resistors |

| Power Rating | Medium Power (0.1W to 0.5W), Low Power (Up to 0.1W), High Power (0.5W to 5W), and Ultra-High Power (Above 5W) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

Yageo Corporation, Vishay Intertechnology Inc., Murata Manufacturing Co. Ltd., Samsung Electro-Mechanics Co. Ltd., Panasonic Corporation, TE Connectivity Ltd., Bourns Inc., CTS Corporation |

| Additional Attributes | Dollar sales by product type (surface mount resistors, through-hole resistors) and end-use segments (automotive, consumer electronics, industrial, telecommunications). Demand dynamics are driven by the increasing use of electronic devices, miniaturization trends in consumer electronics, and the growing demand for efficient components in automotive electronics. Regional trends indicate strong growth in Asia-Pacific, North America, and Europe, fueled by advancements in automotive technologies, smart electronics, and industrial automation. |

The global chip resistor market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the chip resistor market is projected to reach USD 2.8 billion by 2035.

The chip resistor market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in chip resistor market are thick film resistors, thin film resistors, wirewound resistors and carbon film resistors.

In terms of resistance value, medium resistance (10 ohms to 1k ohms) segment to command 36.2% share in the chip resistor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chip-on-the-Tip Endoscopes Market Size and Share Forecast Outlook 2025 to 2035

Chipless RFID Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Chip-On-Flex Market Size and Share Forecast Outlook 2025 to 2035

Chipboard Box Market Size and Share Forecast Outlook 2025 to 2035

Chip-On-Board (COB) Light Emitting Diode (LED) Market Analysis and Forecast 2025 to 2035, By Application and Region

Chip Scale Package LED Market Insights – Trends & Forecast 2025 to 2035

Chip Warmers Market Growth – Trends & Forecast 2025 to 2035

Industry Share & Competitive Positioning in Chipboard Box Industry

Chip Antenna Market

Biochips Market Size and Share Forecast Outlook 2025 to 2035

5G Chipset Market Analysis - Growth & Forecast through 2034

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

IoT Chip Market Size and Share Forecast Outlook 2025 to 2035

Microchip Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

Flip Chip Market Size and Share Forecast Outlook 2025 to 2035

GNSS Chip Market Trends – Growth, Size & Forecast 2025 to 2035

Wood Chipper Market Growth – Trends & Forecast 2024 to 2034

Wi-Fi Chipset Market Growth - Trends & Forecast 2025 to 2035

Power Resistor Market

Lab-On-Chips Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA