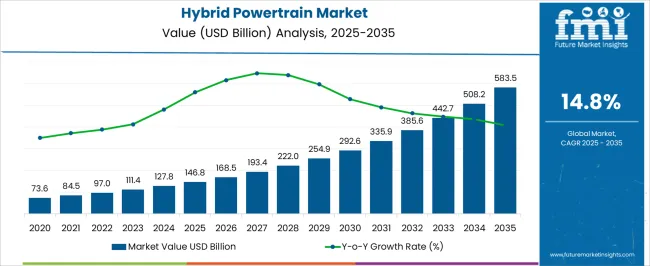

The global hybrid powertrain market is projected to reach USD 146.8 billion by 2025 and is anticipated to grow to USD 583.5 billion by 2035, expanding at a CAGR of 14.8% over the forecast period. A growth contribution index provides insights into the segments and factors driving the market’s expansion across the decade. In the early stage, from USD 73.6 billion to USD 127.8 billion, the growth contribution is primarily driven by rising adoption of hybrid vehicles in developed markets, stringent emission regulations, and initial investments in battery and electric motor technologies.

This period highlights moderate contributions from OEM partnerships and pilot programs for hybrid integration. As the market progresses from USD 146.8 billion to USD 292.6 billion, the contribution index shifts, with technological advancements in energy management systems, increased production of plug-in hybrids, and consumer preference for fuel-efficient vehicles playing a larger role in accelerating growth. In the later phase, from USD 335.9 billion to USD 583.5 billion, the highest contributions come from scaling manufacturing capacities, expansion in emerging markets, and government incentives for low-emission vehicles, reflecting a mature market where multiple growth levers combine to sustain momentum.

The growth contribution index thus illustrates the relative impact of regulatory support, technological innovation, and market adoption across different phases, providing stakeholders with actionable insights to prioritize investments, optimize R&D, and capture value across regions as the hybrid powertrain market transitions from early adoption to widespread commercial penetration over the next few years.

| Metric | Value |

|---|---|

| Hybrid Powertrain Market Estimated Value in (2025 E) | USD 146.8 billion |

| Hybrid Powertrain Market Forecast Value in (2035 F) | USD 583.5 billion |

| Forecast CAGR (2025 to 2035) | 14.8% |

The hybrid powertrain market is closely influenced by five interconnected parent markets that collectively drive its adoption and long-term growth. The largest contributor is the automotive manufacturing market, which accounts for about 40% share, as original equipment manufacturers (OEMs) increasingly integrate hybrid powertrains into passenger vehicles, commercial fleets, and luxury automobiles to meet fuel efficiency and emission regulations. The electric vehicle (EV) components and battery technology sector contributes around 25%, driven by the demand for lithium-ion batteries, power electronics, and energy management systems that enable seamless hybrid operation and enhanced performance.

The government policy and regulatory compliance market holds close to 15% influence, supported by emission reduction mandates, tax incentives, and subsidies that encourage OEMs and consumers to adopt hybrid technologies. The automotive aftermarket and maintenance services sector adds nearly 12%, as hybrid powertrains require specialized servicing, diagnostics, and component replacements, which sustains aftermarket demand. The renewable energy and charging infrastructure market contributes close to 8%, as the growth of hybrid vehicles is complemented by the availability of charging networks and integration with renewable electricity sources, enhancing energy efficiency and reducing operational carbon footprint.

The distribution of market influence shows that automotive manufacturing and EV components form the backbone of this market, while regulatory support, aftermarket services, and energy infrastructure continue to expand adoption and commercial relevance.

The hybrid powertrain market is witnessing significant traction, fueled by global policy shifts toward reduced vehicular emissions and enhanced fuel efficiency standards. With regulatory frameworks tightening across major automotive regions, hybrid technologies are being increasingly adopted as a transitional solution between internal combustion engines and fully electric drivetrains. Current adoption is being driven primarily by incentives for low-emission vehicles, alongside improvements in hybrid system performance and battery efficiency.

As manufacturers continue to diversify powertrain offerings to meet regional and segment-specific emissions targets, hybrid powertrains serve as a pragmatic balance of performance, affordability, and environmental compliance. Market expansion is also being encouraged by rising consumer awareness and infrastructure constraints that limit the immediate scalability of fully electric vehicles.

OEMs are investing in hybrid variants across compact, mid-size, and SUV segments, making hybrids more accessible to mainstream buyers. Over the forecast period, demand is expected to remain robust, especially in markets where electrification infrastructure is still developing, positioning hybrid powertrains as a durable growth category in the evolving mobility landscape.

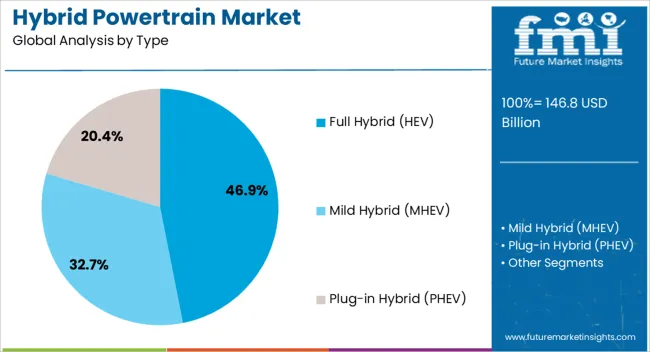

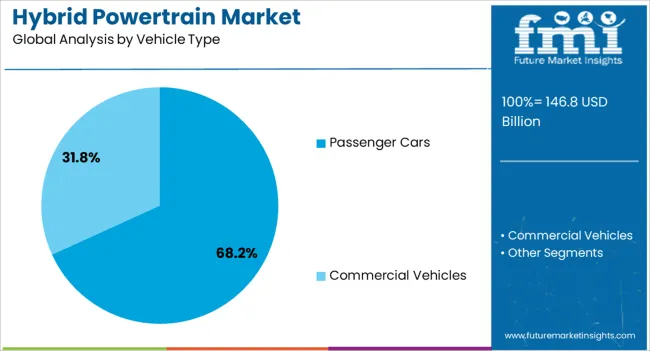

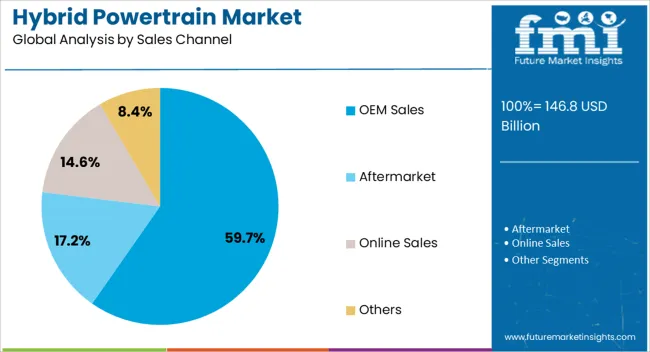

The hybrid powertrain market is segmented by type, vehicle type, sales channel, and geographic regions. By type, hybrid powertrain market is divided into Full Hybrid (HEV), Mild Hybrid (MHEV), and Plug-in Hybrid (PHEV). In terms of vehicle type, hybrid powertrain market is classified into Passenger Cars and Commercial Vehicles. Based on sales channel, hybrid powertrain market is segmented into OEM Sales, Aftermarket, Online Sales, and Others. Regionally, the hybrid powertrain industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The full hybrid (HEV) segment leads the hybrid powertrain market with a share of 46.9%, driven by its mature technology profile and optimized fuel economy across varied driving conditions. This segment has gained prominence due to its self-charging capability, which eliminates the need for external charging infrastructure, thus making it appealing in regions with limited electric vehicle support. HEVs offer a seamless blend of electric and combustion engine operation, providing better fuel efficiency and reduced emissions without compromising on range.

Regulatory incentives and favorable total cost of ownership have further strengthened HEV adoption among consumers and fleet operators. Automakers are increasingly integrating full hybrid systems into high-volume vehicle platforms, enhancing scalability and cost-efficiency.

Continued investment in power electronics, control systems, and battery management has improved the performance and reliability of HEVs, supporting their leadership position. Given their adaptability across markets and sustained OEM focus, the full hybrid segment is expected to maintain its dominant role in hybrid powertrain adoption.

Passenger cars account for 68.2% of the hybrid powertrain market by vehicle type, primarily due to their volume-driven demand and favorable cost-benefit ratio when equipped with hybrid systems. This segment has led the adoption curve as manufacturers prioritize compliance with fuel efficiency and emissions norms across compact and mid-size vehicle categories. Hybrid passenger cars cater to a broad consumer base, ranging from cost-conscious buyers to environmentally aware urban drivers, making them a versatile and scalable solution.

The integration of hybrid technology in sedans, hatchbacks, and SUVs has widened market reach and improved consumer acceptance. Additionally, favorable tax policies and urban congestion charges have contributed to higher uptake in metropolitan regions.

OEMs have aligned their development pipelines to expand hybrid variants across key passenger car platforms, leveraging shared architectures to minimize production costs. With sustained demand for efficient, lower-emission vehicles in both developed and developing regions, the passenger cars segment is expected to remain the primary volume contributor to the hybrid powertrain market.

OEM sales dominate the hybrid powertrain market’s sales channel landscape with a 59.7% share, underscoring the strategic role of direct integration by vehicle manufacturers. Automakers are increasingly embedding hybrid systems within their production lines to align with evolving regulatory requirements and brand-level sustainability commitments. This vertical integration ensures consistent quality, optimized system calibration, and enhanced compatibility between hybrid components and vehicle platforms.

OEM-driven distribution also enables faster market penetration through well-established dealer networks and bundled aftersales support. Moreover, OEM sales benefit from strategic collaborations with battery and powertrain component suppliers, ensuring better supply chain control and economies of scale. The OEM channel also allows manufacturers to directly target fleet operators and government procurement programs focused on emissions reduction.

With hybrid technology becoming a mainstream offering across model lineups, OEMs are prioritizing in-house development and distribution, cementing their leadership in sales volume. As the market matures, OEM sales are expected to retain their dominant position through continuous innovation and regulatory alignment.

The hybrid powertrain market is shaped by rising adoption of fuel-efficient vehicles, integration with advanced battery and electric drive systems, government regulations and incentives, and expanding commercial and fleet applications. Consumers and fleet operators are increasingly prioritizing fuel savings, performance, and emission compliance. Technological improvements in batteries, electric motors, and regenerative systems enhance vehicle efficiency and reliability. Policy support and urban emission regulations are driving adoption, while commercial fleet integration ensures consistent demand. Together, these factors are fostering market growth, expanding applications across passenger and commercial vehicles, and positioning hybrid powertrain solutions as a key component of the evolving automotive landscape.

The market is being driven by increasing adoption of fuel-efficient and low-emission vehicles. Automotive manufacturers are integrating hybrid powertrain systems to reduce fuel consumption, improve mileage, and comply with stricter emission norms. Passenger cars, commercial vehicles, and SUVs are increasingly offered with hybrid variants to meet consumer demand for performance and efficiency. Fleet operators and ride-sharing services are also opting for hybrid vehicles to lower operational costs and reduce environmental impact. Growing consumer awareness of energy efficiency and fuel savings is supporting steady market growth and encouraging investment in hybrid powertrain technology across vehicle segments.

Hybrid powertrain systems are being increasingly integrated with advanced battery technologies and electric drive components to enhance performance and reliability. Lithium-ion, nickel-metal hydride, and emerging solid-state batteries are used to improve energy storage, reduce weight, and extend driving range. Regenerative braking, electric motors, and power management modules are being optimized to maximize efficiency and reduce emissions. OEMs are collaborating with suppliers to ensure seamless integration of battery, electric, and combustion components. This technological coordination enhances vehicle performance, reliability, and consumer appeal, driving broader adoption of hybrid powertrains in light, medium, and heavy-duty vehicles.

Government policies, emission standards, and incentive programs are significant drivers of the hybrid powertrain market. Subsidies, tax benefits, and rebates for hybrid vehicle purchases are encouraging adoption among consumers and fleet operators. Regulatory mandates on fuel efficiency and carbon emissions are prompting automakers to expand hybrid offerings. Urban centers in Europe, North America, and Asia-Pacific are implementing low-emission zones, increasing the attractiveness of hybrid vehicles. Supportive policy frameworks reduce the total cost of ownership, making hybrid systems more economically viable. These regulations and incentive programs are accelerating market penetration and driving growth for hybrid powertrain solutions globally.

Commercial vehicles, buses, and logistics fleets are increasingly adopting hybrid powertrain systems to reduce fuel costs and improve operational efficiency. Delivery services, public transportation, and corporate fleets are implementing hybrid vehicles to optimize route efficiency and minimize emissions. Fleet operators benefit from lower maintenance requirements, extended engine life, and reduced fuel consumption. Hybrid powertrain adoption in commercial applications is being driven by both cost savings and compliance with urban emission regulations. Growing demand from fleet and logistics sectors is providing steady revenue streams, enabling manufacturers to scale production and expand offerings for hybrid powertrain solutions across various vehicle categories.

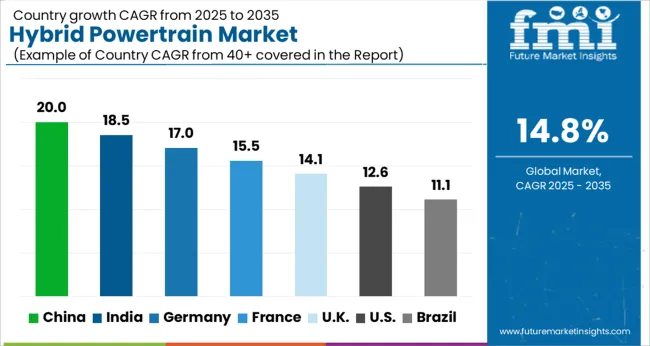

| Country | CAGR |

|---|---|

| China | 20.0% |

| India | 18.5% |

| Germany | 17.0% |

| France | 15.5% |

| UK | 14.1% |

| USA | 12.6% |

| Brazil | 11.1% |

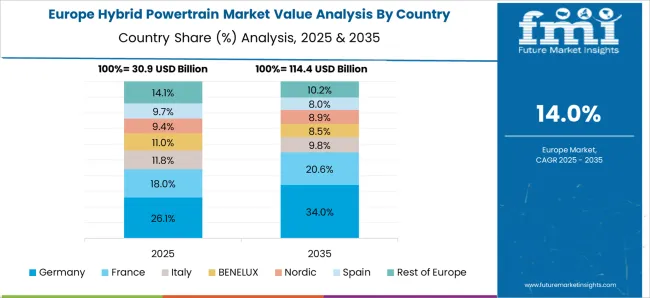

The global hybrid powertrain market is projected to grow at a CAGR of 14.8% from 2025 to 2035. China leads with 20.0%, followed by India at 18.5%, Germany at 17.0%, the UK at 14.1%, and the USA at 12.6%. Growth is driven by increasing demand for fuel-efficient vehicles, government incentives, and stricter emission regulations. BRICS countries, particularly China and India, are scaling production capacity, R&D initiatives, and local supply chains to accelerate adoption. OECD nations such as Germany, the UK, and the USA focus on high-performance hybrid technologies, integration with advanced vehicle systems, and consumer awareness programs to enhance market penetration and efficiency. The analysis spans over 40+ countries, with the leading markets detailed below.

The hybrid powertrain market in China is projected to grow at a CAGR of 20.0% from 2025 to 2035, driven by the country’s aggressive push toward electric mobility, emission reduction targets, and increasing adoption of passenger and commercial hybrid vehicles. Automotive manufacturers are investing in advanced battery systems, efficient engines, and regenerative braking technologies to enhance fuel economy and reduce emissions. Government incentives, subsidies for hybrid vehicle purchases, and strict emission regulations accelerate market adoption. Growing consumer awareness about environmental sustainability and rising fuel costs further support the shift toward hybrid powertrains. Local production and R&D investments ensure China remains a global leader in hybrid vehicle deployment.

The hybrid powertrain market in India is expected to grow at a CAGR of 18.5% from 2025 to 2035, fueled by increasing demand for fuel-efficient and low-emission vehicles. Automotive manufacturers are introducing hybrid variants in passenger cars, commercial vehicles, and two-wheelers to meet regulatory emission norms and urban pollution control measures. Government policies promoting hybrid vehicle adoption, subsidies, and tax benefits encourage consumers to shift toward cleaner mobility solutions. Investment in battery technology, regenerative braking, and engine optimization supports performance improvements. Rising fuel prices, growing environmental awareness, and urban mobility challenges are further contributing to market expansion.

The hybrid powertrain market in Germany is projected to grow at a CAGR of 17.0% from 2025 to 2035, supported by stringent European emission standards and high adoption of electric mobility solutions. German automotive manufacturers are integrating advanced hybrid systems, including plug-in hybrids, regenerative braking, and lightweight engine components, to meet fuel efficiency and emission targets. Incentives for hybrid vehicle purchases, growing charging infrastructure, and consumer preference for environmentally responsible vehicles strengthen adoption. Research partnerships and local production of hybrid components further enhance market competitiveness. Germany’s focus on innovation, efficiency, and sustainability positions it as a key hub for hybrid powertrain growth.

The hybrid powertrain market in the UK is expected to grow at a CAGR of 14.1% from 2025 to 2035, driven by government policies targeting reduced emissions, urban air quality improvements, and promotion of low-emission vehicles. Automotive manufacturers are introducing hybrid and plug-in hybrid models in passenger cars and commercial fleets to comply with regulatory standards and meet consumer demand for sustainable mobility. Investment in battery technology, regenerative braking, and lightweight components enhances vehicle performance and efficiency. Public awareness campaigns, fuel cost considerations, and expansion of hybrid-compatible infrastructure further support market growth.

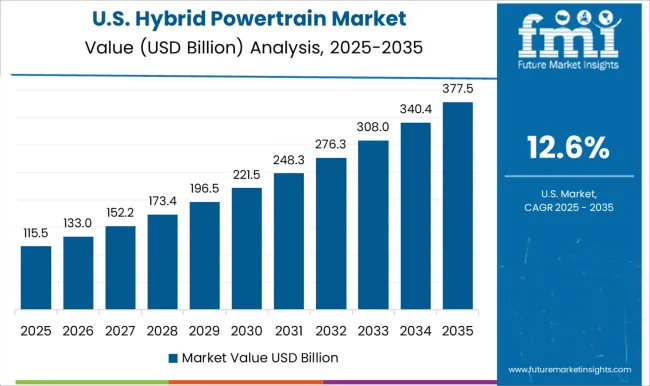

The hybrid powertrain market in the USA is projected to grow at a CAGR of 12.6% from 2025 to 2035, driven by rising fuel prices, emission regulations, and growing demand for environmentally friendly vehicles. Automotive manufacturers are deploying advanced hybrid systems, including full and plug-in hybrids, regenerative braking, and optimized internal combustion engines, to improve fuel efficiency and reduce carbon footprint. Federal and state incentives, tax credits, and emission compliance programs encourage consumer adoption. Consumer preference for high-performance, efficient, and eco-friendly vehicles, combined with ongoing investments in production and R&D, ensures continued market expansion.

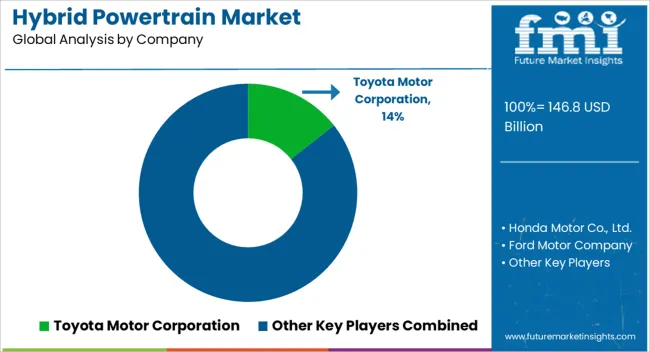

Competition in the hybrid powertrain market is influenced by fuel efficiency, emission compliance, and technological integration. Toyota Motor Corporation, Honda Motor Co., Ltd., Ford Motor Company, Hyundai Motor Company, General Motors Company, Volkswagen Group, BMW AG, Daimler AG, Subaru Corporation, Fiat Chrysler Automobiles (FCA), Porsche AG, Nissan Motor Co. Ltd., and Kia Corporation lead by offering hybrid powertrain solutions for passenger vehicles, commercial vehicles, and high-performance models. Product differentiation is achieved through full hybrid, mild hybrid, and plug-in hybrid architectures, advanced battery management systems, regenerative braking technologies, and optimized electric motor integration, ensuring superior fuel economy and reduced emissions. Mid-tier and regional players focus on cost-effective hybrid modules, retrofit solutions, and modular powertrain kits catering to emerging markets with growing hybrid adoption. These companies emphasize compact design, lightweight materials, and compatibility with existing vehicle platforms to enhance operational efficiency and consumer appeal. Strategies across leading companies prioritize global production capacity, partnerships with battery manufacturers, and investment in research and development for next-generation hybrid systems.

Energy management algorithms, thermal optimization, and lightweight chassis integration are leveraged as key differentiators to improve performance, reliability, and drivability. Differentiation is further reinforced through advanced connectivity, predictive diagnostics, and integration with autonomous driving features for a seamless user experience. Companies aim to balance fuel efficiency, performance, and cost-effectiveness while ensuring compliance with stringent global emission standards. The market demonstrates intense competition based on technological innovation, efficiency, and scalability, where global and regional players maintain leadership by delivering versatile, high-performance hybrid powertrain solutions. Continuous advancements in battery chemistry, electric motor efficiency, and energy recovery systems support long-term growth, while partnerships, supply chain optimization, and customer-focused deployment reinforce competitive positioning. The hybrid powertrain market reflects a dynamic landscape shaped by emission regulations, technological differentiation, and evolving consumer demand for fuel-efficient mobility.

| Item | Value |

|---|---|

| Quantitative Units | USD 146.8 Billion |

| Type | Full Hybrid (HEV), Mild Hybrid (MHEV), and Plug-in Hybrid (PHEV) |

| Vehicle Type | Passenger Cars and Commercial Vehicles |

| Sales Channel | OEM Sales, Aftermarket, Online Sales, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Toyota Motor Corporation, Honda Motor Co., Ltd., Ford Motor Company, Hyundai Motor Company, General Motors Company, Volkswagen Group, BMW AG, Daimler AG, Subaru Corporation, Fiat Chrysler Automobiles (FCA), Porsche AG, Nissan Motor Co. Ltd., and Kia Corporation |

| Additional Attributes | Dollar sales, share, vehicle type adoption, regional demand, powertrain type trends, competitor landscape, pricing benchmarks, emission compliance, technology integration, efficiency improvements, after-sales services, OEM partnerships. |

The global hybrid powertrain market is estimated to be valued at USD 146.8 billion in 2025.

The market size for the hybrid powertrain market is projected to reach USD 583.5 billion by 2035.

The hybrid powertrain market is expected to grow at a 14.8% CAGR between 2025 and 2035.

The key product types in hybrid powertrain market are full hybrid (hev), mild hybrid (mhev) and plug-in hybrid (phev).

In terms of vehicle type, passenger cars segment to command 68.2% share in the hybrid powertrain market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hybrid Reactive Power and Harmonic Compensation Device Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Vision Sensor Chips Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Printing Market Forecast Outlook 2025 to 2035

Hybrid Boat Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Metal-Paper Seamers Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Sealing-Cut Machines Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hybrid Additive Manufacturing Machines Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Integration Platform Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Meat Products Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Rice Seeds Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Memory Cube Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Cutters Market Analysis Size and Share Forecast Outlook 2025 to 2035

Hybrid Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Train Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hybrid Solar Wind Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA