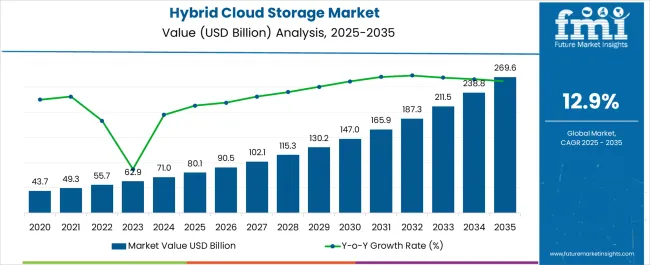

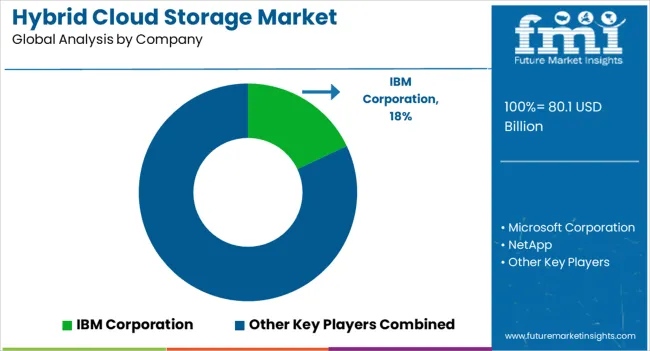

The Hybrid Cloud Storage Market is estimated to be valued at USD 80.1 billion in 2025 and is projected to reach USD 269.6 billion by 2035, registering a compound annual growth rate (CAGR) of 12.9% over the forecast period.

| Metric | Value |

|---|---|

| Hybrid Cloud Storage Market Estimated Value in (2025 E) | USD 80.1 billion |

| Hybrid Cloud Storage Market Forecast Value in (2035 F) | USD 269.6 billion |

| Forecast CAGR (2025 to 2035) | 12.9% |

The hybrid cloud storage market is undergoing accelerated adoption as enterprises seek to balance data security, performance, and flexibility. The model offers a combination of on-premise infrastructure with public cloud services, enabling organizations to retain control over sensitive data while scaling compute and storage capabilities on demand.

Increasing volume and variety of enterprise data, coupled with compliance mandates and workload-specific latency requirements, are making hybrid solutions more attractive. Enterprises are leveraging hybrid cloud to optimize costs, ensure business continuity, and enhance data accessibility across distributed environments.

Additionally, integration with AI, container orchestration platforms, and edge infrastructure is strengthening hybrid deployments in digitally transforming sectors. Strategic collaborations between cloud providers and data center operators are further fueling this shift, while innovations in cloud-native storage interfaces and data fabric technologies are expected to shape future market evolution.

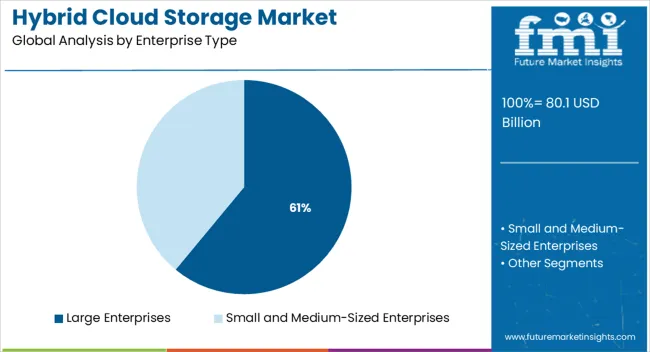

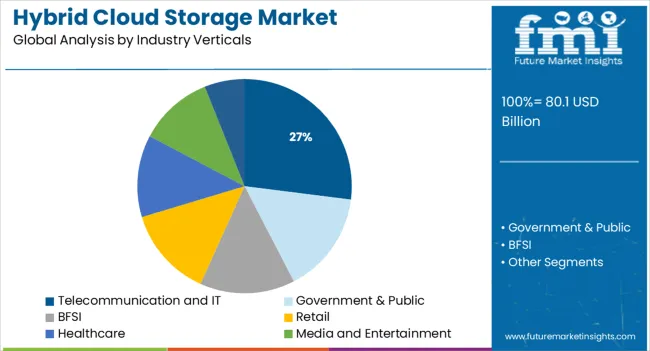

The market is segmented by Enterprise Type and Industry Verticals and region. By Enterprise Type, the market is divided into Large Enterprises and Small and Medium-Sized Enterprises. In terms of Industry Verticals, the market is classified into Telecommunication and IT, Government & Public, BFSI, Retail, Healthcare, Media and Entertainment, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Large enterprises are expected to hold 61.0% of the total revenue share in the hybrid cloud storage market by 2025, making them the dominant enterprise type. This leadership is being driven by their need to manage massive volumes of structured and unstructured data across diverse geographies and business units.

The hybrid model supports tiered storage, data residency compliance, and seamless application performance—requirements that are particularly critical for complex IT environments. Large organizations often operate legacy infrastructure alongside modern platforms, and hybrid cloud allows a gradual transition while avoiding business disruption.

Investment in digital transformation, cybersecurity frameworks, and disaster recovery strategies has also intensified the demand for hybrid cloud. Additionally, the ability to retain mission-critical workloads in private environments while extending capacity through public cloud has reinforced its appeal among large enterprises managing high-value and regulated data assets.

The telecommunication and IT sector is projected to account for 27.0% of the overall hybrid cloud storage market share in 2025, making it the leading industry vertical. This dominance is being driven by the sector’s high data throughput requirements, real-time processing needs, and geographically distributed user bases.

Telecom and IT firms are leveraging hybrid cloud to meet low-latency demands while ensuring robust data governance and network reliability. Hybrid storage models support edge deployments, mobile computing, and seamless integration with existing virtual infrastructure, making them ideally suited for fast-evolving service environments.

Additionally, the rise of 5G, AI-driven customer engagement platforms, and digital service delivery models has further accelerated hybrid adoption. Regulatory compliance, network scalability, and the need for resilient storage architectures have positioned the telecom and IT vertical as a key growth driver in this market.

The hybrid cloud storage market size in North America is anticipated to be the greatest due to the thriving IT sector in the countries of this region.

The presence of a dynamic corporate environment, the rising use of numerous cloud services for cost savings, and an unavoidable need to improve productivity and efficiency through centralized cloud governance are the key reasons that will continue to propel the growth of the hybrid cloud storage market.

Numerous local businesses are transitioning from the public cloud to a new age of hybrid IT, which mixes the public cloud, private cloud, and conventional IT. These businesses have adopted a hybrid cloud approach, which helps them grow their operations and provide customer service. Government policies in the nations in this region support digitization as well, which has fueled the growth of the global hybrid cloud storage market in this region.

Research released by Stormforge in April 2024 states that 18% of North American respondents indicated that their company spends between USD 100,000 and USD 250,000 per month on cloud computing. In addition, 44% of respondents anticipate a little rise in cloud spending over the coming year, while another 32% predict a considerable increase in cloud spending for their firm over the same period. Additionally, vendors are supporting the hybrid approach in a variety of ways.

Companies in North America are actively engaged in strategic mergers and acquisitions. For instance, to improve its cloud offerings, American technology giant IBM purchased Sanovi Technologies. Sanovi offers business continuity, cloud migration, and hybrid cloud recovery software for corporate data centers and cloud infrastructure.

There are several significant participants in the extremely fragmented hybrid cloud industry. Few big firms now control the majority of the industry in terms of market share. These significant industry participants are concentrating on growing their consumer base internationally.

These businesses use tactical joint ventures to raise their market share and profitability. For instance, Citrix Systems and Google Cloud announced a new partnership in October 2024, as part of which Citrix would introduce a new Desktop-as-a-Service (DaaS) product on Google Cloud.

To support the smooth delivery of virtualized apps and desktops on Google Cloud, the service makes use of Citrix's management plan and HDX protocol. To improve the capabilities of their products, industry players are also buying up startups developing hybrid cloud technology.

New players in the hybrid cloud storage market are concentrating on providing hybrid cloud storage services, primarily for business and financial services.

Advanced storage solutions are being introduced by several international service providers to make data availability and accessibility across hybrid clouds simpler. The businesses are concentrating on providing streamlined hybrid storage systems.

For instance, For HPE GreenLake, the company's flagship product that enables businesses to update all of their apps and data, Hewlett Packard Enterprise introduced platform upgrades and new cloud services in June 2025.

This includes a contemporary private cloud that has been reinvented and offers a cloud-native experience to enable any organization's hybrid approach, regardless of location.

Challenges such as keeping a secure backup and lack of storage space on either a cloud or on-premise were eliminated with the introduction of hybrid cloud storage as hybrid cloud storage, in integration, uses both on-premises and cloud storage services.

Hybrid cloud storage supplements on-premise storage in addition to public cloud storage by keeping frequently used data on-premise while storing inactive data on the cloud simultaneously. Hybrid cloud storage, henceforth, enables flexibility in operation and efficiently undergoes the process of transferring data between the two environments.

Different organizations use hybrid cloud storage differently. For some hybrid cloud storage is a mediator between their on-site data storage and public cloud, while for some hybrid cloud storage leverages the scalability of cloud computing to have an access to a more stable and flexible storage platform.

Hybrid Cloud storage is widely adopted by enterprises whose volume of storage is considerably high. Furthermore, due to several benefits offered, high demand for hybrid cloud storage is witnessed by both large and small & medium-sized enterprises.

Low costs associated with an enterprise hybrid cloud storage solution, due to its consolidated storage infrastructure and automated data management, are a major factor driving the growth of the hybrid cloud storage market.

Added security offered to enterprises is the primary reason for the high demand witnessed, for hybrid cloud storage. In addition to this, added features such as flexibility, stability, faster data recovery, and reduced latency are expected to drive the overall hybrid cloud storage market.

The complexity observed in maintaining an efficient network across both cloud and on-premise is one of the restraining factors for the hybrid cloud storage market. Additionally, compatibility across dual levels of infrastructure to run different stacks efficiently is another major challenge faced by hybrid cloud storage.

Certain geographical locations do not possess a strong network bandwidth to support the integration of hybrid cloud storage systems, thus impeding the growth of the market.

End-user industries present in the USA and Canada are relying on private clouds and public clouds. The increasing dependency on the same for completing various tasks such as data collection and retrieving information is augmenting the growth of the hybrid cloud storage market.

In addition, companies such as IBM, HudsonAlpha, and VMWare are creating lucrative opportunities for hybrid cloud storage in North America.

Owing to the above-mentioned reasons, North America is expected to hold a 32.2% market share for the hybrid cloud storage market in 2025.

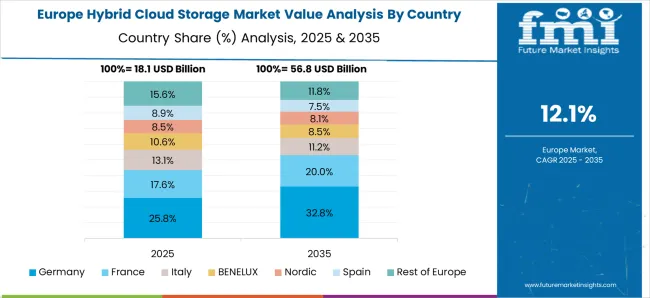

Europe is a hub of technological advancement. The strong presence of the IT industry, healthcare sector, and the automotive sector has increased the demand for hybrid cloud storage systems. Moreover, digitalization and automation especially in countries like the United Kingdom. and Germany is augmenting its reliance on the hybrid cloud storage market.

Due to the reasons mentioned above, Europe is expected to possess a 24.7% market share for the hybrid cloud storage market in 2025.

Growing internet penetration along with customization of hybrid cloud services is favoring the growth of the hybrid cloud storage market, especially in India and China. In addition, the increasing population and end-user industries in the Asia Pacific region are propelling the growth of hybrid cloud storage systems as they offer a secure space for storing and maintaining information.

Asia Pacific is expected to procure a 27% market share for the hybrid cloud storage market in 2025.

Some of the key players in the hybrid cloud storage market are Virtustream, Hewlett Packard Enterprise, Gigas, Stratoscale, and Quali

Some of the key players in the hybrid cloud storage market are IBM Corporation, Microsoft Corporation, NetApp, Amazon Web Services, Inc., VMware, Inc., Micro Focus, Google Cloud Platform, Dell Inc., Rackspace, Inc., Panzura, Spectra Logic Corporation, Cloudian, and Quantum Corporation.

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 80.1 billion |

| Market Value in 2035 | USD 269.6 billion |

| Growth Rate | CAGR of 12.9% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered |

Enterprise Type, Industry Verticals, Region |

| Regions Covered |

North America; Latin America; Western Europe; Eastern Europe; Asia Pacific Excluding Japan; Japan; Middle East and Africa |

| Key Countries Profiled |

United States of America, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASIAN, GCC Countries, South Africa |

| Key Companies Profiled |

IBM Corporation; Microsoft Corporation; NetApp; Amazon Web Services, Inc.; VMware Inc.; Micro Focus; Google Cloud Platform; Dell Inc.; Rackspace, Inc.; Panzura, Spectra Logic Corporation; Cloudian; Quantum Corporation. |

| Customization | Available Upon Request |

The global hybrid cloud storage market is estimated to be valued at USD 80.1 billion in 2025.

The market size for the hybrid cloud storage market is projected to reach USD 269.6 billion by 2035.

The hybrid cloud storage market is expected to grow at a 12.9% CAGR between 2025 and 2035.

The key product types in hybrid cloud storage market are large enterprises and small and medium-sized enterprises.

In terms of industry verticals, telecommunication and it segment to command 27.0% share in the hybrid cloud storage market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hybrid Reactive Power and Harmonic Compensation Device Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Vision Sensor Chips Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Printing Market Forecast Outlook 2025 to 2035

Hybrid Boat Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Metal-Paper Seamers Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Sealing-Cut Machines Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hybrid Powertrain Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Additive Manufacturing Machines Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Integration Platform Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Meat Products Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Rice Seeds Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Memory Cube Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Cutters Market Analysis Size and Share Forecast Outlook 2025 to 2035

Hybrid Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Train Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA