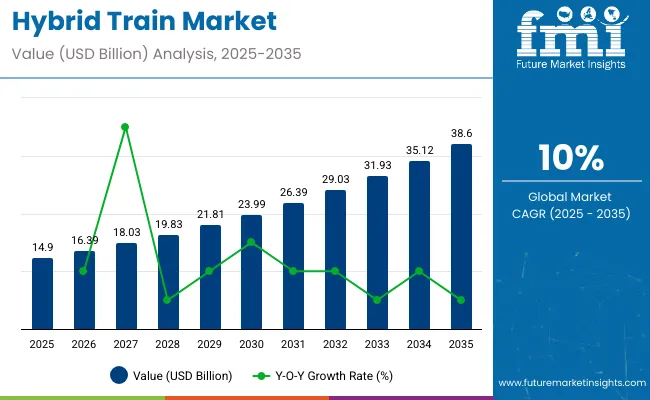

The hybrid train market is valued at USD 14.9 billion in 2025 and is likely to reach USD 38.6 billion by 2035, reflecting a CAGR of 10%. The multiplying factor for this period is roughly 2.6x, indicating that the market in 2035 will be about 2.6 times the 2025 base. Comparing early and late growth curves highlights differences in adoption dynamics over the decade.

During the early phase, from 2025 to 2028, growth accelerates sharply as railway operators adopt hybrid trains to reduce fuel consumption, lower emissions, and meet emerging regulatory standards. Incentives for clean and energy-efficient transportation solutions support faster uptake during this period. In the later phase, from 2029 to 2035, the growth curve moderates slightly as market penetration increases and earliest adopters have already integrated hybrid solutions.

Expansion continues through replacement of conventional trains, deployment in new regional corridors, and technological improvements in battery and energy management systems. The early vs late growth comparison, along with a multiplying factor of 2.6x, demonstrates strong initial momentum followed by steady long-term market expansion, offering consistent opportunities for manufacturers and operators to scale operations and innovate.

The hybrid train industry draws support from several key parent sectors with varied contributions. Transportation infrastructure makes up around 33%, covering rail networks, depots, and charging or fueling facilities. Logistics and freight transport account for approximately 26%, as fuel-efficient hybrid trains are increasingly used for regional and long-haul cargo.

Rail equipment and rolling stock contribute about 21%, providing hybrid locomotives, carriages, and essential components. Industrial manufacturing represents nearly 12%, producing engines, battery modules, and drive systems. Information and communication technology (ICT) contributes roughly 8%, enabling energy management, real-time monitoring, and predictive maintenance. These sectors together support the expansion and adoption of hybrid rail solutions.

The hybrid train sector is witnessing a shift toward greener and more efficient operations. Companies such as Alstom, Siemens Mobility, Hitachi Rail, and CRRC are developing locomotives that combine diesel engines with batteries or ultracapacitors to reduce emissions and fuel usage. Regenerative braking systems and intelligent energy management enhance efficiency.

Deployment of hybrid trains is growing on regional passenger lines and freight corridors to meet stricter environmental regulations. Adoption of digital monitoring, predictive maintenance, and smart control systems improves performance and reliability. Collaborations between train manufacturers and energy solution providers are accelerating innovation and the rollout of hybrid rail services worldwide.

The hybrid train market is expanding as operators focus on lowering fuel consumption and reducing emissions. Globally, over 2,500 hybrid trains are in operation, primarily across Europe and Asia. These trains can cut diesel use by up to 30% through regenerative braking and electric-assist propulsion on partially electrified routes.

Governments are introducing low-emission mandates and subsidies, encouraging fleet modernization. The adoption of lightweight train materials, modular energy storage systems, and advanced traction technology enhances operational reliability while lowering lifecycle costs.

Driving Force Energy Efficiency and Emission Reduction

Hybrid trains deliver measurable reductions in fuel use and greenhouse gas emissions. Electric-assist motors allow diesel engines to operate nearer optimal efficiency, cutting fuel burn by 12–15% per trip. Regenerative braking stores up to 25% of braking energy in onboard batteries for later use.

Hybrid trains produce 20% less CO2 and 15% fewer nitrogen oxides than conventional diesel locomotives. Operators can seamlessly switch between diesel and electric modes on partially electrified tracks, meeting emission standards efficiently. Reduced engine load extends maintenance intervals, while onboard sensors track system performance to prevent inefficiencies and lower downtime.

Growth Avenue Expansion in Regional and Commuter Networks

Regional and commuter lines represent strong growth opportunities. Routes under 200 km achieve up to 30% fuel savings due to frequent stopping patterns. Asia Pacific has introduced more than 1,000 hybrid trains, with China accounting for approximately 60% of the total.

Lightweight composite train bodies reduce energy consumption by 8–10%, and modular battery packs allow rapid replacement, minimizing service downtime. Smart scheduling coordinates acceleration and braking patterns, providing an additional 5–8% energy savings per route. Retrofitting existing diesel trains with hybrid technology enables operators to expand capacity without building new locomotives, accommodating rising passenger volumes.

Emerging Trend Battery Storage and Smart Power Management

Battery storage and smart power management systems are reshaping hybrid train performance. Advanced lithium-ion and solid-state batteries increase energy storage capacity by 15–20%, extending electric-only operation. Intelligent energy management monitors track profile, speed, and passenger load to optimize diesel-electric switching.

Integration with signaling networks coordinates acceleration and braking to save energy. Predictive maintenance reduces unplanned downtime by 10%, while modern traction motors improve acceleration by 8%. These technologies enhance hybrid train efficiency on partially electrified corridors while improving service reliability and passenger comfort.

Market Challenge High Initial Costs and Infrastructure Needs

High upfront costs and infrastructure demands limit hybrid train adoption. Developing hybrid locomotives with batteries, power electronics, and lightweight materials can increase unit costs by 25–30% compared with standard diesel trains. Establishing partial electrification and charging infrastructure may cost USD 1–2 million per km.

Training specialized maintenance crews raises operational expenses by 15–20%. Retrofitting older fleets requires service interruptions and careful integration to maintain performance. Payback periods for low-density routes can exceed seven years, making operators carefully weigh initial investment against projected fuel savings, emission reductions, and available incentives.

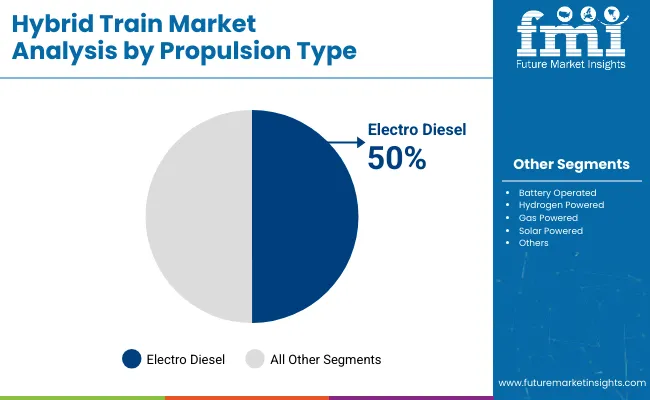

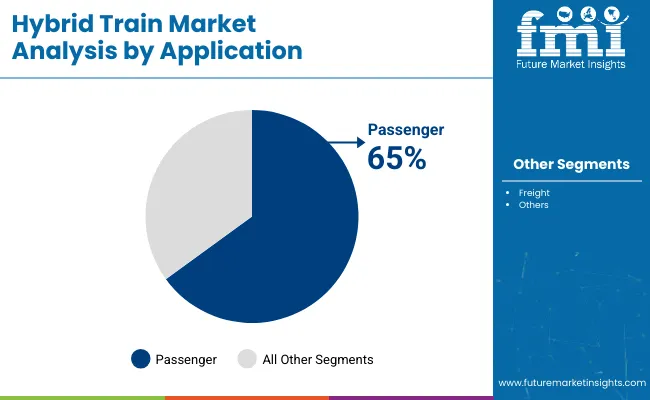

The hybrid train market is shaped by propulsion type, application, and operating speed. Electro diesel dominates with 50% share due to reliability and fuel efficiency, while battery and hydrogen options grow as eco-friendly alternatives. Passenger services account for 65% of demand, driven by rising urban mobility requirements, whereas freight represents 35%.

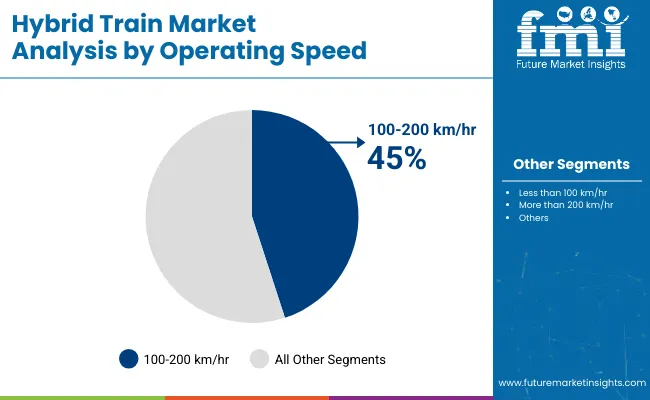

Trains operating at 100-200 km/hr lead with 45% share, followed by slower and high-speed segments. Growth is supported by infrastructure modernization, rising commuter volumes, and investments in low-emission technologies for both freight and passenger transport across global networks.

Electro diesel propulsion captures 50% of the hybrid train market due to fuel efficiency, operational flexibility, and compatibility with existing rail infrastructure. Battery-operated trains hold 20%, primarily for short-distance and urban routes, while hydrogen-powered options account for 15% as clean-energy alternatives gain traction.

Gas-powered and solar-powered trains contribute 10% and 5% respectively. Major manufacturers focus on modular hybrid designs to reduce emissions and maintenance costs while supporting variable operating conditions. Electro diesel trains are favored for regional routes and freight corridors requiring long-range travel without extensive charging or refueling infrastructure.

Passenger services account for 65% of hybrid train usage, driven by urban and intercity commuting demands. Growing population density and mobility requirements push rail operators to deploy hybrid trains for improved efficiency and reduced emissions. Freight services make up 35%, used primarily for lightweight cargo and industrial goods where flexible propulsion is advantageous.

Passenger-focused trains benefit from higher speeds, better scheduling, and lower operational costs compared to traditional diesel trains. Investments in hybrid trains support enhanced reliability, comfort, and connectivity, meeting the evolving demands of daily commuters and long-distance travelers while aligning with regulatory emission targets.

Trains operating between 100–200 km/hr capture 45% of market share, suitable for regional and medium-distance routes. Slower trains below 100 km/hr represent 35%, primarily used for urban and local services, while high-speed trains exceeding 200 km/hr account for 20% for long-distance routes.

Medium-speed hybrid trains provide the optimal balance of energy efficiency and passenger capacity. Rail operators invest in infrastructure upgrades, traction control systems, and modular propulsion units to maintain operational reliability. This speed segment benefits from reduced fuel consumption and enhanced scheduling flexibility, supporting both passenger and light freight services.

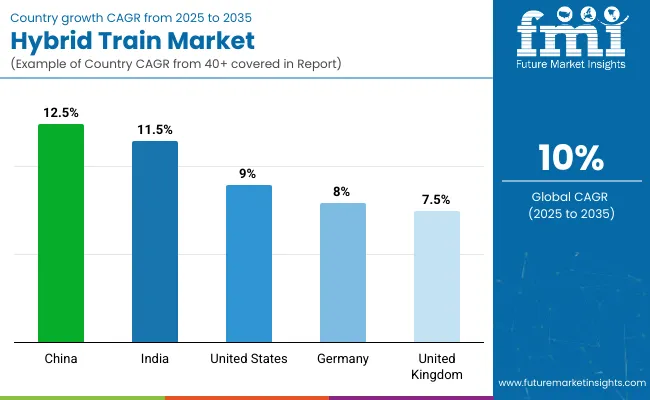

In 2025, the global hybrid train market is expected to grow at a CAGR of 10% through 2035. China leads at 12.5%, +25% above the global average, driven by BRICS-focused investment in energy-efficient rail networks and rapid fleet expansion. India follows at 11.5%, +15% higher than the global rate, supported by ASEAN-linked projects and growing demand for electrified rail services.

The United States records 9.0%, −10% below the global CAGR, reflecting gradual modernization within established OECD rail systems. Germany and the United Kingdom stand at 8.0% and 7.5%, −20% and −25% compared with the global average, driven by incremental upgrades in OECD infrastructure and sustainable rail initiatives. The BRICS nations are outpacing OECD peers in hybrid train adoption, with China and India leading the market momentum.

China is advancing at a CAGR of 12.5%, exceeding the global 10%. Investments focus on connecting regional and intercity corridors with hybrid technology. Domestic manufacturers are developing high-capacity batteries, electric propulsion systems, and smart energy management solutions.

Hybrid trains provide operational flexibility on routes with limited electrification and support both passenger and freight operations. Pilot programs in Shanghai, Beijing, and Guangdong validate fuel savings and reliability, while collaboration with international technology partners accelerates deployment and production efficiency.

India is recording a CAGR of 11.5%, above the global 10%. Expansion is driven by modernization of regional rail lines and hybrid solutions bridging electrification gaps. Regenerative braking, battery storage, and advanced power management improve operational efficiency. Pilot deployments in Maharashtra, Tamil Nadu, and Karnataka focus on regional passenger and freight corridors. Policy initiatives and public-private partnerships encourage adoption, network reliability, and energy savings.

The United States is expanding at a CAGR of 9%, slightly under the global 10%. Hybrid technology is applied to retrofit diesel routes and commuter networks, reducing fuel use and emissions. Advanced energy storage, control software, and regenerative braking systems enhance reliability. Implementation focuses on major corridors in California, Texas, and the Northeast, covering both passenger and freight operations. Investments in infrastructure upgrades and operational training support efficient hybrid deployment.

Germany is growing at a CAGR of 8%, below the global 10%. Growth relies on hybrid adoption in partially electrified regional and commuter networks. Investments include battery propulsion, low-emission engines, and regenerative braking systems. Fleet modernization emphasizes operational reliability and passenger comfort. Pilot programs in Bavaria, North Rhine-Westphalia, and Baden-Württemberg test hybrid technologies for energy efficiency and long-term performance. Germany also exports hybrid technology, supporting domestic production.

The United Kingdom is progressing at a CAGR of 7.5%, below the global 10%. Growth is concentrated on routes with partial electrification, emphasizing energy efficiency and reduced emissions. Investments focus on battery systems, regenerative braking, and hybrid diesel engines. Pilot projects in Scotland, London, and the Midlands target operational efficiency and passenger reliability. Collaboration with European suppliers accelerates technology adoption and integration.

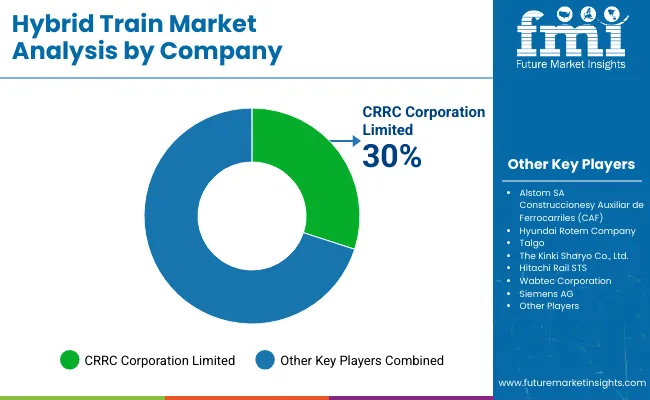

The industry is influenced by a combination of established manufacturers and emerging players, each focusing on strategies to enhance efficiency and expand market share. CRRC Corporation Limited continues to lead the sector with large-scale production of hybrid locomotives for regional and urban transit, emphasizing modular designs that can be customized for different rail networks.

Alstom SA actively develops hybrid multiple units and battery-assisted trains, recently launching new models in Europe designed for low-emission and energy-efficient operation. Construcciones y Auxiliar de Ferrocarriles (CAF) focuses on lightweight train designs and battery integration, while Hyundai Rotem Company invests in hybrid propulsion solutions to cater to both domestic and international clients. Talgo specializes in high-speed hybrid trains, combining battery power with traditional diesel engines for flexible operations.

Other companies strengthen their position through targeted research, product launches, and collaborations. The Kinki Sharyo Co., Ltd. emphasizes commuter rail solutions with hybrid technology, while Hitachi Rail STS develops modular hybrid units for European and Asian markets. Wabtec Corporation focuses on freight locomotives with hybrid capabilities to improve fuel efficiency, and Siemens AG integrates battery-assisted systems in urban and regional trains. These strategies, including R&D, partnerships, and regional expansions, allow companies to respond to increasing demand for hybrid trains, enhance operational performance, and maintain competitive positions in the global market.

Recent Industry News

| Report Attributes | Details |

| Market Size (2025) | USD 14.9 billion |

| Projected Market Size (2035) | USD 38.6 billion |

| CAGR (2025 to 2035) | 10% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Propulsion Types Analyzed (Segment 1) | Electro-diesel, Hydrogen Powered, Battery Electric, Others |

| Application Segments Analyzed (Segment 2) | Passenger, Freight |

| Speed Segments Analyzed (Segment 3) | Below 100 Km/h, 100 - 200 Km/h, Above 200 Km/h |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia Pacific; Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, China, Japan, India, UAE, South Africa, others |

| Key Players Influencing the Market | CRRC Corporation Limited, Alstom SA, Construcciones y Auxiliar de Ferrocarriles (CAF), Hyundai Rotem Company, Talgo, The Kinki Sharyo Co., Ltd., Hitachi Rail STS, Wabtec Corporation, Siemens AG |

| Additional Attributes | Dollar sales by train type and propulsion system, demand dynamics across passenger, freight, and commuter services, regional adoption trends across Europe, Asia-Pacific, and North America, innovation in battery-hybrid integration and regenerative braking, environmental impact of reduced emissions, emerging use in green rail corridors |

The market is expected to reach nearly USD 38.6 billion by 2035.

The market is growing at a CAGR of 10% during this period.

Electro Diesel leads with 50% market share in 2025.

Passenger services hold the largest share with 65% in 2025.

CRRC Corporation Limited holds a leading 30% industry share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hybrid Powertrain Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Drivetrain Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Vision Sensor Chips Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Printing Market Forecast Outlook 2025 to 2035

Hybrid Boat Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Metal-Paper Seamers Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Sealing-Cut Machines Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hybrid Additive Manufacturing Machines Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Integration Platform Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Meat Products Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Rice Seeds Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Memory Cube Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Cutters Market Analysis Size and Share Forecast Outlook 2025 to 2035

Hybrid Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA