The hybrid printing market is expanding steadily due to the increasing demand for high-quality, cost-efficient, and versatile printing solutions that combine the strengths of digital and conventional technologies. Market growth is being driven by rapid adoption across packaging, labeling, and commercial printing sectors, where customization and shorter production runs are essential. Integration of digital components into traditional systems is enhancing operational flexibility, reducing setup times, and improving print consistency.

Rising investments in smart manufacturing and automation are further supporting technological adoption. The future outlook indicates strong growth potential, supported by continuous innovation in ink formulations, printhead precision, and substrate compatibility.

The transition toward sustainable and eco-friendly printing processes is creating additional opportunities for hybrid solutions Overall, the market’s growth rationale is centered on the ability of hybrid printing systems to deliver superior efficiency, reduced waste, and higher return on investment, positioning them as a preferred choice for manufacturers and brand owners across diverse industrial and commercial segments.

| Metric | Value |

|---|---|

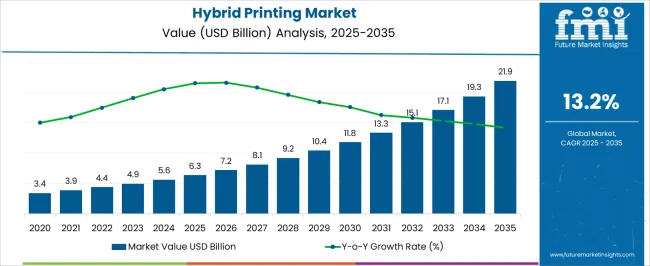

| Hybrid Printing Market Estimated Value in (2025 E) | USD 6.3 billion |

| Hybrid Printing Market Forecast Value in (2035 F) | USD 21.9 billion |

| Forecast CAGR (2025 to 2035) | 13.2% |

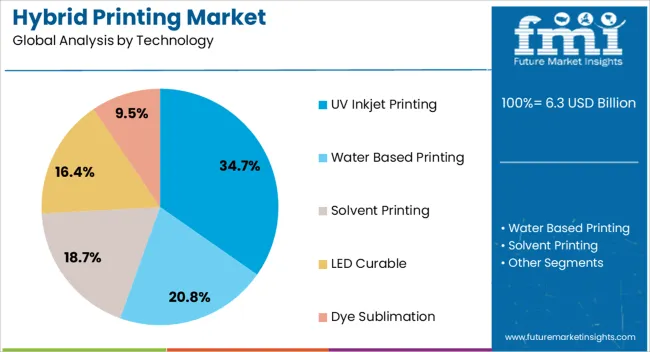

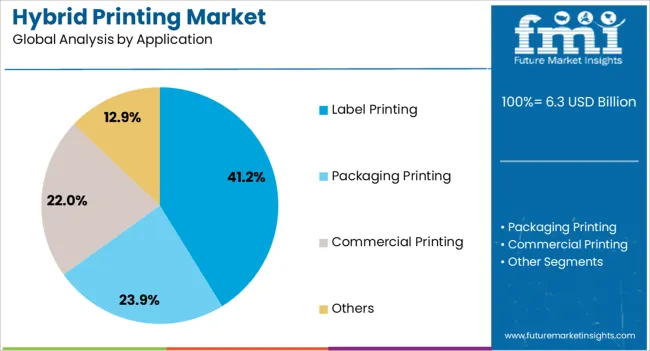

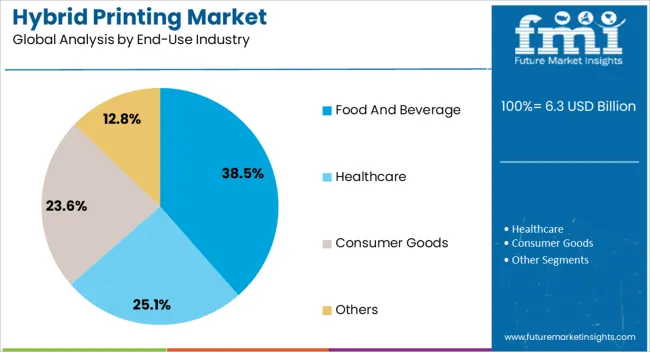

The market is segmented by Technology, Application, and End-Use Industry and region. By Technology, the market is divided into UV Inkjet Printing, Water Based Printing, Solvent Printing, LED Curable, and Dye Sublimation. In terms of Application, the market is classified into Label Printing, Packaging Printing, Commercial Printing, and Others. Based on End-Use Industry, the market is segmented into Food And Beverage, Healthcare, Consumer Goods, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The UV inkjet printing segment, accounting for 34.70% of the technology category, has emerged as the leading technology due to its superior print quality, fast curing time, and ability to print on diverse substrates. Its adoption is being driven by increasing demand for durable, high-resolution prints across packaging and labeling applications.

The segment’s success is supported by advances in ink chemistry that ensure better adhesion, gloss control, and resistance to abrasion and UV light. Operational efficiency is being enhanced through reduced drying times and minimal maintenance requirements.

Manufacturers are focusing on integrating UV inkjet technology with offset and flexographic systems to achieve hybrid capabilities that improve production flexibility Continued research in low-migration and eco-friendly inks is expected to further strengthen the technology’s position, making it a cornerstone of innovation in the hybrid printing market.

The label printing segment, representing 41.20% of the application category, has maintained its leading position owing to the growing need for premium, customizable, and short-run label solutions in consumer goods and packaging industries. Demand is being reinforced by brand differentiation strategies that rely on vivid color reproduction and variable data printing capabilities.

Hybrid printing systems enable high-speed production while retaining design flexibility, allowing manufacturers to respond quickly to market trends. The segment’s expansion is further supported by increasing regulations on labeling and traceability, particularly in food, beverage, and pharmaceutical sectors.

As sustainability becomes a priority, hybrid label printing solutions offering reduced material waste and lower energy consumption are gaining traction This balance of efficiency, adaptability, and quality continues to position label printing as a key growth driver within the hybrid printing market.

The food and beverage segment, holding 38.50% of the end-use industry category, dominates the market due to its extensive reliance on packaging and labeling solutions that require precision, durability, and compliance with safety standards. Demand for hybrid printing in this sector is being propelled by the need for high-quality graphics and the ability to print variable data such as expiration dates, barcodes, and batch information.

The technology’s versatility allows for effective printing on diverse packaging materials including cartons, bottles, and flexible films. Producers are leveraging hybrid systems to streamline production and reduce turnaround times, enhancing overall supply chain efficiency.

Regulatory compliance related to food-grade materials and ink safety has prompted ongoing innovation in ink formulations As consumer demand for visually appealing and informative packaging grows, the food and beverage industry is expected to remain the largest adopter of hybrid printing technologies.

Industries Embrace Hybrid Printing for Cost-effective Solutions! The hybrid printing market is expanding rapidly due to a rising need for short-run printing services.

Tech Innovations Propel Hybrid Printing to New Heights! The hybrid print production market is experiencing significant expansion due to the increasing demand for top-notch printing solutions, particularly in the packaging and labeling sectors.

Market Soars as Personalized Printing Takes Center Stage! The increasing adoption of personalized printing materials across various industries is also fueling the hybrid printing solutions market growth.

Hybrid Printing Leads the Digital Charge! The ongoing digital transformation across industries is driving the adoption of hybrid printing as businesses seek to leverage its capabilities for digital integration and automation.

The intricacy of operation is a noteworthy obstacle and discourages hybrid printing. Hybrid printing calls for complex processes, the fusion of many printing technologies, and the expertise of knowledgeable personnel to effectively oversee and resolve a variety of printing-related issues. This intricacy can impede the adoption and use of hybrid printing systems by causing operational inefficiencies, longer setup times, and possible mistakes.

The requirement for smooth integration between digital and conventional printing technologies is one of the main weaknesses in managing the complexity of operation in hybrid printing. It can be difficult to ensure interoperability across various hardware, software, and workflows; this necessitates the need for professional expertise and the purchase of interoperability solutions.

From 2020 to 2025, the hybrid printing market showed impressive growth, boasting a 16.3% CAGR. During this period, innovation flourished, and businesses embraced hybrid printing technologies to enhance their efficiency and capabilities. From personalized marketing materials to on-demand packaging solutions, hybrid printing emerged as a cornerstone in modern printing workflows. This trend has contributed to the positive outlook of the hybrid printing industry.

| Attributes | Quantitative Outlook |

|---|---|

| Hybrid Printing Market Size (2025) | USD 4.9 billion |

| Historical CAGR (2020 to 2025) | 16.3% |

Short-term Hybrid Printing Market Analysis

Despite the anticipated decrease in growth rate, the hybrid printing market global forecast that the groundwork laid during the historical period sets the stage for continued innovation and market dynamism. Advancements in materials and ink technologies are likely to expand the application scope of hybrid printing. This, in turn, is anticipated to facilitate the creation of high-quality, vibrant prints on a diverse range of substrates.

Long-term Hybrid Printing Market Analysis

Global trends in the hybrid printing industry spotlight a shift toward eco-friendly methods, such as using recycled materials and minimizing waste. There is also a growing demand for personalized products, with hybrid printing allowing for unique designs and adaptations.

Advancements in technology are streamlining production processes, making them more efficient. For instance, a 3D inkjet printer with contact-free computer vision feedback has been developed recently to manufacture hybrid objects with several novel functional chemistries. These are expected to have a highly positive impact on the global demand for hybrid printing in the long run.

The versatility of hybrid printing enables the creation of innovative products with diverse substrates, finishes, and effects. This opens up new opportunities for hybrid printing technology applications in areas like packaging embellishments, variable data printing, and specialty graphics, driving market growth as businesses seek to differentiate their offerings and meet evolving customer demands.

The burgeoning eCommerce sector is generating novel opportunities for hybrid printing producers. Hybrid printing is a useful tool for eCommerce companies that need to create premium labels and packaging fast and affordably. The potential of hybrid printing to provide scalable, customized, and personalized products is one of its main benefits.

Personalized experiences are the lifeblood of eCommerce companies, and hybrid printing enables them to build customized labels, packaging, and marketing materials that appeal to specific consumers.

The North America hybrid printing market stands out as a dominant force. The region boasts a robust technological infrastructure, fostering innovation and adoption of hybrid printing solutions. Europe is witnessing continuous and steady growth in demand for hybrid printings. Advancements in technology have made hybrid printing more accessible and cost-effective, making it an attractive option for businesses of all sizes here.

The Asia Pacific hybrid printing industry is likely to progress significantly. The region boasts a robust manufacturing sector, particularly in countries like China, Japan, South Korea, and India, which are embracing advanced printing technologies. These nations have well-established infrastructures and a skilled workforce conducive to hybrid printing innovation and adoption.

| Country | United States |

|---|---|

| Forecasted CAGR (2025 to 2035) | 13.4% |

| Projected Market Size by 2035 | USD 3.4 billion |

| Country | United Kingdom |

|---|---|

| Forecasted CAGR (2025 to 2035) | 14.5% |

| Projected Market Size by 2035 | USD 775.5 million |

| Country | China |

|---|---|

| Forecasted CAGR (2025 to 2035) | 13.6% |

| Projected Market Size by 2035 | USD 3 billion |

| Country | Japan |

|---|---|

| Forecasted CAGR (2025 to 2035) | 13.8% |

| Projected Market Size by 2035 | USD 2 billion |

| Country | South Korea |

|---|---|

| Forecasted CAGR (2025 to 2035) | 14.8% |

| Projected Market Size by 2035 | USD 1 billion |

Demand for hybrid printings in the United States is set to rise with an anticipated CAGR of 13.4% through 2035. Key factors influencing the hybrid printer market include:

The United Kingdom hybrid printing market is expected to surge at a CAGR of 14.5% through 2035. The topmost dynamic forces supporting the hybrid printing adoption in the country include:

The China hybrid printing market is forecasted to inflate at a CAGR of 13.6% through 2035. Prominent factors backing up the hybrid printing industry growth are:

Sales of hybrid printing in Japan are estimated to record a CAGR of 13.8% through 2035. The primary factors bolstering the hybrid printing system market size are:

The market in South Korea is likely to exhibit a CAGR of 14.8% through 2035. Reasons supporting the growth of the hybrid printing market in the country include:

As far as the technology of hybrid printing is concerned, the UV inkjet printing segment is likely to dominate through 2035, registering a CAGR of 13.0%. Similarly, the label printing segment is expected to lead the revenue share of the hybrid printing market in terms of application, with a projected CAGR of 12.8% through 2035.

| Segment | Forecasted CAGR (2025 to 2035) |

|---|---|

| UV Inkjet Printing | 13.0% |

| Label Printing | 12.8% |

The UV inkjet printing segment is anticipated to lead the way, holding an impressive hybrid printing market share. Here are a few key factors that contribute to UV inkjet printing’s acceptance in the market:

The label printing segment takes the top spot, a hybrid printing technology market trend validated by factors such as:

Hybrid printing market players employ diverse strategies to gain a competitive edge. Some focus on enhancing print quality and speed, while others prioritize developing hybrid printers with advanced functionalities. Cost-effective solutions and environmentally friendly practices are key selling points. Additionally, companies are exploring partnerships to leverage expertise and expand market reach. Continuous innovation and customer-centric approaches drive competitiveness in this dynamic landscape.

Recent Developments

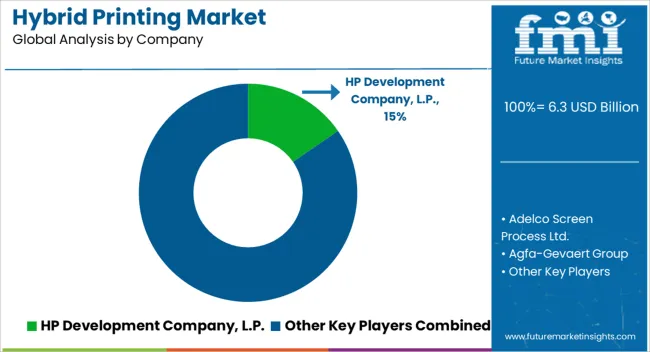

The global hybrid printing market is estimated to be valued at USD 6.3 billion in 2025.

The market size for the hybrid printing market is projected to reach USD 21.9 billion by 2035.

The hybrid printing market is expected to grow at a 13.2% CAGR between 2025 and 2035.

The key product types in hybrid printing market are uv inkjet printing, water based printing, solvent printing, led curable and dye sublimation.

In terms of application, label printing segment to command 41.2% share in the hybrid printing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hybrid Vision Sensor Chips Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Boat Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Metal-Paper Seamers Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Sealing-Cut Machines Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hybrid Powertrain Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Additive Manufacturing Machines Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Integration Platform Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Meat Products Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Rice Seeds Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Memory Cube Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Cutters Market Analysis Size and Share Forecast Outlook 2025 to 2035

Hybrid Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Train Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hybrid Solar Wind Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Drivetrain Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA