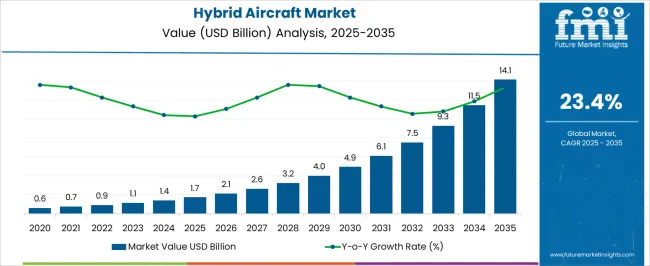

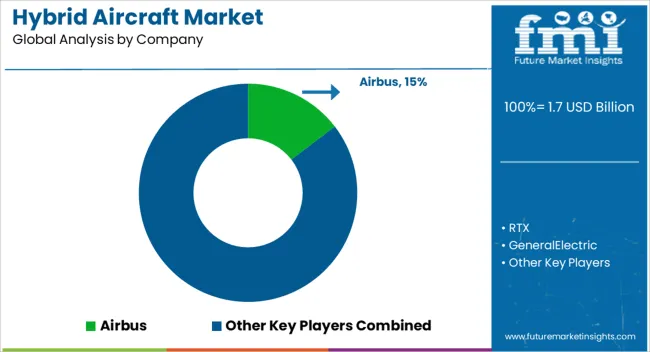

The hybrid aircraft market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 14.1 billion by 2035, registering a compound annual growth rate (CAGR) of 23.4% over the forecast period. The steep annual increase from USD 1.7 billion to USD 14.1 billion indicates that hybrid propulsion technologies, including parallel and series-electric configurations, are driving the market, with series-electric systems expected to capture a substantial share due to efficiency gains in short- and medium-haul operations.

Parallel hybrid systems, integrating conventional engines with electric motors, also contribute to incremental value, particularly in regional and commuter aircraft applications. Battery technology, including lithium-ion and emerging solid-state solutions, contributes critically by enabling higher energy density, longer cycle life, and improved thermal management, thereby supporting the adoption of hybrid configurations. Power electronics, electric motors, and integrated control systems further enhance the contribution of technology by improving performance, reducing emissions, and optimizing energy use.

The market’s growth trajectory suggests that advancements in lightweight materials, system integration, and certification frameworks will progressively increase the value contribution of these technologies over the forecast period. The market’s expansion is closely tied to technological innovation across propulsion, energy storage, and control systems. The cumulative effect of these technology components is evident in the substantial projected growth from USD 1.7 billion in 2025 to USD 14.1 billion in 2035, positioning hybrid technology as the primary driver of market value in the coming decade.

Flight test operations encounter unique challenges as hybrid aircraft validation requires coordination between traditional flight test procedures and electric system monitoring protocols while managing battery state management, power transition testing, and emergency procedure validation. Test engineering teams work with certification authorities to establish testing protocols for dual propulsion modes while coordinating with maintenance teams about specialized ground support equipment and charging infrastructure requirements that differ from conventional aircraft servicing procedures.

Cross-functional coordination between propulsion system engineers and aircraft integration teams creates ongoing dialogue about power management strategies versus aircraft operational requirements. Systems engineers work with flight operations specialists to evaluate battery capacity requirements against mission profiles while managing thermal management systems and electrical distribution architecture that must accommodate both electric motor operation and conventional engine backup across diverse flight conditions and mission requirements.

Airline operations experience fleet integration complexity as hybrid aircraft deployment requires coordination between pilot training programs, maintenance procedures, and ground support equipment while managing charging infrastructure requirements and operational procedures that differ from conventional aircraft operations. Flight operations departments work with maintenance planning teams to establish dispatch procedures and range planning considerations while coordinating with airport infrastructure teams about charging station installation and electrical grid capacity requirements.

| Metric | Value |

|---|---|

| Hybrid Aircraft Market Estimated Value in (2025 E) | USD 1.7 billion |

| Hybrid Aircraft Market Forecast Value in (2035 F) | USD 14.1 billion |

| Forecast CAGR (2025 to 2035) | 23.4% |

The hybrid aircraft market is undergoing a pivotal transformation as the aviation industry increasingly prioritizes sustainability, fuel efficiency, and operational versatility. The demand for reduced carbon emissions and compliance with environmental regulations is influencing a shift toward hybrid propulsion architectures, combining electric motors with conventional engines to enhance range, lower noise, and improve fuel economy.

Government-backed programs and public-private collaborations have accelerated innovation in electric aviation technologies, while advances in battery density, thermal management, and lightweight materials are supporting scalability in hybrid aircraft designs. The expansion of infrastructure for advanced air mobility and the growing readiness of urban air transport systems are further enabling deployment.

Strategic investments by major aerospace companies and startups alike are fostering innovation in propulsion systems, autonomous flight technologies, and smart avionics As airspace regulations evolve to accommodate new flight models, the hybrid aircraft market is expected to see sustained growth, especially in short-haul and regional air transport, cargo logistics, and specialized defense missions.

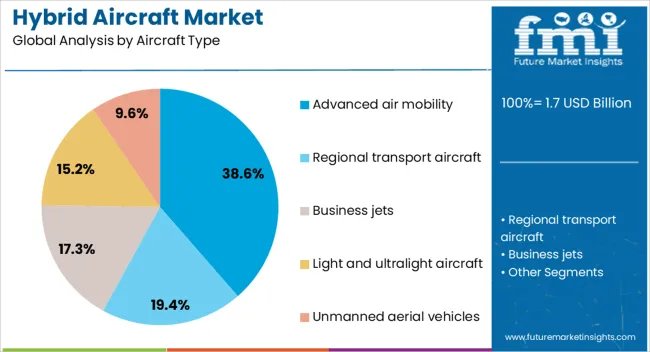

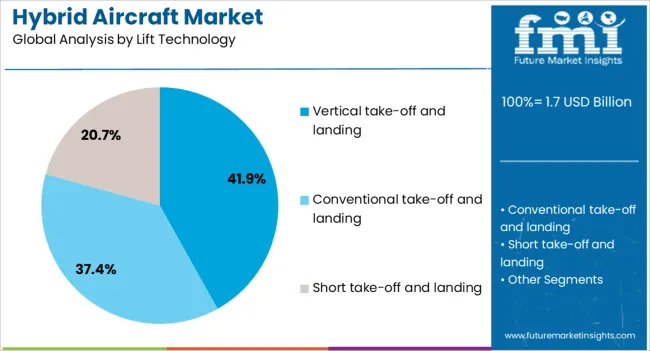

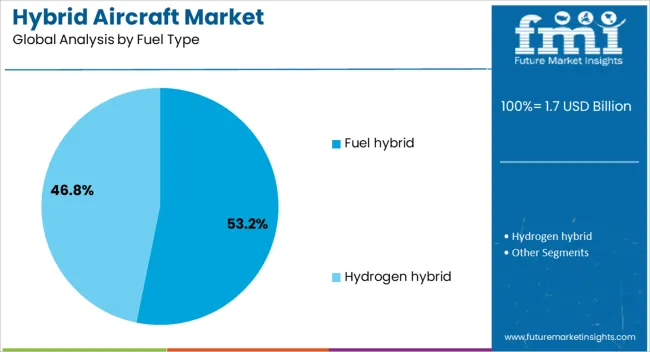

The hybrid aircraft market is segmented by aircraft type, lift technology, fuel type, range, mode of operation, and geographic regions. By aircraft type, the hybrid aircraft market is divided into Advanced air mobility, Regional transport aircraft, Business jets, Light and ultralight aircraft, and Unmanned aerial vehicles. In terms of lift technology, the hybrid aircraft market is classified into Vertical Take-off and Landing, Conventional Take-off and Landing, and Short Take-off and Landing. Based on fuel type, the hybrid aircraft market is segmented into Fuel hybrid and Hydrogen hybrid. The range of the hybrid aircraft market is segmented into 101 km to 500 km, 100 km, and > 501 km. The mode of operation of the hybrid aircraft market is segmented into Piloted and Autonomous. Regionally, the hybrid aircraft industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The advanced air mobility segment is projected to contribute 38.6% of the total revenue share in the hybrid aircraft market in 2025, emerging as the leading aircraft type. This segment’s dominance is being shaped by increasing urban congestion, the need for alternative intracity transport, and the expansion of point-to-point air travel networks. Advanced air mobility platforms are being developed for passenger and cargo transport within densely populated regions, supported by scalable hybrid-electric systems that extend range and minimize emissions.

Advancements in autonomous flight control, lightweight composites, and compact hybrid propulsion units further support the segment. Integration with smart city infrastructure and air traffic management systems is reinforcing its commercial feasibility.

Strategic partnerships among eVTOL manufacturers, mobility service providers, and regulatory authorities have accelerated certification pathways, enabling faster market entry The adaptability of hybrid aircraft in vertical and short take-off scenarios has made advanced air mobility the focal point for sustainable aviation development initiatives globally.

Vertical take-off and landing platforms are expected to account for 41.9% of the hybrid aircraft market revenue in 2025, reflecting their crucial role in enabling flexible, space-efficient operations. The demand for aircraft capable of operating without long runways is being fueled by urbanization trends, defense requirements, and the need for rapid deployment in inaccessible regions.

Hybrid propulsion in VTOL aircraft allows for quieter vertical lift and improved fuel efficiency, addressing critical limitations of conventional rotary-wing systems. The segment is benefiting from engineering improvements in distributed propulsion, rotor design, and flight control software, which enhance maneuverability and optimize energy usage.

These aircraft types are being adopted in both civilian and military applications, including urban air taxis, air ambulances, and surveillance missions. With infrastructure investments targeting vertiports and last-mile air connectivity, vertical take-off and landing systems are poised to serve as key enablers in the next generation of regional and metropolitan air transport ecosystems.

Fuel hybrid aircraft are forecast to represent 53.2% of the hybrid aircraft market’s revenue share in 2025, establishing this fuel type as the most dominant propulsion configuration. The segment’s growth is being supported by the technical maturity of fuel-based systems combined with supplementary electric propulsion, which allows aircraft to reduce emissions while maintaining operational reliability and extended range.

The ability to leverage existing fuel infrastructure while introducing partial electrification has positioned fuel hybrid systems as a practical transitional solution in the path toward fully electric aviation. Enhanced power management systems, regenerative braking during descent, and onboard energy storage have improved overall propulsion efficiency.

Industry adoption has been driven by commercial aviation’s focus on emission reduction goals, while military and cargo operators have also embraced fuel hybrid designs for extended endurance missions. The relative ease of certification and integration into current aviation ecosystems has further supported this segment’s leadership, making it the preferred configuration in both near-term development and scalable deployment.

The market has been expanding due to rising demand for environmentally efficient, low-emission air transportation solutions in commercial and regional aviation. Hybrid aircraft, combining conventional fuel engines with electric propulsion systems, have been valued for reduced fuel consumption, lower carbon emissions, and improved operational efficiency. Market growth has been reinforced by advancements in lightweight materials, battery technology, and powertrain integration. Increasing airline investments, sustainability regulations, and passenger demand for greener travel options have further strengthened adoption, positioning hybrid aircraft as a key innovation for the future of aviation.

The market has been significantly driven by growing environmental concerns and stringent aviation emission regulations. Airlines and aircraft manufacturers have been encouraged to adopt hybrid propulsion systems to comply with carbon reduction targets and sustainable aviation policies. Hybrid aircraft have been designed to reduce fuel consumption during takeoff, landing, and cruise phases while minimizing greenhouse gas emissions. Governments, international aviation authorities, and environmental organizations have promoted research and incentives for electric-assisted propulsion and hybrid powertrains. Regional commuter aircraft and urban air mobility vehicles have increasingly incorporated hybrid technology to improve air quality and noise performance. Rising public awareness of climate impact and carbon footprint has further reinforced adoption, positioning hybrid aircraft as a critical solution for sustainable aviation operations globally.

Technological innovations have strengthened the market by improving propulsion systems, energy storage, and aerodynamics. Advanced battery technologies, such as lithium-sulfur and solid-state designs, have allowed higher energy density and extended flight ranges. Electric motors integrated with conventional turbine engines have provided flexible thrust management and reduced fuel consumption. Lightweight composite airframes, efficient wing designs, and smart thermal management systems have enhanced overall aircraft performance and operational efficiency. Integration with energy recovery systems and optimized power electronics has improved endurance and reduced maintenance requirements. Research in autonomous flight controls, predictive maintenance, and hybrid-electric system modeling has enabled safer, more reliable, and efficient hybrid aircraft. These technological advancements have reinforced the viability and attractiveness of hybrid aircraft across commercial and regional aviation markets worldwide.

The market has been reinforced by adoption in regional and short-haul commuter aviation, where operational efficiency and environmental performance are critical. Hybrid-electric propulsion has been employed to reduce operating costs, fuel consumption, and noise pollution for short-range flights. Airlines operating in densely populated regions and urban air mobility sectors have increasingly favored hybrid aircraft to meet local emission targets and noise restrictions. Integration of hybrid systems with airport infrastructure, ground operations, and energy management has improved overall efficiency. Rising demand for point-to-point regional connectivity and the need for greener urban air transport solutions have further accelerated adoption. Collaboration between aircraft manufacturers, airlines, and research organizations has strengthened technological readiness and market acceptance, making hybrid aircraft a key enabler for sustainable regional aviation worldwide.

Despite strong growth, the market has faced challenges associated with high development costs, limited energy storage capacity, and regulatory certification. Advanced hybrid propulsion systems, lightweight materials, and battery technologies have required substantial investment and research expenditures. The energy density limitations of current batteries have restricted range and payload capacity, influencing operational flexibility.

Certification processes for hybrid-electric aircraft, including safety, reliability, and airworthiness standards, have required rigorous testing and regulatory approval. Manufacturers have responded by investing in modular systems, battery management innovations, and scalable hybrid designs. Continuous improvements in cost-effective energy storage, certification compliance, and system integration have remained essential for sustaining adoption across commercial, regional, and urban aviation markets, ensuring hybrid aircraft remain a viable solution for sustainable air transport globally.

| Countries | CAGR |

|---|---|

| China | 31.6% |

| India | 29.3% |

| Germany | 26.9% |

| France | 24.6% |

| UK | 22.2% |

| USA | 19.9% |

| Brazil | 17.6% |

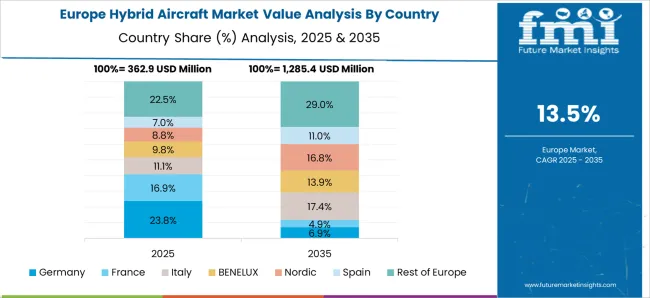

The market is projected to expand at a CAGR of 23.4% between 2025 and 2035, driven by advancements in electric propulsion, fuel efficiency mandates, and rising demand for low-emission aviation solutions. China leads with a 31.6% CAGR, advancing through large-scale aircraft development programs and investment in hybrid-electric propulsion technology. India follows at 29.3%, scaling rapidly with government-backed initiatives and modernization of regional fleets. Germany, at 26.9%, innovates through advanced aerospace engineering and integration of hybrid propulsion systems. The UK, with a 22.2% CAGR, focuses on research and development in sustainable aviation technologies, while the USA, at 19.9%, witnesses’ consistent growth through industry adoption and commercial fleet upgrades. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 31.6%, supported by increasing adoption of electric and hybrid propulsion technologies. Major aircraft manufacturers are investing in research and development to optimize fuel efficiency and reduce emissions. Government initiatives promoting green aviation and renewable energy integration further accelerate market expansion. Collaborations between aerospace companies and technology providers enhance technological innovation, particularly in battery systems, electric motors, and lightweight materials. The rising demand for regional commuter aircraft with lower operating costs also contributes to market growth. China's growing aerospace industry and infrastructure development provide strong domestic and international market opportunities.

India is anticipated to expand at a CAGR of 29.3%, fueled by government policies supporting low-emission aviation solutions. Domestic aerospace firms are focusing on hybrid-electric propulsion and energy-efficient designs to reduce fuel consumption. Collaborative research programs with international aerospace companies accelerate the development of lightweight materials, high-performance batteries, and electric motors. Increasing air travel demand and regional connectivity projects provide additional market potential. Emerging investments in sustainable aviation technologies and infrastructure development support long-term growth prospects, while regulatory compliance ensures safe and reliable adoption.

Germany is expected to grow at a CAGR of 26.9%, driven by technological innovation and rising environmental regulations. Aerospace companies are investing in hybrid-electric aircraft solutions for regional transportation and cargo applications. Government funding and research grants promote the development of energy-efficient propulsion systems, lightweight composite materials, and battery technologies. Market growth is reinforced by Europe-wide initiatives for reducing aviation emissions. Domestic demand from commercial and private aviation sectors contributes to stable market expansion. Focus on eco-friendly aviation and collaboration with international aerospace manufacturers ensures long-term adoption and competitive advantage in the European aerospace industry.

The United Kingdom market is projected to expand at a CAGR of 22.2%, supported by rising interest in sustainable aviation and emission reduction strategies. Aerospace manufacturers are prioritizing hybrid-electric designs and battery-powered propulsion for regional and short-haul aircraft. Collaborative initiatives with technology firms and research institutes accelerate development of lightweight materials and efficient energy systems. Domestic air travel growth and government incentives for low-carbon technologies enhance market potential. Compliance with aviation safety and environmental regulations ensures reliability and adoption. Emerging demand for eco-friendly air transportation provides strategic opportunities for domestic and international stakeholders.

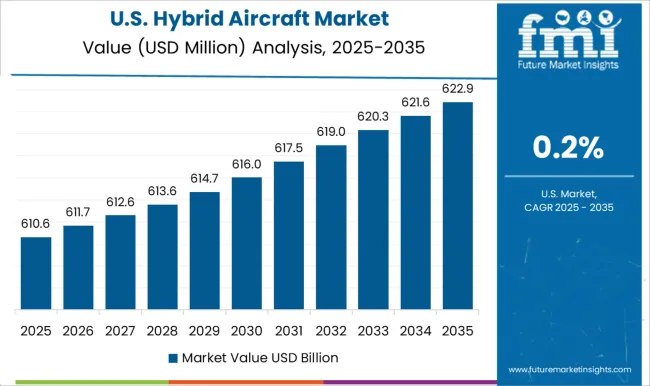

The United States is expected to grow at a CAGR of 19.9%, fueled by investments in hybrid-electric propulsion and sustainable aviation technologies. Aerospace companies are focusing on energy-efficient aircraft designs, high-performance battery systems, and lightweight components. Federal initiatives promoting green aviation and emission reduction strategies accelerate technological development. Market expansion is supported by rising regional air travel, cargo operations, and commercial aircraft demand. Collaborative programs between aerospace manufacturers and technology providers enhance innovation in propulsion and energy storage. Long-term growth is driven by domestic infrastructure development and the adoption of low-emission aviation solutions across the United States.

The hybrid and electric aircraft market is expanding rapidly as manufacturers integrate conventional propulsion systems with electric and hybrid-electric technologies to improve efficiency, reduce emissions, and lower operational costs. Airbus SE, RTX Corporation, General Electric Company, Embraer S.A., and Safran S.A. lead the market, leveraging deep aerospace expertise and advanced R&D to develop next-generation platforms for regional and urban air mobility. Their efforts focus on powertrain integration, advanced energy management systems, and aerodynamic optimization, enabling higher fuel efficiency and reduced carbon footprints.

Emerging innovators such as Ampaire Inc., Heart Aerospace AB, XTI Aircraft Company, and Pipistrel d.o.o. are pioneering lightweight hybrid-electric solutions for small and medium-sized aircraft. These players emphasize modular design, lower noise emissions, and flexible operational performance, aligning with global sustainability goals and evolving aviation regulations.

Further diversification comes from Electric Aviation Group Ltd., Faradair Aerospace Ltd., and VoltAero SAS, which are developing scalable hybrid concepts tailored for short-haul and commuter segments. Their designs combine advanced composite materials, distributed propulsion architectures, and digital flight systems to optimize performance and energy efficiency.

Collectively, these companies are reshaping the future of aviation through innovation in propulsion technologies, sustainability-driven design, and collaboration with regulators and energy suppliers. The growing adoption of hybrid-electric aircraft signals a major shift toward cleaner, smarter, and more sustainable air transport solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| Aircraft Type | Advanced air mobility, Regional transport aircraft, Business jets, Light and ultralight aircraft, and Unmanned aerial vehicles |

| Lift Technology | Vertical take-off and landing, Conventional take-off and landing, and Short take-off and landing |

| Fuel Type | Fuel hybrid and Hydrogen hybrid |

| Range | 101 km to 500 km, 100 km, and > 501 km |

| Mode of Operation | Piloted and Autonomous |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Airbus SE; RTX Corporation (formerly Raytheon Technologies Corporation); General Electric Company; Embraer S.A.; Safran S.A.; Ampaire Inc.; Heart Aerospace AB; XTI Aircraft Company; Pipistrel d.o.o. (a Textron Inc. company); Electric Aviation Group Ltd.; Faradair Aerospace Ltd.; VoltAero SAS. |

| Additional Attributes | Dollar sales by aircraft type and propulsion system, demand dynamics across commercial, regional, and private aviation, regional trends in hybrid adoption, innovation in fuel efficiency, battery integration, and noise reduction, environmental impact of emissions and lifecycle energy use, and emerging use cases in short-haul flights and urban air mobility. |

The global hybrid aircraft market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the hybrid aircraft market is projected to reach USD 14.1 billion by 2035.

The hybrid aircraft market is expected to grow at a 23.4% CAGR between 2025 and 2035.

The key product types in hybrid aircraft market are advanced air mobility, regional transport aircraft, business jets, light and ultralight aircraft and unmanned aerial vehicles.

In terms of lift technology, vertical take-off and landing segment to command 41.9% share in the hybrid aircraft market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hybrid Sleeve Cartridges Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hybrid Reactive Power and Harmonic Compensation Device Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Vision Sensor Chips Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Printing Market Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Hybrid Boat Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Metal-Paper Seamers Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA